Summary

Table of Content

Bone Void Fillers Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Bone Void Fillers Market Size

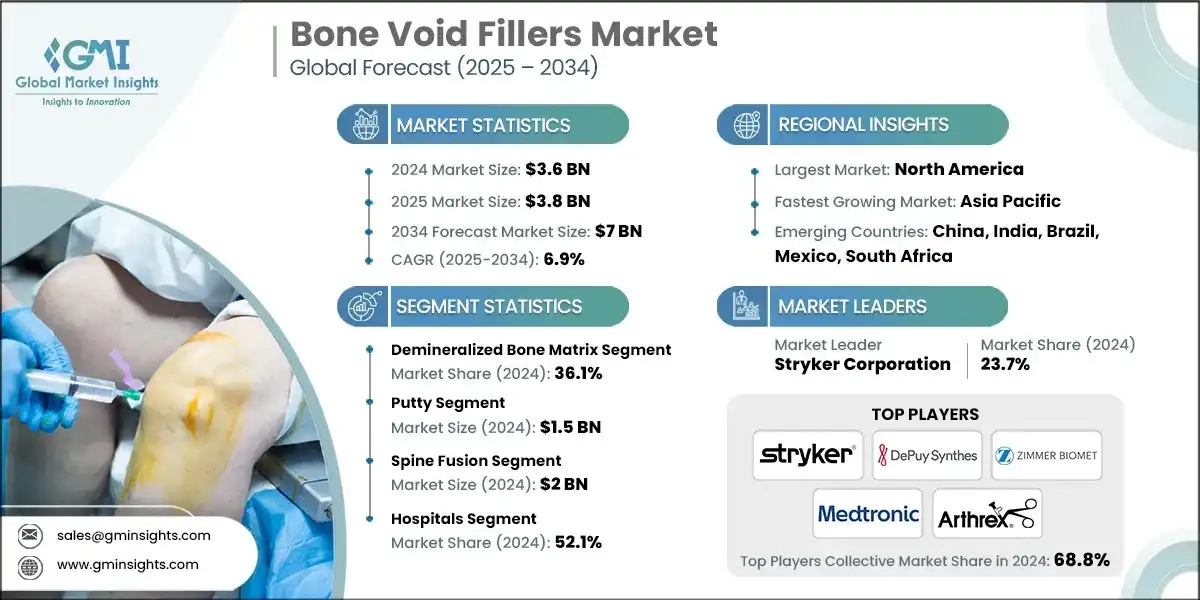

The global bone void fillers market was valued at USD 3.6 billion in 2024. The market is expected to grow from USD 3.8 billion in 2025 to USD 7 billion in 2034, at a CAGR of 6.9% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The bone void fillers market is experiencing robust growth, primarily driven by the increasing volume of orthopedic and trauma surgeries and the rising incidence of bone-related conditions, including osteoporosis and fracture-associated defects. For instance, the total number of orthopedic surgeries in the period 2001–2022 was 1.5 million, of which 189,881 were hip replacement surgeries; 51,035 were knee replacement surgeries; 11,085 were revision hip arthroplasty; 1497 were revision knee arthroplasty; 541,440 were operated fractures; and 16,418 were operated bone tumors. The growth rates of surgical interventions are hip replacement surgery, 8.2%; total knee replacement surgery, 19.5%; revision hip arthroplasty, 9.4%; and revision knee arthroplasty, +28.6%. Such a high volume of orthopedic surgeries increases the demand for bone void fillers to effectively manage the procedures and increase success rates, thus driving the demand for bone void fillers.

Bone void filler is a material used to fill and support gaps or defects in bones that occur due to fractures, surgeries, infections, or tumor removal. These help the bone to heal by providing structural support and a scaffold for new bone growth. Key players driving the growth of the market include medical device and orthopedic companies such as Stryker, Zimmer Biomet, and DePuy Synthes, which offer a wide range of synthetic and biologic graft substitutes. These companies play critical roles in product innovation, surgeon training, regulatory approvals, and expanding global distribution networks, thereby accelerating the adoption and expansion of bone void fillers worldwide.

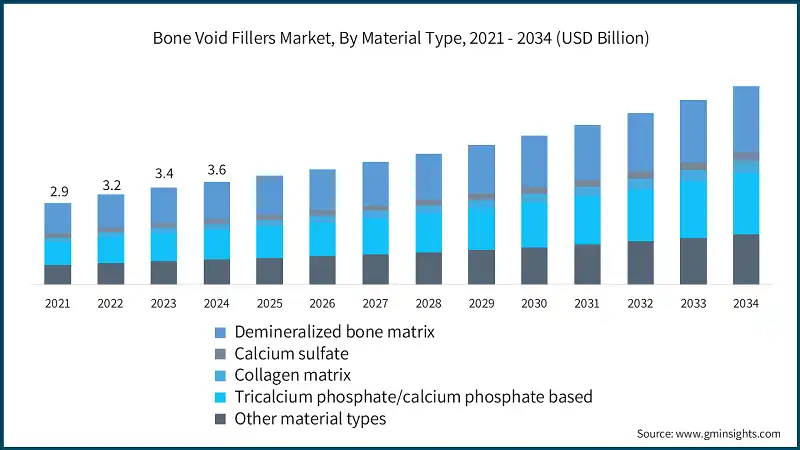

Between 2021 and 2023, the bone void fillers market witnessed considerable growth, driven by increased surgical volumes, a rising geriatric population, and rising access to advanced biomaterials. For instance, the global market was valued at about USD 2.9 billion in 2021 and reached around USD 3.4 billion in 2023. This growth can be majorly attributed to the rising incidence of bone disorders and trauma, a rapid shift toward minimally invasive surgery, and the availability of improved synthetic and biologic bone void fillers that reduce autograft/allograft dependency.

The bone void filler market refers to the global industry focused on biomaterials used to fill bone defects or voids resulting from trauma, surgery, or disease. These materials support bone regeneration, structural stability, and natural healing, often serving as alternatives or adjuncts to bone grafts.

Bone Void Fillers Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.6 Billion |

| Market Size in 2025 | USD 3.8 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.9% |

| Market Size in 2034 | USD 7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing incidence of bone disorders and injuries | A rising number of trauma cases, osteoporosis-related fractures, and bone infections is increasing the demand for bone void fillers to support bone regeneration and healing. |

| Rise in geriatric population | As aging leads to reduced bone density and higher fracture risk, the growing elderly population is significantly boosting the need for bone repair solutions. |

| Advancements in surgical techniques | The adoption of better orthopedic and trauma surgery techniques has increased the use of synthetic bone substitutes that offer improved outcomes and faster recovery. |

| Growing orthopedic surgeries | A global rise in joint replacement, spine, and trauma surgeries is driving the consistent use of bone void fillers to support structural stability and bone healing. |

| Pitfalls & Challenges | Impact |

| High cost associated with bone disorders | Treatment, surgical procedures, and advanced graft materials can be expensive, limiting access in low-resource healthcare settings. |

| Stringent regulatory scenario | Regulatory approvals for new biomaterials and drug-eluting fillers require extensive clinical evidence, slowing product launches and market entry. |

| Opportunities: | Impact |

| Shift toward minimally invasive and injectable solutions | Demand is increasing for injectable and moldable fillers that reduce surgical complexity, recovery time, and hospital stay. Thus, with the rise in the adoption of minimally invasive surgeries, the demand for bone void fillers will rise, thereby driving the market growth. |

| Advancement in bioactive and antibiotic-eluting fillers | Innovation in resorbable and infection-preventing materials is expanding the clinical use of bone void fillers in complex and high-risk bone defects. |

| Market Leaders (2024) | |

| Market Leaders |

23.7% |

| Top Players |

Collective market share in 2024 is 68.8% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, Brazil, Mexico, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Bone Void Fillers Market Trends

- A key trend in the bone void fillers industry is the growing shift from traditional autografts and allografts to synthetic and bioactive bone void fillers. These materials, such as calcium phosphate, bioactive glass, and composite scaffolds, offer predictable resorption rates, reduced infection risk, and improved biocompatibility. Their consistency, availability, and safety profile make them more suitable for large-scale clinical use, especially in orthopedic and trauma surgeries.

- Additionally, there is a growing adoption of injectable bone void fillers due to their ease of use in minimally invasive procedures. They can be molded or injected directly into bone defects, reducing surgical time, incision size, and patient recovery periods. This aligns with the broader healthcare shift toward outpatient and faster-healing treatment approaches, particularly in aging and trauma-prone populations.

- Furthermore, the increasing prevalence of bone-related disorders, trauma injuries, and degenerative skeletal diseases is a major catalyst for the bone void fillers (BVF) market. As global life expectancy rises and urbanization accelerates, the burden of bone fractures and orthopedic defects continues to expand across both developed and emerging regions.

- According to the World Health Organization (WHO), there were 178 million new fractures globally in 2019, marking a 33% increase since 1990, alongside 455 million cases of acute or chronic bone injury symptoms.

- Similarly, in Europe, new fragility fractures are projected to increase by 23% between 2017 and 2030, from 2.7 million to 3.3 million cases across major EU6 countries. In Italy, fragility fractures are expected to rise from 0.6 million to nearly 0.7 million during the same period (International Osteoporosis Foundation). As the number of fractures and bone defects continues to rise, surgeons and hospitals increasingly demand biocompatible, osteoconductive, and bioresorbable fillers that can seamlessly integrate with natural bone tissue. The growing clinical emphasis on faster healing, reduced donor site morbidity, and improved post-surgical functionality is fueling sustained market expansion.

- Also, technological innovations such as antibiotic-loaded bone void fillers are gaining traction. Such fillers allow localized drug release directly at the surgical site, reducing reliance on systemic antibiotics and lowering the risk of post-operative complications. This trend is particularly important for complex fractures and osteomyelitis management.

- Moreover, expanding applications of bone void fillers are further boosting market growth. Bone void fillers are increasingly being used beyond standard fractures, particularly in tumor resection surgeries, spinal reconstruction, and complex trauma repairs. Their role in stabilizing bone defects after cancer-related bone removals and correcting non-unions is expanding clinical demand.

- Thus, as orthopedic oncology and spine surgery volumes increase, the need for reliable bone defect management solutions will continue to rise, further driving market growth.

Bone Void Fillers Market Analysis

Learn more about the key segments shaping this market

Based on the material type, the global market is segmented into demineralized bone matrix, calcium sulfate, collagen matrix, tricalcium phosphate/calcium, and other material types. The demineralized bone matrix segment has asserted its dominance in the market by securing a significant market share of 36.1% in 2024 and is anticipated to grow at a CAGR of 6.1% over the forecast years.

- The demineralized bone matrix segment leads the market owing to its excellent osteoinductive potential, biocompatibility, and clinical versatility. Derived from processed allograft bone, DBM retains essential organic components such as collagen, growth factors, and bone morphogenetic proteins (BMPs), which play a critical role in stimulating new bone growth and enhancing graft integration. Its adaptability in multiple delivery forms, such as putty, paste, gel, and strips, offers surgeons greater convenience during orthopedic, trauma, and spinal fusion procedures.

- DBM has become a preferred alternative to autografts, as it eliminates donor-site morbidity, reduces surgical time, and minimizes post-operative complications. The segment’s growth is further supported by the rising number of spinal fusion and reconstructive surgeries, increasing use of biologic bone repair materials, and growing clinician awareness regarding DBM’s regenerative potential.

- The tricalcium phosphate/calcium phosphate-based filler material, on the other hand, held the second largest market share of 29%, driven by its excellent biocompatibility, osteoconductivity, and predictable resorption profiles. Calcium phosphate-based fillers, including α-TCP and β-TCP, provide structural scaffolds that facilitate bone cell proliferation and gradual replacement with native bone. These fillers are extensively used in spinal fusion, fracture repair, joint reconstruction, and dental implantology, serving as synthetic alternatives to autografts and allografts.

Based on the form, the global bone void fillers market is classified into gel, granules, paste/ injectable, putty, and other forms. The putty segment accounted for the highest market revenue of USD 1.5 billion in 2024 and is projected to grow at a CAGR of 7.2% during the analysis period.

- The putty form has emerged as the preferred choice among surgeons owing to its superior handling characteristics, adaptability, and ease of application in complex or irregular bone defects.

- Unlike granular or rigid alternatives, bone void filler putties provide a moldable, cohesive texture, allowing precise contouring and placement, particularly advantageous in craniofacial reconstruction, spinal fusion, orthopedic trauma, and dental surgeries.

- On the other hand, the paste/injectable segment is anticipated to witness growth at a CAGR of 7.4% over the forecast period, driven by its precise placement, adaptability, and suitability for minimally invasive surgeries.

- These formulations allow surgeons to inject or mold the material directly into bone defects, ensuring accurate filling in confined or irregular anatomical spaces such as spinal, craniofacial, and trauma sites.

Based on the application, the global bone void fillers market is classified into spine fusion, bone fracture, joint reconstruction, dental / cranio-maxillofacial surgery (CMF), and other applications. The spine fusion segment accounted for the highest market revenue of USD 2 billion in 2024 and is projected to grow at a CAGR of 7.2% during the analysis period.

- The spinal fusion segment represents one of the most significant and rapidly expanding areas of application within the market.

- Growth is primarily driven by the rising prevalence of degenerative spine disorders, traumatic spinal injuries, and age-related conditions such as osteoporosis, disc degeneration, and spondylosis.

- According to the North American Spine Society (NASS), over 450,000 spinal fusion surgeries are performed annually in the U.S., a figure expected to rise with the growing elderly population and improved diagnostic awareness of spinal pathologies.

- With rising procedural volumes, increasing technological sophistication, and expanding clinical evidence supporting bioactive fillers, the spinal fusion segment is expected to remain a major driver of market growth and innovation over the coming decade.

- On the other hand, the dental / cranio-maxillofacial surgery (CMF) segment is anticipated to witness high growth at a CAGR of 7.7% between 2025 – 2034.

- The segmental growth is driven by facial trauma, dental implant procedures, congenital craniofacial anomalies, and cosmetic reconstructive surgeries. According to NIH, there are over 10.7 million facial fracture cases, with men disproportionately affected (80.4% of cases; male: female ratio 4.1:1), while senior citizens and children account for 5.7% of cases.

- Similarly, the increasing volume of dental implants is also boosting filler demand, with over 12 million implants sold globally per year (MDPI).

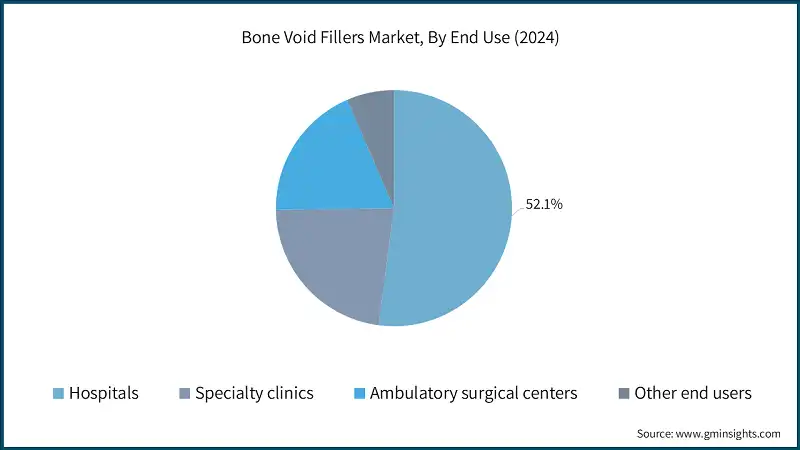

Learn more about the key segments shaping this market

Based on end use, the global bone void fillers market is classified into hospitals, specialty clinics, ambulatory surgical centers, and other end users. The hospitals segment held a market share of 52.1% in 2024 and is projected to grow at a CAGR of 6.7% during the analysis period.

- Hospitals remain the primary centers for complex orthopedic, trauma, and spinal surgeries, where bone void fillers are extensively utilized to promote bone regeneration, enhance implant stability, and accelerate post-surgical recovery.

- Their dominance stems from the high procedural volume, access to advanced surgical infrastructure, and the presence of specialized orthopedic and neurosurgical teams capable of performing intricate bone reconstruction procedures.

Looking for region specific data?

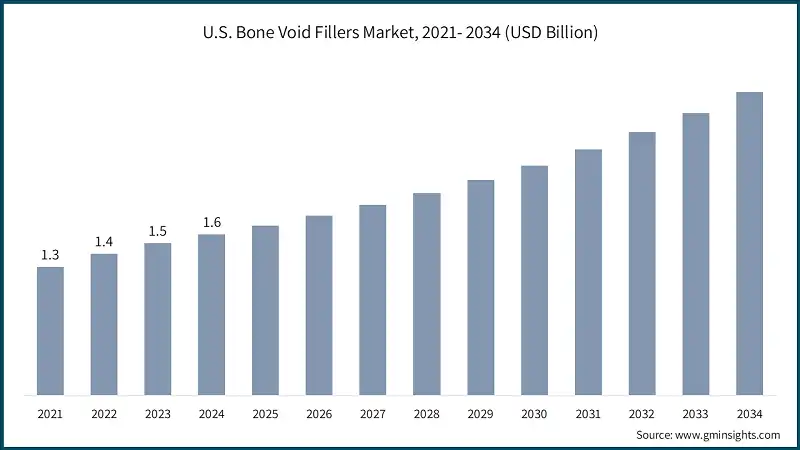

North America Bone Void Fillers Market The North America market dominated the global bone void fillers industry with a market share of 48.9% in 2024. The U.S. bone void fillers market was valued at USD 1.3 billion and USD 1.4 billion in 2021 and 2022, respectively. The market size reached USD 1.6 billion in 2024, growing from USD 1.5 billion in 2023. Europe market accounted for USD 928 million in 2024 and is anticipated to show lucrative growth over the forecast period. Germany dominates the Europe bone void fillers market, showcasing strong growth potential. The Asia Pacific market is anticipated to grow at the highest CAGR of 7.4% during the analysis timeframe. China bone void fillers market is estimated to grow with a significant CAGR, in the Asia Pacific market. Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period. Saudi Arabia market is expected to experience substantial growth in the Middle East and Africa bone void fillers industry in 2024. The global bone void fillers industry is moderately consolidated, with leading orthopedic and medical device companies dominating the space, while innovation continues to thrive among. Top 5 players such as Stryker Corporation, DePuy Synthes (Johnson & Johnson), Zimmer Biomet, Medtronic, and Arthrex hold a combined market share of 68.8% in the global bone void fillers market. These players are continuously investing in research and development to expand their pipelines and enhance their product pipelines. The market also sees strategic partnerships, mergers, and acquisitions aimed at accelerating the commercialization of novel products and accessing new markets. Additionally, smaller players and niche biotech firms contribute by focusing on specialized products and cutting-edge technologies. This dynamic environment fosters rapid technological advancements and competitive differentiation, driving the overall growth and diversification of the market. Prominent players operating in the bone void fillers industry are as mentioned below: Stryker Corporation is a key player in bone void fillers, holding a substantial market share of 23.7% in the global market. The company offers well-established products such as Vitoss (a highly porous β-TCP scaffold that supports natural bone regeneration) and Pro-Dense (an injectable, triphasic bone graft that provides both immediate structural support and gradual resorption for long-term healing). Stryker’s competitive advantage comes from its integration with a large orthopedic implant and surgical solutions portfolio, extensive surgeon training programs, and a global distribution network, which together drive widespread clinical adoption and reinforces its leadership in the bone repair and regeneration market. DePuy Synthes, part of Johnson & Johnson MedTech, maintains a strong role in the bone void fillers market through its comprehensive orthopedic and trauma product ecosystem, which allows surgeons to use bone repair materials alongside fixation systems, implants, and reconstruction tools from a single platform. Its global reach, long-standing surgeon relationships, and continuous clinical training programs help drive widespread adoption, while its ability to bundle bone void fillers with complete surgical solutions provides a competitive advantage in hospitals and large health systems.Europe Bone Void Fillers Market

Asia Pacific Bone Void Fillers Market

Latin American Bone Void Fillers Market

Middle East and Africa Bone Void Fillers Market

Bone Void Fillers Market Share

Bone Void Fillers Market Companies

Bone Void Fillers Industry News

The bone void fillers market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Material Type

- Demineralized bone matrix

- Calcium sulfate

- Collagen matrix

- Tricalcium phosphate/calcium phosphate based

- Other material types

Market, By Form

- Gel

- Granules

- Paste / injectable

- Putty

- Other forms

Market, By Application

- Spine fusion

- Bone fracture

- Joint reconstruction

- Dental / cranio-maxillofacial surgery (CMF)

- Other applications

Market, By End Use

- Hospitals

- Specialty clinics

- Ambulatory surgical centers

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the market size of the U.S. bone void fillers industry in 2024?

The U.S. market was valued at USD 1.6 billion in 2024. Growth is fueled by high orthopedic surgery volumes, rising geriatric population, and increased incidence of fall- and fracture-related hospitalizations among older adults.

Who are the key players in the bone void fillers market?

Key market players include Stryker Corporation, DePuy Synthes (Johnson & Johnson), Zimmer Biomet, Medtronic, and Arthrex, collectively holding 68.8% of the global market share. Other prominent companies include Bioventus, Bonesupport, Baxter International, Abyrx, Acumed, and Medline.

What are the upcoming trends in the bone void fillers industry?

Emerging trends include the shift toward synthetic and bioactive fillers, adoption of antibiotic-eluting and injectable materials, and integration of 3D printing and regenerative biomaterials to improve surgical precision and post-operative healing.

What is the growth outlook for the paste/injectable bone void fillers segment from 2025 to 2034?

The paste/injectable segment is projected to grow at a CAGR of 7.4% through 2034.

What is the market size of the bone void fillers industry in 2024?

The market size was USD 3.6 billion in 2024, with a CAGR of 6.9% expected through 2034, driven by increasing orthopedic and trauma surgeries, and advancements in bone repair biomaterials.

What is the current bone void fillers market size in 2025?

The market size is projected to reach USD 3.8 billion in 2025.

What is the projected value of the bone void fillers market by 2034?

The market size for bone void fillers is expected to reach USD 7 billion by 2034, supported by the growing adoption of bioactive, resorbable, and antibiotic-loaded fillers enhancing bone regeneration outcomes.

What was the valuation of the putty form segment in 2024?

The putty segment accounted for USD 1.5 billion in 2024, leading the market due to superior moldability and surgeon preference for complex orthopedic and craniofacial applications.

How much revenue did the demineralized bone matrix (DBM) segment generate in 2024?

The demineralized bone matrix segment generated 36.1% of total market revenue in 2024.

Bone Void Fillers Market Scope

Related Reports