Home > Media & Technology > Media and Entertainment > Audio Video > Cloud Gaming Market

Cloud Gaming Market Analysis

- Report ID: GMI2368

- Published Date: Jun 2019

- Report Format: PDF

Cloud Gaming Market Analysis

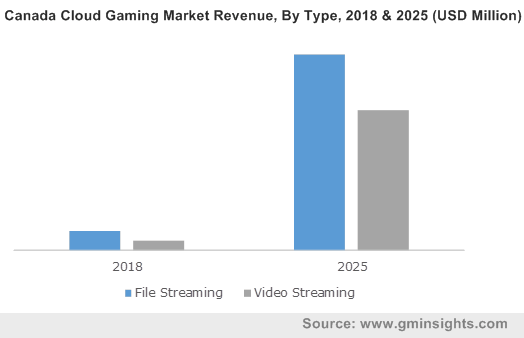

The file streaming cloud gaming market will grow at a CAGR of over 25% during the projected timeline. The file streaming approach is being typically applied by large players in their product offerings, such as PlayStation Now and Xbox Game Pass, due to the presence of their compatible gaming consoles. The use of file streaming allows companies to provide a seamless gaming experience to their users despite lower internet speeds. It further allows users to customize their gaming library and save their progress and gain instantaneous access to their profiles. The mandatory need for specialized gaming consoles is restricting its adoption among cloud gaming providers, offering their services through smartphones, PCs, and laptops.

The video streaming market has dominated the cloud gaming landscape with over 55% market share in 2018. The video streaming mechanisms are widely implemented by the start-ups operating in the market as they virtually eliminate the need for any expensive external gaming consoles or any computer-based tech devices to stream the gaming content. The lack of adequate telecommunication infrastructure in emerging countries such as India, Brazil, and Indonesia is limiting its usage among large players.

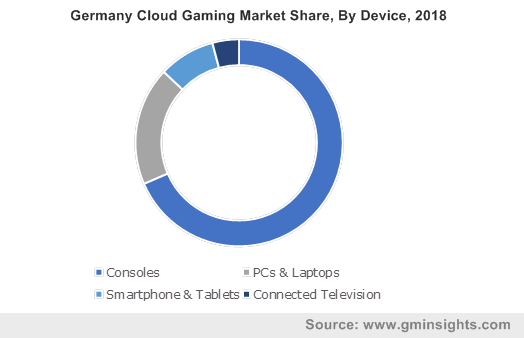

The console segment held over 60% share in the cloud gaming market due to the extensive and robust distribution network of major players such as Sony and Microsoft. These large players are primarily using their cloud gaming platforms to generate recurring revenue streams through their existing gaming customer base. The high price associated with the purchase of every new game inherently limits its usage among cost-sensitive buyers. The introduction of cloud gaming platforms has provided console manufacturers with a lucrative opportunity to monetize on their already existing large library of gaming content and augment their product capabilities.

The smartphones and tablets segment is expected to grow at a CAGR of over 45% over the forecast timeframe due to steadily increasing adoption of smartphones across the globe. The worldwide smartphone penetration was over 39% in 2018 and is expected to grow to over 48% by 2022. The players in the market are leveraging on the widespread adoption of smartphones and tablets to increase their customer base, thereby increasing their profitability. Moreover, it also allows companies to launch their services in various price-sensitive regions with an under-developed communication infrastructure.

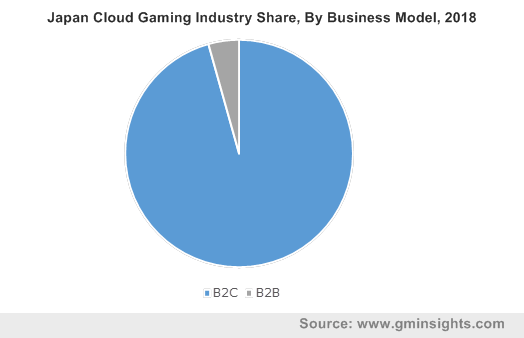

The Business-to-Business (B2B) cloud gaming market is expected to register a CAGR of over 40% during the forecast time duration. The cloud gaming platforms are focusing on signing partnerships with internet service providers and telecom companies to further extend the distribution network of their services. Furthermore, the set-top box manufacturers and telecom operators are showing interest in monetizing their fiber investments. With the increasing deployment of 5G services, particularly in countries such as South Korea, the U.S., and the MEA region, the telecom providers are focusing on forming exclusive contracts with cloud gaming platforms to augment their service offerings.

The Business-to-Consumer (B2C) model is mainly adopted by gaming giants such as Sony, Microsoft, and NVIDIA. The use B2C model reduces the company’s dependency on external stakeholders such as telecom providers and allows the companies to personalize their service offerings to best suit the customer needs. The inherent requirement for high capital expenditure is limiting its adoption among smaller players and start-ups.

The Asia Pacific cloud gaming market is anticipated to grow at a CAGR of over 46% from 2019 to 2025 due to the increasing number of 5G infrastructure development initiatives in the region. For instance, in April 2019, the major south Korea-based telecom providers, Korea Telecom, LG Uplus, and SK Telecom launched 5G mobile networks nationwide. The rising adoption of smartphones & gaming consoles and constantly surging online population have created a myriad of opportunities to spur the size of the market. In addition, the cost-effective nature of the cloud gaming platforms is promoting its usage across various new customer classes, that were vary of investing in gaming systems due to their expensive nature.

Europe accounted for over 34% of the share in the market in 2018 due to the presence of a large number of gaming enthusiasts and high penetration of gaming consoles such as PlayStation and Xbox. The companies operating in the landscape are introducing their product offerings in countries such as the UK, Germany, France, and the Netherlands due to the presence of robust and high-speed connectivity architecture in the region.