Summary

Table of Content

Digital Therapeutics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Digital Therapeutics Market Size

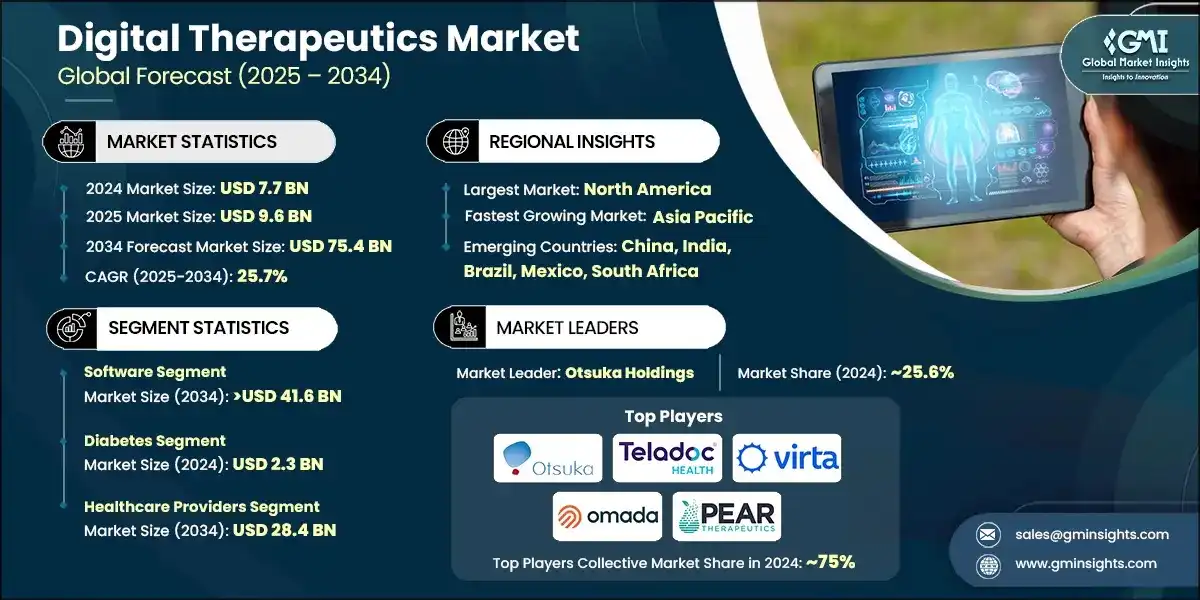

The global digital therapeutics market was valued at USD 7.7 billion in 2024. The market is expected to grow from USD 9.6 billion in 2025 to USD 75.4 billion in 2034, at a CAGR of 25.7% during the forecast period according to the latest report published by Global Market Insights Inc. This growth is attributed to the global increase in chronic conditions, including diabetes, cardiovascular diseases, and mental health disorders, that has created a demand for digital therapeutics.

To get key market trends

These solutions provide scalable, cost-effective, and personalized treatment options for disease management, which appeal to both healthcare providers and patients. In addition, the increasing integration of AI, machine learning, mobile apps, wearables, and gamification enhances the effectiveness and personalization of digital therapeutics. These innovations improve patient engagement, adherence, and outcomes, accelerating market adoption. For instance, according to the U.S. Food and Drug Administration (FDA), the number of AI/ML-enabled medical devices receiving marketing authorization increased from 29 in 2021 to 91 in 2022. Additionally, Accenture reported that 85% of healthcare executives implemented AI strategies in their organizations by 2022.

Digital therapeutics reduce healthcare costs by decreasing hospital visits and enabling remote patient monitoring. According to the Centers for Medicare & Medicaid Services (CMS), U.S. healthcare spending reached USD 4.3 trillion in 2021, with an estimated 20% reduction potential through digital health solutions. The U.S. Food and Drug Administration (FDA) approved 132 digital therapeutics solutions in 2022, a 45% increase from 2021.

Similarly, McKinsey's 2023 report projects that digital therapeutics could generate USD 23 billion in annual healthcare cost savings by 2025 through reduced hospital readmissions and enhanced remote monitoring capabilities. These solutions are more affordable and accessible than traditional therapies, particularly through smartphone applications.

Digital therapeutics (DTx) are patient-focused software applications that deliver evidence-based clinical interventions to prevent, manage, or treat a medical condition or disease. These software programs, which can take various forms like mobile apps or virtual reality experiences, have proven clinical benefit and are regulated like medical devices. Major players in the industry are Otsuka Holdings, Virta Health, and Omada Health Inc. These players dominated the market by adopting various strategies such as product expansion and establishing global distribution networks.

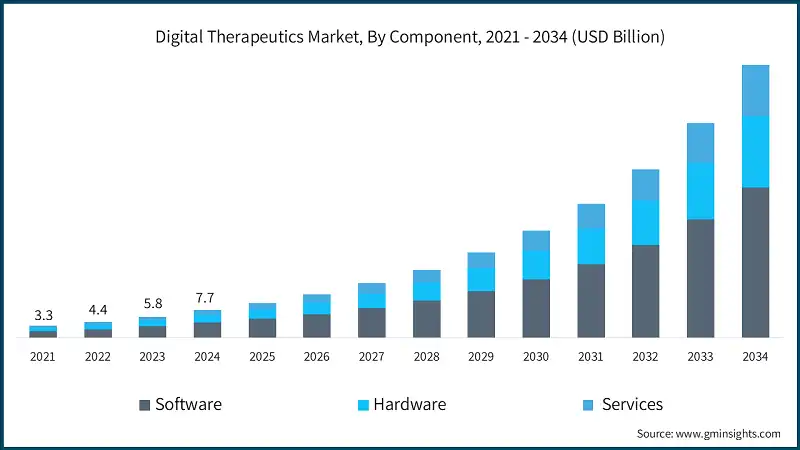

Digital therapeutics market has witnessed steady growth, growing from USD 3.3 billion in 2021 to USD 5.8 billion in 2023. The approval and recognition of digital therapeutics by governments and health authorities continue to increase. Regulatory frameworks, such as Germany's Digital Healthcare Act, enable healthcare providers to prescribe digital therapeutics, which enhances their credibility and market acceptance. As of 2023, the German Federal Institute for Drugs and Medical Devices (BfArM) has approved 48 digital health applications (DiGA) for prescription, that further contributes to market growth.

Additionally, growing investment and partnership by venture capital firms and tech companies in DTx startups, drives the growth of the market. Strategic collaborations between pharma and digital health firms are accelerating innovation and expanding market reach.

Digital Therapeutics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 7.7 Billion |

| Market Size in 2025 | USD 9.6 Billion |

| Forecast Period 2025 – 2034 CAGR | 25.7% |

| Market Size in 2034 | USD 75.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing prevalence of chronic disease | Rising chronic conditions boost demand for scalable, personalized digital solutions for long-term disease management. |

| Rising demand for cost containment | DTx reduces hospital visits and treatment costs, supporting more efficient and affordable healthcare delivery. |

| Expansion of quality-of-care delivery | Digital tools enhance care coordination, monitoring, and outcomes, improving overall healthcare quality and accessibility. |

| Growing popularity of digital therapeutics | Wider acceptance of app-based therapies drives adoption across patients, providers, and payers globally. |

| Pitfalls & Challenges | Impact |

| Data security and privacy concerns | • Lack of trust in data handling discourages adoption, especially in sensitive areas like mental health and chronic care. |

| Lack of skilled IT professionals | • Shortage of tech talent slows development, integration, and support of advanced DTx platforms across healthcare systems. |

| Opportunities: | Impact |

| Increasing shift toward preventive and value-based care | As healthcare systems move toward preventive and value-based models, DTx platforms offer personalized, data-driven interventions that reduce hospitalizations and improve long-term outcomes. |

| Expansion of combination therapy models | Combining digital therapeutics with traditional pharmaceuticals enhances treatment adherence, patient engagement, and clinical outcomes. |

| Market Leaders (2024) | |

| Market Leaders |

25.6% market share |

| Top Players |

Collective market share in 2024 is 75% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Digital Therapeutics Market Trends

- The rising prevalence of chronic conditions, including diabetes, cardiovascular diseases, and mental health disorders, drives the demand for digital therapeutics. These solutions offer scalable, cost-effective, and personalized treatment options for chronic disease management, benefiting both healthcare providers and patients.

- The American Heart Association (2023) indicated that cardiovascular diseases affect 48% of adults in the U.S., while the World Health Organization estimates that depression affects 280 million people globally. In addition, digital therapeutics companies such as Livongo Health reported a 168% year-over-year growth in diabetes management enrollment in 2021, highlighting the growing adoption of digital solutions for chronic disease management.

- Moreover, the increasing focus on early intervention and lifestyle changes is expanding digital therapeutics into preventive healthcare, particularly for metabolic and neurological conditions. Digital therapeutics company Omada Health reported in 2023 that its preventive digital care program reduced the risk of type 2 diabetes by 30% among high-risk participants.

- Additionally, the National Institute of Mental Health (NIMH) data from 2021 showed that 21% of U.S. adults experienced mental illness, leading to increased adoption of preventive digital mental health solutions.

- The digital therapeutics market is expanding through direct-to-consumer sales and employer wellness programs, extending beyond traditional healthcare settings. According to the National Business Group on Health's 2021 survey, 76% of employers planned to offer digital therapeutics as part of their employee wellness programs by 2023.

- Further, digital therapeutic platforms targeting mental health conditions, ADHD, and behavioral disorders are experiencing significant growth, driven by increased mental health awareness and widespread smartphone adoption. The National Institute of Mental Health reported that mental health app usage increased by 47% from 2021 to 2023, with 38 million Americans using at least one mental health app regularly.

- Additionally, innovations like smart inhalers, microneedle patches, and targeted-release devices are enhancing precision and reducing side effects. In addition, virtual replicas of human physiology are being used to simulate drug responses and optimize therapy design.

- Further, regulatory acceptance of Real-World Evidence (RWE) and randomized clinical trials is improving the credibility and reimbursement potential of DTx products.

- Cloud platforms enable hosting, data analytics, and remote updates, which reduces infrastructure costs and improves accessibility. For instance, International Data Corporation (IDC) forecasts that global spending on public cloud services and infrastructure will reach USD 1.3 trillion by 2025. Similarly, Microsoft reported that its Azure cloud revenue grew by 46% in Q4 2021, while Amazon Web Services (AWS) recorded a 40% year-over-year revenue growth in the same period.

Digital Therapeutics Market Analysis

Learn more about the key segments shaping this market

Based on component, the global digital therapeutics market is divided into software, hardware and services. The software segment accounted for 54.3% of the market in 2024. The segment is expected to exceed USD 41.6 billion by 2034, growing at a CAGR of 25.9% during the forecast period. The software segment is further divided into on-premise and cloud-based software.

- Digital therapeutics software enables highly personalized treatment plans using patient data, AI algorithms, and behavioral science. These platforms help users build long-term healthy habits, improve medication adherence, and manage chronic conditions more effectively. The ability to tailor interventions to individual needs is a major driver of software adoption in the DTx market.

- Software-based DTx solutions are easily scalable and accessible via smartphones, tablets, and computers. This allows healthcare providers to reach patients in remote or underserved areas, reducing the need for in-person visits and expanding care delivery. The convenience and flexibility of software platforms are key growth enablers.

- Further, hardware segment is expected to grow with a significant CAGR of 25.2% during the analysis period. Hardware-integrated DTx devices are increasingly receiving regulatory approvals (e.g., FDA, CE) for use in clinical settings. This validation boosts trust among providers and patients, encouraging adoption.

Based on the application, the digital therapeutics market is segmented into diabetes, obesity, cardiovascular, mental & behavior health, hypertension, insomnia and other applications. The diabetes segment dominated the market in 2024 with a revenue of USD 2.3 billion.

- The increasing incidence of Type 1, Type 2, and gestational diabetes driven by aging populations, sedentary lifestyles, and poor dietary habits is fueling demand for scalable and effective management solutions. Digital therapeutics offer personalized, non-invasive interventions that help patients monitor glucose levels, adhere to medication, and modify behavior, making them essential tools in chronic disease care.

- In addition, Innovations in mobile apps, wearable sensors, AI-driven analytics, and cloud-based platforms have transformed diabetes care.

- These technologies enable real-time monitoring, predictive insights, and tailored behavioral coaching, improving glycemic control and reducing complications. Their integration into DTx platforms enhances usability and clinical outcomes, driving adoption across healthcare systems.

- The cardiovascular segment of the digital therapeutics market is projected to grow rapidly due to aging populations, sedentary lifestyles, and poor dietary habits. This growing health crisis is fueling demand for scalable, non-invasive solutions.

- Artificial intelligence and machine learning are transforming cardiovascular disease management by enabling predictive risk assessments, early diagnosis, and personalized treatment plans.

Learn more about the key segments shaping this market

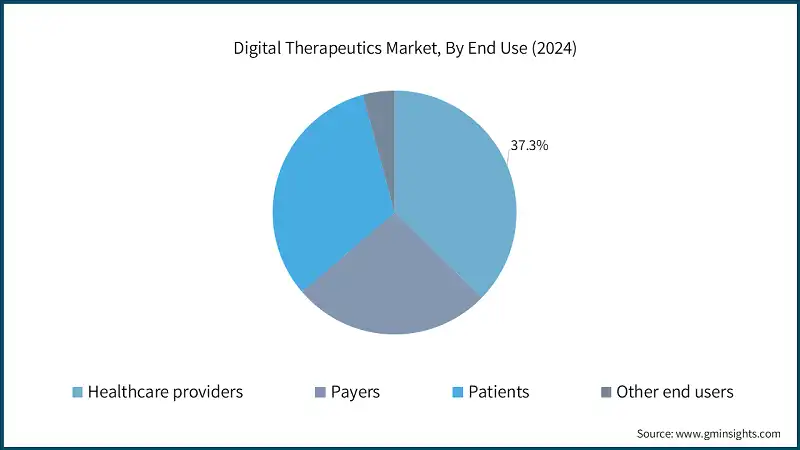

Based on end use, digital therapeutics market is classified into healthcare providers, payers, patients and other end users. The healthcare providers segment dominated the market in 2024 and is expected to reach USD 28.4 billion by 2034.

- Healthcare providers are increasingly integrating DTx into clinical workflows to monitor patient progress, adjust treatments, and enhance care delivery. These platforms offer real-time data, predictive analytics, and personalized interventions, helping clinicians make informed decisions. The ability to streamline care and improve outcomes is a major driver for provider adoption.

- Providers prioritize DTx solutions with strong clinical evidence and regulatory approvals (e.g., FDA, CE). These credentials ensure safety, efficacy, and reliability, making DTx a trusted tool in clinical settings. As more digital therapies receive formal recognition, healthcare professionals are more confident in prescribing and integrating them into treatment plans.

- DTx platforms often include gamification, reminders, and interactive interfaces that boost patient engagement. Providers benefit from improved adherence to treatment plans, better communication, and more consistent health tracking, which collectively enhance clinical outcomes and patient satisfaction.

Looking for region specific data?

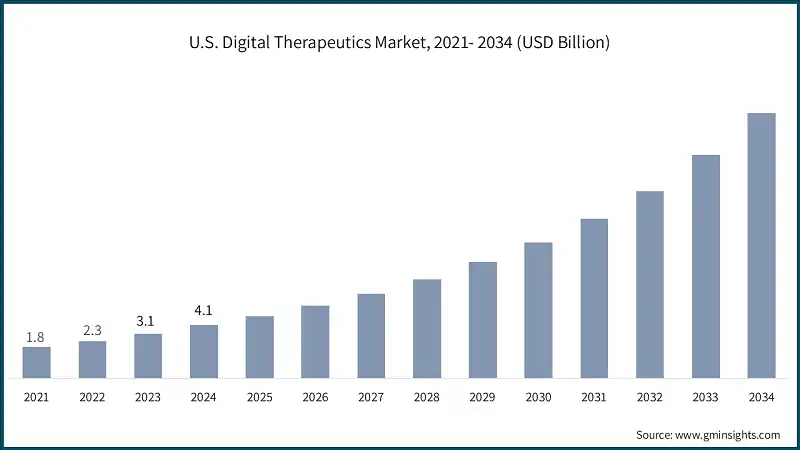

North America Digital Therapeutics Market The North America market dominated the market with a market share of 58.1% in 2024. The U.S. digital therapeutics market was valued at USD 1.8 billion and USD 2.3 billion in 2021 and 2022, respectively. The market size reached USD 4.1 billion in 2024, growing from USD 3.1 billion in 2023. Europe Digital Therapeutics Market Europe market accounted for USD 1.6 billion in 2024 and is anticipated to show lucrative growth over the forecast period. Germany dominates the European digital therapeutics market, showcasing strong growth potential. The Asia Pacific market is anticipated to grow at the highest CAGR of 26.1% during the analysis timeframe. China digital therapeutics market is estimated to grow with a significant CAGR, in the Asia Pacific market. Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period. Saudi Arabia market to experience substantial growth in the Middle East and Africa market in 2024. The market presents a dynamic and moderately consolidated competitive landscape, shaped by a mix of established MedTech giants, digital health innovators, and emerging health tech startups. Leading companies such as Otsuka Holdings, Teladoc Health, Virta Health, Pear Therapeutics, and Omada Health collectively account for approximately 75% of the market share. Their dominance is driven by strategic investments in IoT integration, remote monitoring technologies, and AI-powered diagnostics. To reinforce their market positions, these companies are adopting multi-pronged strategies including mergers and acquisitions, strategic partnerships with hospitals, insurers, and technology firms, and expansion into cloud-based health platforms. Their focus remains on enhancing device interoperability, improving patient outcomes, and supporting value-based care models across global healthcare systems. Meanwhile, emerging players such as Pear Therapeutics, Akili Interactive Labs, Kaia Health, Click Therapeutics, Welldoc, and Big Health are fueling innovation through the development of wearable biosensors, gamified mobile health apps, and edge computing-enabled devices. These startups are particularly influential in regions like Asia-Pacific, Latin America, and the Middle East, where rising mobile penetration, healthcare digitization, and demand for affordable remote care solutions are accelerating adoption. The market continues to evolve amid intensifying competition, growing regulatory alignment (e.g., FDA and CE approvals for Software as a Medical Device), and a shift toward patient-centric, data-driven care. Companies are actively adapting their product portfolios to meet the increasing demand for real-time monitoring, home-based care, and preventive health solutions, ensuring sustained innovation and global market expansion. Prominent players operating in the digital therapeutics industry are as mentioned below: Otsuka Holdings leads the digital therapeutics market with a share of ~25.6% in 2024. Combines pharmaceutical expertise with digital psychiatry innovations, offering clinically validated solutions for mental health and behavioral disorders. Virta Health specializes in digital diabetes reversal using nutrition therapy and continuous remote care, delivering clinically proven outcomes and reducing medication dependency for long-term disease management. Omada Health offers evidence-based digital programs for diabetes, hypertension, and behavioral health, combining data-driven coaching with employer and payer partnerships to improve outcomes and reduce costs.Asia Pacific Digital Therapeutics Market

Latin American Digital Therapeutics Market

Middle East and Africa Digital Therapeutics Market

Digital Therapeutics Market Share

Digital Therapeutics Market Companies

Digital Therapeutics Industry News

The digital therapeutics market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Component

- Software

- On-premise

- Cloud-based

- Hardware

- Wearable devices

- Sensors and monitoring devices

- Other devices

- Services

- Consulting and integration

- Training and education

- Other services

Market, By Application

- Diabetes

- Obesity

- Cardiovascular

- Mental and behavior Health

- Hypertension

- Insomnia

- Other applications

Market, By End Use

- Healthcare providers

- Hospitals

- Clinics

- Telehealth platforms

- Payers

- Patients

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the digital therapeutics market?

Key players include AmerisourceBergen, Akili Interactive, Click Therapeutics, Hyfe, LifeScan, Omada Health, Orexo, Otsuka Holdings, and Pear Therapeutics.

How much revenue did the diabetes segment generate?

The diabetes segment generated USD 2.3 billion in 2024, dominating the market by application.

What was the valuation of the healthcare providers segment?

The healthcare providers segment dominated the market in 2024 and is projected to reach USD 28.4 billion by 2034.

Which region leads the digital therapeutics market?

North America led the market with a 58.1% share in 2024, driven by advanced healthcare infrastructure and high adoption of digital health solutions.

What is the market size of the digital therapeutics in 2024?

The market size was USD 7.7 billion in 2024, with a CAGR of 25.7% expected through 2034, driven by the rising prevalence of chronic conditions such as diabetes, cardiovascular diseases, and mental health disorders.

What is the projected value of the digital therapeutics market by 2034?

The market is expected to reach USD 75.4 billion by 2034, fueled by increasing adoption of scalable, cost-effective, and personalized digital solutions for chronic disease management.

What are the upcoming trends in the digital therapeutics industry?

Key trends include the growing adoption of digital solutions for chronic disease management, advancements in personalized treatment options, and increasing integration of digital therapeutics into healthcare systems.

What is the projected size of the digital therapeutics market in 2025?

The market is expected to reach USD 9.6 billion in 2025.

Digital Therapeutics Market Scope

Related Reports