Home > Packaging > Industrial Packaging > Battery Packaging Material Market

Battery Packaging Material Market Analysis

- Report ID: GMI4602

- Published Date: Mar 2020

- Report Format: PDF

Battery Packaging Material Market Analysis

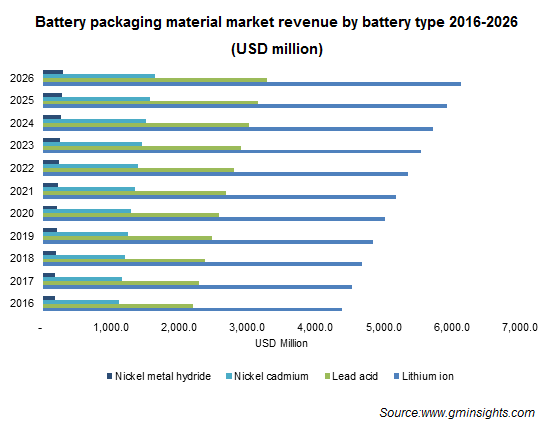

The battery packaging material market is segmented based on various batteries, including, lithium ion, lead acid, nickel cadmium, and nickel metal hydride. Among the battery type segment, lithium ion will be the fastest growing segment owing to its increasing demand in electric vehicles and solar energy. The popularity of battery in these industries is increasing due to its high energy density, and low self-discharge. With growth of lithium ion batteries, its packaging sector is expected to grow at 3.4% over the forecast period.

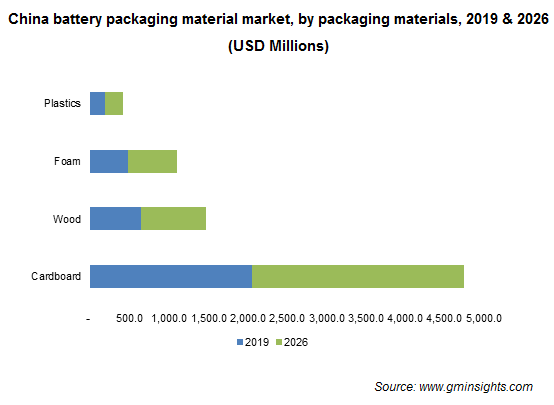

The battery packaging material market is also segmented on the basis of the packaging materials, which includes, cardboard, wood, foam and plastics. These are the most commonly used material in packaging sector, that are also used to successfully transport and handle complex battery stacks.

The plastics are further sub segmented into following types, including, polyethylene terephthalate, HDPE, polypropylene, PVC, and others. The other materials in plastics are LDPE, Polystyrene etc. Among the segment, the cardboard and wood material are expected to grow at the 3.9% and 3.5% CAGR.

Batteries such as lithium ion have the potential to start fires or explode. Hence, proper steps are taken to avoid such risks. Cardboard packaging is made of 2 or 3 sheet of cardboard lining to provide greater structural strength to the package. Wood and cardboard also have moisture soaking capacity, which protects the battery from damage. It is due to their easy availability, sturdiness, sustainability and low-cost, cardboard and wood considered a reliable option for battery packaging.

Battery safety during the storage and transporting, handling is also largely depended on the type of the cases utilized in the packaging. Battery packaging industry is divided on the lines of the type of battery cases, including, corrugated, wooden boxes, plastic cases, foams, and others. The other segment includes cases made of rubbers and other similar material etc.

While packaging batteries, special steps are taken to provide greater stability to the product during handling and transportation. In 2019, corrugated boxes or cardboard boxes had the largest share of 62.78% in the battery packaging material market.

Corrugated or cardboard is a common term for strong paper products which includes, card stock, paperboard, and corrugated fiberboard. Corrugated fiberboard is made by gluing a flat sheet of paper to a corrugated (wavy) sheet of paper. Its design gives the case a tear resistant property that protect the batteries from exposure. corrugated are largely recyclable and result in increased adoption of sustainable practices among the intermediaries in the value chain.

The growing use of biodegradable cardboard boxes may increase the sustainability factor of battery packaging operations.

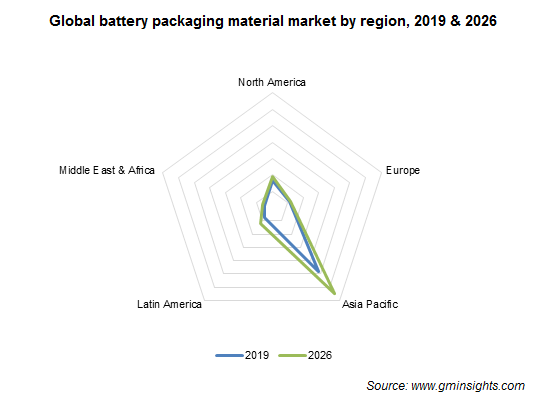

In terms of regional growth, Asia Pacific will be the fastest growing region where the battery packaging material market share will observe 4.1% CAGR. Sturdy economies such as China, Japan and South Korea are major countries where the battery packaging will be a major activity. Till 2019, China held almost 70% of the market share due to its major share in battery production. However, coronavirus crisis is expected to result in economic downturn. As result, the production of batteries in general is forecasted to suffer. It will result in lowering of the share of China over the forecast period.

Other than China, Japan and India are expected to be a major market for the battery packaging, owing to the rising adoption of electric cars in these countries. Additionally, in India, solar energy sector going leaps and bound. As per the India Brand Equity Foundation, globally, in 2018, India ranked 5th in term of solar energy production.

South Korea’s has a strong domestic battery industry that supports its electric vehicle industry. Battery companies such as LG Chem and SK Energy together represent 20% of the global lithium ion battery market, which provides a greater avenue for the growth of battery packaging material market in overall Asia Pacific.