Summary

Table of Content

Chlorinated Polyvinyl Chloride (CPVC) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Chlorinated Polyvinyl Chloride Market Size

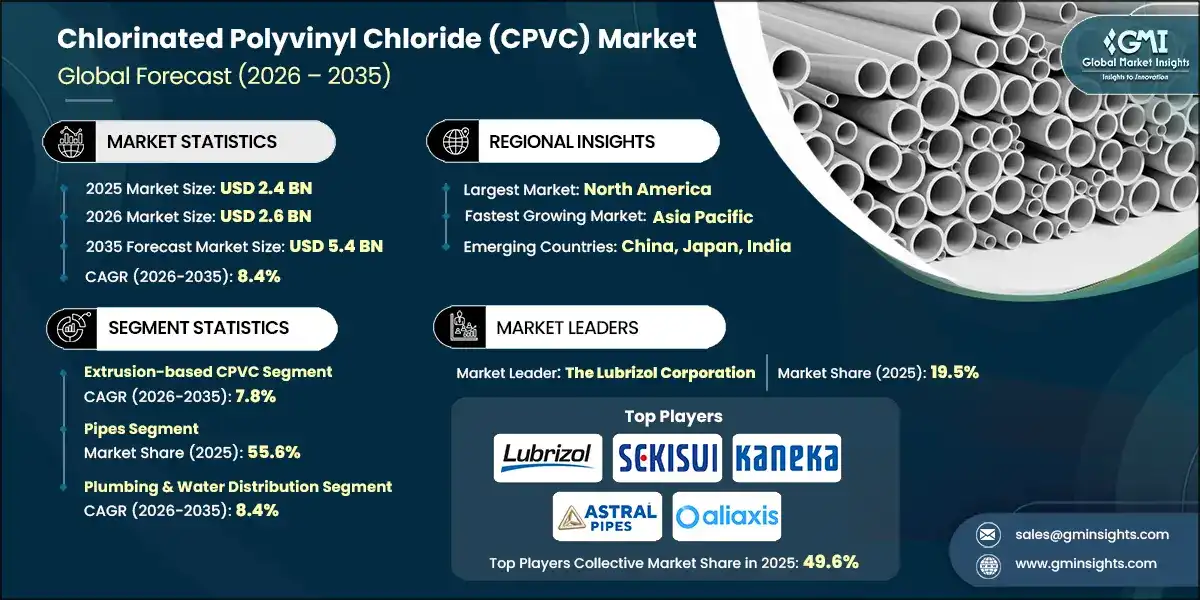

The global chlorinated polyvinyl chloride market was valued at USD 2.4 billion in 2025. The market is expected to grow from USD 2.6 billion in 2026 to USD 5.4 billion in 2035, at a CAGR of 8.4% according to latest report published by Global Market Insights Inc.

To get key market trends

- The increasing use of CPVC for residential, commercial, and industrial applications along with the increased demand for CPVC in multiple areas has helped to grow the CPVC market. CPVC has also increased its use in the fire protection systems, industrial fluid handling systems, and HVAC and chilled water systems.

- The extrusion-based CPVC process dominates the CPVC manufacturing process market with a share of about 72.7% in 2025, which will be valued at approximately USD 1.7 billion, due to the efficiency of producing pipes, tubes, sheets, and profiles. The projection for injection molding the market is expected to expand at a CAGR of 9.8% during the forecast period, allowing for the possibility of ongoing system integration and customization of product design.

- By product type, CPVC pipes hold the largest share of 55.6% in 2025, as they are extensively used in plumbing, fire protection, and industrial piping systems. They are also expected to continue to see growth through sheet, panel, and profile products, with CAGR's of 7.2%. The projected primary driver of future growth will be driven by the need for line products for industrial constructions and other applications.

- In 2025, plumbing and building water distributions services are expected to dominate with about 49% of total sales volume and be followed closely behind by fire protection systems, industrial process piping and HVAC/chilled water systems. This shows the versatility of CPVC as well as its reliability for these types of applications. Fire Protection Systems are expected to grow at a CAGR through 2025 of 10.1%.

- Regionally, North America chlorinated polyvinyl chloride market is leading the worldwide CPVC sales with revenues of USD 865.2 million in 2025, this is mainly due to continued infrastructure upgrades and regulatory compliance, with the United States being the largest market for CPVC material. Europe is currently at 21.5% of worldwide sales due to stricter building codes and the growing need for retrofitting; Germany is at the forefront of these developments in Europe. The Asia Pacific region, where China will drive approximately 10% CAGR, is experiencing rapid growth, mainly due to Urbanization and industrialization.

Chlorinated Polyvinyl Chloride (CPVC) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.4 Billion |

| Market Size in 2026 | USD 2.6 Billion |

| Forecast Period 2026 - 2035 CAGR | 8.4% |

| Market Size in 2035 | USD 5.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for durable and corrosion-resistant piping materials | Drives widespread CPVC adoption in residential, commercial, and industrial piping systems due to long service life. |

| Rising construction activity across residential and commercial infrastructure | Expands CPVC consumption through higher installations in plumbing, fire protection, and HVAC networks. |

| Preference for high-temperature and chemically stable plastic materials | Supports replacement of traditional metals, increasing CPVC usage in demanding fluid handling applications. |

| Pitfalls & Challenges | Impact |

| Volatility in raw material availability and pricing structures | Creates cost uncertainties for manufacturers, affecting profitability, pricing consistency, and long-term supply planning. |

| Competition from alternative piping materials and technologies | Limits CPVC penetration in cost-sensitive markets where substitutes appear economically or technically attractive. |

| Opportunities: | Impact |

| Rapid urbanization and infrastructure development in emerging economies | Generates sustained demand for CPVC piping in water supply, sanitation, and fire safety systems. |

| Technological improvements enhancing CPVC performance characteristics | Enables expansion into higher-temperature, higher-pressure, and more aggressive industrial environments. |

| Market Leaders (2025) | |

| Market Leaders |

19.5% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, Japan, India |

| Future outlook |

|

What are the growth opportunities in this market?

Chlorinated Polyvinyl Chloride Market Trends

- The use of CPVC pipe fittings (perforated) and couplings (raw) has grown over time from just being used for plumbing to the following other applications; CPVC piping is now used for fire suppression systems; Industrial Fluid Transport; and HVAC systems. The trend toward using CPVC for those applications has been caused in part by the material's high-temperature resistance, high-pressure performance, and high-corrosive chemical capability. CPVC is a favourite of both Engineers and Contractors due to its reliability, ease of installation, and long life span. The use of these multi-purpose materials significantly reduces the overall complexity (number of types) of piping materials used in construction projects while still maintaining both environmental and building safety, as well as continuing to be a viable option for a long time.

- Due to the labour shortage facing the construction industry and the need to control costs, the trend toward reducing installation time and requirements will continue to drive the use of lightweight products like CPVC, as it is easier to cut, join together, and move than products, such as metal. As the number of construction projects continues to be reduced due to the ongoing shortage of Labour, the number of projects using CPVC is going to rise due to its lower weight and flexibility compared with heavier and less flexible metal products.

Chlorinated Polyvinyl Chloride Market Analysis

Learn more about the key segments shaping this market

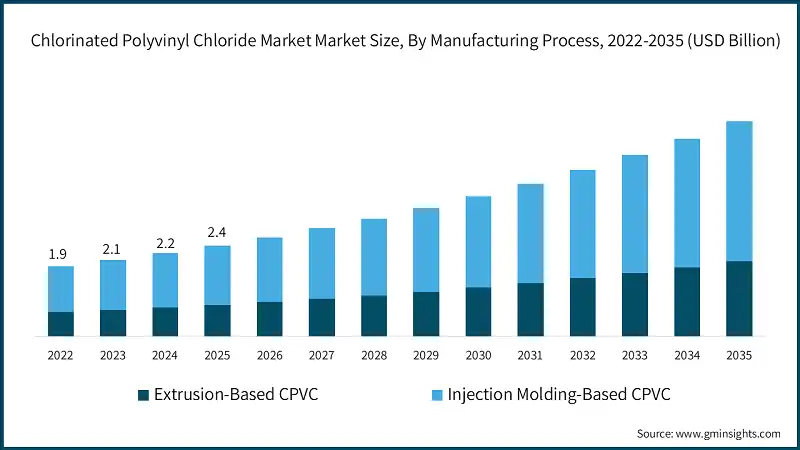

Based on manufacturing process, the market is segmented into extrusion-based CPVC, and injection molding-based CPVC. Extrusion-based CPVC dominated the market with an approximate market share of 72.7% in 2025 and is expected to grow with a CAGR of 7.8% by 2035.

- Extrusion-based manufacturing generated USD 1.7 billion in 2025 and is expected to continue to be a leader in the market because of its ability to produce pipes, tubes, sheets, and profiles with the same dimensions and large outputs. Extrusion-based manufacturing is used for large infrastructure projects, plumbing systems, and industrial pipe systems where consistency in size and cost is vital.

- The injection-molded manufacturing method is used mainly for fittings, valves, and intricate components requiring accurate shape and measurement. Injection molding is expected to experience a compound annual growth rate of 9.8% during the forecast period. While injection molding is typically not produced in as large quantities as extrusion machining is, it does significantly increase the adding value of product development by allowing for merging and tailoring to fulfill end-user requirements. Both manufacturing processes complement each other in supporting the needs for increased volume, lasting performance, and application-specific design throughout the CPVC markets.

Learn more about the key segments shaping this market

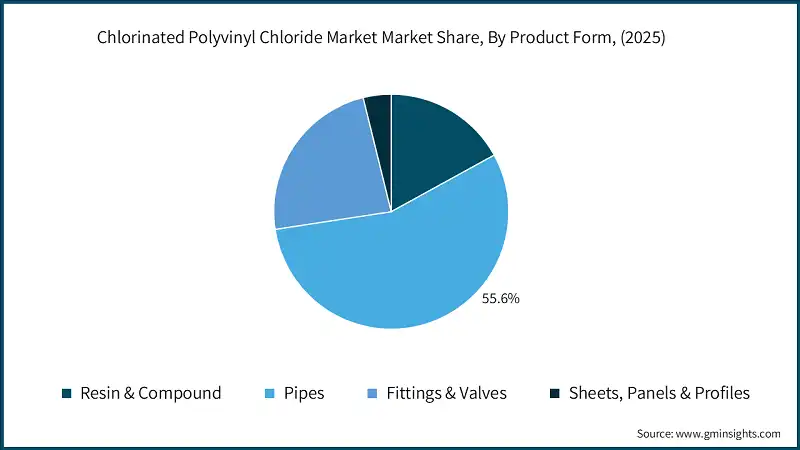

Based on product form, the chlorinated polyvinyl chloride market is segmented into resin & compound, pipes, fittings & valves, and sheets, panels & profiles. Pipes held the largest market share of 55.6% in 2025 and is expected to grow at a CAGR of 8.1% during 2025-2034.

- The pipe form segment is the largest product form segment in the industry because they are used repeatedly in plumbing systems such as residential plumbing, as well as fire protection and industrial piping systems, because of their durability and thermal resistance as opposed to other types of pipes.

- Valves and fittings are important to the CPVC industry in that their function enables both the customization of the system's ability to connect and is expected to generate an increasing market share of 54.2% by 2034. The upgrades that are being made to the infrastructure also provides valves and fittings with greater potential for expanded growth, giving manufacturers an opportunity to develop and innovate new types of products that will provide users with improved performance characteristics and durability.

- Sheet, panel, and profile product forms currently represent a small niche within the CPVC market. However, these product forms are expected to experience a CAGR of 7.2% throughout the forecast period due to the products' usage for lining and constructing industrial applications. Each of these three product forms meets many types of end-use needs and therefore allows for flexibility during the manufacturing process, facilitates installation in a timely manner, and provides reliable performance during the CPVC applications in both the residential, commercial, and industrial segments across the globe.

Based on application, the chlorinated polyvinyl chloride market is segmented into Plumbing & Water Distribution, Fire Protection Systems, Industrial Process Piping, and HVAC & Chilled Water Systems. Plumbing & Water Distribution segment dominated the market with an approximate market share of 49% in 2025 and is expected to grow with the CAGR of 8.4% by 2035.

- The largest share of the market is held by plumbing and water distribution because CPVC pipes are durable, resistant to corrosion and moisture damage, easy to install and reliable for both residential and commercial applications.

- Fire protection systems are growing rapidly, with a CAGR of 10.1% for the CPVC market in forecast year. This growth is due to the ability of CPVC to provide flame retardant protection systems, as well as meeting the high levels of safety regulation that are required in the construction of buildings and other industrial facilities. Additionally, CPVC provides excellent chemical and temperature resistance, thus providing a solution for transporting various fluids through the manufacturing and processing industries.

- HVAC / Chilled water systems are expected to have an increasing share of the CPVC market, projected at 6.6% by 2026. CPVC is increasingly becoming the preferred choice in the HVAC / Chilled water systems segment due to its lightweight, low-maintenance and high-performance characteristics, which are very desirable to users. These applications will continue to drive the growth of CPVC within the infrastructure markets, industrial segments and commercial sectors alike.

Looking for region specific data?

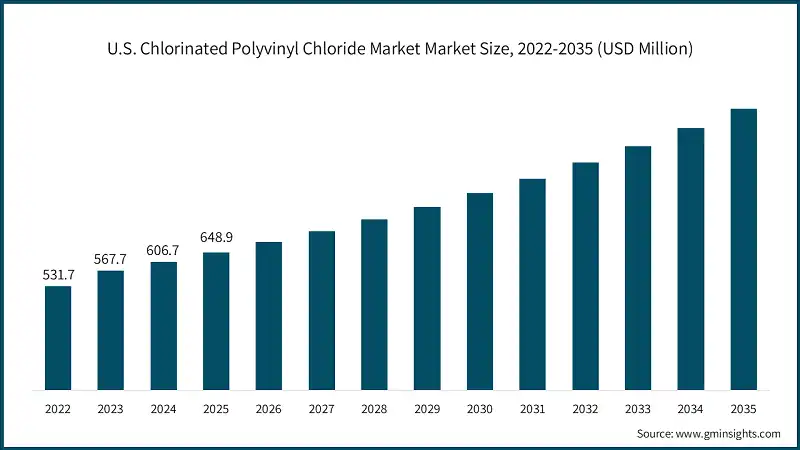

North America chlorinated polyvinyl chloride market leads the industry with revenue of USD 865.2 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Infrastructure, renovations, and stricter safety codes are driving the North American CPVC market. The high use of this product in plumbing, fire protection, and industrial piping means that there is a very strong demand for CPVC products. The mature markets in Canada and the U.S. will replace approximately half of current materials and upgrade all of their systems by replacing them with newer and upgraded versions. There are continuing technological improvements being made to the formulation of CPVC making them more reliable and increasing their performance.

U.S. dominates the North America chlorinated polyvinyl chloride market, showcasing strong growth potential.

- The U.S. CPVC market will be driven by an increase in infrastructure projects and an increase in residential and commercial building projects; and by increased efforts to comply with stricter safety regulations. The high use of CPVC products within the plumbing, fire sprinkler, and industrial piping markets means that CPVC has the ability to drive continued demand for CPVC. As metal piping systems continue to be replaced with CPVC because of corrosion resistance, CPVC will achieve higher market penetration. Technological advancements in the manufacturing processes of CPVC have allowed manufacturers to develop a more technologically sound product.

The Europe chlorinated polyvinyl chloride market is growing rapidly on the global level with a market share of 21.5% in 2025.

- Europe's CPVC market benefits from a combination of strong construction activity, strict building codes, and stringent environmental regulations. The high priority placed on Fire Safety and Sustainable Plumbing Solutions is driving increased usage of CPVC on residential, commercial, and industrial projects. Most countries in Western Europe have been focused on retrofitting and upgrading to current codes of existing infrastructures. In comparison, Eastern Europe offers significant growth opportunities related to new Urban Development projects.

Germany chlorinated polyvinyl chloride market dominates the European market, showcasing strong growth potential.

- The market for Germany is supported mainly by Building and Fire safety codes and large-scale industrial plants. High levels of Fire Safety, Plumbing, and HVAC systems continue to drive demand. Additionally, Manufacturers continue to develop innovative high-performance CPVC materials to comply with TM standards. With the development of Retrofit projects and Modernisations of Infrastructure, manufacturers are taking advantage of continuous growth possibilities. Manufacturers use both advanced production technology and compliance with regional standards to remain competitive. Sustainability and Fire Safety are the driving forces for the continued demand for CPVC products in Germany through continuous innovations.

The Asia Pacific chlorinated polyvinyl chloride market is anticipated to grow at a CAGR of 10% during the analysis timeframe.

- The Asia Pacific CPVC Market is rapidly growing due to the factors of Urbanization, Industrial Development, and Major Infrastructure Projects. China, India, and Southeast Asia are currently experiencing significant investment into all sectors of Residential, Commercial, and Industrial Construction; thus, the demand for Pipe, Fittings, and Fire Protection Systems is also increasing significantly. There is an increase in awareness regarding Safety Standards and Compliance related to the Environment, all of which promote the movement towards increased CPVC use. It is anticipated that as the population increases and more infrastructure is developed, the CPVC Market will also continue to grow.

China chlorinated polyvinyl chloride market is estimated to grow with a significant CAGR in the Asia Pacific region.

- China’s CPVC market has been significantly growing as China is rapidly urbanising, industrialising and developing infrastructure, along with a growing amount of residential, commercial and industrial construction taking place, creating a need for durable, and inexpensive pipe systems. The characteristics that make CPVC suitable for multiple applications include its ability to resist corrosion, thermally stable, and to provide fire safety; additionally, increasing government sponsored water supply modernisation and industrial safety initiatives strengthen CPVC adoption.

Latin America chlorinated polyvinyl chloride market accounted for 5.8% market share in 2025 and is anticipated to show highest growth over the forecast period.

- In Latin America, the CPVC market is expanding as a result of increasing levels of construction activity and the upgrading of water supply infrastructure as well as industrial processing upgrades. The urbanisation and infrastructure development in Brazil, Mexico and other countries is creating a higher demand for durable and corrosion resistant piping products. Many are gaining increased attention with regard to fire protection and industrial piping applications, which results in diverse adoption.

Brazil chlorinated polyvinyl chloride market leads the Latin American market, exhibiting remarkable growth during the analysis period.

- The growth of Brazil's CPVC market is attributed to the rise of urbanization and infrastructure development as well as growth in the industrial sector. High demand for use in plumbing, fire protection and industrial applications has caused this market to continue to grow. The replacement of outdated metal piping systems with durable CPVC based systems will also result in increased demand. Due to CPVC's easy installation, low maintenance, and long service life, it is becoming a preferred choice for both residential and commercial projects.

Middle East & Africa chlorinated polyvinyl chloride market accounted for 2.9% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Middle East and Africa CPVC market also continues to grow due to the increased number of major infrastructure, Oil and Gas, and the industrial projects throughout the region. The rapid growth of urbanization in Gulf States and the growth of developing markets in Africa will support the increased demand from different sectors for reliable plumbing, fire protection and process piping systems.

Saudi Arabia chlorinated polyvinyl chloride market to experience substantial growth in the Middle East and Africa chlorinated polyvinyl chloride industry in 2025.

- Saudi Arabia’s CPVC market is expanding due to large-scale infrastructure projects, industrial growth, and residential development. Harsh climatic conditions and corrosive environments increase the preference for CPVC over metallic piping. Adoption in plumbing, fire protection, and industrial process piping is rising, supported by government initiatives and safety regulations. CPVC’s heat resistance, durability, and low maintenance make it ideal for commercial and industrial applications. Ongoing investments in urbanization, construction, and industrial modernization ensure steady market growth in the country.

Chlorinated Polyvinyl Chloride Market Share

The top 5 companies in chlorinated polyvinyl chloride industry include The Lubrizol Corporation, Sekisui Chemical Co., Ltd., Kaneka Corporation, Astral Limited, and Aliaxis Group S.A.These are prominent companies operating in their respective regions covering approximately 49.6% of the market share in 2025. These companies hold strong positions due to their extensive experience in chlorinated polyvinyl chloride market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- The Lubrizol Corporation is an American-based company that produces and sells advanced technology solutions for plumbing, fire protection, and more. As an innovative company focused on using high-performance materials (e.g., resins) in the design of their piping systems, Lubrizol offers its customers products that are long-lasting, environmentally friendly and effective in preventing corrosion. Lubrizol also produces a variety of products for global markets, including the residential, commercial, and industrial systems worldwide.

- Sekisui Chemical Co., Ltd. is a Japan-based manufacturer that designs, manufactures and sells a complete line of CPVC pipes and other piping products for both domestic and international customers. Through their emphasis on developing high-quality products using sustainable materials, Sekisui provides their customers with safe solutions for both fire protection and water distribution/transportation.

- Kaneka Corporation creates new products that use durable, heat- and corrosion-resistant materials for plumbing systems. The company has an extensive line of CPVC resin products designed to meet the needs of multiple markets (industrial, commercial, residential). Kaneka has been able to establish itself as a premier global supplier of CPVC resins due to its ability to design innovative products and build strong relationships with customers and supply chain partners.

- Astral Limited manufactures CPVC fittings, CPVC pipes and CPVC-related systems for plumbing as well as water distribution and other industrial applications. The company places an emphasis on the importance of using innovative methods, producing high-quality products, providing cost effective options and expanding its market presence across the world.

- Aliaxis Group S.A. is a worldwide provider of plastic piping systems, including but not limited to CPVC solutions for plumbing, fire protection and industrial applications. They have a focus on innovation, sustainability, and based on experience developing integrated solutions to meet the requirements of all three sectors. The strength of Aliaxis' research and development, combined with its worldwide distribution channels allows for continuous growth in the marketplace.

Chlorinated Polyvinyl Chloride Market Companies

Major players operating in the chlorinated polyvinyl chloride industry include:

- Aliaxis Group S.A.

- Astral Limited

- Charlotte Pipe and Foundry

- Georg Fischer Ltd.

- IPEX Inc.

- Kaneka Corporation

- Lubrizol Corporation

- Prince Pipes and Fittings

- Sekisui Chemical Co., Ltd.

- Supreme Industries Limited

Chlorinated Polyvinyl Chloride Industry News

- In December 2025, Grasim Industries announced that it is set to commission its ECH and CPVC plants by March 2026, expanding its chemicals business and enhancing production capacities for the domestic and international markets.

- In December 2025, Westlake Chemical Corporation revealed plans to shut down several US plants including suspension PVC in Aberdeen, Mississippi, VCM and styrene in Lake Charles, Louisiana, and a diaphragm chlor-alkali plant. The closures, driven by challenging global market conditions, are expected to incur pre-tax costs of USD 415 million, with operations continuing at other North American facilities to supply chlorovinyl products.

This chlorinated polyvinyl chloride market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2025 to 2034, for the following segments:

Market, By Manufacturing Process

- Extrusion-Based CPVC

- Injection Molding-Based CPVC

Market, By Product Form

- Resin & Compound

- Pipes

- Fittings & Valves

- Couplings & Adapters

- Elbows & Tees

- Unions & Reducers

- Valves (Ball, Gate, Check)

- Sheets, Panels & Profiles

Market, By Application

- Plumbing & Water Distribution

- Hot Water Systems

- Cold Water Systems

- Recirculation Systems

- Fire Protection Systems

- Residential Fire Sprinklers (NFPA 13D)

- Commercial Fire Sprinklers (NFPA 13)

- Multifamily Fire Sprinklers (NFPA 13R)

- Industrial Process Piping

- Chemical Processing & Handling

- Water & Wastewater Treatment

- Desalination Plants

- Power Generation

- Oil & Gas Operations

- Mineral Processing

- HVAC & Chilled Water Systems

- Hydronic Heating

- Chilled Water Distribution

- Cooling Towers

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the chlorinated polyvinyl chloride market?

Major companies operating in the CPVC industry include The Lubrizol Corporation, Sekisui Chemical Co., Ltd., Kaneka Corporation, Astral Limited, Aliaxis Group S.A., IPEX Inc., Prince Pipes and Fittings, and Supreme Industries Limited.

What are the key trends shaping the chlorinated polyvinyl chloride industry?

Key trends include increasing replacement of metal pipes, rising use of CPVC in fire protection systems, and growing adoption in HVAC and industrial fluid handling due to superior thermal and chemical resistance.

Which region leads the chlorinated polyvinyl chloride market?

North America led the CPVC market with revenues of USD 865.2 million in 2025. Growth is driven by infrastructure renovation, strict safety codes, and strong adoption across plumbing, fire sprinkler, and industrial piping systems in the U.S.

What is the growth outlook for fire protection systems in the CPVC market?

Fire protection systems are projected to grow at a CAGR of 10.1% during the forecast period, driven by stringent building safety regulations and increasing adoption of flame-retardant CPVC piping.

What was the market share of CPVC pipes by product form in 2025?

CPVC pipes held the largest share of 55.6% in 2025, reflecting strong demand from plumbing, fire protection, and industrial piping applications across residential and commercial buildings.

Which application segment dominated the CPVC industry in 2025?

Plumbing and water distribution dominated the CPVC market with around 49% share in 2025, supported by the material’s durability, corrosion resistance, and suitability for hot and cold water systems.

How much revenue did the extrusion-based CPVC manufacturing segment generate in 2025?

Extrusion-based CPVC manufacturing generated approximately USD 1.7 billion in 2025, accounting for a dominant 72.7% market share due to its efficiency in producing pipes, tubes, and profiles at scale.

What is the projected value of the chlorinated polyvinyl chloride market by 2035?

The CPVC market is forecast to reach USD 5.4 billion by 2035, growing at a CAGR of 8.4% due to sustained urbanization, infrastructure upgrades, and wider adoption in fire protection and HVAC systems.

What is the market size of the chlorinated polyvinyl chloride (CPVC) industry in 2025?

The chlorinated polyvinyl chloride market was valued at USD 2.4 billion in 2025, supported by rising demand for corrosion-resistant and high-temperature piping materials across construction and industrial applications.

What is the projected chlorinated polyvinyl chloride (CPVC) market size in 2026?

The CPVC industry is expected to reach USD 2.6 billion in 2026, driven by expanding residential and commercial infrastructure projects and increasing replacement of metal piping systems.

Chlorinated Polyvinyl Chloride (CPVC) Market Scope

Related Reports