Summary

Table of Content

Autonomous Mobile Robots (AMR) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Autonomous Mobile Robots Market Size

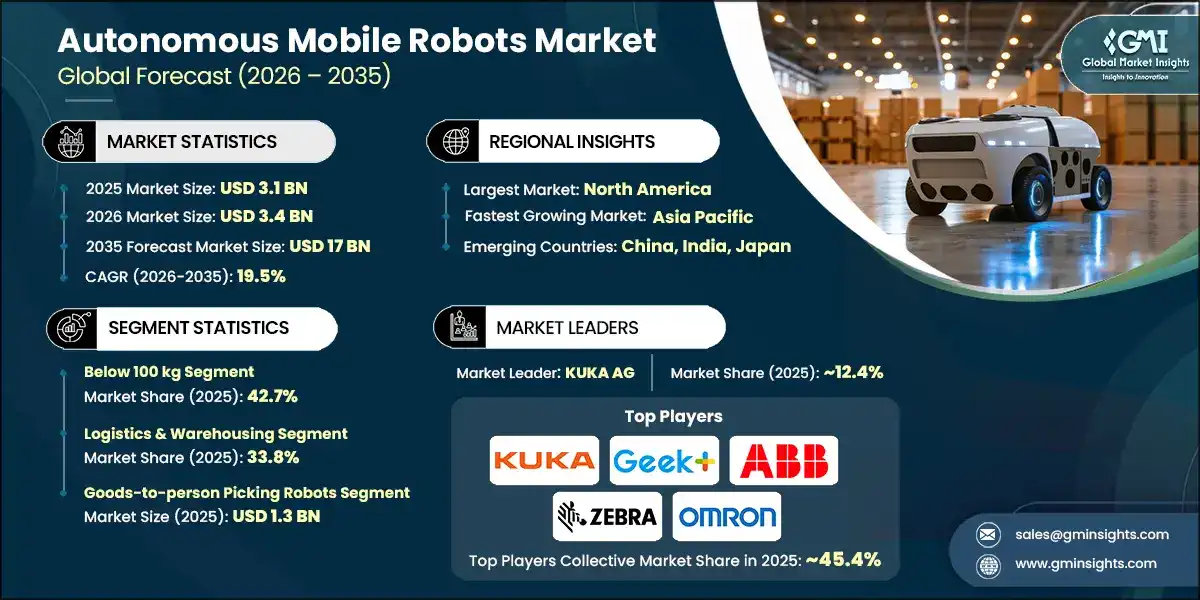

The global autonomous mobile robots market was valued at USD 3.1 billion in 2025. The market is expected to grow from USD 3.4 billion in 2026 to USD 7 billion in 2031 and USD 17 billion in 2035, at a CAGR of 19.5% during the forecast period according to the latest report published by Global Market Insights Inc.

To get key market trends

The rise of the AMR market can be attributed to several factors such as E-commerce and warehouse automation, increasing presence of AMR in health care and pharmaceutical industries, enhanced safety and efficiency of industrial and logistic operations, and utilization of autonomous mobile robots (AMR) in the hospitality sector.

The increase in online sales through e-commerce and remote shopping portals through omni-channel retailing affects the use and growth of autonomous mobile robots (AMRs) in the warehouse environment as fast as possible since by 2027 the total worldwide business-to-consumer (B2C) according to the International Trade Administration, e-commerce industry is estimated to reach approximately USD 5.5 trillion, leading to an increase in the number of AMRs being employed to perform activities such as sorting, assembly, warehouse management, and distribution of goods. Because of all these improvements in the warehouse process, AMRs are a major contributor to increasing warehouse operational efficiency by streamlining and simplifying warehouse operations, reduction of development cost, and significantly decreasing turnaround time on warehouse/ inventory fulfillment whereby consequently enhancing speed to customer gratification.

AMR usage in agriculture and food processing significantly contributes to the growth of this market segment. Crops are monitored, harvested, and packaged through automation, resulting in higher levels of productivity, lower reliance on employees, and improved precision in operations. As reported by the USDA Economic Research Service, in 2023, 52% of midsize farms and 70% of large-scale crop farms used auto-steering systems that are part of AMRs—this represents an increase in use compared to the early 2000s. The widespread adoption of auto-steering systems further advances the integration of AMRs into agriculture.

Between 2022 and 2024, the autonomous mobile robots market witnessed considerable growth, increasing from USD 2.4 billion in 2022 to USD 2.8 billion in 2024. AMRs are being developed with higher load capacities to facilitate larger payloads across industries. This has become increasingly common over the last few years, as AMRs are now optimizing processes like warehousing, manufacturing, and logistics by reducing the number of trips made by the AMR and reducing the amount of time and effort needed to complete those tasks. One example of this is Omron Corporation's announcement in November 2023 of their MD-series AMRs, which have payload capacities of 650 kg and 900 kg and allow for greater efficiency and productivity in the industrial environment.

Autonomous Mobile Robots (AMR) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 3.1 Billion |

| Market Size in 2026 | USD 3.4 Billion |

| Forecast Period 2026 - 2035 CAGR | 19.5% |

| Market Size in 2035 | USD 17 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Growth of E-commerce and warehouse automation | Drives 24% growth as the surge in online shopping fuels demand for efficient warehousing and logistics operations, with AMRs optimizing tasks like sorting, transportation, and inventory management. |

| Expansion of AMRs in healthcare and pharmaceuticals | Contributes 20% growth as AMRs enhance logistics in healthcare by automating tasks such as medication delivery, specimen transport, and inventory management. |

| Adoption of AMRs in agriculture and food processing | Accounts for 18% growth as AMRs automate agriculture tasks like sowing, harvesting, weeding, and crop monitoring, improving productivity and enhancing precision. |

| Enhanced safety and efficiency in industrial and logistics operations | Drives 19% growth by improving safety and streamlining industrial and logistics processes, where AMRs autonomously transport materials, reduce labor risks, and optimize workflow. |

| Increasing application of AMRs in the hospitality industry | Fuels 19% growth as hotels and resorts adopt AMRs to automate services like room delivery and luggage transport, improving guest experience and operational efficiency. |

| Pitfalls & Challenges | Impact |

| High cost associated with autonomous mobile robots | Restrains 22% of market growth as the high initial investment and maintenance costs of AMRs limit their adoption, particularly among smaller businesses and startups. |

| Challenges in integration and deployment of AMR technologies | Limits 18% of market growth due to the complexity of integrating AMRs with existing systems, requiring significant time, resources, and expertise for successful deployment. |

| Opportunities: | Impact |

| Expansion in Last-Mile Delivery | AMRs present a significant opportunity in last-mile delivery, reducing delivery times and costs while enhancing customer satisfaction with autonomous, efficient, and contactless service options. |

| Integration with Smart Factories | The rise of Industry 4.0 creates an opportunity for AMRs to seamlessly integrate with smart factories, enhancing automation, reducing downtime, and improving overall production efficiency in manufacturing environments. |

| Market Leaders (2025) | |

| Market Leaders |

~12.4% market share. |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Japan |

| Future outlook |

|

What are the growth opportunities in this market?

Autonomous Mobile Robots Market Trends

- Artificial intelligence (AI) and machine learning (ML) are being used in autonomous mobile robots (AMRs) for navigation, real-time decision making, and data processing. This has become increasingly popular since the mid-2010s, improving the performance of robots by enabling them to adapt to dynamic environments, plan more efficient paths, and provide safer operations.

- For Instance, ABB Robotics' Flexley Tug T702, which uses AI visual slam (simultaneous localization and mapping) technology and allows the AMR to identify both static and moving objects and make real-time decisions while navigating through the AMR's environment.

- Collaborative autonomous mobile robots (AMRs), designed to collaborate with human employees, are becoming increasingly prominent in the autonomous mobile robots market. They first became popular during the latter part of the 2010s. Collaborative AMRs have increased productivity in many areas where humans used to handle repetitive work so that they could concentrate on more complex work. The rise of collaborative AMRs is largely due to the many advantages they provide to businesses and workers alike includes reduced workplace accidents, optimized workflow, and improved efficiency.

- The National Robotics Initiative 2.0 supports research that develops collaborative robotic systems. With funds provided by multiple federal agencies, the National Robotics Initiative 2.0 promotes the creation of safe, and environmentally friendly, integrated environments for human-robot collaboration.

- Another significant growth trend in the autonomous mobile robot industry is related to energy efficiency improvements. Since energy efficiency has been one of the strongest trends in the AMR industry since the 2012s, as battery technologies have developed to allow AMRs to operate longer without having to recharge, this also results in lower operational costs and reduces downtime related to charging.

- For Instance, the energy-efficient AMR technology is seen in 2024 when Axiomtek introduced their energy-efficient AMR controller called the ROBOX300. The ROBOX300 was based on an Intel Core i5 processor and greatly increased reliability and reduced power consumption for use with industrial automation applications.

Autonomous Mobile Robots Market Analysis

Learn more about the key segments shaping this market

The global market was valued at USD 2.4 billion and USD 2.5 billion in 2022 and 2023, respectively. The market size reached USD 3.1 billion in 2025, growing from USD 2.8 billion in 2024.

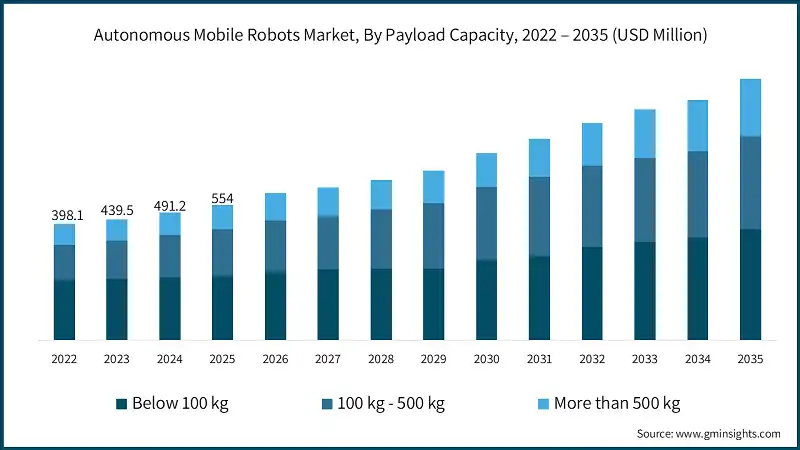

Based on the payload capacity, the global autonomous mobile robots market is divided into below 100 kg, 100 kg - 500 kg, and more than 500 kg. The below 100 kg segment accounted for 42.7% of the market in 2025.

- Small AMRs generally fall below the 100 kg payload range. They operate with electric motors, and manufacturers develop light and efficient payload designs and navigation systems. These types of AMRs provide efficient operation of lower-weight items (e.g., food, documents) indoors.

- Manufacturers of small AMRs should place emphasis on maximizing battery efficiency, enhancing navigation accuracy, optimizing payload handling capabilities, and implementing safety features, while maintaining affordability and scalability to meet various industry needs in the AMR range under 100 kg.

- The more than 500 kg segment was valued at USD 554 million in 2025 and is anticipated to grow at a CAGR of 21.8% over the forecast years. Heavy payload robots (AMR's) with a weight carrying capacity greater than 500 kg generally use powerful electric motors for their motion, providing excellent stability, advanced sensors, and industrial grade construction.

- Manufacturers need to concentrate their efforts on maximizing the electrical motor performance providing maximum load stability increasing the degree of durability of AMR's creating integrated safety systems and successfully integrating AMR's into large, high-volume operational environments.

Learn more about the key segments shaping this market

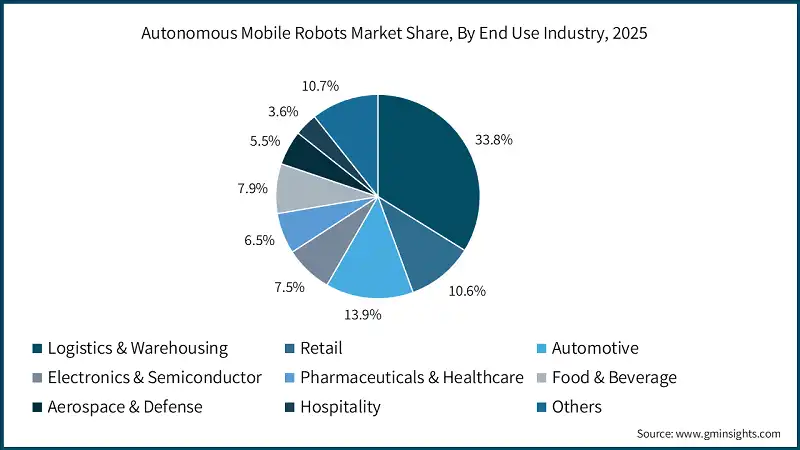

Based on the end-use industry, autonomous mobile robots market is classified into logistics & warehousing, retail, automotive, electronics & semiconductor, pharmaceuticals & healthcare, food & beverage, aerospace & defense, hospitality, & others. The logistics & warehousing segment dominated the market in 2025 with a market share of 33.8%.

- AMRs (autonomous mobile robots) are utilized for logistical applications that require increased efficiency, decreased costs, quicker delivery times, automation of tasks, improved safety, and the ability to respond quickly to the ever-changing demands of e-commerce.

- Manufacturers need to maximize their supply chain efficiency, integrate automated processes into their business, improve & manage inventories, lower Operational costs, improve worker safety & stay flexible to the changing demands of the market.

- The electronics & semiconductor segment is expected to witness growth at a CAGR of 20.8% during the forecast period. Electronics and semiconductor industries drive technological growth based on their need to provide increased processing speeds, develop smaller devices, provide innovative consumer electronic products, provide an increased level of automation in manufacturing, and to provide components that have very high levels of reliability and quality.

- Manufacturers must continue to improve their manufacturing processes through innovation, provide higher quality products, remain flexible to the evolving landscape of consumer demand, and invest in research & development.

Based on the type, the autonomous mobile robots market is segmented into goods-to-person picking robots, self-driving forklifts, autonomous inventory robots, & unmanned aerial vehicles. The goods-to-person picking robots segment dominated the market in 2025 with a revenue of USD 1.3 billion.

- Goods-to-person pick robots are types of warehouses or distribution facility shopping robots that retrieve goods directly from a shelf and bring them to the picker buyer. This design provides a cost reduction in labor and improved efficiency in order delivery.

- Companies should focus on enhancing their precision with robotic solutions, improving the use of AI in inventory administration, and integrating their robotic systems to improve the efficiency of their order fulfilment process.

- On the other hand, the autonomous inventory robots segment is expected to witness growth at a CAGR of 19.2% during the forecasted period.

- The new autonomous inventory robot uses a combination of advanced sensors, AI based software algorithms and the real-time data processing capabilities of the computer to enable the efficient storage and tracking of stock, as well as the establishment of an accurate and seamless integration with the warehouse management systems, to provide maximum efficiency for the company and the customer.

- Companies should concentrate on increasing the accuracy of their sensors, improving AI to support the tracking of stock, and connecting real-time data to support optimising inventory management.

Looking for region specific data?

North America Autonomous Mobile Robots Market

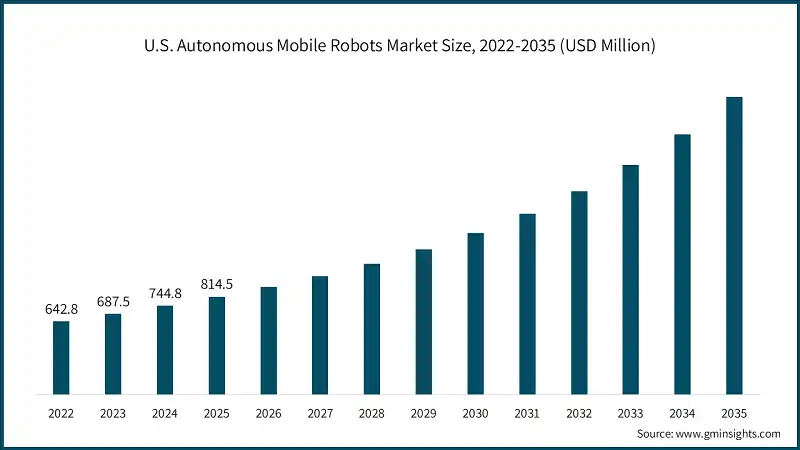

The North America market dominated the global autonomous mobile robots industry with a market share of 33.5% in 2025.

- Drivers for the AMR market in North America include developing advancements in manufacturing technology and the growing demand for E-commerce labour cost increases and improvements in technology, which all encourage AMR growth to drive operational efficiencies in North America.

- In addition, investments into robotics development a strong focus on achieving operational efficiencies demand for flexible logistic solutions and the introduction of Industry 4.0 technologies into the marketplace are all driving factors of the North American AMR industry.

The U.S. autonomous mobile robots market was valued at USD 642.8 million and USD 687.5 million in 2022 and 2023, respectively. The market size reached USD 814.5 million in 2025, growing from USD 744.8 million in 2024.

- United States AMR market is a result of the country's need to find solutions to their increasing labour shortages, combined with the rapid growth of artificial intelligence technologies, investment into smart manufacturing solutions, and the need for faster delivery services all of which are helping to drive operational efficiencies.

- Manufacturers should concentrate their efforts on enhancing AI capabilities, making improvements in automated systems, determining ways to overcome labour shortages, and providing quick delivery services and should also invest in scalable smart manufacturing systems.

Europe Autonomous Mobile Robots Market

Europe market accounted for USD 816.2 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- European AMR market is being driven by an increased demand in the automated logistics industry the concentration on the principles of Industry 4.0 by companies and the expansion of both E-commerce and retail that have created opportunities for companies to adopt autonomous mobile robots as part of their operations.

- In Europe, there are also increased opportunities to incorporate robotic mobility technology that enhance automation, improve productivity and provide greater operational flexibility for companies and increase the number of companies that adopt robots.

Germany autonomous mobile robots market dominates the Europe market, showcasing strong growth potential.

- German market is powering forward due to its position as the leader in manufacturing innovations through a focus on providing energy-efficient solutions and a strong demand for the automation of automotive vehicles with the support of the government.

- Manufacturers should focus on developing their production processes through increased energy efficiency, automotive automation, to Assist them in innovating and growing their business.

Asia Pacific Autonomous Mobile Robots Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 22.7% during the analysis timeframe.

- In the Asia-Pacific market, the significant drivers of the market growth are the increasing retail distribution, increases in manufacturing output and exports, and increased government initiatives on automation are leading to the continued use of autonomous mobile robots being used in various industries.

- Further, Asia-Pacific market is the increased demand for warehouse automation, increased focus on supply chain resilience, and the growing use of advanced robotic technology to improve efficiency of operations.

China autonomous mobile robots market is estimated to grow with a significant CAGR, in the Asia Pacific market.

- Chinese market changes are being driven by the expansion of E-commerce logistics and the application of artificial intelligence (AI) and 5th generation (5G) technologies, the increasing focus on the optimization of labour efficiency, and the expansion of intelligent transportation systems to enhance automation.

- Manufacturers should focus on increasing the adoption of AI in their logistics systems, improving their labour efficiency, advancing their 5g connectivity, and developing intelligent transportation systems for logistics optimization.

Latin American Autonomous Mobile Robots Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

- Brazil's economic growth is largely attributed to companies taking actions to reduce the cost of labor investing in smart manufacturing and improving government sponsored technological innovation. With government assistance and support, there has been a high level of increase in the number of autonomous mobile robots utilized across various industries.

- Manufacturers could benefit from increasing the efficiency of labor cost using smart manufacturing systems, leveraging additional government initiative to advance robot technology.

Middle East And Africa Autonomous Mobile Robots Market

South Africa autonomous mobile robots industry to experience substantial growth in the Middle East and Africa market in 2025.

- The South African economic growth is driven and supported by an ever-increasing desire for automation from the manufacturing sector supply chain efficiency and a government initiative and support of technology-based advancements as well as a considerable increase logistics.

- Manufacturers need to focus on increasing the level of automation increasing supply chain efficiency utilizing government assistance programs and reducing the overall cost of labor.

Autonomous Mobile Robots Market Share

The AMR industry is led by a few major players like KUKA AG, Geekplus Technology Co., Ltd., ABB Robotics, Zebra Technologies and Omron Corporation with 45.4% market share combined in 2025, these leading companies are key players when it comes to creating innovations and driving AMR technology adoption across all industries with their state-of-the-art products, robotics, AI integration and automation capabilities. KUKA AG, Geekplus and ABB Robotics have established themselves as major key players and most major companies in the AMR industry. In addition, KUKA AG and Geekplus have advanced robotics, efficient supply chain solutions and a history of technological advancements, these companies have been making significant contributions to the future of AMRs.

Several smaller niche companies that enter the AMR industry also contribute to creating innovations through their ability to provide niche specific solutions to specific industries and therefore help drive the flexibility, cost-effective and customizable advancements in AMRs.

Autonomous Mobile Robots Market Companies

Prominent players operating in the autonomous mobile robots industry are as mentioned below:

- ABB Ltd.

- Aethon, Inc.

- Balyo

- Boston Dynamics

- Fanuc

- ForwardX Robotics

- Geekplus Technology Co., Ltd.

- GreyOrange

- Honda Motor Co., Ltd.

- JBT

- KUKA AG

- Locus Robotics

- Mobile Industrial Robots

- Murata Machinery Ltd.

- Omron Corporation

- Onward Robotics

- Seegrid

- Teradyne Inc.

- Vecna Robotics

- YUJIN ROBOT Co., Ltd.

- Zebra Technologies Corp

KUKA AG can leverage its expertise through its advanced robotics and automation capabilities, and provide highly flexible, customizable AMRs for both industrial and commercial applications and their strong integration capabilities allow for advanced manufacturing and logistics solutions.

Geekplus is mainly focused on developing and producing cost- effective, reliable and intelligent AMRs that meet the specific needs of the warehouse and fulfillment center (WFC) sector. Geekplus's AMRs are designed to increase operational efficiency and scalability and use a variety of sophisticated artificial intelligence (AI)-driven technologies to enable rapid navigation, increasing density and reducing the need for human intervention in the WFC sector.

ABB Ltd.

ABB Robotics is different than either KUKA AG or Geekplus as its AMRs are among the most reliable autonomous mobile robots worldwide based on ABB Robotics' expertise in developing, designing and producing high-quality AMR solutions for the precise handling of material in many different markets including manufacturing and logistics.

Zebra Technologies Corp

Zebra Technologies’ AMR technology is built on the company’s industrial automation and real-time data technologies. Zebra’s AMRs provide improved tracking and analytics, improved operational efficiency, and better management of supply chains by integrating advanced tracking and analytics capabilities into the AMR’s design.

Omron Corporation

Omron uses innovative automation and provides AMRs designed with artificial intelligence (AI) and vision systems to improve the workflow of manufacturing processes by enabling the AMRs to seamlessly navigate complex manufacturing facilities.

Autonomous Mobile Robots Industry News

- In November 2023, OMRON officially announced the launch of two autonomous mobile robots (AMRs), the MD-900 and MD-650. Designed for medium payloads of 650 kg (MD-650) and 900 kg (MD-900), the MD-900 and MD-650 include advanced navigation, obstacle avoidance and battery technology that allows for a 30-minute charge and a maximum operational range of 7.5 hours.

- In March 2023, OTTO Motors launched their new OTTO 600 autonomous mobile robot (AMR) in March 2023, which is designed to transport a variety of loads, including pallets, carts, and any other products that can weigh up to 600 Kg (1323 lb), among many other things. The 600 also has very strong all-metal construction with an IP54 rating that protects it from damage from water and dust.

- In 2023, the AMR from WEG, which was introduced, is designed to improve the way that manufacturers handle production and manufacturing processes. The WEG AMR uses natural SLAM technology (simultaneous localization and mapping) allowing it to detect and avoid objects in motion, as well as reroute itself to navigate through obstacles. These features allow the WEG autonomous mobile robot to help increase overall efficiency within the manufacturing operation, while simultaneously improving the speed at which repetitive processes are performed.

The autonomous mobile robots market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million & in terms of volume in Units from 2022 – 2035 for the following segments:

Market, By Component

- Hardware

- Software & services

Market, By Type

- Goods-to-person picking robots

- Self-driving forklifts

- Autonomous inventory robots

- Unmanned aerial vehicles

Market, By Payload Capacity

- Below 100 kg

- 100 kg - 500 kg

- More than 500 kg

Market, By Navigation Technology

- Laser/LiDAR

- Vision guidance

- Others

Market, By Battery Type

- Lead battery

- Lithium-ion battery

- Nickel-based battery

- Others

Market, By Application

- Sorting

- Transportation

- Assembly

- Inventory management

- Others

Market, By End Use Industry

- Logistics & warehousing

- Retail

- Automotive

- Electronics & semiconductors

- Pharmaceuticals & healthcare

- Food & beverage

- Aerospace & defense

- Hospitality

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the autonomous mobile robots market?

Major companies operating in the autonomous mobile robots industry include KUKA AG, Geekplus Technology Co., Ltd., ABB Robotics, Zebra Technologies, and Omron Corporation.

What is the size of the U.S. autonomous mobile robots market?

The U.S. autonomous mobile robots industry reached USD 814.5 million in 2025. Growth is supported by labor shortages, increasing AI adoption, and demand for faster, automated delivery systems.

What are the key trends in the autonomous mobile robots industry?

Key trends include AI- and machine-learning-enabled navigation, collaborative AMRs, and energy-efficient battery technologies improving operational uptime and safety.

Which end-use industry leads the autonomous mobile robots market?

The logistics & warehousing industry led the market with a 33.8% share in 2025, fueled by rapid expansion of e-commerce and automated distribution centers.

What is the growth outlook for the more than 500 kg payload segment?

The more than 500 kg payload segment is expected to grow at a CAGR of 21.8% through the forecast period, driven by heavy-duty material handling requirements in manufacturing and industrial facilities.

What was the market share of the below 100 kg payload segment in 2025?

The below 100 kg payload segment accounted for 42.7% market share in 2025, supported by growing demand for lightweight AMRs in indoor logistics and service applications.

How much revenue did the goods-to-person picking robots segment generate in 2025?

Goods-to-person picking robots generated USD 1.3 billion in 2025, leading the AMR industry by improving order fulfillment efficiency and reducing labor dependency.

What is the projected value of the autonomous mobile robots market by 2035?

The market is expected to reach USD 17 billion by 2035, expanding at a CAGR of 19.5% due to AI integration, smart factories, and autonomous logistics solutions.

What is the current autonomous mobile robots market size in 2026?

The autonomous mobile robots industry is projected to reach USD 3.4 billion in 2026, driven by accelerating warehouse automation and e-commerce fulfillment demand.

What is the market size of the autonomous mobile robots market in 2025?

The market was valued at USD 3.1 billion in 2025, supported by rising adoption across logistics, healthcare, and industrial automation applications.

Autonomous Mobile Robots (AMR) Market Scope

Related Reports