Summary

Table of Content

Diesel Fired Construction Generator Sets Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Diesel Fired Construction Generator Sets Market Size

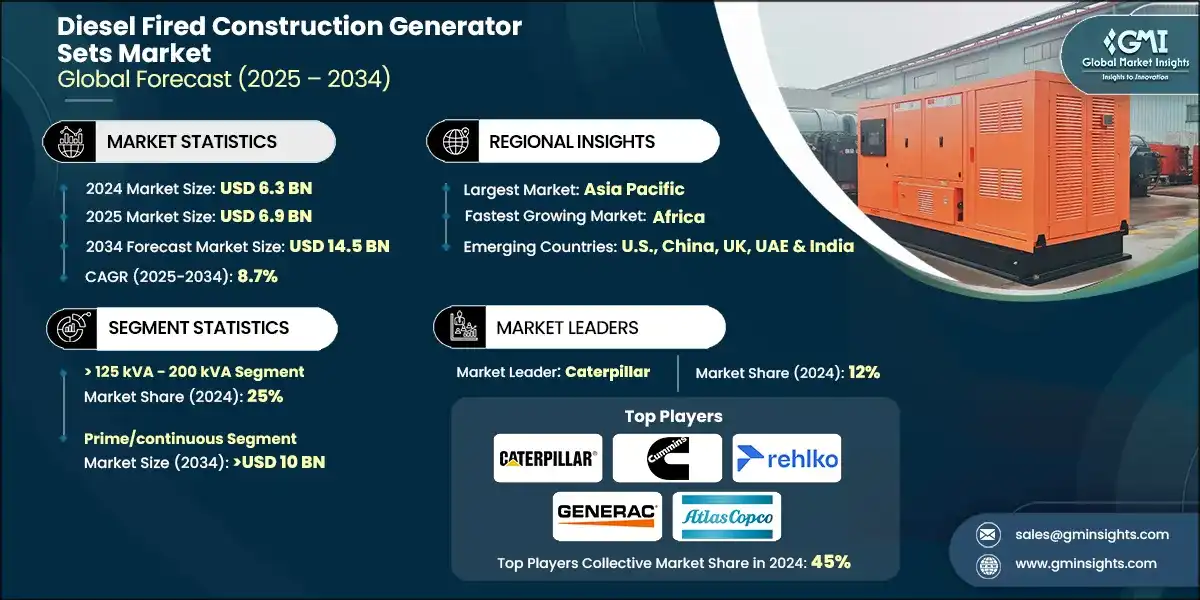

According to a recent study by Global Market Insights Inc., the diesel fired construction generator sets market was estimated at USD 6.3 billion in 2024. The market is expected to grow from USD 6.9 billion in 2025 to USD 14.5 billion by 2034, at a CAGR of 8.7%.

To get key market trends

- Rising environmental compliance standards, along with growing emphasis on cost optimization and energy efficiency, are key factors influencing the industry. The construction projects are progressively adopting cleaner, high efficiency genset solutions to align with sustainability objectives while ensuring dependable on-site power supply, which in turn will favor the business scenario.

- Diesel fired construction generator sets are portable or stationary power systems that use diesel engines to generate electricity for construction sites. They provide reliable, off-grid power to operate machinery, lighting, and temporary infrastructure where grid electricity is unavailable or unstable. Designed for durability and high performance, these gensets can withstand harsh construction environments and deliver consistent energy for various projects.

- Diesel gensets continue to play a vital role in bridging power gaps at remote construction sites with limited or no grid access. Their function has expanded beyond temporary use to being a crucial element of construction site operations. Reliable and uninterrupted power is essential for operating heavy equipment, site offices, lighting, and safety infrastructure.

- For illustration, India’s National Infrastructure Pipeline, valued at USD 1.4 trillion, and Saudi Arabia’s Vision 2030 infrastructure program, worth USD 1.3 trillion, are driving substantial demand for dependable construction power solutions. Globally, infrastructure investment needs are projected to exceed USD 1.7 trillion annually through 2030, with developing nations leading this growth.

- The diesel fired construction generator sets market was valued at USD 4.7 billion in 2021 and grew at a CAGR of approximately 4% through 2024. The continuous development of smart city initiatives and the surge in real estate construction are creating significant growth opportunities for generator sets.

- A robust construction and infrastructure development sector continues to fuel the demand for diesel-fired construction gensets. Moreover, the growing occurrence of weather-related disruptions such as floods, storms, and heatwaves has highlighted the critical need for dependable backup power to maintain project continuity. These gensets help minimize downtime and avert costly delays during grid outages or emergency situations.

- Manufacturers are consistently developing gensets that meet strict emission and noise standards, ensuring alignment with urban infrastructure and green building requirements. Continuous technological advancements have improved the efficiency, reliability, and environmental performance of these systems, making them increasingly appealing to construction companies focused on operational continuity, regulatory compliance, and sustainability goals.

- For citation, according to the International Energy Agency, electricity’s share of final energy consumption has risen from 15% in 2024 and is projected to reach 24% by 2040. Coupled with aging grid infrastructure in developed markets, this trend is fueling the need for dependable construction-site power systems globally.

Diesel Fired Construction Generator Sets Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 6.3 Billion |

| Market Size in 2025 | USD 6.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 8.7% |

| Market Size in 2034 | USD 14.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Flourishing construction sector | Expanding infrastructure projects and residential-commercial developments increase power demand at sites, driving adoption of these gensets for uninterrupted operations. |

| Surging intensity of weather-related disasters | Frequent storms, floods, and cyclones disrupt power supply, necessitating reliable diesel generators for construction and emergency site operations. |

| Surging demand for emergency power | Critical reliance on backup power for construction continuity, hospitals, and remote operations fuels the requirement for efficient units. |

| Rapid urbanization & increasing consumer propensity | Growing cities and higher electricity consumption accelerate construction and infrastructure needs, promoting diesel gensets deployment for consistent, on-site electricity supply. |

| Pitfalls & Challenges | Impact |

| High initial cost | Significant upfront investment for generator sets can limit adoption, especially among small contractors and budget-constrained construction projects. |

| Opportunities: | Impact |

| Renewable Hybrid Integration | Combining diesel gensets with solar and wind can offer cleaner, efficient, and cost-effective power solutions for construction sites. |

| Emerging Markets Expansion | Rapid urbanization creates high demand for reliable off-grid construction power solutions. |

| Technological Advancements | Adoption of IoT, remote monitoring & fuel-efficient engines enhances performance, maintenance efficiency, and operational reliability of construction gensets. |

| Disaster Recovery Projects | Increasing frequency of natural disasters generates opportunities for diesel gensets in emergency construction and temporary infrastructure restoration projects. |

| Market Leaders (2024) | |

| Market Leaders |

12% market share |

| Top Players |

Collective market share in 2024 is 45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Africa |

| Emerging Country | U.S., China, UK, UAE & India |

| Future outlook |

|

What are the growth opportunities in this market?

Diesel Fired Construction Generator Sets Market Trends

- The growing frequency of extreme weather events has strengthened the demand for resilient power solutions at construction sites. Extended power outages can disrupt operations and compromise time-sensitive materials, making gensets an essential investment for contractors. Over time, the construction genset sector has experienced notable technological advancements, particularly in emission reduction, noise control, and fuel efficiency.

- For instance, in 2024, global environmental initiatives, such as the European Union’s Green Deal, shaped the construction practices and power system choices. Construction companies are increasingly adopting low-emission generator sets to meet sustainability targets and comply with green building standards.

- The growing frequency of large-scale infrastructure developments such as highways, metros, industrial parks, and smart cities has increased the reliance on diesel gensets. Construction firms prefer these units due to their fuel availability, durability, and easy maintenance. These generators can handle fluctuating load demands efficiently, making them indispensable for both short-term and long-term construction activities.

- For instance, Caterpillar’s USD 90 million investment in Texas for C13D engine production highlights the company’s strategic focus on construction and industrial applications. This move demonstrates how leading manufacturers are expanding capacity to meet growing demand for reliable, high-performance power solutions, supporting large-scale infrastructure projects and ensuring efficient operations across global construction markets.

- The industry is set to evolve toward cleaner, smarter, and more efficient solutions. While electrification and renewable integration are gaining traction, diesel units will continue to dominate heavy-duty applications where mobility and robustness are critical, accelerating the business potential.

- For citation, regional construction demand is exemplified by China, where 56,000 urban renovation projects and ongoing infrastructure expansion in western provinces are driving significant power requirements for construction activities. Simultaneously, India’s market is growing rapidly, fueled by the USD 1.4 trillion national infrastructure pipeline, smart cities development across tier-2 and tier-3 cities, and manufacturing expansion supported by incentive schemes.

- The market supports diesel generator adoption in construction. The contractors rent gensets to manage project costs and reduce capital expenditure, especially for short-duration projects. Rental providers maintain large fleets with varying capacities, offering flexible power solutions. This model ensures that construction projects can quickly deploy power sources without major upfront investment or long procurement cycles.

Diesel Fired Construction Generator Sets Market Analysis

Learn more about the key segments shaping this market

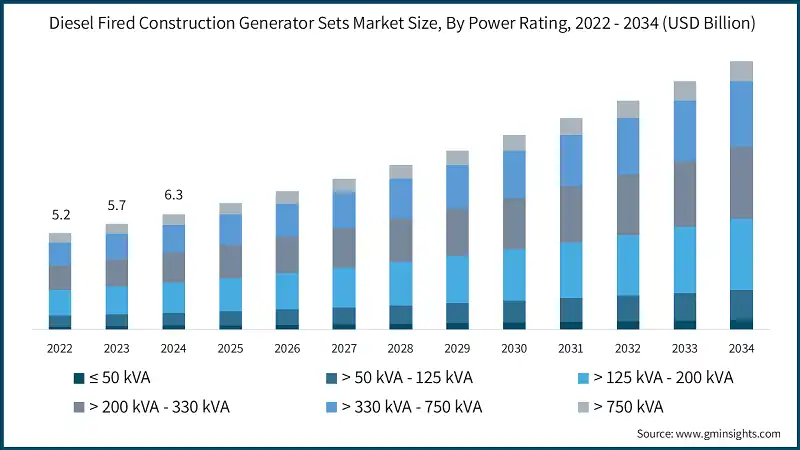

- Based on power rating, the industry is segmented into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA and > 750 kVA. The > 125 kVA - 200 kVA rated gensets market holds a share of about 25% in 2024 and is projected to grow at a CAGR of over 8.5% through 2034.

- The ≤ 50 kVA diesel fired construction generator sets market will be driven by frequent power disruptions, remote construction sites, and aging power distribution networks. Contractors are opting for smaller, fuel-efficient units for short-term or low-load operations owing to their affordability, mobility, and simple installation requirements, driving the industry potential.

- The > 50 kVA - 125 kVA capacity segment is set to exceed USD 1.5 billion by 2034. The industry is experiencing increased demand due to their adaptability in mid-scale construction activities such as commercial building projects, roadworks, and infrastructure maintenance. These generators provide reliable power for operating heavy construction machinery, mixers, pumps, and material handling systems.

- The > 200 kVA - 330 kVA diesel fired construction generator sets industry was valued at USD 1.6 billion in 2024. These gensets are favored for their automatic start functionality, superior fuel efficiency, and dependable performance under demanding site conditions. The ongoing surge in infrastructure expansion and large-scale construction projects particularly in areas with limited grid access has further accelerated the adoption of these high-capacity power units.

- The diesel construction gensets rated between 330 kVA and 750 kVA are seeing growing adoption in large-scale infrastructure and government-supported construction projects, where sustained high-power output is essential. These units supply electricity to extensive machinery setups, on-site housing, and project management facilities.

- The diesel-fired construction genset segment above 750 kVA is projected to witness significant growth, driven by increasing demand from large-scale industrial and infrastructure projects, including metro rail networks, refineries, and smart city initiatives. These high-capacity units support critical, power-intensive operations such as cranes, tunneling machinery, and batching plants.

- For illustration, Aggreko’s deployed a 20MW temporary power package for the Guam Power Authority illustrates the growing reliance on high-efficiency, low-emission generators in remote locations. Using units from its Greener Upgrades line, the company is ensuring uninterrupted electricity for businesses, highlighting the importance of reliable, eco-friendly construction and standby power solutions.

- Additionally, the rise of digitalized construction management—with real-time monitoring and automation has amplified the need for uninterrupted power. Their robust reliability and ability to operate continuously under challenging site conditions make them a preferred choice for major contractors and EPC firms in regions with limited grid availability.

Learn more about the key segments shaping this market

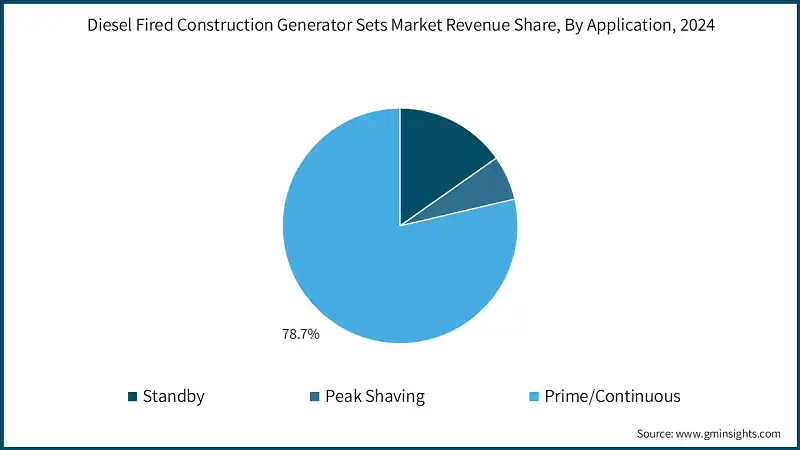

- Based on application, the industry is divided into standby, peak shaving, and prime/continuous. The prime/continuous diesel fired construction generator sets market holds a share of 78.7% in 2024 and is set to exceed USD 10 billion by 2034.

- These gensets are utilized at remote or off-grid sites where public electricity access is limited or unstable. Acting as the main power source for extended periods, these units ensure uninterrupted operation of heavy machinery, on-site offices, lighting systems, and material handling equipment.

- Growing demand for off-grid power at construction sites especially in remote areas including mining operations, oil & gas facilities, and large infrastructure projects is fueling the adoption of prime power gensets. Designed to function as the main power source for prolonged periods, these units guarantee uninterrupted operation of essential equipment.

- Peak shaving diesel fired construction generator sets industry was estimated at USD 382.7 million in 2024. Peak shaving in construction refers to minimizing electricity consumption from the grid during periods of high demand, helping reduce energy costs at grid-connected sites. Gensets are commonly used to provide supplementary power during peak hours, maintaining uninterrupted operations while enhancing overall energy efficiency.

- For instance, in 2024, an infrastructure project in Berlin utilized diesel generators during periods of high electricity demand across Brazil. The gensets supplied supplemental power to cranes, concrete pumps, and site lighting, reducing grid dependency, lowering energy costs, and ensuring uninterrupted construction operations, illustrating peak shaving’s effectiveness on European projects.

- The standby construction generator market is set to grow at a rate of over 8% from 2025 to 2034. These systems supply temporary power during unforeseen outages due to grid failures or extreme weather events. Typically installed permanently on-site, these units can automatically activate when the main power supply is interrupted. The rising frequency and intensity of weather-related disruptions, along with greater reliance on consistent electricity at construction sites, are boosting the adoption of standby gensets across projects of all scales.

- For instance, in 2024, construction sites in Florida relied on on-site standby generators to maintain operations during severe storm-induced outages. These systems automatically activated when the grid failed, highlighting how rising weather disruptions and the need for continuous electricity are driving greater adoption of standby gensets across projects of all sizes.

Looking for region specific data?

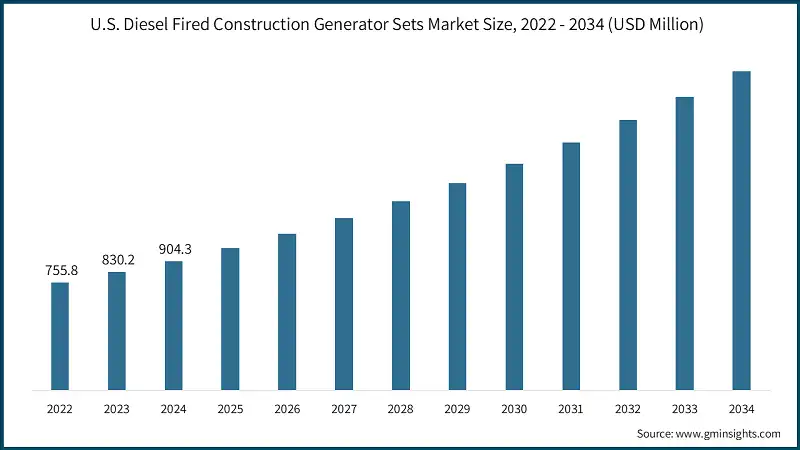

- The U.S. dominated the diesel fired construction generator sets market in North America with around 85% share in 2024 and generated USD 904.3 million in revenue. The construction projects demand uninterrupted power to operate essential equipment, including cranes, concrete pumps, lighting, and material handling systems. Persistent grid outages, deteriorating power infrastructure, and severe weather events underscore the importance of dependable on-site backup power, positioning these gensets as the preferred choice.

- For instance, in 2023, hurricane-induced outages in Texas forced several large-scale construction sites to rely on on-site standby generators. These gensets powered essential equipment including cranes, concrete pumps, lighting, and material handling systems ensuring uninterrupted operations despite persistent grid failures and severe weather, highlighting their critical role in projects.

- The North America diesel fired construction generator sets market is projected to surge USD 2.2 billion by 2034. Tighter emission regulations are prompting manufacturers to implement cleaner technologies, while government incentives promoting reliable on-site power are opening new growth avenues. Additionally, the incorporation of smart monitoring systems enables operators to optimize fuel usage, monitor performance, and minimize downtime, further boosting the adoption of diesel gensets in construction projects.

- The Europe diesel fired construction generator sets industry is set to grow at a rate of over 8% through 2034. Tighter emission regulations are prompting manufacturers to implement cleaner technologies, while government incentives promoting reliable on-site power are opening new growth avenues. Additionally, the incorporation of smart monitoring systems enables operators to optimize fuel usage, monitor performance, and minimize downtime, further boosting the adoption of diesel gensets in construction projects.

- The Asia Pacific accounts for about 45% of the diesel fired construction generator sets market share in 2024. The developing nations dominate the market, with India projected to rank as the world’s third-largest construction market, fueled by commercial, transport, and urban infrastructure developments. Persistent grid outages and the expansion of large-scale projects make diesel gensets essential for supplying power to temporary sites, construction equipment, and on-site worker accommodations.

- For instance, region’s leadership in construction activity is evident from large-scale urbanization efforts worldwide. For instance, China has undertaken 56,000 urban renovation projects as of December 2024, while India’s Smart Cities Mission is boosting construction across tier-2 and tier-3 cities. Similar urban expansion programs in other developing regions are further amplifying demand for construction power solutions globally.

- Rapid infrastructure expansion and upcoming megaprojects are driving increased demand for diesel gensets across Middle East. Countries such as Saudi Arabia and the UAE are investing in large-scale construction, tourism, and industrial projects, creating significant growth opportunities for reliable on-site power solutions.

- The shortage of reliable grid infrastructure, especially in sub-Saharan regions, is driving increased adoption of diesel gensets for construction projects across Africa. The countries are progressively relying on these generators to power machinery, temporary offices, and water systems, reflecting a broader shift toward off-grid and autonomous energy solutions.

- Rapid urbanization, infrastructure growth, and industrial construction will augment the Latin America diesel fired construction generator sets industry. Remote projects without reliable grid access increasingly depend on generators for uninterrupted operations. Additionally, foreign investments and large-scale government initiatives in urban and transport infrastructure are driving further development of construction-site gensets.

- For illustration, in Brazil, the expansion of metro lines in São Paulo and highway construction in rural regions relies heavily on generators. Remote sites with limited grid connectivity use these gensets to power machinery and lighting, while foreign investments and government infrastructure programs further boost demand, illustrating the growing role of construction-site generators.

Diesel Fired Construction Generator Sets Market Share

- The top 5 players in diesel fired construction generator sets industry are Caterpillar, Cummins, Rehlko, Generac Power Systems and Atlas Copco contribute around 45% of the market share in 2024.

- The industry is characterized by its highly dynamic and demand-driven nature, closely tied to the growth of the construction and infrastructure sectors. The market is largely influenced by factors such as urbanization, industrialization, and the increasing need for reliable off-grid power solutions. It is competitive, with manufacturers focusing on technological innovations, fuel efficiency, and compliance with stringent emission and noise regulations.

- Caterpillar offers an extensive product portfolio in the market, covering diesel, gas, and hybrid gensets for diverse applications. Their range includes portable, stationary, and containerized generator sets, designed to provide reliable power for construction, industrial, commercial, and emergency backup needs. Caterpillar gensets feature advanced technologies such as fuel-efficient engines, low-emission systems, and digital monitoring for enhanced performance, operational efficiency, and maintenance management.

- Cummins offers a diverse and robust product portfolio in the Generator Sets market, encompassing diesel, natural gas, and hybrid generator solutions for a wide range of applications. Their offerings include portable, standby, and prime power gensets, designed to deliver reliable electricity for industrial, commercial, construction, and emergency backup purposes.

- Rehlko product portfolio in the market includes a wide range of diesel, gaseous, and hybrid generators, catering to construction, industrial, commercial, and residential applications. Their offerings include the KD Series for reliable prime and backup power, mobile generators for temporary sites, marine generators, automatic transfer switches, and comprehensive accessories, controllers, and maintenance service.

- Generac Power Systems offers a diverse product portfolio in the Generator Sets market, including diesel, natural gas, and hybrid generators designed for industrial, commercial, and construction applications. Their offerings include stationary and mobile gensets, light towers, and integrated energy storage solutions, all engineered for reliable, efficient, and continuous power supply.

- Atlas Copco offers a comprehensive and versatile product portfolio in the gensets market, catering to diverse power needs across various industries. Their range includes small portable generators, mid-sized mobile units, and large-scale diesel generators, designed for applications in construction, infrastructure, events, and utilities. The QAS series, for instance, provides robust mobile diesel generators featuring advanced control systems for paralleling and modular power setups.

Diesel Fired Construction Generator Sets Market Companies

- Cummins reported its 2024 revenue of USD 34.1 billion, remaining consistent with 2023 levels. Regional performance was mixed, with North America sales increasing 1%, while international revenues declined by 1% year-over-year. The company’s net income for 2024 rose sharply to USD 3.9 billion or USD 28.37 per diluted share.

- Atlas Copco generated USD 4.1 billion in revenue in Q1 2025, supported by steady growth across its industrial and power technology divisions. The company reported strong demand for its portable diesel gensets, particularly in construction, mining, and emergency power applications across developing markets. Atlas Copco’s focus on fuel-efficient and low emission genset models also contributed to its resilient performance in the quarter.

- Caterpillar recorded a revenue of USD 14.2 billion in the first quarter of 2025, while it generated 64.8 billion in 2024, with an investment of USD 2.1 billion in research and development. The company's profit before tax rose to USD 13.4 billion, marking a 2.3% increase from USD 13.1 billion in 2023. Additionally, it is enhancing its product portfolios by incorporating smart and energy-efficient solutions.

Major players operating in the diesel fired construction generator sets industry are:

- Aggreko

- Ashok Leyland

- Atlas Copco

- Caterpillar

- Cummins

- FG Wilson

- Generac Power Systems

- Greaves Cotton

- HIMOINSA

- Jakson

- J C Bamford Excavators

- Kirloskar

- Mahindra Powerol

- Mitsubishi Heavy Industries

- Rehlko

- Rolls-Royce

- Sterling Generators

- Sudhir Power

- Supernova Genset

- Wärtsilä

Diesel Fired Construction Generator Sets Industry News

- In August 2025, Caterpillar in collaboration with Joule Capital Partners and Wheeler Machinery announced a landmark agreement to power Joule’s upcoming High-Performance Compute (HPC) Data Center Campus in Utah. The project is set to become the largest single data center campus in the state, delivering up to four gigawatts of total energy to the heart of the Intermountain West. At the core of this initiative is a distributed generation system powered by Caterpillar’s latest G3520K generator sets and advanced support equipment. These systems will provide prime power and enable integrated Combined Cooling, Heat and Power (CCHP) solutions, supporting the campus’s by-design liquid cooling architecture, a critical feature for next-generation, high-density server environments.

- In June 2025, Rolls-Royce announced a USD 24 million investment to significantly expand its diesel backup generator production for the rapidly growing U.S. data center market. The investment includes the construction of a new 250,000-square-foot logistics operations center adjacent to its existing manufacturing facility in Minnesota. Furthermore, the LOC will support the assembly and logistics of MTU Series 4000 generator sets, which are in high demand for mission-critical backup power in hyperscale data centers across the U.S.

- In November 2024, Wärtsilä contracted to supply generating sets and auxiliary equipment for Tampa Electric Company’s new MacDill Power Station in Florida. The facility is designed to serve both commercial customers and a military base, offering enhanced resilience and reliability under varying operational conditions. This deployment further strengthens its presence in the energy market, showcasing its ability to deliver flexible, future-proof power systems that support both grid-connected and islanded operations.

- In March 2024, Cummins India partnered with Sudhir Power to showcase the advanced capabilities of CPCB IV+ compliant gensets. The initiative served as a strategic platform to highlight the technological innovations, regulatory compliance, and operational reliability of Cummins-powered gensets to a broad spectrum of customers.

The diesel fired construction generator sets market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) & volume (Units) from 2021 to 2034, for the following segments:

Market, By Power Rating

- ≤ 50 kVA

- > 50 kVA - 125 kVA

- > 125 kVA - 200 kVA

- > 200 kVA - 330 kVA

- > 330 kVA - 750 kVA

- > 750 kVA

Market, By Application

- Standby

- Peak Shaving

- Prime/Continuous

The above information has been provided for the following regions & countries:

- North America

- U.S.

- Canada

- Europe

- Russia

- UK

- Germany

- France

- Spain

- Austria

- Italy

- Asia Pacific

- China

- Australia

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Philippines

- Middle East

- Saudi Arabia

- UAE

- Qatar

- Türkiye

- Iran

- Oman

- Africa

- Egypt

- Nigeria

- Algeria

- South Africa

- Angola

- Kenya

- Mozambique

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

Frequently Asked Question(FAQ) :

Who are the key players in the diesel fired construction generator sets market?

Key players include Caterpillar, Cummins, Rehlko, Generac Power Systems, Atlas Copco, Aggreko, Ashok Leyland, FG Wilson, Greaves Cotton, HIMOINSA, Jakson, J C Bamford Excavators, Kirloskar, Mahindra Powerol, Mitsubishi Heavy Industries, Rolls-Royce, Sterling Generators, Sudhir Power, Supernova Genset, and Wärtsilä.

What is the growth outlook for standby generators from 2025 to 2034?

Standby construction generators are projected to grow at a rate of over 8% from 2025 to 2034, due to rising frequency of weather-related disruptions and greater reliance on consistent electricity.

Which region leads the diesel fired construction generator sets market?

Asia Pacific held approximately 45% share in 2024. Rapid urbanization, infrastructure expansion, and persistent grid outages fuel the region's dominance.

What are the upcoming trends in the diesel fired construction generator sets market?

Key trends include integration of digital monitoring systems, hybrid fuel options combining diesel with renewables, cleaner emission technologies, and IoT-enabled remote performance optimization.

What was the valuation of prime/continuous application segment in 2024?

Prime/continuous application held 78.7% market share and is set to exceed USD 10 billion by 2034, serving as the main power source for remote and off-grid construction sites.

How much revenue did the > 125 kVA - 200 kVA power rating segment generate in 2024?

The > 125 kVA - 200 kVA rated gensets held approximately 25% market share in 2024 and is projected to grow at a CAGR of over 8.5% through 2034.

What is the current diesel fired construction generator sets market size in 2025?

The market size is projected to reach USD 6.9 billion in 2025.

What is the market size of the diesel fired construction generator sets in 2024?

The market size was USD 6.3 billion in 2024, with a CAGR of 8.7% expected through 2034 driven by stricter environmental norms and focus on cost-efficient, energy-efficient operations.

What is the projected value of the diesel fired construction generator sets market by 2034?

The diesel fired construction generator sets market is expected to reach USD 14.5 billion by 2034, propelled by expanding infrastructure projects, urbanization, and demand for reliable off-grid power solutions.

Diesel Fired Construction Generator Sets Market Scope

Related Reports