Summary

Table of Content

Data Center Infrastructure Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Data Center Infrastructure Market Size

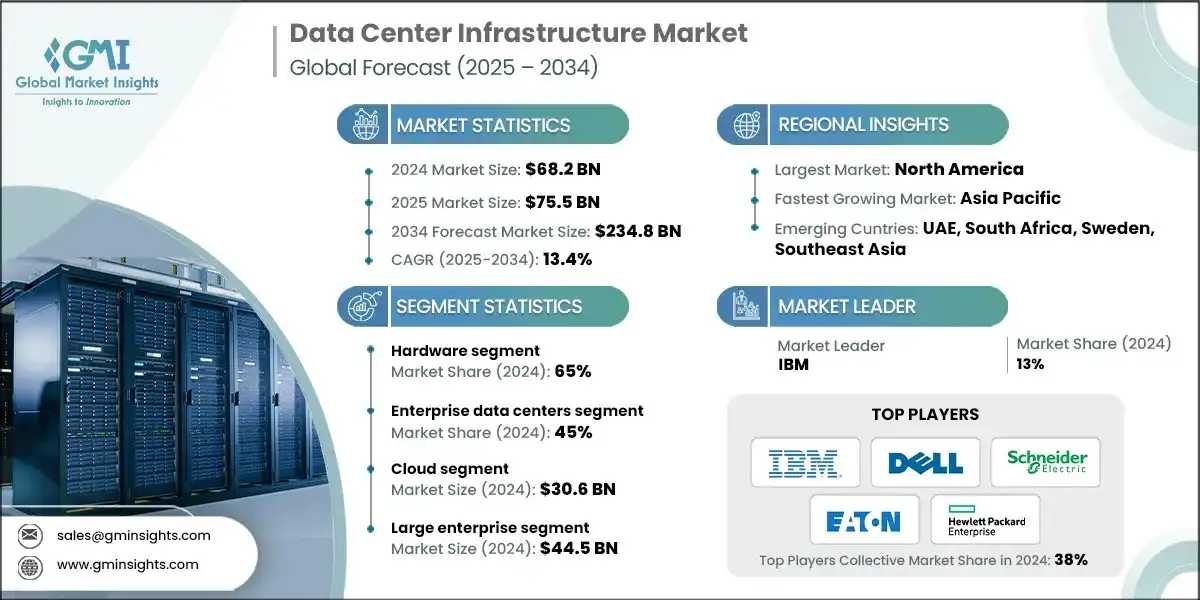

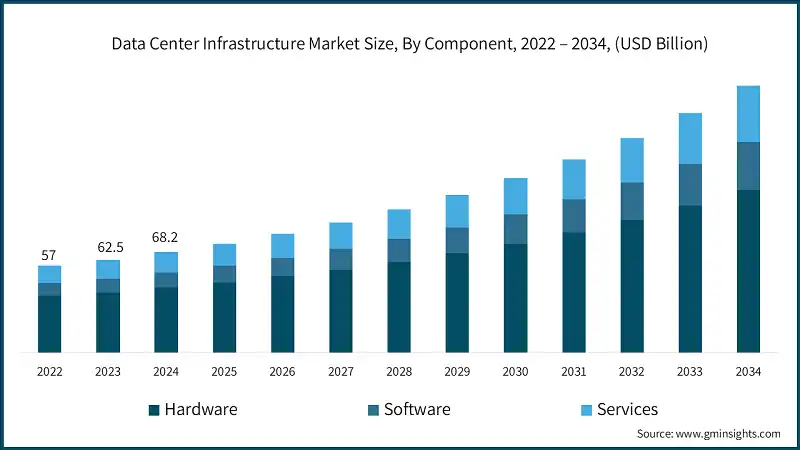

The global data center infrastructure market was estimated at USD 68.2 billion in 2024. The market is expected to grow from USD 75.5 billion in 2025 to USD 234.8 billion in 2034, at a CAGR of 13.4%, according to latest report published by Global Market Insights Inc.

To get key market trends

The data center infrastructure market is growing due to converging factors of artificial intelligence workloads, hyperscale cloud growth, and enterprise digitization. The acquisition of higher density racks, purpose-built servers, GPUs and accelerators is fundamentally changing the requirements for power distribution, cooling solutions, and network interconnect architectures. In 2024, global electricity consumption by data centers reached roughly 415 TWh, or around 1.5% of global power demand, perhaps to double by 2030 as workloads of computing continue growth into AI and machine learning.

With government pressures for digitization, smart cities, and data-driven governance, the need for many data centers has dramatically increased in importance. These activities are intended to drive efficiencies, improve safety, and innovate under high demand. For example, in March 2024, Bangladesh Data Center Company Limited (BDCCL) updated a data center by implementing Oracle Cloud Infrastructure (OCI) Dedicated Region. As such, the OCI solution now supports more than 30 government agencies and functions while maintaining data compliance and governance at both privacy controls and oversight levels.

The COVID-19 pandemic served as a substantial, unintended stress test of global data center infrastructure by simultaneously stressing capacity and rapidly accelerating a digital transformation phase for enterprises. With lockdowns facilitating work, education, and social life online, capacity on international internet grew by 35%. While international internet capacity was growing, the accelerated adoption of remote work and AI-based research tools resulted in the market for AI-optimized infrastructure and liquid cooling technologies being enhanced by 2 to 3 years, creating a need for data centers to support workloads of higher density.

North America has been the most dominant global market, driven largely by the significant investment in infrastructure from hyperscale operators, technology companies, and financial services companies. In North America, the U.S. represents about 79.9% of the regional market share. Major data center markets include Northern Virginia, Dallas, Silicon Valley, Phoenix, and Chicago. Northern Virginia alone accounts for approximately 13% of global data center capacity.

The Asia-Pacific region presents the largest growth potential. China is leading growth in the region with national priorities designed to build out computing infrastructure, including work related to the Eastern Data, Western Computing strategy which is a national government initiative and aims to achieve total computing capacity in the country of 300 exaflops by 2025. In addition, India is installing the largest IT capacities in 2025. The capacity is projected to double in 2 years. This is in addition to major investments that have been made in the region, including Google's recent announcement for a USD 15 billion AI data center hub in Visakhapatnam, India.

Data Center Infrastructure Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 68.2 Billion |

| Market Size in 2025 | USD 75.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 13.4% |

| Market Size in 2034 | USD 234.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| AI & Hyperscale compute demand | Rapid procurement of higher-density racks, custom servers, GPUs/accelerators, cooling upgrades and power distribution from hyperscale’s and enterprise AI projects. |

| Cloud migration & continued hyperscale rollouts | Ongoing migration of enterprise workloads to cloud + growth of edge sites drives sustained demand for modular data centers, interconnect, and managed infrastructure. |

| Modernization for energy efficiency & power resiliency | Upgrades to efficient cooling, power management, DCIM, and grid/backup integration to lower OPEX and meet sustainability targets. |

| Greater focus on sustainability & alternative energy sourcing | Investments to reduce carbon intensity including PPA contracts, on-site renewables, energy storage, and to comply with regional regulation. |

| Pitfalls & Challenges | Impact |

| Power & grid constraints | In some regions, insufficient grid capacity and lengthy permitting slow new builds and delay projects resulted in project cancellations or costly grid upgrades. |

| Supply-chain, cost inflation and skills shortages | Higher component costs, longer lead times for specialized gear, and shortages of skilled installers/engineers inflate build timelines and margins. |

| Opportunities: | Impact |

| Custom silicon & architecture shift | Shift to non-x86 architectures and accelerators change server BOMs and system vendor mix; demand for new board, rack and thermal designs. |

| Edge densification & distributed footprint | More small-footprint sites to serve low-latency apps — increases unit counts but with lower spend per site; overall increases systems and services revenue. |

| Market Leaders (2024) | |

| Market Leaders |

13% market share |

| Top Players |

Collective market share in 2024 is 38% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia-Pacific |

| Emerging countries | UAE, South Africa, Sweden, Southeast Asia |

| Future outlook |

|

What are the growth opportunities in this market?

Data Center Infrastructure Market Trends

The industry is witnessing a fundamental shift away from traditional x86 architectures toward custom silicon and specialized accelerators designed specifically for AI and machine learning workloads. Hyperscale operators like Google, Amazon, Microsoft, and Meta have created proprietary server designs, deploying custom processors, AI accelerators, and custom networking silicon to optimize performance, power, and total cost of ownership for their specific workload profiles.

The economics of edge infrastructure are significantly different than that of hyperscale deployments. The individual capital expenditure for edge sites is considerably lower, ranging from USD 500,000 to USD 5 million, and for hyperscale campuses, it is USD 500 million to as high as USD 5 billion. At scale across many edge sites, the market will be significant. Edge infrastructure requires modular, pre-integrated solutions to quickly deploy and require little on-site construction and commissioning. Power, cooling, and IT configurations must be standardized across edge sites to both impact operational efficiency at size and enable remote management at scale.

The burgeoning policy-led impetus towards efficiency and low-carbon data center operations is emerging as a signature market trend, compelling operators to rethink their designs based on stricter energy performance, renewable-power sourcing, and heat-reuse criteria. For example, Germany’s new law explicitly targets data centers and mandates PUE (Power Usage Effectiveness) and waste-heat reductions, mandates 100% renewable-energy by 2027, and requires at least 50% renewable sourcing by 2024. These policy mandates accelerate investment in higher-efficiency cooling, higher-density power systems, heat-recovery infrastructure, and long-term renewable procurement contracts.

The continuing global attention on the energy intensity of data centers is shaping into a core market trend, urging operators to drive aggressive efficiency improvements, sustainability-linked procurement, and next-generation cooling and power architecture. RMI’s latest analytic reveals global data center electricity consumption could increase to between 750-2300 TWh by 2030, which would represent between 0.9-2.8% of global CO2 emissions. Numbers are leading boards, regulators and investors to have energy optimization be treated as a strategic priority rather than an "optional" ESG project.

Telecom service providers and edge computing vendors are spearheading the adoption of modular buildouts, allowing for rapid deployment of distributed edge sites. Operators are deploying standardized edge modules with capacities ranging from 50 kW to 500 kW, which enables them to replicate the same base infrastructure at hundreds or thousands of site locations with minimal engineering and construction site-specific design. In China, for instance, the operator completed a rollout of 16 sites with standardized modular builds across six cities, supporting approximately 125 MWs of IT capacity and a total of about 17,000 racks.

Data Center Infrastructure Market Analysis

Learn more about the key segments shaping this market

Based on component, the market is divided into hardware, software, and services. Hardware segment dominated the market accounting by around 65% in 2024 and is expected to grow at a CAGR of 12.7% from 2025 to 2034.

- The hardware segment of the data center infrastructure represents the largest space in the data center infrastructure market as it relates to servers, storage systems, networking equipment, power distribution units (PDUs), uninterruptible power supplies (UPS), cooling infrastructure, racks, and enclosures. Data centers not only require the most capital to build physical infrastructure, but the hardware requires technology refresh cycles that have little to no impediment to performance, efficiency, or workload evolution.

- The shift to AI workloads will drive a substantial increase in hardware used in data centers since AI training servers sell for USD 200,000 to USD 500,000 per server while traditional enterprise servers sell for between USD 5,000 and USD 15,000 per server. Demand for the power infrastructure hardware required for transformers, switchgear, PDUs, and UPS systems has also risen and fundamentally shifted, driven by increasing facility power densities.

- The software segment for data center infrastructure management (DCIM), monitoring, and optimization is the fastest growing segment, with 15.5% CAGR. Data center infrastructure management platforms provide real-time visibility into power usage effectiveness, cooling effectiveness, environmental conditions, and utilization metrics, allowing data center data center operators to measure performance and look for areas for efficiency improvement. Supermicro Introduces New Business Line, Data Center Building Block Solutions, for Data Center Facilities Equipment and Management Services, in October 2025.

Learn more about the key segments shaping this market

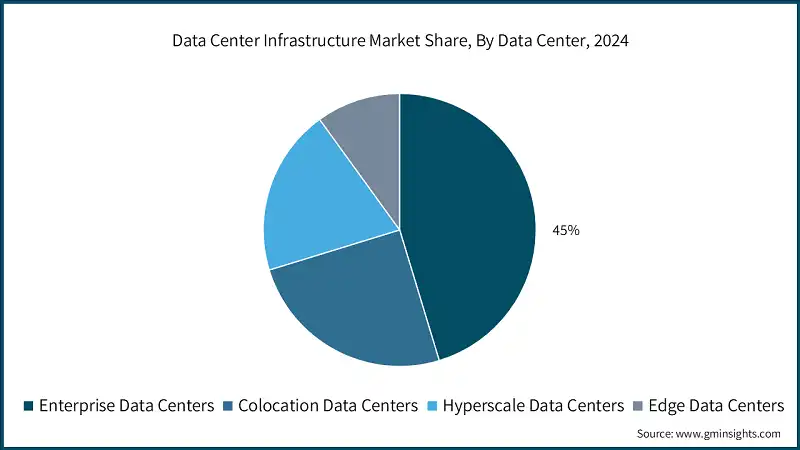

Based on data center, the data center infrastructure market is categorized into enterprise data centers, colocation data centers, hyperscale data centers, and edge data centers. Enterprise data centers segments dominate the market with 45% share in 2024 and is expected to grow at a CAGR of 12.6% between 2025 & 2034.

- Enterprise data centers, owned and operated by organizations to support their internal IT needs, are the largest segment to date by data center type, although this segment is gradually shrinking due to the enterprise migration to colocation facilities and public cloud platforms. Many of the enterprise data center facilities still operate with a power usage effectiveness (PUE) value of greater than 1.8-2.0, largely due to legacy infrastructure, under-scaled cooling systems, and lack of optimization, which represents significant opportunities for improvement.

- Hyperscale shows a trailing CAGR of 14.6% from 2025-2034. The segment facilities operated by cloud service providers, internet companies, and large technology companies are the fastest growing data center segment due to the increase in cloud adoption, the increase in AI workloads, and content delivery.

- Hyperscale operators such as Amazon Web Services, Microsoft Azure, Google Cloud, Meta, and Alibaba are developing large campus facilities of more than 100 MW of IT capacity with standardized and highly efficient infrastructure design that is optimized for specific workload profiles.

Based on deployment, the data center infrastructure market is divided into cloud, hybrid, and on-premises. Cloud dominates the market and was valued at USD 30.6 billion in 2024.

- Cloud deployment is rapidly transforming towards AI focused, high-density infrastructure. The driving force behind this shift is the move by enterprises of highly advanced training and inference workloads to the cloud, where they can utilize massive GPU capacity, best-in-class elastic scale, and low latency interconnects. This trend is changing the cloud architecture paradigm by creating AI-ready campuses - providers are reengineering power, cooling, and network topologies for the express purpose of enabling next-generation model training and supercomputing performance.

- For example, Prime Data Centers and Lambda announced a partnership in November 2025 to deploy high-density NVIDIA GPU infrastructure at the Prime flagship campus, LAX01, in Vernon, California. The partnership combines the next-generation campus design of Prime with the AI cloud platform from Lambda, facilitating enterprises to train and deploy ever more complex models at superintelligence scale by AI-native companies, and even research institutions.

- On-premises deployment models where enterprises own and operate dedicated infrastructure are still active due to specific use cases despite the trends of cloud migration. Organizations keep on-premises infrastructure for latency-sensitive applications, data sovereignty, specialized hardware including mainframes and proprietary systems, with operational technology integration in industrial and manufacturing environments, and workloads where workload utilization is high enough that cloud economics are unfavorable.

Based on organization size, the data center infrastructure market is divided into large enterprises and SME. Large enterprise dominates the market and was valued at USD 44.5 billion in 2024.

- Large enterprises are accelerating to high-density, AI-optimized data-center architectures due to necessity of running LLM workloads, GPU clusters, and latency-sensitive AI applications. This trend showcasing the enterprises will restructure their infrastructure strategies across the enterprise by adopting multi-facility architectures, liquid-cooled deployments, and vertically integrated architectures that support hyper-intensive compute density while optimizing energy and operational efficiency.

- In October 2025, Microsoft’s new Fairwater 2 data center in Atlanta, Georgia, which has interconnections with its Fairwater facility in Wisconsin to create a multi-site AI training system. This building includes two-story structures to minimize GPU interconnect distances, reduce latency, and improve cluster efficiency, in addition to a liquid cooling system to facilitate energy optimization in large-scale AI workloads. This is an example of how large enterprises are engineering data centers around AI performance and energy efficiency and will pave the way for the rest of the market.

- SME segment growth rate of 14.1% CAGR above large enterprise growth is indicative of enhanced digitalization of small and medium businesses, increasing adoption of cloud-native applications and the economic advantage of outsourced infrastructure for organizations without adequate scale or expertise. Cloud platforms offer SME-focused programs including credits, technical support, and simplified management interfaces.

Looking for region specific data?

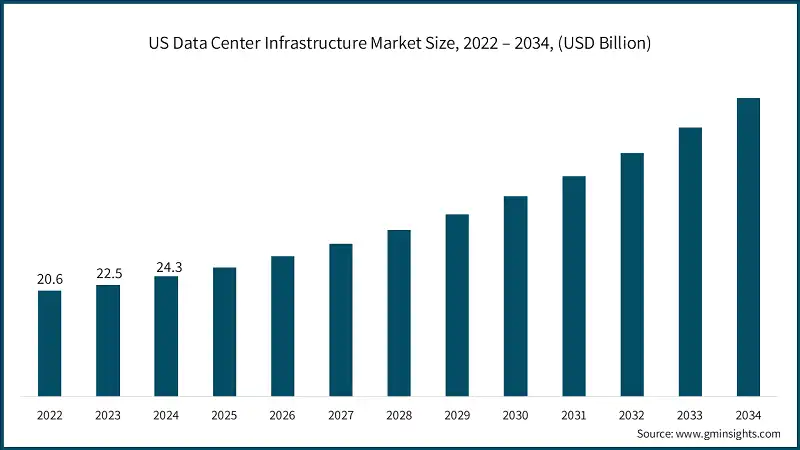

The US dominated North America market with revenue of USD 24.3 billion in 2024.

- In 2024, North America holds the biggest share of the global data center infrastructure market at 38%, worth approximately USD 26.3 billion, due to their heavy presences of hyperscale operators, technology companies, financial services companies, and highly digital infrastructure. US market is currently poised to growth explosively because of AI infrastructure investment, as demand for data center power is expected to increase more than 30-times, with demand projected to reach 123 GW by 2035, up from approximately 4 GW in 2024.

- Key investments include Nvidia and OpenAI's joint strategic investment partnership of USD 100 billion for 10 GW of GPU systems to start being deployed in H2 2026, CloudHQ's announcement of a USD 4.8 billion investment to build 6 data centers in Mexico City, supported by a private 900 MW substation - announced in 2023, and now with several concurrent, state-level initiatives to incite tax benefits and infrastructure support.

- Canada accounts for approximately 7% of the North American market with major concentrations in Toronto, Montreal, and Vancouver. Data centers consumed approximately 1.4% of national electricity in 2021, which rose to 2.1% in 2023, with most of the electricity consumption in the main data centers estimated at 520 MW in Montreal, 320 MW in Toronto, and 46 MW in Vancouver.

- The Canada government is pursuing data center consolidation, as well Cloud Smart policies to create more efficiency for government data center infrastructure. Canadian data centers tend to have strong PUE performance, driven by the favorable climate, however only about 22% of Canadian data centers report PUE metrics compared to worldwide averages as well.

China data center infrastructure market will grow tremendously with CAGR of 11.9% between 2025 and 2034.

- The Asia-Pacific region holds a 21% share of the global market, which is anticipated to reach nearly USD 14.7 billion in 2024, exhibiting the highest regional growth rate with a CAGR of 15.4%, spurred by rapid digitalization trends worldwide, government infrastructure initiatives, and migration toward cloud adoption.

- China is at the forefront of the Asia-Pacific region, with approximately 63% of not-yet-mentioned capacity initiatives, largely because of anticipated national computing infrastructure projects and programs from government-led activity. China's overall computing capacity reached an estimated 246 exaflops halfway through 2024, and it is estimated, on a national basis, to reach 300 exaflops, with approximately 35% of that dedicated to AI-enabled computing systems.

- China's data center operations consumed an estimated 150 TWh (terawatt hours) in 2023, accounting for approximately 1.6% of total national electricity consumption. Environmental scenarios from the investigations project consumption to be from 300 TWh to 700 TWh by 2030, which will represent electricity demand of approximately 2.0% to 5.1 %.

- India, qualifying as a globally fast-growing data center market, is rapidly growing at an install IT capacity of 1.4 GW as of Q2 2025, and is projected to double over two years to 2.8 GW with another 1.4 GW under construction. Australia has progressed on key projects as part of data center initiatives including GreenSquareDC's Sydney campus, which is to include 110 MW, including a phase of 15 MW approved for local AI-enabled phased completion to Q3.

The Europe data center infrastructure market in UK will experience robust growth during 2025-2034.

- Europe occupies the second-largest regional market and is characterized by a high level of market concentration in some Mediterranean markets and a more advanced yacht construction industry than the North American markets. The UK, typically hosting around 20% of European fill capacity, with fair share data centers based in London and the surrounding area. The UK has around 477 operational data centers and an additional 100 under development to give around 19% capacity growth with the majority before operational before 2030.

- Germany is another important European market with data centers expected to equate to USD 10.4 billion of GDP in 2024 and anticipated to grow to around USD 23 billion by 2029. In Germany, the Energy Efficiency Act has been passed in 2023, providing the most regulation on data centers in the world. Existing data centers with a capacity of 300 kW or greater now have a building operation PUE (power usage efficiency) of 1.5 or less, by July 2027, and 1.3 or under by 27 July 2030. Germany is striving to be the world leader in sustainable data center development, however, regulatory burden on data center operation will continue to shift investment to other countries with lower or less rigorous regulation.

- The Rest of Europe category captures a mixed assortment of markets across several countries, including the Nordic countries, as well countries like Spain, Italy, in Belgium, and Eastern European data centers. The Nordic countries are perceived as desirable data center markets due to their renewable access, either renewable hydroelectric and/or wind; a cooler climate, political stability and governments willing to plan for less costly, more sustainable value of energy, renewable energy resources.

The Latin America data center infrastructure market in Brazil will experience robust growth during 2025-2034.

- Latin America represents 4.5% of global market share valued at approximately USD 3.1 billion in 2024, demonstrating strong growth at 14.4% CAGR driven by digital transformation, cloud adoption, and government infrastructure initiatives. Brazil leads the Latin American market, managing about 67% of the regional share, and is establishing itself as the digital infrastructure center of the region. Brazil also announced a national strategy that aims for USD 350 billion in data centers over the next 10 years with a goal of becoming the AI and cloud infrastructure hub in the Global South.

- Mexico also has potential, as there is ongoing digital infrastructure development. CloudHQ announced an investment of USD 4.8 billion, to develop six data centers in Mexico City, which include a new 900 MW private substation expected to go live in 2027, and represents the one of the largest private power infrastructure projects in the region.

- Chile has approximately 198 MW capacity focused on Santiago and has some political stability and connectivity features. Google invested USD 200 million in a data center in Quilicura, and Chile announced a Data Center National Strategy to develop incentives and development zones, which could include about USD 200 million in grants and tax incentives for investments in data center development.

UAE data center infrastructure market will grow tremendously with CAGR of 13.8% between 2025 and 2034.

- The Middle East & Africa region represents 3.8% of global market share valued at approximately USD 2.6 billion in 2024, demonstrating strong growth at 14.5% CAGR driven by government digital transformation initiatives, economic diversification strategies, and strategic positioning as a connectivity hub between Asia, Europe, and Africa.

- Data center capacity in the UAE is expected to increase from around 429 MW of operational capacity in 2024 to 841 MW by 2029. Federal Data Law No. 45 of 2021 from the UAE establishes data subject rights, restrictions on cross-border transferring of data, and accountability from both controllers and processors, supporting the requirements to host data in the country.

- Saudi Arabia also makes up a significant portion of the MEA market share, with over 33 operational facilities and more than 40 under construction, aiming for a total data center capacity of over 1,300 MW before 2030. Similarly, Saudi Arabia accounts for a good portion of the MEA market share, with over 33 operational facilities and more than 40 under construction, with an aim for total data center capacity of over 1,300 MW before 2030.

Data Center Infrastructure Market Share

The top 7 companies in the market are ABB, Dell, Eaton, Hewlett-Packard Enterprise Company, Huawei Technologies, IBM, and Schneider Electric. These companies hold around 44% of the market share in 2024.

- IBM's market leadership is due to its wide-ranging assets and capabilities that stretch across servers, storage, software-defined infrastructure, hybrid cloud, and professional services. The company's acquisition of Red Hat in 2019 for $34 billion bolstered its hybrid cloud and Kubernetes capabilities to support integrated infrastructure management across both on-premises and cloud environments.

- Dell Technologies is a strong second place for its broad server, storage and converged infrastructure portfolio serving enterprise, service provider and government clients. The PowerEdge server family includes traditional enterprise servers as well as AI-optimized systems with NVIDIA GPUs and AMD accelerators. The company's VxRail hyper-converged infrastructure, developed in partnership with VMware, has gained significant uptake in production virtualized workloads.

- Schneider Electric's position as third largest player reflects its strength in power distribution, cooling systems, and data center infrastructure management software. Schneider's EcoStruxure integrates monitoring, management and optimization across power, cooling, and IT infrastructure. Its portfolio includes uninterruptible power supplies (UPSs), power distribution units, rack systems, cooling solutions, and prefabricated modular data centers.

- Eaton possesses a notable market presence through its power management offerings, including uninterruptible power supplies (UPS), power distribution units, switchgear, and electrical products. With the 93PM and 93PR UPS families, Eaton offers leading efficiencies surpassing 97% in double-conversion mode, lowering operating expenditure and encouraging sustainability metrics.

- Huawei Technologies illustrates its strong position within Asia-Pac and other emerging markets, specifically China, where it operates with a comprehensive infrastructure stack including servers, storage, networking, and cloud-based services. The Kunpeng ARM-based processors and Ascend AI accelerators are evidence of Huawei investing significantly in custom silicon to lessen reliance on U.S. semiconductor suppliers.

- ABB has its roots in electrical equipment, including transformers, switch gear, motor drives, and power distribution systems serving data center and industrial applications. As ABB focuses on electric infrastructure and not IT equipment, the company may benefit as power densities and grid integration protocols increase outpatient. The company is also investing in digital solutions for power management, predictive maintenance, and integration with renewable energy and energy storage systems.

- HPE provides server, storage, and converged infrastructure portfolio including ProLiant servers, Apollo systems for HPC and AI, Nimble and Primera storage solutions, SimpliVity hyperconverged infrastructure, and GreenLake consumption-based services. The company's infrastructure portfolio spans traditional enterprise servers to specialized systems for AI training and inference, high-performance computing, and edge deployments.

Data Center Infrastructure Market Companies

Major players operating in the data center infrastructure industry include:

- ABB

- Cisco Systems

- Dell

- Eaton

- Fujitsu

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- IBM

- Lenovo Group

- Schneider Electric

- The market competition is changing rapidly along key trends. Hyperscale operators such as Amazon, Microsoft, Google, Meta, and Alibaba have begun increasingly more frequently designing their server technology, decreasing their reliance on traditional server vendors, while creating value through vertical integrations. This is placing an additional burden on traditional infrastructure vendors to create differentiation in their specialized capabilities, including AI-optimized systems, liquid cooling integration, and so forth.

- Colocation providers such as Equinix, Digital Realty, and CyrusOne, have consolidated their share of the market through purchase activities, geographic expansion, and the design of specialized services, including cloud connectivity and edge services.

- Mergers and acquisitions have remained steady as companies continue to expand their capabilities, expand their geographic footprint, and scale their business. Noteworthy recent transactions include Brookfield's acquisition of American Tower's data center business, Digital Realty's joint venture with Ascenty in Latin America, and colocation/ infrastructure vendors have acquired companies over the past several quarters.

- Private equity firms such as Blackstone, KKR, and Carlyle, are devoting a significant amount of capital to the data center infrastructure space through direct investments, platform acquisitions, and partnerships with the operator. It is expected that the share of the market will remain stable throughout the outlook period, with most share gains for leaders who are investing in next generation technology such as liquid cooling, AI optimized infrastructure, sustainability.

- Regional and niche providers will continue to target niche areas, such as edge computing, small and medium businesses, and vertical industries where customization and local presence can provide advantages. If the trend toward hyperscale and colocation deployments is extending to other geographical markets, then it is likely that continued concentration may occur when scale economies are realized by big operators, but due to varying customer demands and geographic markets, it appears there will still be competition from a variety of viable providers.

Data Center Infrastructure Industry News

- In September 2025, Nvidia and OpenAI announced a USD 100 billion strategic partnership to deploy 10 GW of GPU systems for data center infrastructure, with first deployments scheduled for H2 2026. This partnership is one of the biggest investments in AI infrastructure announced to date, and expectations are that it will result in significant demand for power distribution and cooling systems and facility infrastructure to support extensive GPU deployment.

- In October 2025, Doña Ana County, NM approved a USD 165 million package of industrial revenue bonds and tax incentives to support four data centers and energy facilities from BorderPlex Digital Assets and Stack Infrastructure. Public financing continues to be used as a common financing mechanism to attract data centers to new U.S. markets.

- In September 2025, NVIDIA and its partners, including Nscale, CoreWeave and others, are scaling out AI factories in the UK with up to 120,000 NVIDIA Blackwell GPUs and up to USD 14.50 billion which constitutes the largest roll-out of AI infrastructure in the UK and supporting initiatives like OpenAI's Stargate UK.

- May 2025, India's IndiaAI Mission committed USD 1.2 billion to procure GPUs using a public-private partnership model, resulting in a pair of tender rounds that awarded more than 34,371 GPUs, which worth USD 1 billion for the continued build-out of AI infrastructure by the middle of 2025.

The data center infrastructure market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Bn) from 2021 to 2034, for the following segments:

Market By Product

- Cooling

- Air-based cooling systems

- Computer room air conditioning (CRAC)

- Computer room air handling (CRAH)

- In-row cooling units

- Overhead cooling systems

- Liquid cooling solutions

- Direct-to-chip cooling

- Immersion cooling systems

- Rear door heat exchangers

- Liquid distribution units

- Hybrid cooling architectures

- Cooling accessories and components

- Air-based cooling systems

- Power

- UPS

- Power Distribution Units (PDUs)

- Generators and backup power

- Power monitoring and management system

- IT racks & enclosures

- Server racks and cabinets

- Network equipment enclosures

- Blade server chassis

- LV/MV distribution

- Switchgear and distribution panels

- Transformers and power conditioning

- Busway system

- Electrical protection devices

- Networking equipment

- Ethernet switches

- InfiniBand switches

- Routers and gateways

- Load balancers and ADCs

- DCIM

Market By Component

- Hardware

- Physical infrastructure hardware

- IT equipment and servers

- Storage systems and arrays

- Networking hardware components

- Power and cooling hardware

- Software

- Infrastructure management software

- Virtualization and hypervisor software

- Security and compliance software

- Monitoring and analytics platforms

- Automation and orchestration tools

- Services

- Professional services

- Managed services

Market By Data Center

- Enterprise data centers

- Colocation data centers

- Hyperscale data centers

- Edge data centers

Market By Deployment

- Cloud

- Hybrid

- On-premises

Market By Organization Size

- Large Enterprise

- SME

Market By Application

- BFSI

- Colocation

- Energy

- Government

- Healthcare

- Manufacturing

- IT & telecom

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Netherlands

- Sweden

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the data center infrastructure market?

The U.S. led the regional market with USD 24.3 billion in 2024, representing the largest share of North America’s data center industry. Growth is driven by massive AI infrastructure investment, hyperscale expansion, and rising power demand for next-gen GPU clusters.

Who are the key players in the data center infrastructure market?

Major industry participants include IBM, Dell, Schneider Electric, Eaton, Hewlett-Packard Enterprise, ABB, Huawei, Cisco Systems, Lenovo, and Fujitsu, offering comprehensive portfolios across compute, power, cooling, and management software.

What are the upcoming trends in the data center infrastructure industry?

Key trends include adoption of AI-optimized server architectures, large-scale liquid cooling solutions, and rising demand for sustainable, energy-efficient power systems across hyperscale and enterprise facilities.

What is the market size of the data center infrastructure industry in 2024?

The market size was USD 68.2 billion in 2024, with a CAGR of 13.4% expected through the forecast period, driven by rapid cloud migration and hyperscale compute expansion.

What is the current data center infrastructure market size in 2025?

The market size is projected to reach USD 75.5 billion in 2025, supported by growing AI-driven workloads and expanding enterprise digitization.

What is the projected value of the data center infrastructure market by 2034?

The market is expected to reach USD 234.8 billion by 2034, fueled by accelerated adoption of AI-optimized infrastructure, liquid cooling, and next-generation data center modernization.

What was the valuation of the cloud deployment segment in 2024?

Cloud deployment was valued at USD 30.6 billion in 2024, driven by enterprise migration to AI-ready cloud campuses and high-density compute clusters.

What is the growth outlook for hyperscale data centers from 2025 to 2034?

The hyperscale segment is expected to grow at a 14.6% CAGR during 2025–2034, supported by surging investments from cloud service providers and rising compute intensity for AI, ML, and content delivery.

Data Center Infrastructure Market Scope

Related Reports