Summary

Table of Content

Battery Packaging Material Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Battery Packaging Material Market Size

Battery packaging material market size was over USD 8.8 billion in 2019 and shall exhibit 3.8% CAGR throughout the forecast timespan. Heavy product requirement in electronics and automotive industry will drive the product demand over the forecast period.

To get key market trends

Packaging has been known to be commonly used in industries such as food, consumer goods, and finished industry products such as mechanical goods and electronics. In recent decades, the need for appropriate packaging for growing electronics such as batteries is rising. Battery packaging material market is poised to grow proportional to the lithium ion battery demand.

Battery Packaging Material Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 8.8 Billion (USD) |

| Forecast Period 2020 to 2026 CAGR | 3.8% |

| Market Size in 2026 | 11.4 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Electric vehicle manufacturers, and energy storage unit users will drive the battery packaging demand for utilizing battery packs. Stringent regulations regarding the packaging will be one of the important hindrances to the growth of battery packaging material market.

One of the main reasons for the presence of these regulations in battery packaging is the risk associated with the battery leakage and subsequent damages to the property and operational capacity. On the other hand, the coronavirus will also be an effective factor playing a major role and limiting the growth of battery packaging. The spread of coronavirus through packaging material will also be a limiting factor for the global market.

Battery Packaging Material Market Analysis

Learn more about the key segments shaping this market

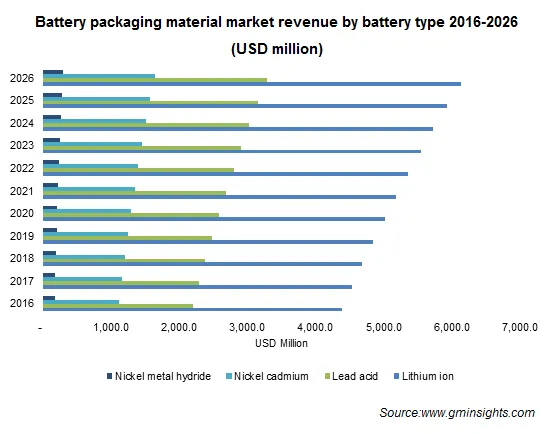

The battery packaging material market is segmented based on various batteries, including, lithium ion, lead acid, nickel cadmium, and nickel metal hydride. Among the battery type segment, lithium ion will be the fastest growing segment owing to its increasing demand in electric vehicles and solar energy. The popularity of battery in these industries is increasing due to its high energy density, and low self-discharge. With growth of lithium ion batteries, its packaging sector is expected to grow at 3.4% over the forecast period.

Learn more about the key segments shaping this market

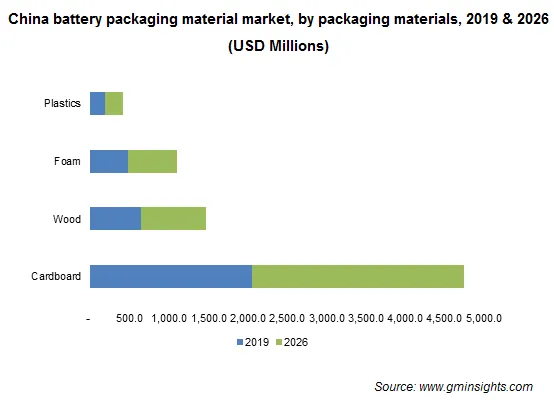

The battery packaging material market is also segmented on the basis of the packaging materials, which includes, cardboard, wood, foam and plastics. These are the most commonly used material in packaging sector, that are also used to successfully transport and handle complex battery stacks.

The plastics are further sub segmented into following types, including, polyethylene terephthalate, HDPE, polypropylene, PVC, and others. The other materials in plastics are LDPE, Polystyrene etc. Among the segment, the cardboard and wood material are expected to grow at the 3.9% and 3.5% CAGR.

Batteries such as lithium ion have the potential to start fires or explode. Hence, proper steps are taken to avoid such risks. Cardboard packaging is made of 2 or 3 sheet of cardboard lining to provide greater structural strength to the package. Wood and cardboard also have moisture soaking capacity, which protects the battery from damage. It is due to their easy availability, sturdiness, sustainability and low-cost, cardboard and wood considered a reliable option for battery packaging.

Battery safety during the storage and transporting, handling is also largely depended on the type of the cases utilized in the packaging. Battery packaging industry is divided on the lines of the type of battery cases, including, corrugated, wooden boxes, plastic cases, foams, and others. The other segment includes cases made of rubbers and other similar material etc.

While packaging batteries, special steps are taken to provide greater stability to the product during handling and transportation. In 2019, corrugated boxes or cardboard boxes had the largest share of 62.78% in the battery packaging material market.

Corrugated or cardboard is a common term for strong paper products which includes, card stock, paperboard, and corrugated fiberboard. Corrugated fiberboard is made by gluing a flat sheet of paper to a corrugated (wavy) sheet of paper. Its design gives the case a tear resistant property that protect the batteries from exposure. corrugated are largely recyclable and result in increased adoption of sustainable practices among the intermediaries in the value chain.

The growing use of biodegradable cardboard boxes may increase the sustainability factor of battery packaging operations.

Looking for region specific data?

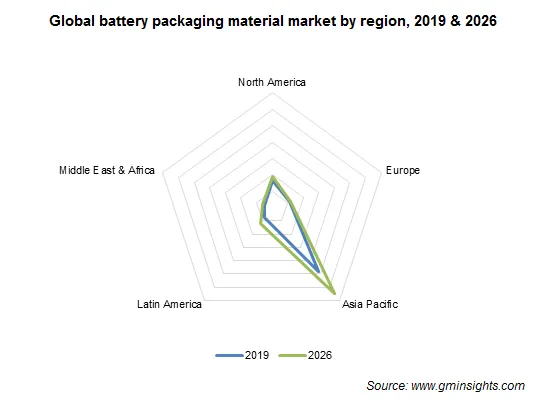

In terms of regional growth, Asia Pacific will be the fastest growing region where the battery packaging material market share will observe 4.1% CAGR. Sturdy economies such as China, Japan and South Korea are major countries where the battery packaging will be a major activity. Till 2019, China held almost 70% of the market share due to its major share in battery production. However, coronavirus crisis is expected to result in economic downturn. As result, the production of batteries in general is forecasted to suffer. It will result in lowering of the share of China over the forecast period.

Other than China, Japan and India are expected to be a major market for the battery packaging, owing to the rising adoption of electric cars in these countries. Additionally, in India, solar energy sector going leaps and bound. As per the India Brand Equity Foundation, globally, in 2018, India ranked 5th in term of solar energy production.

South Korea’s has a strong domestic battery industry that supports its electric vehicle industry. Battery companies such as LG Chem and SK Energy together represent 20% of the global lithium ion battery market, which provides a greater avenue for the growth of battery packaging material market in overall Asia Pacific.

Battery Packaging Material Market Share

The global industry is largely consolidated with presence of major battery packagers such as Nefab and Fedex holding a major share in the market. However, the availability of battery packaging material manufacturers are largely fragmented with the presence of organizations such as

- Ball Corporation

- Amcor

- Crown Holding

- Owens-Illinois

- Reynolds Group

- International Paper Company

- DS Smith

Many players are also play significant role in packaging of other industry products such as food, pharmaceuticals etc. Major players try to leverage their market position through acquisitions and mergers. Small scale manufacturers are also growing in emerging countries, posing a serious challenge to the top players. Some of the key players in the battery packaging material industry are

- Nefab

- Fedex

- DHL

- Rogers Corporation

- United Parcel Service (UPS)

- Umicore

- Zarges

Battery packaging material market report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue in Kilo Tons and USD Million from 2016 to 2026, for the following segments:

By Battery Type

- Lithium ion

- Lead acid

- Nickel cadmium

- Nickel metal hydride

By Packaging Materials

- Cardboard

- Wood

- Foams

- Plastics

- Polyethylene Terephthalate

- HDPE

- Polypropylene

- PVC

- Others (LDPE, Polystyrene etc.)

By Packaging Cases

- Corrugated

- Wooden boxes

- Plastic cases

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Russia

- APAC

- China

- India

- Japan

- Australia

- Thailand

- South Korea

- LATAM

- Brazil

- Mexico

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What will be the worth of global battery packaging material market by the end of 2026?

According to the report published by Global Market Insights Inc., the battery packaging material business is supposed to attain $11.4 billion by 2026.

Which packaging materials segment is expected to drive the market during the forecast period?

The cardboard segment registered a major market share in 2019 and is projected to record a remarkable growth rate throughout the forecast period.

Which are the top companies in the battery packaging material industry?

Ball Corporation, Amcor, Crown Holding, Owens-Illinois, Reynolds Group, International Paper Company, DS Smith, Nefab, Fedex, DHL, Rogers Corporation, United Parcel Service (UPS), Umicore and Zarges are some of the top contributors in the industry.

What are the key factors driving the market?

Surging battery usage in the propelling electronics industry, rising demand for lithium ion batteries in electric vehicles, increasing product manufacturing operations in China, and growing automotive industry are major factors expected to drive the growth of global market.

What kind of growth will global battery packaging material industry size observe during the forecast timeframe?

According to credible reports, battery packaging material market would record a crcr of 3.8% over the anticipated time span.

How much revenue share will battery packaging material industry acquire by the end of 2026?

The worth of battery packaging material market is expected to reach a valuation of $11.3 billion by 2026.

Battery Packaging Material Market Scope

Related Reports