Summary

Table of Content

Cheese Powder Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cheese Powder Market Size

Cheese Powder Market size exceeded USD 485 million, globally in 2018 and is estimated to grow at over 7% CAGR between 2019 and 2025. Globallization of food culture will stimulate preference for exotic flavoured cuisines, thereby fueling global industry demand.

To get key market trends

Cheese powder is extensively used as a seasoning and flavoring agent in the food industry. It is produced by spray drying the mixture of macerated cheese, water & ingredients such as emulsifiers & salts. It can also be made by the addition of whey & water to the mixture and dehydrating it. Addition of whey in the ingredient mixture gives rise to a finer powder essentially called as cheese dust. It is obtained from a variety of types of such as cheddar, blue and Swiss.

Apart from its application as a flavoring ingredient, it is also used in the production of processed and imitation cheese. It is a convenient ingredient that can be added in requisite amounts to the processed products. It also ensures easy storage and transportation as compared to its counterparts pastes and concentrates. It is also consumed in combination with other flavoring powders such as sour cream, pizza, taco, bacon, barbeque, onion, and spices.

The powder is developed by the manufacturer's specifications to suit the needs of the snack producers. On the manufacturers’ side, development of a spectrum of flavor notes in the product, are some of the challenges face by the market participants. The cheese powder market growth is attributed to the availability of flavor varieties. Apart from boosting the flavor profile, the powder also helps in increasing the shelf life of the bakery products, especially filled baked goods.

Cheese Powder Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | USD 489.29 Million |

| Forecast Period 2019 to 2025 CAGR | 7% |

| Market Size in 2025 | USD 777.04 Million |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

They also have a drastically low amount of moisture, which gives it a shelf life of 18 months. The extended shelf life is an important factor in the area space of snacks, nutrition bars, soups, and ready-to-eat food. Since incorporating regular cheeses is difficult in many processed products, powdered formats have enabled manufacturers to gain entry in these markets. Hence, many manufacturers who are venturing expansion in these snacking spaces have begun offering powdered and freeze-dried formats.

For millennials and the younger demograph, savory snacks have become a household staple owing to the frequency of buying and constant flavor innovations from the manufacturer's side. Children's demograph has also shown a strong tendency to opt for cheese snacks to satiate their hunger craving. The young demograph holds a large market potential for the global industry growth.

A recent product that has witnessed the adoption of powdered cheeses are the snack bars. Powders have allowed bar and sweet snack consumers to bridge the gap between purely sweet flavors and savory ones. Many regular consumers of the breakfast cereals and snack bars category have been demanding savory flavors in these products. It offers unlimited opportunity to tap into these unfulfilled market potentials.

They are also a preferred option for consumers to demand healthy ingredients in their diets. The powders’ concentrated composition comprises of major essential milk ingredients such as protein, fat, mineral and vitamin content, and helps it to contribute to enhancing the nutrient profile of snacks. Moreover, the nutrient rich powder is also a natural source for the consumers which has enabled manufacturers to attract the health conscious demo graph.

Cheese Powder Market Analysis

The market study is bifurcated into cheddar, blends, mozzarella, Swiss, blue, asiago, parmesan, gouda, feta, romano and others, on the basis of the type. Cheddar occupied more than half of the global market in the year 2018. This is attributed to the abundant availability of cow and buffalo milk used to produce cheddar. Mass production has also enabled manufacturers to expand their production capacities over the time.

Moreover, production facilities have to make huge investments for the production of other cheese varieties. The advantage of cheddar powder is that it can be manufactured by the equipment used for milk powder. Hence, a production cost advantage encourages key players to produce powder from cheddar that other available cheeses. Other factors such as its superior taste profile has also made it a preferred source for manufacturing powdered cheese.

Learn more about the key segments shaping this market

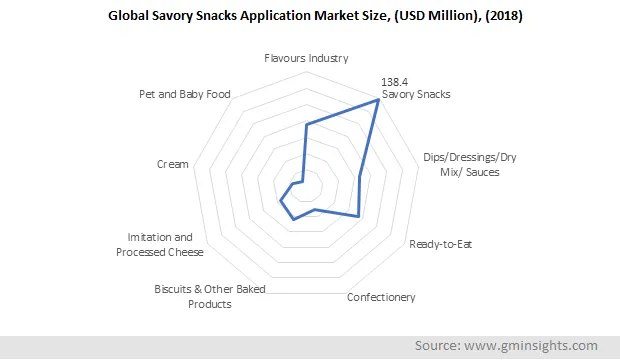

On the basis of application, the global market is segmented into flavours industry, savory snacks, dips/dressings/dry mix/ sauces, ready-to-eat, confectionery, biscuits & other baked products, imitation and processed cheese, cream and pet and baby food. The savory snacks category, especially the salty snacks segment has witnessed exorbitant growth over the past few years. The cheese snacks segment has exhibited a whopping growth of 25% for the years 2011-2016.

A popular snacking cuisine, mac and cheese is emerging in newer formats on the retail shelves. The cheese sauce used in this cuisne will be replaced by the powder format, owing to its convenience. Launch of ready-to-use and on-the-go products should increase market penetration. Popularity of Italian cuisines across the globe will further boost the cheese powder industry demand over the forecast period.

Hectic life-schedules of the time-starved consumers have increased their snacking frequencies in a day. Urbanization has impacted the snacking habits to evolved drastically. Consumers now demand snacks with a better-for-you tag. Cheese snacks fit this class as these have no added sugars and are an excellent source of protein. The value-added benefits of cheese powder as an ingredient will promote market growth.

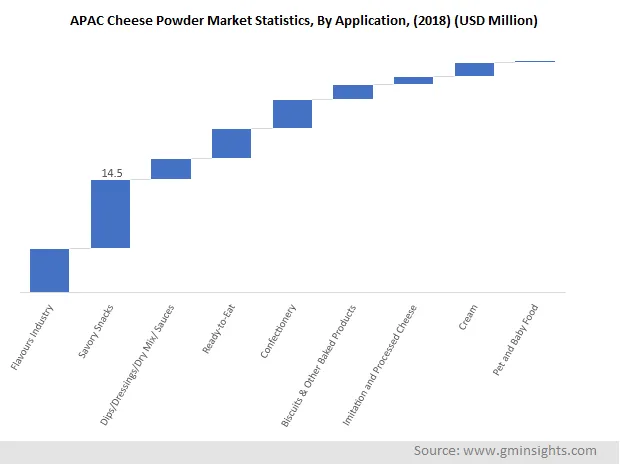

Learn more about the key segments shaping this market

International food chains are rapidly expanding their centers in Asia owing to the immense demand for fast food. This has resulted in higher consumption of Italian and Mexican food which invariantly include cheese-based dips, dressings, and sauces. A major share of Chinese cheese imports is in the form of powdered and grated formats. This reflects the fact that major consumption for cheeses in China takes place though powder and grated forms in processed food.

In India, the major shift in the foodservice industry from unorganized to organized mirrors the rise of continental and international cuisine chains. The Quick Service Restaurants (QSR) and cafes, which serve majorly serve flavopured snacks, held a cumulative share of 20% in India, for the year 2017. The QSR and cafes segment is expected to register a CAGR of 13% and 7% respectively, for the historical timeframe 2013-2017.

In countries like China and India, major dairy processors are expanding their business for cheddar. Consumers in these countries have also developed a liking for cheddar flavor and have also grown in popularity over the past few years. This trend coupled with the increasing snacks business in China and India paves an opportunistic way for the growth of the cheese powder market.

Cheese Powder Market Share

Some of the major companies operating in the cheese powder market are:

- Aarkay Food Products Ltd

- Ace International LLP

- WILD Flavors and Specialty Ingredients (ADM)

- Kanegrade Ltd

- Del-Val Food Ingredients

- All American Foods Inc

- Kerry Inc

- SM Foods

- Vika B.V

- Lactosan Group Land O’lakes, Inc

- Purisons Group

- Commercial Creamery Company

- Bluegrass Dairy & Food, Inc

- Uhrenholt A/S

- Bigtree Group

- Grozette BV

- Aum Agri Freeze Foods

- Saipro Biotech Private Limited

The global industry is characterized by a number of product launches aimed for specific applications in the market. This is in terms of improving the shelf-life stability of the products which cuts down huge costs of manufacturing and transportation. Additional costs of storage and logistics have compelled manufacturers to improve the quality of the powders. For this purpose, powder is manufactured from newer varieties such as Edam cheese.

Clean label and organic ingredients’ demand has also compelled manufacturers to innovate new cheese powders. Some manufacturers have also launched sustainable and organic cheese powders in the market. For instance, in the year 2017, Land O’lakes, Inc, which is a manufacturer of dairy ingredients, launched a line of organic cheese powders. Basically, the organic certification will enable the company to command a higher price in the market as compared to its competitors.

The cheese powder market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue in USD from 2014 to 2025, for the following segments:

By Product

- Cheddar

- Blends

- Mozzarella

- Swiss

- Blue

- Asiago

- Parmesan

- Gouda

- Feta

- Romano

- Others

By Application

- Flavours Industry

- Savoury Snacks

- Dips/Dressings/Dry Mix/ Sauces

- Biscuits & Other Baked Products

- Ready-to-Eat

- Confectionery

- Imitation and Processed Cheese

- Cream

- Pet and Baby Food

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Nordic Countries

- The Nordic Countries

- APAC

- China

- India

- Japan

- South Korea

- Australia

- Malaysia

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- South Africa

- Egypt

- UAE

Frequently Asked Question(FAQ) :

Which factors drive industry growth of cheese powder across the world?

Increasing consumption of flavoured snacks and new product launches in the flavour industry will be key driving factors for the growth of global cheese powder business.

What are the revenue projections for global cheese powder market?

The worldwide market for cheese powder is set to exceed USD 775 million by 2025, according to a new report published by Global Market Insights, Inc.

How is cheese powder produced?

Cheese powder is produced by spray drying the mixture of macerated cheese, water & ingredients such as emulsifiers & salts.

What

Higher consumption of Italian & Mexican food along with the increasing snacks market in the region is fueling the industry demand.

Cheese Powder Market Scope

Related Reports