Summary

Table of Content

Bulletproof Vest Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Bulletproof Vest Market Size

Bulletproof Vest Market size was USD 1.45 billion in 2019 and will grow at a CAGR of 6.7% between 2020 to 2026. The rising focus of defense agencies on enhancing soldier survivability will positively influence the industry growth.

Technological advancements with the usage of para aramid textile, titanium plating, and other nanotechnology materials to manufacture vests will surge product penetration in the defence industry. Further, introduction of modular tactical vests and several military modernization programs, such as the PONARS Eurasia are among some recent trends promoting the market expansion.

To get key market trends

Increasing territorial claims and cross border tension across the globe are surging the demand for ballistic protection equipment. Both developed and emerging economies have subsequently increased their expenditure on defense modernization with shifting focus toward advanced military equipment. In 2020, the Chinese People's Liberation Army (PLA) declared its plan to procure around 1.4 million units of superior quality body armors over the next two years. Protecting workforce from frugalities of war and thriving investments in product innovation and advancement are the other key factors boosting the bulletproof vest market growth.

Bulletproof Vest Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 1.44 Billion (USD) |

| Forecast Period 2020 to 2026 CAGR | 6.7% |

| Market Size in 2026 | 2.30 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Bulletproof Vest Market Analysis

Flexible ballistic vests segment will account for over 55% market share by 2026 owing to the lightweight feature of these variants. Flexible ballistic vests are made of one or multiple ballistic materials that include p-aramid, m-aramids, ceramic materials, and other fibers. These fibers make them an ideal choice for professions, where comfortable and flexible movements are given prime importance.

These include law enforcement officers, bureaucrats, private security personals, businessmen, and several High Networth individuals (HNI) as the key users of flexible ballistic vest in the industry.

Level III based bulletproof vest market is likely to witness more than 6.5% growth rate through 2026 as it provides protection against 9-mm handguns, .357 SIG flash pistol, 44 magnums, and 7.62 mm Nato rifle and is lightweight in nature. Growth in the segment can also be attributed to increasing demand from military and law enforcement users. Manufacturers should focus on product innovations and advancements to offer the highest level of protection against several caliber bullets, which are prevalent among various end-use sectors.

Overt ballistic vests segment is expected to hold 65% market revenue share by 2026 due to their growing usage by military, police as well as security personnel. These vests are worn over the clothing and can also be used as carriers for armor plates when required. Overt bulletproof vests are often heavier and larger as they are engineered using various layers of Kevlar.

These vests are mainly available with protection levels III and IV under National Institute of Justice; and levels 5, 6 and 6a under GOST; thus, their ability to offer a higher level of protection from heavy gunfire and large spikes/blades will increase the market demand.

Learn more about the key segments shaping this market

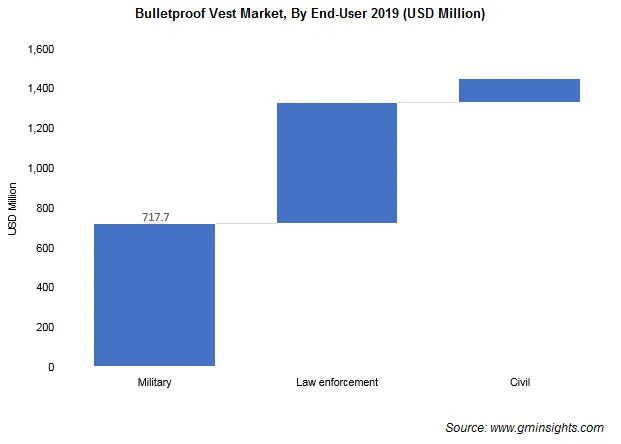

Bulletproof vest demand from military end use generated around USD 717 Million in 2019 impelled by increasing government spending to strengthen military capability. Several defense organizations in countries, such as the U.S., France, and Russia, are laying high emphasis on enhancing personal protection through advanced armor and focusing on upgrading their conventional protective equipment with modernized bulletproof vest.

Further, the demand in the civilian segment is likely to grow significantly owing to increasing burglaries, robberies, and home invasions.

Learn more about the key segments shaping this market

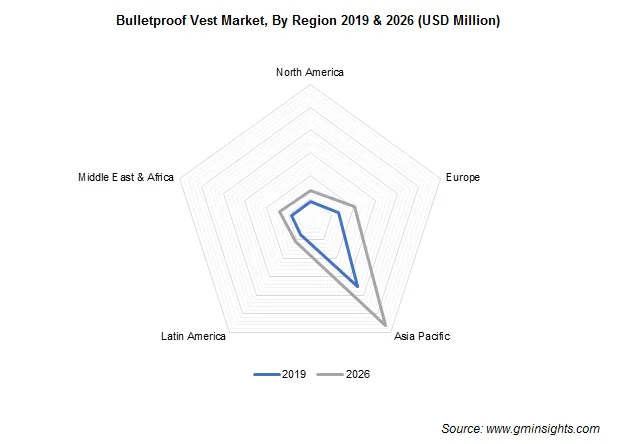

North America bulletproof vest market accounted for 10% share in 2019 and is estimated to grow at a significant rate from 2020 to 2026. Several military modernization programs will drive the regional market growth trends. The programs mainly include the Soldier Protection System -Torso & Extremity Protection (SPS-TEP) program that supports the use of full body armors for soldiers. In addition to these initiatives, higher military spending across the U.S. and Canada will further surge the market penetration.

Defunding police as well as lockdown protest due to black lives movement and coronavirus pandemic has significantly increased product demand to safeguard police and other law enforcement officers across several states in the U.S.

Bulletproof Vest Market Share

The bulletproof vest manufacturers are undergoing technology advancements to improve product differentiation to obtain several contracts from defense organizations and strengthen their industry foothold. For instance, in May 2020, Craig International Ballistics obtained a contract to supply bulletproof vest for Australian troops. The initial contract of USD 1 million includes the delivery 750 soft armor inserts to the Australian Defense Force (ADF).

The key bulletproof vest market participants include

- EnGarde

- Imperial Armour

- PPSS

- Survival Armor

- U.S. Armor Corporation

- BAE Systems

- Safariland

- Sarkar Defense Solution

- Point Blank Body Armor

- VestGuard UK

- Armor Express

- DuPont

- Sioen

- Honeywell International

- C.P.E. Production

This market research report on bulletproof vest includes in-depth coverage of the industry with estimates & forecast in terms of volume in Units and revenue in USD Million from 2016 to 2026, for the following segments:

Market, By Product

Flexible ballistic

- Hard ballistic/ Armor plate

Market, By Protection level

Level I

- Level II

- Level III

- Level IV

Market, By Application

Covert

- Overt

Market, By end-user

Military

- Law enforcement

- Civil

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

- Kuwait

Frequently Asked Question(FAQ) :

Which product will emerge lucrative for the market share through 2026?

Flexible ballistic vests segment will emerge lucrative for the market with a targeted revenue share of 55% by 2026, owing to the product

How will level III bulletproof vests segment fare through 2026?

Level III segment will register 6.5% CAGR through 2026, due to the product

What factors will push the demand for overt ballistic vests?

Rising usage of these vests by the police, security, and military personnel will push the product demand. Overt ballistic vests segment may hold 65% revenue share by 2026.

Why will military sector prove lucrative for the bulletproof vests?

Bulletproof vest will increase in the military sector due to rising government spending to strengthen military capabilities. Military end use segment held USD 717 million in 2019.

Where will bulletproof vest witness high demand?

The product will witness massive demand in North America owing to the existence of numerous military modernization programs. North America accounted for 10% revenue share in 2019.

How much did the global bulletproof vest market size account for in 2019?

The market size of bulletproof vest was valued over USD 1.45 billion in 2019.

How much growth will the bulletproof vest industry share witness during the forecast timeframe?

The industry share of bulletproof vest is projected to expand at 6.7% CAGR during 2020 to 2026.

Bulletproof Vest Market Scope

Related Reports