Home > Packaging > Industrial Packaging > Bulk Packaging > Bulk Container Packaging Market

Bulk Container Packaging Market Analysis

- Report ID: GMI1127

- Published Date: Jul 2019

- Report Format: PDF

Bulk Container Packaging Market Analysis

Flexitank segment will witness highest gains over the forecast time period. These tanks are an alternative to ISO tank containers for shipping oils, wines, food grade liquids and nonhazardous chemicals across the globe. Traditionally, transporting and storing liquids has been expensive and complex. However, flexitank offers a more agile and cost effective approach for storing and transporting liquid and dry bulk products.

Flexible intermediate bulk container (FIBC) accounted for major chunk of the global bulk container packaging market share in 2018. These containers can carry more than thousand times its own weight and can also be customized as per its application. The industry growth for this segment is mainly attributed to increasing product demand for transporting building materials, polymers, detergents and powdered non-hazardous chemicals. It is available in a wide variety of conductive, antistatic, flame retardant and dissipative bags which serves a wide range of packaging applications. In addition, increasing industrial production and its efficient transportation will boost the business growth significantly by 2025. Also, these containers also have excellent recycling and reconditioning possibilities which will further boost its demand across the globe.

Food & beverage accounted for more than 30% of the global industry size in 2018. Rapidly growing population mainly in Asia Pacific and the Middle East has significantly triggered food product demand at low cost. Increasing socio-economic factors and changing spending patterns in emerging economies has substantially propelled tea, coffee, wine and beer demand. These trends will in turn boost import/export activities in food industry to transport products without contamination, which will complement business growth by 2025.

Bulk container packaging market share for chemicals is anticipated to expand at over 10% CAGR by 2025. Increasing demand for transporting semi-finished products, lubricants, materials and minerals will propel industry growth. In addition, drifting chemical manufacturer focus towards setting up their manufacturing facilities in Asia Pacific on account of easy raw material availability, favoring government policies and low operational cost has increased chemical trade to meet the propelling chemicals demand across the globe. According to World Integrated Trade Solutions, China exported chemicals worth USD 14 trillion to North America and worth USD 39 trillion to East Asia and Pacific in 2017. These trends are likely to continue which will positively impact the industry growth rate by 2025.

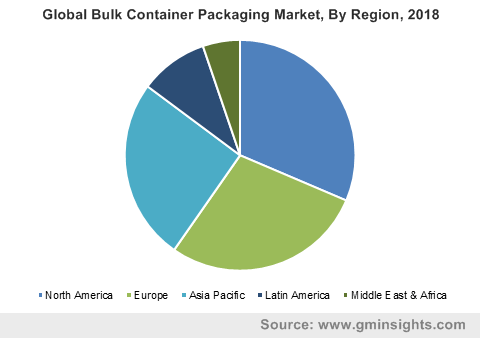

North America led the overall bulk container packaging market size in 2018 with gains of over 9.5% expected in the forecast timeframe. The regional growth is primarily driven by increasing corn, oilseeds, grains such as soybean, and feeds demand from the U.S. Furthermore, one third of the total agricultural land in the U.S accounts particularly for exports. The region is engaged in exporting alcoholic beverages including beer and wine globally in large volume. According to Wine Institute, the U.S. exported wine worth USD 1.18 billion to Hong Kong in 2018, with gains of over 9% from the previous year. Such trends are expected to complement business growth by 2025.

Asia Pacific will witness gains close to 11% over the forecast time period. Rising population primarily in China and India has substantially propelled the overall food & beverage business in the region. Furthermore, upgrading consumer lifestyles in Asia Pacific countries, due to increasing consumer disposable income has triggered demand for the fruit juices, wine, beer and coffee. In order to meet the growing demand for aforementioned food products in the region, the production and supply for food products are on rise, which will have positive influence on the industry growth over the forecast timeframe.