Summary

Table of Content

Diagnostic Ultrasound Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Diagnostic Ultrasound Market Size

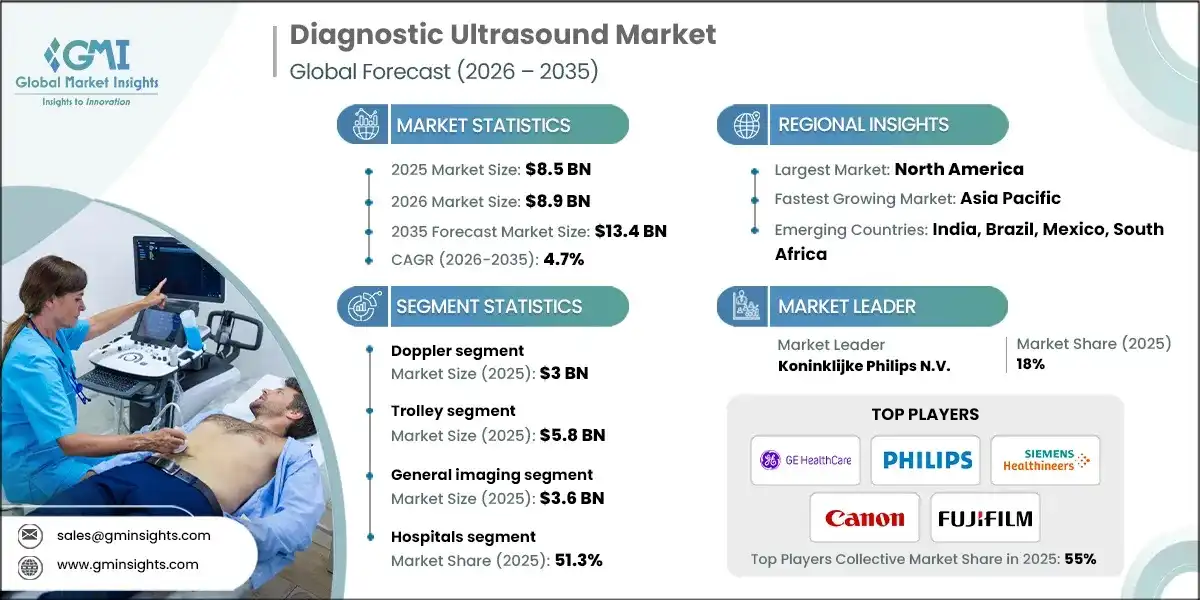

The global diagnostic ultrasound market was valued at USD 8.5 billion in 2025 and is projected to grow from USD 8.9 billion in 2026 to USD 13.4 billion by 2035, expanding at a CAGR of 4.7%, according to the latest report published by Global Market Insights Inc. This substantial growth is driven by numerous factors such as growing geriatric population base in developed as well as developing regions, increasing incidence of chronic diseases, increasing birth rates in developing countries, and technological innovations and advancements in diagnostic ultrasound devices.

To get key market trends

Diagnostic ultrasound, is a non-invasive imaging modality that produces high definition images of body organs using ultra-high-frequency sound waves. Common uses include examination of many different parts of the body such as abdomen, heart, bones, and muscles. Ultrasound is often used to monitor the development of the fetus during pregnancy. Another important advantage of diagnostic ultrasound is its ability to provide accurate guidance for using minimally invasive techniques such as a biopsy.

The leading companies within this sector are GE Healthcare, Koninklijke Philips N.V., Siemens Healthineers, Canon Medical Systems Corporation, and Fujifilm Holdings Corporation, which have consistently expanded within the market through cutting-edge technology and by implementing new product lines such as portable or handheld ultrasound systems. In addition, they continue to build their presence globally by entering into strategic alliances and pursuing acquisitions with other medical imaging manufacturers to meet the increasing need for non-invasive imaging options.

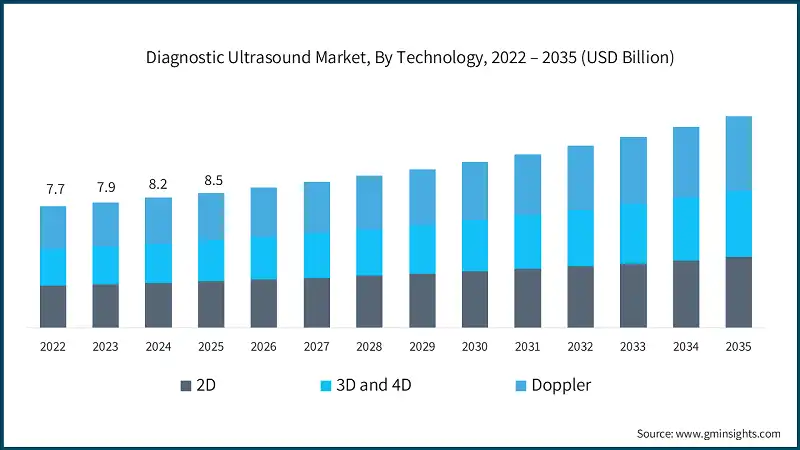

The market grew from USD 7.7 billion in 2022 to USD 8.2 billion in 2024. The rising prevalence of chronic diseases is a major catalyst for the growth of the diagnostic ultrasound market, as these conditions require regular imaging for early detection, disease progression monitoring, and treatment guidance. According to the World Health Organization, noncommunicable diseases (NCDs) caused approximately 43 million deaths in 2021, representing nearly 75% of non-pandemic-related deaths worldwide.

This surge in chronic illnesses such as cardiovascular disorders and cancer has intensified the need for safe, non-invasive, and cost-effective imaging solutions. Diagnostic ultrasound meets these requirements by offering real-time visualization without ionizing radiation, making it ideal for repeated use in long-term care. Furthermore, advancements in portable and point-of-care ultrasound systems are enabling quicker diagnostics in hospitals and outpatient settings, improving accessibility and patient outcomes. As healthcare systems globally prioritize preventive care and early diagnosis, the adoption of ultrasound technology continues to accelerate, driving substantial market growth.

Additionally, the increasing birth rates in developing countries are a significant driver for the growth of the diagnostic ultrasound market, as higher fertility levels directly translate into greater demand for prenatal and obstetric imaging. UNCTAD reported that Africa remains the fastest-growing region, with an annual population growth rate of 2.3% in 2023, fueled by high fertility and birth rates.

Also nations such as the Central African Republic, Chad, Somalia, Niger, and the Democratic Republic of Congo recorded more than 40 births per 1,000 people in 2025, over double the global average of 17.7 births per 1,000. This surge in births necessitates widespread use of ultrasound for monitoring fetal development, detecting complications, and ensuring maternal health. Consequently, healthcare providers and governments in these regions are investing in affordable and portable ultrasound systems to improve access to quality care, driving substantial market expansion in developing economies.

Diagnostic ultrasound is a non-invasive procedure for medical imaging, using high-frequency sound waves to produce real-time images of internal organs and tissues, arteries and veins. Diagnostic ultrasound is used extensively to evaluate a variety of medical conditions throughout the abdomen, heart and musculoskeletal systems, and to monitor fetal development during pregnancy. The use of ultrasound is safe, has no pain associated with it, and does not use ionizing radiation, which allows for the use of ultrasound to be repeated multiple times if necessary. Additionally, the use of diagnostic ultrasound allows for guidance during the performance of procedures like biopsies, by providing a clear picture of the target site.

Diagnostic Ultrasound Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 8.5 Billion |

| Market Size in 2026 | USD 8.9 Billion |

| Forecast Period 2026-2035 CAGR | 4.7% |

| Market Size in 2035 | USD 13.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing geriatric population base in developed as well as developing regions | Fuels demand for diagnostic ultrasound in cardiology, musculoskeletal, and abdominal imaging, boosting adoption in hospitals and outpatient settings. |

| Increasing incidence of chronic diseases | Drives utilization of ultrasound for early detection and monitoring of cardiovascular, hepatic, and renal disorders, accelerating market growth |

| Increasing birth rates in developing countries | Expands need for obstetric and gynecological ultrasound services, supporting higher equipment sales in maternity and neonatal care. |

| Technological innovations and advancements in diagnostic ultrasound devices | Enhances imaging accuracy and workflow efficiency, encouraging healthcare providers to upgrade to advanced systems and stimulating market expansion. |

| Pitfalls & Challenges | Impact |

| Dearth of skilled professionals especially in developing and underdeveloped regions | Limits effective utilization of ultrasound systems, creating barriers to adoption despite growing demand. |

| Barriers impeding use of diagnostic ultrasound in developing economies | High upfront costs and inadequate infrastructure restrict penetration of premium systems, slowing market growth in resource-limited settings. |

| Opportunities: | Impact |

| Integration of AI and advanced imaging technologies | Enables automated measurements and decision support, improving diagnostic confidence and creating differentiation for vendors. |

| Increasing applications in preventive and primary care | Expands ultrasound use beyond hospitals into clinics and home care, opening new revenue streams and accelerating market penetration. |

| Market Leaders (2025) | |

| Market Leaders |

18% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Diagnostic Ultrasound Market Trends

- Technological advancements are playing a pivotal role in driving the growth of the market by enhancing imaging precision, operational efficiency, and accessibility.

- The introduction of compact and handheld ultrasound systems has transformed point-of-care diagnostics, enabling clinicians to perform rapid assessments in emergency, cardiac, and obstetric settings. For instance, GE HealthCare’s Vscan Air offers wireless, dual-probe functionality with high-resolution imaging, while Butterfly Network’s iQ+ utilizes Ultrasound-on-Chip technology to deliver whole-body imaging through a single handheld device, significantly reducing costs and improving portability.

- Artificial intelligence (AI) integration represents another major breakthrough, streamlining workflows and improving diagnostic accuracy. Leading manufacturers such as Philips have introduced AI-driven features like 3D Auto Color Flow Quantification and SmartView Select, which automate image optimization and measurement processes, reducing operator dependency and variability. These innovations enable faster decision-making and enhance clinical confidence, particularly in high-volume environments and regions with limited skilled personnel.

- In addition to portability and AI, advancements in 3D/4D imaging and contrast-enhanced ultrasound (CEUS) are expanding clinical applications across obstetrics, cardiology, and oncology. High-resolution volumetric imaging offered by systems from GE, Siemens, Philips, and Canon provides superior visualization of anatomical structures, while CEUS improves vascular and tissue perfusion assessment without ionizing radiation. Collectively, these technological developments are making diagnostic ultrasound more versatile, and cost-effective, driving its adoption across hospitals, ambulatory care centers, and emerging markets worldwide.

Diagnostic Ultrasound Market Analysis

Learn more about the key segments shaping this market

Based on technology, the market is segmented into 2D, 3D and 4D, doppler. The doppler segment dominated the market with the largest revenue of USD 3 billion in 2025.

- Doppler ultrasound is a specialized imaging technique that evaluates blood flow within vessels by detecting frequency shifts in reflected sound waves. It is available in multiple formats, including color Doppler, power Doppler, and spectral Doppler, and is widely used for cardiovascular, vascular, and obstetric applications to provide real-time hemodynamic information.

- This segment is dominant within the diagnostic ultrasound market due to its importance in diagnosing many different types of cardiovascular disease, tracking fetal health, and assessing various disease states within blood vessels. This segment will continue to dominate because of high volume of chronic and cardiac disease that continues to grow at an alarming rate combined with a much greater demand for non-invasive, radiation-free diagnostic alternatives has led to a widespread increase in the use of doppler technology across the world.

- A notable example is the development of high-performance portable doppler systems designed for vascular and point-of-care use. For instance, Philips’ EPIQ and Affiniti platforms deliver robust doppler functionality within a shared AI-powered ecosystem, while the portable Flash 5100 POC system brings reliable vascular imaging to point-of-care settings.

- Thus, doppler ultrasound remains the leading technology segment due to its ability to deliver critical functional insights for cardiovascular and prenatal care. Continuous innovations in portability, AI integration, and workflow optimization by major manufacturers are reinforcing its dominance and thereby expanding market growth.

Based on portability, the diagnostic ultrasound market is bifurcated into trolley and compact/handheld. The trolley segment dominated the market and was valued at USD 5.8 billion in 2025.

- Trolley-based ultrasound systems are traditional cart-mounted devices designed for comprehensive imaging in hospitals and diagnostic centers. These systems typically feature large consoles, multiple transducer options, and advanced imaging capabilities such as Doppler, 3D/4D, and contrast-enhanced ultrasound. They are primarily used in high-volume settings where detailed imaging and integrated workflow solutions are essential.

- While there is an increase in the use of both handheld and portable ultrasound devices, trolley systems account for the majority of revenue in the portable segment due to their superior image quality, advanced functionality, and ability to perform complex examinations across multiple diagnostic areas including cardiology, obstetrics, oncology, and musculoskeletal radiology. Hospitals and Specialty clinics utilise Trolley based ultrasound systems for both critical care and routine diagnostic exams, where high reliability and the ability to perform multiple diagnostic procedures is crucial

- For example, Canon Medical's Aplio i-series is a high-end trolley ultrasound product designed for use in hospitals and speciality clinics with advanced imaging features including premium Doppler and 3D/4D features as well as quantitative analysis features.

- Therefore, trolley-based ultrasound systems remain a cornerstone of diagnostic imaging due to their robust performance, versatility, and integration of cutting-edge technologies. While portable and handheld devices are gaining traction, trolley systems continue to be fundamental in tertiary care and high-acuity environments, ensuring sustained demand in the global market.

Based on application, the diagnostic ultrasound market is segmented into general imaging, cardiology, OB/GYN, and other applications. The general imaging segment held the largest revenue of USD 3.6 billion in 2025.

- General imaging ultrasound encompasses a broad range of applications, including abdominal, musculoskeletal, small parts, and soft tissue evaluations. These systems provide real-time visualization of organs and structures without ionizing radiation, making them ideal for routine diagnostics and chronic disease monitoring.

- The rising geriatric population is a key driver for this segment, as older adults are more susceptible to conditions such as liver disease, kidney disorders, musculoskeletal degeneration, and vascular complication which require frequent imaging. According to the United Nations, the number of people aged 65 and older worldwide is projected to grow from 703 million in 2024 to 1.5 billion by 2050, representing 1 in 6 people globally, a sharp increase from 1 in 11 in 2019. This demographic shift is fueling demand for safe, cost-effective, and repeatable imaging modalities, with ultrasound emerging as the preferred choice for geriatric care due to its portability and absence of radiation.

- Additionally, manufacturers are responding to this trend by introducing advanced general imaging systems with features such as AI-assisted image optimization, elastography for tissue characterization, and high-resolution probes for deep abdominal scanning

- As healthcare systems worldwide prioritize early diagnosis and preventive care for aging populations, the general imaging segment is expected to witness sustained growth, reinforcing its strategic importance within the market.

Learn more about the key segments shaping this market

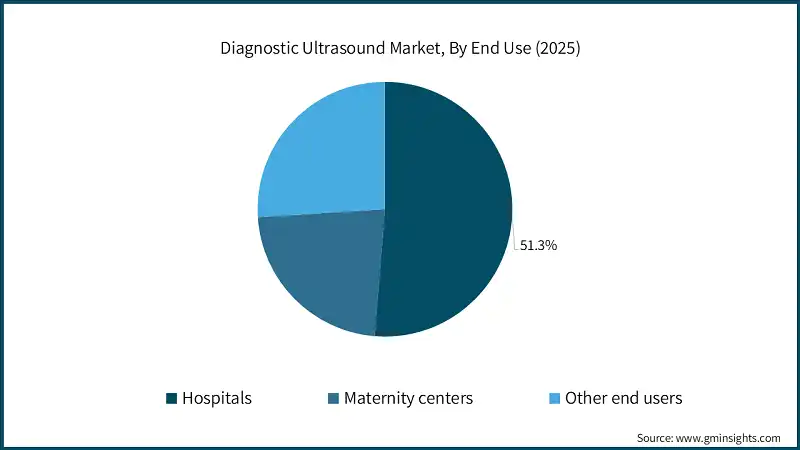

Based on end use, the diagnostic ultrasound market is segmented into hospitals, maternity centers, and other end users. The hospitals segment accounted for market share of 51.3%.

- Hospitals represent a dominant end user segment in the market due to their comprehensive infrastructure, advanced imaging capabilities, and ability to handle high patient volumes. These facilities are primary centers for diagnostic imaging, offering a wide range of ultrasound applications such as obstetrics, cardiology, radiology, and emergency medicine.

- The segment’s growth is driven by increasing hospital admissions for chronic and acute conditions, rising demand for non-invasive imaging, and the adoption of technologically advanced ultrasound systems.

- Hospitals often invest in premium ultrasound devices equipped with features like 3D/4D imaging, doppler capabilities, and AI-assisted diagnostics to improve workflow efficiency and diagnostic accuracy.

- Additionally, government initiatives to enhance healthcare infrastructure and the growing prevalence of lifestyle-related diseases further strengthen the demand for ultrasound systems in hospital settings.

Looking for region specific data?

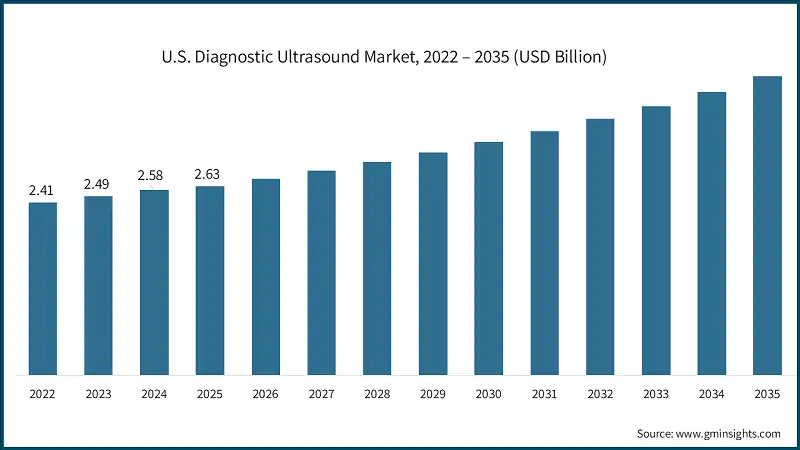

North America Diagnostic Ultrasound Market North America dominated the market with a market share of 33.8% in 2025. Europe market accounted for USD 2.2 billion in 2025 and is anticipated to show lucrative growth over the forecast period. Germany diagnostic ultrasound market is projected to experience steady growth between 2026 and 2035. The Asia Pacific region is projected to be valued at USD 2.4 billion in 2025. Japan diagnostic ultrasound market is poised to witness lucrative growth between 2026 - 2035. Few of the prominent players operating in the diagnostic ultrasound industry include: Canon offers the Aplio iseries, a line of high-performance diagnostic ultrasound systems designed for multi purpose imaging, cardiovascular, and women’s health applications. Powered by advanced beamforming technology (iBeam+), wide-band transducers, and AI-enhanced workflows, the Aplio i series delivers exceptional image clarity, penetration, and consistent diagnostic accuracy across diverse clinical settings. Philips delivers a versatile ultrasound portfolio spanning premium EPIQ systems, compact units, and point-of-care solutions like InnoSight and Lumify. The flagship EPIQ Elite platform integrates xMatrix technology for volumetric acquisition, smart AI-driven tools for automated measurements, and a unified user interface that enhances user experience and diagnostic efficiency across cardiology, general imaging, and OB/GYN. GE Healthcare’s ultrasound lineup ranges from premium cart-based systems to rugged handheld devices. The Vscan Air stands out as a wireless, dual-probe handheld ultrasound that delivers clear imaging for OB/GYN, abdominal, cardiac, and MSK care, ideal for point-of-care environments. For more advanced needs, systems like LOGIQ e (portable laptop design) and Vivid S Series (cardiac and 4D imaging) offer enterprise-level performance and precision diagnostics.Europe Diagnostic Ultrasound Market

Asia Pacific Diagnostic Ultrasound Market

Latin America Diagnostic Ultrasound Market

Middle East and Africa Diagnostic Ultrasound Market

Diagnostic Ultrasound Market Share

Diagnostic Ultrasound Market Companies

Diagnostic Ultrasound Market News:

The diagnostic ultrasound market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2022 - 2035 for the following segments:

Market, By Technology

- 2D

- 3D and 4D

- Doppler

Market, By Portability

- Trolley

- Compact/handheld

Market, By Application

- General imaging

- Cardiology

- OB/GYN

- Other applications

Market, By End Use

- Hospitals

- Maternity centers

- Other End Use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What was the valuation of the trolley segment in 2025?

The trolley segment held a valuation of USD 5.8 billion in 2025, leading the market based on portability.

What was the revenue generated by the Doppler segment in 2025?

The Doppler segment generated USD 3 billion in revenue in 2025, dominating the market based on technology.

What is the projected value of the diagnostic ultrasound market by 2035?

The market is expected to reach USD 13.4 billion by 2035, fueled by innovations in imaging technology, AI integration, and the growing adoption of portable ultrasound systems.

What was the market size of the diagnostic ultrasound market in 2025?

The market size was USD 8.5 billion in 2025, with a CAGR of 4.7% projected through 2035, driven by an aging population, rising chronic disease prevalence, increasing birth rates in developing countries, and technological advancements in ultrasound devices.

Diagnostic Ultrasound Market Scope

Related Reports