Summary

Table of Content

Biofuel Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Biofuel Market Size

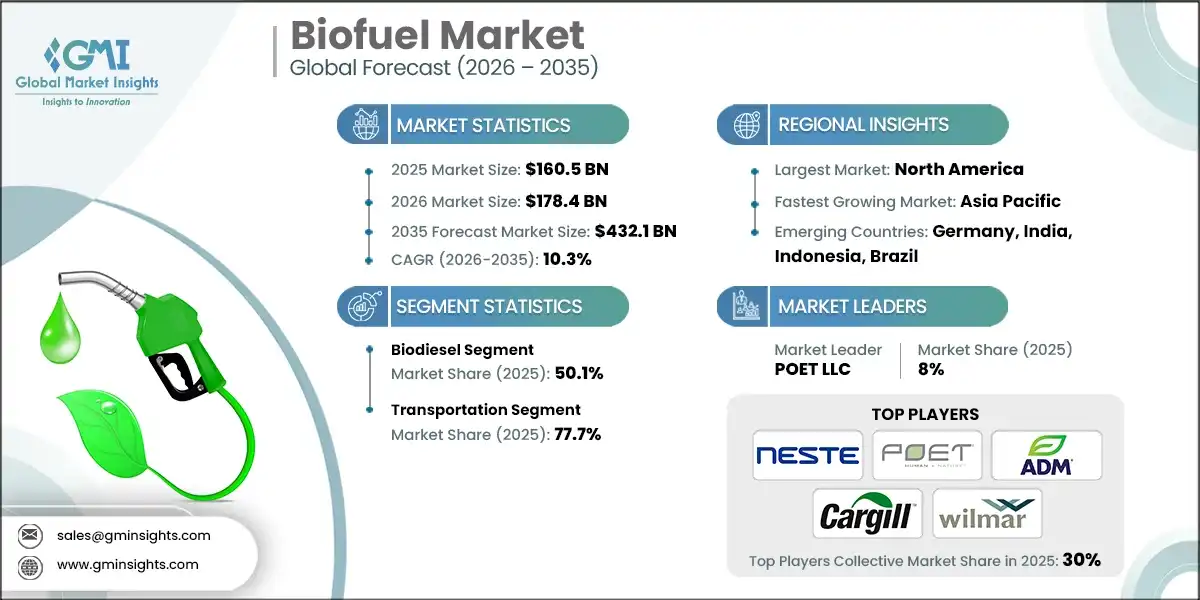

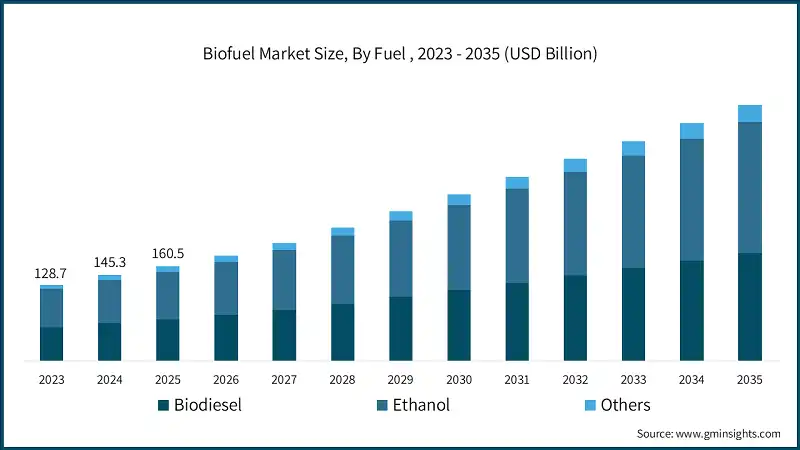

The global biofuel market was estimated at USD 160.5 billion in 2025. The market is expected to grow from USD 178.4 billion in 2026 to USD 432.1 billion in 2035, at a CAGR of 10.3%, according to a recent study by Global Market Insights Inc.

To get key market trends

- Continuous & exponential mandates for decarbonization in transport is tightening compliance and creating durable demand for biofuels across the globe. Governments are hard-coding lifecycle carbon intensity reductions into fuel policy. This is expanding compliance markets where producers earn tradable credits for supplying lower-carbon fuels.

- The rules standardize verification and traceability, which reduces buyer risk and strengthens offtake contracts. This in turn is increasing the demand for ethanol, biodiesel, renewable diesel (HVO), biogas/CBG, and sustainable aviation fuel (SAF) across road, aviation, and, increasingly, marine segments.

- For instance, in September 2025, the Government of Canada signaled its intention to introduce targeted amendments to the Clean Fuel Regulations (CFR) aimed at enhancing regulatory resilience and supporting the growth of the domestic low-carbon fuel sector, while continuing to prioritize greenhouse gas (GHG) emissions reductions and Canada’s transition to a low-carbon economy.

- In addition, The U.S. RFS “set” rule defines category volumes through 2025, sustaining obligated blending and the RIN framework that underpins ethanol, biodiesel, and advanced fuels. The rule locks in growth signals for cellulosic, biomass-based diesel, and total renewable fuel, sustaining producer economics and downstream investment in infrastructure and feedstocks.

- Additional rulemakings around compliance timing and waivers witnesses the program’s active management approach, which keeps market certainty intact, thereby adding to the industry growth. This continuity benefits farmers, refiners, and blenders who rely on predictable volumes to plan operations and capital.

- Introduction to various new reforms including Low Carbon Fuel Standard (LCFS) programs are expanding and tightening, lifting waste-based biofuels, especially across the U.S. This tighten CI benchmarks and broaden credit opportunities for infrastructure and transit, encouraging scale-up of fuels from used cooking oil, animal fats, landfill gas, and organic waste streams.

- LCFS alignment with other clean-transport regulations keeps the signal strong for suppliers targeting premium CI pathways. For instance, in July 2025, CARB approved LCFS program, targeting a 30% CI reduction by 2030 and ramping support for zero emission infrastructure.

- Aviation mandates are switching SAF from voluntary trials to compulsory blending at scale, which in turn is bolstering the industry scenario. Clear targets, feedstock definitions, and database traceability reduce uncertainty and catalyze long-term offtakes. Flexibility mechanisms and certificate systems help overcome uneven airport availability while keeping aggregate targets intact.

- The policy shift now links supply expansions directly to compliance demand across major hubs. For instance, the EU’s ReFuelEU Aviation requires SAF shares with stepped increases; the Commission and EASA reported 2024 SAF uptake progress and the Commission issued Feb 28, 2025, clarifications on flexibility and traceability.

Biofuel Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 160.5 Billion |

| Market Size in 2026 | USD 178.4 Billion |

| Forecast Period 2026 - 2035 CAGR | 10.3% |

| Market Size in 2035 | USD 432.1 billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing popularity as an eco-friendly fuel for road transportation | Biofuels are gaining traction as a sustainable alternative to conventional fuels, reducing reliance on fossil energy in road transport. |

| Growing emphasis on reducing greenhouse gas emissions | Global climate targets and carbon reduction mandates are accelerating biofuel adoption to cut lifecycle emissions. |

| Government initiative for research endeavors and favorable regulatory measures | Supportive policies, R&D funding, and blending mandates are driving innovation and market expansion for biofuels. |

| Pitfalls & Challenges | Impact |

| High feedstock cost | Rising prices and supply volatility of feedstocks such as oilseeds and agricultural residues remain a major barrier to cost-competitive biofuel production. |

| Opportunities: | Impact |

| Expansion of Sustainable Aviation Fuel (SAF) | Rising global mandates for SAF blending create a significant growth opportunity for biofuel producers targeting the aviation sector. |

| Advancement in Waste-Based Feedstocks | Increasing focus on circular economy and waste valorization opens new pathways for biofuel production from residues and non-food sources. |

| Market Leaders (2025) | |

| Market Leaders |

8% market share |

| Top Players |

Collective Market Share 30% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | Germany, India, Indonesia, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Biofuel Market Trends

- Various countries are adopting SAF mandates with detailed compliance guidance, certificate issuance rules, and verifier accreditation. This creates transparent markets, enabling airlines to hedge compliance, and producers to unlock financing against certificate revenues. Sub-targets, feedstock caps, and power-to-liquid provisions shape technology choices while buy out levels cap cost exposure.

- These legal frameworks signal credible, bankable demand for SAF and encourage domestic production through revenue-certainty mechanisms. For instance, in December 2024, the UK SAF Mandate started at 2% in 2025 and will rise to 10% in 2030; the Department for Transport published 2025 compliance guidance and supporting legislative analysis, and the bill progressed to enable revenue-support for UK producers.

- Rising maritime GHG policy is aligning fuel standards and lifecycle accounting, opening a role for sustainable biofuels. This onboards biofuels into a structured decarbonization pathway, particularly for near term dropping options that can be blended or used directly in existing engines.

- Lifecycle guidelines and verification frameworks reduce disputes about emissions accounting and support bunker suppliers offering certified biofuel blends. Early uptake in liner trades and trials around methanol and biodiesel show the sector gearing toward compliance ahead of formal adoption timelines.

- For instance, March 2024, IMO adopted the guidelines on life cycle ghg intensity of marine fuels and, in April 2025, approved draft net-zero framework regulations combining a global fuel standard and GHG pricing, slated for adoption Oct 2025 and entry into force in 2027.

- Companies are converting fossil refineries into biorefineries and scaling coprocessing. This de-risks projects by leveraging existing assets, logistics, and workforce while adding flexible units to process wastes and residues into HVO and SAF. Long dated airline offtakes and credit regimes improve revenue visibility.

- Global majors are structuring partnerships to secure feedstocks and deploying proven technologies, accelerating commissioning timelines and geographic diversification. The focus on waste lipids and advanced residues positions projects to meet sustainability criteria under evolving regulations.

- For instance, in April 2025, Neste began SAF production at Rotterdam lifting global SAF capability to ~1.5 Mt/y, with a strategic expansion toward 2.2 Mt/y by 2027. In addition, it also expanded U.S. airline supply (e.g., United hubs in 2025) via existing pipeline infrastructure.

- Larger offtakes underpin plant utilization and signal bankability to lenders. As more facilities reach steady-state operations, the sector benefits from operational learning, feedstock contracting discipline, and tighter product specifications. This reduces the gap between mandated demand and physical supply.

Biofuel Market Analysis

Learn more about the key segments shaping this market

- Based on fuel, the market is segmented into biodiesel, ethanol, and others. Biodiesel based biofuel industry dominated by 50.1% of the market share in 2025 and is set to grow at a CAGR of 10.5% by 2035. Producers are investing in CCS retrofits to lower lifecycle emissions, improve CI scores under LCFS type regimes, and qualify for better economics in export and domestic compliance markets.

- Operationally, ethanol’s role in octane enhancement remains, while policy moves in several regions (e.g., E10/E15 access, fleet decarbonization roadmaps) ensure steady offtake. The near-term trend is clear, ethanol producers that will document sustainable feedstock sourcing and quantifiable CI cuts gain preferential access to high-value segments and cross border trade.

- For instance, EPA’s final “set” rule for 2023–2025 remained in force, with ongoing notices and adjustments published on the RFS portal updated January 7, 2026, providing the statutory framework that will sustains ethanol blending and RIN markets through 2025.

- Furthermore, for instance, in April 2025, ANP’s definitive CBIO targets and methodology updates tie ethanol producers’ efficiency certification to tradable credits, solidifying carbon-market economics for ethanol in the world’s largest sugarcane ethanol system.

- Biodiesel biofuel market will grow at a CAGR of 9.9% by 2035. Biodiesel is benefiting from tightening lifecycle-carbon policies and the spread of low carbon fuel standards (LCFS), which reward verifiable emissions reductions and push fleets toward waste and residue based feedstocks.

- Producers are prioritizing feedstock aggregation (used cooking oil, tallow, and other byproducts) and refinery conversions to handle variable inputs while meeting stricter sustainability criteria. As trucking, municipal fleets, and logistics providers chase near term decarbonization, drop in biodiesel/HVO solutions will gain traction as they fit existing engines and supply chains.

- For instance, in November 2024, CARB approved LCFS program updates with an effective date of July 1, 2025, sharpening CI targets (e.g., 30% CI reduction by 2030) and expanding support for clean fuel infrastructure, which directly benefits waste based biodiesel/HVO pathways.

- In addition, aviation mandates, emerging marine fuel standards, and expanding biogas/biomethane programs. Furthermore, Renewable diesel/HVO continues to scale via refinery conversions and coprocessing, giving fleets a drop in path to CI reduction across heavy-duty transport and municipal operations.

- For instance, in February 2025, the European Commission and EASA reported progress on 2024 SAF uptake and issued implementation clarifications, confirming the 2025 2% SAF obligation and strengthening traceability via the Union Database for Biofuels; this is a direct demand signal for global SAF supply.

Learn more about the key segments shaping this market

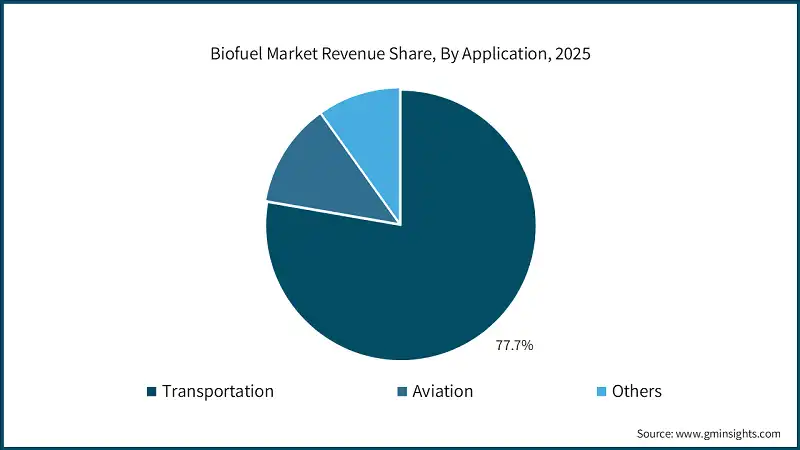

- Based on application, the biofuel market is segmented into transportation, aviation, & others. Transportation application industry held a market share of 77.7% in 2025 and will grow at a CAGR of 9.5% by 2035. The transportation sector remains the largest and most stable demand center for biofuels globally, driven by regulatory mandates, compliance-based credit markets, and the availability of drop in renewable fuel solutions.

- Governments continue to prioritize transport biofuels because they provide immediate emissions reductions without requiring large-scale vehicle or infrastructure overhauls, particularly in heavy-duty trucking, municipal fleets, and long-haul logistics.

- Additionally, energy security considerations reducing dependence on imported fossil fuels are reinforcing biofuel adoption across both developed and emerging economies. As electrification progresses unevenly, biofuels remain the primary transitional solution for decarbonizing existing global vehicle fleets.

- In January 2026, DHL Global Forwarding and CMA CGM announced an advancement in decarbonizing global container shipping by jointly committing to the use of 8,990 metric tons of second-generation UCOME biofuel. This collaboration is expected to deliver an estimated reduction of approximately 25,000 metric tons of CO2e emissions for ocean freight shipments conducted under DHL’s GoGreen Plus service.

- Aviation application industry will grow at a CAGR of 10.6% by 2035. The market growth is driven by mandatory Sustainable Aviation Fuel (SAF) blending requirements and global climate commitments. SAF demand is being reinforced through lifecycle emissions accounting, fuel traceability systems, and financial support mechanisms such as emissions trading allowances and certificate trading.

- Airlines are increasingly signing multi--year offtake agreements to manage compliance risk, accelerating investment across the SAF supply chain. Policy coherence between climate targets, carbon-offset schemes (such as CORSIA), and direct fuel mandates is creating global alignment, enabling SAF deployment beyond pilot projects and into commercial use at scale.

- For instance, in February 2025, European commission confirmed that the ReFuelEU Aviation Regulation became applicable, mandating a minimum 2% SAF blend at EU airports, with implementation guidance and traceability improvements, signaling enforceable SAF demand across the EU aviation market.

Looking for region specific data?

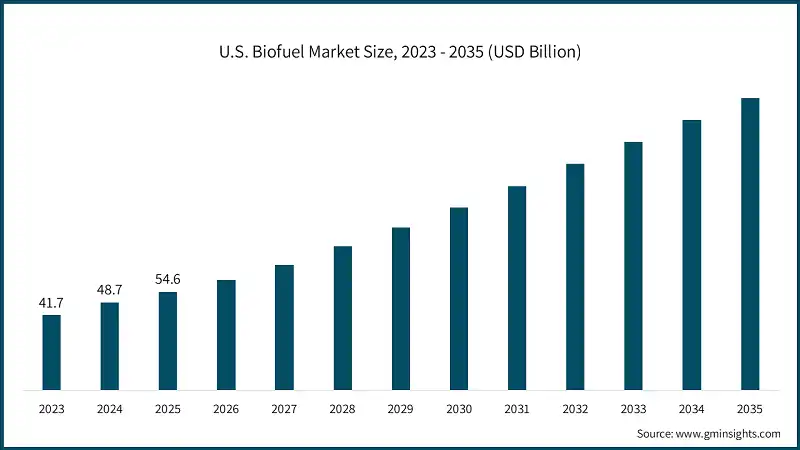

- The U.S. dominated around 93% share of the North America biofuel market in 2025 and generated USD 54.6 billion in revenue. The country continues to lead the global market due to its mature regulatory infrastructure, well-developed feedstock supply chains, and credit driven compliance mechanisms.

- Additionally, energy security considerations and volatility in fossil fuel markets have reinforced political support for domestic biofuel production. Corporate decarbonization commitments from freight, maritime, and aviation sectors further support uptake.

- For instance, U.S. Environmental Protection Agency (EPA) reaffirmed enforcement of its final RFS “Set Rule” volumes through 2025, mandating increased blending of biomass based diesel and advanced biofuels, providing regulatory certainty to North American producers and fuel suppliers.

- The Europe market will at a CAGR of 9.4% by 2035. The growth is driven by binding climate legislation under the Fit for 55 packages, combined with sector specific mandates across transport, aviation, and maritime segments. The region is increasingly shifting toward advanced and waste based biofuels, reflecting sustainability safeguards embedded in the Renewable Energy Directive (RED III).

- Europe’s emphasis on traceability, sustainability certification, and exclusion of food based feedstocks favors second generation biofuels and renewable fuels of non biological origin (RFNBOs). This policy coherence across sectors is transforming Europe into a demand led market, encouraging large scale investment in SAF, HVO, and biomethane production capacity.

- In December 2025, Germany’s federal cabinet approved a draft biofuels bill permitting the continued use of food and animal feed based inputs in biofuel production. The measure forms part of the government’s broader greenhouse gas reduction program, which promotes blending biofuels such as biodiesel and bioethanol with conventional fossil fuels to lower emissions from road transport.

- Asia Pacific biofuel market will cross USD 94 billion by 2035, and is shaped by energy security priorities, rapid transport demand growth, and government backed domestic blending programs. In addition, large populations and expanding vehicle fleets make APAC one of the fastest growing biofuel consumption regions globally.

- In addition, the region’s growth remains policy led, supported by public sector oil marketing companies and national bioenergy missions, making APAC a key volume market for ethanol and biodiesel rather than premium biofuels. For instance, in August 2025, the government of India achieved 20% ethanol blending targets five years ahead of schedule.

- Middle East & Africa market will grow at a CAGR of 3.9% by 2035. The market remains nascent but is gaining momentum through energy diversification strategies, aviation decarbonization initiatives, and long term net zero commitments.

- Governments and national oil companies are increasingly partnering with global energy firms to develop SAF and renewable fuel projects aligned with export markets. These developments position MEA as a future supply side region, rather than a near term demand hub, within the global biofuel value chain.

- Latin America market will grow at a CAGR of 6.1% by 2035, driven by mature and feedstock advantaged biofuel production, underpinned by long standing ethanol and biodiesel programs. In addition, biofuel growth is also supported by abundant agricultural residues and favourable climate conditions.

Biofuel Market Share

- The top 5 companies in the biofuel industry Neste Corporation, POET LLC., ADM, Cargill, and Wilmar International held over 30% market share in the year 2025. POET’s scale, operational efficiency, and integration with carbon capture initiatives position it as one of the major producers for low-carbon ethanol.

- ADM vertically integrates model from feedstock sourcing to fuel manufacturing, provides cost advantages and supply security. ADM’s diversification into renewable diesel and SAF through partnerships and technology investments reflects its strategy to capture growth beyond conventional ethanol.

- Neste with advanced biorefinery capabilities and a strong sustainability brand has catered a major share across the globe. Its focus on waste and residue feedstocks aligns with tightening lifecycle carbon regulations in Europe and North America. The company’s SAF production and partnerships with airlines give it a competitive edge in aviation decarbonization.

Biofuel Market Companies

Major players operating in the biofuel industry are:

- ADM

- Borregaard

- BTG Bioliquids

- Cargill

- Chevron Corporation

- Clariant

- COFCO

- CropEnergies

- FutureFuel

- Munzer Bioindustrie

- My Eco Energy

- Neste Corporation

- POET

- Praj Industries

- The Andersons

- TotalEnergies

- UPM

- Verbio

- Wilmar International

- Zilor

- Cargill strength lies in its integrated supply chain and feedstock dominance, enabling it to support biodiesel and renewable fuel production globally. The company’s role as a major feedstock supplier and its investments in renewable diesel projects make it a critical enabler of biofuel growth.

- ADM holds a strong competitive position in the oil based biofuel landscape, supported by its large scale bioethanol platform comprising 18 operational facilities with a combined annual production capacity of approximately 1.8 billion gallons. The company with adjusted earnings of USD 452 million recorded in Q2 2025, underscoring resilience amid market volatility and the benefits of ongoing portfolio optimization efforts.

- Chevron Corporation aggressively scales renewable diesel and SAF production through biorefinery conversions and coprocessing strategies. The company evidenced by USD 17.7 billion in net income in 2024 and USD 7.7 billion allocated to low carbon and energy transition investments during the same year

Biofuel Industry News

- In August 2025, Cargill decided to build a corn ethanol plant adjacent to their sugarcane plant in Brazil. This in turn will increase in the adoption of feedstock from ethanol production, thereby will significantly add to the market growth across the country.

- In February 2025, POET and Tallgrass agreed to connect POET’s Fairmont, Nebraska bioprocessing facility to the Trailblazer CO2 pipeline, enabling permanent sequestration and lower ethanol CI, an emerging model for ethanol producers to access premium compliance markets

- In January 2025, the U.S. Department of Energy’s Bioenergy Technologies Office (BETO) announced up to USD 10 million in funding to advance high-impact R&D focused on algae cultivation systems and pre-processing technologies. The initiative aims to accelerate next-generation biofuel feedstock pathways and strengthen the foundation for future low-carbon energy solutions.

This biofuel market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) and volume (Mtoe) from 2022 to 2035, for the following segments:

Market, By Fuel

- Biodiesel

- Ethanol

- Others

Market, By Feedstock

- Coarse grain

- Sugar crop

- Vegetable oil

- Others

Market, By Application

- Transportation

- Aviation

- Others

The above information has been provided for the following region and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Spain

- UK

- Italy

- Asia Pacific

- China

- India

- Indonesia

- Australia

- South Korea

- Middle East & Africa

- Saudi Arabia

- South Africa

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

What is the market size of the biofuel industry in 2025?

The market size exceeded USD 160.5 billion in 2025, driven by decarbonization mandates, transport fuel blending requirements, and rising adoption of low-carbon fuels.

Which country leads the global biofuel market?

The U.S. generated USD 54.6 billion in 2025 and accounted for around 93% share of the market. Market growth is driven by a mature regulatory framework under the Renewable Fuel Standard (RFS), robust feedstock supply chains, and credit-based compliance mechanisms.

What are the key trends shaping the biofuel market?

Key market trends include rapid expansion of sustainable aviation fuel, increasing use of waste- and residue-based feedstocks, refinery conversions to renewable diesel and SAF, and integration of carbon capture technologies.

Who are the key players in the biofuel industry?

Major companies operating in the industry include Neste Corporation, POET LLC, ADM, Cargill, Wilmar International, Chevron Corporation, TotalEnergies, UPM, Verbio, and Praj Industries.

What is the growth outlook for the aviation biofuel segment through 2035?

The aviation biofuel industry is projected to grow at a CAGR of 10.6% through 2035, driven by mandatory SAF blending targets, lifecycle emissions accounting, and long-term airline offtake agreements.

What is the projected value of the biofuel market by 2035?

The market is expected to reach USD 432.1 billion by 2035, expanding at a CAGR of 10.3%, as sustainable aviation fuel (SAF) mandates, LCFS programs, and waste-based feedstock adoption accelerate globally.

What was the market share of the transportation application segment in 2025?

The transportation segment accounted for 77.7% of the market share in 2025, as biofuels remain the primary near-term solution for reducing emissions from existing vehicle fleets.

Which fuel segment dominated the biofuel industry in 2025?

The biodiesel segment dominated the industry with 50.1% market share in 2025, driven by strong demand for drop-in renewable fuels and favorable lifecycle carbon credit economics.

What is the current biofuel market size in 2026?

The biofuel industry is projected to reach USD 178.4 billion in 2026, supported by expanding ethanol, biodiesel, and renewable diesel consumption across transportation and aviation applications.

Biofuel Market Scope

Related Reports