Summary

Table of Content

Cold Chain Logistics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cold Chain Logistics Market Size

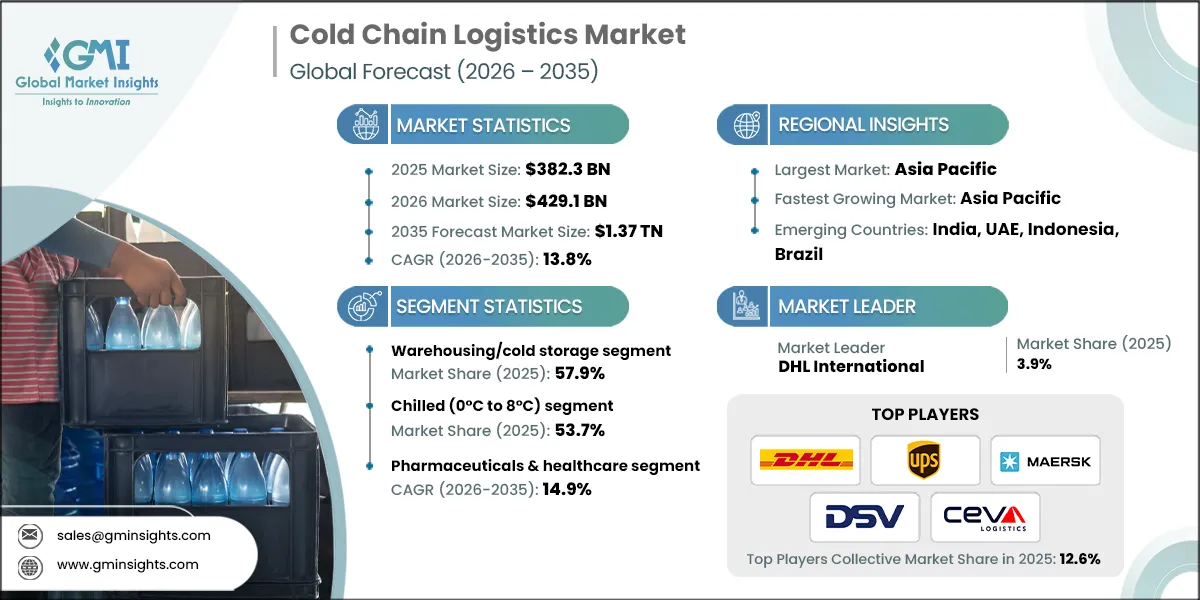

The global cold chain logistics market size was valued at USD 382.3 billion in 2025. The market is expected to grow from USD 429.1 billion in 2026 to USD 1.37 trillion in 2035 at a CAGR of 13.8%, according to latest report published by Global Market Insights Inc.

To get key market trends

Global trade is creating new opportunities for cold chain logistics providers. In the past, importers had trouble with products that needed specific temperatures. Many countries could not access these products because they did not have advanced logistics systems like cold chain logistics.

Now, industries that handle temperature-sensitive or perishable products are quickly using cold chain logistics. The pandemic showed how important these systems are, especially for delivering vaccines. However, some countries lost vaccines because they could not keep the right temperatures.

Cold chain logistics are also helping industries like food and beverages, chemicals, and other perishable goods. These industries used to lose a lot because they did not have systems to maintain the right temperatures.

For example, poor cold chain systems cause about 620 million metric tons of food to go to waste every year. This leads to big losses for manufacturers and makes products harder to get for consumers.

Meanwhile, environmental sustainability is now a key focus in cold chain logistics. Traditional refrigeration systems use a lot of energy and increase greenhouse gas emissions. To solve this, the industry is moving toward energy-saving options like electric refrigerated vehicles, hybrid energy systems, eco-friendly refrigerants, and solar-powered cold storage.

Geographically, the Asia Pacific region is leading the cold chain logistics market because it has many manufacturing companies. This region is expected to grow quickly in the coming years.

Cold Chain Logistics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 382.3 Billion |

| Market Size in 2026 | USD 429.1 Billion |

| Forecast Period 2026-2035 CAGR | 13.8% |

| Market Size in 2035 | USD 1.37 Trillion |

| Key Market Trends | |

| Drivers | Impact |

| Growing Demand for Perishable Food Products | Rising consumption of fresh fruits, vegetables, dairy, meat, and seafood increases dependence on efficient cold chain logistics to preserve quality, safety, and shelf life. |

| Expansion of Pharmaceutical and Vaccine Distribution | Growing vaccine programs and pharmaceutical production drive demand for temperature-controlled logistics to maintain drug efficacy, meet regulations, and support global distribution. |

| Rising Global Trade of Temperature-Sensitive Goods | Increasing cross-border trade of food and pharmaceuticals accelerates the need for robust cold chain networks to manage long-distance transport and reduce spoilage. |

| Increasing Adoption of Frozen and Ready-to-Eat Foods | Busy lifestyles and urbanization boost frozen and ready-to-eat food consumption, increasing reliance on cold storage and refrigerated transportation across supply chains. |

| Pitfalls & Challenges | Impact |

| Lack of Cold Chain Infrastructure in Developing Regions | Limited cold storage capacity, refrigerated transport, and last-mile infrastructure in developing regions constrain market growth and lead to higher post-harvest losses. |

| Energy-Intensive Operations and Power Reliability Issues | Continuous refrigeration demands high energy use, while unreliable power supply raises operating costs, increases spoilage risks, and affects service reliability. |

| Opportunities: | Impact |

| Rapid Cold Chain Infrastructure Development in Emerging Markets | Government support and private investments in emerging economies expand cold chain networks, creating significant growth opportunities for logistics and storage providers. |

| Increasing Demand for Biologics and Specialty Pharmaceuticals | Rising biologics and specialty drug production creates opportunities for advanced cold chain solutions requiring precise temperature control and regulatory compliance. |

| Expansion of Cold Storage Facilities Near Consumption Centers | Building cold storage near urban consumption hubs reduces transit time, improves product freshness, and enhances efficiency in food and pharmaceutical distribution. |

| Growth of E-commerce and Online Grocery Platforms | Expanding online grocery and food delivery platforms increase demand for last-mile refrigerated logistics and decentralized cold storage infrastructure. |

| Market Leaders (2025) | |

| Market Leader |

3.9% market share |

| Top 5 Players |

Collective market share in 2025 is 12.6% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, UAE, Indonesia, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Cold Chain Logistics Market Trends

In the cold chain logistics industry, keeping products at the right temperature and maintaining their quality are top priorities, especially for food, pharmaceuticals, and life sciences. Companies using advanced monitoring and control technologies in their operations are building more trust with customers and seeing wider use of their services.

For instance, in July 2025, Geotab announced a major upgrade to its Cold Chain solution, introducing new hardware and enhanced software capabilities that provide businesses with greater visibility, control, and compliance assurance for temperature-sensitive shipments.

At the same time, cold chain providers are increasingly adopting automation, data analytics, and sensor-based systems to reduce spoilage, follow regulations, and improve operations.

IoT sensors and real-time monitoring systems are improving visibility in cold storage and refrigerated transport. Features like temperature tracking, alerts, and data logging allow faster fixes and help prevent risks in the cold chain.

Digital twin technology is becoming important in cold chain logistics. It lets operators simulate storage conditions, transport routes, and equipment performance. This helps save energy, plan capacity better, and avoid temperature issues before they happen.

Major logistics companies are already using digital twins and smart cold chain solutions to improve efficiency and reliability. As these technologies improve, they are expected to play a bigger role in making cold chains stronger and more precise.

Cold Chain Logistics Market Analysis

Learn more about the key segments shaping this market

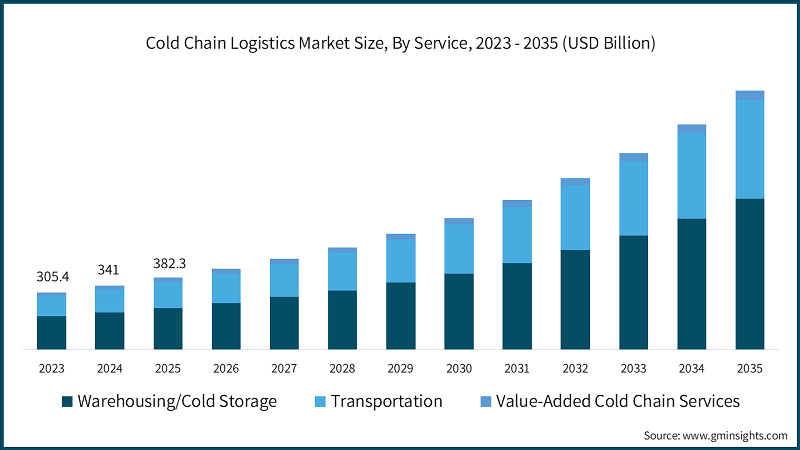

Based on service, the market is divided into warehousing/cold storage, transportation, and value-added cold chain services. The warehousing/cold storage segment dominated the market with 57.9% share in 2025.

- In 2025, the warehousing/cold storage segment was valued at USD 221.2 billion and is the foundation of the cold chain logistics market. Cold storage facilities are expensive and long-lasting, and they need to be built before refrigerated transportation can work effectively.

- These temperature-controlled warehouses store food, pharmaceuticals, and biologics, keeping them stable for weeks or months. Since products stay in warehouses for a long time, warehousing earns more value per unit compared to transportation, which only generates revenue during transit.

- On the other hand, there is an increasing demand for perishable foods, pharmaceutical production, and vaccine storage worldwide that has created a strong need for large, multi-temperature cold storage facilities. Retailers, food processors, and pharmaceutical companies are now using storage facilities closer to production and consumption areas.

- This helps reduce spoilage, follow safety regulations, and manage demand changes. Warehousing services are also adding extra features like blast freezing, ripening, labeling, order picking, and meeting regulatory requirements. These services are hard to provide during transportation, making warehousing and cold storage a key part of the market.

Learn more about the key segments shaping this market

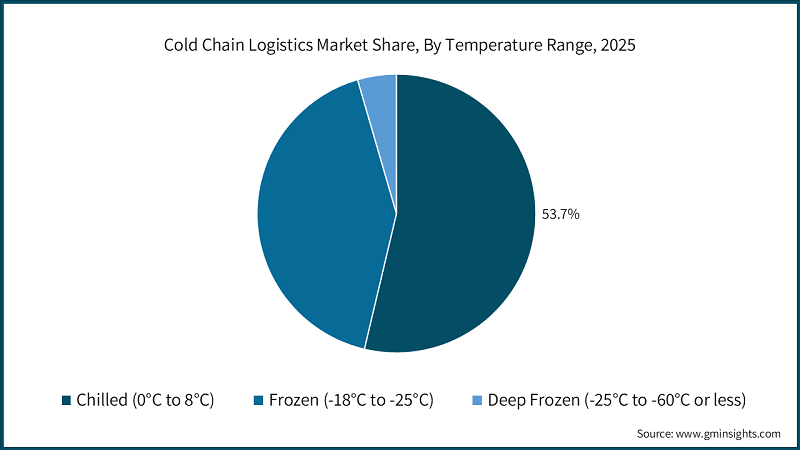

Based on temperature range, the cold chain logistics market is divided into chilled (0°C to 8°C), frozen (-18°C to -25°C) and deep frozen (-25°C to -60°C or less). The chilled (0°C to 8°C) segment accounts for 53.7% share in 2025 and is expected to reach USD 719.9 billion by 2035.

- The chilled segment, which operates between 0°C and 8°C, is the largest part of the cold chain market. It handles perishable goods like fresh fruits, vegetables, dairy products, and ready-to-eat meals. This temperature range keeps products fresh without freezing, making it ideal for supermarkets, retailers, and foodservice providers worldwide. The constant demand for fresh food drives the need for chilled logistics.

- The high demand for fresh food globally ensures its consistent use, while efficient supply chain systems, like refrigerated trucks and warehouses designed for 0°C–8°C, make chilled logistics more affordable than frozen options.

At the same time, the frozen segment, which operates between -18°C and -25°C, is expected to grow the fastest, with a CAGR of 14.7% from 2026 to 2035. This growth is due to rising demand for frozen and ready-to-cook meals, increased global food trade, and better freezing and storage technologies. Frozen logistics allow products to travel long distances without spoiling, meeting the need for convenience foods and supporting global supply chains.

Based on application, the cold chain logistics market is divided into food & beverage, pharmaceuticals & healthcare, chemicals & specialty materials and other applications. The pharmaceuticals & healthcare segment is expected to grow at the fastest CAGR of 14.9% between 2026 and 2035.

- During the forecast period, the pharmaceuticals & healthcare segment is expected to grow the fastest in the cold chain logistics market. This growth is mainly due to the rising demand for temperature-sensitive products like drugs, vaccines, and biologics.

- The increase in chronic diseases and the growth of the global biopharmaceutical industry are driving the need for reliable cold chain systems. Also, advanced therapies like mRNA vaccines need strict temperature control during transportation, which supports the growth of this sector.

- On the other hand, the food and beverage sector is the largest in the cold chain logistics market and is expected to reach USD 242.8 billion by 2025. This is because of the high global demand for fresh and processed foods. Perishable products like dairy, meat, and seafood need constant refrigeration to stay fresh and safe.

- Moreover, the rise in online grocery shopping and food delivery services is also increasing the demand for efficient cold chain logistics. In regions like the U.S., Europe, and Asia-Pacific, strict food safety rules are pushing producers and distributors to use strong cold chain systems to meet regulations and reduce the risk of spoilage or contamination.

Looking for region specific data?

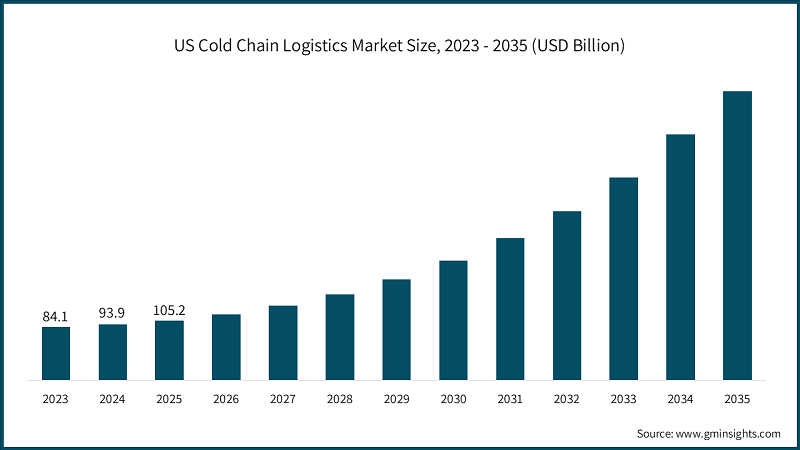

The US cold chain logistics market reached USD 105.2 billion in 2025, growing from USD 93.9 billion in 2024.

- The U.S. has its dominance in the logistics market. According to the USDA, there are over 800 commercial and public warehouses in the 48 states that store refrigerated products for 30 days or more. Such huge availability continuously supports the cold logistics players to expand their services nearby these storages.

- Additionally, the rise of e-commerce, online grocery delivery, and direct-to-consumer models in the U.S. has led companies to build more temperature-controlled warehouses near cities and improve last-mile delivery.

- There is also more focus on refrigerated trucks and ultra-cold storage to handle biopharmaceuticals like vaccines, which need strict temperature control. Third-party logistics (3PL) providers are getting more business as companies prefer outsourcing complex cold chain operations.

- At the same time, stricter food safety rules and temperature regulations are pushing businesses to improve traceability and recordkeeping in the supply chain. These challenges are leading to more use of greener practices and compliance-focused technologies.

The North America region is estimated to reach USD 428.1 billion by 2035 and expected to grow at a CAGR of 14.1% between 2026 and 2035.

- The North America region is home to many cold chain logistics players. In which the U.S. has a lot as compared to Canada. According to a survey, each year, billions of tons of fresh food products and millions of dollars' worth of U.S. exports are lost due to poor cold chain systems in developing markets.

- Companies are also expanding and upgrading cold storage facilities near major distribution hubs and cities to meet growing demand. This demand comes from areas like e-commerce, fresh and frozen foods, and healthcare. They are improving last-mile refrigerated delivery networks to support grocery delivery and direct-to-consumer services. There is also more focus on handling pharmaceuticals and biologics that need precise temperature control, as customer needs and product types continue to change.

- Sustainability is becoming a priority in North America's cold chain logistics. Companies are adopting energy-efficient refrigeration systems, low-emission transport options like electric reefer units, and eco-friendly packaging. These efforts aim to reduce environmental impact, cut costs, and maintain high-quality service.

The Europe cold chain logistics market accounted for USD 90.8 billion in 2025 and is anticipated to grow at the CAGR of 12.9% between 2026 and 2035.

- In European countries, leading companies like DHL International, DSV, and Maersk are growing and keeping their strong position. In the European cold chain logistics market, businesses are using new technology to handle goods that need specific temperatures. They use IoT and real-time systems to check temperature, humidity, and location in refrigerated warehouses and vehicles.

- These technologies help reduce spoilage and meet strict EU food safety rules. Tools like RFID and automated systems are also improving inventory management and protecting products such as fresh food and biopharmaceuticals.

- Moreover, the need for cold chain logistics is growing because of more online grocery shopping, higher demand for fresh food, and the pharmaceutical industry's needs. Customers now expect faster delivery of fresh and refrigerated items. To meet this demand, companies are expanding last-mile temperature-controlled services and building refrigerated facilities closer to cities.

- To meet EU emissions goals and save energy, companies are using eco-friendly refrigeration, renewable energy, and energy-efficient systems. These efforts support sustainability but require large investments, and progress is different across EU countries.

Germany's cold chain logistics market is growing rapidly in Europe, with a strong CAGR of 13.6% between 2026 and 2035.

- In Germany, cities like Berlin, Munich, Hamburg, and Frankfurt are getting more investments in refrigerated warehouses and last-mile delivery systems. These upgrades are helping meet the growing needs of online grocery shopping and the pharmaceutical industry by ensuring quick delivery of groceries and temperature-sensitive products.

- For example, in October 2025, Movianto opened a new sustainable facility in Wiesloch, Germany, doubling its cold storage capacity. The company also signed a lease for a new warehouse to handle frozen goods. This shows how Movianto is meeting rising demand and becoming a key player in the country.

- At the same time, the need for ultra-cold storage and special handling of biologics and vaccines is driving companies to expand their services and improve facilities with multi-temperature zones.

- DHL recently announced the expansion of its Life Sciences & Healthcare (LSH) campus in Florstadt, near Frankfurt am Main. The site is being turned into a European pharmaceutical hub as part of DHL’s global multibillion-dollar investment in Health Logistics. The facility includes multiple temperature zones, with the ability to go as low as -70°C when needed.

The Asia Pacific cold chain logistics market is estimated to grow at the fastest CAGR of 15.2% during the analysis timeframe.

- The market for cold chain logistics in the region is valued at USD 134.3 billion in 2025 and is also to continue to maintain its position at the highest growth rate between 2026 and 2035. Urbanization and higher incomes in countries like China, India, and Southeast Asia are increasing the need for fresh produce, dairy, seafood, and vaccines.

- This has led to more investments in refrigerated warehouses and temperature-controlled transport, especially in countries like Vietnam and Japan. Partnerships between global and local companies are also improving cold chain networks in the region.

- E-commerce and last-mile delivery are changing how logistics work in the region. The growth of online grocery and fresh food delivery is pushing companies to improve last-mile temperature-controlled services with refrigerated vehicles and flexible delivery options in cities.

China is estimated to grow with a CAGR of 14.6% in the projected period between 2026 and 2035, in the Asia Pacific cold chain logistics market.

- China's market is growing fast as infrastructure is being expanded and improved to meet the increasing demand for fresh and imported products. The sector has added more refrigerated transport and storage, with new rail and air cargo routes connecting inland cities to global supply chains.

- These routes help bring in fresh goods like salmon from Europe. Rising catering consumption and strong e-commerce sales of fresh produce are also driving investments in refrigerated vehicles and storage facilities.

- Sustainability and government policies are shaping the market's growth. The use of new energy refrigerated vehicles is increasing, showing a shift toward eco-friendly transport. Government programs, like the “14th Five-Year Plan,” are supporting the market by offering subsidies and encouraging the expansion of cold storage, better standards, and wider coverage, including rural areas.

Latin America cold chain logistics market accounted for USD 12.3 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The market in Latin America is growing because of the increasing demand for perishable foods and medicines. Companies are adding more refrigerated warehouses and improving transportation systems.

- For example, Emergent Cold Latin America has expanded into Uruguay and Paraguay, increasing storage capacity and improving their network. These facilities now use advanced systems and tools to keep products safe and easy to track throughout the supply chain.

- E-commerce and retail growth are changing cold chain services. More people are buying groceries and fresh food online, leading to more investments in refrigerated delivery and urban cold storage. This trend is especially noticeable in countries like Brazil and Mexico. Retailers and logistics companies are focusing on temperature-controlled centers and faster delivery to keep products fresh.

Brazil is estimated to grow with a CAGR of 9.9% between 2026 and 2035, in the Latin America cold chain logistics market.

- Companies in the country are pushing their efforts on improving refrigerated infrastructure. This is supporting industries like agriculture, food processing, and pharmaceuticals. Brazil’s role as a major exporter of perishable goods, such as meat, poultry, fruits, and vegetables, has led to more investments in refrigerated warehouses and temperature-controlled transport.

- These upgrades help keep products fresh for local use and exports. Businesses are also adding storage near production areas and ports to reduce spoilage and make supply chains more reliable.

- The market is also shaped by government programs, sustainability efforts, and ongoing challenges. Public initiatives to improve food safety and cold chain infrastructure are encouraging companies to upgrade their facilities and logistics. At the same time, energy-efficient refrigeration and eco-friendly practices are helping reduce costs and environmental impact.

The Middle East and Africa accounted for USD 28.6 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- The market will see growth in the region, as there are many manufacturing companies being established due to the favourable and supportive policies. Urbanization and changing foods are increasing the need for refrigerated warehouses and transport networks. This growth is especially strong in places like Saudi Arabia and the United Arab Emirates, where food and medicine distribution is improving.

- Companies are focusing on modern facilities that can store both chilled and frozen goods while dealing with the region's extreme weather.

- Sustainability and energy efficiency are becoming more important, especially in areas with weak infrastructure. In Sub-Saharan Africa, where power outages are common, solar-powered storage units and energy-saving refrigeration systems are being used to keep services running and lower costs.

UAE to experience substantial growth in the Middle East and Africa cold chain logistics market.

- The UAE market is growing quickly because of the increasing demand for e-commerce, online grocery delivery, and perishable goods. As more people use online grocery and delivery services, logistics companies are spending more on temperature-controlled transport and storage.

- The 3rd World Cold Chain Expo 2026 is an important event for industry. It will be held on 2–3 September 2026 at Dubai’s Festival Arena. The event will bring together experts and companies, such as technology providers, logistics firms, and equipment manufacturers.

- Attendees will meet, share ideas, and explore partnerships in areas like refrigerated storage, transport, automation, and sustainability. With participants from over 35 countries, the event highlights the UAE’s role as a major hub for cold chain innovation and growth.

Cold Chain Logistics Market Share

- The top 7 companies in the cold chain logistics industry are DHL International, United Parcel Service (UPS), Maersk, DSV, CEVA Logistics, C.H. Robinson Worldwide and Lineage Logistics, contributing 14.3% of the market in 2025.

- DHL provides logistics services for temperature-sensitive goods like perishable foods, pharmaceuticals, and vaccines. They use temperature-controlled transportation, storage, and handling, along with special packaging, real-time monitoring, and humidity control to keep products safe throughout the supply chain.

- UPS Healthcare offers cold chain logistics to protect pharmaceuticals, biotech products, and perishable goods. They use thermal packaging, temperature-controlled transport, and advanced monitoring systems to ensure products stay safe from start to finish.

- Maersk provides cold chain services that include temperature-controlled container transport, remote monitoring, and refrigerated storage. They ensure the quality of perishables and pharmaceuticals while offering logistics across ocean, land, and air transport.

- DSV offers cold chain logistics through its global network. Their services include temperature-controlled air, sea, and road transport with real-time monitoring. They ensure proper handling and consistent temperature for healthcare products, biological samples, and other sensitive goods.

- CEVA provides cold chain solutions with temperature-controlled air freight, special packaging, and compliant storage and distribution. They support perishable and healthcare supply chains with monitored cold logistics.

- C.H. Robinson helps transport temperature-sensitive goods using a network of STF-compliant carriers. They offer customizable temperature-controlled freight solutions, cross-border handling, and cold chain management for food and other sensitive shipments.

- Lineage Logistics runs temperature-controlled warehouses and distribution services. They use automated facilities and real-time tracking to manage the storage and movement of chilled and frozen goods worldwide.

Cold Chain Logistics Market Companies

Major players operating in the cold chain logistics industry are:

- DHL International

- United Parcel Service (UPS)

- Maersk

- DSV

- CEVA Logistics

- C.H. Robinson Worldwide

- Lineage Logistics

- Americold Logistics

- NewCold

- U.S. Cold Storage

- DHL is a global cold chain provider with a large network. It focuses on temperature-controlled transport and storage. DHL competes with multinational companies and regional specialists but stands out with strong compliance and a wide range of services.

- UPS operates in a competitive market with companies like DHL and Maersk. It focuses on healthcare cold chain services and uses its global transport network. UPS competes with large providers and smaller regional companies.

- Maersk is a major player in the cold chain market. It combines container transport, warehousing, and monitoring across different transport modes. Maersk competes with traditional logistics companies and multimodal specialists by offering strong visibility and network coverage.

- After buying Schenker, DSV became one of the largest logistics companies. It offers freight forwarding and temperature-sensitive services. DSV competes with other global companies by focusing on its large network and integrated services.

- CEVA Logistics works in the third-party logistics market, offering cold chain solutions. It competes with companies like DHL and C.H. Robinson in a market where service quality and regional expertise are important.

- C.H. Robinson uses its large carrier network and logistics services to compete. It offers flexible temperature-controlled transport and competes with bigger companies and regional players.

Lineage Logistics focuses on cold storage and automation. It stands out in storage and distribution but faces competition from other large cold chain companies and regional warehouse providers.

Cold Chain Logistics Industry News

- In October 2025, Movianto opened a new eco-friendly facility in Wiesloch, Germany, which doubled its cold storage capacity. The company also leased a new warehouse for frozen goods.

- In July 2025, Geotab upgraded its Cold Chain solution with new hardware and software. This upgrade gives businesses better visibility, control, and compliance for temperature-sensitive shipments. The update includes the IOX-COLD device for in-cabin use and the IOX-COLD RUGGED device, which is IP67-rated for outdoor use.

- In June 2025, GXO Logistics launched GXO IQ, the first AI-powered platform designed for the logistics industry. GXO IQ uses advanced AI to help businesses manage global supply chains more efficiently and improve logistics operations.

In May 2025, DHL expanded its Life Sciences & Healthcare (LSH) campus in Florstadt, near Frankfurt am Main, Germany. The site is being developed into a European pharmaceutical hub as part of DHL's global multibillion-dollar investment in Health Logistics. The facility includes multiple temperature zones, with the ability to go as low as -70°C.

The cold chain logistics market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) from 2022 to 2035, for the following segments:

Market, By Service

- Warehousing/Cold Storage

- Public Warehousing

- Private Warehousing

- Transportation

- Railways

- Airways

- Roadways

- Waterways

- Value-Added Cold Chain Services

Market, By Temperature Range

- Chilled (0°C to 8°C)

- Frozen (-18°C to -25°C)

- Deep Frozen (-25°C to -60°C or less)

Market, By Application

- Food & Beverage

- Fruits & vegetables

- Dairy & frozen desserts

- Meat, Poultry & Seafood

- Bakery & Confectionery

- Beverages

- Ready-to-Eat Meals / Processed Foods

- Pharmaceuticals & Healthcare

- Chemicals & Specialty Materials

- Other applications

Market, By Destination

- Domestic

- International

Market, By End Use

- Food Retailers & Supermarkets

- Food Processors & Manufacturers

- Pharmaceutical & Biotech Companies

- E-Commerce Platforms

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Singapore

- Malaysia

- Indonesia

- Vietnam

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the cold chain logistics industry?

Major players include DHL International, United Parcel Service (UPS), Maersk, DSV, CEVA Logistics, C.H. Robinson Worldwide, Lineage Logistics, Americold Logistics, NewCold, and U.S. Cold Storage.

What are the upcoming trends in the cold chain logistics market?

Adoption of IoT sensors and real-time monitoring, use of digital twins, increased automation, advanced data analytics, and sensor-based systems to reduce spoilage and boost efficiency.

Which region leads the cold chain logistics sector?

The United States leads the market, with a valuation of USD 105.2 billion in 2025. The presence of over 800 commercial and public refrigerated warehouses across 48 states supports the expansion of cold chain services in the region.

What is the projected value of the cold chain logistics market by 2035?

The market is expected to reach USD 1.37 trillion by 2035, fueled by global trade expansion and the adoption of advanced cold chain technologies.

What is the growth outlook for the pharmaceuticals & healthcare segment from 2026 to 2035?

The pharmaceuticals & healthcare segment is anticipated to observe over 14.9% CAGR till 2035.

What was the valuation of the chilled segment in 2025?

The chilled segment (0°C to 8°C) held a 53.7% market share in 2025, valued at USD 205.4 billion, and is set to reach USD 719.9 billion by 2035.

How much revenue did the warehousing/cold storage segment generate in 2025?

The warehousing/cold storage segment generated USD 221.2 billion in 2025, accounting for 57.9% of the market share.

What is the expected size of the cold chain logistics industry in 2026?

The market size is projected to reach USD 429.1 billion in 2026.

What was the market size of the cold chain logistics in 2025?

The market was valued at USD 382.3 billion in 2025, growing at a CAGR of 13.8% during the forecast period. The market is driven by the increasing demand for temperature-sensitive products and advancements in logistics technology.

Cold Chain Logistics Market Scope

Related Reports