Summary

Table of Content

Bakery Processing Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Bakery Processing Equipment Market Size

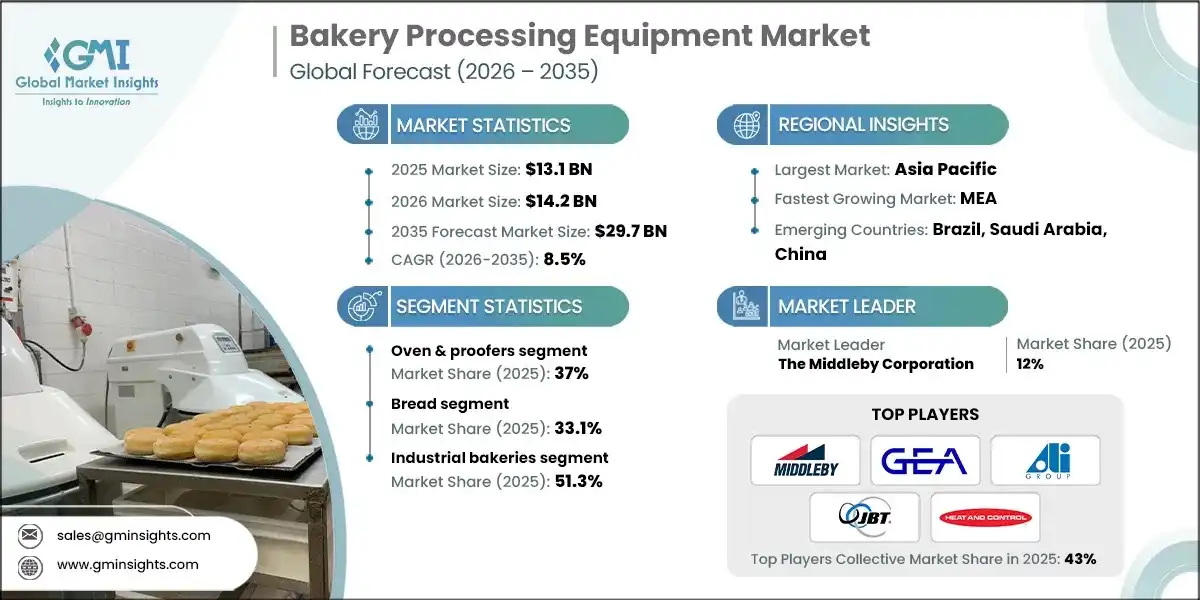

The global bakery processing equipment market size was valued at USD 13.1 billion in 2025. The market is expected to grow from USD 14.2 billion in 2026 to USD 29.7 billion in 2035, at a CAGR of 8.5% according to latest report published by Global Market Insights Inc.

To get key market trends

- The period from 2021 to 2022 was characterized by the increased demand for bakery processing equipment owing to the recovery of food service and retail bakery sales from the disruptions cause by the pandemic. International Food and Agricultural Organization figures indicate that heading to out of home eating was the reason for the cemented increase in bakery product consumption and therefore led to an increase of capital investments in bakeries for the replacement of old equipment, in particular, the mixers, proofers and ovens to process the increased demand in products.

- The period 2022 to 2023 was characterized by continual labor shortages and increasing wage rates in the major economic areas that pushed bakeries to invest in automated baking equipment. For instance, investments to increase automation of lines in dough handling, depositing and packaging systems to reduce food manufacturing labor cost and stabilize production cost were observed.

- As of 2023, the market was pegged at around USD 11.1 billion with the increase of inflation, especially in food ingredients and energy, placed a premium on efficiency. Equipment that reduced baking waste, improved the energy efficiency of the ovens and kept energy use at a lower place were sought by the bakers. The bakeries also needed ovens and proofers with improved digital control to respond to the EU energy situation that was characterized by high prices and the volatile market on grains.

- The change in consumer preferences from 2024 to 2025 toward premium, clean-label, and frozen bakery items continued to influence equipment selection. Companies increased investments to expand capacity for frozen dough, added par-baked lines, and included gluten-free products in their portfolios, consistent with USDA and Eurostat bakery commerce trends. These investments demanded flexible, hygienic, and modular designs to accommodate shorter run lengths, a greater diversity of finished products, and more robust food safety requirements.

Bakery Processing Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 11.1 Billion |

| Market Size in 2026 | USD 14.2 Billion |

| Forecast Period 2026-2035 CAGR | 8.5% |

| Market Size in 2035 | USD 29.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising automation to offset bakery labor shortages | Drives demand for integrated, high-throughput equipment lines |

| Growth in frozen and packaged bakery products | Requires flexible, hygienic systems for diverse SKUs |

| Focus on food safety and product consistency | Encourages adoption of digital controls and monitoring |

| Pitfalls & Challenges | Impact |

| High upfront capital cost for small bakeries | Limits adoption of advanced, fully automated solutions |

| Space and utility constraints in existing facilities | Complicates retrofits and installation of large equipment |

| Opportunities: | Impact |

| Expansion of retail chains and in-store bakeries | Opens demand for compact, semi-automatic baking solutions |

| Clean-label, gluten-free and specialty product trends | Clean-label, gluten-free and specialty product trends |

| Market Leaders (2025) | |

| Market Leaders |

12% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | MEA |

| Emerging countries | Brazil, Saudi Arabia, China |

| Future outlook |

|

What are the growth opportunities in this market?

Bakery Processing Equipment Market Trends

- Bakeries investing in augmented automation: Bakeries are incorporating automated mixers, proofers, ovens and handling systems like robots to alleviate labor shortages and enhance consistency. For instance, bakeries that industrially and rapidly produce sliced bread, buns, and sweet goods are increasingly implementing robots to depinning, pneumatically pick and place, and load/unload from their high volume ovens to proofers.

- Energy-efficient and economically sustainable: Corporate goals for sustainability and increased energy prices are driving demands for energy-efficient ovens and heat-recovering. Improved insulation of proofers also leads to saved energy. Throughout the industry, cut emissions achieved by slower burner and smarter systems controlling temperature lead to lower operating cost. The demand for sustainability in the industry leads to greater throughput and product quality.

- Flexible for high, frozen and other specialty products: The expanding market for frozen dough and other specialty lines like gluten free and artisan-style products shifts the demand for equipment. Production lines need to stand up to varying doughs, differing hydration levels and toppings while allowing for rapid changeovers. Increased support for high Stock Keeping Unit (SKU) variety requires more efficient equipment.

- Getting the most from data predictive maintenance: Today's bakeries are increasingly connected in using equipment outfitted with reliable sensors, programmable logic controllers, and telemetry based remote monitoring. Real-time control of temperature and humidity to improve cooking and baking results through other automated control systems while also allowing the line speed to improve. Downtime is limited and food safety compliance and batch accuracy are improved using predictive maintenance.

Bakery Processing Equipment Market Analysis

Learn more about the key segments shaping this market

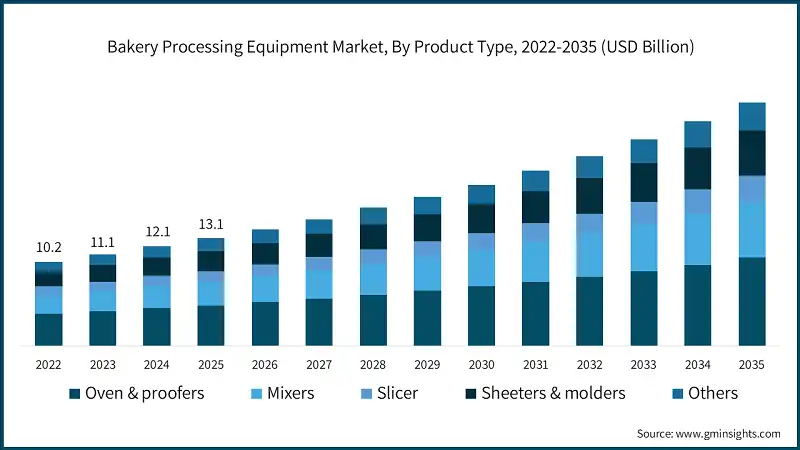

Based on product type, the bakery processing equipment market is segmented into Oven & proofers, mixers, slicers, sheeters & molders, others. Oven & proofers dominated the market with an approximate market share of 37% in 2025 and is expected to grow with a CAGR of 8.1% till 2035.

- The foundation of all bakeries is still the proofers and ovens, and the market is beginning to turn towards energy-efficient, digitally controlled, and climate-and-humidity-responsive systems. Mixers are increasingly spaced out by volume, with those below 250 kg being designed for artisanal or testing batches and those with more than 1,500 kg volume being designed for automatic preparation of dough in large-scale bakeries.

- The slicers and the sheeters/molders are also designed for increased flexibility in volume, greater volume for greater flexibility in product type. Heavier volume bands, slicers and sheeters over 350 kg and sheeters over 1,500 kg are designed for industrial scale, while the lower volume bands are designed for retail or mid-scale.

Based on applications, the bakery processing equipment market is segmented into Bread, pastry, pizza, croissant, flatbread, pie/quiche, biscuits, tortilla. Bread held the largest market share of 33.1% in 2025 and is expected to grow at a CAGR of 7.6% during 2026 to 2035.

- The higher demand applications within the bread-processing equipment are still for proofing, baking, cooling, and slicing due to the need for high volume, continuous processes. The demand for equipment to process pastries is also increasing, focusing on more flexible sheeters, and depositors that can process moist dough-based pastries with high filling and complex shapes.

- Out-of-home pizza, flatbread, quiche, pie, and tortillas will also feel the benefit of the growing demand for frozen food. Both food service and retail sectors require horizontal layered products or filled products that can be automatically portioned into dough balls, pressed, topped, and evenly baked. These equipment manufacturers are looking to deliver solutions that are quick and easy to change over from one size, style of crust, and regional recipe to another.

Learn more about the key segments shaping this market

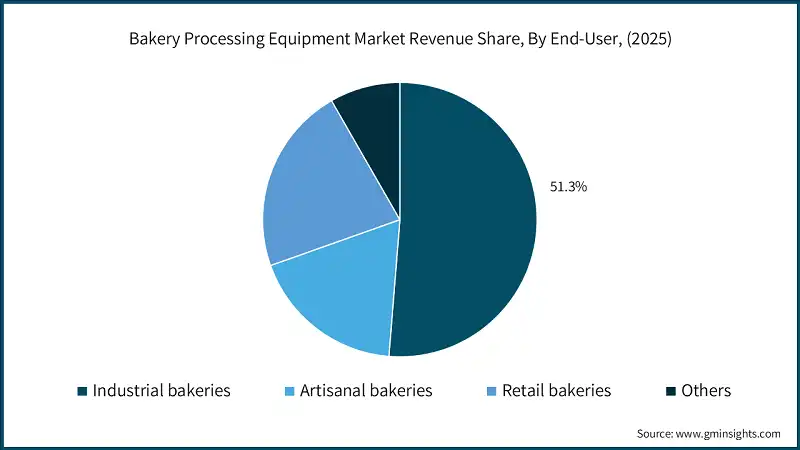

Based on end-user, the bakery processing equipment market is segmented into industrial bakeries, artisanal bakeries, retail bakeries, others. Industrial bakeries segment dominated the market with an approximate market share of 51.3% in 2025 and is expected to grow with the CAGR of 9.2% through 2035.

- Industrial bakeries are the biggest users in this market and are competing to dominate the market in high capacity, fully automated production lines for supermarket suppliers, private label and frozen product offerings in the market. Their focus is on throughput, OEE, labor savings, and the incorporation of more robotics, smart control, and energy saving technologies in the mixing, proofing, baking, and packaging line integration.

- Furthermore, artisanal and retail bakeries are rushing to implement semi-automatic and compact equipment to boost their product consistency and hygiene, although these systems are designed to give the hand-crafted aesthetic of the product. The growing of in-store supermarket bakeries and cafe chains spurs the demand more on compact ovens, proofers, mixers, and sheeters that is also for “others” like contract manufacturers and central kitchens for quick service and convenience.

Looking for region specific data?

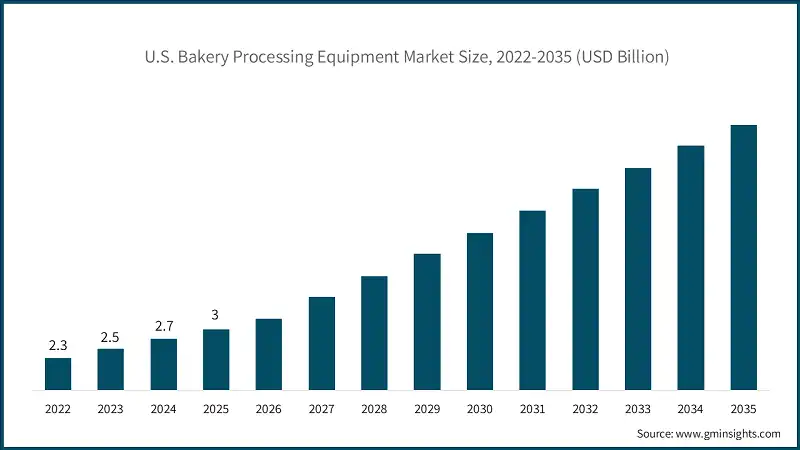

North America accounts for a substantial share of the bakery processing equipment market, rising from USD 3.5 billion in 2025 to about USD 7.4 billion in 2035, supported by an 8.6% CAGR and high automation adoption. U.S. market was valued at around USD 3 billion in 2025.

- The U.S. is the core growth engine in North America. Strong presence of industrial bakeries, private-label producers and retail chains drives investments in high-capacity ovens, proofers and slicing lines, with upgrades focused on automation, energy efficiency and food-safety compliance.

Europe remains a key bakery equipment hub, increasing from USD 3.9 billion in 2025 to roughly USD 8 billion in 2035, driven by an 8.4% CAGR, strong artisan traditions and industrial-scale production. Germany market was valued at about USD 700.3 million in 2025.

- Germany plays a central role in European demand, with advanced industrial bakeries and equipment manufacturers. Focus on premium bread, pastries and frozen products boosts demand for flexible, high-precision lines that meet strict hygiene and sustainability standards.

Asia Pacific is the largest regional market, expanding from USD 4.2 billion in 2025 to nearly USD 8.9 billion in 2035 at an 8.7% CAGR, fueled by urbanization and expanding bakery consumption. China market was valued at around USD 1.9 billion in 2025.

- China leads regional growth with rapid expansion of industrial bakeries, QSR chains and convenience formats. Investments target automated lines for packaged bread, sweet buns and frozen bakery, emphasizing throughput, consistency and integration with cold-chain logistics.

Latin America represents a smaller but steadily expanding market, moving from about USD 800.4 million in 2025 to roughly USD 1.5 billion in 2035, supported by an 8% CAGR and growing retail bakery penetration. Brazil market was valued at nearly USD 234.6 million in 2025.

- Brazil is the primary demand center in Latin America. Rising middle-class consumption of packaged and frozen bakery products encourages bakeries to modernize with more reliable ovens, mixers and sheeters, while still balancing cost sensitivity and limited access to financing.

Middle East & Africa (MEA) shows robust growth prospects and fastest growing, rising from roughly USD 700.2 million in 2025 to about USD 1.4 billion in 2035, underpinned by the highest regional CAGR of 8.8% and expanding modern retail. Saudi Arabia market was valued at nearly USD 234.1 million in 2025.

- Saudi Arabia’s market is driven by strong foodservice, hypermarkets and growing in-store bakeries. Investments focus on semi- and fully-automated lines for flatbreads, buns and pastries, aligning with increasing convenience food demand and government-backed food security initiatives.

Bakery Processing Equipment Market Share

The bakery processing equipment industry is moderately consolidated, with a cluster of global OEMs shaping technology, standards, and service expectations. The Middleby Corporation, GEA Group, ALI Group, John Bean Technologies and Heat and Control together hold 43% of market share in 2025, benefiting from broad portfolios, turnkey line integration and strong installed bases at industrial and large retail bakeries worldwide.

- The Middleby Corporation: The Middleby Corporation is one of the leading players in bakery processing equipment with about 12% market share. It offers a wide range of ovens, proofers, mixers and integrated lines. Recent focus has been on energy-efficient tunnel ovens, automation upgrades and acquisitions to deepen capabilities in artisanal-style and frozen bakery solutions.

- GEA Group: GEA Group holds roughly 10% share, leveraging its strong position in food processing technologies. In bakery, it supplies mixers, proofers, ovens and end-of-line systems, often as part of larger turnkey projects. GEA emphasizes hygienic design, digital controls and energy optimization, targeting large industrial bakeries and multinationals seeking standardized global platforms.

- ALI Group S.R.L. A Socio Unico: ALI Group accounts for around 9% of the bakery equipment market, supported by its portfolio of specialist brands in ovens, mixers and dough-handling solutions. The company is strong in foodservice and retail/in-store bakeries, focusing on compact, reliable equipment and leveraging a broad distribution and service network across Europe and North America.

- John Bean Technologies Corporation: John Bean Technologies (JBT) has approximately 7% share, positioned strongly in industrial food processing lines. In bakery, it focuses on high-throughput, automated systems for bread, buns and sweet goods, with capabilities in proofing, baking and freezing. JBT increasingly integrates automation, controls and aftermarket services to drive lifecycle value for large bakery customers.

- Heat and Control, Inc.: Heat and Control holds about 5% share, with strengths in thermal processing, conveying and integrated solutions. While best known for snacks, it supplies ovens, fryers and handling systems used in certain bakery and snack-bakery applications. The company emphasizes energy efficiency, line integration and robust support, particularly for high-volume producers and co-manufacturers.

Bakery Processing Equipment Market Companies

Major players operating in the bakery processing equipment industry include:

- The Middleby Corporation

- GEA Group

- ALI Group S.R.L. A Socio Unico

- John Bean Technologies Corporation

- Markel Ventures Inc.

- Heat and Control, Inc.

- Rheon Automatic Machinery Co., Ltd.

- Fritsch Group

- Baker Perkins Ltd.

- Gemini Bakery Equipment Company

Bakery Processing Equipment Industry News

- In March 2025, The Middleby Corporation announced new high-efficiency tunnel and rack oven lines with advanced controls aimed at industrial and retail bakeries, emphasizing reduced energy consumption, improved bake consistency and easier integration with automated proofing and cooling systems.

- In September 2024, GEA Group introduced upgraded continuous mixing and proofing solutions for large bakeries, integrating inline quality monitoring and digital control. The systems target higher dough consistency, reduced waste and better line utilization for bread, buns and specialty products.

- In May 2023, ALI Group expanded its bakery equipment portfolio through additional brand integration and product launches focused on compact ovens, proofers and mixers for in-store and artisanal bakeries, responding to rising demand for fresh, on-site baked goods in supermarkets and foodservice outlets.

- In February 2022, John Bean Technologies Corporation (JBT) revealed enhancements to its high-capacity baking and proofing systems for industrial bread and bun lines, including improved heat transfer, sanitation features and automation options designed to increase throughput and reduce operating costs.

This bakery processing equipment market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Product Type

- Oven & proofers

- Mixers

- Below 250 kg

- 250-500 kg

- 500-1,000 kg

- 1,000-1,500 kg

- Above 1,500 kg

- Slicer

- Below 100 kg

- 100-150 kg

- 150-250 kg

- 250-350 kg

- Above 350 kg

- Sheeters & molders

- 500-1,000 kg

- 1,000-1,500 kg

- Above 1,500 kg

- Others

Market, By Application

- Bread

- Pastry

- Pizza

- Croissant

- Flatbread

- Pie/Quiche

- Biscuits

- Tortilla

Market, By End Use

- Industrial bakeries

- Artisanal bakeries

- Retail bakeries

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What was the market size of the bakery processing equipment in 2025?

The market size was valued at USD 13.1 billion in 2025, with a CAGR of 8.5% expected through 2035. The recovery of food service and retail bakery sales post-pandemic significantly contributed to market growth.

What are the upcoming trends in the bakery processing equipment market?

Key trends include increased automation, energy-efficient and sustainable solutions, flexible equipment for specialty products, and predictive maintenance using advanced sensors and remote monitoring.

Who are the key players in the bakery processing equipment industry?

Key players include The Middleby Corporation, GEA Group, ALI Group S.R.L. A Socio Unico, Markel Ventures Inc., Heat and Control, Inc., Fritsch Group, Baker Perkins Ltd., and Gemini Bakery Equipment Company.

What is the growth outlook for the industrial bakeries segment from 2026 to 2035?

The industrial bakeries segment, which held a market share of 51.3% in 2025 and is anticipated to observe around 9.2% CAGR up to 2035.

Which region leads the bakery processing equipment sector?

North America leads the market, with its value rising from USD 3.5 billion in 2025 to approximately USD 7.4 billion by 2035, led by advancements in automation and increased bakery product consumption.

What was the market share of ovens and proofers in 2025?

Ovens and proofers dominated the market with an approximate share of 37% in 2025 and is expected to grow at a CAGR of 8.1% through 2035.

What was the market share of bread in 2025?

Bread held the largest market share of 33.1% in 2025 and is set to expand at a CAGR of 7.6% till 2035.

What is the expected size of the bakery processing equipment industry in 2026?

The market size is projected to reach USD 14.2 billion in 2026.

What is the projected value of the bakery processing equipment market by 2035?

The market is poised to reach USD 29.7 billion by 2035, driven by increased automation, energy-efficient solutions, and the rising demand for specialty bakery products.

Bakery Processing Equipment Market Scope

Related Reports