Home > Media & Technology > Information Technology > IT Software > Data Warehousing Market

Data Warehousing Market Analysis

- Report ID: GMI3744

- Published Date: Sep 2019

- Report Format: PDF

Data Warehousing Market Analysis

Unstructured data warehousing market, which includes data not associated with a recognizable model, is expected to grow at over 10% CAGR from 2019 to 2025 as enterprises leverage unstructured data for advanced analytics. The data is not pre-organized in any format and usually contains text-rich information such as names and addresses. The major driving force leading to the increased popularity of unstructured data warehousing is the presence of crucial underlying information.

The rapidly increasing volumes of Big Data and usage of new business analytics tools for handling it, such as MapReduce and Hadoop, have highlighted the need for unstructured data in warehousing solutions. With the rapid adoption of flexible cloud data warehouses with unstructured data ingestion, the unstructured data segment is expected to witness high growth over the forecast period.

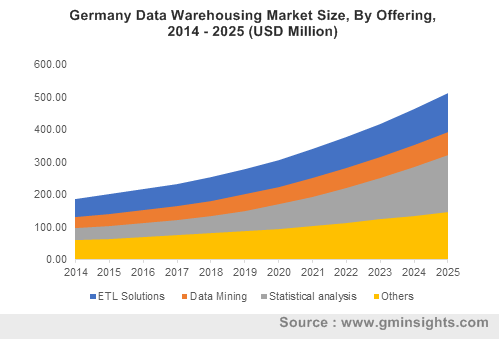

Data mining tools aid in the automated processing and analysis of large volumes of data to discover patterns, trends, or correlations that hold important business value. Enterprises leverage such tools to predict future results, helping them to find new opportunities such as product development and revenue expansion.

Data mining has witnessed a substantial increase in its adoption for fraud detection, consumer profiling, website optimization, and determining potential market segments. A wide variety of data warehousing tools, including Azure ML Studio, RStudio, Python, and SAS are available at affordable prices, enabling enterprises to capitalize on enhanced data insights and increase business productivity. They are forecast to account over 25% of the data warehousing market share by 2025.

Storing data on-premise can become very expensive if computing power and storage have different scalability. Cloud warehouses can instantly scale themselves to deliver as high or as low computing needs as required, making them highly cost-effective.

Cloud data warehousing is gaining significant traction among enterprises as it provides numerous benefits including multiple data type support, on-demand computing, unlimited storage, and flexible pricing models. SME are rapidly adopting the cloud deployment model due to affordable costs and low infrastructure requirements. Favorable government initiatives to promote cloud computing and big data analytics are also a chief growth driver for the market.

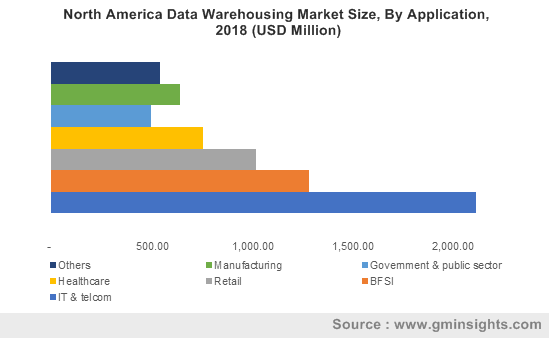

The extensive use of data mining and big data analytics by the BFSI sector has increased the adoption of data warehousing solutions. The industry is under huge pressure to cut down on financial losses caused by frauds and malicious cyber-attacks. This has surged the use of big data analytics among financial institutions. These institutions are increasingly deploying solutions for predictive fraud analytics, detecting fake insurance claims, assessing credit risk, and ensuring government compliance, fueling the data warehousing market demand. The advent of IoT in BFSI with connected devices such as ATMs, mobile banking, and smart credit cards, has further increased the demand for Big Data analytics and data warehousing.

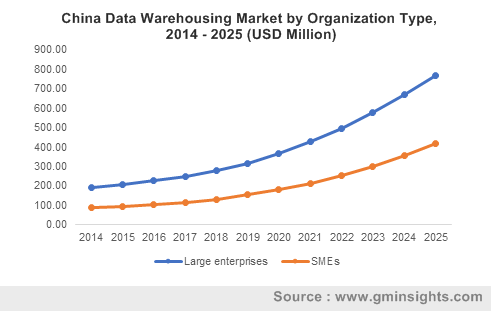

Large enterprises are early adopters of data warehousing solutions. In-house data centers, dedicated IT staff, and availability of financial resources for infrastructure development have fueled the market growth among large enterprises. They deploy advanced enterprise solutions, such as Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP), generating a vast amount of valuable data, which is leveraged for competitive advantage. With the development of hybrid warehousing models, large enterprises can harness the flexibility and scalability of cloud warehouse using on-premise data warehousing.

Enterprises in Asia Pacific are establishing various data centers for providing big data solutions and cloud data warehousing systems. For instance, in 2019, the Chinese e-commerce firm, Alibaba launched two cloud-based data centers in China, targeted at providing cloud data warehousing solutions to Chinese enterprises in the Hohhot and Chengdu industrial areas. The services are also proving economical for SME due to no upfront infrastructure investments and affordable pricing.

The Asia Pacific data warehousing market is expected to witness growth at over 15% CAGR from 2019 to 2025 due to the rapid growth of IT infrastructure, increasing number of data centers, and the wide-scale adoption of cloud technologies.