Home > Aerospace & Defense > Defense and Safety > Weapons and Ammunition > Body Armor Market

Body Armor Market Analysis

- Report ID: GMI4268

- Published Date: Aug 2024

- Report Format: PDF

Body Armor Market Analysis

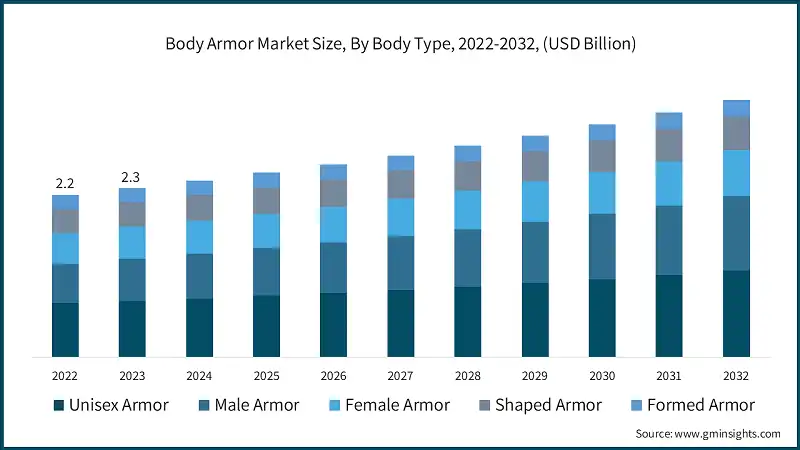

Based on the body type, the body armor market is segmented into unisex armor, male armor, female armor, shaped armor, and formed armor. The male armor represents the fastest growing segment, with a CAGR of over 5% between 2024 and 2032.

- One of the most prominent trends in the male armor segment is the increasing focus on enhancing fit and ergonomics. Manufacturers are prioritizing the design of armor that conforms more closely to the male body shape, providing a better fit, which is crucial for both comfort and effectiveness in the field.

- Customization is becoming a significant trend in male armor, with more options for modular systems that can be tailored to individual needs and missions. This trend allows for the integration of different protective components, enabling users to adapt their armor to various threat levels and operational environments. There is a growing demand for male armor made from lightweight materials that do not compromise on ballistic protection. The trend towards lighter armor is driven by the need to reduce fatigue and increase agility in combat and tactical situations.

Based on the end-use, the market is segmented into defense, law enforcement officers, and civilians. The defense segment dominated the market in 2023 and is expected to reach over USD 1.2 billion by 2032.

- Modern military operations require body armor that not only offers superior protection but also enhances mobility. There is a growing trend toward developing lightweight and flexible armor systems that provide the same level of ballistic protection as heavier alternatives.

- The integration of smart technologies into body armor is becoming increasingly prevalent in the defense sector. These include features like embedded sensors that monitor vital signs, body temperature, and potential impact forces. This trend is driven by the need for enhanced situational awareness and real-time data collection, which can be critical during combat operations.

The body armor market is experiencing growth in North America and is expected to reach USD 1 billion by 2032. The North American market is a leader in both demand and innovation, driven by substantial investments in defense and law enforcement. The region’s focus on safety, coupled with the rising threat of armed conflicts and terrorism, has fueled the need for advanced protective gear.

The U.S. body armor industry is the largest in the world, bolstered by significant defense spending and the size of its law enforcement community. According to the U.S. Department of Defense, the annual budget for military personal protective equipment, including body armor, has seen steady increases, with billions allocated for continuous upgrades and research into new materials. In April 2023, the U.S. Army announced the rollout of the new Integrated Head Protection System (IHPS), which includes advanced body armor designed to provide better protection and comfort. This move is part of a broader modernization effort aimed at improving soldier survivability.

Europe’s body armor market is driven by a combination of military modernization programs, increased security concerns, and growing demand from private security companies. The region’s defense strategies have shifted towards enhancing soldier protection through advanced body armor, which has become a critical focus for NATO-aligned countries. The European Defense Agency (EDA) has been actively promoting joint procurement initiatives to streamline costs and ensure standardization across member states.

In February 2024, the European Defence Agency (EDA), through its Incubation Forum for Circular Economy in European Defence (IF CEED), advanced its commitment to circularity in European defense by launching a new project titled "IOTA 2." This initiative focuses on the circular management of body armor vests and is being carried out by an industrial consortium from Luxembourg, Germany, Spain, and France.

In the civilian sector, there has been a rise in the use of body armor among security personnel, particularly in urban areas where the threat of terrorism and violent crime is higher. The Security Industry Authority (SIA) has reported an increase in the number of licensed security officers in the U.K., many of whom are required to wear body armor as part of their duties.

The Asia Pacific region represents a rapidly growing market for body armor, driven by increasing defense budgets, rising security concerns, and the expansion of law enforcement agencies. Countries like South Korea, Japan, and Singapore are at the forefront of this growth, investing heavily in modernizing their military and law enforcement equipment to address both internal and external threats.

China body armor market is rapidly growing, driven by the country’s increasing defense budget, expanding law enforcement needs, and rising security concerns. China's focus on modernizing its military and enhancing its domestic security apparatus has led to significant investments in body armor technologies, making it one of the fastest-growing markets in the Asia Pacific region.

Japan body armor industry is experiencing steady growth, driven by a combination of factors including rising regional security concerns, the country's strategic defense initiatives, and advancements in technology. As Japan navigates a complex geopolitical landscape, the demand for advanced protective gear is increasingly crucial, particularly for its defense forces and law enforcement agencies.

South Korea’s market is heavily influenced by the country’s ongoing security concerns related to its northern neighbor. The South Korean government has been investing in modernizing its military forces, with a particular focus on enhancing the protection of its soldiers.