Summary

Table of Content

Die-Cutting Machine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Die-Cutting Machine Market Size

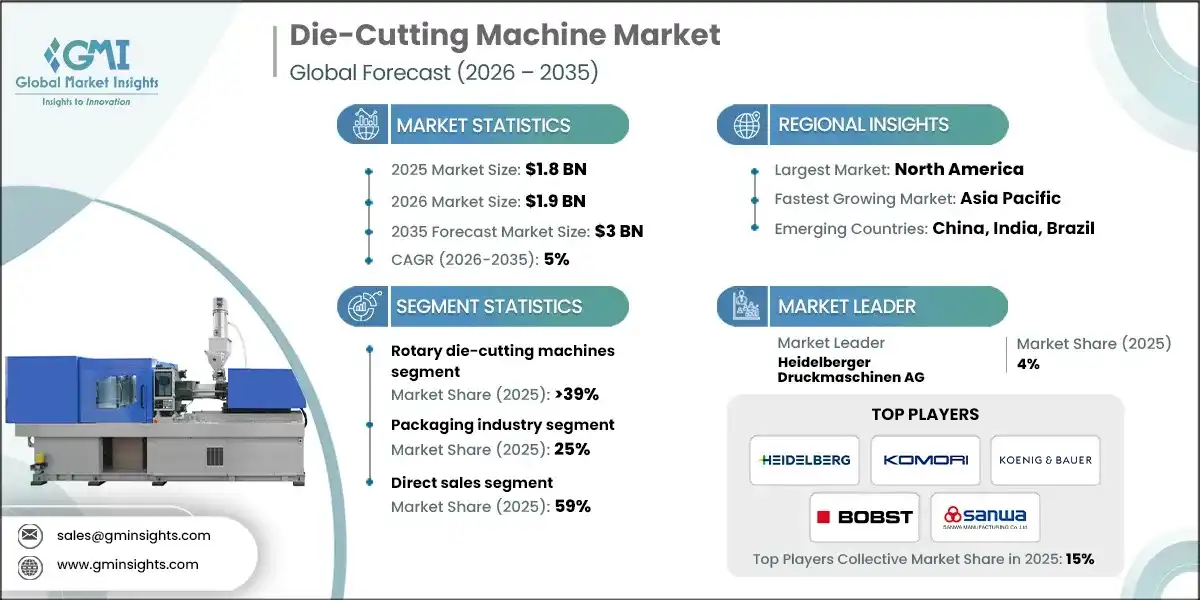

The die-cutting machine market was estimated at USD 1.8 billion in 2025. The market is expected to grow from USD 1.9 billion in 2026 to USD 3 billion in 2035, at a CAGR of 5% according to latest report published by Global Market Insights Inc.

To get key market trends

Die-cutting machines are in a transformative transition from being mere mechanical devices used for production to modules for intelligent, futuristic manufacturing systems. Automation is the dominant driving force, as companies increasingly turn towards sophisticated systems for replacement of human skills. Indeed, manufacturers can achieve better consistency, faster speeds of production, and less reliance on labor.

With the rise in e-commerce, die cutting machines have developed significantly due to the urgency to meet deadlines, improve customer experience, and maintain high quality levels. E-commerce has created increased demand for die-cutting technologies that create packaging that protects products while still presenting a positive image of the company. As companies continue to invest in die-cutting technology to develop innovative ways to package their products, die-cutting machines play a crucial role in determining consumer preference; therefore, die-cutting machines have become essential tools for most companies today.

Sustainability also continues to influence how die-cutting machines are produced. Many consumers and regulators are beginning to pay more attention to sustainable business practices, which has led many manufacturers of die-cutting machines to search for new ways to produce die-cutting machines that allow the use of recyclable materials while maximizing the materials used. Because of this, die-cutting machines are also being redesigned to conform to international environmental regulations, which helps maintain compliance with international standards for sustainability, as well as increase the corporate responsibility of the manufacturers that produce them.

Currently, the main reasons for the ongoing growth of the die-cutting machines market are the increasing use of automation in manufacturing, the continuing rise of e-commerce, and the ongoing demand for sustainable manufacturing practices. As these factors merge to form an integrated system of technology and creativity, the die-cutting market is well prepared to accommodate all the needs of its customers and to develop solutions that meet their needs.

Die-Cutting Machine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.8 Billion |

| Market Size in 2026 | USD 1.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 5% |

| Market Size in 2035 | USD 3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing Demand for Precision in Packaging and Printing | Increasing need for high-quality, accurately cut materials in packaging, labeling, and printing industries is driving adoption of advanced die cutting machines. |

| Automation and Technological Advancements | Integration of CNC systems, digital controls, and automated feeding mechanisms enhances efficiency and reduces labor costs, fueling market growth. |

| Expansion of E-Commerce and Customization Trends | Rising e-commerce activities and demand for customized packaging solutions are creating significant opportunities for die cutting machines in corrugated and flexible packaging. |

| Pitfalls & Challenges | Impact |

| High Initial Investment and Maintenance Costs | Advanced die cutting machines require substantial capital expenditure and ongoing maintenance, which can deter small and medium enterprises. |

| Skill Gap and Operational Complexity | Operating modern automated systems often demands skilled labor and training, posing challenges for companies with limited technical expertise. |

| Opportunities: | Impact |

| Adoption of Digital Die Cutting for Short Runs | Growing preference for digital die cutting solutions in short-run and on-demand production offers new revenue streams for manufacturers. |

| Sustainability and Eco-Friendly Materials | Increasing focus on recyclable and biodegradable materials in packaging creates opportunities for machines capable of handling diverse substrates efficiently. |

| Market Leaders (2025) | |

| Market Leaders |

4% market share |

| Top Players |

Collective market share in 2024 is Consolidate share of 15% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Die-Cutting Machine Market Trends

As many industries adapt to the changing world of manufacturing, the global die cutting machine market has continued to change and develop. The machines in this industry are primarily used for cutting, creasing and shaping various materials including paper/cardboard, plastic and fabric, among others. The evolution of technologies, sustainability and changing consumer needs, continue to drive the direction in which companies in this market are going to grow in the future.

- Laser die-cutting technology: the technology is emerging for its precision, versatility, and capability to handle intricate designs without physical tooling. It is best suited for fragile materials and complicated patterns as this technology minimizes material distortions and setup times. It provides an economic solution for prototyping and high-end specialized applications, thereby extending the capabilities of the market.

- Growth in packaging: the growth of the e-commerce industry and the swelling consumer goods market has led to a sharp increase in demand for die cutting machines in the packaging segment. These machines will be crucial to producing custom boxes, inserts, and protective packaging materials efficiently and precisely. This trend directly correlates with global consumption patterns.

- Increased automation and integration: the usage of highly automated die-cutting systems that integrate well with upstream and downstream processes is gaining momentum among manufacturers. Such systems reduce manual intervention, enhance operational efficiency, and minimize labor costs. The trend is vital for optimizing production lines and improving the overall throughput of the factory, particularly in high-volume industries.

- Sustainability & material versatility: there continues to be an increased demand for die cutting machinery capable of processing a wider variety of sustainable/eco-friendly materials to include biodegradable plastics, recycled content, and lightweight substrates. The die cutting machine market is currently evolving to support the environmentally friendly production practices being requested by customers due to both regulatory pressure and consumer preference for green products.

Die-Cutting Machine Market Analysis

Learn more about the key segments shaping this market

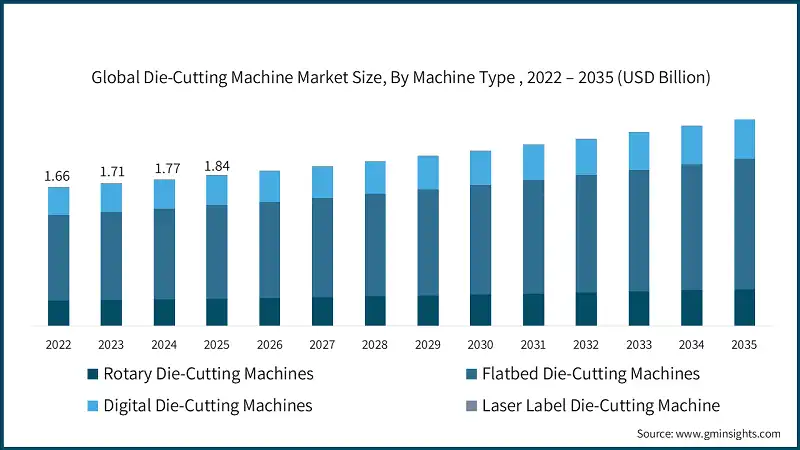

Based on the machine type, the market is divided into rotary die-cutting machines, flatbed die-cutting machines, digital die-cutting machines, and laser label die-cutting machines. The rotary die-cutting machines segment accounted for over 39% of the market share in 2025.

- The dominance of rotary die-cutting machines and their rapid growth in the market can be attributed to the design characteristics of this type of machine that provide high-speed performance combined with continuous operation; two feature sets required by most industries within the packaging, labelling, and other mass production sectors. Unlike flatbed systems, which cut material in a stationary bed, rotating die cutters cut the material as it is moving through the machine. This reduces the amount of 'down time' between jobs which, traditionally speaking, would be caused by removing the finished cut from a flatbed die cutter and then replacing it with a similar-sized blank for the next cut.

- In addition, rotary die-cutting machines can cut intricate shapes and thin materials with great accuracy thanks to new technology that has enabled the integration of automation and digital controls into rotary cutter machines. As a result, rotary cutter machines are becoming increasingly attractive to business owners who have an eye towards productivity and scalability.

- Although less productive than rotary die-cutting machines, flatbed die-cutting machines maintain the next position in the die-cutting machine market. This is primarily due to the ability of flatbed die-cutting machines to cut thick materials, combined with the ability to provide the high degree of detail required for applications such as luxury packaging, signage, and specialty products. Flatbed die-cutting machines serve as an ideal fit for shorter run jobs with custom designs where precision is of utmost importance; therefore, the best die-cutting machine type for short-runs are flatbed die-cutting machines.

- In addition to the above attributes, flatbed die-cutting machines are more cost-efficient compared to rotary die-cutting machines, making them accessible to small-medium enterprises (SMEs) or niche markets. Additionally, flatbed die-cutting machines adapt well to the variety of materials that they may be used to cut; therefore, these die-cutting machines will continue to be viable products within the die-cutting machine marketplace.

Learn more about the key segments shaping this market

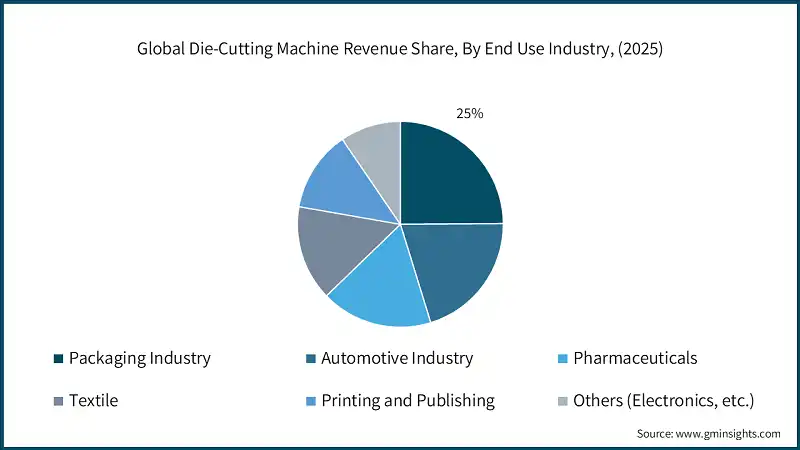

Based on the end use industry, the market is segmented into packaging industry, automotive industry, pharmaceuticals, textile, printing and publishing and others (electronics, etc.). The packaging industry held about 25% market share, generating a revenue of USD 500 million in 2025.

- The die-cutting machines market is heavily driven by the packaging industry, as packaging (boxes, cartons, labels, and flexible packaging) relies almost entirely on the ability to cut precisely with the die-cutting machine. As e-commerce and consumer goods continue to grow, brands will continue to find innovative design solutions that will increase the consumer's desire to purchase and use products they want to buy.

- Die-cutting Machines enable manufacturers to manufacture multiple types of printed product shapes, window cut-outs and embossing products, at high speed. This is essential for mass production.

- In addition, since many brands are attempting to meet sustainability trends by providing eco-friendly packaging options, advanced die-cutting equipment allows for the efficient use of materials and reduction of waste. Consequently, the factors of high-volume demand, customization, and sustainability have contributed to the packaging industry's growth as the fastest growing segment of the die-cutting machines market.

- The automotive industry is in the second dominant segment, as it has a demand for precision components such as gaskets, seals, insulation parts, and interior trims. These parts include many complex forms and durable materials, which are necessary for die-cutting machines to accomplish. Given that more advanced features and lightweight materials have been incorporated into cars, there is a rising demand for accurate cutting processes.

- Electric vehicles and smart car technologies continue to bring in new design specifications, making the requirement for automated die-cutting solutions even stronger. Though the automotive industry does not match the volume of packaging applications, the focus on precision, the variety of materials, and the integration of technologies ensures its growth and a significant market share.

Based on the distribution channel, the market is segmented into direct sales and indirect sales. The direct sales held a major market share of 59% in 2025 and grows with a CAGR of 4.6% from 2026 to 2035.

- The global die cutting machine market is being driven by an increase in direct sales. Through these direct sale practices, producers of die cutting machines can establish more informative and personal relationships with their customers and provide a more customized die cutting solution. Die cutting machines are generally more technical and expensive and require significant consultation, demonstration, and after-sales support before purchase due to the nature of application of die-cutting machines in several industries, including packaging and the automotive industry, where precision is essential.

- When a producer sells their die-cutting machine directly to the customer, it allows the machine manufacturer to fully understand their customer's needs and ultimately provide the customer with a customized die-cutting configuration, while also facilitating an efficient installation and training process. This also helps build a relationship of trust and loyalty between a manufacturer and their customer and will help retain customers. Additionally, by eliminating the need for a middleman, die-cutting manufacturers can provide their customers with lower prices and faster delivery times. As such, direct sales will be the preferred option for customers looking for die-cutting solutions.

- In addition, the rapid growth rate of the direct sales segment is driven in part by the growing complexity of customers' requirements and the ongoing trend toward automation and digital integration, which is impacting the way in which customers purchase die-cutting machines.

- Today, customers expect die-cutting machines that are equipped with advanced features, such as IoT (internet of things) connectivity, quick changeovers and energy efficiency. Many times, these advanced features require technical guidance to fully understand how they will benefit them during their purchase. Having the ability to engage customers directly through regular bulletins and support will enable manufacturers to demonstrate the new advancements in die-cutting technology, as well as provide the customer with continuing support for the upgrades and maintenance of their machines.

- Large enterprises and global brands often prefer to purchase directly from original equipment manufacturers (OEMs), to ensure quality assurance and to establish long-term partnerships. As customization and service increasingly become critical differentiating factors in the die-cutting machine market, direct sales will continue to grow at a faster rate than other sales channels.

Looking for region specific data?

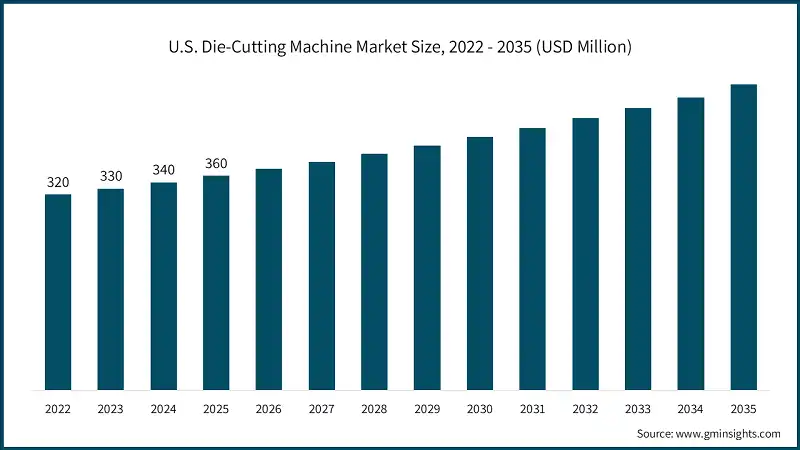

The U.S. dominated the North America die-cutting machine market, which was valued at USD 360 million in 2025 and is estimated to grow at a CAGR of 5% from 2026 to 2035, due to the region's highly developed packaging, printing, and automotive industries that have a strong demand for advanced cutting solutions.

- The rapid growth of e-commerce and the consumer products market are driving a high demand for packaging in North America, resulting in continued capital investment in automated and high-speed machinery.

- To remain competitive, U.S. manufacturers are investing in advanced technology, such as IoT-enabled systems and digital controls, to maximize production efficiency and reduce waste. By focusing on automating processes and making them environmentally friendly, this investment creates an opportunity for increased market growth. The U.S. is the largest and fastest growing contributor to this sector.

- Although Canada is contributing to the growth of the regional market, the combination of large scale, leadership in technology, and a wide industrial base make the U.S. the largest and fastest growing segment in North America.

Europe is the third-largest market estimated at USD 400 million in 2025 with a projected growth rate of 4.6% through 2035. The die cutting market in Germany is expected to experience significant and promising growth at a CAGR of 4.8% from 2026 to 2034.

- The strong packaging, printing, and automotive industries define the die-cutting machine market in Europe. The commitment to greener packaging solutions and enforcement of stern environmental regulations within the region drive the demand for machines that can lessen waste and accommodate recyclable materials.

- Due to this, die cutting finds its usage in intricate designs for premium finishes across Europe's luxury goods and high-end printing sectors, hence further boosting its adoption. Technological innovation-especially regarding automation and digital integration-continues to gain traction as manufacturers seek efficiency and customization.

- While growth is steady rather than explosive, the emphasis on quality, sustainability, and innovation in Europe means that it remains a key market with plenty of opportunities for high-value applications.

Asia Pacific is the largest and fastest-growing regional market. It has an estimated market value of USD 600 million in 2025 with a projected growth rate of 4.7% from 2026 to 2035.

- The Asia-Pacific region is the largest market for die-cutters as there are several of the world's largest manufacturers in this region (China, India, and Southeast Asia). The packaging, printing and electronic industries are strong in these countries and are all frequent users of die-cut technology.

- Rapid urbanization, booming e-commerce, along with rising consumer demand for packaged goods, have together driven massive investments in advanced machinery to improve speed and efficiency.

- The cost-effective production capabilities of APAC combined with increasing focus on automation make this the ideal location for high volume manufacturing. Additionally, local manufacturers are innovating to provide competitive prices and customized solutions, which further strengthens the region's leadership in die-cutting.

Die-Cutting Machine Market Share

In 2025, Heidelberger Druckmaschinen AG is leading with 6% market share. Heidelberger Druckmaschinen AG, Komori Corporation, Koenig & Bauer AG, Bobst, and SANWA Co., Ltd. collectively hold around 26%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Heidelberg has long been a major supplier to the commercial printing, package printing, and post press sectors with die-cutting equipment. Heidelberg's global reach, long-standing experience in delivering advanced automation and integration solutions, and significant influence on the commercial printing and package printing markets demonstrate its capability to drive growth in these areas.

- Komori specializes in printing presses but also offers robust die cutting machinery, particularly for packaging applications. Their focus on precision engineering and efficiency allows them to hold a significant position by providing integrated printing and finishing solutions globally, catering to diverse production demands.

- Koenig & Bauer is the largest manufacturer of die-cutting equipment used in the printing and converting industries and has developed the most advanced automation solutions for automatic die-cutting of cardboard and corrugated materials. The company's strong presence in the package printing market, along with its continued commitment to innovative approaches to improving the automation and production speed of their die-cutting machines, gives Koenig & Bauer a solid strategic advantage to help its customers who operate high-volume die-cutting operations worldwide.

Die-Cutting Machine Market Companies

Major players operating in the die-cutting machine industry are:

- Heidelberger Druckmaschinen AG

- Komori Corporation

- Duplo International

- Yawa Printing Machinery Co., Ltd.

- Masterwork Machinery Co., Ltd.

- Hunkeler AG

- BOBST

- SANWA Co., Ltd.

- ASAHI MACHINERY Limited

- Delta ModTech

- Winkler+Dünnebier GmbH

- Sysco Machinery Co., Ltd.

- Berhalter AG

- DIMO TECH

- Koenig & Bauer AG

BOBST is a global leader in packaging technology, known for its highly productive and flexible die cutting, folding, and gluing machines. Its continuous innovation in automation, quality control, and connectivity cements is top-tier position in serving the needs of the corrugated, folding carton, and flexible packaging markets.

SANWA designs and manufactures die-cutting machines and creasing machines for folding cartons and corrugated board. The company's emphasis on lasting, durable, precise, and accurate manufacturing technologies allows SANWA to capture a considerable share of the global equipment market, particularly within Asia, due to its continued commitment to producing high-quality, highly efficient converting equipment.

Die-Cutting Machine Market News

- In May 2025, Winkler+Dünnebier (W+D) completed acquisition of Sysco Machinery Corporation (US-based rotary die-cutting specialist), adding advanced rotary die-cutting, slitting, and rewinding technologies to W+D's converting portfolio. This is going to help the company in expanding its North American presence, strengthening its rotary die-cutting capabilities for flexible packaging and labels, and creating synergies with W+D's existing converting and finishing equipment lines

- In March 2025, Bobst launched the MASTERCUT 106 PER at drupa 2025, featuring 8,000 sheets/hour speed, Quick Change Device for 15-minute job changeovers, and BOBST Connect PERFORMANCE digital platform for predictive maintenance. This is going to help the company in targeting high-volume folding carton converters, reducing downtime through automation, improving OEE with real-time monitoring, and strengthening its position in premium die-cutting segments globally.

- In September 2024, Bobst launched the NOVACUT 106 ER rotary die-cutter at Labelexpo Europe 2024, featuring 200 m/min speed, servo-driven technology, quick job changeovers, and integration with digital printing workflows. This is going to help the company in addressing growing demand for short-run label production, enabling hybrid analog-digital workflows, reducing waste through precise registration, and expanding its label converting equipment portfolio beyond flexo printing.

- In March 2024, Bobst launched the MASTERCUT 145 PER at drupa 2024, offering 1,450 x 1,060 mm format, 6,500 sheets/hour speed, and Quick-Change Device for large format corrugated and folding carton applications. This is going to help the company in targeting e-commerce packaging and display markets requiring larger formats, differentiating through automation and speed in the large-format segment, and capturing growth in corrugated die-cutting driven by sustainable packaging trends.

The die-cutting machine market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Machine Type

- Rotary die-cutting machines

- Flatbed die-cutting machines

- Digital die-cutting machines

- Laser label die-cutting machine

Market, Mode of Operation

- Semi-automatic

- Automatic

Market, By Application

- Boxes

- Cartons

- Labels and stickers

- Decorative items

- Rubber gaskets

- Others (flyers, etc.)

Market, By End Use Industry

- Packaging industry

- Automotive industry

- Pharmaceuticals

- Textile

- Printing and publishing

- Others (electronics, etc.)

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the die-cutting machine market?

Key players include Heidelberger Druckmaschinen AG, Komori Corporation, Koenig & Bauer AG, BOBST, SANWA Co. Ltd., Duplo International, Yawa Printing Machinery Co. Ltd., Masterwork Machinery Co. Ltd., Hunkeler AG, ASAHI MACHINERY Limited, Delta ModTech, Winkler+Dünnebier GmbH, Sysco Machinery Co. Ltd., Berhalter AG, and DIMO TECH.

Which region leads the die-cutting machine market?

Asia Pacific is the largest market with USD 600 million in 2025 and a projected growth rate of 4.7% through 2035. Strong manufacturing presence, rapid urbanization, and booming e-commerce fuel the region's dominance.

What are the upcoming trends in the die-cutting machine market?

Key trends include laser die-cutting technology for precision cutting, IoT-enabled monitoring systems, digital die-cutting for short-run production, AI-driven predictive analytics, and machines capable of processing eco-friendly and biodegradable materials.

What is the growth outlook for direct sales channel from 2026 to 2035?

Direct sales held 59% market share in 2025 and is projected to grow at a 4.6% CAGR till 2035, due to customized solutions, technical consultation requirements, and long-term partnership benefits.

What was the valuation of the rotary die-cutting machines segment in 2025?

Rotary die-cutting machines held over 39% market share in 2025, fueled by high-speed performance, continuous operation capabilities, and suitability for mass production applications.

What is the market size of the die-cutting machine in 2025?

The market size was USD 1.8 billion in 2025, with a CAGR of 5% expected through 2035 driven by automation adoption, growing e-commerce packaging demand, and the shift to intelligent manufacturing technologies.

What is the projected value of the die-cutting machine market by 2035?

The die-cutting machine market is expected to reach USD 3 billion by 2035, propelled by advanced automation, digital integration, IoT connectivity, and increasing demand for sustainable packaging solutions.

What is the current die-cutting machine market size in 2026?

The market size is projected to reach USD 1.9 billion in 2026.

How much revenue did the packaging industry segment generate in 2025?

The packaging industry generated USD 500 million in 2025, holding approximately 25% market share, supported by e-commerce growth and customization trends.

Die-Cutting Machine Market Scope

Related Reports