Summary

Table of Content

Automotive Digital Instrument Cluster Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Automotive Digital Instrument Cluster Market Size

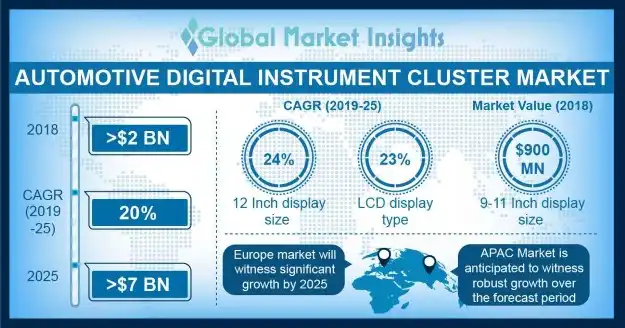

Automotive Digital Instrument Cluster Market size exceeded USD 2 billion in 2018 and is poised to grow at a CAGR of 20% from 2019 to 2025. The global industry shipments are expected to reach 15 million units by 2025.

To get key market trends

A digital instrument cluster is a display used to guide the driver with precise information of vehicle functions and parameters, which can be seen in a visually comfortable format. Through this system, consumers can understand the entire vehicle functions at a single glance. The rapid development of intelligent vehicle technologies with the demand for high-end vehicles and intense competition among manufacturers is a major factor impacting the industry expansion. These digital systems are expected to replace analog instrument cluster systems over the forecast years owing to increased visibility, larger displays, and better user interactivity features.

Automotive Digital Instrument Cluster Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | USD 2 billion |

| Forecast Period 2019 - 2025 CAGR | 20% |

| Market Size in 2025 | 7 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The industry is expected to witness heavy expansion trend due to increasing implementation in premium & luxury cars. Majority of the vehicles currently include analog instrument cluster systems due to low cost and high availability across all regions. However, advanced user interactivity, customizable features, and control of driving assistance functions offered by these solutions are major factors supporting the industry expansion prospects.

Growing electrification and digitization of newly developed passenger and luxury vehicles are driving the automotive digital instrument cluster market growth. The demand is attributed to the integration of complete reconfigurable clusters into luxury vehicles owing to customizable and safety features. Cluster manufacturers are developing solutions with bigger display sizes owing to customer requirement and vehicle digitization trend. The advanced solutions include improved graphics and displays, providing better information to drivers. Additionally, the changing vehicle designs & interiors to provide better user experience are impacting the global automobile sector, resulting in industry growth. Several OEMs including Audi, Volvo, Jaguar, Kia, Tesla, etc., are installing digital instrument clusters in their vehicles. For instance, in June 2019, Kia Motors announced its plan to launch the new completely digitalized 12.3-inch instrument cluster in the upcoming cars with a resolution of 1920x720 pixels.

The benefits offered by these systems over complex and time-consuming analog alternatives include simple reading and intelligible digital display panel. They also aid in vehicle repair & diagnostics as they offer related information display, offering safety and ease to drivers. Furthermore, the development of autonomous & semi-autonomous vehicles is creating the need for reconfigurable clusters, supporting industry growth. The digital instrument cluster market for automotive is hampered by several operational issues in completely digital clusters deployed in high-end vehicles. Several cluster systems are unable to display high-quality images, lose power frequently, and have misfunctioning gauges due to extreme weather conditions; however, the development of high-resolution graphic display and better connectivity aids in overcoming these issues.

Automotive Digital Instrument Cluster Market Analysis

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

LCD is a popular technology due to the lower price point and increased implementation in premium & luxury vehicles. A robust consumption landscape in the European countries is a key contributor to digitized cluster solutions demand. Moreover, the integration of photorealistic graphics, high-resolution displays, and HMIs to offer better visuals and more information will support the automotive digital instrument cluster market. LCD-based instrument cluster market shipments are expected to grow at a CAGR of 23% over the forecast timeframe.

Innovations of larger displays to accommodate components, such as audio assistants, smartphone handling, and infotainment systems, require bigger LCDs. Additionally, OLEDs will gain steady adoption due to brighter display, better image quality, and flexibility over the TFT-LCD and LCD display panels.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

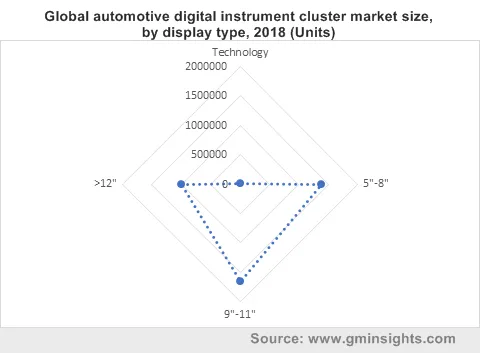

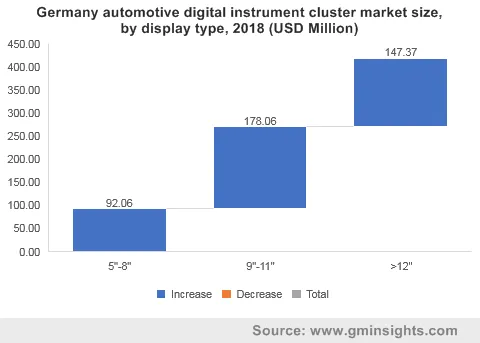

The 9–11 inch displays market was valued at around USD 900 million in 2018. In addition to increased implementation across a wide range of cars, the demand is also attributed to low manufacturing cost and easy component availability compared to the over 12-inch display options.

Automobile manufacturers have incorporated cluster systems ranging from 9 to 11-inch displays to offer better visual features and graphics, displaying information related to various vehicular components. The integration of these systems is done at relatively moderate costs over larger screen options, supporting automotive digital instrument cluster market growth. For instance, in January 2017, Ford GT announced the implementation of a new 10-inch digital instrument display that includes various information, text, and race-inspired graphics in GT’s supercars.

Looking for region specific data?

Looking for region specific data?

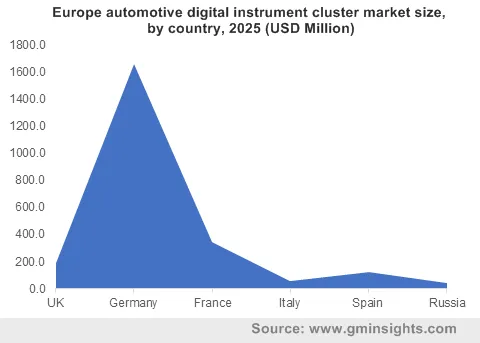

Europe digital instrument cluster market for automotive will witness high growth owing to increasing production & consumption of luxury & high-end vehicles. These solutions offer enhanced safety, convenience, and driving comfort, resulting in high demand from the European consumers. Additionally, the presence of major OEMs including Audi, BMW, Mercedes, Volkswagen, etc., and their cluster implementation strategies is adding up to industry growth in this region. These OEMs in coordination with system manufacturers are continuously engaged in developing advanced & digitized clusters. For instance, in October 2018, Skoda announced the integration of a new digital instrument cluster into its Skoda Octavia model, which has virtual cockpit capabilities.

Automotive Digital Instrument Cluster Market Share

The automotive digital instrument cluster market comprises a few but established companies across the globe. Several upcoming players are investing huge amounts in R&D activities related to the development of advanced systems. These strategies will lead to the emergence of several new players over the forecast timeline owing to the high demand from OEMs.

Prominent companies include:

- Continental AG

- Robert Bosch GmbH

- Visteon Corporation

- Nvidia Corporation

- Nippon Seiki

- Panasonic Corporation

- Denso Corporation

- Magneti Marelli S.p.A

- Luxoft

- ID4Motion

- IAC Group,

- Nippon Seiki Company Ltd.

The players are continuously undergoing product development and innovation strategies to offer application-specific products and address the global automobile industry demand. For instance, in August 2019, Bosch announced its strategic initiative for the development of 3D instrument cluster, which will allow drivers to see dimensions & icons without glasses. The system would be safer and more efficient with the inclusion of all control functions in the central processing unit.

The automotive digital instrument cluster market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue in USD and shipments in Units from 2015 to 2025, for the following segments:

By Display Type

- LCD

- TFT-LCD

- OLED

By Display Size

- 5-8- inch

- 9-11-inch

- >12-inch

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

Frequently Asked Question(FAQ) :

How much size did the global automotive digital instrument cluster market register in 2018?

The market size of automotive digital instrument cluster valued at over USD 2 billion in 2018.

How much will the automotive digital instrument cluster industry share grow during the forecast timeline?

The industry share of automotive digital instrument cluster is estimated to exhibit around 20% CAGR from 2019 to 2025.

What determinants are expected to push automotive digital instrument cluster market expansion?

Rapid development of smart vehicle technologies, increasing demand for luxury vehicles and fierce competition among OEMs are some of the most prominent determinants pushing product sales.

Why are 9-11 inch displays expected to perform better in terms of sales?

The 9

How is the Europe automotive digital instrument cluster industry expected to perform in coming years?

Increasing consumption and production of high-end, luxury vehicles and the presence of prominent OEMs like BMW, Audi, Mercedes and Volkswagen are likely to push product adoption across Europe in coming years.

Automotive Digital Instrument Cluster Market Scope

Related Reports