Summary

Table of Content

Cooling Tower Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cooling Tower Market Size

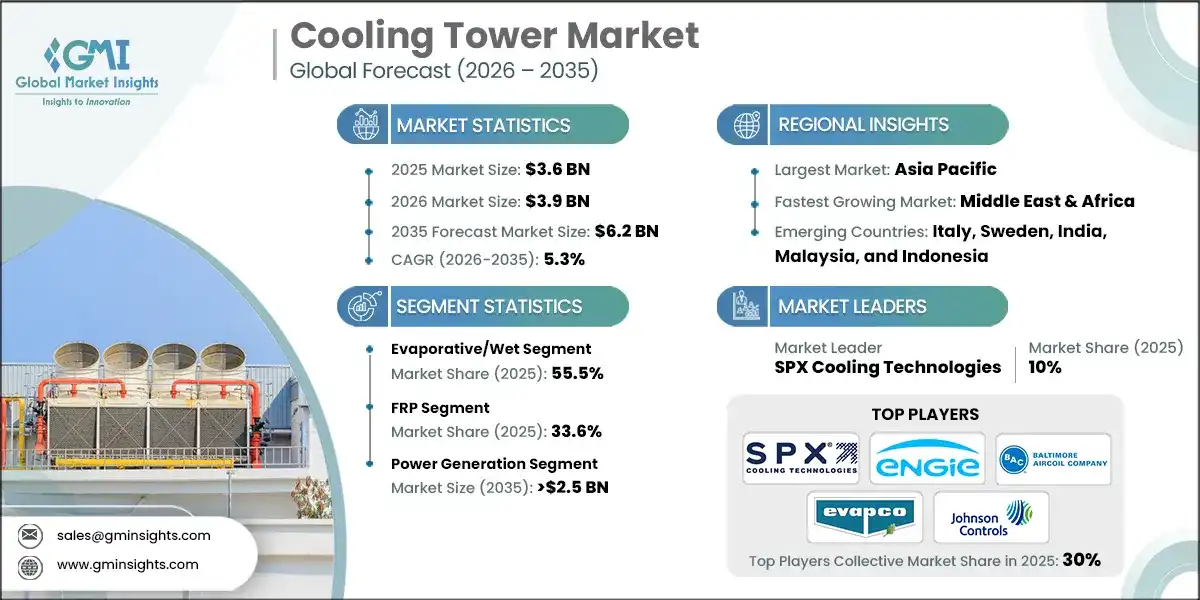

According to a recent study by Global Market Insights Inc., the cooling tower market was estimated at USD 3.6 billion in 2025. The market is expected to grow from USD 3.9 billion in 2026 to USD 6.2 billion by 2035, at a CAGR of 5.3%.

To get key market trends

- Increasing demand for energy-efficient cooling towers coupled with stringent emission norms will accelerate product adoption across industrial, commercial, and utility-scale applications globally. Growing integration of IoT-enabled monitoring systems along with predictive maintenance solutions will stimulate operational reliability and reduce downtime in cooling tower installations.

- A cooling tower is an industrial device designed to dissipate excess heat from processes such as power generation, HVAC systems, and manufacturing by releasing it into the atmosphere. It operates by lowering the temperature of water through evaporation or air contact before recirculating it back into the system for reuse.

- For instance, in October 2024, Schneider Electric announced plans to acquire a controlling stake in Motivair Corporation for approximately USD 850 million. This acquisition will strengthen Schneider Electric’s portfolio in advanced thermal management and enhance its offerings for the rapidly expanding data center market.

- Rising preference for hybrid cooling towers combining wet and dry technologies will proliferate due to water scarcity concerns and evolving environmental compliance standards worldwide. Continuous replacement of traditional wooden and metal structures with fiber-reinforced plastic cooling towers offering superior corrosion resistance and extended lifespan will augment industry growth.

- Increasing emphasis on water conservation technologies including drift eliminators and closed-loop systems will drive adoption of advanced cooling towers in water-stressed regions. Expanding deployment of modular cooling tower designs enabling quick installation and scalable capacity for industrial plants and large-scale data centers will sway market dynamics.

- Surging demand from hyperscale data centers driven by cloud computing and AI workloads will propel installation of high-capacity cooling towers for efficient heat rejection. Growing regulatory focus on noise pollution mitigation will encourage development of low-noise cooling towers incorporating aerodynamic fan blades and advanced sound-absorbing materials.

- For reference, in June 2025, CVC DIF partnered with Tabreed to acquire PAL Cooling Holding from Abu Dhabi’s Multiply Group. The transaction, valued at approximately USD 1.03 billion, encompasses three long-term concessions on Abu Dhabi’s main island and five on Al Reem Island, and is subject to customary regulatory approvals.

- Rising adoption of dry cooling towers in regions with strict water usage regulations will accelerate market penetration of air-cooled systems offering reduced environmental impact. Increasing manufacturers’ focus on sustainable materials and green production processes will enhance cooling tower designs aligned with global carbon reduction and eco-friendly initiatives.

- Advancements in fill media and heat transfer surfaces delivering improved thermal performance and reduced fouling will strengthen product competitiveness across diverse industrial sectors. Expanding HVAC applications in commercial buildings, hospitals, and malls will boost demand for energy-efficient cooling towers meeting green building certification requirements globally.

- The cooling tower market was valued at USD xx billion in 2022 and grew at a CAGR of approximately 5% through 2025. Growing integration of cooling towers in renewable energy projects including geothermal and solar thermal plants will reinforce alignment with global decarbonization and sustainability targets.

- Rising incorporation of automated water treatment systems minimizing scaling and microbial growth will improve operational efficiency and extend cooling tower service life significantly. Increasing retrofitting and refurbishment of aging industrial cooling infrastructure with advanced components will stimulate modernization initiatives without complete system replacement.

Cooling Tower Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 3.6 Billion |

| Market Size in 2026 | USD 3.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.3% |

| Market Size in 2035 | USD 6.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expanding manufacturing sector | Growing industrial output and increased investments in manufacturing facilities are driving demand for efficient cooling towers to maintain process stability and operational reliability. |

| Changing climate conditions | Rising global temperatures and frequent heatwaves are increasing cooling requirements across industries, accelerating adoption of advanced cooling towers for thermal management and energy efficiency. |

| Rising industrialization and power generation demand | Rapid industrial growth and expansion of power generation infrastructure, including thermal and nuclear plants, are fueling the need for high-capacity cooling towers to manage heat rejection effectively. |

| Pitfalls & Challenges | Impact |

| Biological contamination | Cooling towers are prone to microbial growth, including Legionella bacteria, which can compromise water quality, increase health risks, and necessitate stringent maintenance and treatment protocols. |

| Opportunities: | Impact |

| Adoption of Smart and IoT-Enabled Cooling Solutions | Integration of IoT and AI-driven monitoring systems offers opportunities for predictive maintenance, energy optimization, and enhanced operational reliability across industrial and commercial applications. |

| Expansion of Data Centers and Cloud Infrastructure | The rapid growth of hyperscale data centers globally creates significant demand for advanced cooling towers to manage high-density heat loads efficiently and sustainably. |

| Increasing Focus on Sustainable and Water-Saving Technologies | Rising environmental regulations and water scarcity concerns present opportunities for hybrid and dry cooling towers that minimize resource consumption while maintaining high thermal performance. |

| Emerging Hydrogen and Renewable Energy Projects | The development of hydrogen production facilities and renewable power plants opens new avenues for specialized cooling solutions tailored to clean energy applications. |

| Market Leaders (2025) | |

| Market Leaders |

10% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East & Africa |

| Emerging Country | Italy, Sweden, India, Malaysia, and Indonesia |

| Future outlook |

|

What are the growth opportunities in this market?

Cooling Tower Market Trends

- The global manufacturing sector is witnessing significant expansion, driven by industrial automation, increased production capacities, and rising demand for consumer goods. This growth directly impacts the cooling tower market, as manufacturing facilities require efficient heat rejection systems to maintain optimal operating conditions for machinery and processes.

- Industries such as chemicals, pharmaceuticals, food processing, and automotive rely heavily on cooling towers to regulate temperature in production lines and prevent equipment overheating. The integration of smart monitoring systems and IoT-enabled solutions in manufacturing plants enhances operational reliability and reduces downtime, making cooling towers an indispensable component of modern industrial setups.

- For citation, in July 2025, Modine Manufacturing Company announced a USD 100 million investment to expand U.S. manufacturing capacity for its Airedale by Modine™ data center cooling products, including enhanced engineering, testing, and new facilities in Dallas, Grenada, Franklin, and Jefferson City.

- Global climate change is significantly influencing cooling requirements across industrial and commercial sectors. Rising ambient temperatures and frequent heatwaves are increasing the thermal load on power plants, HVAC systems, and industrial processes, thereby driving demand for efficient cooling towers.

- In regions experiencing prolonged hot seasons, cooling towers play a vital role in maintaining operational stability and preventing system failures caused by overheating. Additionally, climate-induced water scarcity is prompting industries to adopt hybrid and dry cooling towers that minimize water consumption while ensuring effective heat rejection.

- For illustration, in December 2025, Fermi America signed a non-binding MOU with Hungary’s MVM EGI Zrt. to engineer next-gen hybrid cooling towers for its Project Matador energy campus in West Texas, aiming to reduce evaporative losses by over 80%.

- Power generation facilities, including thermal, nuclear, and renewable plants, require robust cooling systems to dissipate excess heat and maintain operational efficiency. Cooling towers are integral to these processes, ensuring compliance with safety standards and optimizing energy output. Governments worldwide are investing in infrastructure development and grid expansion, creating a favorable environment for cooling tower installations in power and industrial sectors.

- The expansion of heavy industries such as steel, cement, petrochemicals, and oil & gas further amplifies the need for high-capacity cooling towers capable of handling large thermal loads. Additionally, the growing focus on energy efficiency and sustainability in industrial operations is driving investments in advanced cooling technologies that reduce water consumption and minimize environmental impact.

Cooling Tower Market Analysis

Learn more about the key segments shaping this market

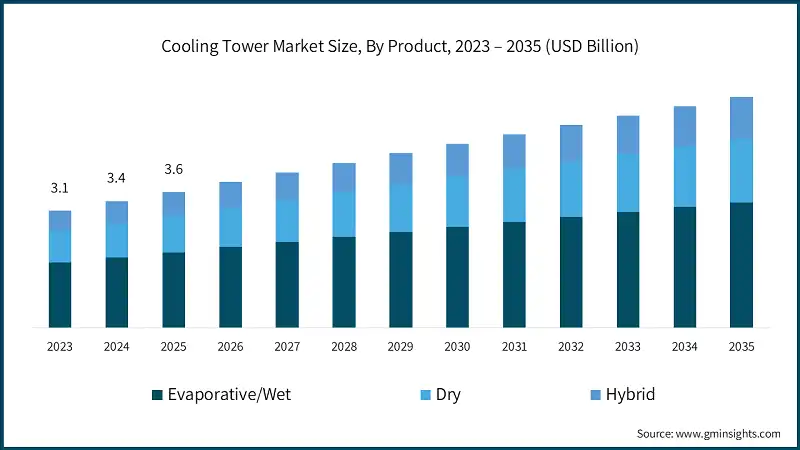

- Based on product, the industry is segmented into evaporative/wet, dry, and hybrid. The evaporative/wet cooling tower market holds a share of 55.5% in 2025. These cooling towers dominate the global market owing to their high thermal efficiency and cost-effectiveness in large-scale industrial and power generation applications.

- These towers operate by evaporating a small portion of water to remove heat, making them ideal for regions with abundant water resources. Industries such as petrochemicals, steel, cement, and HVAC systems in commercial buildings extensively use wet cooling towers for reliable heat rejection

- For reference, in June 2024, Copley Equity Partners announced a strategic investment in OBR Cooling Towers, enabling growth in tower repair, rebuild, maintenance, and installation services across the U.S. financial terms undisclosed.

- The dry cooling tower market is set to exceed USD 1.5 billion by 2035. These cooling towers are gaining traction in regions facing water scarcity and strict environmental regulations, as they eliminate water evaporation and minimize resource consumption. These towers use air as the cooling medium, making them suitable for arid climates and areas with limited water availability.

- The hybrid segment will witness a CAGR of over 5.5% by 2035. These towers combine the benefits of wet and dry systems, offering flexibility to switch between modes based on climatic conditions and water availability. These towers are designed to optimize water usage while maintaining high thermal efficiency, making them ideal for regions with seasonal temperature variations or moderate water scarcity.

Learn more about the key segments shaping this market

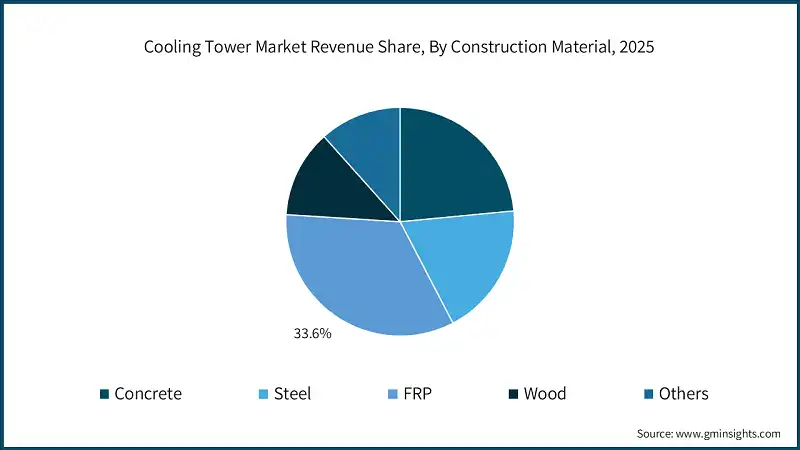

- Based on construction material, the industry is divided into concrete, steel, FRP, wood, and others. The FRP segment holds a share of 33.6% in 2025 and is set to exceed USD 2 billion by 2035. FRP structures offer excellent thermal performance while minimizing maintenance requirements, making them highly cost-effective over their operational lifespan.

- The growing emphasis on energy efficiency and sustainability is driving demand for FRP cooling towers, as they consume less energy during operation and are recyclable. Manufacturers are introducing advanced FRP composites with improved strength and heat resistance to cater to heavy-duty industrial applications.

- For citation, in November 2024, Wahaso introduced a Cooling Tower Reuse System, capable of treating and recycling water for cooling towers in commercial buildings enhancing water efficiency and supporting LEED certification.

- The concrete segment will witness a CAGR of over 5% by 2035. These materials are widely used in large-scale industrial and power generation facilities on account of their exceptional structural strength and durability. These towers are ideal for permanent installations where high thermal capacity and long service life are critical.

- The steel cooling tower market was estimated at USD 684.2 million in 2025. This segment is gaining popularity for industrial applications requiring high strength, flexibility, and faster installation compared to concrete structures. These towers offer excellent resistance to mechanical stress and can be fabricated in modular designs, enabling easy transportation and assembly.

- The wood cooling tower market will exceed USD 700 million by 2035. Wooden cooling towers represent a traditional construction material that is still used in certain industrial applications due to its low initial cost and ease of fabrication. These towers are typically employed in small-scale or temporary installations where budget constraints are a priority.

- Based on application, the industry is divided into chemicals & fertilizers, oil & gas, power generation, HVACR, and others. The power generation cooling tower market holds a share of 43.1% in 2025 and is set to exceed USD 2.5 billion by 2035. It is one of the largest application areas for cooling towers, as thermal and nuclear plants require efficient heat rejection systems to maintain operational efficiency.

- Cooling towers are integral to condensing steam and regulating temperatures in power cycles, making them critical for electricity production. The rising global demand for energy, coupled with the expansion of coal, gas, and nuclear power plants, is driving significant investments in cooling infrastructure.

- For reference, in September 2024, EDF’s Bugey nuclear plant in France commenced a trial to recover water from cooling tower plumes using Infinite Cooling’s charged mesh system testing recovery rates between 1?% and 15% of evaporated water.

- The HVACR cooling tower segment will witness a CAGR of over 5.5% by 2035. This segment is witnessing rapid growth in cooling tower adoption, driven by increasing urbanization, commercial construction, and demand for centralized cooling systems in large buildings. Cooling towers are essential for maintaining comfortable indoor environments in hospitals, malls, office complexes, and data centers.

- The chemicals & fertilizers cooling tower market was valued at USD 528.2 million in 2025. The industry is a major consumer of cooling towers due to its continuous need for process cooling in high-temperature operations. Cooling towers play a critical role in maintaining optimal reaction conditions, preventing overheating of equipment, and ensuring safe production environments.

- The oil & gas segment will exceed USD 600 million by 2035. The sector relies heavily on cooling towers for heat rejection in refining, petrochemical processing, and LNG operations. These towers are essential for maintaining process stability and preventing equipment failures in high-temperature environments.

Looking for region specific data?

- The U.S. dominated the cooling tower market in North America with around 86.7% share in 2025 and generated USD 472.3 million in revenue. The country is witnessing rapid growth fueled by robust industrial infrastructure, growing data center investments, and modernization of aging power generation facilities.

- The North America cooling tower market is projected to hit USD 800 million by 2035. The region is witnessing growing demand for cooling towers driven by industrial expansion and infrastructure development. Environmental regulations and water conservation mandates are pushing industries toward hybrid and dry cooling technologies, particularly in regions with limited water resources.

- For illustration, in July 2025, MGM Resorts International revealed the success of a hybrid cooling tower retrofit pilot at the Bellagio Spa Tower in Las Vegas, expected to save 18 million gallons of water annually.

- The Europe cooling tower market is set to grow at a rate of over 4% by 2035. The region is shaped by stringent environmental regulations, strong emphasis on energy efficiency, and widespread adoption of sustainable technologies. Increasing focus on reducing carbon emissions and water consumption is accelerating the adoption of hybrid and dry cooling towers in power generation and manufacturing facilities.

- The Asia Pacific cooling tower market holds a share of 54.4% in 2025. The region’s expanding manufacturing sector, coupled with large-scale power generation projects, is creating significant opportunities for cooling tower installations. Growing investments in petrochemical plants, steel production, and data centers are further boosting demand for high-capacity cooling solutions.

- For instance, in November 2025, China General Nuclear Power Group (CGN) began construction of a 203?m-high natural-draft cooling tower using secondary-cycle cooling technology for its Hualong One reactor at the Zhaoyuan nuclear power plant in Shandong Province.

- The Middle East & Africa cooling tower market was valued at USD 171.6 million in 2025. The region’s harsh climatic conditions and water scarcity challenges are accelerating the adoption of dry and hybrid cooling towers that minimize water consumption while ensuring efficient heat rejection. Manufacturers are focusing on developing robust, energy-efficient designs tailored to extreme operating conditions.

- The Latin America cooling tower market will exceed USD 300 million by 2035. The region’s focus on improving energy efficiency and reducing environmental impact is encouraging adoption of hybrid cooling towers and FRP-based designs. Countries including Brazil and Argentina are witnessing increased demand for cooling towers in chemical processing, oil refining, and food production industries.

Cooling Tower Market Share

- The top 5 players in cooling tower industry are SPX Cooling Tech, ENGIE, Baltimore Aircoil Company, EVAPCO, Johnson Controls, and Thermax contribute around 30% of the market share in 2025. The market is highly competitive and fragmented, driven by demand from HVAC, power generation, petrochemical, and industrial sectors. Growth is fueled by urbanization, data center expansion, and stricter energy efficiency and water conservation regulations.

- SPX Cooling Tech is a top-tier global manufacturer of cooling towers, evaporative fluid coolers, condensers, and air?cooled heat exchangers through its Marley, Recold, and SGS brands. SPX differentiates with water- and energy-saving technologies (like WaterGard membrane filtration), CTI-certified products, and a wide international footprint supporting design, installation, and aftermarket services.

- Baltimore Aircoil Company excels in manufactured Crossflow and Counterflow cooling towers designed for power generation, industrial processing, and HVAC systems. BAC emphasizes low sound, ease of maintenance, and energy efficiency, featuring proprietary Baltibond coatings, Eurovent- and CTI-certified components, and variable-frequency fan drives.

- EVAPCO is a major employee-owned provider of evaporative cooling towers, air-cooled condensers, and dry/hybrid solutions through its global subsidiaries. Its portfolio includes induced and forced-draft counterflow towers and high-performance modular designs such as the Eco-Air series that spans dry, adiabatic, and evaporative configurations.

- Johnson Controls integrates advanced controls and hybrid cooling technologies into centrally optimized cooling systems. Their systems integrate variable-speed controls, PID logic, and building automation via Metasys, catering to data centers, power plants, and HVAC applications. Johnson Controls offers optimization services and system-wide automation to improve sustainability, efficiency, and lifecycle performance of cooling tower installations.

- Thermax, based in India, specializes in closed-loop cooling towers and dry/adiabatic coolers designed for chemical, oil, pharmaceutical, steel, and HVAC sectors. Their modular closed-loop towers come equipped with integrated heat exchangers and pumps, delivering efficient heat rejection while preventing fluid contamination and enabling online maintenance.

Cooling Tower Market Companies

- In quarter four of 2025, Johnson Controls reported a 3% increase in sales to USD 6.4 billion, with organic sales growing by 4%. For the full year, total sales rose 3% to USD 23.6 billion, while organic growth reached 6%, reflecting strong underlying performance. During the quarter, GAAP net income from continuing operations attributable to Johnson Controls was USD 267 million, and adjusted net income stood at USD 798 million, supported by operational efficiencies and disciplined cost management.

- In the first nine months of 2025, Aggreko reported revenues of USD 2.4 billion. Profit before tax declined by USD 104 million, primarily due to exchange impacts on borrowings included within interest costs. However, excluding these currency-related effects, profit before tax increased by USD 106 million compared to the previous year, driven by higher operating profits and a reduction in interest expenses.

- In 2024, Thermax reported revenue of USD 1 billion, supported by steady demand across its key business segments. Profit before tax stood at USD 96.2 million, reflecting operational efficiency and disciplined cost management. The company maintained an equity share capital of USD 2.5 million, underscoring a strong capital structure and financial stability.

Major players operating in the cooling tower industry are:

- Advance Cooling Towers

- AEW Technik

- Aggreko

- Araco

- Baltimore Aircoil Company (BAC)

- Bellct

- Berg Chilling Systems

- Brentwood Industries

- Classik Cooling Towers

- CTP Engineering

- Delta Cooling Towers

- Enexio

- EVAPCO

- Faisal Jassim Trading

- Harrison Cooling Towers

- HCTC Cooling Equipment Trading

- John Cockerill

- Johnson Controls

- Konuk ISI

- Paharpur Cooling Towers

- SPX Cooling Tech

- Thermax

- Threcell Cooling Tower

- Tower Thermal

- VOLGA COOLING TECHNOLOGIES

Cooling Tower Industry News

- In October 2025, Johnson Controls announced a million-dollar investment in the Accelsius. This advanced solution leverages phase-change from liquid to vapor for heat removal, enabling superior thermal management with reduced energy consumption and improved operational efficiency.

- In October 2025, HACST Cooling supplied a modular closed-circuit cooling tower to a hydrogen production facility operated by China State Shipbuilding Corporation (CSSC). This project marks a significant milestone in advancing reliable cooling solutions within the emerging hydrogen energy sector. The custom-engineered system is designed to deliver efficient thermal management, ensuring operational stability and supporting CSSC’s commitment to sustainable energy innovation.

- In May 2025, Delta Cooling Towers launched the TMX Series, its most advanced and largest product line to date. Built with high-density polyethylene (HDPE), the series features a 20-foot sump molded as a single, seamless piece of engineered plastic. This design eliminates joints, seams, and welds common sources of leaks and maintenance issues ensuring superior durability and long-term, hassle-free performance.

- In July 2024, Baltimore Aircoil Company (BAC) introduced a new line of modular cooling towers that emphasize higher efficiency and ease of installation. These towers are designed to meet the increasing demand in the commercial HVAC market, which is driven by the need for reliable, energy-efficient, and sustainable cooling solutions. The modular design allows for greater flexibility in installation, making it easier to integrate into existing systems or new construction projects.

The cooling tower market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) from 2022 to 2035, for the following segments:

Market, By Product

- Evaporative/wet

- Dry

- Hybrid

Market, By Technology

- Open circuit

- Closed circuit

- Hybrid

Market, By Design

- Mechanical

- Natural

Market, By Build

- Field erection

- Package

Market, By Construction Material

- Concrete

- Steel

- FRP

- Wood

- Others

Market, By Flow

- Cross flow

- Counter flow

Market, By Application

- Chemicals & fertilizers

- Oil & gas

- Power generation

- HVACR

- Others

The above information has been provided for the following regions & countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- France

- Germany

- Italy

- Sweden

- Netherlands

- Denmark

- Spain

- Russia

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Malaysia

- Indonesia

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- Oman

- Kuwait

- Egypt

- South Africa

- Turkey

- Latin America

- Brazil

- Argentina

- Chile

- Peru

Frequently Asked Question(FAQ) :

Who are the key players in the cooling tower market?

Key players include SPX Cooling Technologies, ENGIE, Baltimore Aircoil Company, EVAPCO, Johnson Controls, Thermax, Advance Cooling Towers, Aggreko, Araco, Bellct, Berg Chilling Systems, Brentwood Industries, Delta Cooling Towers, Enexio, John Cockerill, Paharpur Cooling Towers, and Tower Thermal.

Which region leads the cooling tower market?

Asia Pacific held 54.4% share in 2025. The region's expanding manufacturing sector, power generation projects, and data center investments fuel its market dominance.

What are the upcoming trends in the cooling tower market?

Key trends include adoption of IoT-enabled monitoring systems, development of low-noise cooling towers, integration with renewable energy projects, and increasing use of dry cooling technologies in water-scarce regions.

What is the growth outlook for hybrid cooling towers from 2026 to 2035?

Hybrid cooling towers are projected to grow at over 5.5% CAGR through 2035, driven by water scarcity concerns and the need for flexible cooling solutions.

What was the valuation of FRP construction material segment in 2025?

FRP (Fiber-Reinforced Plastic) held 33.6% market share and is set to exceed USD 2 billion by 2035, valued for its corrosion resistance and extended lifespan.

What is the market size of the cooling tower in 2025?

The market size was USD 3.6 billion in 2025, with a CAGR of 5.3% expected through 2035 driven by rising demand for energy-efficient systems and stringent emission regulations across industrial, commercial, and utility sectors.

What is the current cooling tower market size in 2026?

The market size is projected to reach USD 3.9 billion in 2026.

How much revenue did the evaporative/wet cooling tower segment generate in 2025?

Evaporative/wet cooling towers held 55.5% market share in 2025, dominating the market due to their high thermal efficiency and cost-effectiveness in large-scale industrial applications.

What is the projected value of the cooling tower market by 2035?

The cooling tower market is expected to reach USD 6.2 billion by 2035, propelled by IoT integration, hybrid cooling adoption, and expanding data center infrastructure.

Cooling Tower Market Scope

Related Reports