Home > Packaging > Packaging Materials > Plastic Packaging > Blister Packaging Market

Blister Packaging Market Analysis

- Report ID: GMI1726

- Published Date: Apr 2021

- Report Format: PDF

Blister Packaging Market Analysis

Thermoforming technology dominates the blister packaging market with over 85% volumetric share in 2020. Thermoforming technology is widely used in industries owing to high production output, ease of handling, and low costs of production. Almost all the plastic materials used in the forming film form are thermoformed. Further, thermoformed products are widely used in consumer goods, industrial goods, and food packaging applications. The development of new technologies, such as Activ-Blister Packaging, developed by Aptar enabled several drug manufacturers to protect their moisture-sensitive drugs efficiently with a long shelf life. Such technologies are expected to showcase higher demand for thermoforming products along with high growth as compared to cold-forming products.

Clamshell type of products showcase considerable growth in the blister packaging market and are expected to generate around USD 7.40 billion revenue by 2027. Clamshell packaging is widely made up of thermoformed plastics and used for food and consumer goods applications. Several advantages offered by clamshell products are transparent packaging, good protection, improved aesthetics, and easy customization as per product shape, driving the demand over the study timeframe. Several fitting methods, such as friction fitting, self-locking, among others, can be used for packaging of food and consumer goods. However, high production costs as compared to carded type products and risk of injury while handling such packaging may limit its growth over the study timeframe.

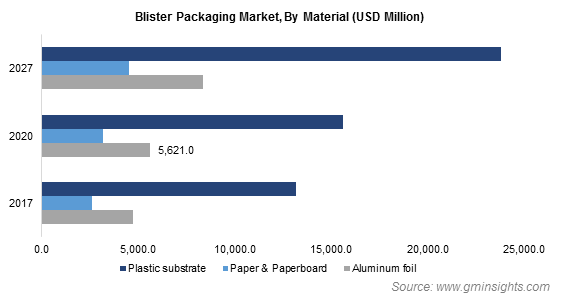

Aluminum foil is expected to hold a nearly 15% volumetric share in 2027. Aluminum foils are widely used in pharmaceutical applications for packaging of several drugs. Excellent moisture protection characteristics of aluminum foil and high recyclability rate of these packaging solutions are supporting the demand for aluminum materials in the market. Further, the development of new aluminum packaging solutions along with the ease in handling new packaging solutions will drive the aluminum foil demand over the study timeframe. For instance, in September 2020, Uflex received the U.S. patent grant for its Alu-Alu blister packs that offer several benefits to consumers including easy tear-ability, child-resistant packaging, and others.

Consumer goods application is expected to showcase a growth rate of around 7% CAGR from 2021 to 2027 owing to the rising demand for blister packaging in electronics, toys, and other industries. The consumer goods segment uses blister packaging owing to affordable mass production of packaging along with improved aesthetic properties of these packaging solutions. The proliferating electronics industry in South Korea, Japan, and China along with the growing demand for thermoformed clamshell products in electronic parts packaging will drive the segment growth over the forecast timeframe.

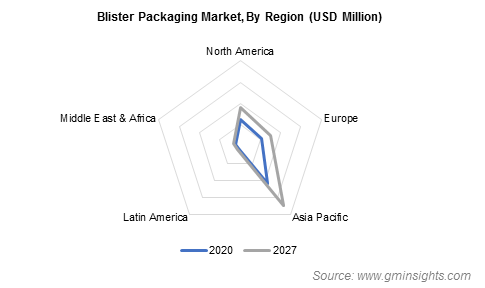

Asia Pacific is expected to hold dominnce in the blister packaging market and held around 45% volumetric shares in 2020. The dominance is owing to strong economic growth of the region along with the positive outlook of the pharmaceutical industry. The presence of several pharmaceutical drug manufacturers along with the large population in the region is driving the product growth. The region is a manufacturing hub for electronics and other consumer goods industries along with home for around 60% of the world’s population. Further, the growing disposable income and higher healthcare expenditure across India, South Korea, and China are driving the blister packaging market growth.