Summary

Table of Content

Cosmetic Contact Lens Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cosmetic Contact Lens Market Size

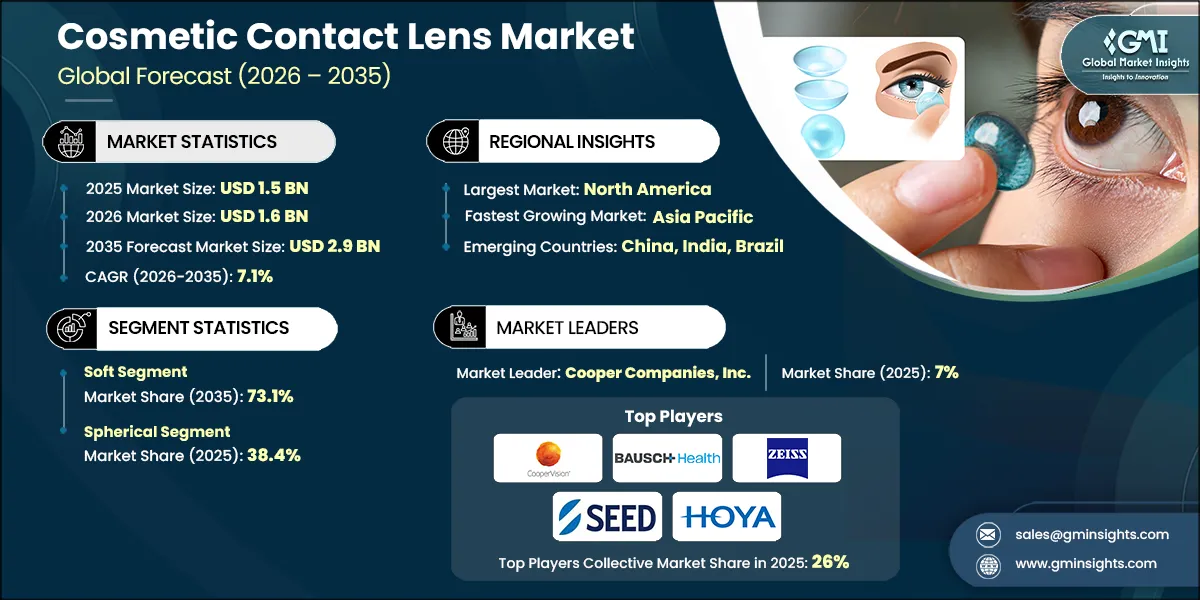

The global cosmetic contact lens market was estimated at USD 1.5 billion in 2025. The market is expected to grow from USD 1.6 billion in 2026 to USD 2.9 billion in 2035, at a CAGR of 7.1% according to latest report published by Global Market Insights Inc.

To get key market trends

The increased attention of regulators to aspects of safety and distribution is a major factor shaping the market, most noticeably in the cosmetic contact lens segment. Authorities and regulatory bodies worldwide have been raising their requirements to ensure safer usage and limit the health risks that may result from decorative lenses.

Platforms like Instagram, TikTok, and YouTube have become hubs for beauty and fashion trends. Influencers and celebrities frequently showcase cosmetic contact lenses, making them a popular accessory for enhancing eye color and overall appearance. Consumers are using cosmetic contact lenses as a form of personal expression. Lenses in different colors and styles allow individuals to experiment with their looks, change their eye color temporarily, and match their lenses with outfits or special occasions. This has made cosmetic lenses a staple in the fashion and beauty industry.

Moreover, the use of colored lenses in movies, music videos, and television shows, especially in fantasy and science fiction genres, has brought them into the mainstream. This has increased consumer interest in trying out colored lenses to replicate their favourite characters or celebrities' looks. Manufacturers now offer a vast array of colors, including natural shades like blue, green, hazel, and brown, as well as more bold and unique hues like violet, red, and even patterned lenses. This variety appeals to both those looking for a subtle change and those seeking a dramatic, standout look. Many brands offer non-prescription colored contact lenses, making them accessible to people who don’t need vision correction but are interested in aesthetic enhancement. This accessibility has broadened the consumer base for colored lenses.

The strong focus on consumer safety that results from this factor is rousing the demand for real and medically approved products. Local distribution models of prescription-only are getting increasingly favored due to their effectiveness in guaranteeing the correct fitting and usage under the guidance of a professional, thus the risk of serious eye infections is significantly lowered.

- In different parts of the world, rules such as the U.S. FDA's classification of all contact lenses as medical devices (including non-corrective/decorative), European medical device regulations (MDR/IVDR), and similar regulations in countries like Canada, Australia, and some Asian regions are getting tougher on the manufacturing, labeling, and selling of colored and decorative lenses. Since the link between these products and potential complications like microbial keratitis due to misuse is already established, cosmetic contact lenses are often required to be following these regulations.

The major factor leading to changes is the worldwide movement towards strict government and international regulations that aim at safeguarding public health by regulating the sale of medical devices. In the past, cosmetic lenses were mostly available for purchase over the counter (OTC) in retail or online stores without the need for a prescription. However, the use of such devices without professional fitting and hygiene instructions increases the risk of corneal ulcers, abrasions, and keratitis.

- Regulatory agencies, mainly in North America and Europe, are continuously taking measures to ensure that the requirement of a valid prescription for all contact lenses, including those used only for cosmetic purposes, is strictly followed. As getting a prescription involves an eye examination and professional fitting, this stage serves as a safety and appropriateness check for the user and at the same time, proper hygiene is instructed.

Thus, the channels of optometrists/ophthalmologists are an excellent choice for brands aiming to comply with the regulations and gain the trust of the consumers. Consequently, there is a substantial amount of money directed towards reliable, verified distribution models, especially for the regulation of the trade in high-fashion and special-effect lenses.

- U.S. FDA decision to call for a prescription as a prerequisite for decorative, non-corrective contact lenses is the way such devices should be treated as medical devices. This regulation targets the problem to which the rise of severely injuring eye conditions caused by non-regulated, often counterfeit, lenses that are sold through unregulated channels is the main reason, that is, the response is very direct. So, reputable optical retailers and e-commerce platforms, which are following the contact lens rule, fulfill the strong demand for cosmetic lenses.

The market reveals that the segment of specialty optical retail and online prescription sales is experiencing a considerable positive change, which is a result of consumer health risk awareness and the desire for luxury and comfort in the choice of lenses.

The high growth rate and large sales volume of this segment, which is mainly achieved through the constant execution of regulatory measures and consumer prioritization of safety, are the major evidence that regulatory actions are the main trigger for long-term, medically compliant transactions worldwide that are held in different countries and regions.

The shift in manufacturing technology and material innovation is the second significant factor behind the changes. Although traditional hydrogel materials have been used as the industry standard for quite a long time, they usually have lower oxygen permeability, which results in dryness and causes the wearers to be uncomfortable, and color vibrancy of hydrogel material is limited when compared to the new ones.

- Comfort & wearability allow for a much higher oxygen permeability and can be used for a longer period; thus, the occurrence of dry eye is greatly minimized, and at the same time, the wearers are made comfortable, which is of great importance if one wants to keep the users of the disposable cosmetic segment.

- Aesthetic quality, color technology and printing (e.g., sandwich printing technology to encapsulate color pigment layers within the lens matrix) innovations help in not only preventing direct contact between the colorant and the eye but also in color consistency. This eliminates the possible irritation sources and is very compatible with high-end and luxury aesthetic requirements.

Such a development in technology allows fashion lens users to enjoy their wear more comfortably and in a more hygienic manner, which in turn is great leverage for the premium sector and daily disposable trend in general.

This fast-paced growth of advanced materials and cutting-edge manufacturing is a strong confirmation of their position as the main innovation that opens the cosmetic market to new consumers who are both fashion-conscious and comfort-oriented. All demonstrated in the market signs of growing further as technology develops and the respective demand continues.

Cosmetic Contact Lens Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.5 Billion |

| Market Size in 2026 | USD 1.6 Billion |

| Forecast Period 2026 - 2035 CAGR | 7.1% |

| Market Size in 2035 | USD 2.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Global Regulatory Enforcement of Prescription-Only Sales | This mandates professional fitting and supervision, reducing misuse and boosting consumer trust in compliant, high-quality, branded products. |

| Rise of Daily Disposable Lenses & SiHy Materials | Offers consumers superior comfort and hygiene, accelerating market adoption and repeat purchases by minimizing eye health risks and maintenance hassles. |

| Social media and Influencer Marketing | Rapidly drives demand by showcasing diverse, natural-looking soft glam and enhancing effects, increasing the markets relevance as a daily fashion accessory. |

| Pitfalls & Challenges | Impact |

| High Cost of Premium Daily/SiHy Lenses | Restricts adoption among price-sensitive consumer segments in emerging markets, potentially limiting overall market penetration in high-volume regions. |

| Health Risks from Counterfeit/Unregulated Products | The continued existence of a grey market erodes consumer confidence in the category due to documented risks of infection, slowing growth for legitimate brands. |

| Opportunities: | Impact |

| Integration of AR/Virtual Try-On Technology | Enhances the e-commerce experience by allowing consumers to visualize lenses before purchase, significantly reducing returns and boosting online sales conversion rates. |

| Launch of Combined Corrective and Cosmetic Lenses | Expands the target market by providing aesthetic options to the large population with refractive errors (like myopia or astigmatism), offering a dual-benefit product. |

| Market Leaders (2025) | |

| Market Leaders |

7% market share |

| Top Players |

Collective market share in 2024 is 26% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Cosmetic Contact Lens Market Trends

The rise of e-commerce platforms offering cosmetic lenses has made it easier for consumers to access a wide variety of brands and colors. Consumers are increasingly seeking customized lenses that fit their specific needs, such as prescription-colored lenses or lenses for special events. The market is going through a major shift with the segment of daily disposable cosmetic lenses being the fastest growing one. Consumers driving this trend are those who put safety, hygiene, and convenience at the top of their priority list. A single-use version thus very much alleviates the risk of infection and discomfort resulting from the wrong cleaning and storage of a reusable lens. As a result, leading manufacturers are investing a great deal of money into the development of their daily wear pre-moistened high-quality product lines to meet this demand which is mainly coming from the younger and urban consumers.

- Adoption of silicone hydrogel (SiHy) materials: One of the most important technological changes is the switch from the old hydrogel to advanced silicone hydrogel (SiHy) for cosmetic lenses since SiHy allows the cornea to get a lot more oxygen. The upgrade has of the main issues associated with the use of colored lenses, i.e. dry eyes and discomfort, has been fixed by the development because SiHy has been found to be the only material that still has good oxygen permeability while using more opacifiers made it for the premium, health-conscious brands the material of choice that are also ensuring long wear time, comfort, and aesthetic appeal.

- 'Soft glam' and natural aesthetic trend: On the market, the best aesthetic solution that has been found for is to move the focus away from the striking dramatic color blocks and instead use subtle enhancements that look natural, and this trend is mainly driven by the influence of marketing and the need for 'soft glam' effects. Buyers are much more inclined now to pick the lenses that seamlessly mix with their original eye hue, make the iris lighter, or have a faint limbal ring (circle lenses) which can bring a youthful, volumizing effect that looks real and can be used in daily life, thereby pushing innovation in advanced lens printing technologies to replicate the natural iris fine details.

- Stricter regulatory enforcement and prescription: The most prominent regulatory trend that has been witnessed is the stringent regulation by worldwide regulatory bodies like the U.S. FDA and European MDR of all cosmetic lenses as medical devices which requires that they be sold only on prescription from a qualified eye care professional. This development is very important in limiting the number of fake and low-quality lenses that are sold in the unregulated market. It thus not only safeguards the public by ensuring good fitting and giving hygiene instructions, but also regulatory compliance market revenues are transferred to optical retailers and e-commerce platforms trusted by consumers.

- Augmented reality (AR) and e-commerce integration: The use of AR virtual try-on (VTO) means in implementing the online presence of brands is leading to a revolution in e-commerce. The lack of color assessment, which has always been considered a major obstacle to online lens sales, is now effectively overcome by this novel approach to digitally try-on different lens colors and effects on one's own image. It provides an extremely customized, risk-lowering, and engaging shopping experience which is a must for winning over the digitally native consumer base and thus is the main driver of direct-to-consumer (D2C) channel growth.

Cosmetic Contact Lens Market Analysis

Learn more about the key segments shaping this market

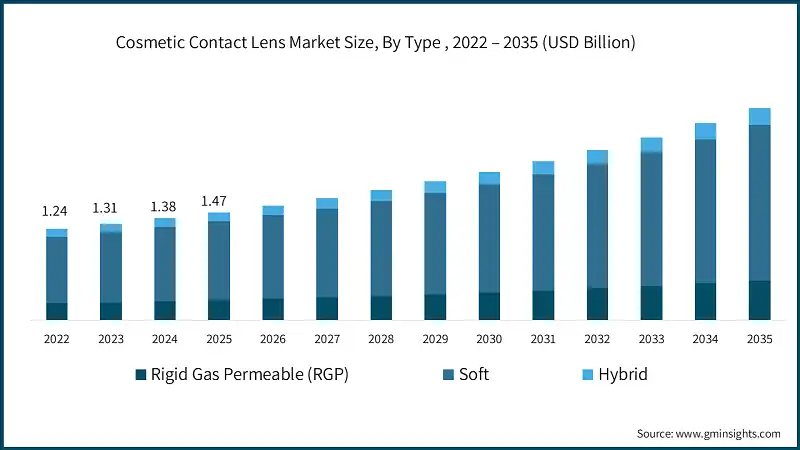

Based on the type of segmentation, the cosmetic contact lens market is categorized into rigid gas permeable (RGP), soft, and hybrid materials. The soft contact lens segment is the established market leader as of 2025 and is set to accelerate its dominance through 2035, driven by superior comfort and the rapid innovation in silicone hydrogel.

- The soft segment held most of the market share, accounting for 72.7% of the total global market value in 2025. This segment is projected to further increase its share to 73.1% by 2035, reaching a projected value of USD 2.1 billion.

- The soft lens segment maintains the highest projected CAGR of 7.1% from 2022 to 2035. This strong growth is primarily fueled by the accelerating consumer preference for daily disposable lenses and the widespread adoption of comfort-enhancing Silicone Hydrogel materials, which are ideal for cosmetic applications.

- The rigid gas permeable (RGP) segment holds the second-largest market share, accounting for 18.9% in 2025. While its market share is projected to remain relatively stable, its slightly lower CAGR of 7% suggests that it is not participating as actively in the high-volume cosmetic trend as the soft lens category.

- The hybrid segment consistently maintains the smallest share, holding 8.5% of the market in 2025. It exhibits the lowest CAGR, indicating its niche role in addressing specific, complex vision or fitting needs that have limited application in the broad, discretionary cosmetic market.

Learn more about the key segments shaping this market

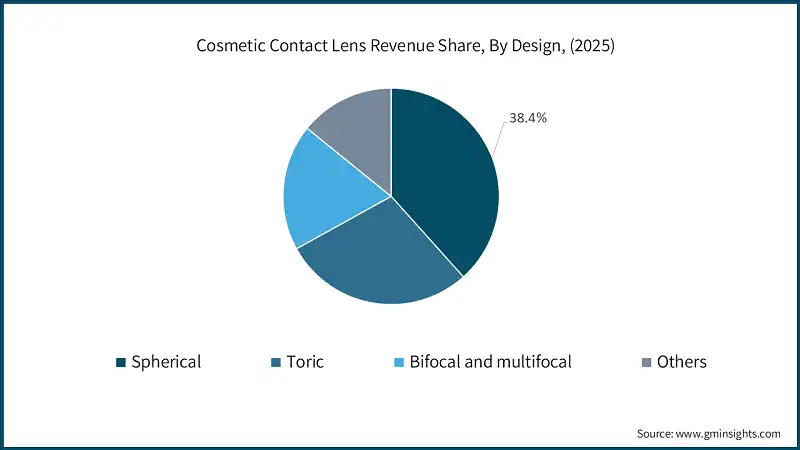

Based on the design segmentation, the cosmetic contact lens market is categorized into spherical, toric, bifocal, & multifocal, and others. The spherical lens segment is the dominant force in the market as of 2025.

- The spherical segment held the largest share, accounting for 38.4% of the total global market by value in 2025, with a value of USD 0.6 billion. This segment is projected to slightly expand its dominance by 2035, reaching a projected value of USD 1.1 billion.

- This spherical segment is the market leader because most cosmetic, or "plano," lenses do not require complex corrective geometry, making the simpler spherical design the base for nearly all non-corrective and low-prescription aesthetic products.

- Toric lenses, designed to correct astigmatism, represent the second-largest design segment, holding 28.6% of the market in 2025 valued at USD 0.4 billion, with its share remaining highly stable through 2035. Its robust CAGR of 7.1% is driven by the increasing availability of colored toric options, addressing the dual need for vision correction and aesthetics among a significant portion of the population.

- Bifocal and multifocal lenses hold a substantial portion, accounting for 18.9% in 2025. It is projected to grow substantially at a 6.9% CAGR, reflecting the aging population's need for presbyopia correction combined with the desire for cosmetic enhancement.

- The others segment (including specialty designs) represents the smallest market segment at 14.2% in 2025. It exhibits the slowest CAGR indicating that specialized aesthetic or prosthetic lenses remain a smaller, niche category compared to the main design types.

Based on distribution channel, the cosmetic contact lens market is broadly segmented into offline sales (optical stores, retail stores, etc.) and online sales (e-commerce platforms and brand websites).

- The offline sales model, particularly through optical stores and eye care professionals (ECPs), is the dominant channel for high-value, medically compliant lenses, such as prescription colored and silicone hydrogel lenses.

- ECPs retain full control over product fitting, patient safety education, and dispensing validation. This is vital for complex, safety-critical products where improper use or fitting can lead to severe eye health issues. This model facilitates a close, long-term relationship for future lens replacements and professional eye care services.

- The online sales model relies on e-commerce platforms and brand websites to reach a broader, more dispersed customer base, primarily in the smaller-scale fashion-driven and high-convenience daily disposable segments.

Looking for region specific data?

North America Cosmetic Contact Lens Market

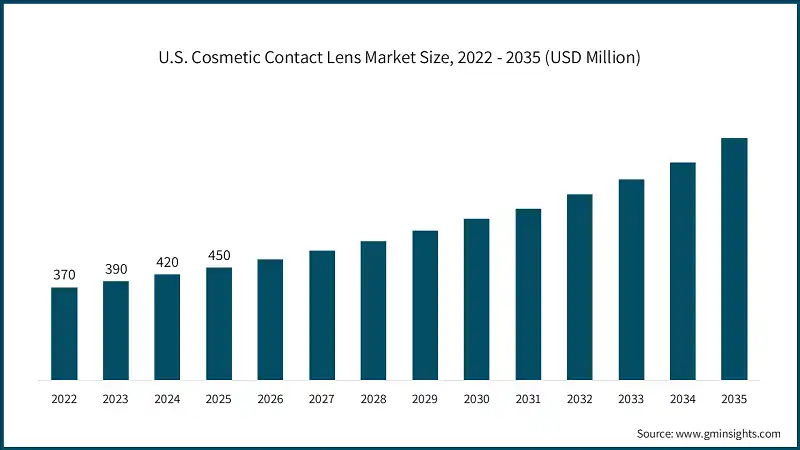

In 2025, North America is projected to dominate the market, holding 36.9% of the market share with an estimated revenue of USD 0.5 billion.

- North America maintains market leadership, driven by a strong consumer base with high discretionary income, early and high adoption of the daily disposable format, and a robust distribution network led by eye care professionals (ECPs).

- The region's growth is heavily fueled by the U.S., which is the primary engine, accounting for 83% of the regional revenue in 2025.

- The market benefits from the region's increasing acceptance of cosmetic lenses as a fashion and lifestyle accessory, alongside a strict regulatory environment that favors medically compliant, premium brands.

- The region's overall market projects the highest regional CAGR from 2022 to 2035, with the U.S. showing an even higher CAGR, supported by continuous product innovation and significant e-commerce integration

Europe Cosmetic Contact Lens Market

Europe is projected to account for 27.2% of the global market in 2025, with a revenue of USD 0.4 billion. Germany is the regional market leader, accounting for 24.4% of the European revenue in 2025.

- European demand is centered on achieving compliance with EU medical device regulations, ensuring product safety, and catering to a sophisticated consumer base that values both natural aesthetics and high-quality lens materials (like Silicone Hydrogel).

- The region's growth is stable, underpinned by established ECP distribution channels and the introduction of new, comfortable cosmetic products. The overall regional CAGR is a steady 6.9% from 2022 to 2035.

- Germany projects the highest CAGR in the region at 7.3%, leveraging its strong economy and consumer preference for quality optical products. Other major markets like the UK and France are also key contributors, maintaining growth through continued product premiumization.

Asia Pacific Cosmetic Contact Lens Market

The Asia Pacific region is projected to account for 21.9% of the global market in 2025. China holds the highest market share in the region, with 32.5% of the APAC revenue in 2025.

- APAC's market growth is driven by a massive youth population, a high cultural acceptance of cosmetic lenses (especially circle lenses for eye enlargement), and increasing disposable income across developing economies.

- The region is characterized by high consumption volume, particularly of daily disposables, and a rapid shift towards regulated channels as consumer health awareness rises.

- The region's overall market projects a CAGR from 2022 to 2035. China is a major engine for growth, projecting a high CAGR of 6.9%, and India is a key emerging market supporting strong future adoption driven by rapid urbanization and fashion consciousness.

Latin America Cosmetic Contact Lens Market

Latin America is projected to represent 6.3% of the global market in 2025. Brazil is the market leader, accounting for 48.3% of the regional revenue in 2025.

- Growth in LATAM is driven by rising urbanization and middle-class expansion, which increases the demand for improved personal care and aesthetic products, including colored contact lenses.

- Market modernization in key economies like Brazil and Mexico is driving investment in new distribution strategies and consumer education on compliant products. The overall regional CAGR is 6.3% from 2022 to 2035.

- The region's growth, while smaller than mature markets, is steady, aimed at improving aesthetic options and product availability as disposable incomes continue to rise.

Cosmetic Contact Lens Market Share

Cooper Companies, Inc. is leading with 7% market share. Cooper Companies, Inc. (CooperVision), Bausch Health Companies Inc., Carl Zeiss AG, Seed Co., Ltd. and Hoya Corporation claiming almost 25-30% of the global market share in cosmetic contact lenses market. These companies lead in innovation, investing in research and development to make UV systems more efficient and sustainable. Their advanced technologies, like energy-saving lamps and modern control systems, set them apart in the market. They have built strong brand reputations over the years, making them trusted providers for municipalities, industries, and utilities worldwide.

Cooper Companies, Inc. (CooperVision) is one of the largest manufacturers of soft contact lenses globally. CooperVision’s strategy in the cosmetic space is to embed aesthetic appeal directly into its scientifically advanced core product line. CooperVision's cosmetic lenses, such as Biofinity Circle and MyDay Daily Disposable with cosmetic tints, are manufactured using its proprietary Aquaform Technology (for Biofinity) and advanced silicone hydrogel materials. This unique approach allows the company to establish itself as a key innovator in the areas of comfort, eye health, and extended wearability while delivering aesthetic enhancement.

Menicon Co., Ltd. is a major Japanese player, recognized as a pioneer in contact lens development in Japan, and is actively pursuing global expansion, particularly in the critical Asia-Pacific market. While its cosmetic market share is smaller than the top three, its strategy is defined by technological innovation focused on hygiene and long-term eye health, which strongly supports the consumer preference for safe cosmetic use. Menicon’s competitive edge comes from its unique "Smart Touch" technology in its 1-DAY disposable lenses, which are packaged so the outer surface always faces up, allowing the user to insert the lens without touching the inner surface. This design promotes superior hygiene and ease of use critical factors for cosmetic users who may be new to lenses.

Cosmetic Contact Lens Market Companies

Major players operating in the cosmetic contact lens industry are:

- Johnson & Johnson Vision Care, Inc.

- Alcon

- Cooper Companies, Inc. (CooperVision)

- Bausch Health Companies Inc.

- Carl Zeiss AG

- Seed Co., Ltd.

- Hoya Corporation

- Menicon Co., Ltd.

- CAMAX Optical Corp.

- Clearlab (Singapore) Pte Ltd.

- QUALIMED SRL

- Viewell Inc.

- X-Cel Specialty Contacts

- Metro Optics.

- Anesthesia USA

Carl Zeiss AG is one of the world's leading technology companies in the optical and optoelectronic industries, which gives its Medical Technology and Vision Care segments a strong competitive advantage built on precision engineering. While its focus is heavily on spectacle lenses, diagnostic devices, and surgical solutions, its presence in the contact lens market, including the cosmetic segment, is driven by the strategic pillar of ultimate quality and precision, appealing to the premium segment of consumers and eye care professionals (ECPs).

Seed Co., Ltd. is a prominent Japanese manufacturer, highly influential in the Asia-Pacific market, which is the engine of global cosmetic lens growth. While its global market share for all lenses is smaller than the Western giants, it focuses on the premium, quality-conscious segment of the cosmetic market.

Cosmetic Contact Lens Market News

- In November 2025, Bausch + Lomb announced major lens innovations focused on enhanced comfort and performance, specifically mentioning the use of a hyaluronic acid material. This investment into next-generation moisture-retaining materials aligns with the critical market trend of reducing lens-related dry eye and improving overall wearing comfort, particularly for cosmetic lenses that are worn for long periods by users sensitive to eye aesthetics and hydration.

- In June 2025, Johnson & Johnson Vision announced the North American launch of ACUVUE OASYS MAX 1-Day Multifocal for Astigmatism, the first and only daily disposable contact lens for people with both astigmatism and presbyopia. This innovation, which incorporates blue light filtering and tear film support technology, exemplifies the industry trend of combining high-performance materials and specialized vision correction (like multifocal and toric designs) with the convenience and comfort of the daily disposable format.

- In November 2024, Alcon announced the U.S. launch of PRECISION7, a one-week replacement contact lens featuring their proprietary ACTIV-FLO technology. The development of a one-week replacement schedule is a significant market innovation that offers a new middle ground between daily and monthly disposables, aiming to provide a cost-effective, high-comfort option that benefits the entire soft lens category by pushing material science boundaries

- In 2024, Carl Zeiss AG (ZEISS International) continued to strategically emphasize its role in the professional eye care channel, supporting optometrists and ophthalmologists with advanced diagnostic and fitting technology for specialty lenses. This focus reinforces the market's shift toward prescription-only distribution for all contact lenses, including cosmetic ones, by ensuring Eye Care Professionals have the tools to accurately fit lenses and uphold regulatory compliance.

- In 2024, SEED Co., Ltd. likely continued to lead the development and expansion of the 'Circle Lens' segment through high-quality manufacturing and vibrant designs, leveraging the strong cultural demand in Asia-Pacific for natural-looking eye enlargement. This continued focus supports the growth of natural-effect cosmetic lenses that combine aesthetic appeal with medically approved materials and high-definition color printing technologies, securing its position in the fastest-growing geographical market for cosmetic products.

- In 2023, CooperVision announced that the sales of their soft contact lenses had shown significant revenue growth, primarily driven by its focus on Silicone Hydrogel (SiHy) technology across its portfolio. This demonstrated commercial success in the broader SiHy segment validates the material's dominance and its role in improving the safety and comfort of daily and monthly disposables, directly benefiting the cosmetic lens segment which increasingly adopts SiHy for enhanced breathability and comfort.

The cosmetic contact lens market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Product Type

- Colored

- Circle

Market, By Type

- Rigid gas permeable (RGP)

- Soft

- Hybrid

Market, By Material

- Hydrogel

- Polymers

Market, By Usage

- Daily disposable

- Weekly disposable

- Monthly disposable

- Yearly disposable

Market, By Design

- Spherical

- Toric

- Bifocal and multifocal

- Others

Market, By Price

- Low

- Medium

- High

Market, By Distribution Channel

- Optical stores

- Online stores

- Retail stores

- Independent brand showrooms

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the cosmetic contact lens market?

Key players include Johnson & Johnson Vision Care, Inc., Alcon, Cooper Companies, Inc. (CooperVision), Bausch Health Companies Inc., Carl Zeiss AG, Seed Co., Ltd., Hoya Corporation, Menicon Co., Ltd., CAMAX Optical Corp., Clearlab (Singapore) Pte Ltd., QUALIMED SRL, and Viewell Inc..

How much revenue did the spherical segment generate in 2025?

The spherical segment generated USD 0.6 billion in 2025, accounting for 38.4% of the total market share.

What was the valuation of the North American cosmetic contact lens market in 2025?

North America held a 36.9% market share, generating USD 0.5 billion in revenue in 2025, driven by strong consumer demand and advanced healthcare infrastructure.

What are the upcoming trends in the cosmetic contact lens industry?

Key trends include the adoption of silicone hydrogel (SiHy) materials for enhanced comfort and oxygen permeability, the growing preference for daily disposable lenses, and increased investment in e-commerce platforms offering diverse lens options.

What was the market size of the cosmetic contact lens market in 2025?

The market size was USD 1.5 billion in 2025, with a CAGR of 7.1% projected through 2035, driven by increasing demand for customized lenses and the growing popularity of daily disposable lenses.

What is the projected size of the soft segment in the cosmetic contact lens market by 2035?

The soft segment is projected to reach USD 2.1 billion by 2035, increasing its market share from 72.7% in 2025 to 73.1%.

What is the projected value of the cosmetic contact lens market by 2035?

The market is expected to reach USD 2.9 billion by 2035, driven by advancements in lens materials, rising e-commerce penetration, and consumer preference for safety and convenience.

Cosmetic Contact Lens Market Scope

Related Reports