Summary

Table of Content

Beta Glucan Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Beta Glucan Market Size

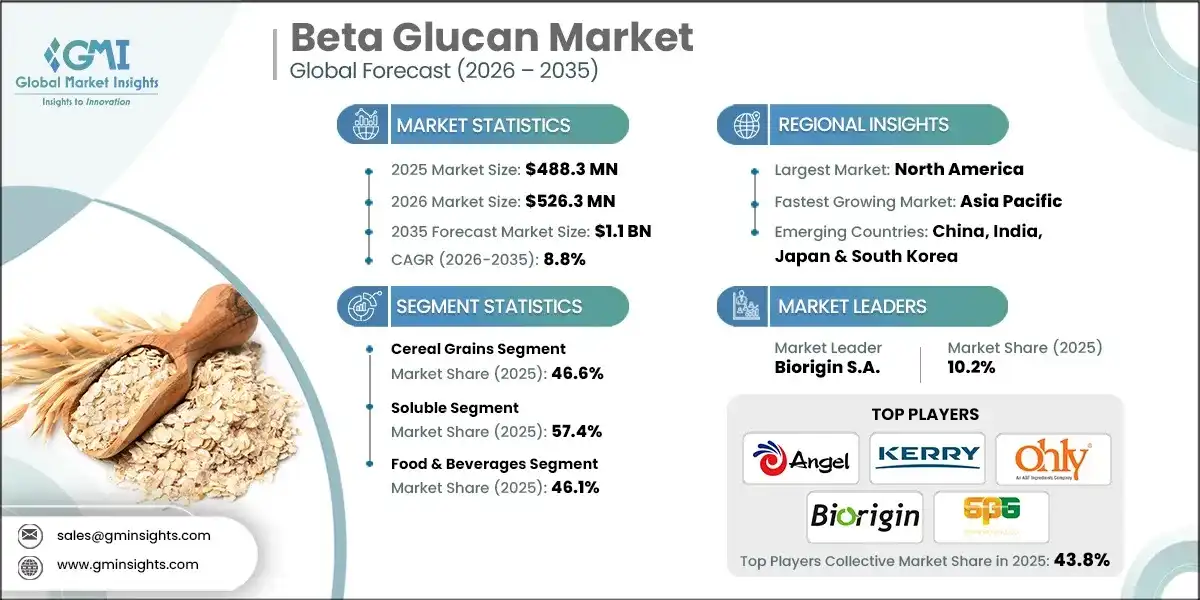

The global beta glucan market size was valued at USD 488.3 million in 2025. The market is expected to grow from USD 526.3 million in 2026 to USD 1.1 billion in 2035, at a CAGR of 8.8% according to latest report published by Global Market Insights Inc.

To get key market trends

- The growth of the beta glucan market is attributed to consumer awareness of its health advantages and application in the various industries. Beta-glucans are water-soluble dietary fibers sourced from oats, barley, yeast, and mushrooms, and are credited with immunity enhancement, the reduction of cholesterol levels, and regulating carbohydrate absorption/release by the body. Its advocacies in cardiovascular health and aiding in immune function have made beta-glucan a key ingredient in functional foods, dietary supplements, and pharmaceuticals.

- Beta glucan provides several benefits. Lower cholesterol levels, which reduces the risk of heart disease. It's a supporter of immune health via activated macrophages and other immune cells within the body; this makes people consuming it keen to search rather natural health products. Aside from helping with regulating blood glucose levels, diabetic patients benefit from it. It further reduces oxidative stress and inflammation as part of its antioxidant faculty.

- In market terms, diversification of applications is developing. Beta glucan is incorporated by the food and beverage industry into cereals, beverages, and snack products suitable for health-conscious consumers. This is also growing in the dietary supplement category with products like powders, capsules, and functional drinks. The pharmaceutical industry uses beta glucan in the formulation of therapies for immune stimulation and wound healing, the cosmetics market studies its skin health value and in anti-aging formulations.

- Continued growth of the beta glucan market is expected due to health awareness, increased rates of chronic diseases, and advancements in innovations of product formulations. As consumers continue to ask for natural, functional ingredients, the role of beta glucan in disease prevention and health promotion will become well-established, making it not just essential in terms of the global nutraceutical market but also in functional foods.

Beta Glucan Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 488.3 Million |

| Market Size in 2026 | USD 526.3 Million |

| Forecast Period 2026-2035 CAGR | 8.8% |

| Market Size in 2035 | USD 1.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing consumer awareness of health benefits | Growing knowledge about beta glucans role in boosting immunity, lowering cholesterol, and managing blood sugar levels fuels demand. |

| Rising prevalence of chronic diseases | The global increase in cardiovascular diseases, diabetes, and immune disorders drives the need for functional ingredients like Beta Glucan. |

| Shift towards natural and plant-based products | Consumers prefer natural, plant-derived ingredients, boosting the popularity of beta glucan as a healthy, sustainable option. |

| Pitfalls & Challenges | Impact |

| High production costs | Extracting and purifying beta glucan can be expensive, affecting profit margins and product pricing. |

| Regulatory challenges | Variations in health claims and approval processes across regions can hinder market expansion and consumer trust. |

| Opportunities: | Impact |

| Product innovation & diversification | Developing novel formulations, such as flavored beverages, functional foods, and topical products, can attract new consumer segments. |

| Personalized nutrition | Tailoring beta glucan-based products for specific health needs and demographics offers customized solutions. |

| Market Leaders (2025) | |

| Market Leaders |

10.2% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, Japan & South Korea |

| Future Outlook |

|

What are the growth opportunities in this market?

Beta Glucan Market Trends

- The dynamic growth of the beta glucans industry is being led by several trends. Technological advancement consisting of innovative fermentation and extraction processes is improving the purity, bioavailability and efficacy of beta glucan products made with these innovations helping manufacturers develop highly bioactive and sustainable ingredients for growing functional food, dietary supplements and pharmaceutical sectors. The other modes being investigated include bringing beneficial effects on the delivery mechanisms and absorption rates using the principles of nanotechnology and enzymatic processing, thus opening even more applications for beta glucan.

- As these markets grow, the regulatory environment is improving, with the FDA and EFSA providing clear guidance on health claims and safety standards that increase consumer confidence and improve international trade. Therefore, companies are investing in compliance to ensure their products conform to the highest quality standards, consciously trying to support the growth of the market.

- There is an increasing emphasis on product innovation & these new formulations address individual health benefits such as immune support, cholesterol-lowering & gut health. Consumer preference for natural and eco-friendly ingredients is creating strong demand for organic and sustainably sourced beta glucan which is further driving the market.

Beta Glucan Market Analysis

Learn more about the key segments shaping this market

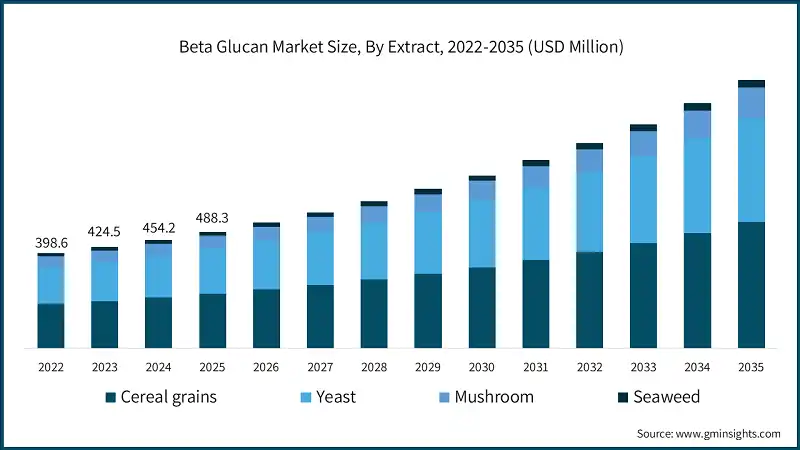

Based on extract, the beta glucan market is segmented into cereal grains, yeast, mushroom, and seaweed. Cereal grains dominated the market with an approximate market share of 46.6% in 2025 and is expected to grow with a CAGR of 8.9% till 2035.

- Cereal grains like oats and barley have been the long-standing sources of beta glucan their segment is witnessing steady growth fueled by consumer demand for natural and healthy substances. Innovations in extraction techniques are improving the yield and purity of beta glucan from cereal sources. Clean-label and organic product trends are driving manufacturers to use non-GMO and sustainably sourced grains. Consumers and producers are further encouraged by regulatory support across regions such as Europe and North America.

- Yeast-derived beta glucan is growing in prominence, because of its immune boosting efficacy combined with high bioavailability. The increased appreciation of the immune enhancement of yeast beta glucan particularly through the immune health supplements and functional food categories is one of the most important trends. Innovators are developing new patented products using different strains and processes of yeast to produce the best products with the best potency. Regulatory frameworks are becoming clearer, facilitating global trade.

- The mushroom-derived beta glucan continues experiencing a growing demand with all its well-documented health benefits, including immune modulation and anti-inflammatory actions. The segment is fueled by innovations in cultivation & extraction technologies catapulting higher yields in high potent products.

- Seaweed-derived beta glucan is rapidly gaining ground as a source of sustainability and naturalness. The segment further grows as awareness surrounding marine ingredients extends to their health benefits, more specifically, immune support and gut health. Certainly, sustainability is another trend for which consumers are adopting seaweed, owing to its environmental friendliness.

Learn more about the key segments shaping this market

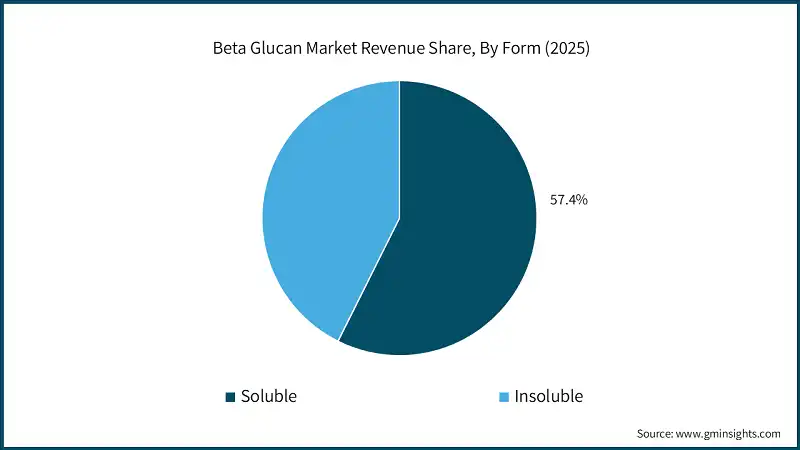

Based on form, the beta glucan market is segmented into soluble and insoluble. Soluble held the largest market share of 57.4% in 2025 and is expected to grow at a CAGR of 8.9% during 2026 to 2035.

- Soluble beta glucan is distinguished by its ability to dissolve in water. This form exhibits high bioavailability and is commonly used in dietary supplements and functional foods and beverages that promote cardiovascular health, immune function, and blood sugar regulation. The absorption in the GI tract is enhanced because of the solubility of beta glucan, which contributes to its efficacy regarding health benefits.

- Soluble beta glucan is mainly extracted from oat and barley sources, yeast, and some mushrooms, making it a choice of easy incorporation into different formulations. The soaring consumer demand for health-oriented and convenient consumption products is aiding the acceleration of soluble Beta Glucan in the market.

- Insoluble beta glucan, on the other hand, does not dissolve in water but retains its structure, thus contributing bulk and fiber. It is mostly used as a dietary fiber for digestive health, aiding regular bowel movements and gut health. Insoluble beta glucan is predominantly extracted from cereal grains, yeast cell walls, & some mushrooms.

Based on application, the beta glucan market is segmented into food & beverage, dietary supplements, pharmaceuticals, cosmetics, animal feed, and others. Food & beverages segment dominated the market with an approximate market share of 46.1% in 2025 and is expected to grow with a CAGR of 8.8% up to 2035.

- Beta glucan is a functional ingredient that appeals greatly to the food and beverage industries with the purpose of enhancing health benefits. In cereals, breads, smoothies, and energy bars, beta glucan is added as a measure to increase the dietary fiber value, contribute towards an effective cardiovascular system, and facilitate improvement of immune function. The trend towards health-conscious, natural ingredients among consumers across the world is anticipated to yield significant growth for this segment since companies are developing innovations in product formulation to conform to clean-label and organic trends.

- The other major consumer segment for beta glucan is dietary supplement products. Health effects from possible intake of beta glucan include boosting the immune system and reducing cholesterol levels. This ingredient is also found in capsules, powders and functional drinks. The increasing trend toward personalized nutrition, and natural support to boost immunity is increasing demand for the product.

- Beta-glucan in cosmetics is an emerging trend that is being used as a skin-soothing, anti-ageing and antioxidant agent. Further applications are in creams, serums and masks meant to produce wet skin, repair damaged skin and protect skin against environmental damage.

- Beta glucan is increasingly being incorporated into animal feed to stimulate the immune response, promote gut health, and, generally, promote growth and performance in livestock and pets. Its intrinsic property to stimulate the immune system naturally provides a sustainable alternative to antibiotics and growth promoters. Adoption in the animal nutrition segment is driven by increasing concern on the part of people about health and safety regulations regarding animals.

Looking for region specific data?

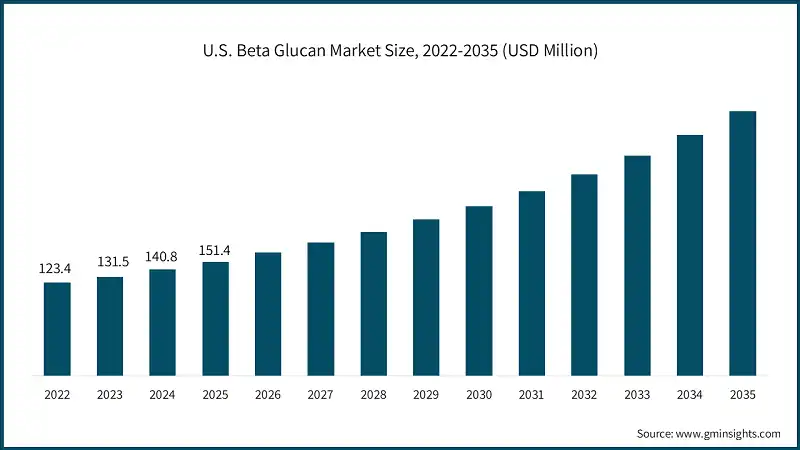

The North America beta glucan market is growing rapidly on the global level with a market share of 38.8% in 2025.

- Beta glucan has the largest market in North America due to awareness regarding health and wellness which has impacted on demand for functional foods, dietary supplements, and the pharmaceutical sector. Growth is augmented by increased focuses on the immune system, cardiovascular health, and weight management. Product innovations are trending, along with other clean label products. The major markets are in the U.S. and Canada where there is a rise in the interest of consumers towards natural and plant-based ingredients.

Europe beta glucan market leads the industry with revenue of USD 156 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- The European beta glucan market is experiencing robust growth driven by increasing consumer demand for immune health, functional foods, and natural ingredients. Trends include rising popularity of plant-based and clean-label products, regulatory support for health claims, and innovation in food and supplement applications. Sustainability and transparency are also key factors shaping market expansion in Europe.

The Asia Pacific beta glucan market is anticipated to grow at a CAGR of 9.1% during the analysis timeframe.

- The Asia-Pacific holds the highest growth because of large populations, increasing health consciousness and the traditional use of mushrooms and grains enriched with beta glucan. Countries such as China, Japan, and India are drivers of demand for functional foods, beverages, and traditional medicines. Meanwhile, the food and beverage sector, especially in China and Japan, is growing swiftly alongside increased inclinations towards vegetarianism and veganism.

Latin America beta glucan accounted for 2.7% market share in 2025 and is anticipated to show steady growth over the forecast period.

- In Latin America, beta glucans have enjoyed steady progress due to the rising awareness of health benefits associated with beta glucan. The growth of the food and beverage industry and increasing demand for dietary supplements support the growth of this market. Brazil and Mexico are large markets in the region where consumers are looking for natural health products and functional foods for immunity and general well-being.

Middle East & Africa beta glucan accounted for 1.5% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- The MEA is an emerging market with slow growth, fueled by increasing urbanization and rising health consciousness. The region has shown increasing demand for dietary supplements and functional foods-drugs in the UAE, & South Africa. The ongoing trend for natural and organic products has added the scope for beta glucan adoption in the region along with the growth of the pharmaceutical sector. However, the market growth is still moderate compared to other regions on account of economic and infrastructural grounds.

Beta Glucan Market Share

The top 5 companies in beta glucan industry include Angel Yeast, Kerry, Ohly, Biorigin S.A., Super Beta Glucan. These are prominent companies operating in their respective regions covering approximately 43.8% of the market share in 2025. These companies hold strong positions due to their extensive experience in beta glucan market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- Angelyeast is a significant player in the fermentation and yeast-derived ingredients segments. The firm has an extensive product line encompassing yeast extracts and beta glucan and other fermentation ingredients derived from yeast. The company's large manufacturing capacity in Asia permits cost-efficient production and broad distribution in the fast-growing Asian markets.

- Kerry is a global leader in the industry of taste and nutrition solutions for the food and beverage sectors. The top-quality science dedicated to the development of functional ingredients such as beta glucan for human nutritional well-being gives Kerry a competitive advantage with global reach and strong R&D capabilities.

- Ohly is a leading player in fermentation technology, enzymes, and natural ingredients, including beta glucan, for health and functional foods. The company's expertise in the business of biotechnological processes for fermenting provides the right mix with noticeable advantages in producing natural high-end quality ingredients aimed at health-conscious applications. The company enjoys a substantial presence in the European market, Asia and North America, fulfilling another cause to hamper growth of global supply.

- Biorigin is known for natural fermentation-derived ingredients, including beta glucan, with a focus on sustainability and clean-label solutions. With Latin America well-positioned in its map and with the strong regional presence, it makes successful geographical serving to the local markets with competitive price points and customizable advantages. There are tremendous growth opportunities for the company in the expansions with North America and Europe as consumer inclinations stretch more towards vegetarian and sustainable production.

- Super Beta Glucan operates as a company that solely concentrates on beta glucan ingredients particularly for immune health applications. Its focus is narrow making the company an excellent candidate for more specialized product offerings and applications that fulfill the demands of the immune support and dietary supplement markets. It is through its focus on beta glucan that Super Beta Glucan possesses an edge in these in terms of expertise and product efficiency.

Beta Glucan Market Companies

Major players operating in the beta glucan industry include:

- Angel Yeast

- Biorigin S.A.

- DSM

- Givaudan

- Kemin Industries

- Kerry

- Lallemand

- Lantmännen Biorefineries

- Leiber GmbH

- Ohly

- Super Beta Glucan

- Tate & Lyle PLC

- VW-Ingredients

Beta Glucan Industry News

- In February 2025, Layn Natural Ingredients announced the launch of its new Galacan beta glucan ingredient and the expansion of its biotechnology facility. Galacan, derived from precision fermentation, offers enhanced bioavailability, immune support, gut health, and skin benefits. The company aims for FDA GRAS and Novel Food certifications.

- In June 2024, Cargill's barley beta-glucan concentrate is set to receive a new health claim from the U.S. Food and Drug Administration (FDA), linking the ingredient to a reduced risk of heart disease.

This beta glucan market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Extract

- Cereal grains

- Yeast

- Mushroom

- Seaweed

Market, By Form

- Soluble

- Insoluble

Market, By Application

- Food & beverage

- Bakery products

- Breakfast cereals & bars

- Functional beverages

- Dairy & dairy alternatives

- Soups, sauces & prepared foods

- Snack foods

- Pharmaceuticals

- Clinical nutrition

- Wound care & tissue repair

- Drug delivery systems

- Cosmetics

- Skin care products

- Hair & scalp care

- Body care

- Animals feed

- Poultry feed (broiler, layer, turkey & game birds)

- Swine feed (piglet, grower, finisher, sow)

- Aquaculture feed (fish, shrimp)

- Ruminant feed (dairy & beef cattle)

- Pet nutrition (companion animals)

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the beta glucan industry?

Key players include Angel Yeast, Biorigin S.A., DSM, Givaudan, Kemin Industries, Kerry, Lallemand, Lantmännen Biorefineries, Leiber GmbH, Ohly, Super Beta Glucan, Tate & Lyle PLC, and VW-Ingredients.

What are the upcoming trends in the beta glucan market?

Key trends include advanced fermentation and extraction technologies, nanotechnology for better absorption, clearer FDA and EFSA regulations, and rising demand for organic, sustainably sourced beta glucan products.

What was the valuation of the soluble segment in 2025?

The soluble segment held the largest market share of 57.4% in 2025 and is anticipated to witness over 8.9% CAGR till 2035.

What is the growth outlook for the food & beverages segment from 2026 to 2035?

The food & beverages segment, which held a market share of 46.1% in 2025 and is set to expand at a CAGR of 8.8% up to 2035.

Which region leads the beta glucan sector?

North America leads the market, accounting for 38.8% of the global share in 2025. The U.S. and Canada are key markets, driven by consumer interest in health and wellness, natural ingredients, and clean-label products.

What is the expected size of the beta glucan industry in 2026?

The market size is projected to reach USD 526.3 million in 2026.

What was the market share of cereal grains in 2025?

Cereal grains dominated the market with an approximate share of 46.6% in 2025 and is expected to grow at a CAGR of 8.9% through 2035.

What is the projected value of the beta glucan market by 2035?

The market is poised to reach USD 1.1 billion by 2035, fueled by advancements in technology, regulatory support, and rising demand for functional foods, dietary supplements, and pharmaceuticals.

What was the market size of the beta glucan in 2025?

The market size was valued at USD 488.3 million in 2025, with a CAGR of 8.8% expected through 2035. The growth is driven by increasing consumer awareness of health benefits and its applications across various industries.

Beta Glucan Market Scope

Related Reports