Home > Semiconductors & Electronics > Automation > Drones > Consumer Drone Market

Consumer Drone Market Analysis

- Report ID: GMI1590

- Published Date: Mar 2018

- Report Format: PDF

Consumer Drone Market Analysis

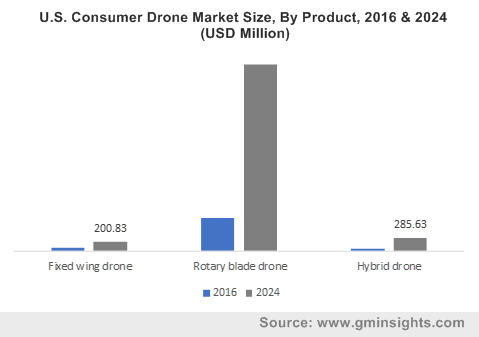

The demand for rotary blade drones will rise sharply over the forecast timeline due to their ability to take off and land vertically. These drones have long-lasting flight time & heavy payload capacity and are easy to control, making them popular among other types of drones including fixed-wing and hybrid drones. The rotary blade drone market will observe a profound growth rate as they are heavily used for aerial photography, surveillance, leisure, and filmmaking.

The autonomous consumer drone market will grow at a CAGR of over 20% between 2017 and 2024 as they are widely used for harnessing data in real-time from mountainous terrains, unmapped environments, and turbulent conditions. The use of machine learning and AI algorithms allows these drones to fly intelligently, reaching at locations when GPS is not available. The efficiency of the autonomous drone is dictated by the low-level control enabling them to operate independently based on high-level inputs. Various drone manufacturers are leveraging the power of AI to introduce the next-generation autonomous drones to cater to the customers’ needs.

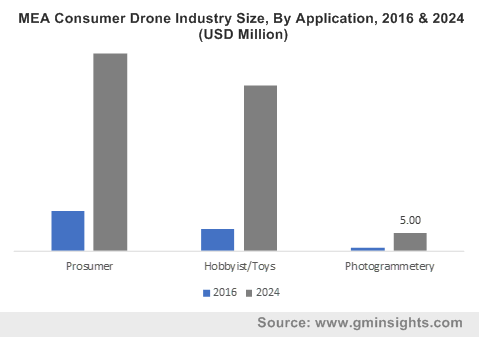

The hobbyists application segment will hold a market share of above 45% by 2024 due to the increase in the number of people willing to fly drones for recreational purposes including photography, entertainment, and videography to capture delightful experiences This rise in the use of drones as toys for recreational applications has driven the consumer drone industry. The regulatory authorities are implementing rules for hobbyist drones to guide their operations. For instance, the Federal Aviation Administration (FAA) has given recreational drone pilots access to the Low Altitude Authorization and Notification Capability (LAANC) system. This enables pilots to get instant permission from the agency to fly drones in controlled airspace.

The Europe consumer drone market is projected to hold a market share of over 10% by 2024 due to EU’s capability and decision making in unleashing advanced technology in experimenting and testing the potential uses of drones. The countries in the region are expected to ease out rules & regulations of civilian drones and showcase a flexible approach in capitalizing on drone technology to its optimum. In the region, the UK had a major market share in 2016 and is expected to maintain its share by 2024 due to huge development and testing of recreational applications for entertainment & accessibility purposes. In 2016, the country with the authorization of the Civil Aviation Authority (CAA), relaxed some of its rules & regulations concerned with applications of the UK drones for trials after requests from Amazon to test its Prime Air delivery services.