Summary

Table of Content

Cooler Box Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cooler Box Market Size

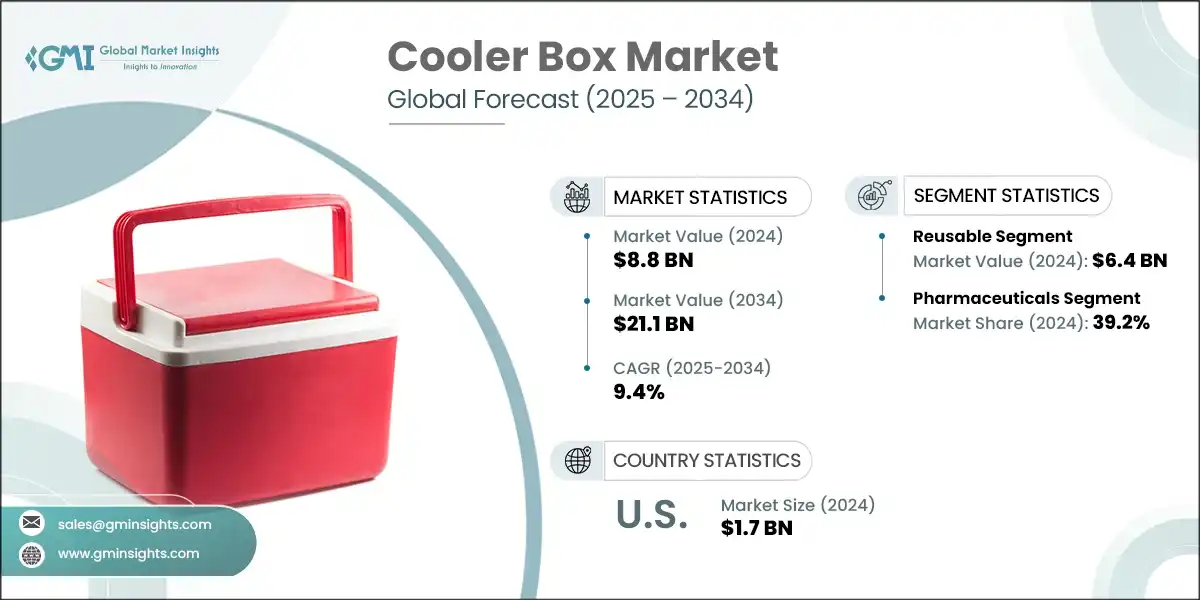

According to a recent study by Global Market Insights Inc., the global cooler box market size was estimated at USD 8.8 billion in 2024. The market growth is projected to reach USD 21.1 billion by 2034 at a CAGR of 9.4%.

To get key market trends

- The market has grown 37% since 2019, driven by rising demand in pharmaceuticals, expanding cold chain logistics, better insulation technologies, and higher disposable incomes in emerging markets.

- The expanding cold chain infrastructure globally is a primary driver behind the growth of the cooler box market. As per the data reported (2022) by World Bank Group, there are approximately 5 million refrigerated road vehicles, 1.2 million refrigerated containers, and 477,000 supermarkets, with footprints ranging from 500 m² to 20,000 m², illustrating substantial investments in cold storage and transportation facilities. This extensive infrastructure supports increased demand for cooling equipment such as cooler boxes, especially in regions with high food and pharmaceutical storage needs.

- Additionally, the versatility of equipment capacities from a few hundred watts to 1.5 MW underscores the widespread application and scalability of cooling solutions, reinforcing the market’s growth potential.

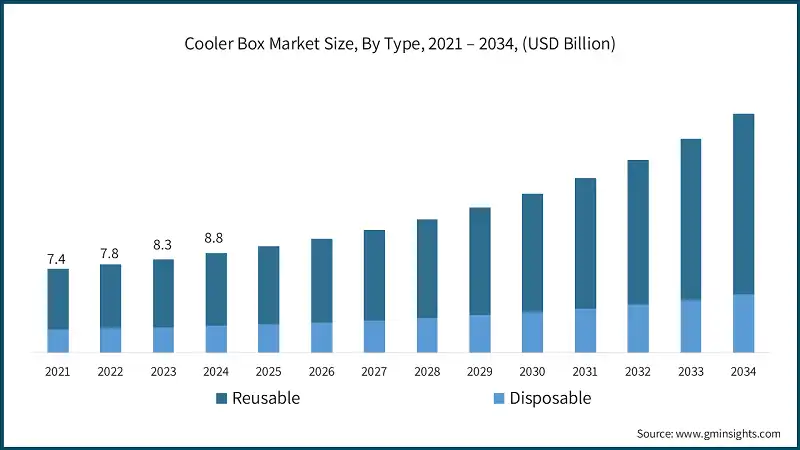

- Based on type, the largest segment reusable represented 73% of total market value in 2024. The reusable segment addresses the growing demand for sustainable alternatives, offering consumers and businesses a durable, cost-effective, and environmentally friendly solution compared to single-use cooler boxes. This trend aligns with broader efforts to reduce waste and minimize the environmental impact of packaging, catering to the preferences of environmentally conscious consumers and industries striving for eco-friendly practices. As sustainability continues to drive consumer choices and industry standards, the reusable cooler box segment is poised for further growth and innovation in the coming years.

- The increasing reliance on temperature-controlled logistics (TCL) is not merely a response to consumer expectations but a critical infrastructure requirement for global health and food security. According to the World Bank, inadequate cold chain systems contribute to the loss of nearly half of global food production annually, with a carbon footprint of approximately 4.4 gigatons of CO2 emissions.

- Moreover, the lack of refrigerated transport and storage in the medical sector alone results in 1.5 million vaccine-preventable deaths among children each year. These figures underscore the urgency for robust TCL systems that can maintain product integrity across diverse temperature ranges from chilled produce to vaccines requiring ultra-low temperatures like -70°C.

The global push to reduce food loss is driving significant investment in cold chain logistics, directly boosting demand for cooler boxes. According to the Food and Agriculture Organization (FAO), nearly one-third of all food produced globally is lost or wasted, much of it due to inadequate temperature-controlled storage and transport. Cooler boxes play a vital role in mitigating this loss, especially in regions with fragmented supply chains. As governments and international bodies prioritize food security and sustainability, the deployment of portable and scalable cooling solutions becomes essential, positioning cooler boxes as a critical component of modern logistics.

Climate change is intensifying the need for reliable cooling solutions across residential, commercial, and recreational sectors. The U.S. Department of Energy highlights that extreme heat events and shifting weather patterns are increasing the demand for energy-efficient cooling technologies. Cooler boxes, particularly those designed for off-grid and outdoor use, offer a flexible response to these conditions. Their utility in disaster relief, outdoor work environments, and recreational settings makes them indispensable as climate resilience tools, especially in regions facing frequent heatwaves and infrastructure stress.

Cooler Box Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 8.8 Billion |

| Forecast Period 2025 – 2034 CAGR | 9.4% |

| Market Size in 2034 | USD 21.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing demand for temperature-controlled transportation and storage | Accelerates global trade in perishable goods and pharmaceuticals by ensuring product integrity across long distances and diverse climates. |

| Ongoing innovations such as advanced insulation materials | Enhances energy efficiency and sustainability in refrigeration systems, reducing operational costs and environmental impact worldwide. |

| Rising outdoor activities and recreational trends | Fuels demand for portable and durable refrigeration solutions, expanding market opportunities in consumer and leisure segments globally. |

| Pitfalls & Challenges | Impact |

| Cost and affordability | Limits widespread adoption of advanced refrigeration technologies, especially in emerging markets where capital investment and operational costs remain prohibitive. |

| Regulatory compliance challenges | Delays product deployment and increases R&D burden as companies navigate complex and evolving environmental and safety standards across regions. |

| Opportunities: | Impact |

| Integration of IoT and Smart Monitoring Technologies | Enables predictive maintenance, real-time performance optimization, and energy savings, thereby reducing downtime and operational costs while enhancing system reliability and customer satisfaction. |

| Expansion into Underserved Emerging Markets | Unlocks significant growth potential by addressing unmet demand for cold storage and transport infrastructure, especially in regions with rising urbanization and food security challenges. |

| Market Leaders (2024) | |

| Market Leaders |

7.85% market share |

| Top Players |

Collective market share in 2024 is Collective Market Share is 12.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Middle East and Africa |

| Emerging Countries | India, China, Brazil, South Africa, Australia |

| Future outlook |

|

What are the growth opportunities in this market?

Cooler Box Market Trends

- A prominent trend shaping the cooler box industry is the increasing emphasis on sustainability and eco-friendly designs. This trend responds to heightened consumer awareness and concerns about environmental impact. Manufacturers are adopting innovative approaches by utilizing recycled materials in cooler box construction, reducing their carbon footprint. There's a notable shift towards biodegradable alternatives for insulation and packaging components, aligning with eco-conscious consumer preferences.

- These initiatives not only reduce the environmental impact of cooler box production but also resonate with a growing segment of environmentally conscious consumers seeking products that support sustainable practices. As demand continues to rise for eco-friendly solutions across industries, the integration of recycled materials and biodegradable elements in cooler box manufacturing is becoming a defining trend, influencing market offerings and consumer choices.

- Another significant trend in the cooler box market revolves around advancements in insulation and technology. Continuous innovation aims to enhance the thermal performance of cooler boxes, extending their ability to maintain desired temperatures for longer durations. Manufacturers are exploring novel insulation materials and design configurations to optimize temperature control within these boxes.

- Moreover, the integration of smart technologies, such as IoT sensors for temperature monitoring and control, is gaining traction. These technological integrations not only improve the efficiency of cooler boxes but also cater to the needs of various industries, including pharmaceuticals, food, and logistics. As businesses and consumers increasingly rely on precise temperature control during transport and storage, the incorporation of advanced insulation and smart technologies emerges as a pivotal trend, driving the evolution of cooler box capabilities and functionalities.

Cooler Box Market Analysis

Learn more about the key segments shaping this market

The cooler box market by type is segmented into reusable and disposable. In 2024, the reusable segment dominated the market and generated a revenue of USD 6.4 billion and is expected to grow at CAGR of around 9.8% during the forecast period 2025 to 2034.

- The trend toward reusable cooler boxes is gaining prominence in the market, reflecting a growing emphasis on sustainability and eco-conscious practices. Reusable cooler boxes represent a shift away from single-use packaging towards durable, multi-purpose solutions designed for extended usage. These boxes are crafted from sturdy materials capable of withstanding multiple applications without compromising their structural integrity or cooling efficiency.

- The reusable segment addresses the growing demand for sustainable alternatives, offering consumers and businesses a durable, cost-effective, and environmentally friendly solution compared to single-use cooler boxes. This trend aligns with broader efforts to reduce waste and minimize the environmental impact of packaging, catering to the preferences of environmentally conscious consumers and industries striving for eco-friendly practices.

Learn more about the key segments shaping this market

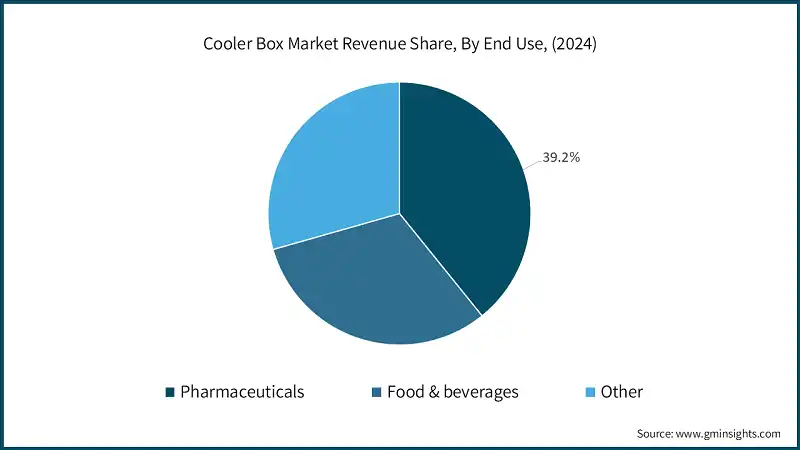

The cooler box market by end use is segmented into pharmaceuticals, food & beverages, and other. The pharmaceuticals segment was the leading segment in this market in 2024 with a revenue of USD 3.4 billion and has a market share of around 39.2%.

- The ongoing global vaccination campaigns, including routine immunization and mass vaccination drives, require efficient cold chain logistics for transporting vaccines. Cooler boxes play a pivotal role in maintaining the required temperature range during transportation and storage, ensuring vaccine efficacy.

- The pharmaceutical industry operates under strict regulatory guidelines mandating the maintenance of specific temperature ranges for various medications. Cooler boxes designed to meet these stringent standards are in high demand to ensure compliance and product integrity. The expansion of remote healthcare and telemedicine services requires secure and temperature-controlled transportation of medical supplies and samples, increasing the demand for specialized cooler boxes catering to these needs.

Looking for region specific data?

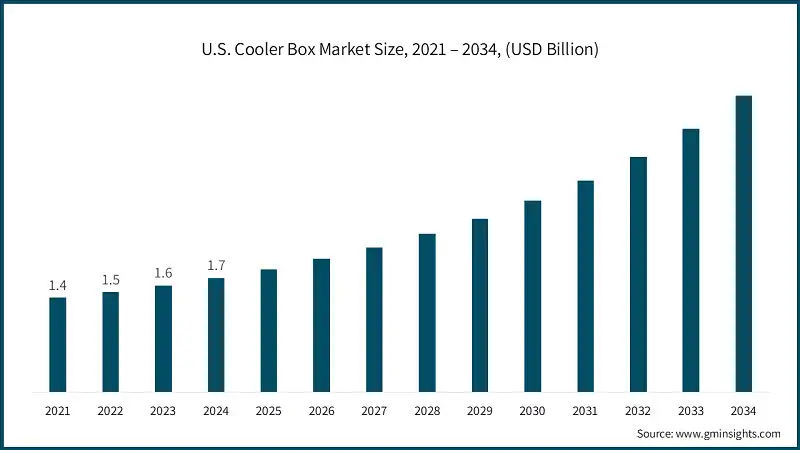

- The U.S. cooler box market was valued at around USD 1.7 billion in 2024 and is anticipated to register a CAGR of 10.3% between 2025 and 2034.

- The U.S. is demonstrating strong demand in the cooler box market due to a convergence of economic, environmental, and lifestyle factors. According to the U.S. Census Bureau, retail trade and manufacturing two sectors heavily reliant on cold chain logistics have shown consistent growth, reflecting increased demand for temperature-sensitive goods such as groceries, pharmaceuticals, and meal kits. Additionally, the U.S. Energy Information Administration (EIA) projects a continued rise in electricity consumption across residential and commercial sectors, which correlates with the growing use of energy-efficient cooling and refrigeration systems. These trends indicate a structural shift toward more robust and sustainable cold storage infrastructure.

- Furthermore, the U.S. Bureau of Economic Analysis (BEA) highlights a steady increase in consumer spending on durable goods and recreational equipment, including outdoor and lifestyle products. This aligns with the surge in demand for portable coolers and insulated containers used in camping, tailgating, and off-grid activities. As climate variability intensifies and consumer preferences shift toward convenience and sustainability, the U.S. market is poised to lead in both innovation and adoption of advanced cooler box technologies. This positions the country not only as a major consumer but also as a global trendsetter in the evolving refrigeration landscape.

- Europe: Europe witnessed promising demand in the cooler box market with a share of around 21.6% in 2024 and is expected to grow at a robust CAGR of 7.7% during the forecast period.

- Europe is demonstrating strong demand in the cooler box market due to its expanding agri-food and healthcare sectors, both of which rely heavily on temperature-controlled logistics. According to Eurostat’s 2025 edition of Key Figures on Europe, the EU continues to show robust growth in food production and distribution, with increasing emphasis on sustainability and supply chain resilience.

- The European Commission’s short-term outlook report further highlights a 4.1% rise in cereal production and a 12% increase in oilseed output, both of which require efficient cold storage and transport to maintain quality and reduce waste. These trends reflect a structural need for advanced cooler box solutions across agricultural and food processing industries.

- Additionally, the UK's Digest of Energy Statistics (DUKES) 2025 reveals a steady rise in domestic and service sector energy consumption, driven in part by climate variability and increased demand for cooling technologies. This aligns with broader EU efforts to decarbonize and modernize infrastructure, where energy-efficient cooler boxes play a critical role. As Europe faces geopolitical and climatic challenges, the demand for reliable, portable, and sustainable cooling solutions is expected to grow, especially in sectors like pharmaceuticals, outdoor recreation, and emergency response. These dynamics position Europe as a key growth region for innovation and investment in the cooler box market.

- Europe is demonstrating strong demand in the cooler box market due to its expanding agri-food and healthcare sectors, both of which rely heavily on temperature-controlled logistics. According to Eurostat’s 2025 edition of Key Figures on Europe, the EU continues to show robust growth in food production and distribution, with increasing emphasis on sustainability and supply chain resilience.

- Asia Pacific: In 2024, the cooler box market revenue for the Asia Pacific was around USD 2.7 billion and is expected to reach USD 7.5 billion by 2034.

- Asia-Pacific (APAC) is demonstrating strong demand and dominance in the cooler box market due to its expansive industrial base and rising consumer needs. According to Japan’s Ministry of Economy, Trade and Industry (METI), the region has shown consistent growth in industrial production and tertiary sector activity, particularly in food processing, pharmaceuticals, and logistics.

- These sectors require reliable temperature-controlled solutions, and the increasing sophistication of supply chains across APAC especially in Japan, South Korea, and China has accelerated the adoption of advanced cooler box technologies. Additionally, Japan’s Statistics Bureau reports a steady rise in household expenditure on durable goods, reflecting growing consumer interest in portable cooling products for leisure and lifestyle use.

- Moreover, APAC’s dominance is reinforced by its manufacturing capabilities and export-driven economies. Japan’s Ministry of Finance trade statistics show a significant volume of exports in machinery and insulated containers, indicating strong production and global distribution capacity. The region’s climate diversity from tropical zones in Southeast Asia to temperate regions in East Asia further drives demand for cooler boxes across both commercial and recreational applications. As governments in APAC continue to invest in infrastructure and sustainability, the market is expected to expand rapidly, positioning the region as a global leader in innovation, production, and consumption of cooler box solutions.

- Asia-Pacific (APAC) is demonstrating strong demand and dominance in the cooler box market due to its expansive industrial base and rising consumer needs. According to Japan’s Ministry of Economy, Trade and Industry (METI), the region has shown consistent growth in industrial production and tertiary sector activity, particularly in food processing, pharmaceuticals, and logistics.

Cooler Box Market Share

- The top 5 companies in the cooler box industry, such as Igloo Products Corp., K2Coolers, Sonoco ThermoSafe, WILD Coolers, and YETI COOLERS, LLC., hold a market share of 12-15%.

- YETI continues to lead through premium branding, product diversification, and experiential marketing. By expanding into drinkware, bags, and outdoor gear, and leveraging influencer partnerships and limited-edition drops, YETI sustains high brand equity and customer loyalty. Its direct-to-consumer model and omnichannel presence further enhance market penetration and margin control.

- Igloo maintains its competitive edge by blending affordability with innovation, targeting both mass-market and lifestyle segments. The company frequently launches themed collaborations and eco-friendly product lines, while strengthening its retail and e-commerce distribution. This dual focus on accessibility and trend responsiveness keeps Igloo relevant across consumer tiers.

- WILD Coolers positions itself as a rugged, American-made alternative in the premium cooler space. The brand emphasizes durability, customization, and patriotic branding, appealing to outdoor enthusiasts and niche markets. Its focus on domestic manufacturing and community engagement reinforces brand authenticity and customer retention.

Cooler Box Market Companies

Major players operating in the cooler box industry are:

- B Medical System

- Bison Coolers

- Blowkings

- Cold Chain Technologies Inc.

- Cool Ice Box Company

- Eurobox Logistics

- FEURER Group GmbH

- Igloo Products Corp.

- K2Coolers

- Pelican Products Inc.

- Sofrigam Group

- Sonoco ThermoSafe

- va-Q-tec Thermal Solutions GmbH

- WILD Coolers

- YETI COOLERS, LLC.

Sonoco ThermoSafe dominates the pharmaceutical and biotech cold chain segment by investing in reusable, high-performance thermal packaging. Its strategy includes expanding global service networks and integrating digital monitoring technologies, ensuring compliance with stringent temperature control standards and sustainability goals.

K2Coolers competes by offering high-performance rotomolded coolers at a more accessible price point. The company targets value-conscious outdoor users and leverages dealer networks and grassroots marketing to build brand loyalty. Its lean operations and focus on core functionality allow it to remain agile in a competitive landscape.

Cooler Box Industry News

- In April 2025, Coleman made a strategic entry into the premium cooler segment with the launch of its Pro Cooler line, introducing a range of hard-sided and soft coolers engineered for durability, portability, and affordability. Designed to compete with high-end brands like YETI and RTIC, the Pro series features materials that are 15–30% lighter than traditional rotomolded coolers, while offering comparable ice retention and ruggedness. Backed by a 10-year warranty and tested under extreme conditions, Coleman’s move reflects a calculated effort to capture market share by offering high-performance coolers at nearly 40% lower cost than competitors, positioning itself as a value-driven disruptor in the outdoor and recreational cooling market.

- In March 2025, Ninja expanded its outdoor product portfolio by launching the FrostVault Wheeled Cooler, a strategic upgrade to its original FrostVault design featuring all-terrain wheels, carry handles, and enhanced portability for outdoor use. Available in three sizes such as 28L, 42L, and 61L, the cooler integrates premium ice retention technology and a dry goods drawer capable of maintaining food-safe temperatures for days, positioning it as a direct competitor to YETI in the high-performance cooler segment. Priced at $349.99, Ninja’s move reflects a calculated effort to capture market share through functional innovation and value-driven design, reinforcing its commitment to becoming a serious contender in the outdoor cooling market.

- In October 2024, Igloo strategically partnered with Minecraft to launch two exclusive cooler and drinkware collections, marking its first collaboration with the globally popular video game franchise. The initiative includes a limited-edition blind box release of 150 collectible coolers and a nine-piece lineup featuring iconic Minecraft characters, aimed at engaging younger, digitally native consumers. By blending gaming culture with outdoor utility, Igloo reinforces its brand relevance and expands its appeal across lifestyle and recreational segments, positioning itself as a creative leader in the cooler box market.

- In February 2023, Moosejaw launched its Cooler Collection exclusively for Walmart, introducing six rugged, high-performance cooler models designed to deliver premium insulation and durability at accessible price points ranging from $99 to $249. The collection includes hard-sided Ice Fort coolers and soft-sided Chilladilla variants, all featuring recycled materials, antimicrobial interiors, and leakproof seals. By combining sustainability, affordability, and functionality, Moosejaw strategically positioned itself to serve both casual and serious outdoor consumers, reinforcing its value-driven approach in the competitive cooler box market.

The cooler box market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Type

- Reusable

- Disposable

Market, By Raw Material

- Extruded polystyrene

- Expanded polystyrene

- Expanded polypropylene

- Others

Market, By Price Range

- Low (Upto USD 30)

- Medium (USD 30 - USD 50)

- High (Above USD 50)

Market, By End Use

- Pharmaceuticals

- Food & beverages

- Other

Market, By Distribution Channel

- Online

- Company Website

- E-commerce website

- Offline

- Supermarkets and hypermarkets

- Specialty outdoor stores

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

How much revenue did the reusable segment generate in 2024?

The reusable segment generated approximately USD 6.4 billion in 2024 and is expected to observe around 9.8% CAGR till 2034.

What was the valuation of the pharmaceuticals segment in 2024?

The pharmaceuticals segment was valued at USD 3.4 billion in 2024, accounting for approximately 39.2% of the market share.

Which region leads the cooler box sector?

The U.S. market was valued at USD 1.7 billion in 2024 and is set to expand at a CAGR of 10.3% up to 2034, led by economic, environmental, and lifestyle factors.

What are the upcoming trends in the cooler box market?

Key trends include eco-friendly designs, recycled materials, better insulation, and IoT-based temperature control.

Who are the key players in the cooler box market?

Major players include B Medical System, Bison Coolers, Blowkings, Coldchain Technologies Inc., Cool Ice Box Company, Eurobox Logistics, FEURER Group GmbH, Igloo Products Corp., K2Coolers, Pelican Products Inc.

What is the market size of the cooler box in 2024?

The market size was estimated at USD 8.8 billion in 2024, with a CAGR of 9.4% expected through 2034. The market growth is driven by rising demand in pharmaceuticals, expanding cold chain logistics, advancements in insulation technologies.

What is the projected value of the cooler box market by 2034?

The cooler box market is projected to reach USD 21.1 billion by 2034, fueled by technological advancements, sustainability initiatives, and growing demand across industries like pharmaceuticals and food logistics.

Cooler Box Market Scope

Related Reports