Summary

Table of Content

Document Scanner Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Document Scanner Market Size

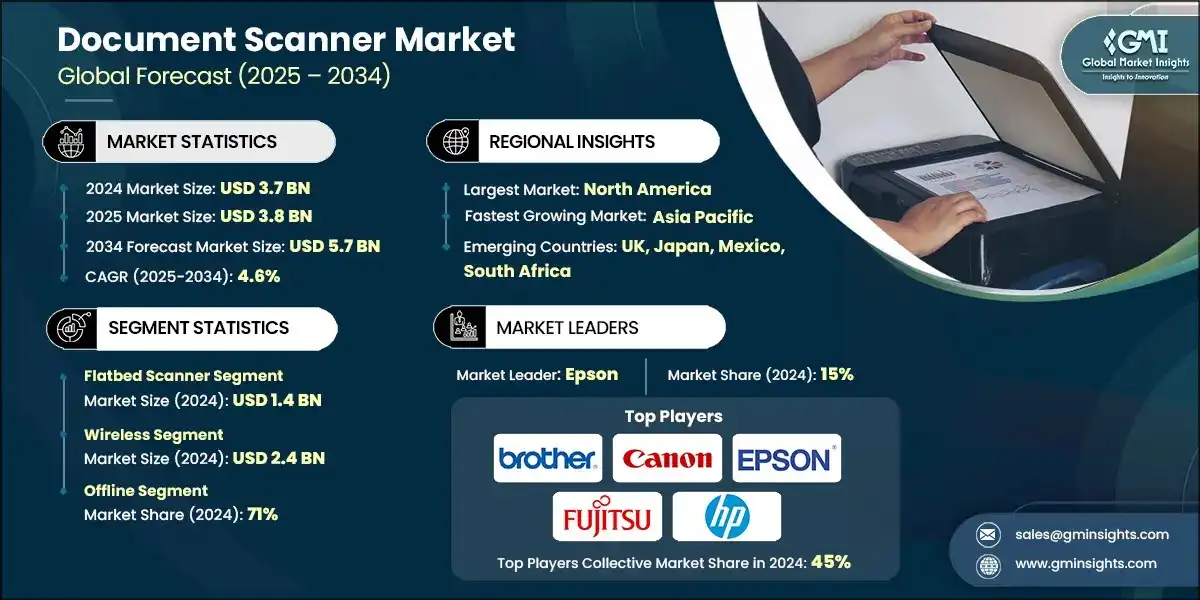

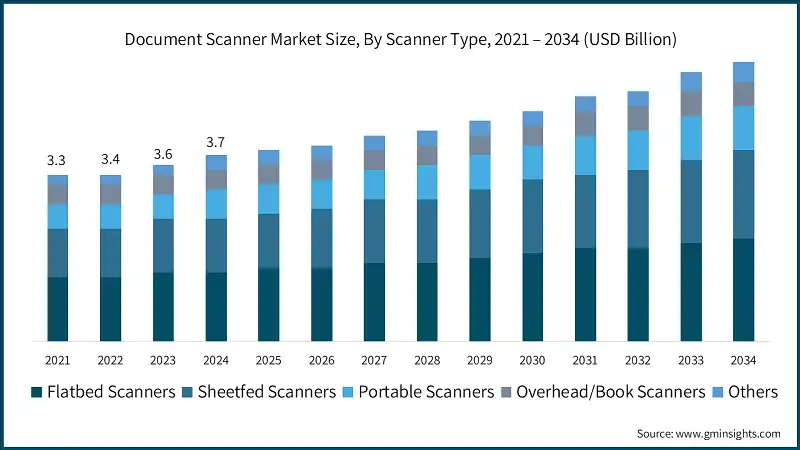

The global document scanner market size was estimated at USD 3.7 billion in 2024. The market is expected to grow from USD 3.8 billion in 2025 to USD 5.7 billion in 2034, at a CAGR of 4.6%, according to latest report published by Global Market Insights Inc.

To get key market trends

The global transformation into a digital world is one of the major components that is driving the document scanner market. Organizations in every sector including healthcare, banking, education, and government are digitizing records to increase the efficiency of their day-to-day operations, decrease reliance on paper, and to provide easier access to data. Speed of retrieval, compliance with data protection laws, and a growing number of enterprise content management (ECM) systems have all impacted this trend toward the need to digitize records and documents.

Scanners will serve as the primary way for organizations to change their business process from physical document management to searchable and secure digital documents. The other major function that is likely to influence the growth of the document scanner market is shift to remote or hybrid working. Documenting work now requires accessibility to documents from different places and will increasingly depend on the type of document management system (DMS) to provide fast archival, sharing, or reproductions.

Scanners that combine cloud storage and software-based collaboration tools will allow teams to share, discuss, and archive documents in a decentralized way. As organizations increase their investments in digital infrastructure, the demand for document scanners that are easy to use, reliable, fast, and intelligent will continue to grow steadily over the long-term.

Flatbed scanners are favored as they can easily cope with fragile, bound, or odd-shaped documents potentially damaging the document. This makes flatbed scanners the preferred choice in areas where document preservation is critical such as education, legal, and archival services. Flatbed scanners offer high resolution and distortion free images, making them appropriate for high-precision functions such as graphic design and medical imaging. These attributes help secure their position at the top of the list of scanners used by professionals and institutions.

North America is at the forefront of the document scanners market attributable to the mature enterprise technology landscape and the omnipresence of digital workflows in industries such healthcare, finance, education, and government. The region's emphasis on data security, EU regulatory compliance, and operational efficiencies has cultivated a growing market for high-speed network-friendly scanners supporting encrypted scanning, seamless cloud integration, and automated document processing.

In this regard, North America is a competitive center for innovation and early adoption of intelligent document scanning technologies. The market in North America benefits from the maturity of the distribution ecosystem consisting of a strong offline retail network integrated with a rapidly growing e-commerce network, giving consumers access to document scanners across a variety of use cases ranging from large enterprises to small businesses to individual consumers.

Document Scanner Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.7 Billion |

| Market Size in 2025 | USD 3.8 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.6% |

| Market Size in 2034 | USD 5.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Digital transformation | This trend is accelerating demand for paperless workflows, forcing organizations to adopt high speed scanners for efficient digitizing documents and compliant data management. |

| Technological advancements | This includes AI-extracted OCR, duplex scanning and image correction, which accelerates scanner functionality, eliminating manual input and improving content workflows. |

| Remote work and cloud integration | This is pushing teams to adopt smaller cloud enabled scanners for decentralized collaboration that allows the entire document to be accessed, shared and stored with easier and simpler formats and across different hybrid environments. |

| Pitfalls & Challenges | Impact |

| High initial investment | Advanced scanners with high speed, duplex and OCR capabilities typically require significant capital at the start, which can limit adoption, particularly on small and medium sized enterprises. |

| Security & privacy concerns | Digitization possesses risks to sensitive documents by creating unauthorised access, data breaches and compliance violations announced sensitive documents. |

| Opportunities: | Impact |

| AI & machine learning integration | Advanced features like automated text recognition, document classification and automated data extraction are streamlining workflows reducing manual workloads and improving accuracy. |

| Mobile & cloud-based scanning apps | The increasing prevalence of remote work and the mobile first workplace is generating interest in portable, app enabled scanners with cloud capabilities, real time storage access and collaboration. |

| Market Leaders (2024) | |

| Market Leaders |

15% market share |

| Top Players |

The collective market share in 2024 is 45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | UK, Japan, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Document Scanner Market Trends

Cloud-based scanning solutions are becoming increasingly popular as organizations look for flexible, secure, and scalable ways to manage documents. These solutions allow users to scan directly to cloud storage platforms, such as Google Drive and Dropbox, and enable remote access and collaboration.

- This is especially relevant to organizations that are employing hybrid work environments, where employees need to access documents from various locations without being limited by physical storage.

- With the shift toward remote and more specialized jobs, the demand for mobile, compact and effective scanners with mobile interfaces is on the rise. Typically, these scanners are wireless, portable, and compatible with numerous mobile apps, meaning that the target market is increasing for organizational personnel working remotely and for consumers and freelancers that need a scanner outside of a traditional office setting.

- Artificial Intelligence (AI) and Machine Learning (ML) are changing document scanners into smart data processing devices. These technologies lead to possible features, like value-added automatic document classification, various intelligent cropping, and in-the-moment error correction.

- Conventional document scanners coupled with AI allow text extraction with Optical Character Recognition (OCR), and Automated Data Capture capabilities give users the ability to search and edit documents that are scanned directly into OCR search or database usage and accessibility, which greatly improves productivity and usability of data.

- Sustainability is a growing challenge when designing products and making purchasing decisions. Manufacturers are operating in energy-efficient scenarios, with their scanners made with less energy usage and recyclability as opposed to typical plastic materials.

- Eco-friendly features that have emerged in the technological landscape of document position scanners are now incorporated into scanning, such as duplex scanning (to save on paper). Energy efficient and lower comparator emissions (which we now sell as green products) are quickly becoming normalized for many buyers today.

Document Scanner Market Analysis

Learn more about the key segments shaping this market

Based on scanner type, the document scanner market is divided into flatbed, sheetfed, portable, overhead/book and others. In 2024, flatbed scanner held the major market share, generating a revenue of USD 1.4 billion.

- Flatbed scanners are of the highest versatility when it comes to scanning documents of all kinds, allowing people to scan anything from documents to bound items, photographs, and books without any risk of damaging them. The open scanning surface allows for lots of different thicknesses and sizes, allowing scanning service providers to take advantage of the different types of documents used in education, legal and archive services.

- They also offer the highest quality images without distortion, allowing for a precise production of document elements like colour, which is critical for document-heavy activities like graphic design, medical imaging, or preserving historical documents. Due to these reasons, flatbed scanners are often the tool of choice by those whose primary commitment is to produce the best quality scanned documents.

- Setup is minimal. Flatbed scanners are very easy to use and have thick documentation explaining their functionality. Most have no physical settings out-of-the-box, and configuration is no more complex than demonstrating functionality. The flexibility and ease of integration and utilization into a digital workflow is advantageous in terms of quality and speed.

- Flatbed scanners are used and preferred in workflows that prioritize preservation, like those in museums, libraries, or legal offices (microfiche). Most flatbed glass scanners employ a straightforward scanning approach for document preservation that does not involve bending a document, feeding a document, or subjecting a document to risks of damage.

Learn more about the key segments shaping this market

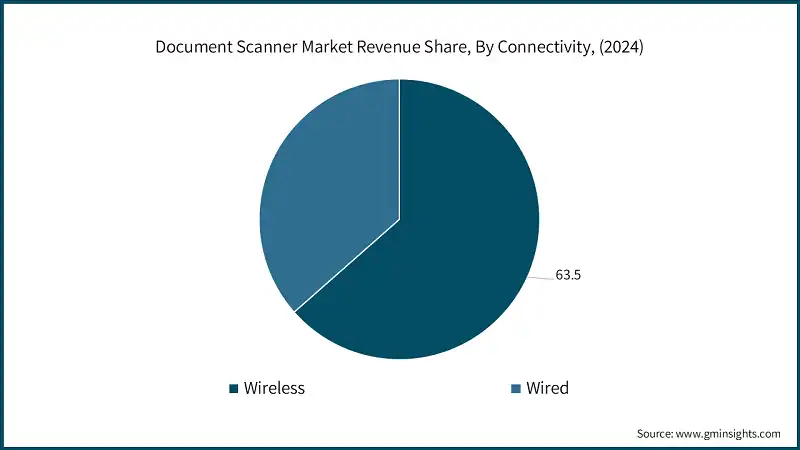

Based on connectivity, the document scanner market is segmented wireless and wired. In 2024, wireless held a major market share, generating a revenue of USD 2.4 billion.

- Wireless capability supports integration with a variety of cloud solutions and mobile devices, which allow users to scan and share documents directly to service or cloud providers like Google Drive, Dropbox, or email without having to make a physical connection to a desktop computer. This mode of operation encourages widespread usage, supports remote work, and minimizes interruptions associated with document scanning.

- The elimination of cables allows for greater physical distribution of wireless scanners, simplified the installation of wireless devices, and offers users a convenient solution that supports shared/open plan office spaces, and often requires less physical space for workplaces that cannot accommodate dedicated desktop file scanner installations.

- Wireless scanning creates access for multi-user functionality, which allows many users to operate the same scanner at a given time from their own individual device.

- In office environments, schools, or government departments where multiple people may require access to a scanner and each employee would require access at various times, wireless is more convenient and has an improved potential for productivity due to its multi-user capacity.

- The emergence of app enabled scanning through mobile phones and tablets is fuelling a trend of more demand for wireless scanning functionality. Many consumers can now begin a scan from their mobile phone, modify their scanning settings, and manage new and revised documents through the app on the existing mobile phone or tablet which negates the need for a dedicated computer system connected via wire or wi-fi.

Based on the distribution channel, the document scanner market is segmented offline and online. The offline segment held the largest share, accounting for 71% of the market in 2024.

- When using offline channels such as retail outlets, authorized resellers, or electronics warehouses, buyers can physically inspect document scanners and see and/or test the scanners in action before making a purchasing decision.

- For buyers for whom build quality, scanning speed, and compatibility with other systems are high priorities, hands-on experiences increase the persuasiveness and trustworthiness of offline sales.

- For several commercial and government entities, the preference for the use of offline channels is also driven by existing relationships - familiarity with a particular vendor - and the possibility of purchasing in bulk and receiving adequate follow-up service.

- Many offline vendors also offer installation, user training, and maintenance services to ensure their systems are established properly and functioning long enough in enterprise aspects that focus on the durability and resilience of the solutions deployed.

- While offline distribution is under pressure to transition online, it also offers affordability, especially in certain emerging markets where penetration of digital and e-commerce can sometimes present obstacles. Local retailers and distributors can offer education about new products, recommendations, and trust through relationships and face-to-face meetings.

Looking for region specific data?

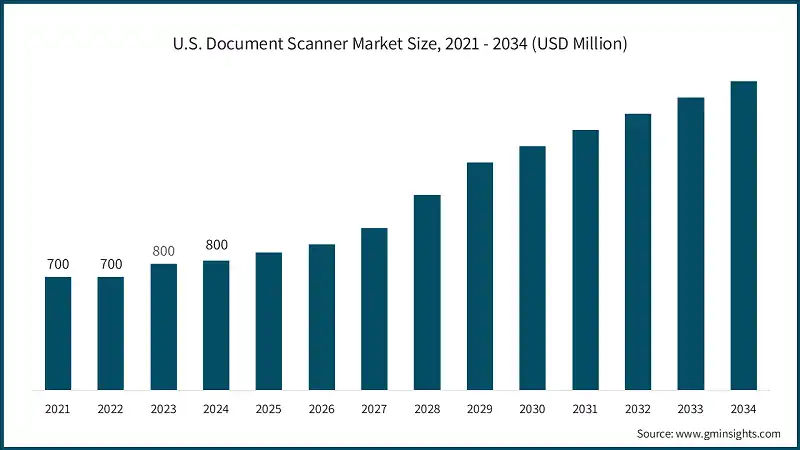

In 2024, the U.S dominated the document scanner market, accounting for around 65.2% and generating around USD 800 million revenue in the same year.

- The U.S. leads the scanner market due to high consumer awareness, maturity of digital workflows, and heavy demand for the scanners from the healthcare, educational sector and government sector. The fact that there are so many "major" scanner manufacturers, together with a technology ecosystem that is now well-established means innovation and speed to market for advanced scanning solutions are great.

- North America leads in market share primarily because of the established and diverse enterprise landscape in the region in which enterprise businesses are willing to invest in quality, security, and automating their workflows. The offline retail network is strong due to retailers too are willing to invest in quality, and online shopping is increasing, and your document scanner can be purchased in a local or regional market.

The Europe document scanner market holds second largest share in 2024 and is expected to grow at 5.1% during the forecast period.

- The European document scanner market continues to develop under strong data protection laws and digital compliance requirements across many sectors, too many to mention comprehensively here, including healthcare, public administration, and legal. The demand for scanners that allow encrypted workflows and produce archival-quality images is being stimulated by front-runners in the market like Germany, France, and the UK.

- Also, a developed enterprise and institutional sector in Europe are advantageous, allowing for ongoing momentum for digital transformation, which is increasingly supported with external funding or tax incentives from many European governments.

- There are both global players and regional producers of scanners in Europe, which means innovation continues, and improved technologies can be accessed. The mix of offline and online channels for distribution offers that the scanners can find their way to many types of environments, primarily in business.

The Asia Pacific document scanner market, China holds a market share of around 42.4% in 2024 and is anticipated to grow with a CAGR of around 5.4% from 2025 to 2034.

- East Asian countries such as China, Japan, South Korea are seeing a rise in myopia cases among children and youth which has arisen from prolonged screen access. The increasing incidence of myopia is contributing to demand for corrective document scanners, especially daily disposable and monthly disposable types.

- Countries in East Asia such as China, Japan, and South Korea are driving an increase in digitalization in their education, healthcare and government systems and this is due to a decrease in the amount of time individuals are using their mobile phones and portable devices and an increase in the consumption of essential data and need for retainment of relevant data associated with said screens.

- The increased consumption of portable devices is contributing to the demand for highly efficient compact document scanners and the increasing demand for network enabled document scanners allowing for high volume scanning and secure digital archives. Rapid levels of urbanization have also increased disposable income within these regions and there is increased access to all forms of office technology including but not limited to document scanners.

- Consumers and institutions are moving away from manual record keeping and associated record- storage to digitized workflows, supported by higher levels of capacity assisting infrastructure potential, and increased awareness of technology and a preference for smart multifunctional scanning devices.

Latin America document scanner market is growing at a CAGR of 2.9% during the forecast period.

- Brazil and Mexico are seeing an increase in digitization of education and public services due to an increased need for better document management and digitized record keeping. The digitization of documents presupposes a far greater need for document scanners - by government offices, schools, and small and medium enterprises who no longer have the patience for slow, unreliable archiving and workflow technologies.

- In addition to institutional buyers, document scanners are growing in acceptance by urban consumers, for their own organizational needs or small businesses. As the standards of living increase together with disposable income, it is easier to find and buy scanning technology. With the upswing of retail and e-commerce, there is also much more access to compact, multi-functional, and easy to operate devices.

Document Scanner Market Share

- Epson is leading with a 15% market share. Brother, Canon, Epson, Fujitsu, and HP collectively hold 45%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Epson has emerged as a name in compact, sustainable, and high-performing scanners. The company has broad offerings of scanners for consumer and enterprise usage with proper attention paid to image quality, scan speed, height, and sustainability. The advanced features included on Epson scanners like duplex scanning, wireless scanning abilities, and intuitive software have made Epson scanners a choice for consumers interested in low-supplying, efficient scanning technologies.

- HP operates as a leader in the document scanner market by providing great value, enterprise document scanner experiences that are easy to adopt for use in larger IT ecosystems. HP is characterized by robust designs, trustworthy use-cases, and very easy interfaces for learning, even in busy environments. Therefore, HP scanners are popular in high-volume environments requiring speed and workflow automation while also adopting secure scanning processes.

Document Scanner Market Companies

Major players operating in the document scanner industry are:

- Ambir Technology

- Avision

- Brother Industries

- Canon

- Contex

- Fujitsu

- HP

- IRIS

- Kodak Alaris

- Panasonic

- Plustek

- Ricoh Company

- Seiko Epson

- Visioneer

- Xerox Holdings

Brother Industries is known for its practical, cost-effective scanning solutions that really made a name for itself among small and medium-sized businesses. The brand is known for its compact desktop scanners that offer speed, simple functionality and reliability. As Brother focuses on ease of use and it has built a strong customer experience and integrated with many document management systems, it has been able to cultivate brand loyalty in an established yet competitive scanning industry.

Kodak Alaris is known for high performance scanning solutions that are designed for permanent business processes. It offers a complete lineup of production-level scanning solutions with high-quality image capture, advanced paper handling, and intelligent data capture. The company is especially respected for its commitment to ensuring workflow efficiency and able to handle a high volume of documents consistently, which is very valuable for most industries that deal in a concentrated amount of documentation daily.

Document Scanner Industry News

- In August 2025, Epson America has launched the DS-730N network color document scanner, compliant with the Trade Agreements Act (TAA), and appropriate for federal agencies, and organizations looking for compliant options. The DS-730N has built-in network connectivity, and TWAIN and ISIS® drivers. The addition of network connectivity provides a variety of document management options, and as a TAA compliant product, can be used in secure, high-volume environments.

- In August 2025, Kodak Alaris enhanced its scanner product line with new features on the KODAK S2085f, S3000 Series and S3000 Max Series scanners to assist in improving the efficiency of the scanner and provide policy compliance with changes in standards. Kodak Alaris has added innovation in support of the growing demands in the document capture market for high quality, flexible and compliant document capture solutions, primarily for government and enterprise markets, in alignment with the Federal Agencies Digital Guidelines Initiative (FADGI).

- In February 2025, Xerox released the EveryDoc IDP App, new intelligent solution which is built on the Intelligent Document Processing platform provided by Xerox. Built using advance AI models, the EveryDoc App automates the ingest, data extraction and workflow of documents. Additionally, the new solution enables multi-channel document ingestion and is integrated with business applications to help organizations make important decisions faster and more with speed and accuracy.

- In September 2024, Canon launched its latest range of innovative office solutions and technologies including two new printers (1440i and C1333i) and the DR-S250N network document scanner, that can increase productivity and connectivity in modern workplaces. These office solutions are designed to suit the various needs of corporates, SMEs and government departments focusing on secure and efficient document management.

- In March 2023, Brother Industries, Ltd. is recognized in the document scanner industry with the ADS-4700W and ADS-4900W, winners in the 2023 Scanner Pick Awards presented by Keypoint Intelligence, an independent evaluator of document technologies. Brother's scanners were recognized for their compact product design and advanced capabilities, including a user defined capability that allows users to store up to 56 configurable scanning workflow patterns that can be customized with associated workflows to enhance processes such as image processing or data extraction.

The document scanner market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Scanner Type

- Flatbed scanners

- Sheetfed scanners

- Portable scanners

- Overhead/book scanners

- Others (drum, barcode)

Market, By Technology

- Optical character recognition

- Duplex scanning

- Color vs monochrome

- Wireless

- Cloud integration

Market, By Capacity

- Upto 100 sheets

- 100-200 sheets

- Above 200 sheets

Market, By Connectivity

- Wired

- Wireless

Market, By Image Quality

- Less than 100 dpi

- 100-300 dpi

- 300-600 dpi

- More than 600 dpi

Market, By Document Size

- Less than A4

- A4

- A3

- A2

Market, By Price

- Low

- Medium

- High

Market, By Application

- Government

- Banking & finance

- Healthcare

- Education

- Others (IT, legal, retail, etc.)

Market, By Distribution Channel

- Offline

- Online

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the document scanner sector?

The U.S. accounting for 65.2% of the global market share and generating approximately USD 800 million in revenue in 2024. This leadership is attributed to high consumer awareness, mature digital workflows.

What are the upcoming trends in the document scanner market?

Key trends include cloud-based scanning, portable/mobile scanners, AI/ML integration, and eco-friendly designs with duplex and energy-efficient features.

Who are the key players in the document scanner industry?

Major players include Ambir Technology, Avision, Brother Industries, Canon, Contex, Fujitsu, HP, IRIS, Kodak Alaris, Panasonic, Plustek, Ricoh Company, Seiko Epson, and Visioneer.

What was the valuation of the wireless scanner segment in 2024?

The wireless scanner segment accounted for USD 2.4 billion in 2024, led by its integration with cloud solutions and mobile devices, enabling seamless remote operations.

What is the market share of the offline segment in 2024?

The offline segment held the largest market share, accounting for 71% in 2024, as buyers preferred physical inspection and testing of scanners before purchase.

What is the expected size of the document scanner market in 2025?

The market size is expected to grow to USD 3.8 billion in 2025.

How much revenue did the flatbed scanner segment generate in 2024?

The flatbed scanner segment generated USD 1.4 billion in revenue in 2024, due to its versatility in scanning various document types.

What is the market size of the document scanner in 2024?

The market size was estimated at USD 3.7 billion in 2024, driven by the global shift towards digitization across various sectors.

What is the projected value of the document scanner market by 2034?

The market is poised to reach USD 5.7 billion by 2034, growing at a CAGR of 4.6%, fueled by advancements in AI, cloud-based solutions, and increasing demand for digital workflows.

Document Scanner Market Scope

Related Reports