Summary

Table of Content

Bicycle Gear Shifter Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Bicycle Gear Shifter Market Size

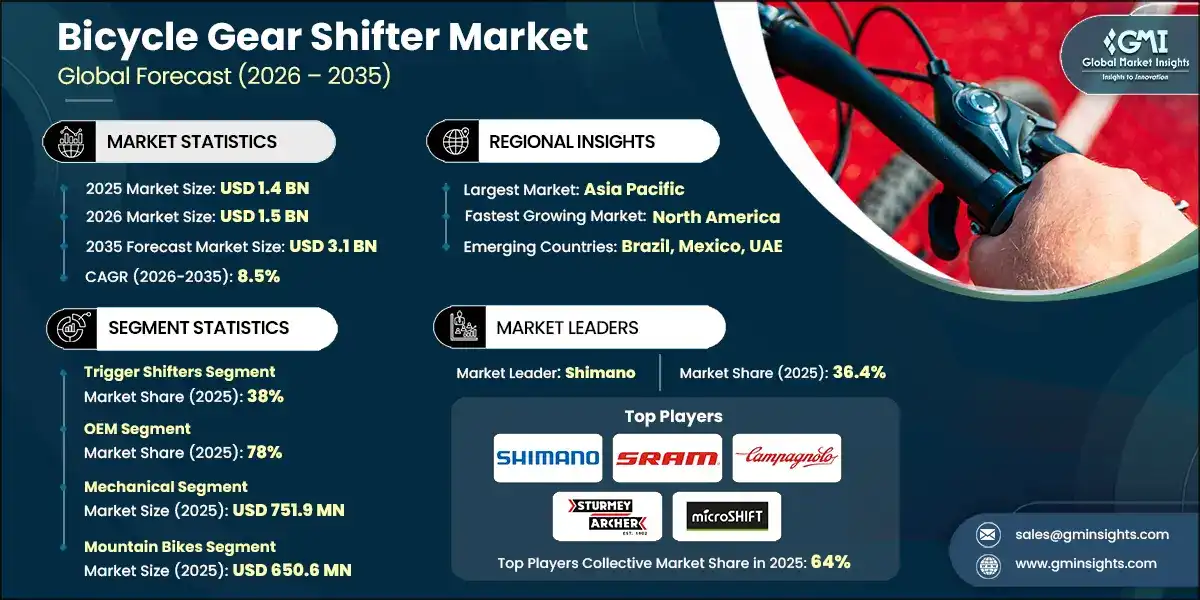

The global bicycle gear shifter market size was valued at USD 1.4 billion in 2025. The market is expected to grow from USD 1.5 billion in 2026 to USD 3.1 billion in 2035, at a CAGR of 8.5%, according to latest report published by Global Market Insights Inc.

To get key market trends

The bicycle gear shifter market is projected to witness significant growth over the coming years, driven by rising demand for customized and high-performance bicycles, increasing adoption of electric bikes (e-bikes), and expanding recreational and commuter cycling activities. As urban areas and cycling enthusiasts prioritize efficient, ergonomic, and reliable mobility solutions, specialized bicycle gear shifters are becoming essential to enhance riding comfort, safety, and performance across diverse terrains and applications.

The integration of advanced technologies, such as electronic shifting systems, hydraulic shifters, smart connectivity modules, and lightweight durable components, is transforming the functionality and efficiency of modern bicycles. These innovations enable smoother gear transitions, reduced maintenance, enhanced rider control, and improved energy efficiency, while materials such as aluminum alloys, carbon composites, and corrosion-resistant finishes allow for customizable and high-performance solutions tailored to different bicycle types.

The market’s growth is further accelerated by the expansion of e-bike fleets, mountain biking, competitive road cycling, and urban mobility programs, as well as the rising demand in recreational, commuting, and fitness-focused bicycles. Gear shifter accessories such as electronic trigger systems, wireless derailleurs, multi-speed cassette compatibility, and ergonomic handlebar designs support seamless cycling experiences, enhance rider satisfaction, and extend component lifespans. Collaboration between shifter manufacturers, bicycle OEMs, and distribution platforms is strengthening market penetration across mountain bikes, road bikes, hybrid bikes, and e-bikes.

In 2024, leading companies such as Shimano, SRAM, Campagnolo, SunRace, Sturmey Archer, microSHIFT, Box Components, and Tektro expanded their product portfolios with electronic, hydraulic, and performance-oriented mechanical shifters tailored for different bicycle segments. Simultaneously, cycling enthusiasts, urban mobility operators, and commercial rental services in the U.S., Europe, China, and the Asia-Pacific region increased investments in high-quality gear shifters to improve cycling efficiency, safety, and overall ride experience.

The bicycle gear shifter ecosystem continues to evolve as innovations in materials, modular designs, electronic integration, and sustainable components reshape cycling mobility solutions. Industry stakeholders are increasingly prioritizing durable, energy-efficient, and customizable shifter solutions that improve rider performance, reduce maintenance costs, and support long-term sustainable cycling initiatives. These advancements are redefining the Bicycle Gear Shifter Market, enabling safer, more versatile, and user-centric mobility solutions for a wide range of cycling applications.

Bicycle Gear Shifter Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.4 Billion |

| Market Size in 2026 | USD 1.5 Billion |

| Forecast Period 2026 - 2035 CAGR | 8.5% |

| Market Size in 2035 | USD 3.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising adoption of e-bikes and high-performance bicycles | Increased use of e-bikes, mountain bikes, and road bikes drives demand for advanced gear-shifting systems. |

| Technological innovations | Integration of electronic, hydraulic, and smart gear shifters enhances rider comfort, efficiency, and durability. |

| Growing recreational and commuter cycling | Urban mobility programs, recreational cycling, and fitness trends boost gear shifter demand globally. |

| Demand for customization and performance | Riders increasingly prefer lightweight, ergonomic, and modular components tailored to specific cycling styles. |

| Pitfalls & Challenges | Impact |

| High cost of advanced shifters | Electronic and hydraulic systems are expensive, limiting adoption among budget-conscious consumers. |

| Limited awareness in emerging markets | In some regions, riders still prefer basic mechanical systems due to low awareness or cost sensitivity. |

| Opportunities: | Impact |

| Expansion in e-bike segment | Rapid growth of urban and recreational e-bikes creates opportunities for advanced electronic and wireless shifters. |

| Collaborations with OEMs and smart-bike platforms | Partnerships for integrated drivetrain solutions and IoT-enabled shifters can capture premium and tech-savvy markets. |

| Market Leaders (2025) | |

| Market Leaders |

36.4% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | Brazil, Mexico, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Bicycle Gear Shifter Market Trends

The demand for advanced bicycle gear shifters is rapidly increasing, driven by growing collaboration among bicycle OEMs, aftermarket component manufacturers, technology providers, and fleet operators. These partnerships aim to enhance riding performance, shift precision, operational efficiency, rider comfort, and safety. Stakeholders are working together to develop integrated, modular, and data-driven gear-shifting solutions, incorporating advanced materials, ergonomic designs, electronic and wireless systems, IoT-enabled drivetrain monitoring, and cloud-based bike management platforms.

For instance, in 2024, leading companies such as Shimano, SRAM, and Campagnolo expanded collaborations with accessory suppliers and bicycle OEMs to develop electronic shifters, hydraulic systems, lightweight mechanical components, and smart drivetrain solutions. These initiatives improved gear-shifting accuracy, durability, rider experience, and operational efficiency across recreational, commuter, competitive, and e-bike segments.

Regional customization of bicycle gear shifters is also emerging as a key trend. Leading providers are establishing local distribution hubs, service centers, and region-specific product lines across North America, Europe, Asia-Pacific, and emerging markets. These centers support market-specific designs, regulatory compliance, and tailored solutions for diverse operational environments, including mountain biking, urban commuting, road cycling, and e-bike applications.

The rise of specialized component startups offering lightweight materials, modular gear systems, AI-enabled shift monitoring, and digitally connected drivetrain platforms is reshaping the competitive landscape. Companies developing ergonomic trigger shifters, advanced electronic drivetrains, and IoT-integrated systems are enabling scalable, cost-efficient deployment of high-performance bicycles. These innovations empower both established OEMs and emerging component operators to improve ride reliability, increase adoption, and reduce time-to-market for customized bicycle gear shifter solutions.

The development of standardized, modular, and interoperable shifters is transforming the market. Leading players such as Shimano, SRAM, Campagnolo, SunRace / Sturmey-Archer, and microSHIFT are deploying platforms that support multiple bicycle types, customizable configurations, and safety-compliant designs. These solutions improve scalability, enable real-time performance tracking, support integration across bicycle fleets, and enhance overall rider experience. The growing adoption of modular, versatile, and connected gear-shifting solutions is reducing operational costs, accelerating market adoption, and fostering a future-ready, efficient, and high-performance bicycle ecosystem.

Bicycle Gear Shifter Market Analysis

Learn more about the key segments shaping this market

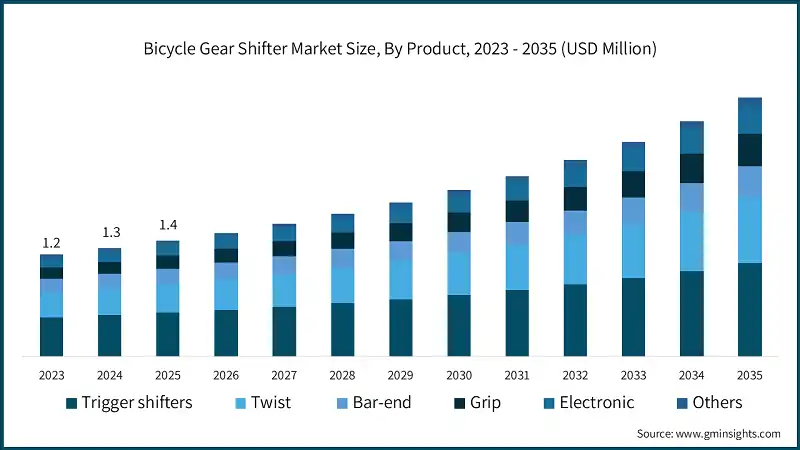

Based on product, the market is divided into trigger shifters, twist, bar-end, grip, electronic, and others. The trigger shifters segment dominated the market accounting for around 38% share in 2025 and is expected to grow at a CAGR of over 7.9% from 2026 to 2035.

- The trigger shifters segment dominates the bicycle gear shifter market, driven by its precise gear control, ergonomic design, and broad compatibility across mountain bikes, hybrid bikes, and e-bikes. Their quick and reliable shifting, combined with durability, makes them the preferred choice for both recreational and competitive riders, as well as large-scale bicycle fleets and urban mobility programs.

- Twist/grip shifters support market growth through their intuitive operation, simple installation, and low maintenance requirements. They are especially popular in commuter bikes, hybrid bicycles, and entry-level segments, providing cost-effective and user-friendly shifting solutions for casual cyclists and urban riders.

- Electronic shifters, bar-end shifters, and other specialized types are gaining traction in premium and niche segments. Electronic shifters enhance rider experience with wireless connectivity, programmable gear settings, and smart drivetrain integration, while bar-end and specialty shifters cater to touring, racing, and compact bike applications, addressing specific performance requirements in smaller but steadily growing market niches.

Learn more about the key segments shaping this market

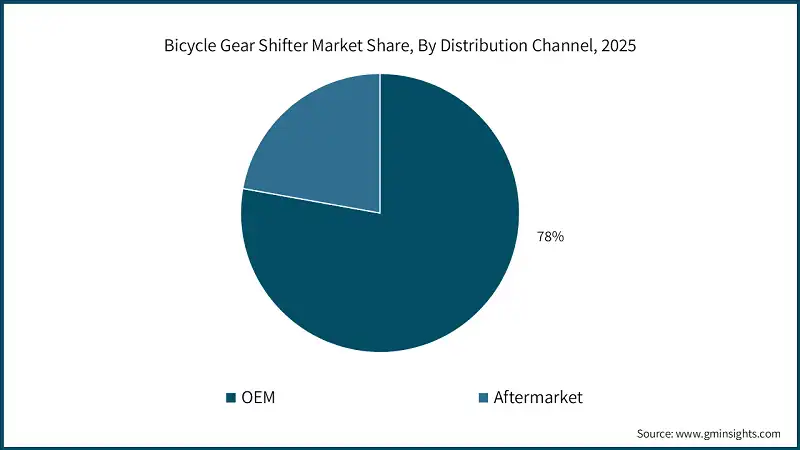

Based on distribution channel, the market is divided into OEM and aftermarket. The OEM segment dominates the market accounting for around 78% share in 2025, and the segment is expected to grow at a CAGR of over 8.2% from 2026 to 2035.

- The OEM segment dominates the bicycle gear shifter market, driven by its integration with new bicycles across mountains, road, hybrid, and e-bike segments. OEM channels ensure authentic, high-quality components, optimized drivetrain design, and seamless compatibility, providing consistent performance, reliability, and enhanced rider experience. This makes OEM the preferred choice for large-scale production and premium bicycle offerings.

- The aftermarket segment supports market growth among cycling enthusiasts, fleet operators, and e-bike owners seeking upgrades, replacements, or customized shifters. Aftermarket channels offer flexibility, wide product selection, and easy access to specialized components, while hybrid strategies combining OEM and aftermarket channels enable rapid deployment, operational efficiency, and customer satisfaction across commercial, recreational, and urban mobility applications.

Based on technology, the market is divided into mechanical, electronic and hydraulic. The mechanical segment dominated the market and was valued at USD 751.9 million in 2025.

- The mechanical segment dominates the bicycle gear shifter market, driven by its reliability, ease of use, and broad compatibility across mountain bikes, road bikes, hybrid bikes, and e-bikes. Mechanical shifters provide precise gear control, durability, and cost-effective performance, making them the preferred choice for both recreational and competitive cyclists. Their popularity is further supported by simple installation, low maintenance requirements, and compatibility with a wide range of drivetrains, establishing mechanical systems as the core technology for shifting performance.

- The electronic segment continues to witness strong growth, fueled by rising adoption in premium, e-bike, and competitive cycling applications. Electronic shifters offer smooth, precise, and programmable gear changes, along with wireless integration, smart drivetrain monitoring, and reduced rider effort, enhancing performance and convenience for tech-savvy cyclists.

- Meanwhile, the hydraulic segment plays a supportive yet significant role in high-performance and mountain biking applications, providing enhanced shifting under load, improved responsiveness, and durability. Hydraulic systems complement mechanical and electronic shifters by enabling consistent performance in rugged conditions, ensuring reliability, rider safety, and optimal drivetrain functionality across diverse cycling environments.

Based on application, the market is divided into mountain bikes, road bikes, hybrid bikes, E-bikes and others. The mountain bikes segment dominated the market and was valued at USD 650.6 million in 2025.

- The mountain bikes segment dominates the bicycle gear shifter market, driven by rising global demand for durable, high-performance, and precise shifting systems capable of handling rugged terrains and challenging trails. Mountain bikes require reliable mechanical, electronic, or hydraulic shifters to ensure smooth gear transitions, enhanced rider control, and optimized performance, making this segment the primary revenue contributor across recreational, competitive, and professional cycling applications.

- The road bikes and hybrid bikes segments continue to grow steadily, as cyclists seek lightweight, efficient, and ergonomic shifting solutions for commuting, fitness, and endurance riding. Manufacturers and component suppliers are focusing on advanced materials, aerodynamic designs, and modular shifter systems to improve ride quality, energy efficiency, and overall cycling experience in these segments.

- E-bikes and other segments are emerging as important contributors to overall market expansion. Increasing adoption of electric bicycles, touring bikes, and specialty bikes is driving demand for smart electronic shifters, wireless integration, and high-durability components. Investment in customized drivetrain solutions, enhanced ergonomics, and technology-enabled shifting systems is supporting adoption across urban, recreational, and performance-focused cycling, contributing to the broader growth of the market.

Looking for region specific data?

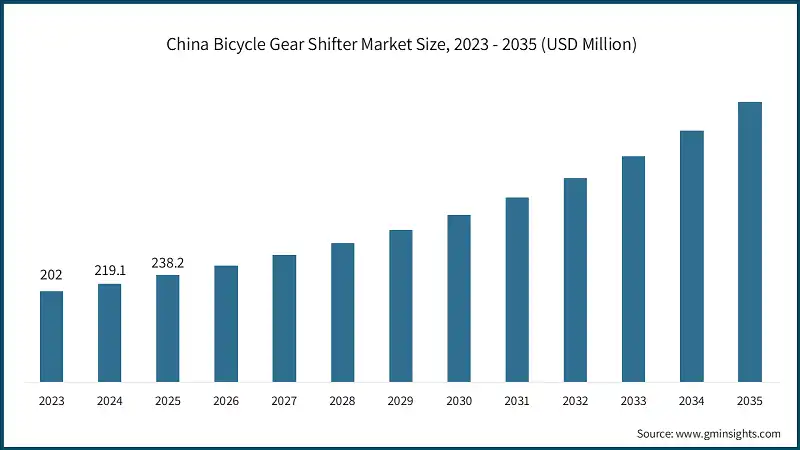

In 2025, China dominated the Asia Pacific bicycle gear shifter market with around 33% market share and generated approximately USD 238.2 million in revenue.

- Asia-Pacific holds a major share of the bicycle gear shifter market in 2025, supported by rapid urbanization, growing adoption of cycling, and expanding recreational, commuter, and e-bike fleets. The region is witnessing steady growth as cycling enthusiasts, rental programs, and competitive sports segments invest in high-quality shifters and drivetrain accessories. Strong manufacturing capabilities, rising consumer awareness, and organized distribution networks continue to strengthen Asia-Pacific’s position in the global market.

- China represents the largest market in Asia-Pacific, driven by widespread adoption of mountain bikes, road bikes, and e-bikes, strong government support for sustainable mobility solutions, and significant investment from leading gear-shifter manufacturers such as Shimano, SRAM, and Campagnolo. Major cities including Beijing, Shanghai, Shenzhen, and Guangzhou are witnessing high demand for mechanical, electronic, and hydraulic shifters, along with modular and ergonomic drivetrain solutions.

- Other Asia-Pacific markets, including Japan, South Korea, and India, are emerging as high-growth regions, supported by increasing urban cycling, recreational adoption, and commuter bike programs. Japan emphasizes high-end performance bicycles, South Korea focuses on customized urban and recreational bikes, and India is investing in e-bikes and hybrid bicycles for community and commercial mobility. Despite varying levels of market maturity and infrastructure, these countries are rapidly adopting durable and advanced bicycle gear shifters, strengthening Asia-Pacific’s overall contribution to the global market.

- North America dominated the bicycle gear shifter market, supported by a mature consumer base, established golf and residential communities, and strong adoption of electric and gas-powered carts. The region benefits from robust manufacturing capabilities, advanced retail networks, and widespread awareness of safety and comfort accessories, positioning it as the global leader in golf cart accessory adoption.

- Within North America, the United States accounted for the largest share, driven by high demand for residential and neighborhood personal transport, golf course operations, and hospitality/resort services. Large-scale adoption of lift kits, wheels & tires, and protective covers, combined with strong aftermarket distribution channels including direct-to-consumer and online marketplaces fuels market growth. States such as Florida, California, and Texas, with extensive golf communities and resort operations, serve as primary hubs for accessory sales and innovation.

- Key industry players in the U.S., including Yamaha Golf-Car Company, Club Car, EZGO, US Battery Manufacturing Company, and Buggies Unlimited, continue to expand their product portfolios, enhance customization options, and strengthen dealer and e-commerce networks. Their ongoing investment in innovative designs, durable materials, and technologically advanced accessories consolidates the U.S.’s dominant position in the North American market.

US holds 91% share in North America bicycle gear shifter market in 2025 and it will grow tremendously between 2026 and 2035.

- North America holds a major share of the market, supported by a mature cycling consumer base, established urban and recreational cycling infrastructure, and strong adoption of mountain bikes, road bikes, hybrid bikes, and e-bikes. The region benefits from robust manufacturing capabilities, advanced retail and distribution networks, and widespread awareness of performance and safety-enhancing components, positioning it as a key contributor to bicycle gear shifter demand.

- Within North America, the United States accounted for the largest share, driven by high adoption of recreational, commuter, and competitive cycling, as well as expanding e-bike and hybrid fleets. Strong demand for mechanical, electronic, and hydraulic shifters, combined with well-established aftermarket channels including direct-to-consumer sales and online marketplaces, fuels market growth. States such as California, New York, and Texas, with large urban cycling populations, competitive cycling communities, and e-bike adoption programs, serve as primary hubs for product sales and innovation.

- Key industry players in the U.S., including Shimano, SRAM, Campagnolo, SunRace/Sturmey-Archer, and microSHIFT, continue to expand their product portfolios, enhance customization options, and strengthen dealer and e-commerce networks. Their ongoing investment in innovative designs, durable materials, and technologically advanced shifters consolidates the U.S.’s dominant position in the North American market.

Germany holds share of 26% share in Europe bicycle gear shifter market in 2025 and it will grow tremendously between 2026 and 2035.

- Europe accounted for a significant share of the market, supported by growing urban and recreational cycling adoption, strong aftermarket distribution networks, and rising demand for e-bikes, mountain bikes, and road bikes. Countries across the region are expanding residential, commuter, and recreational cycling infrastructure, while retailers and distributors focus on providing diverse shifter options and performance accessories. Well-established manufacturing capabilities, favorable trade policies, and increasing awareness of safety and performance components reinforce Europe’s position as a key regional market.

- Germany dominated the Europe bicycle gear shifter market, supported by its advanced manufacturing ecosystem, high consumer awareness, and strong adoption of high-performance bicycles and e-bikes. German cycling enthusiasts, urban mobility programs, and competitive cycling communities are leading large-scale adoption of mechanical, electronic, and hydraulic shifters, along with modular and ergonomic drivetrain components. Investments in durable materials, customization options, and technologically advanced shifters have strengthened operational efficiency, expanded product offerings, and accelerated market growth, positioning Germany as the regional leader.

- Other major European countries, including France, the UK, and Italy, are contributing to regional expansion, driven by increasing sales of bicycle gear shifters, growing commuter and recreational demand, and strategic aftermarket distribution. France emphasizes high-end performance bikes, the UK focuses on residential and urban cycling solutions, and Italy prioritizes durable and performance-enhancing drivetrain components. Despite varying market maturity levels, Germany maintains its leading role in scale, innovation, and product diversity within Europe’s market.

The bicycle gear shifter market in Brazil will experience significant growth between 2026 and 2035.

- Latin America holds a smaller but growing share of the bicycle gear shifter market in 2025, supported by increasing investments in recreational, commuter, and e-bike adoption, as well as expanding cycling infrastructure. The region is witnessing steady demand for high-quality shifters, drivetrain components, and performance accessories across urban cycling programs, residential communities, and recreational applications. Expanding dealer networks, local manufacturing capabilities, and public-private collaborations continue to strengthen Latin America’s position in the market.

- Brazil represents the largest market in Latin America, driven by strong adoption of mountain bikes, road bikes, hybrid bikes, and e-bikes in recreational, commuter, and competitive segments. Major cities such as São Paulo, Rio de Janeiro, and Brasília are witnessing increasing demand for mechanical, electronic, and hydraulic shifters, along with modular, durable, and high-performance drivetrain solutions. Integration of advanced components, robust supply chains, and growing consumer awareness has reinforced operational efficiency, product availability, and market penetration, cementing Brazil’s dominant position in the regional Bicycle Gear Shifter market.

- Mexico is emerging as a high-growth market, supported by rising residential, recreational, and urban cycling programs, early adoption of e-bikes and hybrid bicycles, and increasing investments in customized drivetrain solutions and aftermarket accessories. Cities such as Mexico City, Guadalajara, and Cancun are expanding cycling adoption, while growing availability of aftermarket shifters, localized distribution channels, and consumer interest accelerates market penetration. Together with Brazil’s established leadership, Mexico is contributing to the overall growth and development of the Latin American Bicycle Gear Shifter ecosystem.

The bicycle gear shifter market in UAE will experience significant growth between 2026 and 2035.

- MEA accounted for a modest share of the market in 2025, supported by growing investments in urban mobility, smart-city initiatives, and recreational cycling programs. The region is witnessing steady adoption of mountain bikes, road bikes, hybrid bikes, and e-bikes across residential communities, resorts, corporate campuses, and leisure facilities. Expanding distribution networks, localized manufacturing, and government-backed cycling initiatives continue to strengthen MEA’s presence in the bicycle gear shifter market.

- The UAE dominated the MEA market, driven by strong adoption of high-performance bicycles and e-bikes for recreational, commuter, and institutional applications. Cities such as Dubai and Abu Dhabi are deploying bicycles equipped with mechanical, electronic, and hydraulic shifters, along with modular and ergonomic drivetrain components, to enhance performance, safety, and rider experience. Integration of robust supply chains, aftermarket customization, and localized distribution channels has reinforced product availability, quality, and scalability, cementing the UAE’s leadership in the regional Bicycle Gear Shifter market.

- A notable trend in the UAE market is the increasing adoption of smart, modular, and connected shifter systems, AI-enabled performance monitoring, and IoT-integrated bicycle management platforms for recreational, commuter, and institutional cycling fleets. Manufacturers and distributors are leveraging predictive maintenance, durable components, and technologically advanced solutions to optimize performance, reduce downtime, and enhance rider experience. These initiatives are solidifying the UAE’s position as the leading MEA market, setting benchmarks for innovation, reliability, and efficiency in bicycle gear shifters.

Bicycle Gear Shifter Market Share

- The top 7 companies in the market are Shimano, SRAM, Campagnolo, SunRace Sturmey Archer, microShift, Box Components and Tektro. These companies hold around 65% of the market share in 2025.

- Shimano is a global leader in bicycle gear shifters, offering mechanical, electronic, and hydraulic systems for mountain bikes, road bikes, hybrid bikes, and e-bikes. Shimano emphasizes high-precision shifting, durable materials, and ergonomic designs to enhance rider performance, comfort, and drivetrain efficiency. The company serves both recreational and competitive cycling markets, supporting large-scale adoption through OEM partnerships, aftermarket channels, and global distribution networks.

- SRAM provides a comprehensive range of bicycle shifters, including trigger, grip, bar-end, and electronic systems, for professional and recreational cyclists. The platform integrates lightweight materials, advanced ergonomics, and modular compatibility to improve shift accuracy, reliability, and riding experience. SRAM leverages OEM collaborations, aftermarket service networks, and e-commerce platforms to deliver scalable, high-performance gear-shifting solutions globally.

- Campagnolo specializes in high-end road and racing bicycle shifters, offering mechanical and electronic drivetrains for competitive cycling. The company focuses on precision engineering, lightweight components, and customizable setups, catering to professional athletes, cycling teams, and high-performance enthusiasts. Campagnolo’s extensive dealer networks and aftermarket support enable reliable deployment across global cycling markets.

- SunRace Sturmey-Archer offers a wide range of bicycle shifters and hub gear systems for mountain, road, and urban bicycles. The company emphasizes durable components, smooth shifting, and versatile compatibility, serving both OEM and aftermarket channels. SunRace Sturmey-Archer leverages regional distribution networks, online marketplaces, and specialized retailers to reach diverse consumer segments worldwide.

- microSHIFT delivers mechanical and electronic shifters for a variety of bicycle types, including mountain bikes, e-bikes, and hybrid bicycles. The company focuses on affordable, reliable, and user-friendly solutions, integrating durable materials and modular designs. microSHIFT supports both OEM integration and aftermarket distribution, enabling flexible adoption across multiple cycling markets.

- Box Components specializes in innovative, performance-oriented shifters for mountains, BMX, and urban bikes. The company emphasizes ergonomics, precision, and lightweight construction, catering to performance riders and enthusiasts. Box Components leverages e-commerce platforms, specialized retailers, and OEM partnerships to scale adoption and improve rider experience globally.

- Tektro provides high-quality braking and shifting systems, including trigger and electronic shifters, for mountain, road, and hybrid bikes. Tektro focuses on durability, cost-effectiveness, and consistent performance, serving both OEM and aftermarket channels. The company uses regional distributors, online marketplaces, and technical support networks to ensure accessibility and scalability for global cyclists.

Bicycle Gear Shifter Market Companies

Major players operating in the bicycle gear shifter industry include:

- Box Components

- Campagnolo

- microShift

- Paul Components

- Pinion

- Rivendell Bicycle Works

- Shimano

- SRAM

- SunRace Sturmey Archer

- Tektro

- The bicycle gear shifter market is highly competitive, with leading developers, OEMs, and aftermarket solution providers such as Shimano, SRAM, Campagnolo, SunRace Sturmey-Archer, microSHIFT, Box Components, and Tektro occupying key segments across mechanical, electronic, and hydraulic shifters for mountain bikes, road bikes, hybrid bikes, and e-bikes.

- Shimano, SRAM, and Campagnolo lead the market with high-performance, precision-engineered shifters, integrating durable materials, ergonomic designs, modular compatibility, and advanced electronic systems. These companies focus on enhancing rider performance, comfort, safety, and drivetrain efficiency across recreational, competitive, and professional cycling globally.

- SunRace Sturmey-Archer, microSHIFT, Box Components, and Tektro specialize in aftermarket, modular, and affordable shifter solutions, emphasizing mechanical and electronic systems for varied bicycle types. Their platforms support scalable adoption, flexible customization, and improved riding experience, enabling recreational, commuter, and performance-oriented cycling applications.

- Overall, the market is characterized by rapid innovation, with companies continuously developing lightweight, durable, and technologically advanced shifters, integrating modular designs, smart connectivity, and enhanced ergonomics. Market players are focused on delivering reliable, efficient, and high-performance bicycle gear shifters, enabling improved rider experience, operational efficiency, and optimized drivetrain performance across global cycling segments.

Bicycle Gear Shifter Industry News

- In March 2025, Shimano launched a new line of high-performance electronic and mechanical shifters for mountain bikes and e-bikes, featuring enhanced durability, modular design, and improved gear precision. The initiative aims to strengthen OEM and aftermarket offerings, supporting both competitive cyclists and recreational riders globally.

- In February 2025, SRAM introduced advanced wireless electronic shifting systems with programmable gear profiles, faster response times, and lightweight construction. The rollout focuses on improving riding efficiency, drivetrain reliability, and user experience for professional and enthusiast cycling segments.

- In January 2025, Campagnolo unveiled upgraded mechanical and electronic shifter lines for road and racing bikes, emphasizing higher precision, customizable ergonomics, and reduced shifting effort. The initiative targets competitive cycling teams, professional riders, and high-end recreational cyclists, enhancing overall drivetrain performance.

- In December 2024, microSHIFT expanded its affordable and versatile shifter portfolio, incorporating modular designs, smooth gear transitions, and broader compatibility across mountain, hybrid, and commuter bikes. The deployment aims to improve accessibility, usability, and adoption in both OEM and aftermarket channels.

- In October 2024, Box Components and SunRace Sturmey-Archer launched next-generation performance-oriented shifters, integrating lightweight materials, durable construction, and enhanced ergonomics. The move emphasizes scalable adoption, rider comfort, and precision shifting, supporting recreational, commuter, and performance-focused cycling globally.

The bicycle gear shifter market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn) and volume (Units) from 2022 to 2035, for the following segments:

Market, By Product

- Trigger shifters

- Twist

- Bar-end

- Grip

- Electronic

- Others

Market, By Technology

- Mechanical

- Electronic

- Hydraulic

Market, By Application

- Mountain bikes

- Road bikes

- Urban bikes

- Touring bicycles

- Others

Market, By Distribution Channel

- OEM

- Aftermarket

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the bicycle gear shifter industry?

Key players include Shimano, SRAM, Campagnolo, SunRace Sturmey-Archer, microSHIFT, Box Components, Paul Components, Pinion, Rivendell Bicycle Works, and Tektro.

How much revenue did the mountain bikes segment generate in 2025?

The mountain bikes segment generated USD 650.6 million in 2025, driven by the demand for durable and high-performance shifting systems for rugged terrains.

What is the growth outlook for the OEM segment from 2026 to 2035?

The OEM segment is projected to grow at a CAGR of over 8.2% till 2035, maintaining its dominance with a 78% market share in 2025.

Which region leads the bicycle gear shifter sector?

Asia-Pacific leads the market, with China dominating the region with a 33% market share and generating approximately USD 238.2 million in revenue in 2025. The region's growth is supported by rapid urbanization, increasing cycling adoption, and strong manufacturing capabilities.

What are the upcoming trends in the bicycle gear shifter market?

Key trends include modular, interoperable shifters, IoT-enabled monitoring, AI-driven shift systems, regional customization, and increased OEM–technology collaborations driving innovation.

What was the market share of the trigger shifters segment in 2025?

The trigger shifters segment accounted for approximately 38% of the market share in 2025 and is expected to grow at a CAGR of over 7.9% through 2035.

What is the expected size of the bicycle gear shifter industry in 2026?

The market size is projected to reach USD 1.5 billion in 2026.

What is the projected value of the bicycle gear shifter market by 2035?

The market is poised to reach USD 3.1 billion by 2035, fueled by advancements in gear-shifting technologies, IoT-enabled systems, and growing demand for high-performance bicycles.

What was the market size of the bicycle gear shifter in 2025?

The market size was valued at USD 1.4 billion in 2025, with a CAGR of 8.5% expected through 2035. The growth is driven by rising demand for customized bicycles, increasing adoption of e-bikes, and expanding recreational and commuter cycling activities.

Bicycle Gear Shifter Market Scope

Related Reports