Summary

Table of Content

Clinical Nutrition for Diabetes Care Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Clinical Nutrition for Diabetes Care Market Size

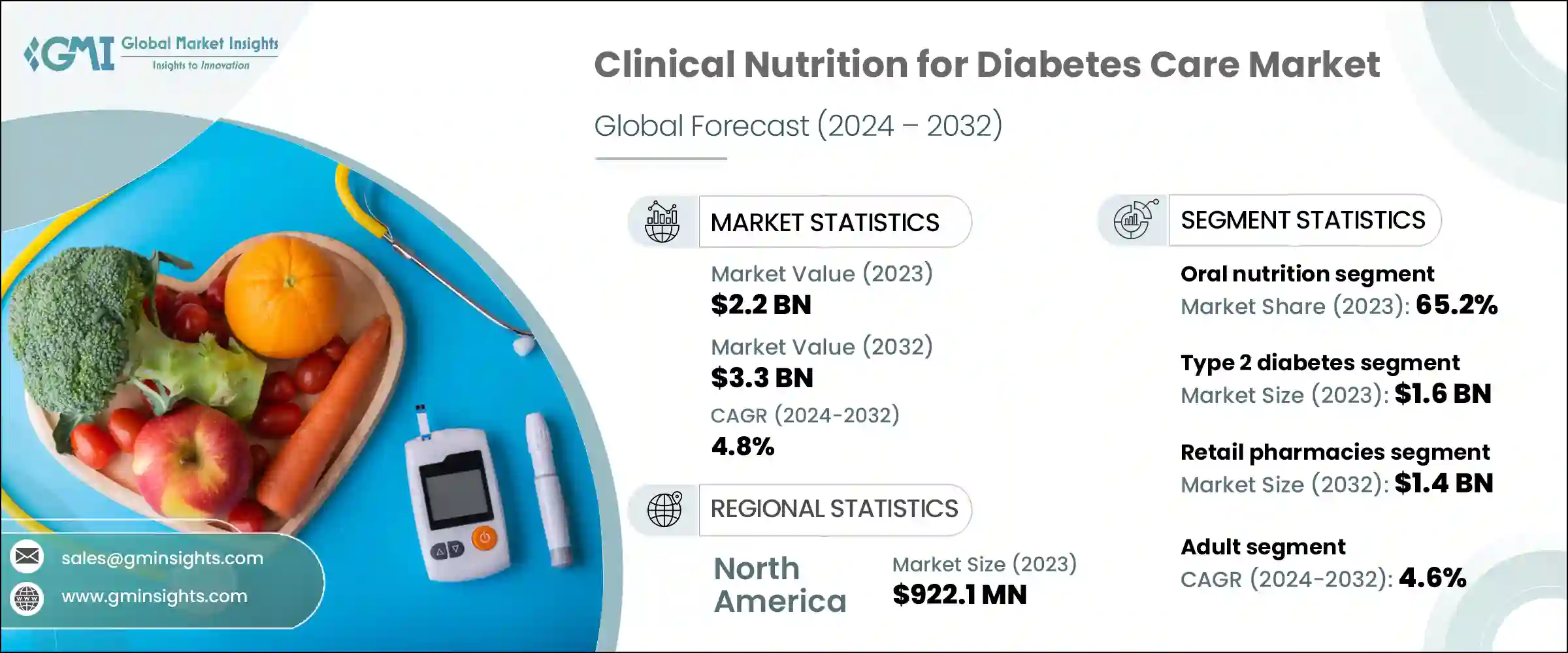

Clinical Nutrition for Diabetes Care Market size accounted for USD 2.2 billion in 2023 and is anticipated to witness growth at 4.8% of CAGR from 2024 and 2032. This market growth is primarily driven by the rising prevalence of diabetes, increased awareness of the importance of nutrition in diabetes management, and advancements in nutritional science and product formulation.

To get key market trends

As diabetes, particularly type 2 Diabetes, becomes more prevalent globally, there is a growing demand for specialized nutritional products that help manage blood glucose levels, support overall health, and prevent complications. Therefore, the increasing prevalence of diabetes is a major factor driving market growth.

Clinical Nutrition for Diabetes Care Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 2.2 Billion |

| Forecast Period 2024-2032 CAGR | 4.8% |

| Market Size in 2032 | USD 3.3 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Additionally, advancements in nutritional science have led to the development of more effective and palatable products, further boosting market expansion. These advancements include the formulation of specialized products catering to specific needs, such as high-protein, low-carbohydrate, and fiber-enriched options, which enhance diabetes management.

Clinical nutrition for diabetes care refers to specialized dietary management aimed at maintaining optimal blood glucose levels and overall health in individuals with diabetes. This involves tailored nutritional strategies and products, such as low-glycemic index foods, meal replacements, and enteral or parenteral nutrition solutions, designed to meet the unique metabolic needs of diabetic patients. The goal is to control blood sugar spikes, prevent complications, and ensure adequate intake of essential nutrients.

Clinical Nutrition for Diabetes Care Market Trends

- Increasing prevalence of diabetes is a major growth driver in the clinical nutrition for diabetes market. For instance, according to IDF Diabetes Atlas 2021, around 537 million adults in world are living with diabetes and the number is projected to rise to 643 million by 2030 and 783 million by 2045.

- This expanding patient base requires effective strategies to manage blood glucose levels and overall health, driving the demand for clinical nutrition for diabetes care.

- Additionally, there increased awareness and education about the importance of nutrition in diabetes management, particularly in developed countries. This rising awareness drives adoption of clinical nutrition products, as patients seek effective dietary solutions to manage their condition.

- Furthermore, growing prevalence of diabetes encourages investment in research and development of new and improved clinical nutrition products, thereby contributing to the market growth.

Clinical Nutrition for Diabetes Care Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is segmented into oral nutrition, parenteral nutrition, and enteral feeding formulas. The oral nutrition segment is further divided into ready-to-use and not ready-to-use. The ready-to-use segment is further sub-segmented into liquids and solids.

- The oral nutrition segment accounted for significant market share of 65.2% in 2023.

- Oral nutritional products tend to be more cost-effective than parenteral or enteral nutrition. They are often more affordable and accessible, making them a preferred choice for both patients and healthcare systems, thereby solidifying its position.

- These products are generally more acceptable and palatable to patients compared to other forms of clinical nutrition. Thus, the ease of consumption and higher palatability contributes to the growth of this segment.

- Furthermore, wide variety of products, balanced nutritional content, and strong market demand supports the growth of the segment.

Based on disease type, the clinical nutrition for diabetes care market is classified into type 2 diabetes and type 1 diabetes. The type 2 diabetes segment dominated the market and was valued at USD 1.6 billion in 2023.

- According to World Health Organization 2023, more than 90-95% of people with diabetes have type 2 diabetes worldwide. This higher prevalence significantly increases the demand for clinical nutrition products tailored to manage this type.

- Type 2 diabetes management heavily relies on lifestyle modifications, including dietary changes. Clinical nutrition products designed for such patients are integral to effective disease management.

- Thus, the aforementioned factors drive the growth of type 2 diabetes segment in this market.

Learn more about the key segments shaping this market

Based on consumer, the clinical nutrition for diabetes care market is divided into adult and pediatric. The adult segment dominated the market in 2023 and is anticipated to grow at 4.6% of CAGR over the forecast period.

- As per the IDF Diabetes Atlas (2021), approximately 10.5% of overall adult population (20 – 79 years) across the world has diabetes. This age group experiences higher rates of diabetes due to factors such as aging, lifestyle changes, and increased incidence of obesity.

- As a result, the demand for clinical nutrition products tailored to adults is significantly higher.

- Furthermore, this demographic is more likely to seek out and adhere to clinical nutrition solutions as part of their diabetes care regimen. Thus, the increased awareness drives demand for these products.

Based on dosage form, the clinical nutrition for diabetes care market is categorized into powder, liquid, and solid. The powder segment held highest market share and is predicted to reach USD 1.8 billion by the end of the analysis timeframe.

- Powdered nutritional products typically have a longer shelf life compared to liquid formulations. This makes them more convenient for storage and distribution, thereby fostering the growth of this segment.

- Additionally, widespread availability and accessibility of powder products contributes to their higher market share as more diabetic patients opt for these products due to convenience and availability.

- Moreover, factors such as versatility, cost-effectiveness, increased patient preference, and improved taste supports the growth of this segment.

Based on distribution channel, the clinical nutrition for diabetes care market is segmented into retail pharmacies, hospital pharmacies, online pharmacies, and other distribution channels. The retail pharmacies segment is poised to grow at 4.6% CAGR and reach USD 1.4 billion by 2032.

- Retail pharmacies offer convenient access to clinical nutrition products for diabetes management and have a widespread network of outlets.

- Further, increased availability of clinical nutrition products over-the-counter significantly drives the growth of retail pharmacies allowing diabetic patients to easily access these products.

- These factors collectively contribute to the growth of this segment.

Looking for region specific data?

North America clinical nutrition for diabetes care market size accounted for USD 922.1 million in 2023 and is anticipated to grow at 4.6% CAGR between 2024 - 2032.

- North America has a significant prevalence of diabetes, which drives the demand for clinical nutrition products designed for diabetes management. For instance, as per the American Diabetes Association, approximately 38.4 million Americans, or 11.6% of the population had diabetes in 2021.

- Moreover, North America has one of the highest healthcare expenditures globally, with significant investments in diabetes management and related healthcare services. This financial commitment supports the availability and affordability of clinical nutrition products within the market.

The U.S. clinical nutrition for diabetes care market is projected to witness growth at 4.5% CAGR to reach USD 1.2 billion by 2032.

- The U.S. boasts a sophisticated healthcare infrastructure with well-established healthcare facilities, including hospitals, clinics, and pharmacies. This infrastructure supports widespread access to clinical nutrition products across the country, facilitating their distribution and availability.

- Additionally, a high level of consumer awareness about diabetes management in the U.S., driven by extensive healthcare education initiatives, further fuel the demand for clinical nutrition products.

Germany clinical nutrition for diabetes care market is anticipated to experience lucrative growth in coming years.

- Growing emphasis on preventive healthcare measures, including early intervention and management of chronic conditions like diabetes has significantly driven the adoption of clinical nutrition products to manage conditions like diabetes.

- Additionally, presence of leading healthcare companies and manufacturers in Germany fosters strong market competition and promotes innovation in clinical nutrition products. This competitive landscape drives continuous improvement in product quality, affordability, and accessibility for diabetic patients in the country, thereby fostering market growth.

India clinical nutrition for diabetes care market is poised to showcase lucrative growth over the analysis period.

- According to World Health Organization, in India there are estimated 77 million people above the age of 18 years suffering from diabetes and nearly 25 million are prediabetics.

- This large and growing diabetes and prediabetes patient population underscores the increasing demand for specialized nutritional products aimed at managing blood glucose levels and preventing complications associated with diabetes.

Clinical Nutrition for Diabetes Care Market Share

The clinical nutrition for diabetes care industry is competitive and dynamic, driven by innovation, expanding global diabetes prevalence, regulatory compliance, and strategic initiatives by key players. Major companies in the market include Abbott Laboratories, Nestle Health Science, Danone Nutricia, and B. Braun Melsungen AG, among others. These companies dominate the market through extensive product portfolios, global distribution networks, and strategic alliances.

Clinical Nutrition for Diabetes Care Market Companies

Prominent players operating in the clinical nutrition for diabetes care industry include:

- Abbott Laboratories

- Baxter International Inc.

- B Braun Melsungen AG

- Danone Nutricia

- Dr Reddy's Laboratories Ltd.

- Mead Johnson & Company, LLC

- Nestlé Health Science S.A.

- Nutrego

- Otsuka Holdings Co., Ltd.

- Pfizer Inc.

- Prohance

- Victus, Inc.

Clinical Nutrition for Diabetes Care Industry News:

- In December 2021, Danone India launched Protinex Diabetes Care to address the nutritional requirements of Indians with diabetes. This product aims in providing adequate protein and fiber, which are important nutrients in managing blood sugar levels. This strategic launch has helped the company to enhance their customer base and generate revenue.

The clinical nutrition for diabetes care market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD Million from 2021 – 2032 for the following segments:

Market, By Product

- Oral nutrition

- Not ready-to-use

- Ready-to-use

- Liquids

- Solids

- Parenteral nutrition

- Macronutrients

- Carbohydrates

- Amino acids

- Lipids

- Micronutrients

- Vitamins

- Minerals

- Macronutrients

- Enteral feeding formulas

- Standard composition

- Disease specific composition

Market, By Disease Type

- Type 2 diabetes

- Type 1 diabetes

Market, By Consumer

- Adult

- Pediatric

Market, By Dosage Form

- Powder

- Liquid

- Solid

Market, By Distribution Channel

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

- Other distribution channels

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the major clinical nutrition for diabetes care industry players?

Abbott Laboratories, Baxter International Inc., Danone Nutricia, Dr Reddy's Laboratories Ltd., Mead Johnson & Company, LLC, Nestl

What is the size of the North America clinical nutrition for diabetes care market?

North America clinical nutrition for diabetes care industry accounted for USD 922.1 million in revenue in 2023 and may grow at 4.6% CAGR between 2024

Why is the demand for oral clinical nutrition for diabetes care rising?

The oral nutrition segment accounted for 65.2% of the market share in 2023, as they are more cost-effective than parenteral or enteral nutrition.

How big is the clinical nutrition for diabetes care market?

Clinical nutrition for diabetes care industry reached a revenue of USD 2.2 billion in 2023 and is anticipated to witness 4.8% CAGR from 2024 to 2032, primarily driven by the rising prevalence of diabetes and the increased awareness of the importance of nutrition in diabetes management.

Clinical Nutrition for Diabetes Care Market Scope

Related Reports