Summary

Table of Content

Continuous Glucose Monitoring Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Continuous Glucose Monitoring Market Size

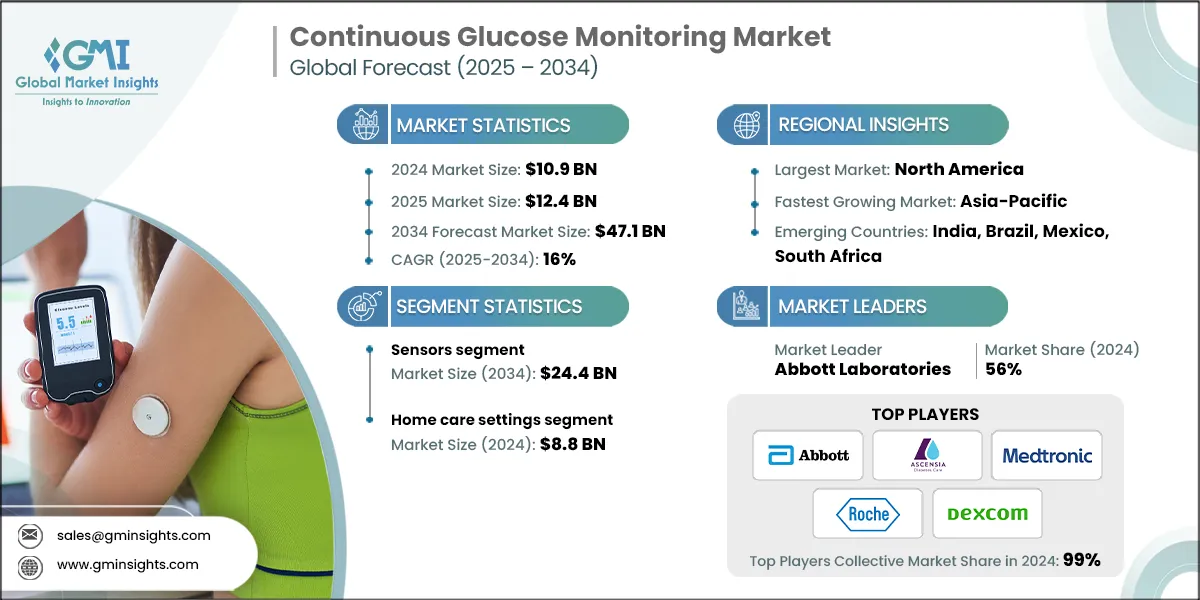

The global continuous glucose monitoring market was valued at USD 10.9 billion in 2024 and is projected to grow from USD 12.4 billion in 2025 to USD 47.1 billion by 2034, registering a CAGR of 16% during the forecast period, according to Global Market Insights Inc.

To get key market trends

The steady growth is driven by various factors, such as the rising prevalence of diabetes globally, the growing demand for continuous monitoring devices, technological advancements in devices, and increasing government initiatives to raise awareness about diabetes. Continuous glucose monitoring (CGM) is an advanced diagnostic device used to track blood glucose levels continuously throughout the day and night. These systems use a small sensor inserted under the skin to measure interstitial glucose levels. Major companies in the industry include Abbott Laboratories, Dexcom, Medtronic, and Ascensia Diabetes Care Holdings, which focus on connected and personalized diabetes management technologies.

Continuous Glucose Monitoring Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 10.9 billion |

| Forecast Period 2025 - 2034 CAGR | 16% |

| Market Size in 2034 | USD 47.1 billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing number of people suffering from diabetes, globally | Boosts demand for CGM devices across demographics, prompting broader adoption and healthcare prioritization. |

| Rising demand for continuous monitoring devices | Spurs innovation in CGM technology, enhancing real-time data access and patient outcomes. |

| Technological advancements in devices | Accelerates development of smarter, more efficient CGMs, expanding market reach and usability. |

| Increasing government initiatives to generate awareness regarding diabetes | Strengthens public understanding and adoption of CGMs through education and subsidized programs |

| Pitfalls & Challenges | Impact |

| High cost related to devices | Limits CGM accessibility for low-income groups, hindering widespread adoption in developing regions. |

| Stringent regulatory scenario | Slows CGM innovation and market entry, especially for smaller manufacturers, due to complex compliance requirements. |

| Opportunities: | Impact |

| Expansion in emerging markets | Present significant growth potential for CGMs through affordable, localized solutions and improving healthcare infrastructure. |

| Market Leaders (2024) | |

| Market Leaders |

56% Market Share |

| Top Players |

Collective market share in 2024 is 99% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

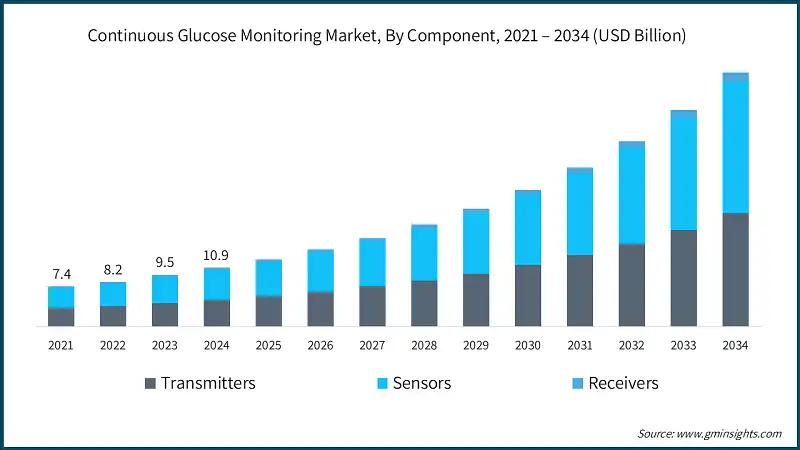

The market grew from USD 7.4 billion in 2021 to USD 9.5 billion in 2023, primarily due to the increased adoption of digital technologies, a shift in consumer behaviour favoring more advanced and sustainable solutions, and growing demand in emerging markets. Moreover, companies capitalized on post-pandemic momentum by expanding their product portfolios and optimizing supply chains to meet changing expectations. These factors collectively contributed to the market's growth during the period.

The increasing prevalence of diabetes is the key factor driving the growth of the market. For instance, according to a report from the World Health Organization (WHO), in 2022, nearly 830 million individuals suffered from diabetes globally, with the majority of cases originating from low and middle-income countries. Additionally, in 2021, diabetes led to 1.6 million deaths, with 47% occurring before the age of 70 years. These statistics highlight the growing need for effective solutions such as continuous glucose monitoring devices, which help individuals check their glucose levels, improve their health, and address the global diabetes problem.

Further, increasing government initiatives to generate awareness regarding diabetes play a vital role in shaping the continuous glucose monitoring market by raising awareness about diabetes monitoring and improving access to these devices. For instance, in the U.S., the Centers for Disease Control and Prevention (CDC) has implemented various programs to tackle diabetes. The National Diabetes Prevention Program, launched in the U.S., aims to prevent or delay type 2 diabetes. As part of this initiative, the CDC provides resources and information about diabetes management tools, such as CGM devices. Thus, technological innovations in CGM devices and the growing demand for continuous monitoring devices globally are fueling the need for more effective and targeted CGM devices.

Continuous glucose monitoring (CGM) is a medical technology used to track glucose levels in the body continuously throughout the day and night. Unlike traditional blood glucose monitoring that requires fingerstick blood samples, CGM systems use a small sensor inserted under the skin to measure interstitial glucose levels in real time.

Continuous Glucose Monitoring Market Trends

- Continuous glucose monitoring (CGM) devices have evolved significantly with notable technological advancements in recent years, driving the growth of the market. These innovations in CGM have improved the accuracy, convenience, and user experience of CGM devices, making them more appealing to both patients and healthcare providers.

- The improvement in sensor accuracy and longevity represents a major technological advancement in CGM devices. Modern sensors now offer extended wear times and enhanced stability. For instance, the Stelo Glucose Biosensor by Dexcom provides a 15-day wear time along with a 12-hour grace period.

- Additionally, the incorporation of smart devices and data-sharing capabilities has enhanced the functionality of CGM devices. Many modern CGM devices transmit real-time glucose level data directly to smartphones, smartwatches, and other connected devices. This feature makes it more convenient for users to monitor and track their glucose levels while also enabling direct data sharing with healthcare providers.

- For example, the Freestyle Libre 2 system offers optional real-time alarms on smartphones, alerting users about their glucose levels.

- Further, artificial intelligence in healthcare and machine learning are being integrated into CGM systems, which offers personalized insights and analytical capabilities. These technologically advanced analytics help individuals and healthcare professionals to identify the patterns, can also assist them to predict the future glucose levels and trends, and accordingly help to make decisions, thus contributing to the market growth.

Continuous Glucose Monitoring Market Analysis

Learn more about the key segments shaping this market

The global market was valued at USD 7.4 billion in 2021. The market size reached USD 9.5 billion in 2023, from USD 8.2 billion in 2022. Based on the component, the market is segmented into transmitters, sensors, and receivers. The sensors segment dominated the market in 2024, holding the largest share due to the widespread adoption across homecare setting, diagnostic centers, and hospitals. This segment was valued at USD 5.5 billion in 2024 and is projected to reach USD 24.4 billion by 2034, growing at a CAGR of 16.2%. In comparison, the transmitters segment, valued at USD 4.9 billion in 2024, is expected to grow to USD 21 billion by 2034.

- The continuous advancement in sensor technology, particularly in terms of its accuracy and reliability, is significantly driving the growth of the continuous glucose monitoring market.

- Modern sensors have significantly improved their accuracy, with some devices achieving a mean absolute relative difference (MARD) lower than 10%. For example, a study published by the National Institutes of Health (NIH) in 2023 reported that Dexcom has an 8.2% MARD, whereas Abbott’s Freestyle Libre has a 9.7% MARD. This accuracy has led to better adoption of CGM systems among individuals.

- In addition, smaller sensors have made CGM devices more comfortable for users. For instance, the latest innovation in CGM sensors, the Dexcom G7, is about the size of a penny and can be worn under an individual’s clothing. This small size has improved user comfort and allows sensors to last up to 10 days of continuous use before requiring replacement.

- Furthermore, many new advanced biosensors, which is estimated to reach USD 68.5 billion by 2034, can track more than just glucose. These advanced sensors can also measure ketones or lactate in an individual’s body. This provides a better overall picture of metabolic health and helps users manage their diabetes more accurately. Thus, this advancement is accelerating market growth.

Learn more about the key segments shaping this market

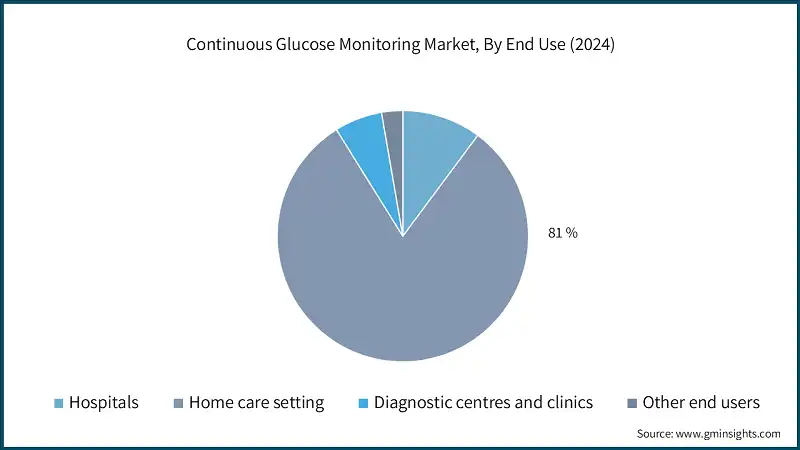

Based on end use, the continuous glucose monitoring market is bifurcated into hospitals, home care settings, diagnostic centres and clinics, and other end users. The home care settings segment held a significant revenue of USD 8.8 billion in 2024 with a revenue share of 81%.

- The growing prevalence of diabetes globally is creating a demand for effective continuous glucose monitoring solutions for home use. Advanced CGM devices help patients by providing real-time data and alerts while also tracking glucose levels, making home care a better and more convenient option for patients.

- Additionally, the introduction of innovative technologies in CGM devices has enhanced their accuracy, comfort, and ease of use, encouraging more individuals to adopt them.

- Similarly, many CGM devices have the ability to connect to smartphones and other digital devices or apps, making it easier to track data and share it with healthcare providers.

- For example, Abbott’s Freestyle Libre 2, Dexcom G7, and Abbott’s Freestyle Libre 3 are designed for home use, with user guides, app support, and phone assistance to help patients.

- Furthermore, due to the COVID-19 pandemic, the adoption of home-based healthcare solutions, such as CGM devices, has further increased. During the pandemic outbreak, people preferred to avoid hospital visits and limit exposure to healthcare settings. As a result, CGM systems have become even more important for managing chronic conditions such as diabetes at home, contributing to market growth.

Looking for region specific data?

North America Continuous Glucose Monitoring Market:

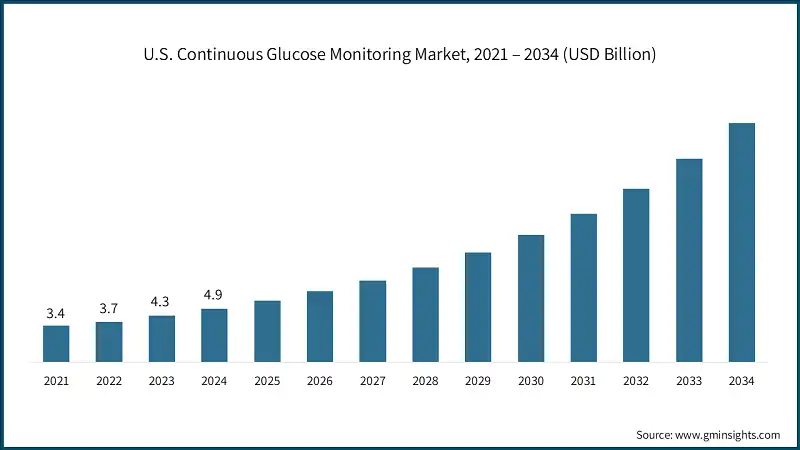

North America dominated the global market, with the highest market share of 47.1% in 2024.

The U.S. continuous glucose monitoring market was valued at 3.4 billion and USD 3.7 billion in 2021 and 2022, respectively. In 2024 the market size reached USD 4.9 billion from USD 4.3 billion in 2023.

- The rising prevalence of diabetes in the U.S. is accelerating the demand for CGM devices.

- For instance, in 2021, data from the Centers for Disease Control and Prevention (CDC) indicated that approximately 38.4 million individuals in the U.S. suffered from diabetes, with 90-95% of them diagnosed with type 2 diabetes.

- The market has also expanded due to favorable reimbursement policies. Medicare has made its coverage for CGM devices more inclusive, increasing system accessibility to a wider population. Starting in January 2023, the Centers for Medicare & Medicaid Services (CMS) broadened the scope of CGM device coverage to include people with diabetes who take insulin or have experienced problematic hypoglycemia in the past.

Europe Continuous Glucose Monitoring Market:

Europe continuous glucose monitoring industry accounted for USD 2.9 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The rising prevalence of diabetes in the region, combined with increasing government initiatives to enhance healthcare infrastructure, is expected to drive market growth.

- Moreover, European governments are making substantial investments in healthcare infrastructure, further encouraging the adoption of CGM solutions in the region. For instance, member countries of the European Union have allocated over EUR 10 billion for healthcare infrastructure investments between 2021 and 2027.

Germany continuous glucose monitoring market is projected to experience steady growth between 2025 and 2034.

- The growth of the market in the country is highly attributed to the rising prevalence of diabetes.

- For instance, according to data from the International Diabetes Federation, Germany has approximately 6.2 million adults living with diabetes, representing a 10% prevalence rate among the adult population.

- Thus, as the rate of diabetes prevalence increases, the adoption of continuous glucose monitoring among the affected population is anticipated to rise in the foreseeable future, propelling market growth in the country.

Asia Pacific Continuous Glucose Monitoring Market

The Asia Pacific region is projected to be valued at USD 2.1 billion in 2024 and is expected to reach USD 9.6 billion by 2034.

- The market in the Asia Pacific region is expanding rapidly due to the growing burden of diabetes, rising health awareness, and continuous advancements in healthcare infrastructure.

- Additionally, the rapid growth in the number of hospitals and diagnostic centers, along with government policies aimed at improving diagnostic capabilities, is further contributing to the growth of the market in the region.

- Countries such as China, India, and Japan are adopting advanced technology, driven by the growing demand for advanced diabetes solutions and expanding access to healthcare services.

China continuous glucose monitoring market is poised to witness lucrative growth between 2025 - 2034.

- The country has a rapidly increasing aging population that necessitates frequent healthcare intervention.

- For instance, according to estimates from the World Health Organization in 2019, approximately 254 million people aged 65 and above were residing in the country. This number is projected to rise significantly, with 402 million people expected to be over the age of 60 by 2040.

- The population of this demographic is more likely to have chronic disease conditions such as diabetes, which often require frequent blood glucose monitoring. This, in turn, stimulates the need for medical devices such as continuous glucose monitoring, thereby propelling market growth in the region.

Latin America Continuous Glucose Monitoring Market

Brazil is experiencing significant growth in the continuous glucose monitoring market.

- The rising prevalence of diabetes is driving the market's growth in the country. For instance, according to data from the International Diabetes Federation, Germany has approximately 16.6 million adults living with diabetes, representing a 10.6% prevalence rate among the adult population.

- Additionally, the increasing rate of obesity and the aging population are further contributing to market growth, as these demographic groups are at a higher risk of developing diabetes. This condition requires frequent monitoring of blood glucose levels, thereby fostering market expansion.

- Moreover, growing awareness about the benefits of early disease detection and prevention, supported by public health initiatives and education campaigns, is encouraging individuals to undergo health check-ups. This trend is expected to drive market growth.

Middle East and Africa Continuous Glucose Monitoring Market

The continuous glucose monitoring market in Saudi Arabia is expected to experience significant and promising growth from 2025 to 2034.

- Saudi Arabia’s advanced healthcare infrastructure and increasing investment in advanced healthcare technologies are creating opportunities for the development and adoption of advanced CGM devices tailored to the country’s patient-specific needs.

- Additionally, health awareness programs in Saudi Arabia, such as the Saudi National Diabetes Screening Program, focus on chronic disease management, including diabetes, and emphasize its prevention and treatment. As a result, CGM devices are playing a key role in promoting early interventions and educating users on adopting healthier lifestyle habits to prevent chronic illnesses and enhance overall well-being.

- Furthermore, Vision 2030’s emphasis on healthcare modernization is boosting investments in continuous glucose monitoring, supported by the growing need for advanced devices to manage diabetes effectively.

Continuous Glucose Monitoring Market Share

- The top five players in the continuous glucose monitoring industry, namely Abbott Laboratories, Ascensia Diabetes Care Holdings, F. Hoffmann-La Roche, Medtronic, and Dexcom, collectively hold a 99% share of the global market. These companies maintain their leadership through diverse product portfolios, strategic collaborations, regulatory approvals, and ongoing innovation. Abbott Laboratories stands out due to its comprehensive range of CGM devices, which are widely adopted in hospitals and diagnostic centers.

- Abbott Laboratories stands out with its FreeStyle Libre platform, which has gained widespread adoption across multiple regions due to its ease of use, affordability, and advanced data connectivity. Abbott continues to enhance its CGM offerings by integrating real-time glucose monitoring with cloud-based analytics and mobile health applications, supporting personalized and proactive diabetes management.

- Manufacturers are embracing value-based pricing models to improve accessibility in diverse healthcare systems while also launching AI-enabled CGM platforms that feature predictive glucose alerts, automated data interpretation, and seamless integration with electronic health records.

- Key trends shaping the market include the development of minimally invasive sensors, AI-powered decision support tools, and interoperable platforms designed for both clinical and home settings. Technologies such as continuous interstitial glucose monitoring, smartphone-based data visualization, and remote patient monitoring are significantly improving diagnostic accuracy, patient engagement, and long-term health outcomes worldwide.

Continuous Glucose Monitoring Market Companies

Few of the prominent players operating in the continuous glucose monitoring industry include:

- Abbott Laboratories

- A. Menarini Diagnostics

- Dexcom

- i-SENS

- F. Hoffmann-La Roche

- Med Trust

- Medtronic

- Medtrum Technologies

- Senseonics

- Sinocare

- Zhejiang POCTech

Abbott Laboratories boasts a robust product portfolio that drives widespread adoption and significant market expansion. The company offers a diverse range of continuous glucose monitoring (CGM) products, including the FreeStyle Libre 2 and FreeStyle Libre 3, which are widely recognized for their innovation and accessibility. Dexcom

Dexcom is committed to research and development, continuously advancing its CGM technology. Its focus on innovation has led to the development of cutting-edge products such as the Dexcom G6 CGM System and the Dexcom G6 Pro CGM System, enhancing user experience and clinical outcomes.

Medtronic leverages its extensive global presence to strengthen market reach, operating in over 150 countries with a robust distribution network. Its CGM product portfolio includes standalone CGM systems as well as integrated solutions such as CGM devices paired with automated insulin pump systems, offering comprehensive diabetes management.

Continuous Glucose Monitoring Industry News:

- In September 2024, Abbott introduced its latest wearable, Lingo, a continuous glucose monitor, aimed at health-conscious individuals by helping them track their glucose levels without needing prior medical approval. This launch will expand the company’s product portfolio of continuous glucose monitors and may enable them to increase customer base.

- In March 2024, Dexcom received FDA clearance for its Stelo glucose biosensor, marking it as the first over-the-counter (OTC) continuous glucose monitor (CGM) available in the U.S. This move may position Dexcom as a leader in the CGM market, responding to increasing demand for accessible diabetes management tools.

- In January 2024, Medtronic plc announced CE Mark approval for the MiniMed 780G system featuring Simplera Syn, a compact CGM that eliminates the need for fingersticks or overtape. With a simplified insertion process and smaller size, it enhances user experience while upholding glucose monitoring accuracy and reliability, marking a notable advancement for Medtronic.

The continuous glucose monitoring market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Component

- Transmitters

- Sensors

- Receivers

Market, By End Use

- Hospitals

- Home care settings

- Diagnostic centres and clinics

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Sweden

- Russia

- Denmark

- Finland

- Norway

- Poland

- Switzerland

- Belgium

- Lithuania

- Latvia

- Estonia

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

- Israel

- Kuwait

- Qatar

Frequently Asked Question(FAQ) :

Who are the key players in the continuous glucose monitoring market?

Key players include Abbott Laboratories, A. Menarini Diagnostics, Dexcom, i-SENS, F. Hoffmann-La Roche, Med Trust, Medtronic, Medtrum Technologies, and Senseonics.

Which region leads the continuous glucose monitoring market?

North America led the market with a 47.1% share in 2024, driven by advanced healthcare infrastructure and high adoption rates of CGM devices.

What are the upcoming trends in the continuous glucose monitoring industry?

Key trends include advancements in sensor technology, extended sensor wear times, and increasing adoption of CGM devices in home care settings.

Which segment held the largest revenue share in 2024?

The home care settings segment held the largest revenue share, generating USD 8.8 billion in 2024, accounting for 81% of the market.

What was the valuation of the transmitters segment?

The transmitters segment was valued at USD 4.9 billion in 2024 and is expected to grow to USD 21 billion by 2034.

How much revenue did the sensor segment generate?

The sensor segment generated USD 5.5 billion in 2024 and is projected to grow to USD 24.4 billion by 2034, with a CAGR of 16.2%.

What is the market size of the continuous glucose monitoring in 2024?

The market size was USD 10.9 billion in 2024, with a CAGR of 16% expected through 2034, driven by advancements in CGM technology and increasing adoption among patients and healthcare providers.

What is the projected size of the continuous glucose monitoring market in 2025?

The market is expected to reach USD 12.4 billion in 2025.

What is the projected value of the continuous glucose monitoring market by 2034?

The market is expected to reach USD 47.1 billion by 2034, fueled by improvements in sensor accuracy, extended wear times, and growing demand for home care solutions.

Continuous Glucose Monitoring Market Scope

Related Reports