Summary

Table of Content

Automotive Portable Lithium Iron Phosphate (LFP) Battery Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Automotive Portable Lithium Iron Phosphate Battery Market Size

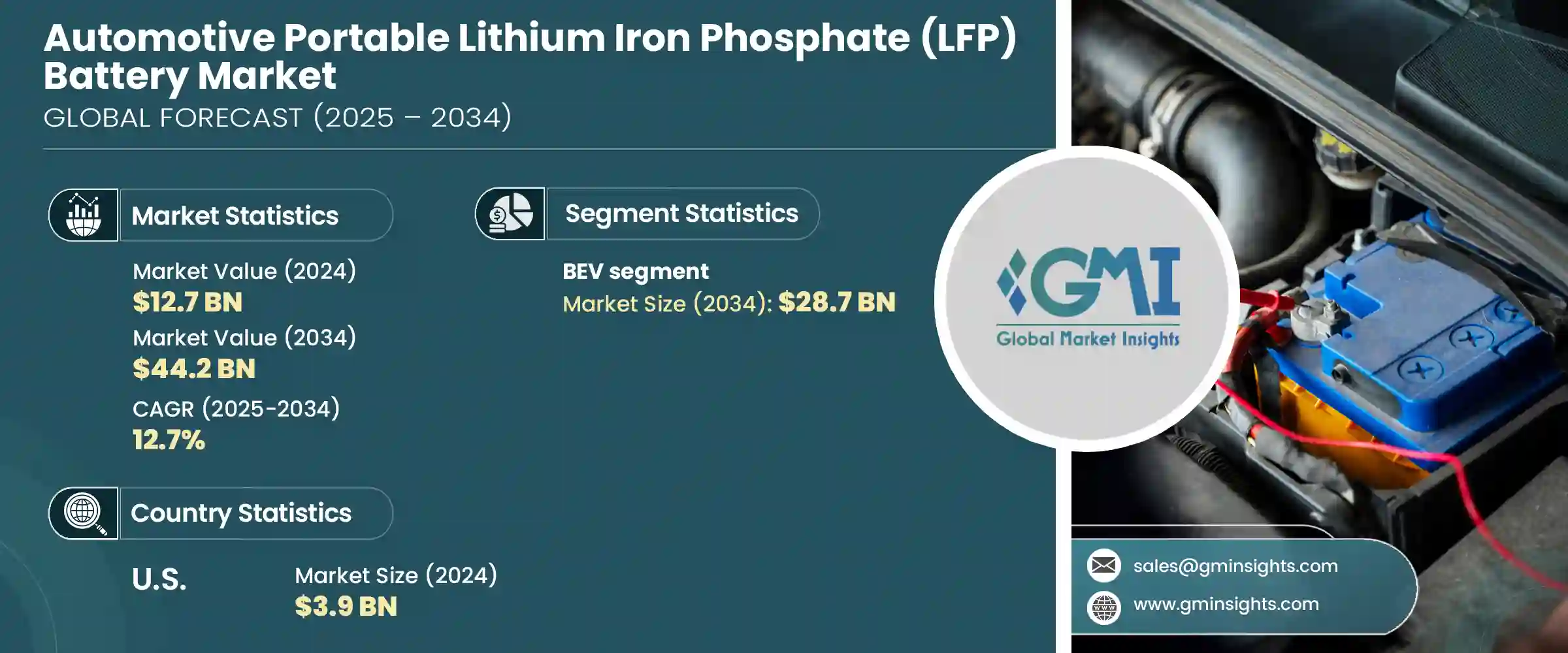

The global automotive portable lithium iron phosphate battery market was at USD 12.7 billion in 2024. The market is expected to grow from USD 15 billion in 2025 to USD 44.2 billion in 2034, at a CAGR of 12.7%. LFP batteries are renowned for their thermal stability and resistance to overheating, making them a safer choice for electric vehicles (EVs). This safety advantage is particularly crucial for entry-level and mid-range battery electric vehicles (BEVs), where cost-effectiveness and reliability are paramount.

To get key market trends

EV users are increasingly turning to LFP batteries, drawn by their safety, extended cycle life, and cost-effectiveness. Major automakers are now integrating LFP batteries into their entry-level and mid-range electric vehicles. For instance, Tesla announced in 2023 that nearly half of its vehicles produced in the first quarter utilized LFP batteries. Due to their thermal stability, LFP batteries offer enhanced safety for automotive applications.

Automotive Portable Lithium Iron Phosphate (LFP) Battery Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 12.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 12.7% |

| Market Size in 2034 | USD 44.2 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

As vehicle safety becomes a heightened priority, markets with stringent battery safety regulations, such as the United States and the European Union, are witnessing a surge in the adoption of LFP batteries. For reference, according to the U.S. Department of Energy, LFP batteries are projected to account for over 40% of the global EV battery market by 2030, driven by their cost advantages and safety features.

The production cost of LFP batteries has decreased, with prices dropping to around USD 55–60 per kilowatt-hour as of September 2024. This reduction is attributed to the lower cost of raw materials and advancements in manufacturing processes, making LFP batteries more affordable for consumers and automakers alike.

Automotive Portable Lithium Iron Phosphate Battery Market Trends

Learn more about the key segments shaping this market

The automotive portable LFP battery market is set to reach a value of USD 8.9 billion, USD 10.7 billion, and USD 12.7 billion in 2022, 2023, and 2024. Governments worldwide are implementing policies to promote EV adoption, including subsidies, tax incentives, and infrastructure development. These initiatives are accelerating the demand for LFP batteries, as they are increasingly used in BEVs to meet environmental and regulatory standards. The automotive industry is increasingly favoring LFP batteries over traditional nickel-cobalt-manganese (NCM) batteries due to environmental concerns and the desire to reduce reliance on scarce materials. LFP batteries offer a more sustainable alternative with a lower environmental footprint.

The Trump administration’s tariffs on Chinese EVs and batteries have introduced significant challenges for the automotive portable LFP battery industry, affecting supply chains, increasing costs, and potentially slowing the adoption of electric vehicles in the U.S. The U.S. has implemented tariffs up to 100% on electric vehicles (EVs) and 25% on EV batteries imported from China. This has disrupted the supply chain for U.S. automakers like Tesla and Ford, which rely on Chinese-made LFP batteries from companies such as CATL. The tariffs have led to increased costs for these automakers, potentially raising vehicle prices and affecting consumer adoption rates.

Ongoing research and development efforts are enhancing the performance of LFP batteries, including improvements in energy density and charging speed. For illustration, according to the U.S. Department of Energy, advancements in lithium iron phosphate (LFP) technology have increased energy density by approximately 20% over the past five years. These advancements are expanding the applicability of LFP batteries in various automotive segments.

LFP batteries are being integrated into renewable energy systems, such as solar-powered electric vehicles, to enhance energy efficiency and sustainability. For instance, as per the U.S. Department of Energy, lithium iron phosphate (LFP) batteries are projected to account for over 40% of the global lithium-ion battery market by 2025, driven by their cost-effectiveness and safety features. This integration is expanding the use cases for LFP batteries beyond traditional automotive applications.

Automotive Portable Lithium Iron Phosphate Battery Market Analysis

Learn more about the key segments shaping this market

- Based on application, the industry can be categorized into HEV and BEV. The HEV application across the global automotive portable lithium iron phosphate (LFP) battery market held a share of 58.9% in 2024.

- The BEV segment is expected to dominate the market and exceed revenue of USD 28.7 billion by 2034. HEVs, which combine an internal combustion engine with an electric powertrain, are gaining traction as transitional technologies in the global shift toward electrification. One of the key growth drivers for LFP batteries in HEVs is their ability to enhance fuel efficiency and reduce greenhouse gas emissions without the need for full electrification infrastructure.

- LFP batteries offer HEVs a lower-cost, safer alternative to traditional lithium-ion chemistries (like NCM or NCA). Their superior thermal stability reduces the risk of overheating, which is especially important in hybrid systems that frequently switch between electric and gasoline modes. As HEVs generally require smaller batteries than BEVs, the slightly lower energy density of LFP is not a limitation, making LFP an ideal match for HEV applications.

- In regions like Southeast Asia, Latin America, and parts of Africa, the charging infrastructure for BEVs remains limited. HEVs serve as a practical intermediate solution, and the adoption of LFP batteries in these vehicles is driven by local manufacturing initiatives and cost constraints. OEMs targeting these markets are turning to LFP chemistry to deliver hybrid vehicles that are affordable, robust, and aligned with environmental mandates.

- BEVs rely entirely on battery systems, and the demand for more affordable models has been a catalyst for the rise of LFP batteries in this segment. Major EV manufacturers like Tesla, BYD, and several Chinese OEMs are increasingly integrating LFP cells into their entry-level and mid-range BEVs due to the lower raw material costs and longer life cycles. As governments continue to offer EV purchase incentives, the lower cost of LFP batteries helps manufacturers pass savings on to consumers, accelerating adoption.

- Though traditionally seen as having lower energy density, LFP batteries have benefited from recent advancements that have enhanced their performance for BEV use. New battery management systems and cell designs allow for faster charging and longer ranges—addressing two of the biggest consumer pain points. LFP’s cycle durability is also ideal for high-mileage applications, making it well-suited for fleet vehicles, ride-hailing services, and last-mile delivery BEVs.

- As geopolitical tensions and tariff policies reshape the global EV supply chain, manufacturers are seeking alternatives to NCM batteries that require scarce and expensive materials like cobalt. LFP chemistry, which uses abundant materials such as iron and phosphate, aligns well with regional self-sufficiency goals in the U.S., Europe, and India. Investment in local LFP battery manufacturing for BEVs is rising, supported by strategic government incentives and industrial policies aimed at reducing reliance on Chinese imports.

Looking for region specific data?

- The U.S. automotive portable lithium iron phosphate (LFP) battery industry is estimated to reach a value of USD 2.8 billion, USD 3.3 billion, and USD 3.9 billion in 2022, 2023, and 2024. The U.S. government, through initiatives like the Inflation Reduction Act (IRA), is offering significant tax credits and subsidies for EVs and battery production. These incentives are driving demand for LFP batteries in the automotive sector by supporting domestic battery manufacturing and reducing reliance on foreign supply chains.

- Commercial fleet electrification across North America—including delivery, municipal, and public transit—is rapidly increasing. LFP batteries, with their long cycle life and thermal stability, are the top choice for these high-usage vehicles. Canada and Mexico are aligning with U.S. EV policies through joint manufacturing strategies and supply chain integration. Canada, rich in raw materials like lithium and phosphate, is investing in LFP battery processing and production, contributing to a regional boom in EV battery demand.

- Europe’s regulatory framework, such as the EU’s “Fit for 55” policy and ICE vehicle bans by 2035, is pushing automakers to accelerate EV rollouts. LFP batteries, being cost-effective and safer, are being adopted in compact BEVs to comply with these mandates while keeping prices competitive. European battery manufacturers like Northvolt and automotive giants such as Volkswagen and Stellantis are investing in LFP gigafactories. These facilities are focusing on producing low-cost LFP cells tailored to the European mass-market EV segment.

- China leads the global LFP battery supply, with companies like CATL and BYD producing high volumes at low cost. This dominance has made LFP the preferred chemistry in Chinese BEVs, particularly in the mass market and public transport sectors. Countries like India, Vietnam, and Thailand are launching aggressive EV adoption targets. LFP’s affordability, safety, and lower dependence on rare minerals make it ideal for two-wheelers, three-wheelers, and compact cars in these emerging economies.

- Gulf countries, especially the UAE and Saudi Arabia, are investing heavily in electric mobility as part of their Vision 2030 strategies. LFP batteries are being deployed in pilot projects for electric buses, taxis, and fleets due to their heat resilience and long life. Africa is seeing a rise in micro-EV use and solar-integrated transport. LFP batteries are preferred for their compatibility with off-grid charging systems and harsh climatic conditions, where battery safety and longevity are critical.

- Latin America holds significant reserves of lithium and phosphate. Countries like Argentina and Brazil are working to attract battery manufacturers, and the push for value-added processing is likely to favor LFP production due to its simpler processing needs compared to NCM. Cities in Brazil, Chile, and Colombia are rolling out electric buses and taxis to combat pollution. LFP batteries are being prioritized for these applications due to their proven performance in large-format battery systems for transit.

Automotive Portable Lithium Iron Phosphate Battery Market Share

The top 5 players operating in automotive portable lithium iron phosphate (LFP) battery markets include CATL, LG Energy Solution, BYD, Clarios and Exide Technologies which collectively hold over 55% of the market share. Major players rely heavily on top-tier LFP suppliers for their entry-level and mid-range EVs. A strong market share allows companies to respond swiftly to regional regulatory changes and win government-backed contracts and incentives.

Companies with larger market share invest more heavily in R&D to stay ahead in improving LFP energy density and fast-charging capabilities along with exploring second-life and recycling solutions for LFP cells. Their technological leadership trickles down to smaller firms through licensing, partnerships, or competitive pressure.

Automotive Portable Lithium Iron Phosphate Battery Market Companies

- CATL, founded in 2011 and based in China, is the world's leading manufacturer of lithium-ion batteries for electric vehicles and energy storage systems. The company continues expanding globally, including battery production plants in Europe and North America, to meet rising demand in the EV sector. The company spent USD 2.6 billion on research & development in 2024.

- LG Energy Solution is headquartered in South Korea and ranks among the top global producers of lithium-ion batteries, including LFP and NCM chemistries. LG is aggressively investing in manufacturing facilities across the U.S., Europe, and Asia, while focusing on sustainable battery development and next-generation technologies like solid-state batteries.

- BYD, founded in 1995 and based in Shenzhen, China, is a vertically integrated EV and battery manufacturer. The company has rapidly expanded its presence internationally, becoming a strong competitor to Tesla in EV production. BYD also manufactures energy storage systems and solar energy products, underlining its focus on clean energy solutions. The company reported operating revenue of over USD 23.64 billion in FY2024.

- Clarios, headquartered in Milwaukee, USA, is a global leader in advanced battery technologies for vehicles, with a strong footprint in North America. The company provides batteries to 1 in 3 vehicles worldwide and is investing in new lithium-ion products alongside its core lead-acid offerings. Clarios is also actively involved in battery recycling and sustainability initiatives to support the circular economy.

- Exide Technologies, with origins dating back to 1947 in India, is a prominent battery manufacturer serving automotive and industrial markets. Traditionally known for lead-acid batteries, Exide is now diversifying into lithium-ion cell manufacturing to align with the electric mobility transition. The company is expanding its manufacturing capabilities to serve both domestic and export markets in the EV and energy storage sectors. The company had PBT of over USD 144.01 million in 2024.

Some of the key market players operating across the automotive portable lithium iron phosphate battery industry are:

- A123 Systems

- Clarios

- Contemporary Amperex Technology

- Ding Tai Battery Company

- Duracell

- ENERGON

- Exide Technologies

- General Electric

- Hitachi Energy

- Koninklijke Philips

- LG Energy Solution

- LITHIUMWERKS

- ProLogium Technology

- Saft

- Tesla

Automotive Portable Lithium Iron Phosphate Battery Industry News

- In May 2025, LG Energy Solution and General Motors (GM) have announced plans to begin commercial production of new, lower-cost lithium manganese-rich (LMR) battery cells for future electric vehicles (EVs) at their U.S.-based Ultium Cells facilities in Ohio and Tennessee, starting in 2028. These new prismatic LMR cells, which are more cost-effective than current nickel-rich cells, will significantly simplify battery packs by reducing component parts by over 50%. GM, currently offering 12 electric vehicle models, is striving to achieve cost parity between EVs and internal combustion engine vehicles. The LMR cells are expected to provide over 400 miles of range per charge in electric trucks while reducing battery costs. GM plans to cut its battery pack costs by USD 30 per kilowatt-hour in 2025 and is also developing other lower-cost lithium-iron phosphate-based cells.

- In February 2025, Exide Technologies launched the Solition Powerbooster Mobile, a compact and portable energy storage solution designed to deliver clean, reliable power wherever needed. The unit is flexible, easy to transport, and simple to set up, making it ideal for temporary or mobile energy demands across industrial and commercial sectors. It integrates advanced battery technology with smart energy management, offering a sustainable alternative to traditional generators.

- In December 2024, ProLogium Technology received a TÜV Rheinland certification confirming an industry-leading energy density of 811.6 Wh/L (volumetric) and 359.2 Wh/kg (gravimetric), exceeding its October forecast by 8.36% and 11.90%, respectively. This advancement positions ProLogium's batteries up to 79.6% more energy-dense than traditional lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) batteries. Additionally, the batteries support rapid 5-minute charging, enabling a 300 km drive, which redefines fast-charging standards and offers a refueling experience comparable to gasoline vehicles.

- In April 2024, Hyundai and Kia in partnership with Exide Energy Solutions, initiated the domestic manufacturing of electric vehicle (EV) battery in India. The goal of the partnership is to incorporate lithium iron phosphate cells into electric vehicles and simultaneously build a robust domestic ecosystem for EV batteries. The initiative would help to lower the degree of dependency on overseas markets while complementing India’s foreign electric vehicle mobility initiatives.

The automotive portable lithium iron phosphate battery market research report includes in-depth coverage of the industry with estimates & forecast in terms of “USD Million” from 2021 to 2034 for the following segments:

Market, By Application

- HEV

- BEV

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Russia

- UK

- Italy

- Spain

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

Who are the key players in the automotive portable LFP battery industry?

Some of the major players in the industry include A123 Systems, Clarios, Contemporary Amperex Technology, Ding Tai Battery Company, Duracell, ENERGON, Exide Technologies, General Electric, and Hitachi Energy.

How big is the automotive portable lithium iron phosphate (LFP) battery market?

The market was valued at USD 12.7 billion in 2024 and is projected to reach USD 44.2 billion by 2034, growing at a CAGR of 12.7% from 2025 to 2034.

What is the projected size of the BEV segment in the LFP battery market by 2034?

The BEV (Battery Electric Vehicle) segment is expected to dominate the market and exceed USD 28.7 billion in revenue by 2034.

How much is the U.S. automotive portable LFP battery market worth in 2024?

The U.S. automotive portable lithium iron phosphate battery market is estimated to be valued at USD 3.9 billion in 2024.

Automotive Portable Lithium Iron Phosphate (LFP) Battery Market Scope

Related Reports