Summary

Table of Content

Brown Commercial Seaweed Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Brown Commercial Seaweed Market Size

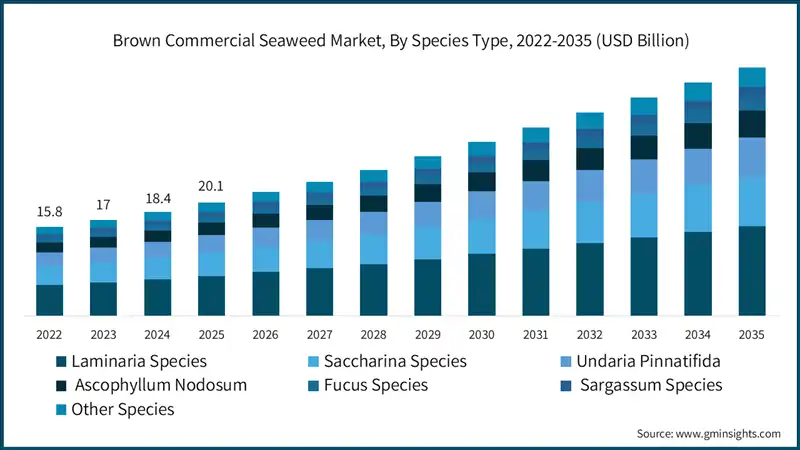

The global brown commercial seaweed market size was valued at USD 20.1 billion in 2025. The market is expected to grow from USD 22 billion in 2026 to USD 44.1 billion in 2035, at a CAGR of 8% according to latest report published by Global Market Insights Inc.

To get key market trends

- The brown commercial seaweed market is flourishing with rapid growth and increasing demand from pharmaceuticals and other industries. Species of brown seaweed, mainly Laminaria, Ascophyllum and Fucus, are important in these sectors due to the presence of nutrients, and bioactive compounds. The market trends indicate that consumers are increasingly preferring natural and sustainable ingredients which is furthering the brown seaweed products.

- In agriculture, brown seaweeds act as biofertilizers and soil conditioners, thereby promoting plant growth, improving crop yields, and enhancing resistance to environmental stresses. Their action as a natural source of plant growth hormones including cytokinins and auxins really play a crucial role in sustainable agriculture. In food applications, brown seaweed is identified to have high dietary fiber, minerals, and antioxidants, thus making brown seaweed a good additive in health foods, snacks, and functional beverages.

- The bioactive compounds extracted from brown seaweed find applications in the cosmetics and pharmaceutical industries owing to their anti-inflammatory, antioxidant, and anti-aging properties, which together form the basis for skincare products, dietary supplements, and therapeutic formulations. Benefits to the market include its environment-friendly, renewable, and multifunctional nature. Growing trends of plant-based and natural products provide additional support for this market.

Brown Commercial Seaweed Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 20.1 Billion |

| Market Size in 2026 | USD 22 Billion |

| Forecast Period 2026 - 2035 CAGR | 8% |

| Market Size in 2035 | USD 44.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for natural and sustainable products | Consumer preference for eco-friendly, plant-based ingredients boosts the use of brown seaweed in food, cosmetics, and agricultural sectors. |

| Expanding applications in agriculture | The use of brown seaweed as a biofertilizer and soil conditioner promotes sustainable farming, increasing its adoption among farmers seeking eco-friendly solutions. |

| Innovations in food and pharmaceutical industries | Development of functional foods, dietary supplements, and therapeutics using bioactive compounds from brown seaweed fuels market growth. |

| Pitfalls & Challenges | Impact |

| Environmental and harvesting challenges | Overharvesting and environmental changes can threaten seaweed supplies, leading to supply chain disruptions and sustainability concerns. |

| High production costs | Cultivation, harvesting, and processing of brown seaweed can be costly, impacting profit margins and price competitiveness. |

| Opportunities: | Impact |

| Technological advancements | Innovations in cultivation, harvesting, and processing techniques can reduce costs and increase yield, enhancing scalability. |

| Product diversification | Developing new applications such as biodegradable packaging, biofuels, and advanced nutraceuticals can open additional revenue streams. |

| Market Leaders (2025) | |

| Market Leaders |

7.4% Market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Europe |

| Emerging countries | Germany, UK, France, Italy |

| Future outlook |

|

What are the growth opportunities in this market?

Brown Commercial Seaweed Market Trends

- The brown commercial seaweed is gaining strength by different trends typical in a dynamic growth mode. The most crucial factor behind the booming business of this industry lies in technological advancements in cultivation, harvesting, and processing techniques, which result in much better yield, improved quality, and cost efficiency. Automated farming systems, seaweed aquaculture farms, and biorefinery technologies allow for mass production without significantly affecting the environment.

- Governments and international organizations are starting to build their frameworks with general industry-specific guidelines to put in place conditions for environmental conservation, safety, and quality standards of the product. These regulations help to create consumer confidence in and widening the aspect of market extension within areas such as Europe and North America, where standards are very stringent. Certification schemes for organic and sustainable harvesting also add credibility to markets while attracting eco-minding consumers.

- Innovation in products remains a major developing trend as most companies create many applications for brown seaweed. In food, functional foods, dietary supplements, and flavor enhancers are examples of such innovations. In cosmetics, seaweed extracts are found in skin care products with good antioxidant and anti-inflammatory properties. Using these bioactive compounds, the pharmaceutical industry tends to draw therapeutic applications for developing anti-inflammatory and immune-boosting agents. New applications include, but are not limited to, biodegradable packaging, biofuels, and agricultural biostimulants because of the demands of sustainability.

Brown Commercial Seaweed Market Analysis

Learn more about the key segments shaping this market

Based on species type, the brown commercial seaweed market is segmented into laminaria species, saccharina species, undaria pinnatifida, ascophyllum nodosum, fucus species, sargassum species, and other species. Laminaria species dominated the market with an approximate market share of 35.3% in 2025 and is expected to grow with a CAGR of 8.3% till 2035.

- Laminaria and saccharina species, the most significant varieties of brown seaweed, are marketed mainly for their high alginate content, which secures their high demand from food, pharmaceutical and industrial applications. As consumers are becoming increasingly health-conscious, products made from Laminaria and Saccharina are becoming popular today, dietary supplements and functional foods are among the many products offered.

- Undaria pinnatifida or wakame are picking up a bit of market traction considering the health benefits it presents together with its many culinary uses especially in Asian types of food. Meanwhile, the exploration of bioactive compounds contributes to the innovation of nutraceuticals and skin good products. Growth in this sector is being further fueled by the opening of export markets and improved processing techniques.

- Other species like ascophyllum nodosum, fucus, and sargassum are being eyed for their unique bioactive properties. Ascophyllum nodosum is used almost universally as a natural fertilizer or biostimulant in agriculture with the sustainability focus of the market. Fucus and sargassum have been incorporated increasingly into biofuel, biodegradable packaging, and formulations in the pharmaceutical sector.

Learn more about the key segments shaping this market

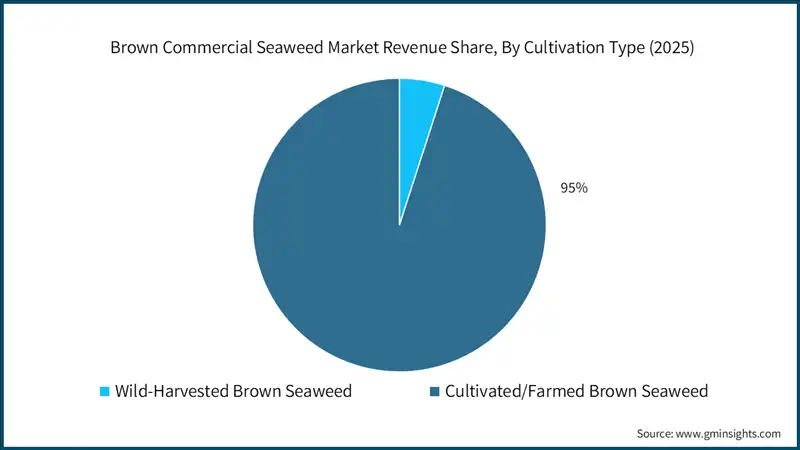

Based on cultivation type, the brown commercial seaweed market is segmented into wild-harvested brown seaweed and cultivated/farmed brown seaweed. Cultivated/farmed brown seaweed held the largest market share of 95% in 2025 and is expected to grow at a CAGR of 8.1% during 2026 to 2035.

- The segment of wild-harvested brown seaweed is anticipated to grow steadily due to increasing awareness among consumers about sustainable, eco-friendly products. Such consumers are. an increasingly concerned form of society regarding the ways of producing food and resorting to buying harvested from wild possession over the advantages of being much more eco-friendly than the cultivated ones. This segment will also see gain based on the sensory attributes that customers in the premium and gourmet markets ascribe to them.

- Compared with those from the wild, the cultivated/farmed brown seaweed segment would grow at a much faster pace, based on technological developments in aquaculture, as well as the growing requirement of quality-consistent products among consumers. Increasing yield, better quality, and lower environmental impacts compared to wild-harvested brown seaweed are some benefits of cultivated brown seaweed. More, emerging farm-gate and direct-to-consumer models in key markets will further profit this segment-moved by the trend of sustainability in locally sourced products.

Based on form, the brown commercial seaweed market is segmented into dried seaweed products, fresh seaweed, liquid extracts, and purified/refined extracts & derivatives. Dried seaweed products segments dominated the market with an approximate market share of 59.5% in 2025 and is expected to grow with a CAGR of 8.1% up to 2035.

- The dried seaweed products segment is seeing rapid growth due to shelf-life stability, convenience, and versatility in food and industrial applications. Increasingly consumers and food manufacturers are selecting dried seaweed because it is easy to store and carry and is nutritionally rich. Demand for dried seaweed in Asian dishes, snacks, and health supplements is gaining worldwide momentum especially with consumers requesting natural, plant-based ingredients. Innovations in drying technology are enhancing flavor and quality retention of these products thus furthering their popularity.

- Fresh seaweed is getting traction in markets that emphasize organic and minimally processed foods, driven by consumers seeking the freshness and natural aspect of ingredients with retained nutrients. On the other hand, liquid extracts and refined derivatives are experiencing increasing demand for functional foods, cosmetics, and nutraceuticals due to their concentrated bioactive compounds. These extracts possess attributes like high bioavailability, ease of incorporation into different formulations, and health advantages such as antioxidant and anti-inflammatory properties. The overall trend is to indicate growing preference for diversified forms of seaweed tailored to meet health-conscious consumers and innovative product developers' needs.

Based on application, the brown commercial seaweed market is segmented into pharmaceuticals & nutraceuticals, animal feed & aquaculture, industrial applications, agriculture, food & beverages, and cosmetics & personal care. Pharmaceuticals & nutraceuticals segments dominated the market with an approximate market share of 30.2% in 2025 and is expected to grow with a CAGR of 8.3% through 2035.

- The pharmaceuticals and nutraceuticals sector is one with strong growth potential for brown seaweed due to its richness in bioactive compounds. Their benefits-aid against inflammation or bolster the immune response or modulate cancer development-are gaining attractiveness for incorporation into health supplements, functional foods and medicines. With the advent of research that finds newer health benefits, this domain will continue to mark significance in the growth of brown seaweed for many years ahead.

- Brown seaweed is beneficial as a feed supplement in livestock and aquaculture due to the vitamins, minerals, and dietary fibers which exert health-maintaining and growth-promoting actions upon livestock. The demand is accelerating; farmers want more feed ingredients that are sustainable and natural to yield their productive capabilities and decrease synthetic additives. Industrial applications of brown seaweed such as bioplastics, biofertilizers and biofuels are now getting the impetus because of increased global interest in environmentally friendly and renewably sourced raw materials.

- The agriculture sector utilizes brown seaweed as a bio-stimulant and soil conditioner for crop growth as well as soil health due to the increasing acceptance of organic and sustainable farming practices. In food and beverages, the natural flavor, nutritional benefits, and functional properties of seaweed are driving an increased use of seaweed in health foods, snacks, and beverages. The cosmetics and personal care industry utilizes seaweed for its moisturizing, anti-aging, and anti-inflammatory properties, which has seen an explosion in products related to skincare, haircare, and body care. The increasing consumer preference for natural and ecological products across these various applications further intends to support the sustained growth of the brown seaweed market.

Based on distribution channel, the brown commercial seaweed market is segmented into direct sales (B2B), distributors & wholesalers, online B2B platforms, and retail & direct-to-consumer. Direct sales (B2B) segments dominated the market with an approximate market share of 55.4% in 2025 and is expected to grow with a CAGR of 8.1% till 2035.

- The distribution channels for the brown commercial seaweed market are undergoing substantial changes and transformations due to changing consumer tastes and technological improvements. Direct sales (B2B) continue to be an important channel, particularly for large-scale industrial buyers such as pharmaceutical companies, nutraceutical manufacturers and agricultural firms. This enables bulk procurement with further customization of orders, thereby developing long-term relationships while maintaining quality control.

- Distributors and wholesalers are extremely important in helping to address the gap between producers and end-users and thus ensuring that products are efficiently delivered across appropriate regions. Online B2B platforms are gaining traction to provide more convenience, transparency and access to a large base of potential customers. These platforms are enabling real-time transactions and bulk purchases while providing for product traceability thus growing in popularity among small-to-medium enterprises that are looking to cut down on the time spent procuring goods.

Looking for region specific data?

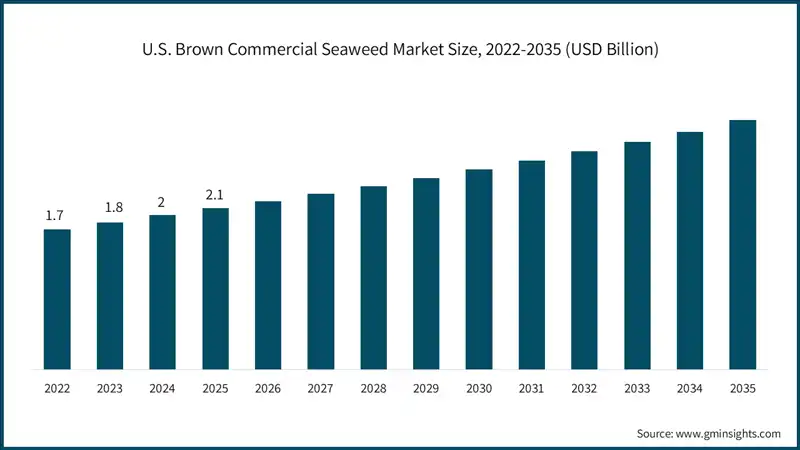

The North America brown commercial seaweed market is growing rapidly on the global level with a market share of 13.3% in 2025.

- North America is witnessing a growing demand for brown commercial seaweeds due to increasing consumer awareness regarding health benefits and growing popularity of plant-based and sustainable products. The established food, nutraceutical and cosmetic industries in the region are adopting seaweed ingredients leading to renewed interest among manufacturers in innovative product launches. In addition, the focus in North America on sustainability and clean-label products is nudging manufacturers to include seaweed in different applications.

Europe brown commercial seaweed market leads the industry with revenue of USD 3.4 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe has seen a marked shift toward natural and organic ingredients, which has been a positive factor for the brown seaweed market. The binding legislation on food safety and sustainability acts as a motivator for companies in Europe to seek their ingredients responsibly, for the good of seaweed as a sustainable ingredient. The needs of consumers for functional foods, dietary supplements, and eco-friendly personal care products are all contributing to the growth of the market. Several other innovations and product development are being fueled by Europe's strong aquaculture sector and research.

The Asia Pacific brown commercial seaweed market is anticipated to grow at a CAGR of 8.3% during the analysis timeframe.

- Asia Pacific region has become the largest market for brown commercial seaweed. China, Japan, and South Korea are the primary producers and consumers in the sector and have various applications of seaweed in food, nutraceuticals, and cosmetics. Rising middle-class population and increasing disposable income are propelling the demand for health supplements and functional food containing seaweed in the region. Asia Pacific is expected to maintain rapid growth, propelled on by technological advancements and increasing domestic consumption.

Latin America brown commercial seaweed accounted for 1.6% market share in 2025 and is anticipated to show steady growth over the forecast period.

- Latin America is gradually emerging to be a key player in the brown seaweed market primarily due to increasing knowledge about its health benefits and the ever-expanding food processing industry in the region. Countries such as Brazil & Mexico are currently investing in seaweed cultivation and processing facilities to leverage on both the domestic and export markets. The focus of the region on natural, organic and functional ingredients fits in well with the larger global trend toward health-oriented products.

Middle East & Africa brown commercial seaweed accounted for USD 178.8 million market size in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Middle East and Africa (MEA) region provides emerging opportunities for brown seaweed driven by an increase in awareness regarding its nutrition and health benefits. This rising demand for natural ingredients in cosmetics, personal care, and food products characterizes the region's market. Some of the countries, like South Africa, & UAE are developing sustainable seaweed farming practices to serve local and regional needs. The growing health and wellness trend in the region, together with the expanding markets for beauty and personal care, has become an encouragement for companies to introduce seaweed-based ingredients.

Brown Commercial Seaweed Market Share

The top 5 companies in brown commercial seaweed industry include Acadian Seaplants Ltd., CP Kelco, W Hydrocolloids, Inc., Qingdao Seawin Biotech Group Co., Ltd., and Seasol International. These are prominent companies operating in their respective regions covering approximately 23.5% of the market share in 2025. These companies hold strong positions due to their extensive experience in brown commercial seaweed market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- Acadian specializes in brown seaweed and has the widest cultivation setups all over the world, where it typically markets extracts, powders, and fertilizers. Due to its strength in global presence and sustainable harvesting, Acadian Seaplants Ltd. has established its competitive edge in quality and reliability to serve more food and agriculture sectors including industries.

- CP Kelco derives high-grade hydrocolloids from seaweed particularly carrageenan and pectin, which are mostly utilized in the food, beverage, and pharmaceutical industries. Focus on innovation, product development and intense quality control allows it to secure its competitive position in the market.

- W Hydrocolloids is engaged in the production of specialty seaweed extracts along with hydrocolloid solutions. It has a strong market presence in the North American region. The real competitive advantage of the company lies in the custom formulations and the approach towards sustainability and organic products, a great attraction to premium markets in food, personal care, and industrial applications. The niche positioning helps W Hydrocolloids, Inc. differentiate itself from bigger, wider diversified players.

- Qingdao Seawin Biotech Group Co., Ltd. is a leading Chinese manufacturer harnessing the power of large-scale seaweed farming coupled with processing capacity to provide value for its customers cost-competitive products in global markets. With its extensive supply chain and scaling efforts, it has advantages in price-sensitive segments, especially in Asia and emerging markets, although it is limited in terms of product differentiation and quality standards.

- Seasol develops entirely natural seaweed-based fertilizers and soil conditioners for the agricultural and horticultural market. With sustainability and organic solutions informed about the market trends interested in eco-conscious consumers, Seasol International is well placed.

Brown Commercial Seaweed Market Companies

Major players operating in the brown commercial seaweed industry include:

- Acadian Seaplants Ltd.

- Algea

- CP Kelco

- Indigrow Ltd.

- Mara Seaweed

- Marcel Carrageenan

- Pacific Harvest

- Qingdao Seawin Biotech Group Co., Ltd.

- Seasol International

- W Hydrocolloids, Inc.

Brown Commercial Seaweed Industry News

- On October 2024, BASF partnered with Acadian Plant Health to expand its BioSolutions portfolio with climate-resilient seaweed-based biostimulants. The agreement enhances global access to patented abiotic stress-management products, helping crops better withstand heat and drought. This collaboration supports BASF’s commitment to climate-smart agriculture and strengthens its biological offerings for sustainable, high-quality crop production.

- On March 2024, Sea6 Energy launched the world’s first large-scale mechanized tropical seaweed farm off Lombok, Indonesia, spanning one square kilometer. The innovation automates seaweed cultivation—boosting productivity, enhancing feedstock shelf life, and enabling industrial uses such as biofertilizers, bioplastics, and renewable chemicals.

This brown commercial seaweed market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Species Type

- Laminaria species

- Saccharina species

- Undaria pinnatifida

- Ascophyllum nodosum

- Fucus species

- Sargassum species

- Other species

Market, By Cultivation Type

- Wild-harvested brown seaweed

- Cultivated/farmed brown seaweed

Market, By Form

- Dried seaweed products

- Fresh seaweed

- Liquid extracts

- Purified/refined extracts & derivatives

Market, By Application

- Pharmaceuticals & nutraceuticals

- Animal feed & aquaculture

- Poultry feed

- Swine feed

- Aquaculture feed

- Pet food

- Ruminant feed

- Industrial applications

- Biofuels

- Bioplastics & biodegradable packaging

- Biochemicals

- Biorefineries

- Water treatment & industrial processes

- Agriculture

- Organic fertilizers

- Biostimulants

- Soil amendments & conditioners

- Seed treatments

- Biopesticides

- Food & beverages

- Food ingredients

- Food additives

- Cosmetics & personal care

- Skincare

- Haircare

- Active ingredients

Market, By Distribution Channel

- Direct sales (B2B)

- Distributors & wholesalers

- Online B2B platforms

- Retail & direct-to-consumer

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the brown commercial seaweed industry?

Key players include Acadian Seaplants Ltd., Algea, CP Kelco, Indigrow Ltd., Mara Seaweed, Marcel Carrageenan, Pacific Harvest, Qingdao Seawin Biotech Group Co., Ltd., Seasol International, and W Hydrocolloids, Inc.

Which region is leading the brown commercial seaweed sector?

North America is a key region, holding a 13.3% market share in 2025. The region's growth is led by increasing consumer awareness of health benefits, sustainability trends, and the adoption of seaweed ingredients in food, nutraceutical, and cosmetic industries.

What are the upcoming trends in the brown commercial seaweed market?

Automated cultivation and biorefinery processing, sustainability-driven regulations, and new applications in biodegradable packaging, biofuels, and agricultural biostimulants.

What was the market share of farmed brown seaweed in 2025?

Farmed brown seaweed held the largest market share of 95% in 2025 and is set to expand at a CAGR of 8.1% from 2026 to 2035.

What was the valuation of dried seaweed products in 2025?

Dried seaweed products accounted for approximately 59.5% of the market share in 2025 and is anticipated to showcase around 8.1% CAGR till 2035.

What was the market size of the brown commercial seaweed in 2025?

The market size was valued at USD 20.1 billion in 2025, with a CAGR of 8% expected through 2035. Increasing demand from pharmaceuticals and other industries is driving market growth.

What is the projected value of the brown commercial seaweed market by 2035?

The market is poised to reach USD 44.1 billion by 2035, driven by technological advancements, sustainability trends, and growing applications across industries.

What was the market share of Laminaria species in 2025?

Laminaria species dominated the market with an approximate share of 35.3% in 2025 and is expected to grow at a CAGR of 8.3% through 2035.

What is the expected size of the brown commercial seaweed industry in 2026?

The market size is projected to reach USD 22 billion in 2026.

Brown Commercial Seaweed Market Scope

Related Reports