Home > Chemicals & Materials > Adhesives and Sealants > Specialty Adhesives > Composite Adhesives Market

Composite Adhesives Market Size

- Report ID: GMI2439

- Published Date: Mar 2018

- Report Format: PDF

Composite Adhesives Market Size

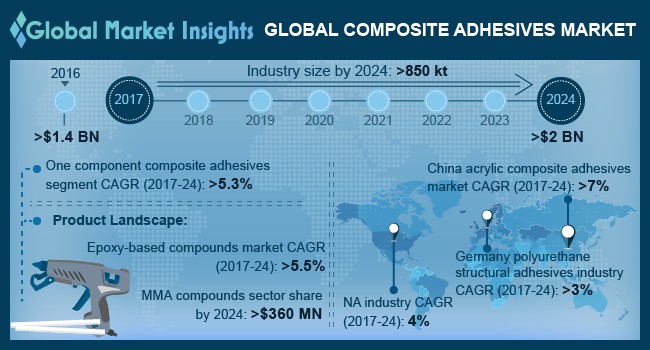

Composite Adhesives Market size surpassed over USD 1.4 billion in 2016 and consumption might exceed 850 kilo tons by 2024.

Construction composites demand registered an annual growth rate of over 6%. Growing popularity for FRP bathtubs, windows, doors and panels in buildings should drive global composite adhesives market size by 2024. U.S. housing industry had constructed over 1 million units of homes in 2015 owing to ease of lending standards, low mortgage rates, slow house price inflation and increasing employment. Increasing funding support from state and local construction organization and agencies should further bolster product demand.

Modern aircrafts are built utilizing over 50% composite material content to reduce weight, emissions and improve fuel efficiency & performance. Major OEM’s in aerospace industry including Bombardier, Airbus and Boeing are strategizing robust plans to increase production rate. Boeing expects an increase of over 6% in annual commercial aircraft deliveries reaching over 770 units in 2016 thus driving global composite adhesive market demand.

Global adhesives & sealants market size exceed USD 30 billion in 2016 and should witness gains at over 5%. Composite bonding of like and unlike materials without using fasteners enables manufacturers to eliminate drilling hole and leverage cascading benefits of cost & weight savings throughout assembled structures. It significantly shortens production time, cycle and cost. Replacing fasteners with adhesive also deliver better fatigue performance resulting in rapid and long-term growth in the development of structural sealant market size. New World Doors an Irish door manufacturing company reduced its production cycle time by 70% for its inner sash door bonding step by using methyl methacrylate (MMA) composite adhesive when applied through an automated dispensing machine.

| Report Attribute | Details |

|---|---|

| Base Year: | 2016 |

| Composite Adhesives Market Size in 2016: | 1.4 Billion (USD) |

| Forecast Period: | 2017 to 2024 |

| 2024 Value Projection: | 2 Billion (USD) |

| Historical Data for: | 2013 to 2016 |

| No. of Pages: | 450 |

| Tables, Charts & Figures: | 969 |

| Segments covered: | Product, Component, Application, and Region |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Selection of a composite adhesives for any given situation is necessarily based on its versatility and frequent overlapping usage. The adhesive selecting process is arduous due to absence of a universal adhesive applicable to every substrate and availability for variety of options like epoxy, polyurethane, MMA, cyanoacrylates, acrylics, phenolics, polyimides and silicones. They are selected based on type & nature of substrate, cure & adhesive application method and stresses the joints will face during service. Mechanical action & characteristics, cost & flexibility also plays an important factor in adhesive selection process.

Stringent regulatory regimes in Europe and North America relating to emission control and limiting use of VOC restricted though policies by EPA regarding Clean Air Act might hamper composite assembly market size. Key raw materials for manufacturing these composite adhesives include matrix resins and fiber composites, which may face volatile pricing in the market along with procurement risk caused by demand & supply fluctuations might hamper composite adhesives industry growth.