Summary

Table of Content

Cannabis Vaporizer Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cannabis Vaporizer Market Size

The global cannabis vaporizer market size was estimated at USD 5.7 billion in 2024. The market is expected to grow from USD 6.5 billion in 2025 to USD 21.4 billion in 2034, at a CAGR of 14.2%, according to Global Market Insights Inc.

To get key market trends

The global push for cannabis legalisation, particularly for recreational use, is greatly expanding the consumer base for vaporizers. With the laws more relaxed around the world, new users are tapping into a new market and are more open to new methods of consumption. With their discreet nature, ease of use and often easier to accept socially compared to smoking, vaporizers are the first consideration for first time or casual consumers.

Legalization has also opened commercial avenues for vendors and manufacturers. Businesses can invest in product development, product marketing, and product distribution with more certainty due to the defined regulatory framework. Licensed dispensaries and e-commerce distributors can produce and sell a wide variety of vaporizer products such as pens and tabletop versions. As the market for vaporization evolves, technology continues to improve, consumer choice expands, there is improved product safety and liability, developments made by both competitors and industry leaders push the market forward.

As public awareness about the risks associated with smoking increases, an eager consumer base seeks out safer alternatives. Vaporization can thermalize cannabinoids without the resulting harmful byproducts that come from combustion. This is appealing for health-conscious recreational users who prefer a healthier option or to precisely dose just enough, as well as their medical patient counterparts that want to minimize the irritation of their lungs, stomach, and throat.

Portable cannabis vaporizers are taking the market by storm due to their convenience that easily fit into appealing modern lifestyles. These devices are small enough to stow away easily, while also allowing users to use them discreetly and on-the-go while enjoying cannabis without the need for setup or bulk of traditional methods. This means convenient usage for quickly approachable millennial and Gen-Z consumers, professionals, and for those looking for maximum flexibility and subtlety while fulfilling their cannabis consumption habits, whether that's to take a break during a long meeting.

Europe leads market share in cannabis vaporizer products because of well-defined bilateral frameworks notably around medical cannabis environment for price wave acceptance. This clarity supports consistent product standards promotes innovation and enables integration into health and wellness channels. European consumers are becoming more interested in vaporizers due to their cleaner, non combustion experience. The regions emphasis on wellness sustainability and discreet use aligns with the characteristics of modern vaporizer devices increasing demand across both therapeutic and recreational segments.

Cannabis Vaporizer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 5.7 Billion |

| Market Size in 2025 | USD 6.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 14.2% |

| Market Size in 2034 | USD 21.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Legalization momentum | Increasingly permissive legislation is opening new potential consumer markets which will lead to a new industry boom. |

| Rising adoption of safer alternatives to traditional cigarettes | Health-conscious users are switching to vaporizers because they are a cleaner, smoke-free alternative for habit, and vice feature. |

| Advancements in technology | User experience, precision dosing, and smart features are enhancing product differentiation. |

| Pitfalls & Challenges | Impact |

| Health & safety concerns | Vape-related illnesses and increased regulations are undermining consumer trust and market stability. |

| Environmental impact | Disposables vape waste and non-recyclable materials are triggering sustainability and compliance concerns. |

| Opportunities: | Impact |

| Smart vaporizers & AI integration | Smart devices offer tailored experiences and user data-driven insights. |

| Medical partnerships | Collaboration with health care professionals can legitimize vaporizers and increase therapeutic use. |

| Market Leaders (2024) | |

| Market Leaders |

13% market share |

| Top Players |

The collective market share in 2024 is 35% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest Growing Market | Europe |

| Emerging Country | Germany, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Cannabis Vaporizer Market Trends

The vaporizer market is growing as cannabis law continue to liberalise across the globe. This increase in cannabis legalisation both opens consumer access and encourages investment and innovation by manufacturers. When the regulations around cannabis are clearer, manufacturers feel more confident to invest their resources to develop and market new vaporizer products.

- Regulations support the emergence of more vaporizer varieties and more vaporizing based quality products, which benefits consumers overall. The legal process is allowing both emerging brands and established brands the opportunity to grow exponentially in this environment.

- Modern vaporizers are becoming technological devices with features like variable temperature control, Bluetooth connectivity, electronic usage, feedback, etc. Vaporizers are becoming a lifestyle enhancement.

- The state-of-the-art vaporizers are also improving user experience by not only offering personalisation, but also safety and convenience. Tech-savvy clientele like the idea of vaporizer being more of a smartphone type device gadget instead of smoking device, thus pushing the market towards advanced vaporizers.

- The increasing popularity of cannabis concentrates and oils is impacting the design of vaporizers for concentrates and other products. These devices are designed specifically for concentrates providing an overall stronger effect with a smaller amount of material, making them appealing to cannabis users that are more experienced.

Cannabis Vaporizer Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is divided into portable and tabletop. In 2024, portable held the major market share, generating a revenue of USD 4.3 billion.

- The portable cannabis vaporizers market surging in popularity due to an unmatched level of convenience and discretion. Consumer demands ease of use and portability, especially for those with an active lifestyle, as well as those who need to consume in public or shared spaces, and portable vaporizer will allow you to combine both.

- It allows a smoke free experience while creating little to no smell, which also makes it easy for recreational users to avoid detection and allows medical patients to attain or control their dosing without being out in the open.

- Technological advancements have been instrumental in the popularity of portable vaporizers. Manufacturers are constantly redesigning these devices with features like accurate temperature control, rechargeable long-lasting batteries, and even Bluetooth connections for app customization.

- In addition to improving overall user experience, these advancements also entice more reasonable device users who understand the value of personalization and performance. Combining slick design with intelligent functionality has raised portable vaporizers from tools to high end gadgets and allowed them to be positioned as desirable brands in an abundant and highly transient market.

Learn more about the key segments shaping this market

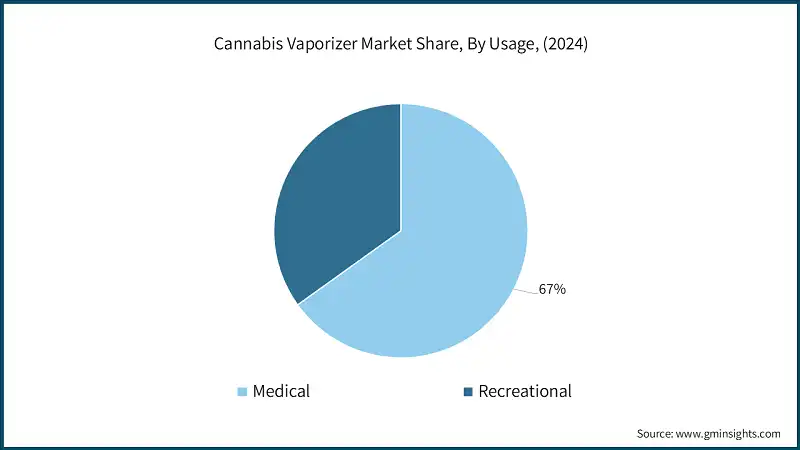

Based on the usage, the cannabis vaporizer market is segmented into medical and recreational. The medical segment held the largest share, accounting for 67% of the global market in 2024.

- Medical cannabis vaporizers are becoming a powerful force in the growing cannabis market due to consumer demand, ongoing technological advancement, and changing perspectives in healthcare. Consumers prefer vaporizers over traditional modes of smoking, because they provide a more controlled administration of cannabinoids, which can be processed and cleaned up more cleanly than other methods of cannabis administration.

- This is especially important aspect for many consumers as they want to minimise harmful byproducts and have more conscious dosing practices, especially for people managing chronic conditions such as pain, anxiety or various neurological conditions. As people become aware of the benefits of cannabis for many health-related solutions, vaporizers will continue to be well utilised by patients and healthcare providers.

- The increase in medical use is bolstered by the advances in vaporizer technology. There are devices with temperature control, improved battery life, and a user-friendly interface to meet diverse patient needs.

- This helps to track dosage and usage from a mobile device for an individualised approach that reflects current healthcare transitions. This innovation simply improves therapeutic results by bringing vaporizers closer to many more patients including older patients and younger patients who are more willing to use technology.

Based on the ingredient, the cannabis vaporizer market is segmented into dry-herb, oil and hybrid. The dry-herb segment held the largest share.

- Consumers prefer dry herb vaporizers for their potential to provide a full cannabinoid and terpenoid profile of whole flower cannabis, along with other emerging trends towards natural and unprocessed formats which maintain flavour, potency and therapeutic value, especially from a wellness and medical perspective.

- Innovations in connection heating, precise temperature control, and portable configurations have enhanced dry herb experiences, enabling users to control their vaping sessions for optimum compound extraction, establishing dry herb vaporizers as the preferred choice for novice and experienced users alike.

Looking for region specific data?

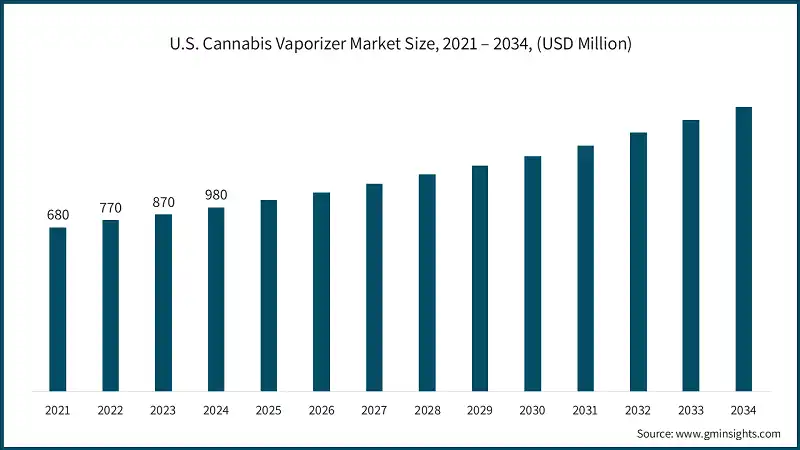

In 2024, the U.S contributed significantly to the North America cannabis vaporizer market, generating revenue of USD 980 million.

- The market in the U.S. is seeing a steady growth, supported by market expansion of cannabis legalization and shifting consumer preferences toward discreet and smokeless consumption methods. Vaporizers are becoming increasingly popular because of their ease of use and being a healthy option compared to others among wellness and medical consumers.

- The market is experiencing remarkable traction as legalization moves forward, and consumer understanding improves. This creates a growing consumer interest for new products especially for those looking for cleaner inhalation experience when using the products that are federally regulated in recreational or wellness context. There’s also growing interest for premium and tech-enabled devices as well as disposable formats for convenience.

Europe cannabis vaporizer market is leading the market and growing at a CAGR of 15.4% during the forecast period.

- Europe's systematic regulatory landscape, along with countries having stabilised medical cannabis plans, has created the ideal environment for vaporizer uptake in the region. The clinical preference for non-combustibles is fulfilling demand, as vaporizers are increasingly recognised as a safer and more accurate form of delivery for therapeutic purposes.

- European consumer is opting more for vaporizer devices due to cleaner inhalation, portability, and discretion. These trends are often part of the general wellness trend that exists across the continent and are fuel by the continued exploration of the benefits of CBT based products, due to which there is innovation and device design and a growing array of product distribution through pharmacies, specialty stores, and online outlets.

Asia Pacific cannabis vaporizer market is growing at a CAGR of 11.4% during the forecast period.

- The region’s young, tech-savvy population is propelling a rapid adoption of advanced vaporization technology, app connectivity, customizable heating profiles and convenient portability offer users modern health-related alternatives to traditional consumption.

- Increased consumer interest in CBD-infused wellness products is opening up demand for vaporizers across multiple consumer segments. Robust e-commerce infrastructure allows for wider access to quality devices, and market growth of vapes can thrive even in jurisdictions with little physical retail presence.

Latin America cannabis vaporizer industry is growing at a CAGR of 14.7% during the forecast period.

- As structured cannabis regulations become more widespread in Latin America, the regions market share is rising. Regulatory improvements are creating demand for vaporizers as a safer and more regulated delivery methods for cannabis and cannabis related products, particularly in countries pursuing world class clinical and Wellness practices with cannabis. As Latin America develops in its therapeutic market, product development is concentrating on portability, precision and compliance.

- The continuing focus on public awareness means consumers are beginning to notice the health impacts of vaporization, especially health-conscious and wellness consumers. Retail channels, physical and digital are continuing to grow to meet additional vaporizer demand, with portable vaporizers projected to capture and grow the market.

Cannabis Vaporizer Market Share

The top 5 companies in the market are Pax Labs, DaVinci Vaporizer, Grenco Science, STORZ & BICKEL, Boundless Technology contributing around approximately 35% of the market in 2024.

These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Pax slabs is one of the market leaders of cannabis vaporizer products, known for its simple and elegant designs, as well as its integration of smart technology into its easy-to-use platform. They value product reliability, product safety, and discretion, to provide premium portable vaporizers for tech savvy consumers. It has numerous retail and e-commerce partners, and its focus on user driven transformation and sustainability has given Pax a reputation of a trusted brand in both medical and recreational cannabis vaporizer products.

DaVinci vaporizer creates high quality vaporizers made with precision engineering, purity, control and discretion. It caters to health focused users looking for high performance products with a clean vapor path and each device has temperature customization. The brand is anchored in minimalist design and durable devices with great performance. It continues to focus on sustainable product development and educating consumers, leading to consumer trust, reliability and comfort.

Cannabis Vaporizer Market Companies

Major players operating in the cannabis vaporizer industry are:

- Apollo AirVape

- Arizer

- AVEO

- Boundless Technology

- CCELL

- DaVinci Vaporizer

- DynaVap

- Elf Bar

- Grenco Science

- Juul Labs

- KandyPens

- O.pen-Slang Worldwide

- PAX Labs

- Smoke Cartel

- STORZ & BICKEL

Apollo AirVape has developed portable vaporizers that integrate superior heating technology with minimalist aesthetics. The company focuses on consumers who fit a lifestyle-oriented model, and appreciate the convenience and performance offered by Apollo AirVape. The company is committed to sustainable design, and consumer satisfaction. An additional factor that sets the company apart from other vaporizers is that the devices can be used with both dry herbs and concentrates.

Grenco Science is a lifestyle driven vaporizer brand primarily recognised for its G Pen line of products. The range of vaporizers incorporates a unique multifunctional design and offers a solid value per price point. The company facilitates the demand of an extensive group of people through hybrid compatibility and user centred design. It continues to sell vaporizer by collaboration, consumer preference of comfort, discretion and cultural relevance across multiple influential markets.

Cannabis Vaporizer Industry News

- In August 2025, PAX Labs has announced the launch of FLOW, a premium cannabis vaporizer for enthusiasts and casual users alike. With hybrid heating, 600% better airflow, and fast-charging USB-C cables, FLOW produces smooth, flavorful vapor without combustion. Flow delivers vaporization at scale with simple clean-up, a 0.5g oven, and compact design and effective performance. FLOW is being offered in Onyx and Greenstone and represents a move to broaden the footprint of flower vaporization.

- In August 2024, STORZ & BICKEL launched its inaugural Smokeless September Challenge, asking consumers to abstain from combustion for the month and vaporize using its new device, the VENTY. The challenge aims to inform users about the health and efficiency benefits of vaporization while providing exclusive discounts and asking participants to document their experience online with #SmokelessSeptember.

- In March 2024, CCELL attended Spannabis in Barcelona, where they displayed their newest vaporizer hardware innovations in exciting new technology and designs designed specifically for the cannabis industry. The company exhibited its EAZE, SOLA, and EVOM battery series and the CCELL EVO cartridge which includes new ceramic heating for even more enhanced flavour and higher efficiency. These products represent CCELL's promise to elevate the vaping experience with precision engineering and innovation driven by the consumer experience.

The cannabis vaporizer market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Portable

- Tabletop

Market, By Ingredient

- Dry herb

- Oil

- Hybrid

Market, By Heating Method

- Conduction

- Convection

- Induction

Market, By Power Source

- Battery-powered

- Plug-in/Electric

- Manual

Market, By Usage

- Medical

- Recreational

Market, By Price

- Low

- Medium

- High

Market, By Distribution Channel

- Offline

- Online

- E-commerce

- Brand website

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the cannabis vaporizer market?

Key players include Pax Labs, Arizer, Boundless Technology, DaVinci Vaporizer, Grenco Science, STORZ & BICKEL, CCELL, Apollo AirVape, KandyPens, Juul Labs, O.pen-Slang Worldwide, and Smoke Cartel.

What is the estimated revenue of the cannabis vaporizer industry in 2025?

The market is projected to generate USD 6.5 billion in 2025.

What is the projected value of the cannabis vaporizer market by 2034?

The market size for cannabis vaporizer is expected to reach USD 21.4 billion by 2034, growing at a CAGR of 14.2%.

What was the valuation of the medical usage segment in 2024?

The medical segment accounted for 67% of the global market in 2024.

Which region leads the cannabis vaporizer industry?

Europe led the global market in 2024, supported by a strong regulatory framework and wellness-driven adoption, and is also the fastest growing region with a CAGR of 15.4%.

How much revenue did the portable vaporizer segment generate in 2024?

Portable vaporizers generated USD 4.3 billion in 2024, dominating the market with strong consumer adoption.

What is the market size of the cannabis vaporizer market in 2024?

The global market size for cannabis vaporizer was USD 5.7 billion in 2024.

Cannabis Vaporizer Market Scope

Related Reports