Summary

Table of Content

Automotive Cockpit Domain Controller Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Automotive Cockpit Domain Controller Market Size

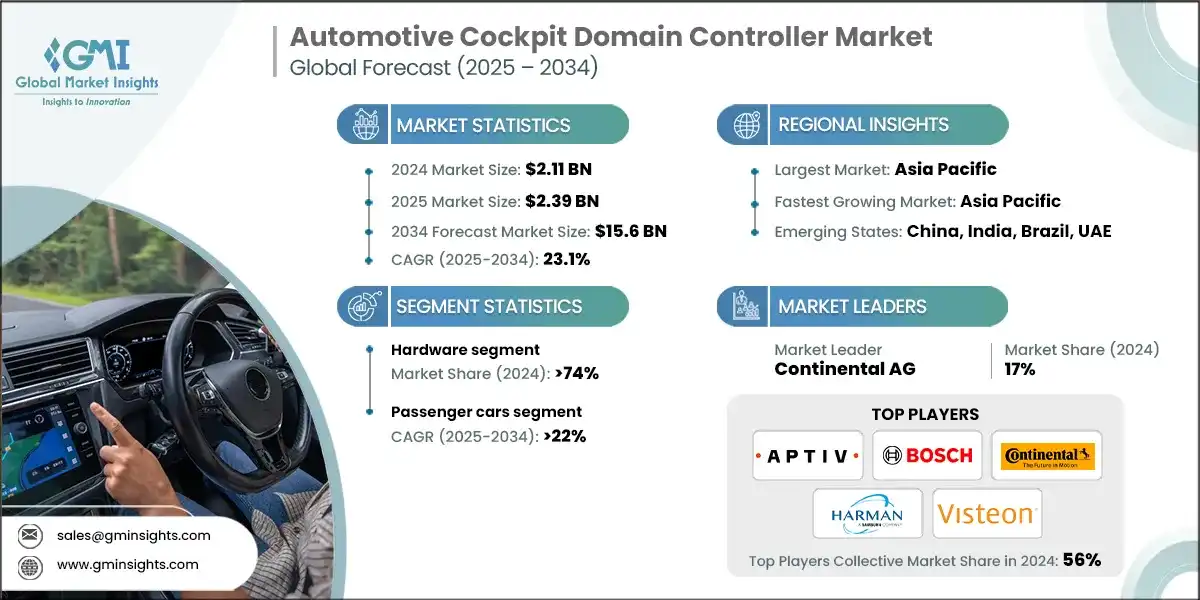

The global automotive cockpit domain controller market size was estimated at USD 2.11 billion in 2024. The market is expected to grow from USD 2.39 billion in 2025 to USD 15.6 billion in 2034, at a CAGR of 23.1%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Automotive Cockpit Domain Controller (CDC) market provides sufficient details, inspired by increased requirements for integrated vehicle electronics, sophisticated human-machine interface (HMI), and software-defined vehicle structure. The original equipment manufacturer (OEMs) and Tier-1 suppliers are allocating capital to assimilate themselves in integrated, adaptable domain checks, thus facilitating more integrated user experiences.

- For instance, Xiaomi's YU7 model showcases a sophisticated consolidation of functions through its utilization of a four-in-one domain control module. This advanced engineering approach has yielded a remarkable 75% decrease in the number of individual control units and a substantial 47% diminution in overall weight, when contrasted with conventional automotive architectures.

- In addition, the progressive development of electric vehicles and the progressive development of autonomous driving technologies is emphasized on increasing requirements for integrated data processing platforms with high reduction in the cabin environment of the vehicle. As more dependent on vehicle software, CDCs are required for real-time information processing, many performance functionality and artificial intelligence-driven functions such as adaptable dashboards, expected maintenance processes and control of custom driver support.

- Geographical augmentation across the Asia Pacific, North American, and European regions constitutes a significant for market progression. The Asia Pacific region, spearheaded by China and Japan, is observing robust adoption rates attributed to governmental encouragement of connected and electric vehicles. Meanwhile, North America and Europe are maintaining their leadership in premium cockpit advancements within the luxury and electric vehicle sectors. Developing economies in Latin America and the Middle East & Africa are also progressively increasing their adoption, facilitated by fleet modernization initiatives and an evolving inclination toward connected vehicles.

- The growth in the market has been further reinforced by collaboration between OEM, semiconductor growers and software developers. This cooperative approach promotes innovation in centralized, zonale and hybrid architectural designs. This partnership provides new features, external software updates and rapid implementation of increased cyber security for the cockpit system.

Automotive Cockpit Domain Controller Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.11 Billion |

| Market Size in 2025 | USD 2.39 Billion |

| Forecast Period 2025 – 2034 CAGR | 23.1% |

| Market Size in 2034 | USD 15.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for connected and software-defined vehicles | Boosts adoption of cockpit domain controllers as a central integration hub for infotainment, HMI, and ADAS |

| Transition toward centralized E/E vehicle architecture | Reduces hardware complexity and improves real-time data processing |

| Increasing consumer demand for advanced infotainment & digital cockpit experiences | Enhances need for digital instrument clusters, HUDs, and driver monitoring systems |

| Growth of EVs and autonomous vehicles | Expands application scope for integrated cockpit and driver-assist platforms |

| OEM–Tier 1 collaborations with semiconductor & software players | Accelerates feature-rich, scalable cockpit domain controller platforms |

| Pitfalls & Challenges | Impact |

| High integration & software validation costs | Advanced cockpit platforms demand heavy R&D and long testing cycles, raising costs and delaying launches |

| Cybersecurity and data privacy risks | Connected cockpits face hacking threats and data breaches, requiring strict protection measures |

| Opportunities: | Impact |

| Expansion of cloud-enabled and OTA update ecosystems | Enables continuous feature upgrades and personalized in-car experiences |

| Growing penetration in emerging markets (APAC, LATAM, MEA) | Affordable EV adoption drives cockpit digitalization |

| Advanced HMI & multimodal interaction systems | Opportunities in voice, gesture, and AR-based cockpit solutions |

| Integration with mobility services and fleet applications | Enhances utilization in shared mobility and commercial fleets |

| Market Leaders (2024) | |

| Market Leaders |

17% market share |

| Top Players |

Collective market share in 2024 is 56% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | China, India, Brazil, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Automotive Cockpit Domain Controller Market Trends

- The automotive cockpit is rapidly evolving, driven by demands for better entertainment, interfaces, and connectivity. Powerful new platforms, like Qualcomm's Snapdragon Cockpit Elite, showcase this, offering huge computing power and AI capabilities for advanced displays and graphics. This reflects a move towards software-centric, experience-focused interiors.

- Another big trend is architectural simplification. Automakers and suppliers reduce the number of ECUs, leading-edge solutions that cut the controller by 75%, thus lowering wires and weight. The zone control units of the continental provide an example of this, offering wide I/O for better cockpit efficiency and scalability and integrated current.

- Power efficiency and display tech are key areas of focus. While LEDs and OLEDs have relatively low power usage, the overall power consumption of cockpits has surged due to increased computing needs. This necessitates advanced heat management and optimized power strategies in CDC development.

- cockpits become sophisticated, power-hungry digital hubs. The partnership between car manufacturers, chipmakers and software companies will be important to meet the AI-enhanced dashboards, seamless integration with multiple screens and increase the demand for individual driver experiences.

Automotive Cockpit Domain Controller Market Analysis

Learn more about the key segments shaping this market

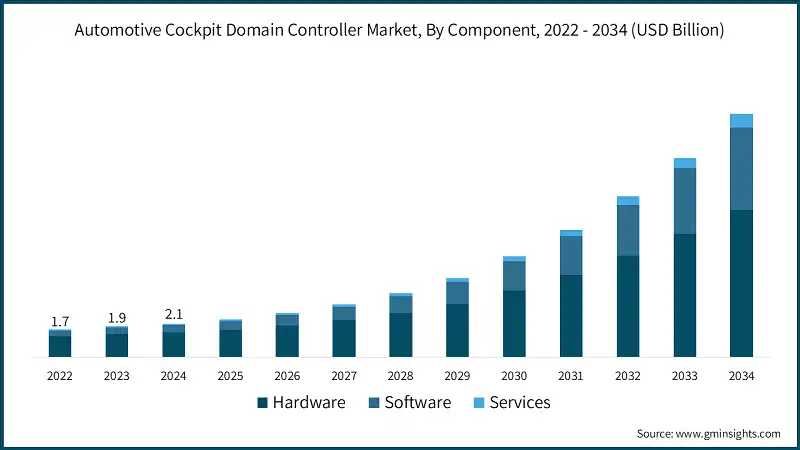

Based on component, the automotive cockpit domain controller market is divided into hardware, software, and services. The hardware segment dominated the market in 2024, accounting for over 74% of total revenue.

- CDC systems rely on hardware like SOCs, memory, display controllers, connectivity, and power management. Advanced SOCs (like Qualcomm Snapdragon) enable real-time AI, multiple displays, and immersive infotainment. Also, combining ECUs and smart power use cuts down on wiring and energy, boosting efficiency and scalability in cars, especially EVs.

- The software runs the CDC value quickly, including operating systems, middleware, application software and security solutions. Platform seamless HMI, infotainment and driver support integration such as Android Automotive, QNX and Autosar Framework. AI-operated functionality such as adaptive dashboard, voice identity and future maintenance is built into software level, while strong cyber security and functional safety structures ensure reliability and regulatory compliance.

- Systems complement hardware and software by offering system integration, perfection, maintenance and counseling assistance. Integration services ensure spontaneous interactions between hardware and software components, while OTA updates, external diagnostics and technical assistance increase the performance of the vehicle during their life cycle. Counseling services guides OEMS in architectural optimization, digital transformation and technology strategy, which helps to accelerate CDCs in different vehicle segments.

Learn more about the key segments shaping this market

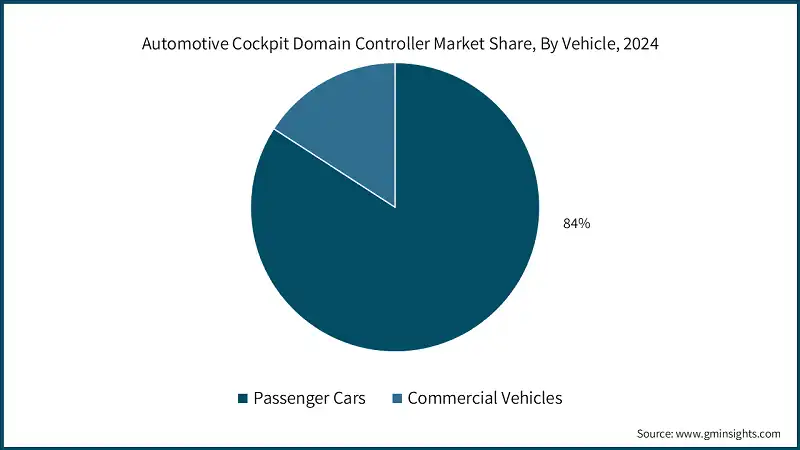

Based on vehicle, the automotive cockpit domain controller market is segmented into passenger cars, and commercial vehicles. The passenger cars segment led the Market in 2024 and is expected to grow at a CAGR of over 22% from 2025 to 2034.

- Passenger cars dominate the CDC market due to the growing demand for advanced infotainment, digital instrument cluster and AI-competent HMI. Compact, medium-sized and luxurious vehicles quickly integrate centralized or zonal cockpit architecture to provide multi-display support, personal dashboards and driver's help functions. The increase and high performance of electric vehicles (EV) in this segment leads up data processing requirements and advanced connection solutions.

- Commercial vehicles, including lighter commercial vehicles, trucks and buses, are using CDCs to improve fleet handling, driver's safety and operating efficiency. Features such as driver monitoring systems, real -time diagnostics and predictive maintenance are important for long -term and urban transport. CDC integration into commercial vehicles also improves telematics and compliance with regulations, which enables smart, connected to fleet.

- Adoption of electric vehicles has required driving for CDC which is able to handle battery systems, energy optimization and real -time root planning. Fleet with mixed vehicle types benefit from integrated cockpit solution for continuous monitoring and control.

- Autonomous and semi-autonomous deployment in both passenger and commercial vehicles accelerates the adoption of the CDC. L2+ and L3 Automation Equipment Vehicles Sensor Infusion, Decision Support and Real-Time AI-based alerts depends on cockpit domain controllers, improves general safety and operating efficiency.

Based on technology, the market is segmented into centralized architecture, distributed architecture, zonal architecture, and hybrid architecture. The centralized architecture segment is expected to dominate the automotive cockpit domain controller market, as the growing demand for high-performance computing, multi-display integration, AI-powered driver assistance, and software-defined vehicle functionalities drives OEMs to adopt unified, powerful cockpit solutions.

- Centralized architecture consolidates multiple vehicle functions in a high -dementia data processing unit. This setup simplifies software management, enables rapid processing to AI and multi-display systems, and reduces hardware surplus. It is especially suitable for premium and electric vehicles, which require high calculation current for infotainment, driver's assistance and energy management.

- Distributed architecture depends on many special controls throughout the vehicle. This approach allows flexibility in integrating inheritance systems and provides modularity for incremental facilities. It is widely used in passenger and commercial vehicles where reliability and cost-effective distribution are the most important ideas.

- Zonal architecture organizes geographical vehicle functions, reduces the wiring complexity and the weight of the vehicle. After groups in the sensor, display and zone, this approach improves scalability, energy efficiency and future preparedness for software -defined vehicles.

- Hybrid architectures cleverly mix centralized, distributed, and zonal setups. This balances speed, expense, and growth potential. They're adaptable, handle complex data needs, and stay modular across vehicle types. That makes them perfect for future connected and self-driving cars.

Based on sales channel, the automotive cockpit domain controller (CDC) market is divided into original equipment manufacturer (OEM) channel and aftermarket.

- The original equipment manufacturer (OEM) channel has a prominent space in the market and accounts for most central performance computers (CDC) companies. Car companies include domain controllers directly during the production process to guarantee infotainment systems, driver-assisted functions, and even operation of paired vehicle functions. The increasing occurrence of electric vehicles and software-defined vehicles (SDVs) continues the demand for OEM for CDC. Centralized and zonal architectures require accurate integration and elevated processor power, which is best absorbed at the factory levels.

- The aftermarket channels meet the need for replacement, retrofitting vehicles, improvement, and existing cars, including the infotainment system, digital dashboard, and upgrades in the Human-Machine Interface (HMI) system. Although the market share is less than the OEM channel, the growing consumer interest in customized driving experiences and expansion of development in the post-development region supports modular CDC solutions.

Looking for region specific data?

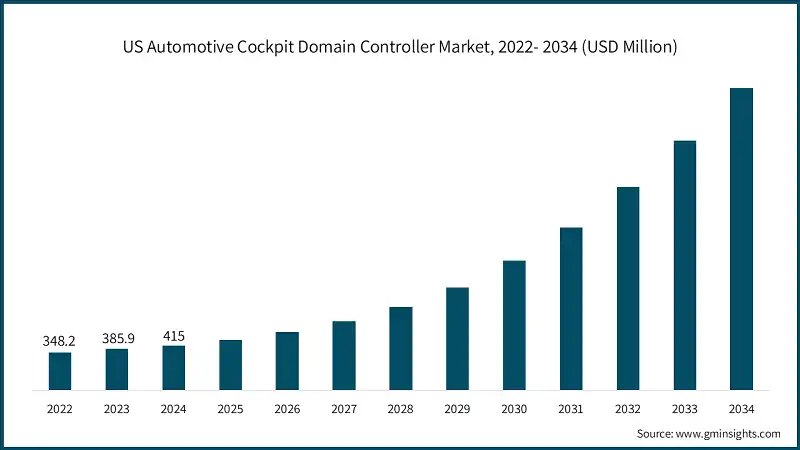

The North America automotive cockpit domain controller market accounted for USD 478.4 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- The region acts as important hub for motor vehicles, and characterizes sophisticated research and development functions, vehicle manufacturers and large part suppliers that embrace advanced software-driven vehicles and electric vehicles. Increasing consumer interest in interconnected and intelligent vehicle interface systems stimulates the integration of cockpit domain controllers (CDC) in both private cars and commercial vehicles.

- North America has a strong technical foundation, including cloud and edge computing skills, implementation of artificial intelligence and vehicle communication systems, which have been expanded by immediate data processing, integration of multiple screens and human machine interface functions in artificial intelligence. This development intensifies the spread of CDC throughout the region.

- Government support from the US Department of Transportation and the National Highway Traffic Safety Administration promotes self-governance and partially secure implementation of self-mobilization technologies, which can increase the need for advanced CDCs that can initially integrate safety facilities, entertainment systems and driver support systems.

The U.S. automotive cockpit domain controller market was valued at USD 322.5 million and USD 348.2 million in 2021 and 2022, respectively. The market size reached USD 415 million in 2024, growing from USD 385.9 million in 2023.

- According to the US Energy Department, the US sale of electric vehicles is estimated to constitute more than 50% of new vehicle sales by 2030. This intensifies the requirement for high-performance domain controllers to manage complex battery systems, sensor fusion and autonomous navigation.

- Large OEMs such as Ford, General Motors, Tesla and Stellantis integrate centralized and zonal CDC architectures in commercial vehicles, enabling multi-display dashboards, AI-controlled HMI and adaptive driver aid functions.

- Government innovation for EV adoption, advanced dynamic testing and collaboration with technology suppliers such as Qualcomm, NVIDIA and Intel further improves the growth of the U.S. CDC market, making it the largest regional market in North America.

The European automotive cockpit domain controller market accounted for USD 582.9 million in 2024 and is anticipated to witness strong growth over the forecast period.

- Europe plays an important role in the global CDC market, supported by the presence of Premium-OEMs, advanced automotive industry, dense vehicle safety regulations and Volkswagen, BMW, Daimler and Jaguar Land Rover.

- In addition, the region leads to software-defined vehicles and autonomous driving development, improving the demand for sophisticated cockpit domain controllers capable of integrating infotainment, driver help and multi-installed HMI system.

- Increasing electric vehicles (EV) in countries such as Germany, France and Norway are the demand for high performance CDC for managing high performance CDC battery systems, sensor fusion and connected vehicle technologies.

- Europe also emphasizes stability and energy-efficient vehicle solutions, encouraging CDC innovations in low power screens, AI-ordered dashboards and modular cockpit architecture.

Germany dominates the European automotive cockpit domain controller, showcasing strong growth potential.

- German OEM and Tier-1 suppliers actively implement centralized, distributed and Zonal CDC architecture in passenger and commercial vehicles to increase support for multiple displays, adaptive driver's assistance and AI-operated HMI experiences.

- Germany's motor vehicle region operates under strict regulatory standards, including Euro NCAP and general safety regulations, which are operating to use advanced cockpit technologies with built-in safety and surveillance tasks.

- In addition, Germany is a center for EV production and autonomous vehicle pilot programs, which require CDCs that are able to treat real-time treatment, AI integration and uninterrupted connection in vehicle systems.

The Asia Pacific dominated the automotive cockpit domain controller market with a market share of 42.3% in 2024.

- Asia is the largest part of global vehicle production led by China, Japan, India and South Korea. Quick adoption of connected vehicles, increasing demand for advanced infotainment systems, and policies for state EV-adoption run large-scale integration of cockpit domain controllers into both passenger and commercial vehicles, which contributes to the increase in the market.

- In addition, Asia is a center for the next generation electronics production of motor vehicles. Countries like Japan and South Korea push semiconductors and AI-based car solutions, while India looks at a rapidly connected car penetration. It keeps the region as a leader in the distribution of centralized and zonal CDC architecture to meet the developed consumer and regulatory requirements.

China automotive cockpit domain controller market is estimated to grow with a significant CAGR, in the Asia Pacific.

- The Chinese government has introduced strict rules for vehicle safety, intelligent connected vehicles (ICV) and EV-adoption, supported by policy as the New Energy Vehicle (NEV) mandate. These measures accelerate the adoption of cockpit domain controllers to enable the integration of multiple displays, advanced driver assistance and connected HMI systems.

- In addition, China distributes aggressively autonomous vehicle pilot programs and the Smart City Mobility Initiative. Leading OEM and technology companies integrate AI-operated CDC solutions, sensor fusion and real-time data processing to support EVs and intelligent dynamic platforms. This accelerates a lot of adoption of the CDC system, making China a major development engine in Asia.

Brazil leads the Latin American automotive cockpit domain controller market, exhibiting remarkable growth during the analysis period.

- Brazil's motor vehicles, which is the largest in Latin America, integrates connected vehicle facilities and advanced infotainment systems. The Government's initiatives for using electric vehicles (EV) and promoting digital mobility are to create opportunities for cockpit domain controllers to manage screen clusters, driver help and connection solutions.

- In addition, Brazilian consumers show digital experiences in the car as upgrading the human-machine interface (HMI), navigation systems and multi-display integration as digital experiences in the car. Local OEM -s and Tier -1 suppliers use centralized and Zonal CDC architecture to match global standards, making Brazil an important growth engine for the CDC market in Latin America.

Saudi Arabia automotive cockpit domain controller market to experience substantial growth in the Middle East and Africa market in 2024.

- The government vision 2030 strategy emphasizes digital transformation and smart mobility, driving investments in connected vehicles and advanced automotive technologies. This push supports the integration of cockpit domain controllers to manage infotainment, navigation, and advanced driver assistance systems.

- Rising demand for luxury and premium vehicles in Saudi Arabia is accelerating adoption of multi-display cockpits, AI-driven HMI systems, and centralized architectures. Global OEMs are partnering with local distributors and assembly plants to expand CDC-enabled models, boosting market penetration.

- In addition, government policies supporting electric vehicles (EVs) and intelligent transport systems encourage deployment of high-performance CDCs to manage EV platforms, sensor fusion, and real-time connectivity, making Saudi Arabia a key growth hub in the region.

Automotive Cockpit Domain Controller Market Share

- The top 7 companies in the automotive cockpit domain controller industry are Continental, Robert Bosch, Visteon Corporation, Aptiv, Qualcomm Technologies, HARMAN International (Samsung), Denso Corporation contributing around 70% of the market in 2024.

- Continental has a leading place in the global CDC market, run by its wide portfolio of zone control units, integrated power control solutions and advanced cockpit platforms with multiple displays. Combined with strategic partnerships with Major OEMS, the company's strong presence in Europe, North America and the Asia Pacific, lets a significant portion of high-end passenger and commercial vehicle areas.

- Bosch utilizes his expertise to maintain important market status in car electronics, sensor technologies and software integration. With progress in ADAs and connected vehicle solutions, its attention helps centralized and distributed cockpit architectures to ensure a large part of the market, especially in Europe and Asia.

- Visteon strength lies in Cockpit Electronics Solutions, including digital instrument clusters, HMI platforms and infotainment systems. By focusing on partnerships with modular, scalable cockpit architecture and leading OEMs, Visteon has established a strong behavior in North America and the Asia Pacific, which contributes to the huge market share.

- APTIV combines advanced software, connection and security solutions to strengthen the CDC deals. The emphasis on software-defined vehicles, AI-driven dashboards and support for multiple display is beneficial for the company in the United States and European markets and occupies a significant portion of the premium and EV vehicles.

- Qualcomm Technologies platforms offer powerful CPUs and AI processing options, multi-display support and real-time 3D graphics integration, making Qualcomm a favorite supplier for the next generation of EVS and connected vehicles, especially in North America and Asia-Pacific.

- Harman focuses on connected car solutions including audio video systems, digital clusters and cloud-based cockpit platforms. The company benefits from the original company Samsung's technological features to offer integrated infotainment and HMI solutions, which gives it a strong position in both North America and Europe.

- Denso’s market presence is driven by Cockpit Domain Control Solutions, Infotainment Integration and Automotive Electronics expertise. Japan, Asia-Pacific and North America emphasize their strong OEM conditions as well as energy-efficient and AI-competent CDC platforms, which contribute to a sufficient part of the global market.

Automotive Cockpit Domain Controller Market Companies

Major players operating in the automotive cockpit domain controller industry are:

- Aptiv

- Continental

- Denso

- Faurecia

- HARMAN

- Intel

- NVIDIA

- Qualcomm Technologies

- Robert Bosch

- Visteon

- Automotive Cockpit Domain Controller (CDC) Top Player in the automotive cockpit domain controller market are Continental AG, Robert Bosch GmbH, Visteon Corporation, APLC, Qualcomm Technology Inc., Herman International (Samsung), Denso Corporation, dominate through advanced cockpit electronics, multi-display. These companies benefit from strong OEM participation, regional production appearance and continuous R&D to offer centralized, distributed and hybrid cockpit architecture in passenger and commercial vehicles.

- Overall, they focus on integrating refined functions such as autonomous driving support, sensor fusion, adaptive dashboards and energy-capable systems. Their strategic emphasis on software-defined vehicle platforms, AI-controlled processing and connected vehicle solutions are to capture them as an important part of the growing global CDC market, while the car's cockpit also runs innovation and standardization in the ecosystem.

Automotive Cockpit Domain Controller Industry News

- In April 2025, At the Shanghai Auto Show, Intel partnered with Black Sesame Technologies to co-develop a cockpit-driving integrated platform that combines Intel’s AI-enhanced software-defined cockpit SoC with Black Sesame’s Huashan A2000 (assisted driving) and Wudang C1200 (cross-domain computing) chips. The solution targets automakers’ L2+ to L4 driving needs, with a joint working group formed and a reference design set for release in Q2 2025 to accelerate mass production.

- In January 2025, At CES 2025, HARMAN launched the next phase of its in-cabin innovations, unveiling “Luna”, an emotionally intelligent AI avatar integrated with its Ready Engage system, alongside upgrades to Ready Vision and Ready Connect—transforming vehicles into empathetic, intelligent companions that personalize interactions and deliver immersive AR-based safety and entertainment experiences.

- In July 2024, Aptiv Launched latest-generation Integrated Cockpit Controllers (ICCs) to streamline in-cabin user experience, supporting immersive audio, seamless smartphone integration, and smart navigation, while reducing design and manufacturing complexity.

- In May 2024, Continental implemented the first cross-domain High-Performance Computer (HPC) in a car, integrating cockpit and additional vehicle functions, including automated parking and holistic motion control, leveraging Qualcomm Snapdragon Ride Flex SoC and the CAEdge cloud framework to demonstrate software-defined vehicle capabilities.

The automotive cockpit domain controller market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) from 2021 to 2034, for the following segments:

Market, By Component

- Hardware

- System on chip

- Modules

- Memory

- Connectivity

- Display interfaces

- Camera & sensors

- Others (Power Management IC, HUD)

- Software

- Services

Market, By Vehicle

- Passenger cars

- Hatchback

- Sedan

- SUV

- Commercial vehicles

- Light commercial vehicles

- Medium commercial vehicles

- Heavy commercial vehicles

Market, By Technology

- Centralized architecture

- Distributed architecture

- Zonal architecture

- Hybrid architecture

Market, By Sales Channel

- Original equipment manufacturer (OEM)

- Aftermarket

Market, By Application

- Infotainment systems

- Digital instrument cluster

- Human machine interface (HMI)

- Head-Up display (HUD) integration

- Driver monitoring systems

- Climate control and comfort systems

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Vietnam

- Indonesia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the automotive cockpit domain controller market?

Key trends include simplified architecture, AI dashboards, multi-screen setups, smart power management, and software-driven interiors.

Who are the key players in the automotive cockpit domain controller industry?

Key players include Aptiv, Continental, Denso, Faurecia, HARMAN, Intel, NVIDIA, Qualcomm Technologies, Robert Bosch, and Visteon.

Which region leads the automotive cockpit domain controller sector?

North America led the market with a valuation of USD 478.4 million in 2024. The region's growth is driven by its strong automotive manufacturing base, advanced R&D capabilities.

What is the growth outlook for the passenger cars segment from 2025 to 2034?

The passenger cars segment is set to witness over 22% CAGR till 2034, supported by the increasing adoption of centralized cockpit architectures and the rise of electric vehicles.

What is the market size of the automotive cockpit domain controller in 2024?

The market size was USD 2.11 billion in 2024, with a CAGR of 23.1% expected through 2034. The market growth is driven by increasing demand for integrated vehicle electronics, advanced human-machine interfaces (HMI.

What is the projected value of the automotive cockpit domain controller market by 2034?

The market is poised to reach USD 15.6 billion by 2034, fueled by advancements in AI, centralized cockpit architectures, and rising adoption of electric vehicles (EVs).

How much revenue did the hardware segment generate in 2024?

The hardware segment generated over 74% of the total revenue in 2024, led by the reliance on components like SOCs, memory, display controllers, and power management systems.

What is the expected size of the automotive cockpit domain controller market in 2025?

The market size is projected to reach USD 2.39 billion in 2025.

Automotive Cockpit Domain Controller Market Scope

Related Reports