Summary

Table of Content

Cultured Meat Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cultured Meat Market Size

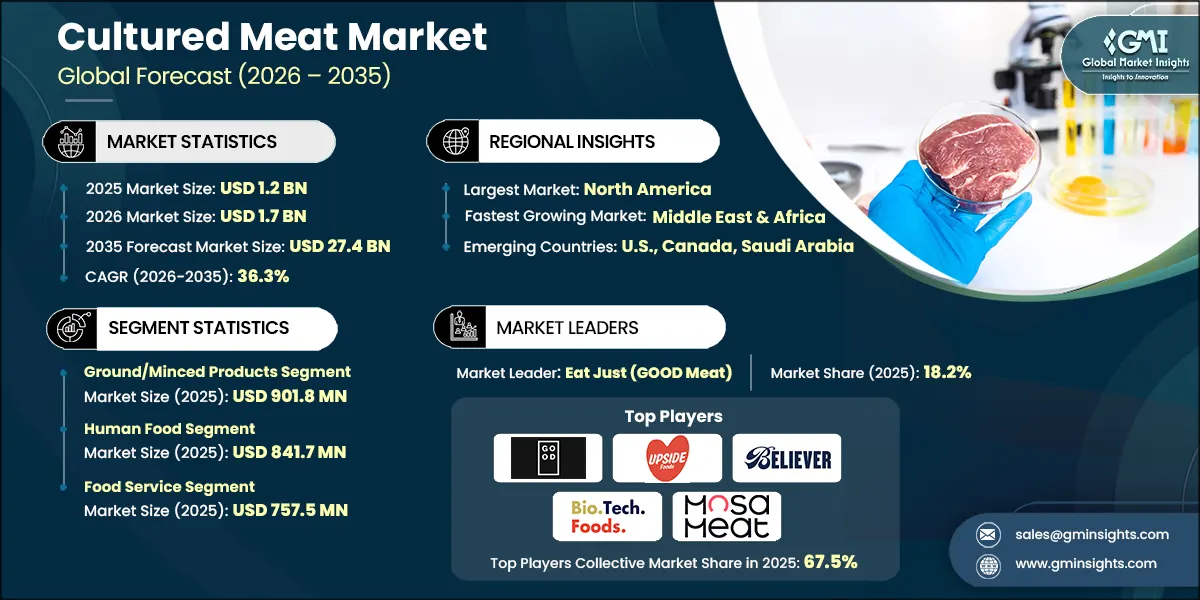

The global cultured meat market size was estimated at USD 1.2 billion in 2025. It is expected to grow from USD 1.7 billion in 2026 to USD 27.4 billion by 2035, at a CAGR of 36.3%, according to latest report published by Global Market Insights Inc.

To get key market trends

- The cultured meat market is evolving out of pilot stages to early commercialization with regulatory authorities in key economic sectors starting to approve products to sell to consumers. The poultry products cultivated have been approved by the FDA and USDA, and this has indicated that institutions have confidence in the safety of the products, prompting more investors to join the sector and increase capacity.

- Increasing environmental demands are driving the pace of adoption, with life-cycle analysis indicating that cultured meat can decrease greenhouse-gasses emissions, land use, and water use by dramatic factors relative to traditional livestock production systems. These are quantifiable benefits of sustainability that are enhancing its long-term value proposal in the international protein markets.

- The technological level of maturity is also influencing market size through the cost cuts. Increases in the serum-free media, improved cell lines, and high throughput bioreactors are reducing the cost per kilogram of production to put the category even nearer to the competitiveness of high-quality animal-based meats.

- Market growth is also supported by the fact that consumers are interested in ethical, safe, and transparent protein products. Premature product releases have revealed high intentions of younger and urban customers to sample cell-based meat provided that it is comparable to conventional meat in terms of taste and texture. The increased pilot tasting events, foodservice relationships, and early retail placements by brands will see market penetration speed up, as cultured meat grows to become a significant share-generating event within the larger alternative-protein environment.

Cultured Meat Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.2 Billion |

| Market Size in 2026 | USD 1.7 Billion |

| Forecast Period 2026 - 2035 CAGR | 36.3% |

| Market Size in 2035 | USD 27.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing demand for animal-based product alternatives | Growing demand for animal-based product alternatives is accelerating consumer adoption of cultured meat as a sustainable protein source. |

| Rapid evolution of online food delivery channels | Rapid evolution of online food delivery channels is creating new distribution opportunities for cultured meat products in mainstream markets. |

| Technology maturation & cost reduction | Technology maturation and cost reduction are improving scalability and moving cultured meat closer to price parity with conventional meat. |

| Pitfalls & Challenges | Impact |

| Stringent regulatory environment & approval timelines | Stringent regulatory environment and lengthy approval timelines are delaying commercialization and increasing compliance costs for producers. |

| High capital expenditure & setup costs | High capital expenditure and setup costs are limiting entry for smaller players and slowing global expansion plans. |

| Opportunities: | Impact |

| Animal-free media commercialization | Commercialization of animal-free growth media is reducing production costs and strengthening sustainability positioning for cultured meat. |

| Hybrid product development | Development of hybrid products combining plant-based and cultured components is enabling faster market acceptance and broader consumer reach. |

| Market Leaders (2025) | |

| Market Leaders |

18.2% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Middle East & Africa |

| Emerging countries | U.S., Canada, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Cultured Meat Market Trends

- There is also growing introduction of hybrid products in the market that involves cultivated meat mixed with plant ingredients. This trend enables the companies to cut production costs, lengthen product diversity, and attract flexitarian consumer segments. An example is that there are startups which are opening chicken-bean or beef-legume blends in small markets. Related to cost-efficiency and consumer experimentation, the concept of hybridization assists companies to slowly shift consumers to products with more cells and content, and to expand market share without necessitating the reliance on fully cultured meat as such.

- Major players are establishing pilot and commercial level plants in other countries other than their own homelands such as North America, Europe, and hubs in Asia-Pacific. This trend minimizes risks in logistics, localization of production and compatibility of regulations with local markets. As an illustration, one U.S. based company is building a massive plant in North Carolina, and a joint venture is in operation in Malaysia in Southeast Asia.

- The industry is moving beyond ground and minced products to structured products, fillets and whole-muscle products. The tendency addresses the changing consumer demands of texture and presentation like the traditional meat. There are interrelations with high-level scaffolding, 3D tissues engineering, and personalization of bioreactors. Firms exhibiting superior sensory qualities are able to take hold of elevated income markets and integrating cultured meat as something beyond a novelty and an alternative to conventional food.

- Producers of cultured meat are also focusing more on sustainability credentials in the form of certifications, eco-labels, and environmental reporting. This tendency appeals to the ESG-sensitive investors and consumers. Companies have placed products as high-end, responsible products by emphasizing decreases in greenhouse-gas emissions, water, and land use. The interconnections are regulatory alignment, marketing differentiation, and early-adopter targeting; these practices can play a role in the pricing strategy and brand loyalty, and competitive positioning in the market.

Cultured Meat Market Analysis

Learn more about the key segments shaping this market

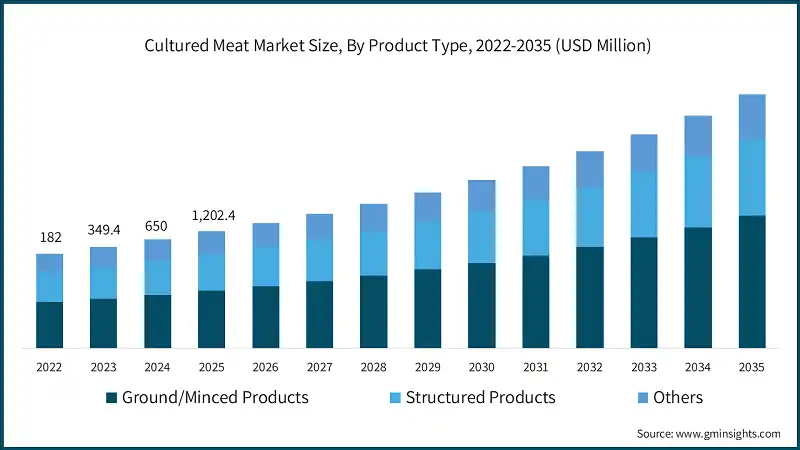

Based on product type, the cultured meat market is segmented into ground/minced products, structured products, and others. Ground/Minced products holds a significant share at a valuation of USD 901.8 million in 2025.

- Ground and minced products are the superior cultured-meat products in the market due to their reduced production complexity and rapid scaling over structured cuts. Such products are more easily formed into tissues, so that companies can commercially use smaller bioreactor volumes without compromising the texture and sensory features. The fact that they are compatible with applications that consumers love like burgers and meatballs, dumplings and nuggets, further enhances adoption, and the producers can tap into high-volume segments that can absorb initial higher pricing and enable predictable demand patterns.

- Ground formats offer a business opportunity interface between cell-culture media refinement and optimization and more complex product categories. They are doing well in promoting foodservice trials, supermarket pilots and hybrid product launches in areas with forward-looking regulatory settings. This segment also has downstream innovation effects, in the form of real-world performance feedback generation and familiarity of consumers with cultivated proteins. The success of the pull in ground and minced offerings so forms the basis of operations and marketplace whereby structured and value-add formats will grow in the forthcoming years.

Based on application, the cultured meat market is segmented into human food, pet food, research & development, and others. Human food holds a significant share at a valuation of USD 841.7 million in 2025.

- Human food holds major share of the cultured-meat market because businesses concentrate on the product that is associated with the mainstream food intake and commercial foodservice demand. Pilot tastings, early regulatory approvals and limited retail introductions are all largely focused on human consumption so that firms can validate safety, taste and texture expectations on a larger scale. This center of attention resonates with more general sustainability discourses and consumer trends toward more ethical proteins, which can assist cultivated meat to establish itself as a potential alternative to standard animal-based products.

- Human food dominance also dictates the movement of investment, the choice of format of products, and the strategy to partner with other companies in the industry. Partnering with restaurants, fast-moving chains and the culinary institutes are driving the refinement of products and speeding up market exposure. Human food will continue to be the most important commercialization route that enhances scale efficiencies in the overall industry as the production cost goes down and bioreactor capacity increases. Indirect momentum in this category supports also the development of the adjacent application like in pet food and R&D because the technical benchmark and regulatory pathways which control the future diversification are provided.

Learn more about the key segments shaping this market

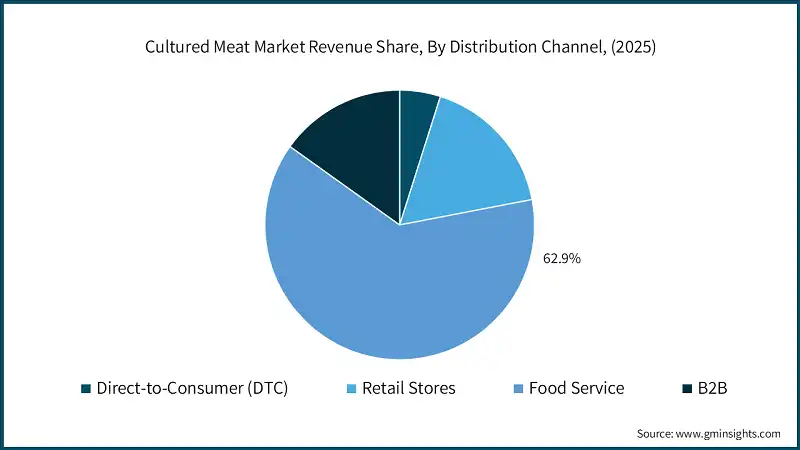

Based on distribution channel, the cultured meat market is segmented into direct-to-consumer (DTC) retail stores, food service, and B2B. Food service is estimated to grasp a value of USD 757.5 million in 2025 and is expected to grow at 36.5% of CAGR during the forecast period.

- Food service has the biggest portion of the distribution channel segmentation since it provides an effective path through which cultured-meat firms can launch offerings in managed culinary set-ups and control customer anticipation in terms of taste, texture and cooking. The restaurants, QSRs and specialty dining establishments enable the producers to present their products as part of recipes and chefs can ensure perfect cooking techniques that maximize acceptability. Initial logistical burdens are also reduced since this channel can be used to supply volumes in limited, high-impact partnerships, as opposed to full-sized retail distribution.

- This dominance of food service is also supported by the fact that it leads to the rapid education of consumers and the development of brand recognition prior to the more extensive retail growth. Premium dining, corporate cafeteria and themed outlets early pilots assist companies in getting real time feedback and optimizing product profiles without compromising operational efficiency. With the growth of regulatory authorization and the increase in level of production, food service remains the strategic frontier of commercialization, generating demand pull and creating the market familiarity which subsequently facilitates roll out in the form of DTC, retail outlets and more comprehensive B2B.

Looking for region specific data?

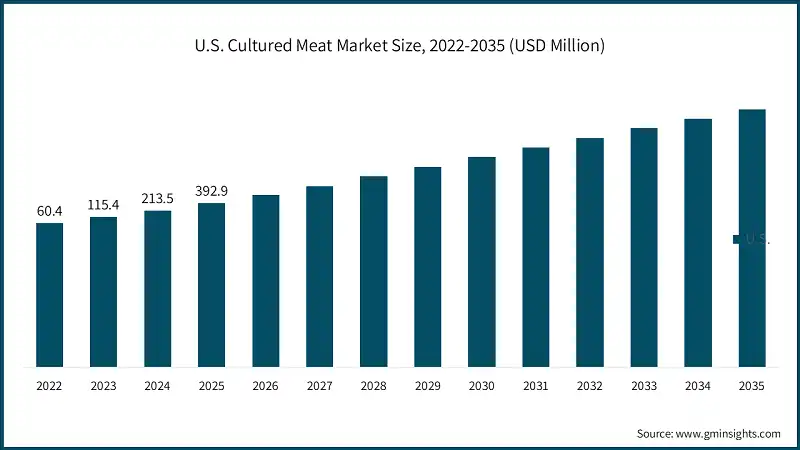

North America cultured meat market accounted for USD 456.9 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- North America accounts 38% market share in year 2025 with the U.S. having the largest market share because of its robust environment of cell-agriculture start-ups, vast venture-capital, and initial regulatory interest by the FDA and USDA. The intensive development of the region is associated with significant investment in large-scale plants, including the commercial plants that the major manufacturers are currently developing, and the continued pilot projects in the food-service restaurants that contribute to the confirmation of consumer acceptance.

- Innovation grants, development of serum-free media and partnership with existing food companies are also boosting commercialization. Also, there is still a high demand among consumers towards sustainable and ethically produced proteins, and a series of public tastings and limited retail trials have been held in some cities in the United States, which supports the claim that North America is the most active and future-moving market when it comes to the adoption of cultivated meat.

Europe accounted for USD 384.8 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe controls 32% of the cultured meat market share in year 2025 with the Netherlands taking the regional market which is characterized by its early R&D initiatives, government-funded innovation schemes, and a robust market strength of the pioneering companies dealing with cultivated beef. The active regulatory debate that occurs within the framework of the European Food Safety Authority (EFSA), numerous investments in large pilot plants, and the cooperation of research institutes and food producers to increase production drive the growth of the region.

- Other countries such as Spain and the UK are also speeding up the activity by coming together with the use of public-private collaboration, sustainability-focused finance, and cellular-agriculture hub. The high consumer interest of the European market in more ecologically friendly protein products, along with an increase in the pressure to achieve climate targets, will keep driving the region towards rapid commercialization and organized product development in the cultured-meat industry.

Asia Pacific cultured meat market accounted for USD 264.5 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Asia Pacific accounts for 22% market share in year 2025 with Singapore taking the largest portion as it has an early regulatory approval structure and it is the first nation to approve commercial sale of cultivated chicken. Growth in the area is happening at an extremely quick pace as Singapore, Japan, South Korea, and China governments invest in food-tech developments, pilot-scale production, and national food-security initiatives that would lessen dependence on conventional imports of meat.

- The capacity additions of new commercial plants in Malaysia and continuous R&D centers in Japan are empowering the supply environment and permitting customers to be exposed to the brand early. The growth of urban population, high demand for tech-driven food solutions and strategic alliance with international cultivated meat firms are boosting the position of the Asia Pacific market as a high-growth market that is nearing early commercialization.

Latin America market accounted for 5% market share in 2025 and is anticipated to show steady growth over the forecast period.

- In Latin America, the cultured-meat market is experiencing steady and consistent growth due to the increased interest in sustainable protein solutions and the increased attention to food security on the government level. The leading countries, Brazil and Argentina, are becoming one of the first movers, with academic research collaborations and the first investments of international cellular-agriculture companies, which test the idea of regional partnerships.

- Regulatory pathways remain in flux, but the massive livestock industry and the rising need to use innovation in a form that is export-oriented in LATAM lends an ideal situation of gradual adoption. The development of the region is not accelerated but steady because stakeholders evaluate the cost-effectiveness and the prospects of commercialization.

Middle East and Africa cultured meat market accounted for 3% market share in 2025 and is anticipated to show steady growth over the forecast period.

- There is a steady, incremental growth of Middle East and Africa region, which has been highly dependent on food importation and a strategic move towards the use of modern food production technologies. The UAE, Israel and Saudi Arabia are among the most active countries, and pilot projects, government innovation funds and alliances with international cultivated-meat companies are contributing to the initial cultivated-meat development.

- Although large scale production is still in its infancy, the area is enjoying significant demand for climate resistant protein alternatives and the rising investment in controlled environment food systems. The gradual yet strong growth is observed when regulations are becoming mature, and pilot projects are moving towards the commercial stage.

Cultured Meat Market Share

The competitive environment of the cultured-meat industry is moderate with the top five companies being Eat Just (GOOD Meat), Upside Foods, Believer Meats, Biotech Foods, and Mosa Meat having a total market share of approximately 67.5% in the year 2025. The dominance of these companies is attributed to developed technology, deep involvement in regulation, scale-up programs that are well-funded, and pilot-to-commercial production facilities. This enables them to shape the trends of pricing, regulatory routes, and early commercialization routes in the major markets due to their strategic positioning.

To be competitive, major actors are working harder in the optimization of core technology, such as high-density cell culture, serum-free growth medium and enhanced bioreactor efficiency. Other strategies that are being implemented by the firms include capacity expansion, long term relationships with food manufacturers, downstream process automation, and hybrid product development to allow cost parity with traditional meat. Moreover, firms are prioritizing regulatory speed, sustainability certifications and entry pilots using premium food-service channels to enhance brand awareness and gain primary consumer acceptance.

Cultured Meat Market Companies

Major players operating in cultured meat industry are:

- Mosa Meat

- Upside Foods

- Aleph Farms

- Finless Foods

- Meatable

- Believer Meats (formerly Future Meat Technologies)

- HigherSteaks

- Avant Meats

- BlueNalu

- Eat Just (GOOD Meat)

- BioFood Systems

- Balletic Foods

- Biotech Foods

GOOD Meat, the cultivated-meat branch of Eat Just, was among the earliest companies worldwide to obtain regulatory authorization to commercially sell its products, starting with Singapore in 2020. The company concentrates more on cultivated chicken, which is backed by serum-free growth media that has been optimized, and scalable bioreactor systems. It has a pilot scale production in the U.S. and Asia with expansion to larger industrial scale to continue. GOOD Meat is still engaging the regulatory bodies to facilitate wider access to the market in North America and the Middle East.

Upside Foods is a major cultivated-meat enterprise in the United States operating in growing chicken, beef, and seafood products cultivated with the help of a complex platform of cell-cultivation and tissue-engineering. The company is currently running its EPIC pilot plant, and it has already stated that it would run a commercial-sized plant that would have the capacity to produce multiple species. Upside was one of the first companies to get a U.S. FDA No Questions letter on its cultured-chicken process, a significant regulatory milestone.

Believer Meats has been known to have high-density technology of cell-cultivation which facilitates quicker production cycles and less expensive production expenses. The corporation is also building a 200,000 sq. ft. commercial plant in North Carolina, which will be one of the largest cultured-meat plants in the world. Its platform is based on poultry farming and hybrid meat products with reuse systems that are efficient and media-reuse.

Biotech Foods is a producer of cultivated-meat based in Spain, and its interests are centered on cell-based beef and the other red-meat varieties. The company uses muscle-cell culture and structured-meat growth to create high-quality and nutritionally similar alternatives to traditional beef. It has the support of large industrial partners such as leading acquisitions by JBS to boost commercial scale-up. BioTech Foods in Spain is working on a massive production plant to facilitate distribution to the EU regions as the regulatory approvals progress.

Mosa Meat, which produced the first cultured-beef burger in the world in 2013, is an industry leader in the cell-based red-meat market. The company is based on serum free media, continuous cell-line advancements and modular production systems in a bid to reduce manufacturing expenses. It runs pilot plants in Maastricht and is moving on to bigger industrial units to facilitate European commercialization. Mosa Meat is still in active collaboration with European regulators to promote approvals of retail and food-service launches.

Cultured Meat Industry News

- In June 2025, Believer Meats made significant construction milestones at its large-scale cultivated chicken production plant in Wilson County, North Carolina. The plant will enhance the manufacturing of industrial quantities of supplies to the North American market and facilitate the expansion of commercialization of the cell-based meat items.

- In May 2025, UMAMI Bioworks and Cell AgriTech ordered their commercial cultivated-seafood production facility in Kulim Hi-Tech Park, Malaysia. The project is targeted to increase the capacity of high-tech protein production in Southeast Asia and facilitate the regional programs of sustainable food security.

- In March 2025, Future Meat Technologies boasted of a manufacturing breakthrough in the R&D plant of Israel. The company said it had obtained much greater biomass yields with an 800-litre bioreactor platform that had been upgraded leading to a reduced cost of production and efficiency in the process.

The cultured meat market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) & volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Product Type

- Ground/minced products

- Burgers

- Meatballs

- Sausages

- Ground meat

- Structured products

- Nuggets

- Strips/tenders

- Whole cuts

- Others

Market, By Application

- Human food

- Pet food

- Dog food

- Cat food

- Exotic pet food

- Research & development

- Academic research

- Product development

- Regulatory testing

- Others

Market, By Distribution Channel

- Direct-to-Consumer (DTC)

- Retail Stores

- Supermarkets & hypermarkets

- Specialty stores

- Convenience stores

- Food Service

- Restaurants

- Catering Services

- Institutional Food Service

- B2B

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What is the growth outlook for human food in the market?

Human food held a significant share of USD 841.7 million in 2025. The market is led by its alignment with mainstream dietary preferences and early regulatory approvals targeting human consumption.

What was the valuation of the food service segment in 2025?

The food service segment accounted for USD 757.5 million in 2025, with a projected CAGR of 36.5% through 2035.

What is the expected size of the cultured meat industry in 2026?

The market size is projected to reach USD 1.7 billion in 2026.

How much revenue did the ground/minced products segment generate in 2025?

The ground/minced products segment generated approximately USD 901.8 million in 2025, due to simpler production processes and compatibility with popular applications like burgers and nuggets.

What is the projected value of the cultured meat market by 2035?

The market is poised to reach USD 27.4 billion by 2035, fueled by advancements in production technologies, regulatory support, and growing consumer demand for sustainable protein alternatives.

What is the market size of the cultured meat in 2025?

The market size was USD 1.2 billion in 2025, with a CAGR of 36.3% expected through 2035. The market is driven by early commercialization, regulatory approvals, and increasing investor interest.

Which region leads the cultured meat sector?

North America leads with a 38% market share in 2025, with the U.S. dominating due to its strong cell-agriculture ecosystem, venture capital investments, and regulatory support from the FDA and USDA.

What are the upcoming trends in the cultured meat market?

Trends include hybrid cultivated–plant products, global expansion of production facilities, development of structured items like fillets, and increased focus on sustainability through certifications and eco-labels.

Who are the key players in the cultured meat industry?

Key players include Mosa Meat, Upside Foods, Aleph Farms, Finless Foods, Meatable, Believer Meats, HigherSteaks, Avant Meats, BlueNalu, Eat Just (GOOD Meat), and BioFood Systems.

Cultured Meat Market Scope

Related Reports