Summary

Table of Content

Diabetes Care Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Diabetes Care Devices Market Size

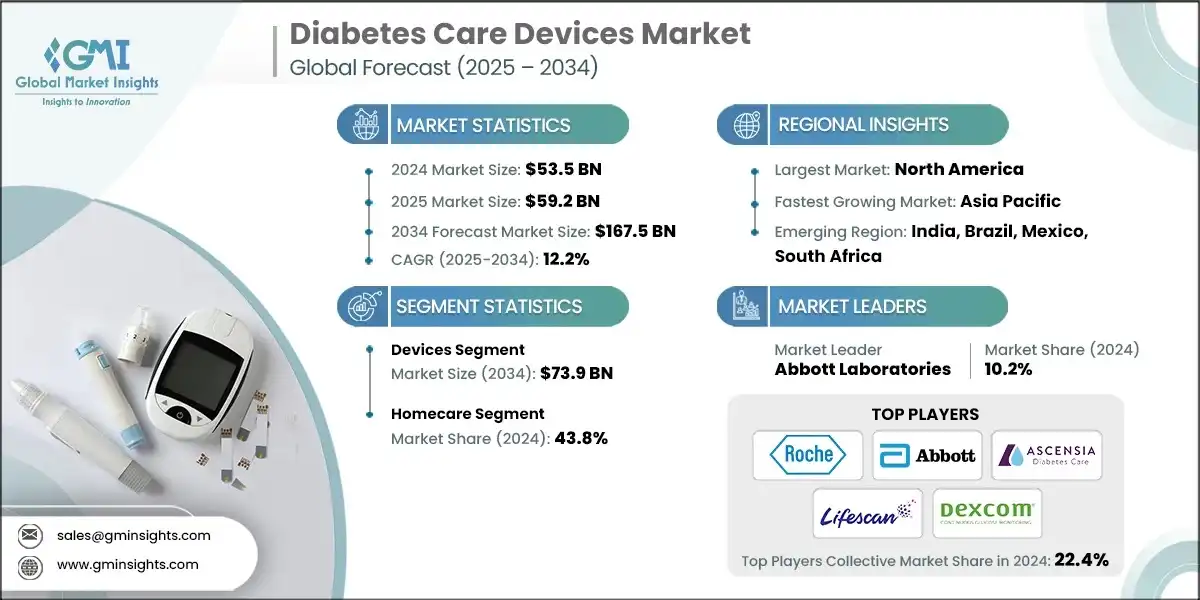

The global diabetes care devices market was valued at USD 53.5 billion in 2024 and is projected to grow from USD 59.2 billion in 2025 to USD 167.5 billion by 2034, expanding at a CAGR of 12.2%, according to the latest report published by Global Market Insights Inc. This steady growth is stimulated by various factors such as the growing prevalence of diabetes across the world, rising technological advancements in diabetes care devices, and increasing investments by public and private organizations for diabetes care.

To get key market trends

Diabetes care devices refer to a range of medical devices designed to help individuals with diabetes manage their condition effectively. These devices play a crucial role in monitoring blood glucose levels, administering insulin, and overall diabetes management. Major companies in the industry include F. Hoffmann-La Roche, Abbott Laboratories, Ascensia Diabetes Care Holdings, LifeScan, and Dexcom.

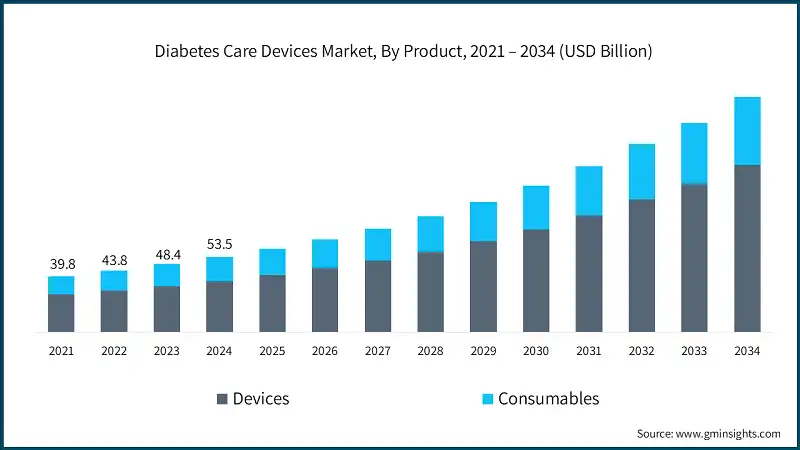

The market increased from USD 39.8 billion in 2021 to USD 48.4 billion in 2023, largely due to the increased adoption of digital technologies, shift in consumer behaviour preferring more advanced and sustainable solutions, and growing demand in emerging markets. Moreover, companies also capitalized on post pandemic momentum, expanding their product portfolio, and optimizing supply chain to meet the changing expectations. Thus, all these factors collectively contributed to the upward growth of the market during the period.

The growth of the global diabetes care devices market is highly attributed to the rising prevalence of diabetes across the globe. For instance, as per the estimates from the International Diabetes Federation (IDF), 537 million people were living with diabetes worldwide in 2021. This number is projected to reach 643 million in 2030 and then to 783 million in 2045. Thus, this increasing prevalence of diabetes among the population necessitates technologically advanced diabetes care devices for monitoring of blood glucose level among the affected patients and for administration of insulin, thereby positively contributing to the growth of the market.

Moreover, the growing elderly population worldwide is one of the significant catalysts for the upward trajectory of the market. For instance, according to data provided by the United Nations, it is projected that the global population aged 65 years and older will reach around 1.5 billion by 2050, representing 16% of the world’s population. Moreover, according to data from the Population Reference Bureau, individuals in the U.S. aged 65 and older are projected to reach 82 million by 2050, up from 58 million in 2022.

The population of this demographic is more likely to have chronic disease conditions such as diabetes, which often require frequent blood glucose monitoring, in turn stimulating the need for reliable and efficient glucose monitors. Therefore, as the population ages, so does the risk of diabetes among the demographic, thereby fostering the growth of the market.

Additionally, growing government initiatives, such as awareness programs to tackle the rising prevalence of diabetes across the world, are accelerating the market growth. For instance, the National Diabetes Prevention Program, launched in the U.S., aims to prevent or delay type 2 diabetes. As part of this initiative, the Centers for Disease Control and Prevention (CDC) provides resources and information about diabetes management tools. Thus, as the awareness among the affected populations increases, so does the demand for diabetes management tools, stimulating the market growth.

Diabetes care devices refer to a range of medical devices designed to help individuals with diabetes manage their condition effectively. These devices play a crucial role in monitoring blood glucose levels, administering insulin, and overall diabetes management.

Diabetes Care Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 53.5 Billion |

| Market Size in 2025 | USD 59.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 12.2% |

| Market Size in 2034 | USD 167.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing prevalence of diabetes across the world | Leads to a surge in demand for diabetes care devices, especially in both urban and rural areas. |

| Rising technological advancements in diabetes care devices | Drives innovation in device design, usability, and connectivity. |

| Increasing investments by public and private organizations for diabetes care | Accelerates R&D and commercialization of next-gen devices. |

| Pitfalls & Challenges | Impact |

| High cost of diabetes care devices | Restricts access for low-income populations and limits adoption in emerging markets. |

| Rigorous regulatory framework | Slows down innovation and time-to-market for new products. |

| Privacy, cybersecurity, and compliance risks in connected devices | Privacy, cybersecurity, and compliance risks in connected diabetes care devices undermine patient trust, increase regulatory and legal burdens, and raise development costs. |

| Opportunities: | Impact |

| Integrated care models combining CGM, insulin delivery, and telehealth | Enhances patient outcomes and convenience; supports remote care and chronic disease management; drives demand for interoperable systems. |

| AI-enabled decision support and closed-loop insulin automation | Improves glycemic control and reduces complications; enables personalized treatment; boosts efficiency in clinical workflows and remote monitoring |

| Market Leaders (2024) | |

| Market Leaders |

10.2% Market share |

| Top Players |

Collective market share in 2024 is 22.4% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Brazil, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Diabetes Care Devices Market Trends

- The technological advancement of diabetes care devices is one of the major trends accelerating the market forward. Many companies in this market are investing in the development of diabetes care devices that are cost-effective, painless, and provide highly effective and reliable results for diabetic patients.

- For instance, Dexcom's G7 continuous glucose monitor is one of the most precise sensors of the company, suitable for patients with type 1, type 2, or gestational diabetes. This sensor is 60% smaller than its predecessor, the G6. It provides real-time data directly to smartwatches or smartphones, eliminating the need for fingerstick tests.

- Moreover, established players in the market are focusing on product launches, acquisitions, regulatory approvals, and partnerships in order to increase their customer base and market presence across the emerging and developed countries of the world.

- For instance, in May 2022, Abbott launched FreeStyle Libre 3, the 14-day sensor. This sensor is suitable for patients aged four and above, offering continuous blood sugar monitoring. This sensor is intended to be worn on the upper arm and transmits to a smartphone application.

- Additionally, SMBG devices have also become more portable and comfortable due to compact and ergonomic designs.

- For instance, the CONTOUR NEXT ONE meter by Ascensia Diabetes Care is equipped with the Second Chance Sampling feature, which enables patients to add more blood to the test strip if the first sample didn't fill the required amount. This cuts down on wasted lancets and test strips, saves on finger pricks, and increases the user's comfort with the device, thereby enhancing usability.

- Thus, these technological advancements are positively contributing to the adoption among the patients, fostering market growth.

Diabetes Care Devices Market Analysis

Learn more about the key segments shaping this market

Based on the product, the market is segmented into devices and consumables. The devices segment is further bifurcated into blood glucose monitoring devices and insulin delivery devices. The blood glucose monitoring devices segment was valued at USD 19.5 billion in 2024 and is projected to reach USD 73.9 billion by 2034, growing at a CAGR of 14.4%. In comparison, the consumables segment, valued at USD 17.2 billion in 2024, is expected to grow to USD 48.5 billion by 2034.

- Blood glucose monitoring devices such as continuous glucose monitors and self-monitoring blood glucose meters are crucial tools for individuals with diabetes. These devices provide critical information to the individual suffering from diabetes to make an informed decision regarding their respective exercise, diet, and insulin dosing.

- Moreover, diabetes requires continuous monitoring of the blood glucose in order to prevent the associated complications such as hyperglycemia and hypoglycemia. Thus, these devices provide real-time monitoring of the blood glucose, allowing the patient to track their glucose level throughout the day.

- Additionally, the rising prevalence of diabetes across emerging and developed nations is a key catalyst for the growth of the segment.

- For instance, according to the data published in the Journal of the Associations of Physicians of India, the estimated number of individuals in India living with diabetes was 32 million in 2000, which rose to 63 million in 2012, 74 million in 2021, and it is now 101 million.

- Thus, this statistic highlights the critical need for technologically advanced blood glucose monitoring devices for effective and timely management of blood glucose among the affected individuals, fostering market growth.

Learn more about the key segments shaping this market

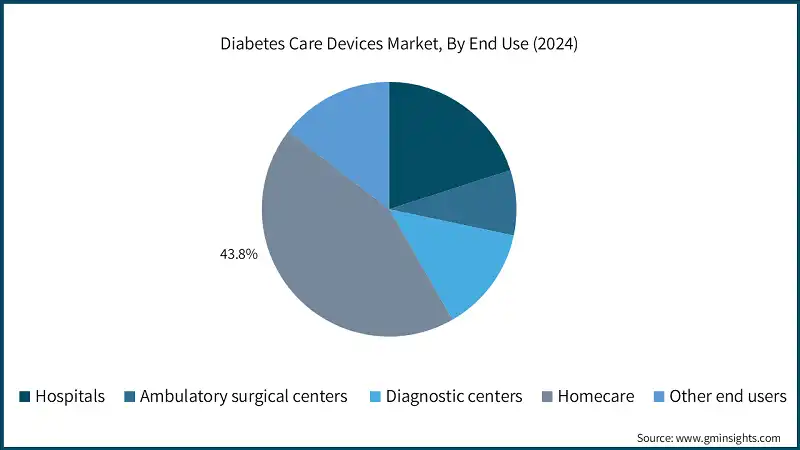

Based on end use, the diabetes care devices market is segmented into hospitals, ambulatory surgical centers, diagnostic centers, homecare, and other end users. The homecare segment accounted for the market share of 43.8% in 2024.

- Individuals with diabetes can now manage their condition from the comfort of their homes. This convenience significantly drives the adoption of home-use diabetes care devices. With these devices, patients can monitor blood glucose levels, administer insulin, and oversee their diabetes management, all without frequent trips to healthcare facilities.

- Homecare devices, such as continuous glucose monitoring (CGM) systems, offer real-time insights into blood glucose levels. This continuous oversight empowers individuals to monitor glucose trends throughout the day, enabling informed choices regarding diet, exercise, and insulin dosing.

- CGM systems have gained traction among those with diabetes, seeking enhanced control and insight into their condition.

- Moreover, these home settings facilitate personalized care plans. Patients collaborate with healthcare providers to customize treatment regimens, aligning them with individual needs and lifestyles. For example, using insulin pumps, patients can modify their insulin doses based on mealtimes and activity levels.

- The older population becomes more susceptible to diabetes, and many opt for home management to maintain independence and minimize healthcare visits. This demographic shift amplifies the demand for homecare devices in the diabetes care market. Individuals aged 65 and above appreciate the convenience of using diabetes care devices at home. The rising geriatric population grappling with diabetes continues to expand the homecare segment.

- Therefore, the increasing preference for home management of diabetes, especially among the elderly, is driving significant growth in the home-use diabetes care devices market.

Looking for region specific data?

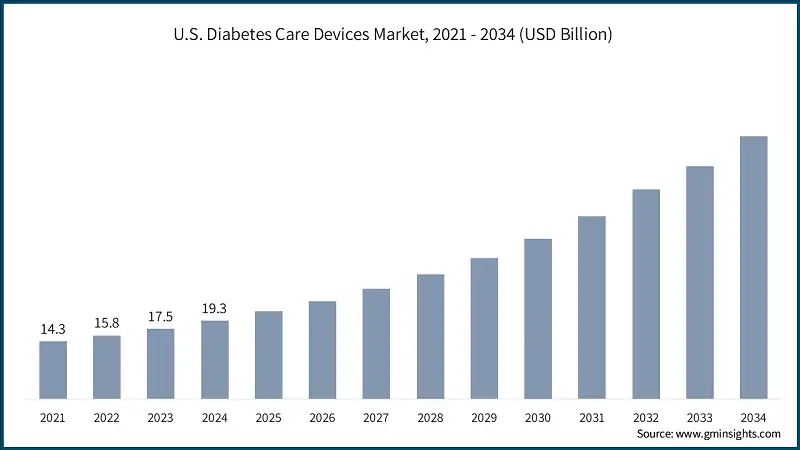

North America dominated the global diabetes care devices market, with the highest market share of 39.3% in 2024.

The U.S. diabetes care devices market was valued at USD 14.3 billion and USD 15.8 billion in 2021 and 2022, respectively. In 2024 the market size reached USD 19.3 billion from USD 17.5 billion in 2023.

- This growth is highly attributed to the rising prevalence of diabetes in the country.

- For instance, in 2021, as per the data from the Centers for Disease Control and Prevention (CDC), approximately 38.4 million individuals in the U.S. were living with diabetes, out of which 90-95% of individuals were affected by type 2 diabetes.

- Therefore, as the prevalence of diabetes increases, so does the demand for technologically advanced diabetes care devices, thereby propelling the market growth in the country.

Europe diabetes care devices market accounted for USD 14.5 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The growth of the market in the region is primarily driven by the increasing aging population, as older adults are more susceptible to chronic disease conditions such as diabetes.

- According to the European Commission, 21.1% of the EU population was aged 65 or older in 2022, and this figure is projected to rise to 32.5% by 2100.

- Therefore, as the population ages, so does the risk of diabetes among the aged population, thereby accelerating the demand for diabetic care devices such as glucose meters for regular monitoring of glucose levels.

UK diabetes care devices market is projected to experience steady growth between 2025 and 2034.

- The growth of the market in the country is highly attributed to the rising prevalence of diabetes in the country.

- For instance, as per the data from the Public Health England’s Diabetes prevalence model, by 2035, the prevalence of diabetes in the country is expected to reach 4.9 million, which is equivalent to 9.7% of the total population of the country.

- Thus, as the rate of diabetic prevalence increases, the adoption of diabetic care devices among the affected population is anticipated to increase in the foreseeable future, propelling the market growth in the country.

Asia Pacific Diabetes Care Devices Market

The Asia Pacific region is projected to be valued at USD 12.2 billion in 2025 and is expected to reach USD 39 billion by 2034.

- The market in the Asia Pacific region is expanding rapidly due to the growing burden of diabetes, rising health awareness, and continuous advancements in healthcare infrastructure.

- Advancements in healthcare infrastructure, including the construction of new hospitals and diagnostic centers, are propelling the demand for advanced diabetes care devices to ensure proper care for individuals suffering from diabetes, thereby propelling the market growth in the region.

Japan diabetes care devices market is poised to witness lucrative growth between 2025 - 2034.

- The country has a rapidly increasing aging population that necessitates frequent healthcare intervention.

- For instance, as per estimates, Japan has around 36.25 million people aged 65 years and above, which leads to one-third of the entire Japanese population.

- The population of this demographic is more likely to have chronic disease conditions such as diabetes, which often require frequent blood glucose monitoring, in turn stimulating the need for medical devices such as self-monitoring blood glucose devices, continuous glucose monitors, testing strips, and lancets, thereby propelling the market growth in the region.

Brazil is experiencing significant growth in the diabetes care devices market.

- The growth of the market in the country is owing to various factors, such as growing government initiatives and the integration of digital health solutions.

- Digital solutions such as telemedicine platforms and mobile apps have enhanced patient engagement and remote care, making diabetes care devices more accessible and effective.

- Moreover, the rising rate of obesity and the aging population further contribute to the growth of the market, since these demographic groups are at high risk of developing diabetes, which in turn requires frequent monitoring of blood glucose levels, thereby fostering the market growth.

The diabetes care devices market in Saudi Arabia is expected to experience significant and promising growth from 2025 to 2034.

- Saudi Arabia’s advanced healthcare infrastructure and rising investment in advanced healthcare technologies create an opening for the development and adoption of advanced diabetes care devices tailored to the country’s patient-specific needs.

- Moreover, there is a rise in health awareness programs in Saudi Arabia, such as the Saudi National Diabetes Screening Program, which focuses on disease management and emphasizes its prevention and treatment. Thus, such awareness programs positively influence market growth in the country.

- In addition, Vision 2030’s focus on healthcare modernization is boosting investments in diabetes care devices, supported by the need for advanced devices for managing diabetes.

Diabetes Care Devices Market Share

- The top 5 players in the diabetes care devices market such as F. Hoffmann-La Roche, Abbott Laboratories, Ascensia Diabetes Care Holdings, LifeScan, and Dexcom collectively hold a 22.4% share of the global market. These companies maintain their leadership through diverse product portfolios, strategic collaborations, regulatory approvals, and ongoing innovation. Abbott Laboratories stands out due to their comprehensive range of diabetes care devices, widely adopted in hospitals and diagnostic centers.

- Abbott Laboratories and Dexcom have strengthened their market positions through acquisitions and product launches. In September 2023, Abbott acquired Bigfoot Biomedical, a renowned developer of smart insulin management systems for individuals with diabetes. This acquisition united two industry leaders in distinct areas of diabetes care including continuous glucose monitoring, which is estimated to reach USD 47.1 billion by 2034, and insulin dosing support. The strategic move enriched the company's product portfolio in diabetic care and bolstered revenue generation.

- Moreover, in March 2024, Dexcom introduced its newest CGM system, Dexcom ONE+, in Ireland. Dexcom ONE+ utilizes Dexcom's top-tier and highly accurate sensor design. This product launch bolstered the company's product portfolio in the Irish market and boosted the company's revenue.

Diabetes Care Devices Market Companies

Few of the prominent players operating in the diabetes care devices industry include:

- Abbott Laboratories

- ARKRAY

- Ascensia Diabetes Care

- B. Braun Melsungen

- Becton, Dickinson and Company

- Bionime

- DarioHealth

- Dexcom

- Dr. Reddy’s Laboratories

- Eli Lilly and Company

- F. Hoffmann-La Roche

- Insulet

- Medtronic

- Nova Biomedical

- Novo Nordisk

- Pendiq

- LifeScan

- Sanofi

- Sinocare

- Tandem Diabetes Care

- Ypsomed Holding

- Abbott Laboratories

Abbott is a global healthcare company with a diversified portfolio of medical devices, diagnostics, nutrition, and branded generic pharmaceuticals. The company is offering a range of products and solutions to help individuals manage their diabetes effectively. FreeStyle Libre is Abbott's flagship continuous glucose monitoring (CGM) system. It offers a factory-calibrated sensor that eliminates the need for routine fingerstick calibrations, providing real-time glucose readings and trend data.

- Ascensia Diabetes Care

Ascensia Diabetes Care specializes in diabetes management solutions. The company is renowned for its portfolio of blood glucose monitoring systems, particularly the CONTOUR brand, which is widely recognized for its accuracy and ease of use. In recent years, Ascensia has expanded its portfolio to include digital health solutions and continuous glucose monitoring (CGM) technologies, advancing personalized care options for diabetes management.

- B. Braun Melsungen

B. Braun Melsungen, a renowned player in the medical technology industry, also holds significance in the diabetic care device market. While traditionally recognized for its expertise in infusion therapy and medical equipment, B. Braun has steadily expanded its portfolio to include innovative solutions for diabetes management. With more than 300 subsidiaries in 64 countries and a portfolio boasting 5,000 healthcare products, the company operates its business on a global scale.

Diabetes Care Devices Industry News:

- In September 2024, Dexcom made a strategic investment of USD 75 million in Oura, a leading health-tracking ring manufacturer, and formed a partnership to enable bi-directional data integration between Dexcom’s CGM and the Oura Ring. This collaboration enhanced Dexcom’s competitive advantage by integrating glucose data with broader health metrics for more personalized insights.

- In January 2024, Dexcom revealed its submission of the new Stelo glucose sensor to the FDA for review. Tailored by the continuous glucose monitor (CGM) maker, Stelo is intended for individuals with type 2 diabetes that do not require insulin. This strategic initiative is anticipated to position Dexcom with a competitive advantage in the market.

- In January 2024, Medtronic announced CE Mark approval for the MiniMed 780G system featuring Simplera Syn, a compact CGM that eliminates the need for fingersticks or overtape. With a simplified insertion process and smaller size, it enhances user experience while upholding glucose monitoring accuracy and reliability, marking a notable advancement for Medtronic.

- In March 2023, Astellas Pharma Inc. disclosed its partnership with Roche Diabetes Care Japan Co., Ltd. to collaboratively develop and commercialize the Accu-Chek Guide Me blood glucose monitoring system with enhanced accuracy. Additionally, the agreement involved integrating BlueStar, FDA-cleared digital health solution for diabetes patients developed by Welldoc, Inc. and presently accessible in the U.S. and Canada. The primary objective of this collaboration was to enhance the accuracy of the product and attain a competitive edge in the market.

The diabetes care devices market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- Devices

- Blood glucose monitoring devices

- Self-monitoring blood glucose meters

- Continuous glucose monitors

- Insulin delivery devices

- Insulin pumps

- Tubed pumps

- Tubeless pumps

- Pens

- Reusable

- Disposable

- Other insulin delivery devices

- Insulin pumps

- Blood glucose monitoring devices

- Consumables

- Testing strips

- Lancets

- Pen needles

- Standard

- Safety

- Syringes

- Insulin pumps consumables

Market, By End Use

- Hospital

- Ambulatory surgical centers

- Diagnostic centers

- Homecare

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Sweden

- Belgium

- Denmark

- Finland

- Norway

- Lithuania

- Latvia

- Estonia

- Russia

- Poland

- Switzerland

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

- Israel

- Kuwait

- Qatar

Frequently Asked Question(FAQ) :

What is the projected size of the diabetes care devices market in 2025?

The market is expected to reach USD 59.2 billion in 2025.

How much revenue did the blood glucose monitoring devices segment generate?

The blood glucose monitoring devices segment generated USD 19.5 billion in 2024, with a projected CAGR of 14.4% through 2034.

Who are the key players in the diabetes care devices market?

Key players include Abbott Laboratories, ARKRAY, Ascensia Diabetes Care, B. Braun Melsungen, Becton, Dickinson and Company, Bionime, DarioHealth, Dexcom, Dr. Reddys Laboratories, Eli Lilly and Company, F. Hoffmann-La Roche, Insulet, and Medtronic.

What was the valuation of the consumables segment?

The consumables segment was valued at USD 17.2 billion in 2024 and is expected to grow significantly by 2034.

Which region leads the diabetes care devices market?

North America led the market with a 39.3% share in 2024, driven by advanced healthcare infrastructure and high adoption of diabetes care technologies.

What is the projected value of the diabetes care devices market by 2034?

The market is expected to reach USD 167.5 billion by 2034, fueled by innovations in diabetes care devices and growing demand for effective diabetes management solutions.

What is the market size of the diabetes care devices in 2024?

The market size was USD 53.5 billion in 2024, with a CAGR of 12.2% expected through 2034, driven by the rising prevalence of diabetes, technological advancements, and increased investments in diabetes care.

What are the upcoming trends in the diabetes care devices industry?

Key trends include the development of cost-effective and painless devices, real-time glucose monitoring solutions, and strategic initiatives like product launches, acquisitions, and partnerships by major players.

Diabetes Care Devices Market Scope

Related Reports