Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Dodecanedioic Acid (DDDA) Market

Dodecanedioic Acid (DDDA) Market Size

- Report ID: GMI422

- Published Date: May 2016

- Report Format: PDF

Dodecanedioic Acid Market Size

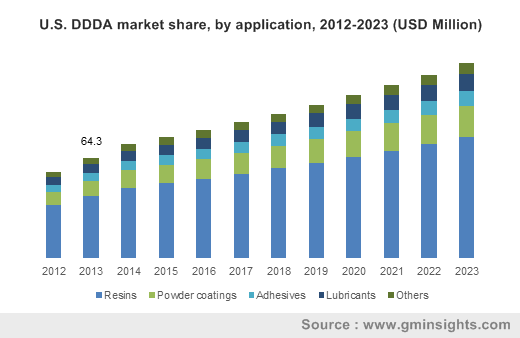

(Dodecanedioic Acid) DDDA Market size was over USD 370 million in 2015 and shall witness gains at over 5.5% CAGR over the estimated timeframe.

The global (dodecanedioic acid) DDDA market size is primarily driven by its demand in producing high-performance nylon. The overall nylon production was roughly around 4 million tons in 2015 and is likely to exceed 6 million tons over the estimated period. Increasing demand for nylon 6,12 due to the paint & coating business expansion is analyzed to be the prime factor that would propel the industry growth by 2023. This high-performance nylon is widely used in manufacturing thermoplastics, which has a widespread application spectrum across greases, polyesters, detergents, fragrances, coatings, and adhesives. These products have an enormous demand in the end-user industries owing to the (dodecanedioic acid) DDDA market size. Additionally, the nylon 6, 12 offers value-added characteristics such as scratch resistance, flexibility, heat stability accompanied, and superior corrosion resistance, which make it preferred for applications in the automotive industry. Furthermore, owing to its properties, it is also used in manufacturing fabrics and ropes.

Growth indicators in the construction business are analyzed to boost the overall (dodecanedioic acid) DDDA market size by 2023. The growing construction industry will substantially boost the product demand across paints & coatings. The product offers desirable solubility with solvents including water, acetone, and benzene and is therefore preferred in paint & coating applications. The overall construction expenditure is set to surpass USD 13 trillion over the projected timeframe. The construction industry essentially requires paints & coatings to upscale the steel & metal durability by providing them corrosion resistance. It also helps in enhancing the aesthetic appearance of the structure. In addition, the global paints & coatings production capacity was roughly around 1.5 million tons in 2015 and is forecast to surpass 3 million tons over the projected timeframe. This trend is analyzed to significantly boost the business growth by 2033.

| Report Attribute | Details |

|---|---|

| Base Year: | 2015 |

| Forecast Period: | 2016 to 2023 |

| Historical Data for: | 2012 to 2015 |

| No. of Pages: | 80 |

| Tables, Charts & Figures: | 69 |

| Segments covered: | Application and Region |

The rapidly growing automotive industry across the globe owing to the improved consumer lifestyles and spending dynamics is another prominent factor propelling the (dodecanedioic acid) DDDA market size over the estimated period. Paints & coatings are vital for the vehicle’s body parts including engine and body panels. These automotive parts require powder coatings to enhance the appearance along by providing corrosion resistance. The global automotive production, both commercial as well as personal vehicle, was approximately 90 million units in 2015 and is likely to increase by 2023. This trend shall boost the business growth. Furthermore, the product is also used in the personal care industry as an antiseptic. Increasing consumer awareness toward personal wellbeing will increase the product demand by 2023.

The global (dodecanedioic acid) DDDA market size is directed and regulated by stringent environmental legislations toward VOC emissions. This may hamper the overall business growth over the projected period. In addition, the product faces stiff substitute threats from sebacic acid and adipic acid as these acids can be used in the nylon production. However, the emergence of bio-based (dodecanedioic acid) DDDA market share will create new growth opportunities for the industry participants. The bio-based industry comprises environment-friendly feedstock including fatty acids, fatty acid distillates, plant oils (nonfood), palm oil, palm kernel oil, and soap stocks.