Summary

Table of Content

Breast Biopsy Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Breast Biopsy Devices Market Size

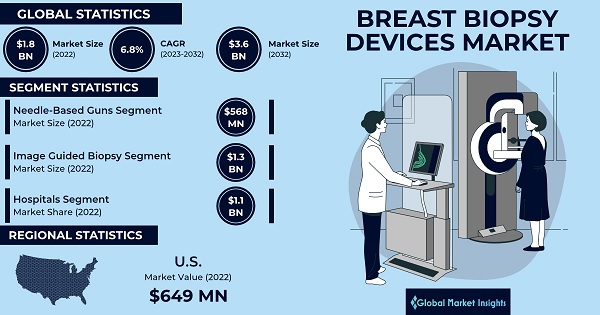

Breast Biopsy Devices Market size was valued at USD 1.8 billion in 2022 and is anticipated to register a CAGR of over 6.8% between 2023 and 2032. These devices are medical instruments or tools used by healthcare professionals to obtain tissue samples from the breast for diagnostic purposes. For instance, a report in the Journal of Clinical Oncology projects a 31% rise in new global female breast cancer cases, from 2,260,127 in 2020 to an estimated 2,964,197 cases in 2040.

To get key market trends

Furthermore, an improved reimbursement landscape for breast biopsy procedures and associated diagnostic tests incentivizes healthcare providers and patients to utilize these services.

Breast Biopsy Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2022 |

| Market Size in 2022 | USD 1.8 Billion |

| Forecast Period 2023 to 2032 CAGR | 6.8% |

| Market Size in 2032 | USD 3.6 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

COVID-19 Impact

The COVID-19 storm had cast a shadow over the market, disrupting healthcare services, triggering safety apprehensions among patients, leading to supply chain hiccups, constraining healthcare budgets, and diverting resources to the COVID-19 research front.

Breast Biopsy Devices Market Trends

Continuous advancements in biopsy technologies and equipment, such as more precise and minimally invasive techniques, improved imaging capabilities, and enhanced tissue sampling methods. For instance, Mammotome's Mammotome Elite Tetherless Biopsy System uses dual vacuum-assisted technology for precise breast biopsies and features an ergonomic design with multiple buttons for flexibility, enhancing efficiency in complex procedures.

- Furthermore, public awareness campaigns and initiatives aimed at educating individuals about the importance of regular breast cancer screening and early detection have increased the demand for breast biopsy devices.

- Therefore, this heightened awareness encourages more people to undergo screening, leading to higher utilization of biopsy devices, which is estimated to reach USD 4.8 billion by 2032.

Breast Biopsy Devices Market Analysis

Learn more about the key segments shaping this market

The market by product is categorized into breast biopsy guidance systems, needle-based breast biopsy guns, breast biopsy needles, breast biopsy forceps and other products. The needle-based breast biopsy guns segment is bifurcated into vacuum-assisted biopsy (VAB) devices, fine needle aspiration biopsy (FNAB) devices, and core needle biopsy (CNB) devices. This segment garnered USD 568 million revenue size in the year 2022 and is projected to have the fastest-growing CAGR in the forecast period.

- Their ease of use, accurate lesion targeting, and compatibility with imaging guidance contribute to widespread adoption. Furthermore, advances in needle design and technology bolster diagnostic accuracy, instilling confidence among healthcare professionals.

Learn more about the key segments shaping this market

Based on technique, the breast biopsy devices market is segmented into image guided biopsy and liquid biopsy. The image guided biopsy segment is further bifurcated into MRI guided breast biopsy, ultrasound guided breast biopsy, mammography guided stereotactic biopsy and other image guided biopsies. This segment garnered USD 1.3 billion revenue size in the year 2022.

- Image-guided biopsy dominates due to its superior precision, offering real-time visualization through techniques such as ultrasound or stereotactic guidance. This precision enhances diagnostic outcomes, instilling confidence in healthcare professionals.

- Furthermore, the technique's minimally invasive nature reduces patient discomfort, ensuring quicker recovery and driving widespread adoption.

Based on end-use, the breast biopsy devices market is segmented into hospitals and ambulatory surgical centres. The hospitals segment garnered USD 1.1 billion revenue size in the year 2022.

- Hospitals dominates the segment, leveraging advanced infrastructure and skilled professionals to integrate sophisticated biopsy procedures seamlessly. Their possession of cutting-edge imaging technologies fosters widespread adoption. Moreover, patient trust in hospital-based diagnostic services contributes to a preference for breast biopsy procedures in these settings.

Looking for region specific data?

U.S. breast biopsy devices market accounted for USD 649 million revenue size in 2022.

- The U.S. has taken a commanding position in the industry, primarily due to its advanced healthcare infrastructure, widespread access to cutting-edge diagnostic technologies, and proactive breast cancer awareness programs.

- Furthermore, the country's robust reimbursement framework accelerates device adoption. For instance, in 2023, the American Cancer Society estimates 297,790 new cases of invasive breast cancer in the U.S., with an anticipated 43,700 women succumbing to the disease.

Breast Biopsy Devices Market Share

The breast biopsy devices industry is consolidated, with key players including, Medtronic plc, Hologic Inc, and others dominating the market space. These companies focus on ongoing product innovation, geographical expansion, and partnerships to secure substantial market shares. For instance, in January 2021, Hologic, Inc., acquired SOMATEX Medical Technologies GmbH, thereby strengthening its breast marker portfolio and consolidating its position in biopsy site markers and localization technologies. The strategic move also extended Hologic's sales presence in Europe by expanding its direct channel in Germany and augmenting its network of regional and international distributor partners.

Some of the eminent market participants operating in the breast biopsy devices industry include:

- Stryker Corporation

- Boston Scientific Corporation

- FUJIFILM Holdings Corporation

- Argon Medical Devices, Inc

- Hologic Inc

- Cook Group Incorporated

- Becton, Dickinson and Company (BD)

- Medtronic plc

- Olympus Corporation

- Cardinal Health

- INRAD Inc

- Danaher Corporation

- B. Braun Melsungen AGS

Breast Biopsy Devices Industry News:

- In May 2023, Argon Medical Devices, a leader in device solutions for various medical fields, launched the SuperCore Advantage Semi-Automatic Biopsy Instrument in the U.S., expanding its soft tissue biopsy product line. This strategic introduction aimed to diversify the company's offering and enhance revenue.

- In August 2022, Mammotome (Danaher Corporation) launched the Mammotome Revolve EX, the first vacuum-assisted biopsy system designed for the efficient excision of benign breast lesions, featuring double the speed compared to traditional systems. This product launch expanded the company's product portfolio, delivering a significant competitive edge.

Breast biopsy devices market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD and volume in Units from 2018 to 2032 for the following segments:

By Product, 2018 – 2032 (USD Million and Units)

- Breast biopsy guidance systems

- Manual

- Robotic

- Needle based breast biopsy guns

- Vacuum-assisted biopsy (VAB) devices

- Fine needle aspiration biopsy (FNAB) devices

- Core needle biopsy (CNB) devices

- Breast biopsy needles

- Disposable

- Reusable

- Breast biopsy forceps

- General biopsy forceps

- Hot biopsy forceps

- Other products

- Brushes

- Curettes

- Punches

By Technique, 2018 – 2032 (USD Million)

- Image guided biopsy

- MRI guided breast biopsy

- Ultrasound guided breast biopsy

- Mammography guided stereotactic biopsy

- Other image guided biopsies

- Liquid Biopsy

- NGS based biopsy

- PCR based biopsy

- Micro-array based biopsy

By End-use, 2018 – 2032 (USD Million)

- Hospitals

- Ambulatory surgical centers

- Other end-users

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Which companies define the competitive landscape of breast biopsy devices market?

Stryker Corporation, Boston Scientific Corporation, FUJIFILM Holdings Corporation, Argon Medical Devices, Inc, Hologic Inc, Cook Group Incorporated, Becton, Dickinson and Company (BD), Medtronic plc, Olympus Corporation, Cardinal Health, and INRAD Inc among others.

How big is the global breast biopsy devices market?

The global breast biopsy devices market was valued at USD 1.8 billion in 2022 and is estimated to reach USD 3.6 billion by 2032, backed by surge in breast cancer cases, favorable reimbursement policies, awareness about benefits of early detection.

How are hospitals influencing the demand for breast biopsy devices?

The hospitals segment generated USD 1.1 billion in 2022 and will continue to drive demand as these healthcare settings leverage advanced infrastructure and skilled professionals to integrate sophisticated biopsy procedures seamlessly, gaining patient

What is the size of the U.S. breast biopsy devices industry?

U.S. market accounted for USD 649 million in 2022 and is predicted to witness substantial growth through 2032, primarily due to the advanced healthcare infrastructure, widespread access to cutting-edge diagnostic technologies, and proactive breast cancer awareness programs.

Breast Biopsy Devices Market Scope

Related Reports