Summary

Table of Content

Data Warehousing Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Data Warehousing Market Size

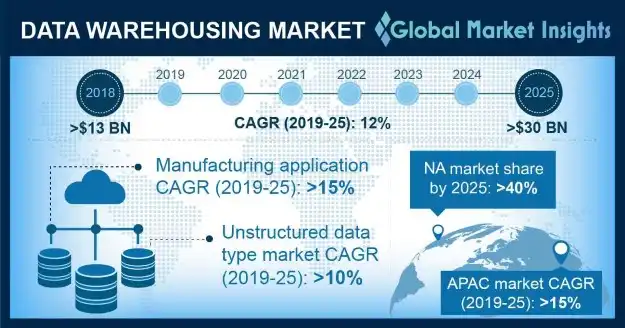

Data Warehousing Market size exceeded USD 13 billion, globally in 2018 and is estimated to grow at over 12% CAGR between 2019 and 2025.

To get key market trends

Data warehousing refers to the amalgamation of data from several disparate sources, including social media, mobile data, and business applications. This data is used for delivering valuable business insights and analytical reports. Heterogeneous data obtained from various sources is first cleansed and then organized into a consolidated format in the data warehouse. Enterprises use data warehousing tools and Database Management System (DBMS) to access the data stored on warehouse servers to support their operational decisions.

The data warehousing market growth is attributed to factors such as the increasing amount of data generated by enterprises and growing need for Business Intelligence (BI) to gain competitive advantage. The vast volumes of data produced by various business verticals are exerting tremendous pressure on existing enterprise resources, forcing them to adopt data warehousing solutions for efficient, flexible, and scalable storage. This data can be leveraged using advanced data mining and BI tools, providing valuable business insights to users for increased operational efficiency, better decision making, strengthening customer retention, and increasing revenue streams.

Data Warehousing Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 13 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 12% |

| Market Size in 2025 | 30 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Another factor leading to market growth is the rising trend of cloud computing. The growing adoption of cloud-based services will facilitate the demand for cloud data warehousing. Enterprises and government agencies are realizing the economic benefits of cloud data warehouse, such as on-demand computing, unlimited storage, integrated BI tools, and affordable pricing options. The proliferation of Data Warehouse as-a-Service (DWaaS) and the increasing popularity of unstructured data for data analytics are further expected to fuel market growth.

Data Warehousing Market Analysis

Unstructured data warehousing market, which includes data not associated with a recognizable model, is expected to grow at over 10% CAGR from 2019 to 2025 as enterprises leverage unstructured data for advanced analytics. The data is not pre-organized in any format and usually contains text-rich information such as names and addresses. The major driving force leading to the increased popularity of unstructured data warehousing is the presence of crucial underlying information.

The rapidly increasing volumes of Big Data and usage of new business analytics tools for handling it, such as MapReduce and Hadoop, have highlighted the need for unstructured data in warehousing solutions. With the rapid adoption of flexible cloud data warehouses with unstructured data ingestion, the unstructured data segment is expected to witness high growth over the forecast period.

Learn more about the key segments shaping this market

Data mining tools aid in the automated processing and analysis of large volumes of data to discover patterns, trends, or correlations that hold important business value. Enterprises leverage such tools to predict future results, helping them to find new opportunities such as product development and revenue expansion.

Data mining has witnessed a substantial increase in its adoption for fraud detection, consumer profiling, website optimization, and determining potential market segments. A wide variety of data warehousing tools, including Azure ML Studio, RStudio, Python, and SAS are available at affordable prices, enabling enterprises to capitalize on enhanced data insights and increase business productivity. They are forecast to account over 25% of the data warehousing market share by 2025.

Storing data on-premise can become very expensive if computing power and storage have different scalability. Cloud warehouses can instantly scale themselves to deliver as high or as low computing needs as required, making them highly cost-effective.

Cloud data warehousing is gaining significant traction among enterprises as it provides numerous benefits including multiple data type support, on-demand computing, unlimited storage, and flexible pricing models. SME are rapidly adopting the cloud deployment model due to affordable costs and low infrastructure requirements. Favorable government initiatives to promote cloud computing and big data analytics are also a chief growth driver for the market.

Learn more about the key segments shaping this market

The extensive use of data mining and big data analytics by the BFSI sector has increased the adoption of data warehousing solutions. The industry is under huge pressure to cut down on financial losses caused by frauds and malicious cyber-attacks. This has surged the use of big data analytics among financial institutions. These institutions are increasingly deploying solutions for predictive fraud analytics, detecting fake insurance claims, assessing credit risk, and ensuring government compliance, fueling the data warehousing market demand. The advent of IoT in BFSI with connected devices such as ATMs, mobile banking, and smart credit cards, has further increased the demand for Big Data analytics and data warehousing.

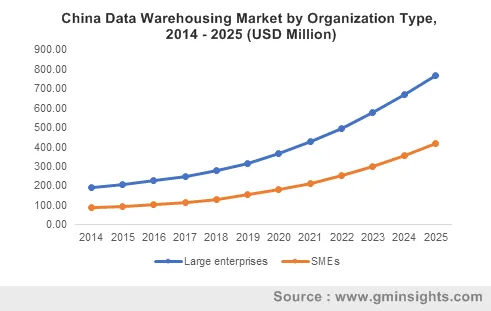

Large enterprises are early adopters of data warehousing solutions. In-house data centers, dedicated IT staff, and availability of financial resources for infrastructure development have fueled the market growth among large enterprises. They deploy advanced enterprise solutions, such as Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP), generating a vast amount of valuable data, which is leveraged for competitive advantage. With the development of hybrid warehousing models, large enterprises can harness the flexibility and scalability of cloud warehouse using on-premise data warehousing.

Looking for region specific data?

Enterprises in Asia Pacific are establishing various data centers for providing big data solutions and cloud data warehousing systems. For instance, in 2019, the Chinese e-commerce firm, Alibaba launched two cloud-based data centers in China, targeted at providing cloud data warehousing solutions to Chinese enterprises in the Hohhot and Chengdu industrial areas. The services are also proving economical for SME due to no upfront infrastructure investments and affordable pricing.

The Asia Pacific data warehousing market is expected to witness growth at over 15% CAGR from 2019 to 2025 due to the rapid growth of IT infrastructure, increasing number of data centers, and the wide-scale adoption of cloud technologies.

Data Warehousing Market Share

Enterprises operating in the market are adopting strategies such as collaborations, new data center launches, and product developments, to enhance their existing offerings and expand their portfolio for targeting a wider customer base. For instance, in May 2019, Oracle partnered with SUSE, a German company developing Linux software, for integrating its Oracle Database 19c data warehouse software into its SUSE platform. The collaboration brings new developments in data warehousing software such as hybrid memory partitioning and advanced diagnostics.

Some of the major companies operating in the data warehousing market are

- AWS

- 1010DATA

- Accur8Software

- Actian Corp

- AtScale, Inc.

- Attunity

- Cloudera, Inc.

- Dell

- IBM Corporation

- Informatica

- Microfocus

- Microsoft Corporation

- MarkLogic Corporation

- Netavis Software Gmbh

- Oracle Corporation

- Panoply Ltd.

- Pivotal Software, Inc.

- SAP SE

- Sigma Computing

- Snowflake, Inc.

- Teradata

- Talend

- SAS Institute, Inc.

Industry Background

Data warehousing technology has revolutionized business intelligence by allowing organizations to cost-effectively store and analyze vast volumes of enterprise data. Traditionally, enterprises used database management systems and data marts for storing data separately based on business verticals. This led to complications in integrating data from disparate sources and made data analytics difficult. The rising volumes of data and the speed at which data entered traditional data storage systems was beyond the capabilities of legacy systems. This resulted in the development of hyper-scale data warehouses with robust computing power and high storage capacities. The integration of cloud computing technologies into data warehousing and the availability of affordable big data solutions caused a disruption in the way enterprises leveraged data analytics. With the growing popularity of cloud data warehousing and extensive usage of big data analytics, the demand for these solutions will increase over the forecast timespan.

The data warehousing market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue in USD from 2014 to 2025, for the following segments:

By Data Type

- Structured

- Unstructured

By Deployment Model

- On-premise

- Cloud

- Hybrid

By Organization Type

- Large enterprises

- SME

By Offering

- Statistical analysis

- Data mining tools

- Extract, Transform & Load (ETL) Solutions

- Others

By Application

- Retail

- IT & Telecom

- BFSI

- Manufacturing

- Healthcare

- Government

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- APAC

- China

- India

- Japan

- South Korea

- ANZ

- Southeast Asia

- LAMEA

- Brazil

- Mexico

- Colombia

- Chile

- MEA

- Saudi Arabia

- South Africa

- Qatar

- UAE

Frequently Asked Question(FAQ) :

Which are the prominent players in the data warehousing industry?

Some of the major companies operating in the market are AWS, 1010DATA, Accur8Software, Actian Corp, AtScale, Inc., Attunity, Cloudera, Inc., Dell, Google, IBM, Informatica, Microfocus, Microsoft, MarkLogic, Netavis Software Gmbh, Oracle, Panoply Ltd., Pivotal Software, Inc., SAP SE, Sigma Computing, Snowflake, Inc., Teradata, Talend, and SAS Institute, Inc.

Why are the large enterprises witnessing high adoption of data warehousing solutions?

In-house data centers, dedicated IT staff, and availability of financial resources for infrastructure development will fuel the adoption of data warehousing solutions among large enterprises.

What was the estimated global data warehousing market size in 2018?

The market size of data warehousing was exceeded USD 13 billion in 2018.

What is the anticipated growth for the data warehousing industry share during the forecast period?

The industry share of data warehousing is estimated to grow at over 12% CAGR between 2019 and 2025.

What are the growth estimations for Asia Pacific data warehousing market?

The Asia Pacific market is expected to witness growth at over 15% from 2019 to 2025 led by rapid growth of IT infrastructure, increasing number of data centers, and wide-scale adoption of cloud technologies.

How will the cloud data warehousing solutions gain during the forecast period?

According to this research report by GMI, the cloud warehousing solutions will grow at nearly 15% CAGR through 2025.

Data Warehousing Market Scope

Related Reports