Home > Media & Technology > Next Generation Technologies > Fintech > Contactless Payment Market

Contactless Payment Market Analysis

- Report ID: GMI3380

- Published Date: Aug 2020

- Report Format: PDF

Contactless Payment Market Analysis

Ongoing advancements in networking infrastructure and rising government initiatives for the development of smart solutions are the key driving factors. Several government administrations are encouraging their merchants to adopt advanced payment solutions. The Australia & New Zealand (ANZ) contactless POS terminals market is predicted to register around 17% growth rate through 2026.

The NFC technology segment accounted for more than 60% of the market share in 2019 owing to the extensive usage of NFC technology, facilitating real-time transactions. Increasing penetration of NFC-based mobile handsets is contributing to the NFC-based contactless payment market growth. The technology provides short-range communication between electronic devices, providing a high degree of customer satisfaction & experience and helps in fast-tracking connections.

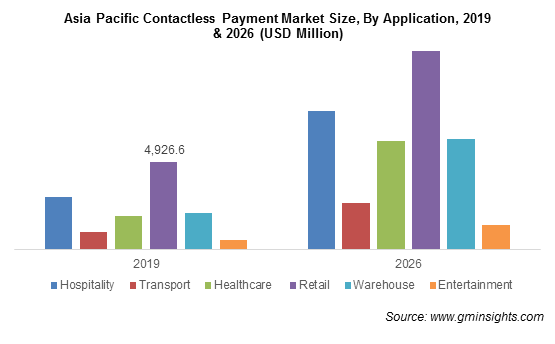

The Asia Pacific contactless payment market size is poised to expand at about 17% gains till 2026. Contactless POS reduces transactional time and helps retailers to accelerate transaction process and reduce counter queues. Inserting an EMV chip takes 30 seconds while a contactless method only takes 15 seconds, saving 15 seconds per transaction. According to the Mastercard Survey, more than 68% of consumers in Asia Pacific prefer to shop at stores with contactless payment options.

The COVID-19 pandemic has become a catalyst in the widespread adoption of contactless payments. As a result of the pandemic, retail stores have limited the number of consumers in their stores, improved their sanitization regimen, and introduced social distancing markers. The pandemic will force retailers to implement protective measures and adopt contactless POS terminals within their stores.

Europe held nearly 25% of the volume share in 2019 and is anticipated to dominate the contactless payment market through 2026 on account of consistently rising electronic payment transactions. Visa and Mastercard accounted for majority of electronic payment transactions and more than 85% of the transaction via payment cards in Europe were on these cards. The secured performance of smart card transactions along with payment solutions enabled by real-time and biometric will boost the demand for contactless payments.

Prominent companies in the region are Thales Group, IDEMIA, and Ingenico Group SA. Robust growth of account-to-account payment systems at the POS terminals in countries including Russia, Denmark, Sweden, Italy, and Spain will further augment the regional market demand. Moreover, favorable government regulations such as second payment services directive and open banking are also contributing to the market revenue.