Summary

Table of Content

Construction Equipment Telematics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Construction Equipment Telematics Market Size

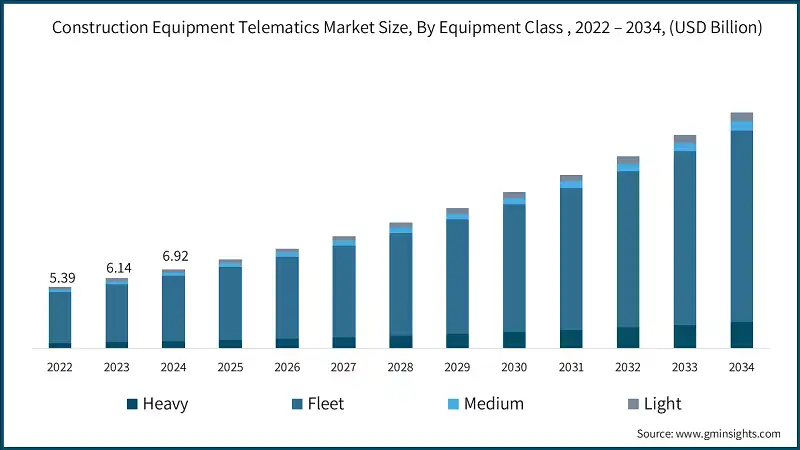

The global construction equipment telematics market was valued at USD 6.92 billion in 2024. The market is expected to grow from USD 7.76 billion in 2025 to USD 20.59 billion in 2034, at a CAGR of 11.5% according to latest report published by Global Market Insights Inc.

To get key market trends

- The construction equipment telematics segment is moving from fundamental GPS and fleet tracking solutions to software-enabled predictive maintenance, fuel management, and operational efficiency solutions. Over-the-air (OTA) updates are helping manufacturers and telematics providers deliver additional functionality without replacing hardware, which resulted in maintenance cost avoidance of 15-20% in annual expenditures. For example, in March 2025, Caterpillar launched a fleet management solution with AI-enablement of predictive maintenance that reduced unplanned downtime by 25% for rental fleets.

- Adoption of AI, IoT, and cloud-based telematics platforms leveraging data analytics are increasing in a data-driven ecosystem of real-time decision making. Major manufacturers like Komatsu and Volvo are incorporating telematics dashboards that analyze machine and operational data through machine learning algorithms, providing fuel savings of 10-15%, on average, across medium to heavy construction equipment.

- The Acute disruption caused by COVID-19 created a significant immediate disruption in the construction equipment telematics market. European countries faced significant declines, particularly in the equipment rental business. According to Statista, the European equipment rental market declined by 10.4% in 2020, and half of the renters reported declines of 50% in business (19% reporting declines of 30% to 50%). These reductions were a mixture of not only project delays caused by COVID restrictions but also construction activity stoppages due to government restrictions to stop the spread of the virus.

- The global heavy construction equipment market is resilient, with estimates showing a recovery from USD 176.2 billion in 2020, to USD 193.8 in 2022, indicative of a recovery phase and again, representing a renewed demand for equipment telematics solutions to improve fleet efficiency, with remote monitoring and operational safety returning to post-pandemic ways of working in construction.

- In North America, growth is led by large construction companies and equipment rental companies using telematics for fleet utilization and compliance. Statista estimates US construction equipment rental revenues will reach USD 59 billion in 2024, great for telematics to return and be fully adopted again.

- Asia-Pacific is the fastest growing market due to large scale infrastructure projects alongside rapid urbanization and mining activities expanding across China, India and Southeast Asia, generating their rise for operational efficiency and data driven fleet management. IEA further states that China alone added 5.4 million battery electric vehicles in 2023, indicating that the Asia-Pacific market continues to accept new telematics integrations in electric and hybrid construction equipment.

Construction Equipment Telematics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 6.92 Billion |

| Market Size in 2025 | USD 7.76 Billion |

| Forecast Period 2025 - 2034 CAGR | 11.5% |

| Market Size in 2034 | USD 20.59 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Infrastructure investment acceleration and equipment modernization | Toward modernization of infrastructure is driving unprecedented demand for advanced construction equipment monitoring. |

| Labor shortages mitigation through automation and remote monitoring | Ongoing skilled labor shortage impacting roughly 25% of companies according to industry surveys is accelerating the adoption of telematics-enabled automation and remote monitoring technologies |

| Penetration rate expansion across equipment categories and customer segments | The construction equipment telematics market is undergoing consistent and widespread growth across all equipment categories and customer segments. |

| ARPU growth through feature enhancement and value-added services | The market is seeing strong growth in Average Revenue Per Unit (ARPU) across all customer segments. The shift from basic GPS tracking to comprehensive fleet optimization platforms. |

| Pitfalls & Challenges | Impact |

| Data interoperability and standardization gaps | The shift from aftermarket telematics solutions to factory-installed, OEM-integrated systems marks a major transformation in the construction equipment market. |

| High implementation costs for smaller operators | The high upfront and ongoing costs associated with implementing comprehensive telematics systems remain a major barrier for small and mid-sized construction operators. |

| Opportunities: | Impact |

| Small business market penetration | The small business segment of the construction equipment market represents a $2.8–$4.2 billion addressable opportunity, characterized by historically low telematics adoption rates |

| AI-enhanced predictive analytics | The integration of artificial intelligence (AI) and machine learning (ML) into construction equipment telematics represents a significant incremental revenue opportunity estimated at $1.5 to $2.8 billion through the introduction of premium service tiers |

| Market Leaders (2024) | |

| Market Leaders |

14% market share |

| Top Players |

Collective market share in 2024 is 46% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Mexico, China, Brazil, Indonesia |

| Future outlook |

|

What are the growth opportunities in this market?

Construction Equipment Telematics Market Trends

- The construction equipment telematics industry is a continuing uptick in construction activity, where worldwide construction spending is projected to reach approximately USD 13.5 trillion (+6.8% year-on-year) in 2024. The increased investment has fed directly into the demand for fleet efficiency solutions. In the telematics ecosystem, OEM-integrated hardware continues to dominate, comprising 85-95% of new equipment delivered, and aftermarket software platforms provide an important service to 25-40% of existing fleet machines by providing retrofit solutions.

- As the construction industry deals with ongoing skilled labor shortages impacting about 25% of firms according to industry surveys, the urgency to drive telematics-based automation and/or remote monitoring solutions to boost productivity per labor unit also increases. The irony of managing labor productivity from a labor unit perspective, is specific to how telematics is shifting away from traditional roles like fleet vehicle data acquisition to support strategic workforce productivity. Specifically, telematics technology now enables an operator to manage multiple machines and allows a supervisor to be remotely located while monitoring and optimizing machines on multiple job sites simultaneously.

- Several major OEMs including Caterpillar, Komatsu, Volvo Construction Equipment, and John Deere have transitioned from a model where telematics is offered as an option to the standardization of connectivity across most new machines we see today, achieving 85-95 percent penetration for new equipment (versus only 25-40 percent penetration for aftermarket retrofit segments).

- For example, Volvo Construction Equipment recently made CareTrack standard on compact excavators and all compact wheeled loaders selling in the EMEA region, providing standard features, including mapping, tracking, and service management free for three years.

- The convergence of telematics data with construction management platforms, ERP systems, and project management tools is the strongest driver in the market, creating USD1.2-2.1 billion in value through integration services, data monetization, and end-to-end workflow automation. The benefit of integrating telematics with wider business systems is to enable limited and previously isolated monitoring tools to be utilized in a wider business intelligence asset. Currently, most telematics systems operate in vacuums or silos, require users to export data and run separate analytics not only creates value that isn't realized but also creates operational inefficiencies.

Construction Equipment Telematics Market Analysis

Learn more about the key segments shaping this market

Based on equipment class, the market is divided into Heavy, Fleet, Medium, and Light. The Fleet segment dominated around 80% share in 2024 and is expected to grow at a CAGR of over 11% from 2025 to 2034.

- Construction fleets are increasingly utilized by advanced telematic systems using GPS and various sensors to capture real-time location, usage, fuel consumption, and operator behavior data.

- This ongoing data stream allows fleet managers to use data to optimize route efficiencies, limit downtime/theft, provide better maintenance planning, lower fuel cost, and improve the safety of operators. Telematics enables managers to monitor and manage the entire construction fleet, from heavy equipment to smaller vehicles/machines, resulting in greater productivity and more profit.

- For example, in November 2023, Cango Mobility entered into a strategic partnership to build and integrate a machine monitoring data solution with MachineMax. The partnership combines Cango's on-highway fleet management capabilities with MachineMax's monitoring platform, and the companies will allow their hardware to be integrated with existing data solutions. This partnership is a clear example of how telematics is bringing two industries together to improve building and construction fleets smarter and more efficient than ever.

- The heavy construction segment is the fastest growing segment within telematics, and machines such as excavators, bulldozers, loaders, and cranes dominate telematic acceptance due to their higher value and complexity to operate, leading clients to invest in an economy of scale for full monitoring. Manufacturers, such as Caterpillar, Komatsu, and Volvo have all invested significant resources in excavation telematics capabilities. Caterpillar International reports to have 300,000 connected machines across the world, and they also reported double-digit productivity increases.

Learn more about the key segments shaping this market

Based on industry, the construction equipment telematics market is categorized into rental, contractor, heavy civil, and vertical construction. The rental segment dominates the market with 45% share in 2024 and is expected to grow at a CAGR of 12% between 2025 and 2034.

- Rental companies are among the first telematics user groups in construction equipment, with some important needs behind it like the need to track assets deployed across multiple sites, utilization to improve revenue and track all equipment under the full fleet management umbrella across many different types and across locations.

- United Rentals is a great example of advanced use of telematics: tracking greenhouse gas emissions to fulfill compliance obligations, understanding fuel consumption, improving utilization of equipment (we have even seen data used to make a buy versus rent decision), monitoring generator loads, use based monitoring to understand maintenance scheduling.

- Similarly, contractor segment is very prevalent with more than 11.6% growth. General contractors are moving towards telematics increasing potential for improved operational efficiency and create more competitive edge, with many focusing on projects where telematics can leverage asset location tracking, predictive maintenance, monitoring for personnel operator safety, usage-based scheduling maintenance planning and tracking costs related to fuel, repairs and downtime.

- All adding to a defined job cost; telematics can support more precise job costing while assisting billing, using telematics to connect with accounting platforms and greater accuracy when billing, using geofencing to better track presence on site, or use geofencing intervention to mitigate disputes, usages-based travel plans measure project timeline, enforced labour and other expenses.

Based on product, the market is divided into hardware and software. The hardware segment dominates the market and was valued at USD 4.95 billion in 2024.

- The hardware segment drives telematics growth through advanced sensor integration and connectivity, with Telematics Control Units (TCUs) collecting data from GPS, engine monitors, load sensors, tire pressure systems, and cameras, while supporting cellular, satellite, LPWAN, and shortrange communications.

- For example, in January 2023, Cummins and Topcon/Tierra joined forces to allow diagnosing and troubleshooting for major system components on LiuGong construction equipment through a single interface. The partnership will help to increase equipment availability and decrease the overall cost of operation by using actionable insights to help with components "care and feeding," damage avoidance, and service response times.

- Similarly, the software segment takes the collected hardware data and turns it into actionable insight by utilizing predictive maintenance, real time risk detection, operations optimization, and cloud-based interface with project management and BIM systems using artificial intelligence and machine learning. A company such as Wialon provides companies with a solution for fleet tracking, fuel management, video telematics, etc. to allow for digital transportation and completely streamline fleet activity. The Wialon platform has worked with 2,700 partner companies in 160 countries supporting fleets across verticals and processing over five billion data points per day.

Based on sales channel, the market is divided into OEM and Aftermarket. The OEM segment dominates the market and was valued at USD 4.8 billion in 2024.

- OEM's sales channels provide the most comprehensive telematics solutions, with many major OEM's opting to embed telematics in the production process as standard equipment which included very deep access into unique engine data sets, hydraulic systems and OEM diagnostics, paired with partnerships for predictive analytics.

- Even with this robust options OEM telematics can be challenged by competitive pricing or innovative features driven by aftermarket solutions that are being increasingly priced into their product options, and thus OEM's have had to deploy competitive pricing models to the extend telematics features in the product offering are priced where customers expect more adaptable sophisticated Ops management and lower accounting costs.

- For example, in November 2024 Bobcat launched a capability to remotely disable/enable the engine of its various models of telematics platform Machine IQ, which enhances the security or operational control of Bobcat owners’ portable equipment within Europe.

- This capability can be used with models of Bobcat equipment including skid steer loaders, compact track loaders, mini excavators, and compact wheel loaders engine can according to Bobcat, be disabled via website or in the Machine IQ app and remotely enabled again.

- Aftermarket telematics solutions have provided another means of providing flexibility through retrofitting existing fleets, whether customers need to have all telematics managed by one unique source or if they want to manage or monitor various brands including OEMs. Aftermarket vendors have touted these vendors as vendor-neutral platforms, with faster innovation cycles and more flexible pricing compared to OEM, while able to leverage comprehensive fleet management, for customers who have multiples of a brand or, for customers who have different equipment, makers and operations.

Looking for region specific data?

The US dominated the North America construction equipment telematics market with around 89% market share and revenue of USD 2.15 billion in 2024.

- The growing utilization of advanced technologies including IoT, 4G or 5G networks, and cloud computation has increased the prospect for telematics systems in the country. The degree of construction telematics in the US is large in average construction due to necessity with efficient fleet management, better operational activities and corresponding lower maintenance costs. Additionally, due to increased concerns in construction in sustainability practices and compliance with regulatory emission and safety standards, construction companies can use telematics systems to improve the environmental performance of their equipment.

- The National Equipment Register estimates losses attributed to equipment theft in the US range from $300 million to $1 billion every year; these losses are hardly valued accurately (<25% of stolen equipment is recovered) which is one driver of interest in telematics solutions involving, theft deterrence and if necessary, recovery. The U.S. Mobile Resource Management Systems Market Study's estimates suggest that approximately 25 million GPS/wireless devices in use on fleet vehicles, trailers, construction machinery, and field service workers will grow to over 34 million units producing more than $12 billion dollars in revenues by 2028.

- In Canada, where construction equipment telematics remains a robust and growing market due to extensive and expansive infrastructure development programs, adverse camp operations needing oversight innovations based on equipment health and the acceptance of the adoption of advanced technologies not only in construction but also in the mining sector. The massive telematics Canadian market was bolstered by strong public sector investments in infrastructure, including transportation investments, energy infrastructure development, and urban community building construction projects that generated interest in more sophisticated equipment management, monitoring, and telematics solutions conversations with construction and contractor companies.

Germany construction equipment telematics market will grow tremendously between 2025 and 2034

- Europe is projected to deliver a CAGR of roughly 11.7%, with countries such as Germany, the UK, and the Netherlands leading the adoption. Germany is one of the largest and most developed construction telematics markets in Europe because it has a combination of factors, a strong industrial manufacturing base, considerable infrastructure development, as well as being an industry leader in industrial automation and digitalization initiatives. In January 2023, Global IoT services company Trackunit announced that it has struck a deal for Germany's Flexcavo enabling the telematics specialist to penetrate the contractor market.

- The UK is a well-established and mature market for construction equipment telematics developed from harsh environmental requirements, urban construction limitations and adoptions of digitalization defined by the ever-changing landscape of construction. The UK has LEZ (Low Emission Zones) and ULEZ (Ultra Low Emission Zones) with a rigorous monitoring of telematics to guarantee emissions conformity and environmental reporting. British construction companies are typically working in and coordinating in an urban environment where space is limited, noise requirements are inhibited, and there are many stakeholders.

- Conversely, the Italian market benefits from the investment of state infrastructure which include transport refurbishment and upgrades, renewal programs and betterment or disaster recovery work creates demand for sophisticated equipment management and surveillance. Italian construction companies work in a challenging environment, including historical city centers with strict conservation requirements, require special construction techniques in seismically active areas, and varied geographical conditions from alpine regions to the coastal areas require adapted equipment management solutions.

The construction equipment telematics market in China will experience strong growth during 2025 to 2034.

- Asia-Pacific contributes 30% of the global construction equipment telematics industry, making it the fastest growth region with a projected CAGR increase of approximately 12%. China has the highest volume construction equipment market in the world with burgeoning emerging opportunities for telematics growth due to substantial infrastructure development, urbanization, and increasing focus on improved efficiency and cleaner operations.

- China is expected to grow, by far the biggest opportunity for the APAC market, at a 12.5% compound annual growth rate from 2025-2030. Domestic infrastructure projects have required huge capital investment from government driven projects such as the Belt and Road Initiative and urban smart city development programs to create this unprecedented demand in construction equipment and supporting monitoring technologies.

- Similar, the telematics market in India is valued at USD 200 million with a projected growth to 500 million by 2024. India is also a fast-paced developing market for construction telematics in Asia Pacific across the major tertiary infrastructure development projects due to high capital investment growth levels, urbanization and degrees of digital applications.

- This is complementing the commitment from Indian companies on accountability through driving operational efficiency through telematics solutions in terms of fuel efficiencies, equipment utilization, and maintenance management while trying to address and manage the challenges of operating telematics to support equipment in India's climate and infrastructure environment as an example.

The construction equipment telematics market in Brazil will experience significant growth between 2025 and 2034.

- Latin America holds an 7% share of the global construction equipment telematics industry in 2024 with a CAGR of 8.4%. Brazil is the largest market for construction equipment telematics in Latin America, with large infrastructure development projects, urban construction development, and increasing technology use in the construction industry. The Brazilian construction equipment telematics market is becoming increasingly sophisticated, with solution providers, construction companies and equipment manufacturers increasingly adopting telematics equipment and service solutions that create operational and regulatory efficiencies and align with the improving digital ecosystem in Brazil.

- Mexico is another significant and growing market for construction equipment telematics, due to infrastructure development projects, manufacturing facility construction, and increasing synchronicity to the practices of the construction industry. The Mexican market has been aided by several major federal government investments in infrastructure projects, which has included transportation projects, energy infrastructure development, and urban construction development projects, which warrant the need for sophisticated management and monitoring of construction equipment.

- Argentina represents an emerging market for construction equipment telematics, due to infrastructural modernization projects, demands for agricultural equipment applications, and a push toward adopting more digital technologies across the wider construction and agriculture industry.

The construction equipment telematics market in UAE is expected to experience high growth between 2025 and 2034.

- The United Arab Emirates is the most developed telematics market for construction equipment in the Middle East, driven by the influx of infrastructure projects, smart city developments, and the high level of technology adoption in the construction sector. Thanks to various governmental investments in transportation and urban development and upcoming mega events, the UAE market generates substantial demand for technologies/platforms that provide advanced management and monitoring of equipment.

- The UAE market demonstrates advanced applications of telematics including AI and predictive maintenance, as well as total project management systems which are key to the UAE’s aspirational construction and infrastructure projects.

- Saudi Arabia is also an expanding telematics market for construction equipment due to the Vision 2030 programmed, massive infrastructure development, and increasing digital technology adoption in the construction industry. The Saudi market benefits from government's capital investment in infrastructure such as NEOM and transportation project investment, which creates the demand for construction equipment and, therefore, for monitoring and other technologies.

- Operators of South African construction and mining companies operate in widely varying operating environments from urban construction projects, remote mining projects and rigging/quarrying operations, and conditions with extreme geography and circumstances, so need a strong solution for tracking and equipment management.

Construction Equipment Telematics Market Share

The top 7 companies in the market are Caterpillar, KOMATSU (Komtrax), Verizon Connect, Geotab, MiX, Telematics, Volvo CE, and TOPCON. These companies hold around 55% of the market share in 2024.

- Caterpillar's unique value propositions include enhanced predictive analytics, considerable OEM integration and leadership in the development of autonomous equipment. Caterpillar’s partnership with Uptake is just one example of the company’s pre-eminent focus on advanced analytics, allowing predictive and prescriptive maintenance that is able to predict failure dates (several weeks in advance) as well as optimize lead time on parts by tracking actual usage.

- Komatsu’s “smart construction” initiatives leverage Komtrax data to refine machine control, GPS guidance, and machine-controlled construction workflows for precise earthmoving and construction operations. Komatsu is also seen as a leader in automation and robotics, as evidenced by their autonomous haul trucks and intelligent machine control that positions them on the cusp of next-generation construction technologies.

- Verizon Connect is an aftermarket telematics provider and a leader in the after-market telematics construction equipment market, benefiting from Verizon’s network of cellular coverage and industry knowledge to offer substantial aftermarket fleet management into and across a variety of vehicles and equipment.

- Geotab is known for their data-centric telematics platform: examining telematics data with emphasis on analytics, open architecture and scalable systems, accommodating a spectrum of fleet management needs in various settings, such as construction. The platform transfigures raw telematics data into meaning and business intelligence, simplifying fleet management and enabling clients to improve fleet performance.

- MiX Telematics (Mix by Powerfleet) specializes in fleet and asset management with a strong focus on safety, driver behavior, and risk management in construction and commercial fleets. Its platform emphasizes safety through driver coaching, collision avoidance, and incident management, helping reduce accidents, insurance costs, and enhance overall safety performance.

Construction Equipment Telematics Market Companies

Major players operating in the construction equipment telematics industry include:

- Caterpillar

- Fleet Complete

- Geotab

- HCSS

- KOMATSU (Komtrax)

- MiX Telematics

- Omnitracs

- Samsara

- Teletrac Navman

- Tenna

- TOPCON

- Trackunit

- Verizon Connect

- Volvo CE

- The global construction equipment telematics market is a highly competitive marketplace characterized by fierce competition. Market share is accounted for predominantly by larger OEMs which tend to have more levels of technology, reliability and geographic extent as a characteristic compared to smaller participants.

- Within this larger category, larger OEMs are also introducing differentiation against competition by providing enhanced capabilities, such as, autonomous haulage systems, electric and hybrid drive capabilities and high-capacity payload designs. With the level of innovation in products that these OEMs can develop, and the sheer size of their North American and global space, it is difficult for smaller participants to compete within their own portfolio in construction telematics by product category.

- Volvo CE is signaling its competition mode as a technology provider in construction equipment telematics through its CareTrack system, advanced integration into equipment and leveraging their experience in automotive telematics and safety.

- With $11 billion in revenue, Volvo CE is providing strong innovation related to telematics inputs like ActiveCare Direct and integrating the price of telematics into bundles for their products, which in the case of ActiveCare Direct, par to where the fault codes come into play and provides a clear diagnostic for the maintenance technician and operator.

- TOPCON is one of the top contenders for precision construction technology and telematics through its capabilities in GPS based machine control for the surveying and integration of telematics through project management systems that utilize positioning and fleet management. The solutions for construction with TOPCON rely on achieving precision in construction tasks like automated grade control, machine guidance for construction and preparing other data and interfaces utilized for the construction process in surveying or project management.

Construction Equipment Telematics Industry News

- In July 2025, New Holland added to their lineup of C Series compact wheel loaders by introducing the all-new W100D compact wheel loader. The new model features a new cab to provide added operator comfort, new attachment capabilities, as well as a complimentary telematics package to improve connectivity and management of your fleet.

- In January 2025, Caterpillar announced their new line of next generation Cat telehandlers - models TH0642, TH0842, TH1055, and TH1255 - which will replace the TL series of telehandlers. The new machines are powered by the Cat C3.6TA engine, with new and enhanced capabilities in operator safety, performance, and maintenance. The telehandlers come with integrated telematic systems to provide fleet owners with advanced fleet management capabilities.

- In March 2024, Hitachi Construction Machinery (Europe) NV (HCME) announced a strategic partnership with fleet management systems provider ShareMat in France. The partnership is geared toward transforming equipment management by the combination of Hitachi's machinery and ShareMat's sophisticated software solutions that begin to offer enhanced transparency and efficiency of fleet operations.

- In May 2023, Develon added two new 6-tonne Stage V mini-excavators, the DX62R-7 and DX63-7 to its compact equipment portfolio. Both machines are equipped with the Develon Fleet Management TMS 3.0 Cellular, an upgraded system that captures real-time update data from sensors on-board the machine.

The construction equipment telematics market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue and volume ($ Bn & Units) from 2021 to 2034, for the following segments:

Market, By Equipment Class

- Heavy

- Backhoe

- Excavator

- Loader

- Compaction equipment

- Bulldozer

- Grader

- Crane

- Others

- Fleet

- Pickup trucks

- Service trucks

- Tandem trucks

- Water trucks

- Dump trucks

- Refrigerated trucks

- Concrete Mixer trucks

- Others

- Medium

- Light towers

- Generators

- Pumps

- Compressors

- Forklift

- Others

- Light

- Power drills

- Compressors

- Jackhammers

- Surveying & testing equipment

- Others

Market, By Industry

- Rental

- Contractor

- Heavy civil

- Vertical construction

Market, By Product

- Hardware

- Telematics control units

- GPS trackers & location sensors

- Engine monitoring sensors

- Load & payload monitoring sensors

- Tire pressure monitoring systems

- Camera systems & dashcams

- RFID tags & asset tracking devices

- Connectivity hardware

- Software

- Tracking

- Diagnostics

- Asset management

- Fuel management

- Others

Market, By Technology

- GPS tracking

- Cellular communication

- IOT sensors

- Machine learning

- AI

- Others

Market, By Customer GAR

- 1-5b

- 500-1b

- 100-500m

- 50-100m

- 10-50m

- <10m

Market, By Sales Channel

- OEM

- Aftermarket

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the construction equipment telematics market?

The US dominated the North America construction equipment telematics market with around 89% market share and revenue of USD 2.15 billion in 2024.

What are the upcoming trends in the construction equipment telematics market?

Key trends include adoption of AI-driven predictive maintenance, cloud-based platforms with real-time analytics, autonomous equipment integration, and expansion of OTA updates reducing maintenance costs by 15-20%.

What is the growth outlook for the rental industry segment from 2025 to 2034?

The rental segment is projected to grow at a 12% CAGR through 2034, fueled by asset tracking needs across multiple sites and utilization optimization requirements.

Who are the key players in the construction equipment telematics market?

Key players include Caterpillar, KOMATSU (Komtrax), Verizon Connect, Geotab, MiX Telematics, Volvo CE, TOPCON, Fleet Complete, Samsara, Teletrac Navman, Tenna, Trackunit, Omnitracs, and HCSS.

How much revenue did the hardware segment generate in 2024?

Hardware solutions generated USD 4.95 billion in 2024, dominating the market through advanced sensor integration and connectivity solutions.

What was the valuation of OEM sales channel segment in 2024?

OEM sales channel held the dominant position and generated USD 4.8 billion in 2024, providing comprehensive telematics solutions with deep equipment integration.

What is the current construction equipment telematics market size in 2025?

The market size is projected to reach USD 7.76 billion in 2025.

What is the market size of the construction equipment telematics in 2024?

The market size was USD 6.92 billion in 2024, with a CAGR of 11.5% expected through 2034 driven by infrastructure investment acceleration and equipment modernization.

What is the projected value of the construction equipment telematics market by 2034?

The construction equipment telematics market is expected to reach USD 20.59 billion by 2034, propelled by AI integration, IoT adoption, and demand for operational efficiency.

Construction Equipment Telematics Market Scope

Related Reports