Home > Automotive > Automotive Materials > Automotive NVH Materials Market

Automotive NVH Materials Market Analysis

- Report ID: GMI1458

- Published Date: May 2020

- Report Format: PDF

Automotive NVH Materials Market Analysis

The polypropylene material segment is expected to witness around 7% CAGR through 2026. The extremely fine PP fibers enable high energy absorption without adding much weight and density to the structure. Furthermore, the hydrophobic properties of the material are eliminating the water absorption concern for the NVH industry. Ongoing innovation and technological advancements in resin systems, fiber reinforcements, and manufacturing concepts will fuel the market demand.

Polyurethane (PU) holds significant market share driven by ideal noise and vibration absorption properties for lightweight acoustic applications. The material presents production benefits as polyurethane foam shots can be easily adjusted to the necessary volumes that allows OEMs to make quick development changes during testing phase. Additionally, it introduces opportunities to converters as it can be cut and shapes exactly to fill specific and intricate spaces.

The automotive NVH materials market size from absorber & insulator treatment is likely to see substantial growth during 2020 to 2026 due to its large scale coverage for vibration isolation and absorption application. Absorptive materials provide light weight properties and reduces reverberant sound energy. The vibration isolators incorporate resilient pads and metallic springs to reduce transmitted forces. Damping treatment is set to gain foothold significantly with increasing need of dissipation of vibration and acoustic energy in high end and luxury vehicles. Damping treatment includes viscoelastic materials with relive internal loss of energy.

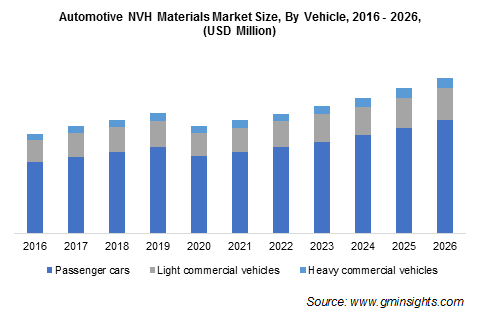

Passenger cars captured over 70% market share in 2019. The absolute demand and road share of passenger vehicle as compared to light and heavy commercial vehicle segment positions passenger vehicle segment to be the largest consumer of acoustic and dampening materials. Rising consumer expectation amidst competition amongst automakers have resulted in increasing focus towards added features and incorporation of premium materials. Automakers are increasing investments in acoustic solutions enabling them to place themselves at competitive position.

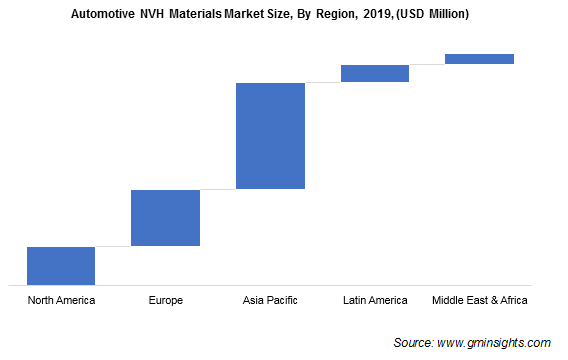

Asia Pacific automotive NVH materials market held more than 50% share in 2019 and will observe significant growth through 2026. The presence of established industry participants such as 3M, BASF, NVH Korea and Sumitomo Riko will contribute to the considerable revenue generation. Manufacturers across the region are focusing on increasing their manufacturing and R&D capacities to gain a competitive edge.