Summary

Table of Content

Beverage Container Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Beverage Container Market Size

The global beverage container market was valued at USD 245.4 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 407.2 billion by 2034. The growth of the market is attributed to factors such as consumer’s preference towards healthy lifestyles and the increasing demand for convenient and on-the-go beverage consumption.

To get key market trends

The shift in consumer’s preference towards healthier lifestyles is driving significant growth in the beverage container market. Consumers are constantly moving away from sugar and carbonated drinks towards healthier alternatives such as plant-based beverages and fruit juice, which demands reliable beverage containers for extended shelf life and to preserve freshness. Moreover, sustainable and eco-friendly packaging further cater to consumers preferring healthy lifestyles as they offer chemical-free packaging while reducing significant impact over the environment, further fuels the demand for sustainable beverage containers.

Beverage Container Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 245.4 Billion |

| Forecast Period 2025 – 2034 CAGR | 5.2% |

| Market Size in 2034 | USD 407.2 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

This healthier lifestyle approach among consumers is expected to create new opportunities for container manufacturers are they can focus on development of advanced packaging solution such as UV-blocking materials that has better barrier properties that aid in increasing product shelf-life. This will help them attract plant based & fruit juice beverage manufacturers.

Increasing consumers preference for on-the-go beverages is resulting in increase in demand for recyclable beverage containers which is a major factor expected to support the growth of target market.

Rapid urbanization and busy lifestyle, consumer preference towards ready-to-drink beverages is increasing as they provide portability and aid in on-the-go consumptions. For instance, according to a Statista, 274 billion liter of packed beverage was consumed in China, and it is predicted to surpass 306 billion liter by 2026. Several manufacturers are adopting recyclable can, paperboard, and pouches to cater the growing demand for single serve and on-the-go beverages, fuelling the demand for market.

The surge in consumption of alcohol is one of the major growth factor expected to drive the beverage container market. For instance, according to IBEF, the alcohol market in India accounted for USD 52.4 billion in 2024 and is expected to reach USD 64 billion by 2030. Aluminium cans and glass bottles are gaining rapid traction in alcohol industry as they provide premium packaging, reducing environmental impacts and meet regulatory requirements. Moreover, manufacturers are focusing on unique design and lightweight glass bottle propels the growth of market.

Beverage Container Market Trends

- Recent trend observed in the market is shift towards multilayer beverage containers from monolayers in order to increase shelf life, enhance barrier properties and recyclability. Multilayers beverage packaging provides better oxygen and moisture resistance which is increasing manufacturers inclination towards adoption of multilayers PET/PE/EVOH composites.

- This shift towards adoption of multilayers packaging is expected to create new opportunities for beverage container manufacturers as they can invest in development of advanced multilayers barriers material with bio-based and recyclable layers. This will help then distinguish their products resulting in attracting new customer and strengthening their position in beverage containers market.

- Another trend observed in the market is increasing beverage manufactures approach towards adoption of recyclable packaging solution or mono-material containers as they lower waste and aid in easy recyclability. Beverage manufactures are more inclined towards using containers that support their brand sustainability goals and align with strict regulatory mandates related to environment pollution.

- This transition of beverage manufacturers inclination towards adoption of fully recyclable packaging solution is anticipated to present new opportunities for containers manufacturers as they can focus on development of biodegradable barrier technologies. This development and introduction of new recyclable packaging solution will help them attract new customers and increase their revenue.

Beverage Container Market Analysis

Learn more about the key segments shaping this market

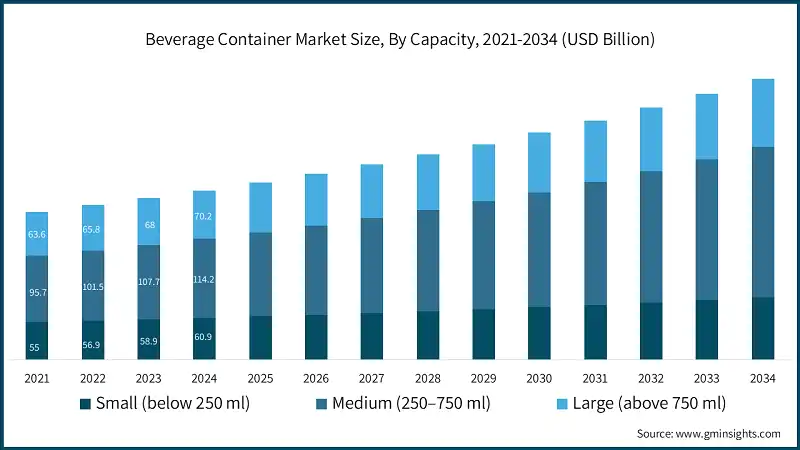

The market based on the capacity is categorized as small (below 250ml), medium (250-750ml), and large (above 750 ml).

- The small capacity container market is anticipated to surpass USD 90.5 billion by 2034. The increasing demand for on-the-go beverage for easy consumption and single serve beverages like milk, energy drink coupled with the growing demand for eco-friendly packaging is pushing the growth for small capacity beverage containers.

- The medium capacity market dominated the beverage containers market by accounting for USD 114.2 billion in 2024. The market growth is attributed to consumer fast-paced lifestyle which is increasing demand for medium capacity containers as they are portable and have exact quantity.

- Large capacity container market held 28.6% of total market share in 2024. The market growth is attributed increasing consumers preference for family-pack beverages as they offer better cost-per liter economics.

Learn more about the key segments shaping this market

The beverage container market based on the material type is bifurcated into plastic, metal, glass, and paper & paperboard.

- The plastic material market held 39.5% of total market share in 2024. The market growth is attributed to increasing manufacturers preference for lightweight, cost-effective and recyclable packaging solution. In addition, stringent government regulations pertaining to environment is increasing demand for rPET.

- The Metal market is anticipated to surpass USD 82.7 billion by 2034. The market growth is due to milk & energy drink manufacturers approach towards adoption of enhance packaging solution that is easily recyclable and has high barrier properties.

- The glass segment held 26.5% of total market share in 2024. The market growth is attributed to factor such as glass beverages containers are perceived as a safer and chemical free option, catering to the health-conscious consumers. Also, alcohol manufactures preference for premium and eco-friendly packaging solution in order to enhance consumer experience is expected to support the growth of target market.

- The paper & paper board segment is the fastest growing segment and is anticipated to reach USD 51.3 billion by 2034. Paper board beverage container such as tetra pack cartons align with sustainable regulations and government’s restriction on single use plastic are major growth drivers, as these materials can be recycled and produced from renewable sources.

The beverage container market based on application is divided into alcoholic beverages and non-alcoholic beverages.

- The alcoholic beverages container market accounted for USD 102.8 billion in 2024. The increasing consumer demand for premium alcoholic beverages such as wine, beer and spirits which requires high-end packaging such as glass bottles, aluminium cans, and bag in box packaging.

- The non-alcoholic beverages container market is anticipated to reach USD 247.6 billion by 2034. The market growth is attributed to rising demand for healthy and plant-based drinks such as fruit juice, milk, etc. are driving the demand for non-alcoholic beverage containers. Manufacturers are adopting pouch, cartons, and PET bottles as they offer extended product life and ease of transportation. Moreover, the shift towards urbanization fuels the demands for single serve drinks and on the go consumption. PET bottles, cans and pouches are catering to growing demand by offering consumer with portability and reliability.

Looking for region specific data?

The North America region held 20.5% of the global beverage container market share in 2024. Sustainable and efficient packaging technologies are some of the main drivers of market in North America. Governmental support on adoption of eco-friendly packaging material and ban on single usage plastics is promoting the demand for beverage container industry in the region.

- The U.S. dominated the beverage container market, accounting for USD 56.2 billion in 2024. The market growth in the country is attributed to increasing consumer preference for aluminium can and paperboard cartons in energy drinks & beers. According to Statista, report the market for energy and sports drink in the U.S. is expected to be USD 119.5 billion in 2025 and is anticipated to grow at a CAGR of 3.3% by 2029. Major containers manufacturers in the region are focusing on innovation & development of sustainable packaging solutions which is expected to support the market growth.

- The Canada beverage container market is anticipated to grow at a CAGR of over 3.7% during the forecast period. Governments approach towards the ban on single use plastic is expected to push the adoption of glass & paper packaging solution among beverage manufacturers this is expected to support the market growth. Moreover, growing investment in sustainable beverage containers for dairy and juice industry further propel the growth of market.

The Europe region held 26.1% of the global beverage container market share in 2024. The growth of Europe’s market stems from the heightened interest in sustainable packaging solutions.

- The Germany market accounted for USD 21.2 billion in 2024. The strong beer culture of country drives constant demand in beverage container market for high-end glass and metal containers. The country also has an advanced recycling system which includes the Pfand (deposit refund) scheme that promotes the use of refillable bottles. Also, consumers focus towards improving sustainability and product freshness demands brands to utilize reusable and recyclable materials. There is also rising demand for high-quality tamper-proof packaging, especially for organic and craft beverages which has increase in demand for beverage containers.

- The UK beverage container market is expected to grow at a CAGR of over 6.4% during the forecast period. UK Craft beers, premium soft drinks and ready-to-drink beverages are gaining increasing popularity within the UK market, due to cost-efficient advantages. The shift in consumers preference towards sustainability is pushing the demand for recyclable and biodegradable containers. Brand innovations revolving around aluminum cans and paper-based containers are stimulated due to regulatory compliance on plastic bans and EPR schemes. There is also an increase in convenience factors with the demand for resealable single portions for on-the-go consumption.

- The France market is projected to reach USD 14.3 billion by 2034. France’s beverage container market is heavily influenced by its renowned wine and sparkling beverage industry. France remains one of the largest wine producing countries in the world and uses glass bottles as the beverage container solution to keep the taste intact, promote the brand, and preserve quality. Moreover, luxury brands of spirits and champagne use high glass packaging for differentiating themselves from competitors.

- The Italy beverage container market accounted for USD 4.3 billion in 2024. The government’s circular economy policies are pushing industries towards adopting new sustainable packaging solutions such as recyclable PET investments and reusable containers. Furthermore, supportive regulatory frameworks focused on waste management and high recycling rates have increased the utilization of deposit return schemes (DRS) for plastic bottles and glass containers.

- The Spain beverage container market is anticipated to grow at a CAGR of over 2.8% during the forecast period. The Spain market is growing due to surge in tourism industry which demands convenient and portable packaging coupled with the shift in consumer's preference towards sustainable packaging is pushing the brands to adopt recyclable and reusable materials. Moreover, the government regulations for ban on the single usage plastic is further pushing the demand for sustainable beverage containers in the region.

The Asia-Pacific region held 32.8% of the global beverage container market share in 2024. The Asia Pacific region, headed by China, Japan, and South Korea due to their robust food and beverage industry, is the largest market for the beverage containers. The growth of the market is being supported by the surging demand for eco-friendly packaging and on-the-go consumption beverages.

- The Japan beverage container market accounted for USD 16 billion in 2024. The growth in demand for beverage container industry is supported by the change in the consumer preference towards sustainable material, and advancement in packaging technology. Besides, the increasing popularity of vending machines also requires lightweight and portable containers which is pushing the demand for market.

- The China market is projected to reach USD 54.3 billion by 2034. Stringent government regulations for sustainable beverage container and plastic waste reduction are the key growth driver in the country. Moreover, the growing dairy and functional drink reliability on paperboard carton and glass bottles packaging is driving significant demand for the market.

- The India beverage container market is anticipated to grow at a CAGR of over 8.1% during the forecast period. PET bottles dominate the packaging market in India. However, increasing governmental measures to cut down on plastic waste are aiding in the development of recyclable and biodegradable substitutes. The growth soft drink, juice, and plant-based beverage industries are also further driving the demand for paperboard cartons and aluminium cans.

- The ANZ beverage container market accounted for USD 11.9 billion in 2024. Strict regulations on sustainable packaging and ban on single use plastic are factors increasing the demand for cans, glasses, and eco-friendly packaging. Furthermore, recycling efforts from the government are increasing the demand for sustainable beverage containers in the region.

The Latin America region held 6.3% of the global beverage container market share in 2024. The market in Latin America is fueled by initiatives such as increasing non-alcoholic beverage consumption coupled with growing demand for sustainable packaging

- The Brazil beverage container market is anticipated to grow at a CAGR of over 4.7% during the forecast period. The growing demand for ready-to-drink beverages and the increasing government’s investment in establishment of refillable glass and aluminium can packaging industries is pushing the growth of the market.

- The Mexico market is projected to reach USD 6 billion by 2034. The growing demand for beer and soft drink are major growth driver for beverage container industry specifically refillable glass bottle and aluminium cans in the region. Additionally, government regulation towards plastic wastage reduction further pushes the demand for sustainable beverage containers.

The MEA region held 4.2% of the global beverage container market share in 2024. The market in the Middle East & Africa is boosting due to surging food and beverage industry coupled with government regulation for wastage reduction

- The South Africa beverage container industry accounted for USD 1.6 billion in 2024. The market growth is attributed to government ban on single-use plastics which is resulting in shift towards adoption of more sustainable packaging solutions such as glass bottles and aluminium cans. This is especially predominant with alcoholic beverages as brands look to shift from PET bottles to more environmentally friendly options

- The UAE market is predicted to reach USD 4 billion by 2034. Growing investments in rPET bottles , pouches, and aluminum cans, are gaining popularity due to rise in demand for bottled water and functional beverages like energy and vitamin drinks. Although PET is the dominant material due to the high average temperature and consumption of bottled water, there is a strong demand for recyclable and biodegradable alternatives.

- The Saudi Arabia beverage container market is anticipated to grow at a CAGR of over 4.2% during the forecast period. The increasing demand for soft drinks and dairy industries is driving innovation needs for eco-friendly packaging such as paperboard cartons and aluminium cans. These beverage containers ensure eco-friendly packaging while ensuring extended product life.

Beverage Container Market Share

The market is highly competitive and fragmented due to presence of well-established players as well as local players and startups. The top 5 companies in the global beverage container industry are Ardagh group, Ball Corp, Berry Global, Crown Holdings, and Showa Aluminium can, collectively accounting for a share of 22% market share. Major key leaders of the market are investing in sustainable material and biodegradable packaging solutions to meet the government regulations and growing consumer preference towards sustainable packaging options. The next-generation beverage containers are focusing towards the lightweight and biodegradable material to cater the growing demand for sustainability and on-the-go consumption while ensuring the extended shelf life of the product.

The adoption of smart manufacturing industry and sustainable packaging is fuelling the demand for the advanced beverage container solutions which can optimize the process ensuring maximum efficiency and enhanced waste management. Digital tracking technology and smart labelling techniques are improving consumer engagement and reducing operational costs around several industries.

Beverage Container Market Companies

The beverage container industry features several prominent players, including:

- Amcor Limited

- Ball Corporation

- Rexam Inc.

- Silgan Holdings

- Owens-Illinois

- Toyo Seikan Group Holdings

- CLARCOR

- Huber Packaging Group

- Ardagh Group

Amcor limited is a global leader in the beverage container market. Amcor offers a wide range of beverage containers solutions for packaging while offering premium look and protection. Amcor offers AmFiber product line, an innovative solution for beverage containers which offers paper-based packaging enabling consumers to recycle containers at home or on-the-go.

Ball corporation, a close competitor operating in the same vertical offers Alumi-Tek an aluminium based beverage bottle. These bottles stand out from competitors due to their enhanced shelf-life abilities and 100% recyclability. Additionally, these unique bottles offer better consumer engagement and are gaining rapid traction in the market.

Beverage Container Market News

- In December 2024, Novolex partnered with Pactiv evergreen Inc to offer various sustainable packaging solution and is focusing on expanding distribution networks. These partnership aims to serve growing large scale to small scale businesses, which demand various packaging solutions.

- In December 2024, Ball corporation announced their partnership with Dabur India ltd to expand the juice portfolio in aluminium cans. The partnership aims to enhance sustainable packaging while ensuring product life and catering to consumer’s preferences for on-the-go consumption.

- In September 2024, Tetrapack entered into a partnership with Nectars to launch Tetra Prism Aseptic 300 Edge cartons. The product offers distinct tall and slim packaging with an attached cap making it easier for on-the-go consumption and ensuring extended shelf life, while meeting sustainable packaging regulations.

The beverage container market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) and volume (Units) from 2021 to 2034, for the following segments:

Market, By Material

- Plastic

- PET (Polyethylene Terephthalate)

- HDPE (High-Density Polyethylene)

- PP (Polypropylene)

- Bioplastics

- Metal

- Aluminum

- Steel (Tinplate)

- Glass

- Soda-lime glass

- Borosilicate glass

- Paper and Paperboard

- Molded fiber

- Tetra Pak & aseptic cartons

- Other Materials (Composite materials and Ceramic)

Market, By Capacity

- Small (below 250 ml)

- Medium (250 – 750 ml)

- Large (above 750 ml)

Market, By Application

- Alcoholic Beverages

- Beer

- Wine

- Spirits

- Non-Alcoholic Beverages

- Soft Drinks

- Juices

- Tea & Coffee

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europ

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

How big is the beverage container market?

The market size for beverage container was valued at USD 245.4 billion in 2024 and is expected to reach around USD 407.2 billion by 2034, growing at 5.2% CAGR through 2034.

Who are the key players in beverage container industry?

Some of the major players in the industry include Amcor Limited, Ball Corporation, Rexam Inc., Silgan Holdings, Owens-Illinois, Toyo Seikan Group Holdings, CLARCOR, Huber Packaging Group, and Ardagh Group.

What will be the size of small capacity container segment in the beverage container industry?

The small capacity container segment is anticipated to cross USD 90.5 billion by 2034.

How much beverage container market share captured by North America in 2024?

The North America market held around 20.5% share in 2024.

Beverage Container Market Scope

Related Reports