Summary

Table of Content

Bioanalytical Testing Services Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Bioanalytical Testing Services Market Size

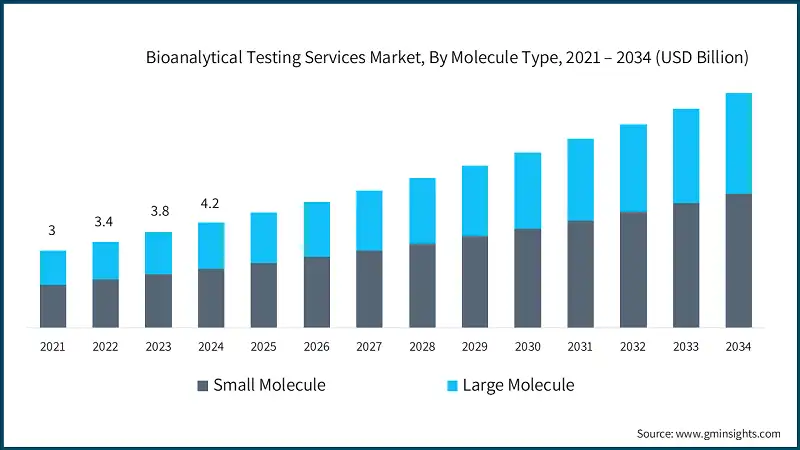

The global bioanalytical testing services market was valued at USD 4.2 billion in 2024 and is projected to grow from USD 4.6 billion in 2025 to USD 9.3 billion by 2034, expanding at a CAGR of 8.2%, according to the latest report published by Global Market Insights Inc. This steady growth is driven by the increased trend of outsourcing laboratory testing services, rising advancements in bioanalytical technology, growing drug development and approval processes, and increasing volume of ongoing research activities and clinical trials.

To get key market trends

Bioanalytical testing services refer to a range of laboratory services that involve the analysis of biological samples such as blood, urine, tissue, etc. to quantify the concentration of drugs, metabolites, biomarkers, and other analytes in biological matrices. These services are commonly used in the pharmaceutical and biotechnology industries for various purposes, including drug development, pharmacokinetic studies, bioequivalence assessments, and in overall clinical trials.

Major companies in the industry include Labcorp Drug Development, SGS Société Générale de Surveillance SA, Thermo Fisher Scientific Inc., Eurofins Scientific, and ICON Plc. This globalization of testing capabilities enables companies to expand market reach, develop strategic alliances, and leverage regional resources and expertise to support drug development activity in multiple market segments, thereby enhancing the growth of the industry.

The market increased from USD 3 billion in 2021 to USD 3.8 billion in 2023. This growth can be primarily attributed to the increased trend of outsourcing laboratory testing services. As pharmaceutical and biotechnology companies face increasing pressure to reduce costs and accelerate drug development timelines, outsourcing has emerged as a strategic solution. The growing complexity of biologics and personalized therapies further amplifies the need for specialized testing capabilities, making outsourcing a key driver of innovation and scalability in the bioanalytical landscape.

The growing drug development and approval processes is one of the key factors aiding in the growth of the bioanalytical testing services industry. For instance, in March 2025, there were 10,134 new medicines under development globally, reflecting a 20% increase compared to September 2021. Oncology represented 38% of all pipeline medicines, while metabolic disorders accounted for 15% of the pipeline. These statistics suggest that pharmaceutical and biotechnology companies are expanding their pipelines to include novel drugs, biologics, and personalized therapies, thereby driving a surge in demand for robust bioanalytical testing. These services are essential for ensuring the safety, efficacy, and regulatory compliance of drug candidates during preclinical and clinical phases.

Additionally, increasing volume of ongoing research activities and clinical trials is a significant driver of growth in the bioanalytical testing services market. According to Statista, as of mid-2025, there were over 540,000 registered clinical studies worldwide, reflecting the growing scale of global drug development efforts. Between 2018 and 2023, 28% of clinical drug trials initiated were in oncology, while infectious diseases accounted for 13%. This surge in clinical trials translates into a higher demand for bioanalytical testing services to support complex studies, including pharmacokinetic and pharmacodynamic evaluations, biomarker analysis, and method validation.

Bioanalytical testing services are performed on biological specimens, such as blood, plasma, and tissue, to evaluate drug concentration and behavior in the body. Bioanalytical testing offer support to pharmacokinetic and pharmacodynamics studies, biomarker analysis, and method validation during preclinical and clinical studies. These services are critical for ensuring drug safety, drug efficacy, and regulatory compliance in drug development.

Bioanalytical Testing Services Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 4.2 Billion |

| Market Size in 2025 | USD 4.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 8.2% |

| Market Size in 2034 | USD 9.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increased trend of outsourcing laboratory testing services | Drives demand for specialized bioanalytical service providers offering cost-effective and scalable solutions. |

| Rising advancements in bioanalytical technology | Enables development of more precise, sensitive, and high-throughput testing methods, enhancing data quality and regulatory compliance. |

| Growing drug development and approval processes | Fuels the need for robust bioanalytical support to meet stringent regulatory requirements and accelerate time-to-market. |

| Increasing volume of ongoing research activities and clinical trials | Expands the scope and complexity of bioanalytical testing, requiring diversified capabilities and global infrastructure. |

| Pitfalls & Challenges | Impact |

| Complex regulatory framework for maintaining laboratories | Creates operational hurdles and increases compliance costs for bioanalytical service providers. |

| High cost of advanced analytical instruments and technologies | Limits accessibility for smaller CROs and labs, potentially slowing innovation and market entry. |

| Opportunities: | Impact |

| Expansion of clinical trials in emerging markets | Opens new avenues for bioanalytical service providers to establish regional hubs and tap into underserved geographies. |

| Integration of AI and automation in bioanalytical workflows | Enhances efficiency, reduces human error, and accelerates data processing and decision-making in drug development. |

| Market Leaders (2024) | |

| Market Leaders |

27% market share |

| Top Players |

Collective market share in 2024 is 60% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Bioanalytical Testing Services Market Trends

- The global market is undergoing a dynamic transformation, driven by rising advancements in bioanalytical technology.

- Advancements in bioanalytical technologies such as mass spectrometry, chromatography, and immunoassays are significantly improving the sensitivity, accuracy, and throughput of testing services. These innovations enable faster turnaround times, better data quality, and expanded capabilities in metabolite profiling, biomarker discovery, and pharmacokinetic studies.

- For instance, ICON plc’s LC-MS/MS bioanalytical services offer full method development and validation aligned with ICH M10 standards. They use advanced Sciex instruments to analyze a wide range of samples like plasma, urine, and tissue, including wet and dried microsampling. These services support clinical trials, bioequivalence studies, biomarker analysis, and immunogenicity testing with high sensitivity and regulatory compliance.

- Additionally, pharmaceutical companies are increasingly adopting high-throughput screening (HTS), lab-on-a-chip (LOC) devices, and biosensors to accelerate drug discovery and development, allowing rapid candidate screening, target identification, and efficacy assessment.

- For example, Single Molecule Array (SIMOA) platform is a cutting-edge immunoassay technology used in Syneos Health’s bioanalytical services for biomarker analysis. Its key features include ultrasensitive detection of low-abundance biomarkers, making it ideal for early-phase clinical trials and precision medicine. It supports multiplexing, high-throughput screening, and is compatible with various biological matrices, ensuring robust and reproducible data for pharmacodynamic and safety assessments.

- Collectively, these factors are driving strong market growth, although the complex regulatory framework for laboratory compliance may pose certain challenges.

Bioanalytical Testing Services Market Analysis

Learn more about the key segments shaping this market

The bioanalytical testing services market based on molecule type is segmented into small and large. The small segment accounted for majority of market share of 56% in 2024 and is expected to dominate throughout the analysis period.

- The demand for small molecule bioanalytical testing is rising due to the continued dominance of small molecule drugs in therapeutic areas like oncology, cardiovascular diseases, and infectious diseases. Their relatively simpler structure, cost-effective manufacturing, and well-established regulatory pathways make them convenient for pharmaceutical companies.

- Moreover, increasing number of generic drug approvals and patent expirations for branded small molecule drugs, there is a growing demand for bioequivalence studies. Bioanalytical testing services are essential for demonstrating the bioequivalence of generic drugs compared to their branded counterparts, ensuring comparable pharmacokinetic profiles and therapeutic efficacy, thereby augmenting the segmental growth.

- As the pharmaceutical industry continues to innovate and expand its small molecule pipeline, bioanalytical testing services will remain a critical component, ensuring drug safety, efficacy, and regulatory compliance across global markets.

Based on test type, the bioanalytical testing services market is classified into DMPK testing, biomarker testing, virology testing, serology testing, immunogenicity testing, and other test types. The virology testing segment has been further divided into in-vivo virology testing and in-vitro virology testing. Biomarker testing dominated the market and was valued at USD 1.1 billion in 2024.

- Biomarker testing plays a crucial role in the bioanalytical testing services across various industries, including pharmaceuticals, biotechnology, CRO, and academic research. Biomarkers are measurable indicators of biological processes, disease states, or responses to therapeutic interventions.

- For instance, BioAgilytix offers advanced biomarker testing services using platforms like MSD-ECL (Meso Scale Discovery Electrochemiluminescence), which provide high sensitivity, multiplexing capability, and broad dynamic range. MSD-ECL is particularly effective for detecting multiple biomarkers simultaneously in complex biological matrices such as serum or plasma, making it ideal for immuno-oncology, inflammation, and neurodegenerative disease studies.

- Additionally, the segment growth is majorly attributed to early disease detection and prediction of disease progression which will help physicians to make informed decisions about patient management and treatment. Thus, demand for biomarker testing is anticipated to grow in upcoming years.

Based on application, the bioanalytical testing services market is divided into oncology, neurology, infectious diseases, gastroenterology, cardiology, and other applications. The oncology segment accounted for significant market position and is predicted to reach USD 2.2 billion by 2034.

- Bioanalytical testing services play a crucial role in oncology that help in supporting research, drug development, clinical trials, and patient care.

- The global rise in cancer incidence is significantly contributing to the expansion of the bioanalytical testing services market. In 2022, approximately 20 million new cancer cases and 9.7 million cancer-related deaths were reported worldwide, with projections indicating a surge to 35 million new cases by 2050, primarily driven by population growth and aging. This escalating burden underscores the critical need for advanced bioanalytical solutions particularly in biomarker testing to support early detection, accurate diagnosis, and therapeutic monitoring, thereby enhancing clinical decision-making and patient outcomes.

- Additionally, advancements in bioanalytical testing methods used in oncology are further propelling market growth, as they enhance the accuracy, efficiency, and reliability of cancer diagnostics and therapeutic monitoring.

Learn more about the key segments shaping this market

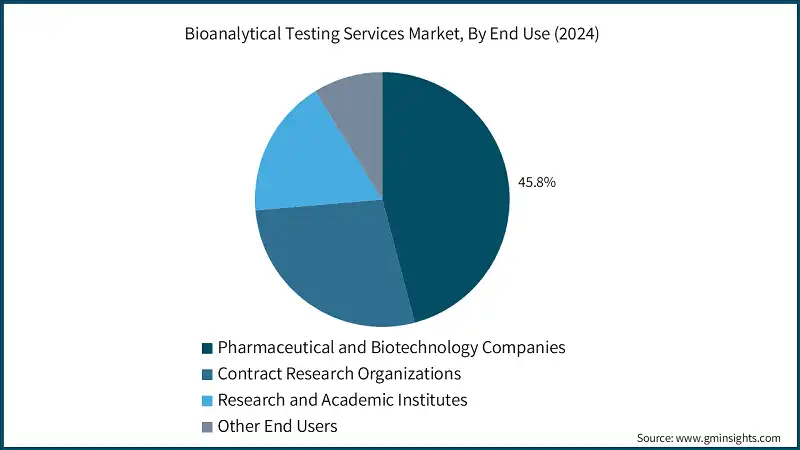

Based on end use, the bioanalytical testing services market is segmented into pharmaceutical and biotechnology companies, contract research organizations, research and academic institutes, and other end users. The pharmaceutical and biotechnology companies segment held a market share of 45.8% in 2024.

- The pharmaceutical and biotechnology segment is expanding rapidly due to the increasing development of complex biologics, biosimilars, and targeted therapies. These companies rely heavily on bioanalytical testing to support drug discovery, preclinical studies, and clinical trials, ensuring regulatory compliance and data integrity.

- Additionally, collaboration between bioanalytical testing companies and pharmaceutical or biotech firms is rapidly expanding the bioanalytical services market. These partnerships improve efficiency, accelerate drug development, and ensure high-quality compliant testing. For instance, in May 2024, BBI Solutions and BioAgilytix formed a strategic partnership aimed at streamlining and simplifying bioanalytical testing processes for pharmaceutical and biopharmaceutical companies. This collaboration integrated the BBI's expertise in producing high-quality custom antibody reagents with BioAgilytix's renowned bioanalytical testing services, expanding both the companies offering in the bioanalytical testing services market.

- The growing emphasis on personalized medicine and precision therapeutics is expected to further drive the growth of the bioanalytical services market.

Looking for region specific data?

North America Bioanalytical Testing Services Market

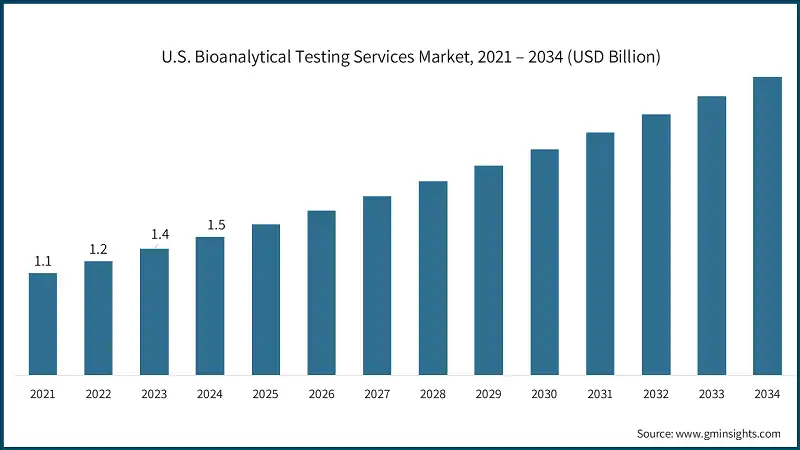

North America dominated the market with the highest market share of 39.4% in 2024.

- In the U.S., the market was valued at USD 1.1 billion in 2021 and USD 1.2 billion in 2022. By 2024, the market size grew to USD 1.5 billion, up from USD 1.4 billion in 2023. This growth is primarily driven by increasing investment in the research and development of new drugs by pharmaceutical and biotechnology industries. Additionally, pharmaceutical and biotechnology companies are focusing on expanding their capabilities in biologics development and partnering with CROs and CDMOs.

- The North America bioanalytical testing services market is driven by several key factors contributing to its robust growth. The region's highly advanced pharmaceutical and biotechnology sectors play a pivotal role, with extensive research and development activities and a high number of drug discovery and development projects requiring specialized bioanalytical testing.

- The growing number of approvals for novel medicines to meet the rising demand is also positively impacting market growth. For instance, the U.S. FDA approved 55 new drugs in 2023, while 37 were approved in 2022.

- Moreover, regulatory agencies like the FDA emphasize stringent testing protocols to ensure drug safety and efficacy, boosting reliance on bioanalytical services. Additionally, the increasing adoption of biologics, biosimilars, and gene therapies has expanded the scope of testing services, particularly for complex molecular structures which is significantly impacting market in North America.

Europe Bioanalytical Testing Services Market

Europe market accounted for USD 1.1 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- The increasing demand for biologics and biosimilars is a key growth driver for the bioanalytical services market, as these complex molecules require stringent testing to meet regulatory standards. Regulatory bodies such as the European Medicines Agency (EMA) are enforcing rigorous compliance requirements, prompting pharmaceutical companies to outsource bioanalytical testing to specialized providers to ensure quality and adherence.

- Moreover, the surge in clinical trials across Europe supported by a strong healthcare infrastructure and a focus on innovation is further accelerating demand. The rising prevalence of chronic diseases, including cancer and diabetes, continues to drive the development of advanced therapeutics, necessitating robust bioanalytical validation. For example, the European Commission reports that over 33 million people in the region are affected by diabetes, a figure projected to reach 38 million by 2030.

- Advancements in analytical technologies, such as mass spectrometry and chromatography, have significantly improved testing accuracy and efficiency. These innovations make outsourcing more cost-effective and scalable, positioning Europe as a critical hub for bioanalytical testing services.

Germany bioanalytical testing services market is projected to experience steady growth between 2025 and 2034.

- Germany’s bioanalytical testing services market is witnessing significant growth, largely driven by the rising demand for biomarker testing and other test types used in oncology studies. According to the German Centre for Cancer Registry Data (ZfKD), over 500,000 new cancer cases are reported annually, making cancer one of the leading causes of death nationwide. These tests are increasingly utilized in cancer research due to their ability to support targeted and personalized treatment approaches.

- Rising advancements in bioanalytical technologies are further propelling the growth of Germany’s market. Innovations in platforms such as high-resolution mass spectrometry, next-generation sequencing, and automated liquid handling systems have significantly enhanced the sensitivity, accuracy, and throughput of testing processes.

Asia Pacific Bioanalytical Testing Services Market

Asia Pacific is the fastest-growing market, expected to show a lucrative growth rate of 9.1% during the forecast period.

- The rapid expansion of the pharmaceutical and biotechnology sectors in countries such as China, India, and South Korea is a major driver of growth in the market.

- This expansion is supported by substantial government investments in healthcare infrastructure and innovation. For example, India’s Union Budget allocated USD 10.7 billion to enhance healthcare accessibility and foster innovation, underscoring the government's commitment to strengthening the sector.

- Moreover, the region's growing importance as a hub for clinical trials, supported by cost-effective operations and a diverse patient pool, has significantly boosted the demand for bioanalytical testing services. The rising prevalence of chronic diseases, coupled with the growing adoption of biologics and biosimilars, further underscores the need for advanced bioanalytical capabilities to ensure therapeutic safety and efficacy.

Japan bioanalytical testing services market is poised to witness lucrative growth between 2025 - 2034.

- Japan’s market is experiencing steady growth, driven by significant advancements in analytical technologies and an increasingly dynamic pharmaceutical landscape. Innovations in high-throughput screening, mass spectrometry, and bioinformatics have enhanced the precision, sensitivity, and efficiency of bioanalytical testing, enabling more robust support for complex drug development processes.

- Concurrently, Japan’s strong focus on pharmaceutical innovation bolstered by regulatory reforms and expedited drug approval pathways has led to a surge in clinical research and new drug applications.

Latin America Bioanalytical Testing Services Market

Brazil is experiencing significant growth in the market

- Brazil is emerging as a key player in the global market, driven by a sharp rise in ongoing research activities and clinical trials. As of April 2024, Brazil had registered approximately 10,000 clinical studies, making it the leading country in Latin America for clinical trials surpassing Mexico and Argentina, which reported around 5,000 and 4,000 studies respectively. This surge in clinical research is significantly boosting the demand for specialized bioanalytical testing services to support drug development, pharmacokinetic studies, and regulatory submissions.

- The increasing volume of clinical trials has also prompted greater investment in advanced bioanalytical technologies and infrastructure across Brazil. These developments are enabling more accurate, efficient, and compliant testing processes, which are essential for the evaluation of complex biologics, biosimilars, and targeted therapies.

Middle East and Africa Bioanalytical Testing Services Market

The market in Saudi Arabia is expected to experience significant and promising growth from 2025 to 2034.

- Saudi Arabia is rapidly emerging as a regional hub for clinical research, significantly boosting the demand for bioanalytical testing services. According to the Saudi Clinical Trials Registry (SCTR), the country received 477 drug clinical trial applications between 2010 and 2021, with a notable increase in annual submissions from 18 in 2010 to 55 in 2021.

- Coupled with investments in research infrastructure and the establishment of institutions like the Saudi National Institute of Health (NIH), these initiatives are creating a favorable environment for clinical trials and bioanalytical testing. Consequently, Saudi Arabia has emerged as a leading country for global pharmaceutical companies seeking efficient, compliant, and regionally accessible testing services across the Middle East and Africa.

Bioanalytical Testing Services Market Share

- The top 5 players, such as Eurofins Scientific, Labcorp Drug Development, ICON Plc, Thermo Fisher Scientific Inc., and SGS Société Générale de Surveillance SA, collectively held 60% of the total market share.

- The growth of the market is being significantly propelled by the strategic actions and innovations of leading global players such as Eurofins Scientific, Labcorp Drug Development, and Thermo Fisher Scientific. These companies are playing a pivotal role in shaping the market through their investments in advanced technologies, expansion of laboratory networks, and commitment to regulatory compliance and quality standards.

- Key players are offering comprehensive testing solutions that span pharmacokinetics, pharmacodynamics, biomarker analysis, and immunogenicity assessments. Their ability to deliver accurate and timely results helps pharmaceutical and biotech companies accelerate their development timelines and reduce costs, which in turn boosts market activity.

- Moreover, these companies are expanding their global footprint by establishing laboratories and service centers in emerging markets, thereby improving access to bioanalytical services worldwide.

- Through sustained investments in cutting-edge technologies, expansion into emerging markets, and a strong focus on regulatory compliance, leading bioanalytical testing service providers are further accelerating market growth.

Bioanalytical Testing Services Market Companies

Few of the prominent players operating in the bioanalytical testing services industry include:

- Altasciences

- BioAgilytix

- Cambrex Corporation

- Charles River Laboratories, Inc.

- Eurofins Scientific

- Frontage Labs

- ICON Plc

- Intertek Group Plc

- Labcorp Drug Development

- LGC Limited

- Pace Analytical Services LLC

- SGS Société Générale de Surveillance SA

- Syneos Health

- Thermo Fisher Scientific Inc.

- WuXi AppTec

Thermo Fisher Scientific Inc. is a major participant in the bioanalytical testing services market, leveraging its extensive portfolio of high-performance analytical tools and technologies. The company supports pharmaceutical and biotechnology organizations by offering end-to-end testing services, including pharmacokinetics, toxicology, and biomarker analysis. Its global infrastructure facilitates efficient service delivery across diverse regulatory environments, ensuring compliance with international standards. By integrating advanced instrumentation with scalable laboratory solutions, Thermo Fisher provides robust testing capabilities to support the growing demand for biologics and precision medicine.

LabCorp Drug Development plays a pivotal role in the bioanalytical testing services market, offering a wide array of clinical and preclinical analytical solutions. The company’s expertise extends to pharmacodynamics, bioavailability studies, and custom assay development, addressing the critical requirements of pharmaceutical innovation. With a network of integrated laboratories, LabCorp provides seamless support for complex testing workflows, ensuring consistency and quality across its services. Its strength in biomarker discovery and validation supports personalized medicine and the development of novel therapeutics.

SGS Société Générale de Surveillance SA

SGS Société Générale de Surveillance SA is a key player in the bioanalytical testing services market, specializing in regulatory-compliant solutions for pharmaceutical and biotechnology clients. The company’s portfolio includes analytical services for small molecules, biologics, and biosimilars, addressing the complex demands of modern drug development. Through its global network of laboratories, SGS delivers region-specific testing capabilities, ensuring alignment with local regulatory guidelines. Its use of advanced technologies, such as mass spectrometry and chromatography, enhances the precision and sensitivity of bioanalytical processes.

Bioanalytical Testing Services Market News:

- In January 2024, Frontage Laboratories completed the acquisition of Accelera S.r.l.'s Bioanalytical and Drug Metabolism & Pharmacokinetics (DMPK) businesses. This strategic move was carried out through Frontage's wholly-owned subsidiary, Frontage Europe S.r.l., which expanded the company’s market presence.

- In December 2023, SGS partnered with Agilex Biolabs, Australia’s leading regulated bioanalytical laboratory, to enhance its global bioanalysis capabilities. This collaboration strengthened SGS’s position in the market, supporting advanced drug development and regulatory compliance worldwide.

The bioanalytical testing services market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and from 2021 - 2034 for the following segments:

Market, By Molecule Type

- Small molecule

- Large molecule

Market, By Test Type

- DMPK testing

- Biomarker testing

- Virology testing

- In-vivo virology testing

- In-vitro virology testing

- Serology testing

- Immunogenicity testing

- Other test types

Market, By Application

- Oncology

- Neurology

- Infectious diseases

- Gastroenterology

- Cardiology

- Other applications

Market, By End Use

- Pharmaceutical and biotechnology companies

- Contract research organizations

- Research and academic institutes

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the bioanalytical testing services market?

Key trends include advancements in mass spectrometry, chromatography, and immunoassays, enabling faster turnaround times, improved data quality, and expanded capabilities in biomarker discovery and pharmacokinetic studies.

Who are the key players in the bioanalytical testing services market?

Prominent players include Altasciences, BioAgilytix, Cambrex Corporation, Charles River Laboratories, Inc., Eurofins Scientific, Frontage Labs, ICON Plc, Intertek Group Plc, Labcorp Drug Development, and LGC Limited.

Which end-use segment dominated the bioanalytical testing services market in 2024?

The pharmaceutical and biotechnology companies segment held the largest market share of 45.8% in 2024.

Which region leads the bioanalytical testing services market?

North America dominated the market with a 39.4% share in 2024, driven by advanced healthcare infrastructure and significant R&D investments.

What was the valuation of the biomarker testing segment in 2024?

The biomarker testing segment was valued at USD 1.1 billion in 2024, leading the market among test types.

What was the market share of the small molecule segment in 2024?

The small molecule segment accounted for 56% of the market share in 2024 and is anticipated to dominate throughout the analysis period.

What is the projected size of the bioanalytical testing services market in 2025?

The market is expected to reach USD 4.6 billion in 2025.

What is the projected value of the bioanalytical testing services market by 2034?

The market is expected to reach USD 9.3 billion by 2034, fueled by innovations in testing technologies and growing drug development activities.

What is the market size of the bioanalytical testing services in 2024?

The market size was USD 4.2 billion in 2024, with a CAGR of 8.2% expected through 2034, driven by the outsourcing of laboratory testing services, advancements in bioanalytical technology, and increasing clinical trials.

Bioanalytical Testing Services Market Scope

Related Reports