Home > Chemicals & Materials > Specialty Chemicals > Custom Synthesis > Dimer Acid Market

Dimer Acid Market Size

- Report ID: GMI509

- Published Date: Jun 2016

- Report Format: PDF

Dimer Acid Market Size

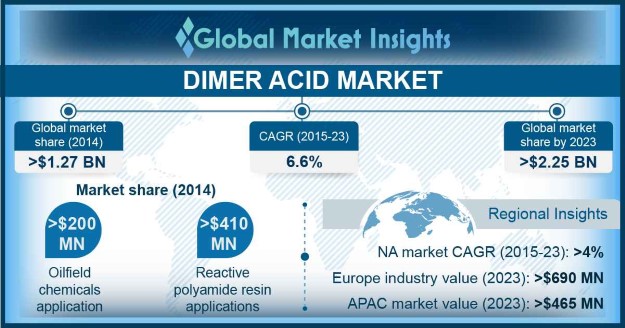

Dimer Acid Market size surpassed USD 1.35 billion in 2015 and may expect gains at over 6.5% from 2016 to 2023.

Increasing construction activities and supportive government initiatives to liberalize infrastructure spending is expected to boost dimer acid market share. India, China, Thailand and Malaysia are expected to witness high growth over the forecast period owing to rapid urbanization trends which has facilitated the need of better commercial and residential infrastructure. They are widely used in construction industry in manufacturing paints & coatings owing to their durability against environmental subspecialties such as acid rain & snow and resonance with various architectural styles may augment market growth.

The product is widely used in manufacturing thermally stable coatings for utilization in various industries such as automotive, construction, and electronics. Its chemically inert and low toxic nature makes it a viable choice for manufacturers owing to rising stringent regulations for high quality and customer centric safe products.

They are also known as dimerized fatty acids and are prepared from unsaturated fatty acids obtained from oleic acid, canola oil, cotton seed oil, or tall oil. They are widely utilized for manufacturing polyamide hot melt adhesives, alkyd resins, surfactants, lubricants, and fuel oil additives. Its nontoxic nature, economic feasibility, and easy availability makes it attractive to manufactures. It is utilized in various industries such as adhesives, oil & gas, and lubricants owing to chemical and thermally stable characteristics which may accelerate dimer acid market value.

| Report Attribute | Details |

|---|---|

| Base Year: | 2015 |

| Dimer Acid Market Size in 2015: | 1.35 Billion (USD) |

| Forecast Period: | 2016 to 2023 |

| Forecast Period 2016 to 2023 CAGR: | 6.5% |

| 2023 Value Projection: | 2.25 Billion (USD) |

| Historical Data for: | 2012 to 2015 |

| No. of Pages: | 70 |

| Tables, Charts & Figures: | 66 |

| Segments covered: | Application and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Rising demand for alternatives products may hamper industrial growth owing to rising presence of synthetic and more economically feasible alternatives such as mineral turpentine and zinc oxide. Manufacturers are investing in developing novel methods of production which are economically compatible with synthetic products, offer low toxicity, and better chemical stability over wide working temperature which may stimulate market share.