Summary

Table of Content

Current Sensor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Current Sensor Market Size

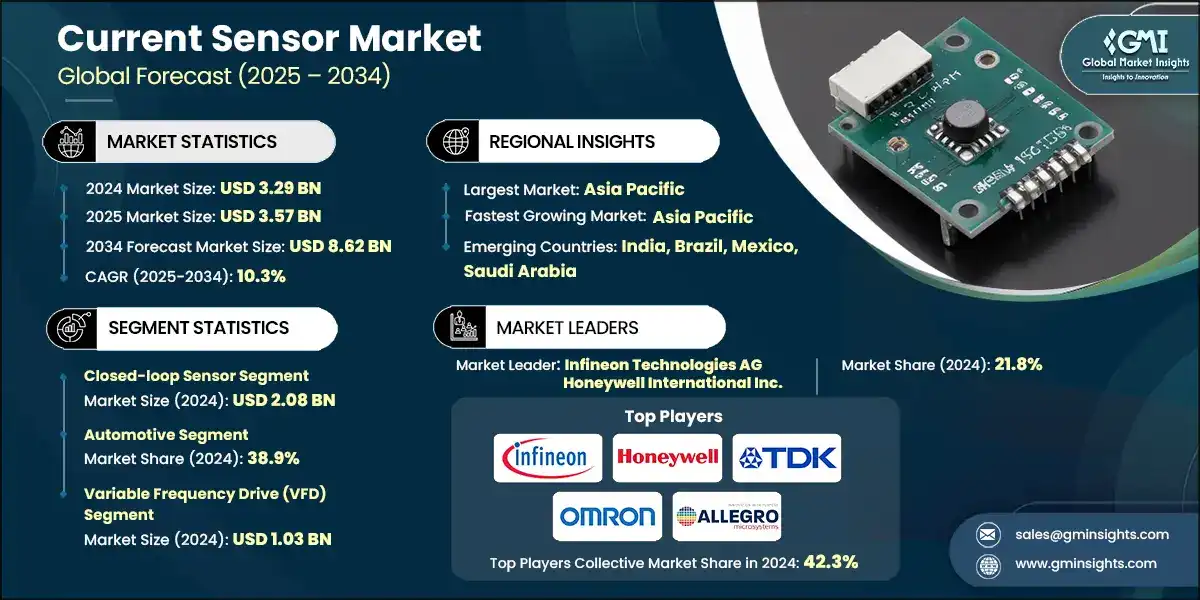

The global current sensor market was valued at USD 3.29 billion in 2024 with a volume of 1,344.3 million units. The market is expected to grow from USD 3.57 billion in 2025 to USD 5.68 billion in 2030 and USD 8.62 billion in 2034, growing at a CAGR of 10.3% during the forecast period of 2025-2034, according to Global Market Insights Inc.

To get key market trends

- The growing demand for precise, energy-efficient current measurement in automotive, industrial automation, renewable energy, and consumer electronics is one of the primary drivers of the current sensor market. With global EV sales surpassing 14 million units in 2023 and projected to keep rising, each EV typically requires 15–30 current sensors for traction inverters, on-board chargers, and battery management systems. Similarly, renewable energy systems are expanding rapidly, with over 500 GW of new solar and wind capacity added globally in 2023, each inverter requiring multiple current sensors for monitoring and safety. Enterprises, OEMs, and system integrators are increasingly using Hall-effect sensors, shunt-based sensors, and magneto-resistive technologies to achieve higher accuracy, lower power loss, and enhanced system safety. This demand is further amplified by the surge in hyperscale data centers consuming more than 400 TWh annually, where efficient current monitoring in power supplies and cooling systems is critical.

- The transition to advanced sensing technologies is significantly accelerating market growth. Open-loop and closed-loop Hall sensors dominate high-volume applications, while fluxgate-based sensors and digital current sensors are gaining traction in high-precision and high-voltage environments. For instance, closed-loop Hall sensors can achieve accuracy better than ±0.5%, compared to ±2–3% in traditional resistor-based shunt systems. With EV powertrains and industrial drives increasingly operating at 800 V and beyond, demand for isolated high-voltage sensors is growing rapidly. Leading suppliers have reported that current sensor shipments into automotive applications alone have doubled over the past five years, reflecting electrification momentum. This technology shift is driving OEMs and energy infrastructure providers to replace conventional current measurement systems with high-performance, integrated current sensors, thereby raising both unit demand and average selling prices (ASPs).

- The integration of current sensors across a broadening array of applications beyond traditional motor control and power supply monitoring is further driving market expansion. In EV traction inverters, each inverter may embed 6–8 current sensors, while battery management systems in large EV packs can require 20+ sensors for precise cell monitoring. In solar inverters, each power stage uses 2–4 sensors depending on design, and global solar installations exceeded 400 GW in 2023, underscoring scale. In robotics and factory automation, compact current sensors enabling predictive maintenance and safety functions. With increasing power density and thermal constraints in electronic systems, demand for compact, high-reliability, and galvanically isolated current sensors is accelerating. Manufacturers are responding with innovations in PCB-embedded sensors, miniaturized IC-based sensors, and isolation techniques supporting >3 kV, making them essential for energy-efficient, safe, and connected ecosystems.

Current Sensor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.29 billion |

| Market Size in 2025 | USD 3.57 billion |

| Forecast Period 2025 - 2034 CAGR | 10.3% |

| Market Size in 2034 | USD 8.62 billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand from data centers and cloud infrastructure | Drives large-scale adoption of current sensors, contributing to approximately 27% of market demand, fueled by high-efficiency server power supplies, real-time current monitoring in cooling systems, and hyperscale data center energy management. |

| Adoption of advanced current sensing technologies | Accelerates accuracy and efficiency improvements, projected to drive around 24% of market growth through higher precision, faster response times, and enhanced thermal stability compared with traditional shunt-based measurement. |

| Integration of current sensors in consumer and high-performance electronics | Estimated to add 16% to market growth, supported by gaming PCs, high-performance laptops, smart appliances, and advanced industrial electronics requiring compact, low-loss current measurement solutions. |

| Use of current sensors in industrial and automation systems | Expected to account for 14% growth, driven by robotics, motor drives, predictive maintenance systems, renewable energy inverters, and factory automation requiring high-reliability monitoring. |

| Deployment of current sensors in automotive and EV applications | Forecasted to contribute about 19% of growth, supported by EV traction inverters, battery management systems (BMS), on-board chargers, and advanced driver-assistance systems (ADAS) that require multiple high-voltage, galvanically isolated current sensors per vehicle. |

| Pitfalls & Challenges | Impact |

| High implementation and upgrade costs | Elevated costs associated with adopting advanced current sensors, particularly fluxgate, magneto-resistive, and high-precision digital types, can slow adoption among small and mid-sized enterprises and limit deployment in cost-sensitive automotive, industrial, and consumer applications. |

| Competition from alternative sensing technologies | Emerging alternatives such as integrated shunt-based monitoring solutions, software-based current estimation methods, and system-on-chip (SoC) power management features pose competitive challenges to standalone current sensors, potentially impacting market share and innovation cycles. |

| Opportunities: | Impact |

| Growing adoption of current sensors in emerging applications | The use of power switches in EV/HEV powertrains, renewable energy systems, industrial automation, and edge AI devices is set to unlock specialized, high-value applications, particularly in autonomous vehicles, smart factories, and energy-efficient computing infrastructure. |

| Development of advanced power management and optimization technologies | Innovations in gate drivers, integrated power modules, and thermal management solutions are enhancing switch performance, deployment efficiency, and overall system reliability across automotive, industrial, and data center environments. |

| Market Leaders (2024) | |

| Market Leaders |

Top two companies hold 21.8% market share in 2024 |

| Top Players |

Collective market share for top 5 players in 2024 is 42.3% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Current Sensor Market Trends

- The integration of current sensors into next-generation grids, renewable power plants, and industrial energy systems is accelerating worldwide, driven by the growing need for precise energy monitoring, load management, and fault detection. Since 2020, the rapid expansion of electrification projects particularly in North America, Asia Pacific, and Europe has led utilities and enterprises to prioritize advanced sensing technologies. This momentum is expected to strengthen through 2030 as renewable integration, electric mobility, and digital substations drive large-scale deployments across utility and industrial environments.

- Manufacturers are focusing on developing high-accuracy, durable current sensors tailored for renewable energy, smart grid, and transportation applications. Emphasis on higher voltage ratings, faster response times, and integration with digital monitoring systems will be essential. Partnerships with utilities, EPC contractors, and energy technology providers will allow current sensor manufacturers to capture rising demand in both developed and emerging markets through 2030.

- Smart factories, electric vehicles, and rail networks are increasingly adopting advanced current sensors to support real-time energy measurement and high-load operations. These sensors are steadily replacing conventional resistor-based solutions, enabling safer and more efficient power management in automation, e-mobility, and large-scale manufacturing. Adoption has risen considerably since 2020 and is projected to grow further by 2030, fueled by the need for grid reliability, electrification, and resilient infrastructure.

- Digital grid management tools and IoT-based monitoring systems are enhancing the deployment, control, and lifecycle optimization of current sensors, particularly in mission-critical environments. These solutions are gaining traction in utilities, transportation, and industrial plants for their ability to deliver predictive maintenance, remote diagnostics, and scalable integration.

Current Sensor Market Analysis

Learn more about the key segments shaping this market

On the basis of type, the market is divided into closed loop and open loop.

- The closed-loop sensor segment was a significant market, valued at USD 2.08 billion in 2024. The adoption of closed-loop systems in various applications such as industrial automation, robotics, and smart devices is a key factor driving growth. These sensors provide real-time feedback, enabling precise control and monitoring of processes, enhancing efficiency, and reducing errors. Moreover, manufacturers prioritize advancements in sensor miniaturization, durability, and cost-effectiveness. Incorporating enhanced technologies, such as AI and IoT integration, can help sensors offer smarter data processing, predictive capabilities, and seamless connectivity, ensuring they keep pace with the rapidly evolving sensor market.

- The closed-loop sensor segment is among the fastest-growing and is projected to expand at a CAGR of 11% during the forecast period of 2025–2034. The growth is driven by the increasing deployment of closed-loop sensors in industrial automation, robotics, and smart devices, where real-time feedback and precise control are critical.

Learn more about the key segments shaping this market

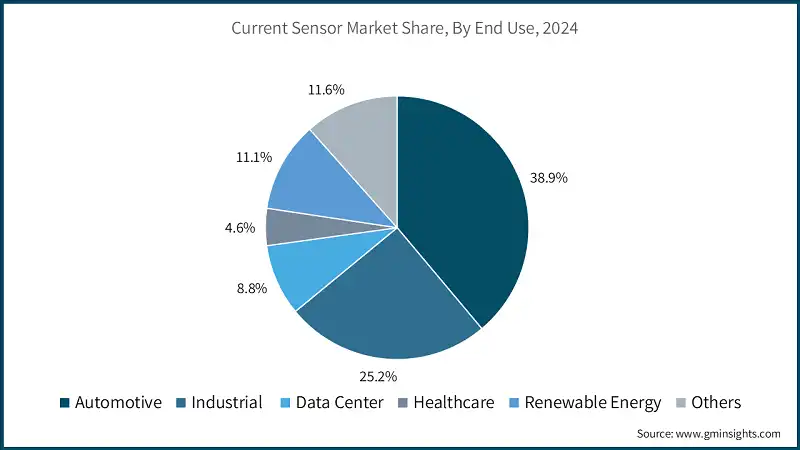

On the basis of end use, the market is divided into automotive, industrial, data center, healthcare, renewable energy, and others.

- The automotive segment dominated the current sensor market in 2024 with a market share of 38.9%, driven by its widespread adoption across electric vehicles (EVs), hybrid vehicles (HEVs), and advanced driver-assistance systems (ADAS). Automotive applications rely on current sensors for traction inverters, battery management systems (BMS), on-board chargers (OBCs), and auxiliary electronics, where accuracy, isolation, and reliability are critical. Their extensive use in EV powertrains, charging infrastructure, and vehicle safety systems continue to reinforce the segment’s dominance, supported by global electrification initiatives and rising EV production. The segment’s position has been further strengthened by ongoing innovations in high-voltage, compact, and digital current sensing solutions, enabling automakers to meet the growing demand for efficiency, safety, and energy optimization.

- The renewable Energy segment is projected to grow at a CAGR of 11.7% from 2025 to 2034, fueled by rising adoption of solar, wind, and energy storage systems that require precise current measurement for efficiency, reliability, and grid stability. Current sensors play a critical role in inverter systems, energy management solutions, and grid interface equipment, enabling accurate monitoring, protection, and optimization of renewable power flows. Their growing role in solar string inverters, wind turbine converters, and battery storage systems further supports accelerated market penetration, as utilities and energy providers demand high-efficiency, durable, and isolated sensing technologies.

Based on the application, the market is segmented into battery management systems (BMS), power distribution units (PDUs), switched-mode power supply (SMPS), UPS, calibration benches, traction motor inverter, on-board charger (OBC), variable frequency drives (VFDs), and others.

- In 2024, the variable frequency drive (VFD) segment accounted for USD 1.03 billion. Its strong position in the current sensor market is driven by widespread usage in industrial motor control, HVAC systems, and robotics. The growing demand for precise, real-time current measurement in predictive maintenance, energy-efficient motor drives, and automation processes has significantly boosted the adoption of current sensors in VFDs. With the global push toward industrial automation, smart factories, and energy optimization, VFD-integrated current sensors remain a preferred choice due to their ability to enhance efficiency, ensure equipment protection, and support high-load operations across diverse applications.

- The on-board charger (OBC) segment is anticipated to grow at a CAGR of 12.5% during the forecast period of 2025–2034. This growth is fueled by rising demand for electric vehicles and the increasing integration of high-accuracy current sensors to ensure safe, efficient charging operations. The adoption of isolated, high-voltage current sensors which are capable of handling fast charging requirements and ensuring battery protection that is further accelerating segment expansion. Additionally, global electrification initiatives, expansion of charging infrastructure, and the scaling of EV production are reinforcing the importance of OBC-integrated current sensors in automotive and energy applications.

Looking for region specific data?

North America current sensor market held a market share of 28.6% in 2024, driven by the strong presence of advanced industrial facilities, rapid electrification of vehicles, and growing deployment of renewable energy infrastructure and smart grids. The region’s leadership is further supported by significant investments in EV production, data center expansion, and automation technologies, all of which require precise, high-reliability current measurement.

- In 2024, the U.S. market accounted for USD 840.38 million. The growth is driven by robust adoption of electric vehicles, battery management systems, and charging infrastructure, as well as increasing deployment of renewable energy and smart grid projects. Rising demand for accurate, reliable current measurements in industrial automation, data centers, and high-performance consumer electronics is also contributing significantly to this expansion. Furthermore, to strengthen their position in the U.S. market, manufacturers focus on advanced current sensing solutions tailored for EV platforms, renewable energy systems, and industrial automation applications. Collaborations with automakers, utility providers, and industrial system integrators can help capitalize on this growth, while ensuring accuracy, safety, and scalability of deployed systems.

- Canada current sensor market is projected to grow steadily, with a market size of USD 98.95 million in 2024, supported by gradual modernization of energy infrastructure, increasing deployment of renewable energy systems, and moderate investments in industrial automation across utilities, manufacturing, and public facilities. While overall growth remains stable, the transition toward smart grids, electrified transportation, and energy-efficient monitoring solutions is expected to create incremental opportunities for current sensor manufacturers.

Europe current sensor market is projected to grow at a CAGR of 8.0% during 2025–2034. This growth is driven by steady investments in smart grids, renewable energy integration, and industrial automation across the region. Increasing adoption of electric mobility, battery management systems, and energy-efficient infrastructure is further supporting the deployment of advanced current sensing solutions.

- Germany market accounted for USD 204.02 million in 2024, driven by the country’s strong industrial base, growing adoption of electric mobility, and increasing deployment of advanced automation and energy-efficient systems across manufacturing, utilities, and transportation sectors. Germany’s focus on Industry 4.0, renewable energy integration, and smart factory initiatives is accelerating demand for accurate, high-reliability current sensors in automotive, industrial, and energy applications. Government incentives for energy efficiency and digital infrastructure further reinforce the adoption of scalable, durable sensing technologies.

- The U.K. current sensor market was valued at USD 121.95 million in 2024, supported by the country’s advanced energy infrastructure, early adoption of smart grids, and growing deployment of automation across utilities, industrial facilities, and transportation networks. The accelerating shift toward renewable energy integration, electrification of transport, and energy-efficient industrial systems is driving demand for accurate and reliable current measurement solutions. Government initiatives in smart energy management, grid modernization, and sustainability targets are further propelling adoption across critical sectors.

Asia Pacific accounted for USD 1.47 billion in the current sensor market in 2024, driven by rapid growth in industrial automation, expanding renewable energy infrastructure, and increasing adoption of electric vehicles, smart grids, and IoT-enabled energy systems across major economies like China, India, Japan, and South Korea. Government-backed electrification initiatives, rising demand for energy-efficient solutions, and growth in consumer electronics.

- China current sensor market is expected to grow at a CAGR of 13% during the forecast period 2025–2034, driven by rapid expansion in renewable energy projects, electric vehicle adoption, and industrial automation. The development of smart grids, high-capacity manufacturing facilities, and urban electrification initiatives is fueling demand for precise and high-performance current sensing solutions. China’s position as a global hub for energy technology manufacturing and infrastructure development further supports domestic adoption of advanced current sensors. Further, to effectively serve China’s evolving energy and industrial landscape, manufacturers should prioritize localized product development and partnerships with leading Chinese utilities, EV OEMs, and industrial equipment providers.

- Japan current sensor industry is estimated at USD 331.23 million in 2024, supported by the country’s advanced industrial and electronics sectors, rising demand for reliable current sensing solutions in industrial automation, and widespread adoption of electric mobility and smart energy systems. Japan’s strong presence in robotics, automotive innovation, and high-tech manufacturing is driving consistent investment in energy-efficient and high-performance sensing infrastructure.

- India current sensor market is expected to grow at a CAGR of 11.7% during the forecast period 2025–2034, fueled by rapid electrification, expansion of renewable energy projects, and government initiatives supporting Make-in-India and Smart Grid programs. Rising adoption of electric vehicles, industrial automation, and energy-efficient infrastructure across sectors such as manufacturing, transportation, and utilities is driving demand for reliable and high-performance current sensing solutions. Additionally, India’s growing base of tech-savvy consumers and industrial modernization is fostering adoption of advanced, compact, and energy-efficient sensors.

Latin America current sensor market was valued at USD 134.03 million in 2024, driven by the region’s increasing investment in energy infrastructure, rising adoption of renewable energy, and modernization of industrial and utility systems. Countries like Brazil, Mexico, and Chile are witnessing growing deployment of smart grids, electric mobility solutions, and industrial automation, contributing to the rising demand for reliable and high-performance current sensing solutions.

The Middle East & Africa (MEA) market is projected at USD 115.35 million in 2034, driven by the region’s growing investment in energy infrastructure, national electrification initiatives, and increasing deployment of smart grids, renewable energy systems, and industrial automation. Programs such as Saudi Arabia’s Vision 2030 and the UAE’s Smart Dubai are accelerating the adoption of electric mobility, energy-efficient industrial solutions, and smart city infrastructure—all of which require reliable and high-performance current sensing solutions.

Current Sensor Market Share

- The current sensor industry is highly competitive, with leading semiconductor and sensor manufacturers holding significant market influence. In 2024, the top five companies including Infineon Technologies AG, Honeywell International Inc., TDK Corporation, Omron Corporation, and Allegro MicroSystems, Inc. accounted for a combined market share of 42.4%, reflecting a moderately consolidated market where key players drive innovation and set industry benchmarks.

- Infineon Technologies AG led the market with an 11.9% share in 2024. The company’s focus on high-performance current sensors for automotive, industrial, and energy applications, combined with global manufacturing capabilities, positions it as a leader across multiple sectors.

- Honeywell International Inc. held 10% of the market, driven by its advanced sensor solutions for industrial automation, building management, and automotive applications. Strong R&D and strategic partnerships support its adoption of high-precision and energy-efficient current sensing technologies worldwide.

- TDK Corporation accounted for 8% of the market, leveraging its portfolio of high-reliability and miniaturized current sensors for automotive, industrial, and consumer electronics applications. Innovations in compact designs and performance optimization strengthen its competitive position.

- Omron Corporation captured 6.6% of the market, focusing on industrial-grade current sensors, automation solutions, and smart manufacturing applications. Its emphasis on durability, precision, and energy efficiency fuels growth in industrial and commercial markets.

- Allegro MicroSystems, Inc. held 5.9% market share, supported by its automotive-grade and industrial current sensors. Its innovations in high-accuracy and cost-effective.

Current Sensor Market Companies

The major companies operating in the current sensor industry are:

- Aceinna

- Allegro MicroSystems, Inc.

- Asahi Kasei Microdevices Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- KOHSHIN ELECTRIC CORPORATION

- LEM International SA

- Littelfuse, Inc.

- Melexis

- NVE Corporation

- Omron Corporation

- ROHM Co., Ltd.

- Sensitec GmbH

- Silicon Laboratories

- STMicroelectronics N.V.

- TAMURA Corporation

- TDK Corporation

- TE Connectivity

- Texas Instruments Incorporated

- VACUUMSCHMELZE GmbH & Co. KG

- Vishay Intertechnology, Inc.

- Leading players in the current sensor market include Infineon Technologies AG, Honeywell International Inc., TDK Corporation, and Omron Corporation. These companies dominate the market due to their extensive sensor portfolios, technological expertise in Hall-effect, fluxgate, and magnetoresistive sensors, and strong presence across automotive, industrial, energy, and consumer electronics sectors. Their leadership is reinforced by large-scale manufacturing, aggressive R&D investment, and vertically integrated supply chains, enabling high-performance, precise, and energy-efficient current sensing solutions at scale.

- Companies such as Aceinna, Melexis, Sensitec GmbH, KOHSHIN ELECTRIC CORPORATION, and NVE Corporation are considered market challengers. These firms focus on specialized current sensing solutions for industrial automation, electric vehicles, energy management, and renewable energy applications. Their strength lies in offering high-precision, application-specific sensors, including compact, high-speed, and low-power designs. However, compared to the leading incumbents, their penetration in large-scale automotive or utility projects may be more limited.

- Vendors such as Littelfuse, TAMURA Corporation, Silicon Laboratories, and TE Connectivity are positioned as market followers. These companies focus on niche applications, cost-effective solutions, and compact industrial or consumer-grade sensors. While they maintain a presence in specialized segments, their limited global manufacturing scale and R&D intensity restrict their ability to compete directly with top-tier current sensor manufacturers in high-volume automotive, industrial, and energy markets.

- Emerging and niche players, including Aceinna, NVE Corporation, and Sensitec GmbH, focus on high-performance, rugged, and energy-efficient current sensors for mission-critical applications such as electric vehicles, aerospace, renewable energy, and industrial automation. Their emphasis on superior accuracy, fast response, and advanced materials provide differentiated value, though their focus on specific verticals limits mass-market scalability.

Current Sensor Industry News

- In February 2025, STMicroelectronics expanded its automotive-grade current sensor portfolio, introducing high-efficiency devices optimized for EV traction systems and industrial motor drives. These sensors feature enhanced reliability, low power consumption, and compatibility with next-generation sensing platforms.

- In October 2024, Texas Instruments released a new line of compact, high-accuracy current sensors for industrial automation and consumer electronics applications. The devices are designed for precise measurements, low noise, and easy PCB integration, providing robust solutions for energy-efficient systems.

- In August 2024, Allegro MicroSystems, Inc. began mass production of advanced current sensors targeting renewable energy inverters and EV charging infrastructure. These sensors enable higher measurement precision, reduced system size, and improved reliability, supporting sustainability initiatives in industrial and energy markets.

- In May 2024, Honeywell International Inc. introduced specialized current sensor modules for smart grids and high-capacity industrial drives. The modules feature integrated protection, fault detection, and high-temperature tolerance, aimed at mission-critical applications in utilities, transportation, and heavy industry.

This current sensor market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and Volume (Units) from 2021 to 2034, for the following segments:

Market, By Type

- Closed loop

- Open loop

Market, By Technology

- Hall-effect

- Shunt

- Fluxgate

- Magneto-resistive

Market, By Application

- Battery Management Systems (BMS)

- Power Distribution Units (PDUs)

- Switched-mode Power Supply (SMPS)

- UPS

- Calibration benches

- Traction motor inverter

- On-board charger (OBC)

- Variable Frequency Drives (VFDs)

- Others

Market, By End Use

- Automotive

- Industrial

- Data center

- Healthcare

- Renewable energy

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the current sensor market?

Key players include Infineon Technologies AG, Honeywell International Inc., TDK Corporation, Omron Corporation, Allegro MicroSystems, Inc., STMicroelectronics, Onsemi, Texas Instruments, and LEM International SA.

What are the upcoming trends in the current sensor industry?

Key trends include the integration of AI and IoT for smarter data processing, adoption of advanced sensing technologies, and increasing demand for compact, high-precision sensors in EVs and industrial applications.

What is the projected value of the current sensor market by 2034?

The market size for current sensor is expected to reach USD 8.62 billion by 2034, fueled by advancements in sensing technologies, EV adoption, and renewable energy integration.

What was the valuation of the automotive segment in 2024?

The automotive segment held a 38.9% market share and generated significant revenue in 2024.

Which region leads the current sensor market?

The U.S. market accounted for USD 840.38 million in 2024. Growth is driven by robust EV adoption, renewable energy projects, and advancements in industrial automation and smart grid systems.

How much revenue did the closed-loop sensor segment generate in 2024?

The closed-loop sensor segment generated USD 2.08 billion in 2024.

What is the market size of the current sensor industry in 2024?

The market size was USD 3.29 billion in 2024, with a CAGR of 10.3% expected through 2034, driven by rising demand across data centers, automotive applications, and industrial automation systems.

What is the current sensor market size in 2025?

The market size is projected to reach USD 3.57 billion in 2025.

Current Sensor Market Scope

Related Reports