Summary

Table of Content

Digital Pathology Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Digital Pathology Market Size

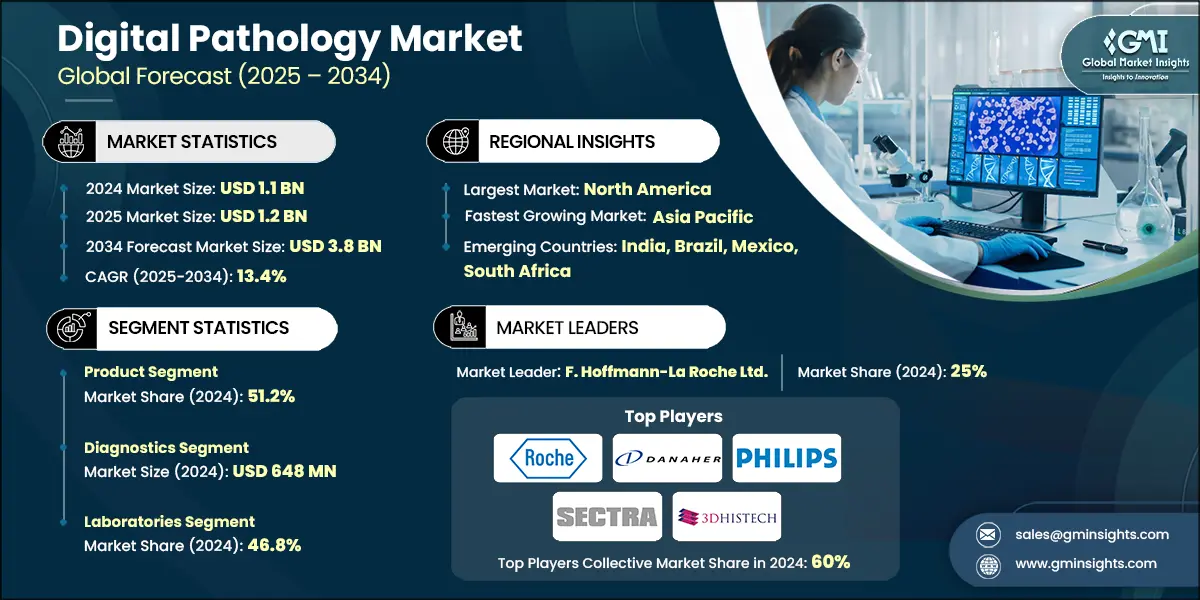

The global digital pathology market was valued at USD 1.1 billion in 2024 and is projected to grow from USD 1.2 billion in 2025 to USD 3.8 billion by 2034, expanding at a CAGR of 13.4%, according to the latest report published by Global Market Insights Inc. This steady growth is driven by the increasing adoption of digital solutions, growing modernization in diagnostic infrastructure in digital pathology, integration of digital pathology systems with electronic health records (EHRs), increasing application in drug discovery and companion diagnostics.

To get key market trends

Digital pathology refers to the application of digital imaging technology to scan, analyze, and manage pathology slides and pathology-based data. Digital pathology enables remote diagnostic, artificial intelligence-assisted diagnosis, and electronic health record (EHR) integration. Digital pathology increases the accuracy of diagnoses, accelerates pathologist workflows, and supports research and drug discovery efforts. Leading companies in the digital pathology sector are F. Hoffmann-La Roche Ltd, Danaher Corporation, Koninklijke Philips N.V., Sectra AB, and 3DHISTECH. They are making investments in research and development towards enhancing the accuracy and reliability of digital pathology technologies.Top players in this market leverage advanced platforms such as next-generation sequencing and AI-driven analytics to actively strengthen their competitive position in the digital pathology market.

Digital Pathology Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.1 Billion |

| Market Size in 2025 | USD 1.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 13.4% |

| Market Size in 2034 | USD 3.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing adoption of digital solutions | Fuels demand for efficient, scalable, and data-driven pathology workflows across healthcare systems, enabling faster diagnosis and better resource utilization. |

| Growing modernization in diagnostic infrastructure in digital pathology | Drives investment in advanced imaging technologies and cloud-based platforms, improving diagnostic precision and reducing turnaround times. |

| Integration of digital pathology systems with electronic health records (EHRs) | Enhances clinical collaboration and continuity of care by allowing real-time access to pathology data across departments and institutions. |

| Increasing application in drug discovery and companion diagnostics | Supports pharmaceutical R&D by enabling high-throughput tissue analysis and biomarker identification, accelerating drug development and regulatory approvals. |

| Pitfalls & Challenges | Impact |

| Lack of standard guidelines for digital pathology | Creates uncertainty in clinical validation and regulatory compliance, slowing adoption and limiting cross-platform compatibility. |

| High cost associated with the implementation and integration of hardware or software | Acts as a barrier for small and mid-sized labs, reducing market penetration and widening the gap between resource-rich and resource-limited settings. |

| Opportunities: | Impact |

| Growing demand for remote pathology and telepathology solutions | Fuels expansion into underserved regions and supports continuity of care through remote diagnostics, especially in rural and low-resource settings. |

| Market Leaders (2024) | |

| Market Leaders |

25% market share |

| Top Players |

Collective market share in 2024 is 60% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

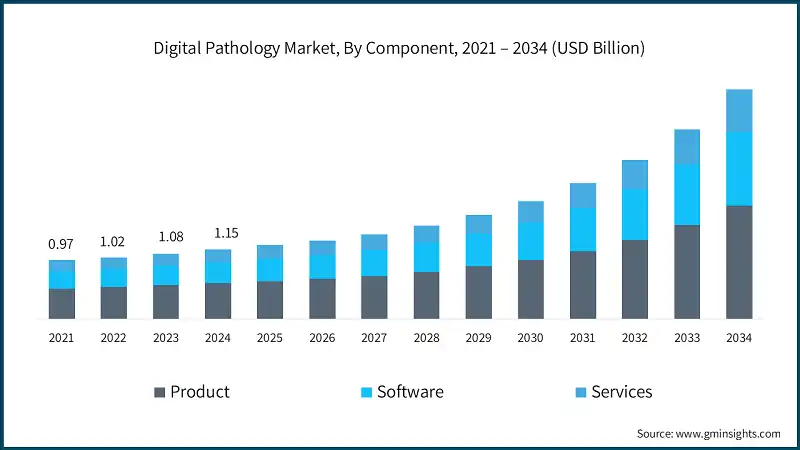

The market increased from USD 968.1 million in 2021 to USD 1,080.4 million in 2023. This growth can be primarily attributed to the increasing adoption of digital solutions and growing modernization in diagnostic infrastructure in digital pathology. Governments and institutions across different regions are investing heavily to enhance diagnostic capabilities through digital platforms. For instance, the National Pathology Imaging Co-operative (NPIC) in the UK received EURO 5.1 million to establish a national digital pathology platform focused on improving cancer diagnosis. Similarly, in the U.S., the Moffitt Cancer Center was awarded USD 2 million in state funding to expand digital pathology services, particularly targeting faster diagnostics in underserved regions. These strategic investments are accelerating the growing modernization in diagnostic infrastructure in digital pathology contributing significantly to the market’s growth and paving the way for more efficient, accessible, and AI-integrated healthcare diagnostics.

Additionally, the integration of digital pathology systems with electronic health records (EHRs) is revolutionizing healthcare by streamlining workflows and enhancing diagnostic efficiency. For instance, in U.S., the Digital Pathology Program by the Department of Defense (DoD) enables seamless integration with EHRs, significantly improving accessibility and reducing turnaround time for pathology consultations. Such efforts not only improve patient care coordination but are also drive the growth of the digital pathology market by increasing demand for interoperable systems and scalable digital infrastructure.

Digital pathology is a category of devices and systems used with glass pathology slides and their relevant metadata, as well as the systems required for storage, review, and analysis. Digital pathology refers to the use of hardware and software for acquiring, storing (or retrieving), manipulating, sharing, and analyzing data derived from glass slides.

Digital Pathology Market Trends

- The global digital pathology industry is changing rapidly by continuous technological advancements in cancer diagnostics.

- The growing integration of digital pathology in drug discovery is revolutionizing pharmaceutical companies’ approach in research and development. For instance, Roche leverages digital pathology through its subsidiary Ventana Medical Systems to accelerate oncology drug development. By digitizing tissue samples and applying AI algorithms, Roche can analyze tumor microenvironments more efficiently, enabling faster identification of therapeutic targets.

- In companion diagnostics, digital pathology plays a transformative role by enabling personalized treatment strategies. Philips, through its IntelliSite Pathology Solution, collaborated with pharmaceutical companies to develop diagnostic tools that identify patients most likely to benefit from specific therapies. For example, in oncology trials, Philips’ platform helps pathologists detect biomarkers like PD-L1 or HER2 with high accuracy, ensuring that only eligible patients are enrolled in targeted therapy programs. This precision improves clinical trial outcomes and supports regulatory approvals, thereby expanding the market for digital pathology solutions.

- Additionally, Danaher Corporation’s Leica’s Aperio AT2 scanner and AI-powered software are widely used in translational research and clinical trials. Their solutions enable seamless integration of pathology data into drug development workflows, supporting biomarker validation and regulatory submissions.

- As pharmaceutical companies increasingly adopt these technologies to meet the demands of precision medicine, the market is experiencing robust global growth, driven by its vital role in accelerating and personalizing therapeutic development.

Digital Pathology Market Analysis

Learn more about the key segments shaping this market

Based on components, the market is segmented into products, software, and services. The product segment led this market in 2024, accounting for 51.2% of market share because of its ability to streamline the operations and improve diagnostic accuracy.

- The product segments play a significant role in the growth of the digital pathology market. Scanners allow for remote diagnostics and telepathology, addressing the situation of transporting physical slides. Slide management systems improve workflow efficiency and data accessibility, making it easier for pathologists to collaborate across locations. Meanwhile, other products help in automating routine tasks, reducing human error, and accelerating diagnosis, which is especially valuable in high-volume clinical settings.

- Some companies have produced standout products in these segments. For example, The Mikroscan SL5 by Mikroscan Technologies Inc. It is a compact whole-slide imaging scanner created for telepathology and remote diagnostics. The scanner provides high-resolution imaging for a precise digitization of the slide, which helps it maintain a light footprint for a point-of-care environment. It also creates opportunities for real-time, remote viewing and collaboration.

- The technological framework of digital pathology is made up by scanners, slide management systems, and supportive digital technologies. Collectively, these technologies allow for more rapid, accurate, and collaborative diagnostics, and move pathology from a traditional to a more connected, data-driven solutions. As their use widens, significant growth can be seen in digital pathology market.

Based on the application, the market is segmented into diagnostics, research, and education and training. The diagnostics segment was valued at USD 648 million in 2024.

- Diagnostics in digital pathology involves interpreting digitized tissue slides for the purpose of disease detection within clinical workflows. Rather than looking at slides underneath a microscope, pathologists use digital images, which AI and image analysis tools often augment, to diagnosis abnormalities (tumor, infection, or inflammatory conditions).

- Many companies have come up with their own unique diagnostic platforms. Roche has uPath enterprise software, which is supported by VENTANA scanners, allowing for pathology and AI based diagnostic algorithms for oncology. Proscia has its Concentriq Dx platform, which will be used for diagnostic intentions, for companies which diagnosis in a regulated environment, having automating works flows and AI features.

- By enabling faster, more accurate, and collaborative diagnoses, it is reshaping the future of pathology. As innovation continues, diagnostics will remain central to improving outcomes and expanding the reach of digital healthcare.

Learn more about the key segments shaping this market

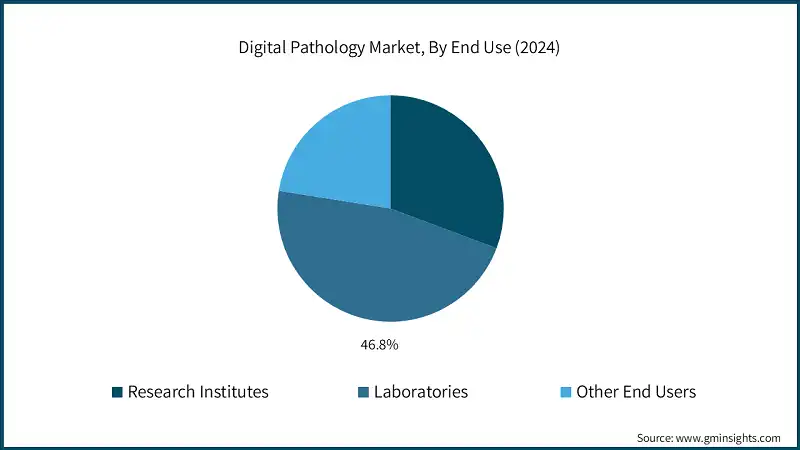

Based on the end use, the market is segmented into research institutes, laboratories, and other end users. The laboratories segment is further classified into pathology labs and cytology labs. The laboratories segment accounted for the 46.8% market share in 2024.

- The laboratory segment is essential to the digital pathology market owing to its recognized role in the diagnostic workflow. Laboratories, specifically pathology and cytology laboratories, serve as the primary locations for pathology services, handling large volumes of specimens daily.

- One of the key reasons for the dominance of laboratories in this market is their need for efficiency and accuracy. Traditional pathology methods are time-consuming and prone to human error, whereas digital tools streamline processes, reduce turnaround times, and enhance diagnostic precision. These platforms also enable centralized data management, remote access, and seamless collaboration among pathologists.

- By embracing digital transformation, laboratories enhance diagnostic capabilities, improve patient outcomes, and contribute to a more connected and efficient healthcare system further accelerating the market growth.

Looking for region specific data?

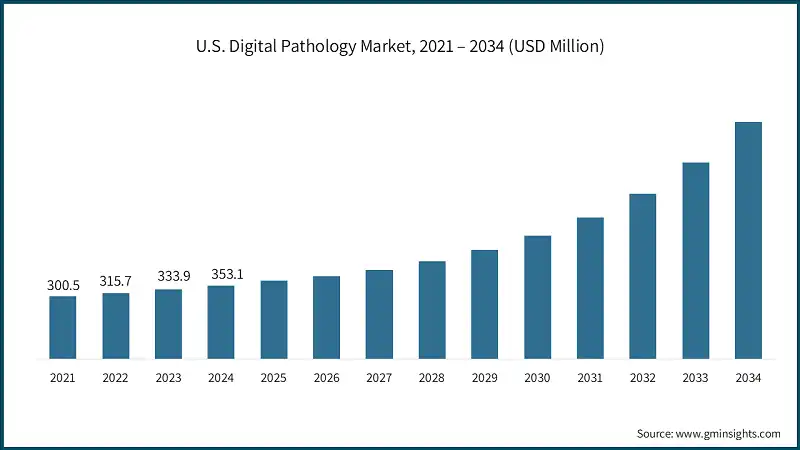

North America dominated the global digital pathology market with a market share of 33.4% in 2024.

- The U.S. market for digital pathology is experiencing robust growth, driven by its expanding role in drug discovery and companion diagnostics. As pharmaceutical companies and research institutions seek faster, more precise methods for analyzing tissue samples, digital pathology has emerged as a transformative tool.

- The growth of digital pathology in U.S. is strongly supported by the U.S. government's investment in biomedical drug discovery and development. The National Institutes of Health (NIH), as the largest public funder of biomedical R&D, allocated USD 97 billion for basic research, USD 28 billion for clinical trials, and USD 9 billion for biomedical workforce training between 2017 and 2021. These investments have accelerated the adoption of digital pathology in drug discovery and companion diagnostics, enabling faster, more precise, and personalized approaches to treatment development.

- As regulatory frameworks evolve and AI technologies become more integrated, U.S. is poised to remain as a leading country in market.

Europe digital pathology market accounted for USD 330.3 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- The European market is witnessing accelerated growth, largely fueled by the increasing integration of digital pathology systems with electronic health records (EHRs). This synergy enables seamless access to patient data, enhances diagnostic accuracy, and supports more personalized treatment planning especially in oncology and chronic disease management.

- In 2024, the average digital health score across Europe countries reached 83%, showing steady progress. The EU plans to ensure all citizens have access to their electronic health records by 2030, and currently, 23 out of 27 member states reported that most of their population already access these records through national systems.

- This widespread EHR infrastructure not only facilitates interoperability but also enables digital pathology platforms to integrate imaging, annotations, and AI-driven insights directly into patient records. As a result, healthcare providers across Europe are increasingly adopting digital pathology to improve workflow efficiency, reduce diagnostic turnaround times, and support collaborative care models.

Germany market is projected to experience steady growth between 2025 and 2034.

- Germany’s digital pathology market is undergoing rapid transformation, fueled by the country’s strategic push to modernize its diagnostic infrastructure. With the healthcare system embracing digital technologies, hospitals and laboratories are increasingly adopting digital pathology solutions to enhance diagnostic accuracy, streamline workflows, and support remote consultations.

- The modernization of diagnostic infrastructure is not only improving operational efficiency but also enabling Germany to lead in personalized medicine, oncology diagnostics, and drug discovery.

The Asia Pacific region is projected to be valued at USD 307.1 million in 2024.

- The Asia Pacific digital pathology market is experiencing rapid growth, fuelled by the region’s increasing adoption of digital healthcare solutions. Governments and healthcare providers are embracing digital transformation to address rising patient volumes, improve diagnostic accuracy, and expand access to specialized care especially in underserved and rural areas.

- Countries such as India, China, and South Korea are leading the way by integrating whole-slide imaging, AI-powered diagnostic tools, and cloud-based pathology platforms into their healthcare systems. For instance, Healthy China 2030 initiative program includes substantial funding for smart hospitals and AI-driven diagnostics. This national strategy is accelerating the adoption of digital pathology by promoting the integration of advanced imaging technologies, cloud-based platforms, and intelligent diagnostic systems across public and private healthcare institutions.

Japan digital pathology market is poised to witness lucrative growth between 2025 to 2034.

- Japan’s digital pathology industry is expanding steadily, propelled by the country’s rapidly aging population and the increasing prevalence of chronic diseases. According to Statistics Bureau of Japan, as of 2023, 29.1% of Japan’s population was aged 65 and older. This demographic shift is driving demand for more efficient, scalable, and accurate diagnostic solutions to manage age-related conditions such as cancer, cardiovascular diseases, and neurodegenerative disorders.

- Digital pathology offers a transformative solution by enabling faster diagnosis, remote consultations, and AI-assisted image analysis which are critical for managing the growing volume of diagnostic cases.

Brazil is experiencing significant growth in the digital pathology market, driven by growing adoption of digital healthcare solutions

- Brazil is emerging as a key player in the market, propelled by the country’s growing adoption of digital healthcare solutions. As public and private healthcare providers seek to modernize diagnostic services, digital pathology is gaining traction for its ability to improve diagnostic accuracy, reduce turnaround times, and support remote consultations especially in underserved regions.

- Government initiatives like Brazil’s National Digital Health Strategy (2020-2028) are also supporting this shift by promoting interoperability, data integration, and digital infrastructure upgrades across the healthcare system. As Brazil continues to invest in smart health technologies, digital pathology is becoming a cornerstone of its efforts to deliver more efficient and high-quality care.

The digital pathology market in Saudi Arabia is expected to experience significant and promising growth from 2025 to 2034.

- Saudi Arabia is rapidly modernizing its healthcare system, and the digital pathology industry is benefiting significantly from this transformation. The country’s strategic focus on digital health solutions, as part of its Vision 2030 initiative, is driving the adoption of advanced diagnostic technologies across public and private healthcare sectors.

- Digital pathology is gaining momentum as hospitals and laboratories implement whole-slide imaging, AI-powered diagnostics, and cloud-based platforms to improve efficiency and accessibility.

Digital Pathology Market Share

- The top 5 players, such as F. Hoffmann-La Roche Ltd, Danaher Corporation, Koninklijke Philips N.V., Sectra AB, and 3DHISTECH collectively held 60% of the total market share.

- Leading companies in the digital pathology industry are driving innovation through a combination of AI-powered diagnostics, regulatory alignment, and clinical partnerships. Firms like F. Hoffmann-La Roche Ltd and Danaher Corporation are integrating advanced imaging platforms with machine learning algorithms to enhance diagnostic precision, particularly in oncology and rare disease detection. Roche’s cloud-based pathology solutions and Danaher’s Leica Biosystems are enabling scalable, interoperable workflows that support early diagnosis and therapy planning across global healthcare networks.

- Meanwhile, Koninklijke Philips N.V. and Sectra AB are strengthening their market positions by offering enterprise-grade digital pathology systems that seamlessly integrate with hospital IT infrastructure and electronic health records (EHRs). These companies are also investing in AI-driven quality control, ensuring reproducibility and reducing diagnostic error margins in high-throughput environments.

- Emerging players like 3DHISTECH are reshaping the market by offering cost-effective, high-resolution whole-slide imaging scanners and modular software solutions tailored for academic institutions and mid-sized labs. Their focus on affordability and customization is expanding access to digital pathology in developing regions.

Digital Pathology Market Companies

Few of the prominent players operating in the digital pathology industry include:

- 3DHISTECH

- CellaVision

- Danaher Corporation

- Dedalus

- F. Hoffmann-La Roche Ltd

- Fujifilm Holdings Corporation

- Glencoe Software Inc.

- Hamamatsu Photonics K.K.

- Huron Digital Pathology

- Ibex Medical Analytics

- Indica Labs Inc.

- Koninklijke Philips N.V.

- Mikroscan Technologies Inc.

- Olympus Corporation (Evident Scientific, Inc.)

- Paige AI

- PathAI

- PHC Holding Corporation (Epredia)

- Proscia, Inc.

- Sectra AB

- Visiopharm A/S

- F. Hoffmann-La Roche Ltd

F. Hoffmann-La Roche Ltd is a key innovator in the digital pathology space, leveraging its deep expertise in diagnostics and oncology to advance AI-powered solutions for precision medicine. Roche’s global footprint and investment in healthtech ventures further reinforce its leadership in deploying scalable, interoperable digital pathology systems that support both clinical and research applications.

Danaher Corporation plays a transformative role in digital pathology through its subsidiary Leica Biosystems, which delivers a comprehensive suite of AI-powered imaging and workflow solutions. Central to its offering are the Aperio Digital Pathology Slide Scanners, which provide high-resolution whole slide imaging with rapid throughput and consistent image quality, supporting both clinical diagnostics and research workflows.

Koninklijke Philips N.V. stands out in the digital pathology market by offering end-to-end solutions that integrate cloud-based infrastructure, AI capabilities, and enterprise-wide interoperability. Its IntelliSite Pathology Solution, the first FDA-approved system for primary diagnosis, enables remote collaboration and real-time consultations, significantly improving diagnostic accuracy and workflow efficiency.

Digital Pathology Market News:

- In March 2022, Dedalus announced a strategic partnership with Ibex Medical Analytics to deliver an end-to-end AI-powered digital pathology solution. The collaboration aimed to enhance cancer diagnostics by integrating Ibex’s clinical-grade AI algorithms into Dedalus’ pathology information systems. This move marked a significant step toward improving diagnostic accuracy and workflow efficiency across European healthcare institutions.

- In January 2025, F. Hoffmann-La Roche Ltd received FDA clearance for its VENTANA DP 600 slide scanner, part of the Roche Digital Pathology Dx system. This followed the earlier clearance of the VENTANA DP 200 on June 14, 2024. Both scanners are integrated with NAVIFY Digital Pathology and uPath AI algorithms, enabling whole-slide imaging and AI-assisted analysis for clinical diagnostics. The approval reinforced Roche’s leadership in digital pathology innovation and its commitment to advancing precision medicine.

The digital pathology market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Component

- Product

- Scanners

- Slide management systems

- Other products

- Software

- Type

- AI enhanced image analysis software

- Data management software

- Other software

- Deployment mode

- Cloud-based

- On-premises

- Type

- Services

Market, By Application

- Diagnostics

- Research

- Education and training

Market, By End Use

- Research institutes

- Laboratories

- Pathology labs

- Cytology labs

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What was the valuation of the laboratories segment in 2024?

The laboratories segment held 46.8% market share in 2024.

How much revenue did the product segment generate in 2024?

The product segment accounted for 51.2% of the market share in 2024, due to its role in improving diagnostic accuracy and operational efficiency.

What is the current digital pathology market size in 2025?

The market size is projected to reach USD 1.2 billion in 2025.

What is the market size of the digital pathology in 2024?

The market size was USD 1.1 billion in 2024, with a CAGR of 13.4% expected through 2034, driven by increasing digital adoption and modernization in diagnostics.

What is the projected value of the digital pathology market by 2034?

The digital pathology market is expected to reach USD 3.8 billion by 2034, propelled by advancements in AI, cloud computing, and whole slide imaging technologies.

Which region leads the digital pathology market?

North America led the market with a 33.4% share in 2024. The region's dominance is attributed to advanced healthcare infrastructure and increasing adoption of digital pathology in drug discovery.

What are the upcoming trends in the digital pathology market?

Key trends include the integration of AI-powered platforms, expansion of telepathology solutions, and the adoption of cloud-based systems for enhanced collaboration and efficiency.

Who are the key players in the digital pathology market?

Key players include 3DHISTECH, Danaher Corporation, F. Hoffmann-La Roche Ltd, Hamamatsu Photonics K.K., Koninklijke Philips N.V., Sectra AB, and Proscia, Inc.

Digital Pathology Market Scope

Related Reports