Summary

Table of Content

Contact Lenses Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Contact Lenses Market Size

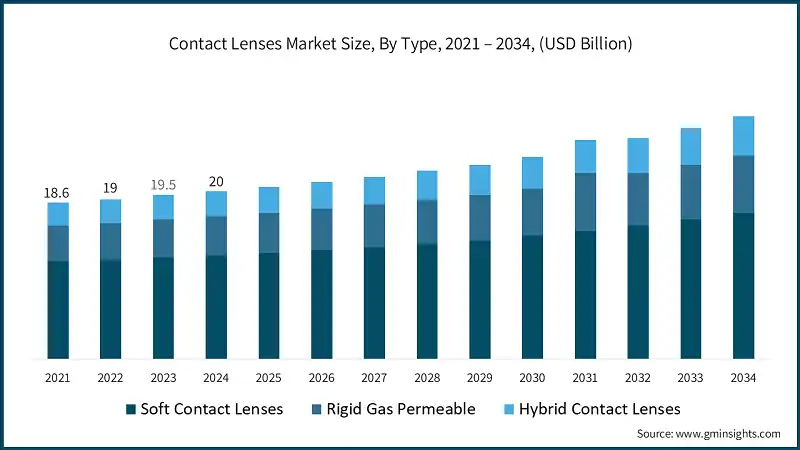

The global contact lenses market size was estimated at USD 20 billion in 2024. The market is expected to grow from USD 20.5 billion in 2025 to USD 28.9 billion in 2034, at a CAGR of 3.9%, according to the latest report published by Global Market Insights Inc.

To get key market trends

The worldwide increase in refractive vision disorders such as myopia?, hyperopia?, and astigmatism? is greatly increasing the addressable market for contact lenses. The trend is especially stark among younger populations, as screen time increases while outdoor time diminishes. As awareness of, and access to, eye care increases, earlier diagnosis occurs, and the need for corrective solutions, such as contact lenses, is increasing.

Daily disposable contact lenses are becoming increasingly popular for their convenience, hygiene, and ease of use. These lenses do not require cleaning solutions and storage cases like monthly or bi-weekly lenses. Due to the rising tendency of fast-paced lifestyle or for new contact lens wearers, the lack of cleaning solutions and storage cases is a draw. The daily disposable feature of lenses reduces chances of eye infections and allergic reactions to lenses because they have not been used for too long.

Consumers are pursuing vision correction options that require less maintenance, and daily disposables are an ideal product for this purpose. It is convenient to wear new lens each day without needing to adhere to a cleaning and care routine. Consumers prefer these "hands-off" health-conscious options as it saves time as well. This trend is most prevalent among urban professionals and students that value time as a premium resource.

Due to new innovations in lens materials, like silicone hydrogel and moisture-locking technologies, users’ daily wear has increased. These advancements in lenses have made it much easier for users to wear lenses for longer periods. The options of UV protection and blue light filtering lenses are also adding beneficial functional value.

Active individuals and those who play sports often prefer contact lenses, particularly daily disposables when glasses are impractical. Due to availability of daily disposable contact lenses in colored and cosmetic lenses form, the users like the dual purpose of having vision correction and changing the look of their eyes. The dual-purpose appeal is helping to expand the market and usage of contact lenses beyond strict medical usages.

Contact Lenses Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 20 Billion |

| Market Size in 2025 | USD 20.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 3.9% |

| Market Size in 2034 | USD 28.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising prevalence of refractive errors | This trend is significantly impacting the vision care market, creating opportunities for innovation and growth in diagnostic and treatment solutions. |

| Shift towards daily disposable lenses | This is impacting the market by boosting demand for convenient and hygienic eye care solutions. This trend is encouraging manufacturers to focus on product innovation and cater to evolving consumer needs. |

| Cosmetic and lifestyle appeal | Cosmetic and lifestyle appeal significantly impacts consumer behavior by driving the demand for products that enhance personal aesthetics and align with evolving lifestyle preferences. |

| Pitfalls & Challenges | Impact |

| High cost of advanced lenses | The high cost of advanced lenses significantly limits their adoption, particularly among price-sensitive consumers and small-scale businesses. |

| Competition from surgical alternatives | The competition from surgical alternatives significantly impacts the market by offering patients more immediate and potentially effective treatment options. |

| Opportunities: | Impact |

| Smart contact lens innovation | The innovation in smart contact lenses is set to transform the healthcare market by enabling real-time monitoring of health parameters such as glucose levels and intraocular pressure. |

| AI-driven customization | AI-driven customization impacts businesses by enabling precise personalization of products and services, leading to improved customer satisfaction and loyalty. |

| Market Leaders (2024) | |

| Market Leaders |

12% market share |

| Top Players |

The collective market share in 2024 is 35% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | UK, Japan, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Contact Lenses Market Trends

Daily disposables are growing rapidly as consumers show more interest in convenience, hygiene, and less maintenance. This shift is strengthened by lifestyle shifts and increased sensitivity of eye health, especially in younger and urban populations.

- Manufacturers are developing new materials like silicone hydrogel and incorporating retention technologies, UV protection and blue light filtering technologies to create new contact lenses every year that patients can find more comfortable and due to this each brand generates repeat purchases and brand loyalty.

- Online sales portals are changing how consumers buy contact lenses by introducing subscription models, virtual try-on, and personalized suggestions. Shifting the way that consumers purchase contact lenses is improving access and convenience.

- In addition to vision correction, an increased focus on aesthetics of wearing contact lenses has emerged. Opaque colored and cosmetic lenses are becoming popular with fashion-oriented consumers.

- As environmental issues continue to emerge brands are looking at biodegradable packaging and recyclable lens materials. This trend is appealing to many environmentally aware consumers and is affecting purchasing decisions in premium lens segment.

- Soft contact lenses are made of hydrogel or silicone hydrogel materials that retain moisture and allow oxygen to pass to the cornea. This creates a comfortable feeling for users and is an important aspect of soft lenses. This comfort contributes to rapid growth in this category for both first time and existing users.

- These lenses are available in many different formats as dailies, bi-weekly, or monthly disposables, and with colored and cosmetic options. Being able to present a product that fits an entire spectrum of consumer preferences, from vision to aesthetics, is advantageous.

- North America is the leader in contact lenses sales globally. It has an established health care system that delivers easy access to prescriptive eye health options, and consumers who are generally interested in overall eye health. Regular eye interventions and prescriptions of professional, quality lenses create constant demand and sales.

- North Americans usually prefer quality lenses that provide UV protection, high oxygen permeability mitigation of digital eye fatigue. This preference for high performance features creates a strong demand for pioneering technology as lenses are priced towards premium range.

Contact Lenses Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is divided into soft, rigid gas permeable, and hybrid contact lenses. In 2024, soft contact lenses held the major market share, generating a revenue of USD 12.3 billion.

- Soft contact lenses have become popular for their flexible and breathable materials, which easily mold to the shape of a person's eye causing the highest comfort for long time wear even with sensitive eyes.

- Soft lenses will accommodate a wide range of optical correction needs from myopia, hyperopia, astigmatism, and presbyopia as well and can be worn in any format such as daily disposables, bi-weekly, or monthly lenses to accommodate each user's lifestyle and budget.

- The contact lens market continually innovates with newer manufacturers that offer enhanced hydration technologies and UV protection along with innovative oxygen permeability that help improve eye health and reduce the risk of dryness, especially for users that spend most of the time in front of a screen or in dry environments.

- In addition to having the ability to correct vision, soft contact lenses are also being cited as having aesthetic uses like colored lenses that add or change your eye color. The medical and cosmetic use of soft contact lenses has contributed to its attractiveness to youth and fashion-oriented markets.

Learn more about the key segments shaping this market

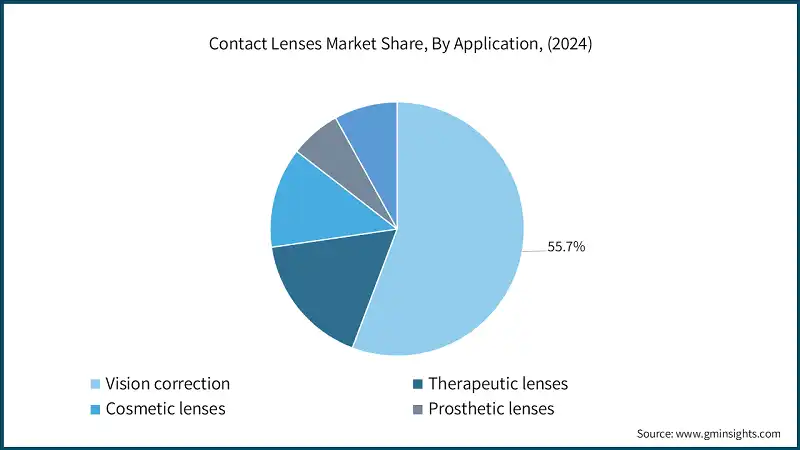

Based on applications, the contact lenses market is segmented into vision correction, therapeutic lenses, cosmetic lenses, prosthetic lenses and others. In 2024, vision correction lenses held the major market share, generating a revenue of USD 11.1 billion.

- Vision correction remains the predominant application for contact lens wearers around the world. Contact lenses specifically replace vision correction requirements for basic and everyday refractive errors: myopia, hyperopia, astigmatism, and presbyopia, ensuring acceptable levels of visual clarity and eye comfort and health for everyday use. According to the National Programme for control of blindness and visual impairment over 50 million people suffer from uncorrected refractive errors.

- Vision correction lenses serve an equally wide selection of ages, from adolescence onwards, providing vision correction needs, which will continue to be necessary as people engage in a variety of life stages. Whether to engage in social recreation, work, or a combination of activities, likely to continue challenging requirements for vision clarity, particularly as the rates of myopia (myopic progression) and digital eye strain (computer vision syndrome) continue to rise worldwide.

- Manufacturers of vision correction contact lenses are continuously developing human lens use technologies, including oxygen-permeable and moisture-retaining systems for enhanced comfort and use. These comfort-based system improvements encourage end-user wear time and will encourage end-users to seek corrective visual solutions in the future while reducing the chances of complications tracking dryness and eye irritation.

Based on the distribution channel, the contact lenses market is segmented offline and online. The offline segment held the largest share, accounting for 61% of the global market in 2024.

- Bricks and mortar retail, including optometrists, optical stores, and eye care clinics still dominate from a distribution standpoint. The physical store also allows for personalized approaches that lend itself to consultations, fittings, and the ability and access for consumers to receive their products instantly. This certainly builds loyalty and trust.

- The offline channels also benefit from seeing optometrists and ophthalmologists who will recommend lenses or a specific brand during their eye exam. There is no denying professional endorsement is impactful on buying decisions, particularly for a first-time user.

- Offline stores provide immediate access to products too, which also matters more than online channels when we're discussing consumption of any product that has a category of "urgent". Online is also at the mercy of delivery expectations, however, when you're a first-time user of lenses, the urgency to try them typically leads these users to brick and mortar retailers.

- Offline meters often provide trial fittings, product demonstrations, and after sales support, therefore users expect higher satisfaction. Off-line ability to provide many of these features and benefits are not easily duplicated on-line, which is why offline has a built-in advantage for engaging users and retaining them.

Looking for region specific data?

In 2024, the U.S dominated the contact lenses market, accounting for around 73.1% and generating around USD 5.1 billion revenue in the same year.

- The U.S. is the largest single topical market for contact lenses in the world, mainly due to large amounts of consumer awareness and eye care visits, as well as a strong acceptance of premium and specialty lenses. The sophisticated healthcare framework and availability of large manufacturers have made it a center for innovation and distribution.

- North America leads in terms of market share with a differentiated market of healthcare systems, complete access to optometrists, and a consumer base that demands quality and innovation. North America also benefits from active offline retail networks, as well as an increase in e-commerce.

The European contact lenses market is expected to experience significant and promising growth from 2025 to 2034.

- Countries in Europe have a cultural norm of having regular check-ups for eye health, which ensures that they have knowledge of their eyes health and the options they could pursue for vision correction. Eye health ensures a permanent demand for contact lenses, especially with an aging population and populations of younger individuals with existing refractive errors.

- It has a well-established distribution chain with optical retail chain store, pharmacies, and specialty eye clinics that allow patients to easily access both prescription and cosmetic lenses. These established routes benefit in the continued growth of not only the contact lens market, but the entire region.

The Asia Pacific contact lenses market, China holds a market share of around 30% in 2024 and is anticipated to grow with a CAGR of around 5.2% from 2025 to 2034.

- East Asian countries such as China, Japan, South Korea are seeing a rise in myopia cases among children and youth which has arisen from prolonged screen access. The increasing incidence of myopia is contributing to demand for corrective contact lenses, especially daily disposable and monthly disposable types.

- Rapid urban migration and the increased disposable income in Asian countries have further bolstered levels of availability to contact lenses and is seeing growth. Consumers are switching from prescription glasses to cosmetic contact lenses or specialty lenses which has led to better health care infrastructure and improvements in awareness of vision care.

Latin America contacts lenses market is growing at a CAGR of 2.4% during the forecast period.

- Brazil and Mexico have reported high rates of myopia, astigmatism and presbyopia particularly amongst school children and adults in their middle age, as everyday visual impairment rates grow significantly and many of these consumers desire corrective contact lenses as a remedy, particularly the daily disposable contact lenses.

- There is also a non-medical need for contact lenses as a fashion accessory, and filter in lifestyle changes for those in the urban population, particularly young consumers. Increasing disposable income, better living standards and a higher interest in clothing and cosmetics utilisation fuelled the development of coloured and custom contact lenses, with increasing e-commerce measures and development of retail segments.

Contact Lenses Market Share

- Johnson & Johnson Vision Care is leading with a 12% market share. Alcon Vision, CooperVision, Bausch+Lomb, EssilorLuxottica, Menicon collectively hold 35%, indicating moderately fragmented market concentration.

- These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Alcon Has historically been a powerhouse eye care due to its dedication to eye care advancement using innovative technology and clinical support. in contact lenses segment the company is known for its user comfort and clarity of vision products, while utilizing some of the new materials, designs and technology for lens manufacturing. Its collaboration with eye care professionals have reinforced its leadership position in the country.

- Bausch+Lomb has a well stabilised reputation in the contact lens industry due to its focus on eye health and ease to use products. The company is known for its wide selection of options to meet a wide range of vision needs, and its reputation for quality and access have made it a trusted option for consumers. The history of the organisation in ophthalmic care is reflected in the values that continue to shape the company’s innovation and products.

Contact Lenses Market Companies

Major players operating in the contact lenses industry are:

- Alcon vision

- Bausch+Lomb

- Blanchard Contact Lenses

- Carl Zeiss Beteiligungs

- Clerio Vision

- Contamac

- CooperVision

- EssilorLuxottica

- Hoya Corporation

- Johnson & Johnson vision care

- Menicon

- SEED

- Shanghai Weicon Optics

- SynergEyes

- Visioneering Technologies

Contamac has established itself as a leader in the development of innovative materials for contact lenses. The company's known for its customised design and specialty contact lenses, by providing advanced high-performance polymers. Its reputation is based on technical excellence, reliability and improving outcomes for patients with complicated vision needs.

Menicon follows a holistic approach to developing contact lenses from material science to lens care systems. The company is known for its precision engineering and focus on specialty lenses for situations requiring customised vision correction. It is recognised as an important player in both the professional and consumer markets, focusing on quality assurance and continuous improvement.

Contact Lenses Industry News

- In august 2025, CooperVision has expanded its plastic neutral contact lens initiative to Hong Kong, bringing the total number of participating countries and territories to 34. Through this program, eye care professionals and contact lens wearers contribute to environmental sustainability by prescribing and wearing CooperVision's participating contact lenses. In 2021, CooperVision established a partnership with Plastic Bank, becoming the first contact lens manufacturer to offer a complete range of plastic neutral lenses

- In July 2025, EssilorLuxottica has signed an agreement to acquire PUcore's ophthalmic lens materials division, which specializes in the development, manufacturing, and sale of ophthalmic lens materials. The agreement with the South Korean company PUcore includes the acquisition of all assets and entities involved in developing, manufacturing, and selling monomers used in high index ophthalmic lens production.

- In June 2025, Johnson & Johnson introduced ACUVUE OASYS MAX 1-Day MULTIFOCAL for ASTIGMATISM, the first daily disposable multifocal toric contact lens. The lens provides clear vision across all distances and lighting conditions, with sustained comfort throughout the day. The product incorporates four proprietary technologies to enhance visual performance and comfort. The company plans to release ACUVUE OASYS MAX 1-Day for ASTIGMATISM later this summer.

- In March 2025, Bausch + Lomb Corporation launched Arise, a new orthokeratology lens system in the United States. The system integrates cloud-based technology to optimize the lens design process, connects directly with topographers to generate precise lens designs within seconds for myopia treatment, and features the first FDA-approved orthokeratology lens design with toric peripheral curves for overnight myopia treatment.

- In November 2024, Alcon introduced PRECISION7, a new one-week replacement contact lens that joins their Water Innovations portfolio. The product features 7-day ACTIV-FLO System for 16 hours of comfort and vision clarity throughout the week-long wear period.

The contact lenses market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, by Type

- Soft contact lenses

- Rigid gas permeable lenses

- Hybrid contact lenses

Market, by Material

- Hydrogel

- Silicone hydrogel

- HEMA hydrogel

- Rigid gas permeable

- Others (PMMA, hybrid)

Market, by Design

- Spherical

- Toric

- Multifocal

- Others (monovision, etc.)

Market, by Color Variation

- Opaque contact lenses

- Enhancers/tinted contact lenses

- Visibility tinted contact lenses

Market, by Usage

- Daily disposable

- Frequently disposable

- Disposable

- Reusable

Market, by Pricing

- Low

- Medium

- High

Market, by Application

- Vision correction

- Therapeutic lenses

- Cosmetic lenses

- Prosthetic lenses

- Others (myopia control, smart contact)

Market, by Distribution Channel

- Offline

- Specialty stores

- Supermarket & hypermarkets

- Pharmacy stores

- Online

- E-commerce

- Brand website

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the contact lenses industry?

North America led the market in 2024, while Asia Pacific is expected to be the fastest-growing region from 2025 to 2034.

Who are the key players in the contact lenses market?

Key players include Johnson & Johnson Vision Care, Alcon Vision, CooperVision, Bausch+Lomb, EssilorLuxottica, Menicon, Hoya Corporation, SEED, SynergEyes, and Carl Zeiss.

What is the estimated revenue of the contact lenses market in 2025?

The market is projected to generate USD 20.5 billion in 2025.

How much revenue did the soft contact lenses segment generate in 2024?

Soft contact lenses generated USD 12.3 billion in 2024, holding the major market share.

What was the valuation of the vision correction segment in 2024?

Vision correction contact lenses generated USD 11.1 billion in 2024, making it the leading application segment.

Which distribution channel led the contact lenses industry in 2024?

The offline distribution channel held 61% of the global market share in 2024.

What is the market size of the contact lenses market in 2024?

The global market size for contact lenses was USD 20 billion in 2024.

What is the projected value of the contact lenses market by 2034?

The market is expected to reach USD 28.9 billion by 2034, growing at a CAGR of 3.9%.

Contact Lenses Market Scope

Related Reports