Home > Chemicals & Materials > Specialty Chemicals > Cellulose Market

Cellulose Market Analysis

- Report ID: GMI4854

- Published Date: Nov 2020

- Report Format: PDF

Cellulose Market Analysis

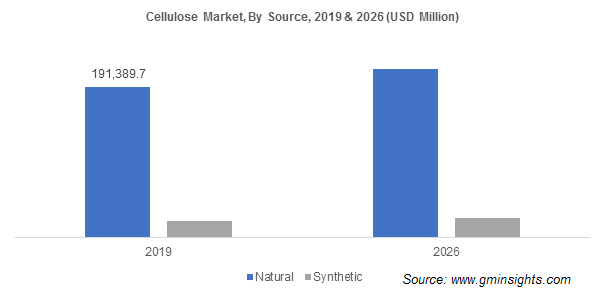

The natural source cellulose segment is estimated to hold over USD 190 billion of the total cellulose market. Over the past few years, many manufacturers are producing cellulose from non-edible plant materials, which include grass, stalks of cereal crops, and wood, to develop natural & bio-bridgeable solutions. It is also easily soluble in seawater, which is expected to solve the marine plastic waste problem as it decomposes in seawater twice as fast as conventional products.

Furthermore, processing of naturally sourced cellulose is easy and is also used in various end-use industries such as packaging and textiles, among others. The superior durability along with the ability to withstand superior compressive force will enhance the cellulose market penetration.

In 2019, the unmodified segment held over 90% share in cellulose market. Unmodified cellulose is a biodegradable & compostable compound used in numerous applications in food, pharmaceutical, cosmetics & personal care, and paints & coating industries. The growing COVID cases across the world have adversely impacted cellulose production and its related end-use industries over past few months, however, many manufacturers are using this event as an opportunity as nano cellulose-based bio sensors can be used to manufacture COVID 19 test kits.

According to the American National Institute of Health, the proposed test kit can identify spike proteins from insulating antibodies of people. The cellulose-based device is called point-of-care molecular device. These products are low-cost, lightweight, hydrophilic, and porous and it is also developed with renewable materials which is expected to positively influence the cellulose market expansion in the future.

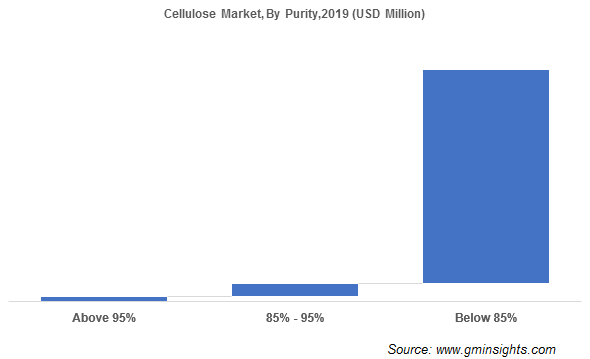

The below 85% segment will witness over 2.5% CAGR in cellulose market size, as these are used for the paper and clothing’s production owing to higher presence of cellulose in the pulp. Moreover, these types of pulp grade also used to produce paper packaging, the growing implementation of paper and flexible packaging across the FMCG sector is likely to create substantial opportunities for the paper packaging, further strengthening the product penetration.

Paper applications will witness over 3% CAGR through 2026 owing to the high usage of cellulose in paper production. It helps to reduce the drying time of the paper. It improves the paper quality, making it is less porous & translucent with higher printing quality. The cellulose also requires lesser raw materials and energy to produce paper. The cellulose will also support light weighting, improving energy efficiency in transportation.

Cellulose foams are being used in the production of packaging reels to substitute polystyrene-based products. The key advantage of using cellulose instead of wood-based pulp fibers is that CNF can reinforce the thin cells in the starch foam, replacing polymer reels manufactured using fossil fuels with a renewable material that decreases weight. This will have a positive effect on cellulose market growth.

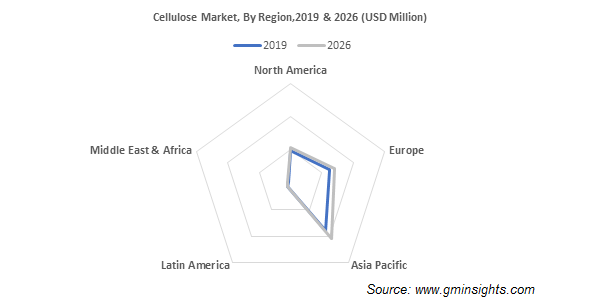

Asia Pacific will witness over 3% CAGR through 2026 in cellulose market. A substantial demand for printed books, clothing’s, pharmaceutical products and packaging, especially in essential goods, owing to the rising disposable income and standard of living will essentially contribute toward the high revenue generation. Moreover, Asia Pacific has seen significant growth in the textile industry owing to increasing in consumer inclination towards the comfortable clothing, which result in increasing the demand for high-value fabrics such as hemp, silk and viscose.

The regional paper and paperboard industry gained a significant share during the last few years, holding 47.4% of the production in 2016 and reaching 48.1% in 2019. Moreover, improvements in the education system and the growing demand for printed books across developing countries including India and Thailand will propel the cellulose market revenue over the forecast span.